Despite economic carnage and a raging pandemic, housing prices remain steady. 4 charts highlighting where things may go.

It seemed that 2020 was already turning out to be a relatively challenging year with a massive global pandemic ravaging the world. Now we have nationwide unrest with protests and rioting. Yet somehow with all of this disturbing news, housing values remain strong. Now is this simply a lag factor? Is it because people are stuck at home now for nearly 3-months and are hunkering down? There are many reasons as to why home values remain strong at the moment, but the next few months will be very telling in terms of where things will go. I’ve talked about California becoming a renter’s paradise and how the majority of people that don’t own are not going to continue voting for things like Prop 13 especially when we have such massive wealth inequality in the country. I think many people are living detached in a small bubble and this nationwide unrest is a culmination of anger, frustration, and economic inequality that has created a two-tiered system. In the end, it reflects in our social fabric and housing is the cornerstone of the American Dream. Where is housing heading if only a small portion of the population can even afford to think about the dream?

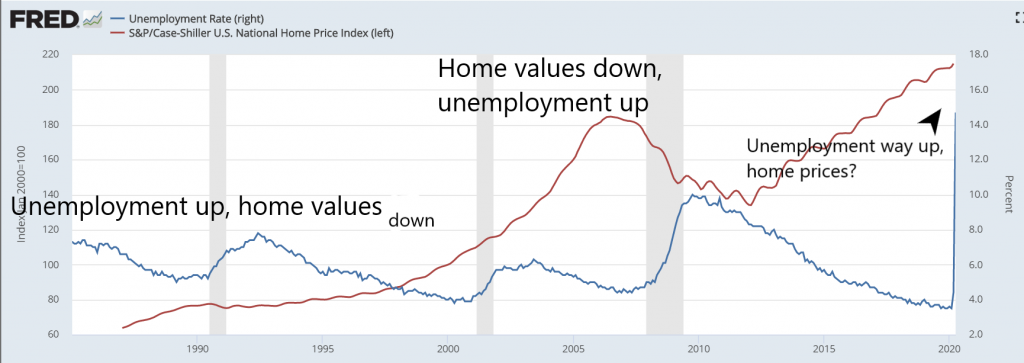

Chart 1 – Unemployment and Home Values

Overall it would be helpful to take a look at home values and unemployment to see if there is anything we can spot. We have never seen this level of unemployment in our lifetimes, so we are truly in uncharted territory.

Take a look at this chart highlighting home values and the unemployment rate:

During the early 1990s we did have a recession. Unemployment shot up, and homes values went down. In Southern California, home values actually took a big hit. But once the unemployment rate came down, home values went up.

We then have a mega bull-run in housing starting in the late 1990s. That culminated with the grand housing bubble and once it popped, the unemployment rate shot up. This was a case of our nation being obsessed with housing and it seemed like everyone had some hand in real estate during this bubble. So the argument at the time was “the unemployment rate is low, why would housing ever come down?†Of course this was circular logic since the housing market was a house of cards just waiting to pop and once it did, it took down the real estate industrial complex.

Fast forward to the current market. Home values are at record levels yet we now have an unemployment rate that is on par to levels last seen during the Great Depression. Past cycles would indicate that home values will be coming down shortly since housing lags the overall economy.

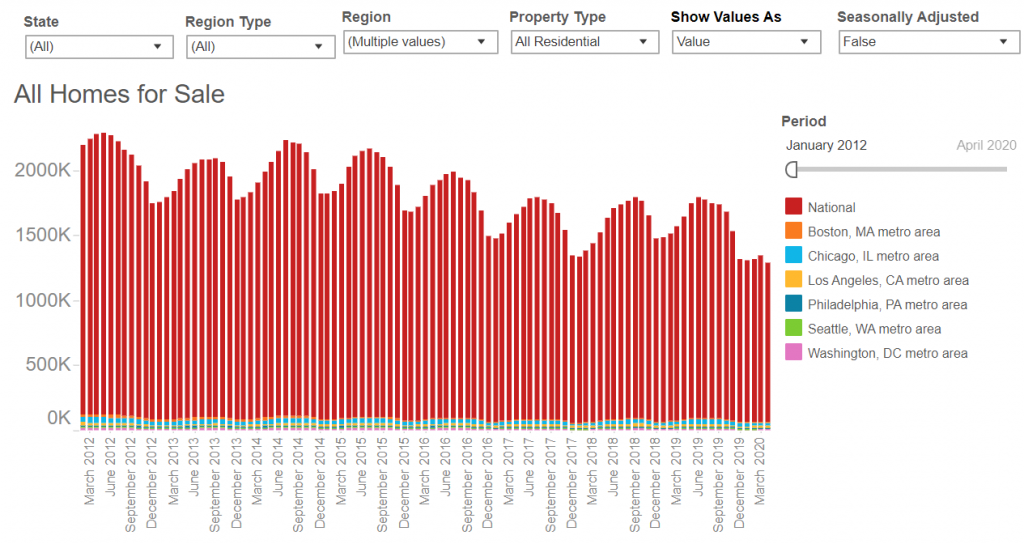

Chart 2 – Inventory

Home values remain high as well since inventory is incredibly low. Not only are people staying at home but so is inventory. I mean think about selling a home today. Do you want people walking through your place with Covid-19 still out there? Probably not and with so much uncertainty, people are just hunkering down. It felt like things were slowly opening up after Memorial Day but we are now seeing nationwide unrest. You had major protests in Santa Monica and other areas that are supposedly affluent. This notion that you can keep people out of your enclaves only works if you want to stay at home indefinitely – not likely and not a way to live either.

With inventory remaining low, prices will be sticky moving down.

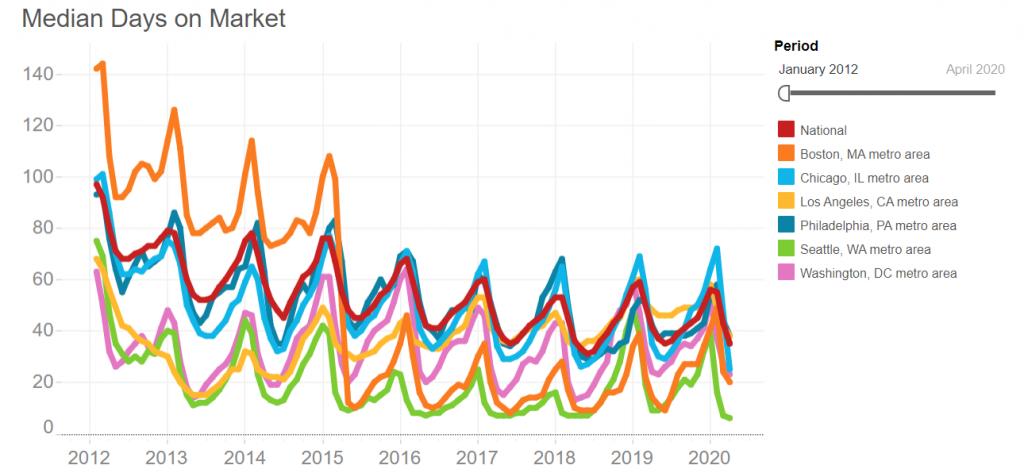

Chart 3 – Median Days on the Market

Homes are still moving in this market. If you need to buy, there isn’t much inventory so your options are limited. Based on the above chart, homes are moving fast. You would think that a global pandemic would slow housing down but not in this situation. It is a supply and demand situation – low supply is keeping prices steady at the moment.

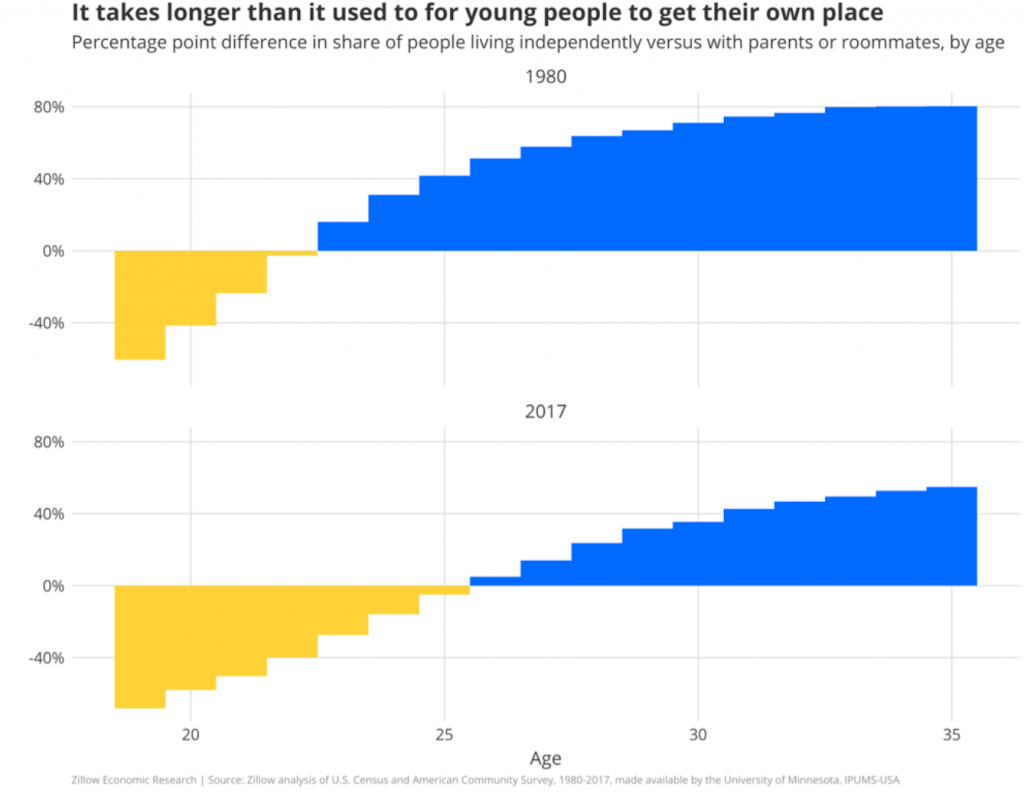

Chart 4 – Living at Home

And finally, we have younger Americans having a tougher time buying homes:

You can see that many young Americans are taking much longer to move out on their own. High rents, high home prices, and overall economic uncertainty doesn’t bode well for housing long-term. But in the short-term, you have very little inventory so those seeking to buy have to contend with what is out there. Yet once things “open up†are people going to be anxious to sell? What was a feature of a city (density, tons of people, etc.) may be a bug when it comes to a highly infectious virus. And with many baby boomers essentially in the “high risk†group, this may unlock more inventory in high density areas. You also must wonder how many older Americans want to live in nursing homes now given they are essentially the main place where Americans are catching Covid-19 and dying.

If history is any guide, the pattern seems clear here. Housing prices will come down but lag the employment situation. But this is also dependent on when things open up. As we recently discussed we have close to 5 million Americans that have stopped paying their mortgage and are now in forbearance. We will likely get a true sense of sentiment once things fully open up which doesn’t seem like it will happen until we have a vaccine or the number of infected individuals decreases dramatically.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

193 Responses to “Despite economic carnage and a raging pandemic, housing prices remain steady. 4 charts highlighting where things may go.”

CA Doesn’t Look So Dreamie- The La Jolla Light in California. “In the weeks following the state’s stay-at-home coronavirus order in March this year, some communities saw a break in the turnover of short-term rentals. Gordon and Maureen Dunfee, who have lived in the same Barber Tract home for 30 years, said short-term rentals took over their street.â€

“‘We had a beautiful neighborhood, beautiful community with kids and families,’ Gordon Dunfee said. ‘Things change, which is natural. But with the short-term rentals, things changed drastically and negatively and it became a hotel zone. We were surrounded by short-term rentals; we have no neighbors now. Every two or three days … we would have new people come in and celebrate something like a graduation, bachelor party, etc.’â€

“But during the pandemic, Maureen Dunfee said, ‘we have enjoyed peacefulness in our neighborhood. But it has also profoundly shown us that we have no more neighbors in our neighborhood. We feel alone on an island, so to speak.’â€

The Associated Press on Hawaii. “Hawaii County has processed nearly all of its short-term vacation rental applications, but it could be months before the units are allowed to operate as a result of the coronavirus. Under emergency health restrictions issued by the state, the rentals can be used only to house tenants who were already there when the restrictions went into effect or workers for essential businesses or operations, such as first responders.â€

“Vacation rental occupancy statewide was 5% in April, the first month after Democratic Gov. David Ige’s March 26 mandatory 14-day quarantine for travelers. Hotels that were allowed to remain open had an occupancy rate of 8.9%, according to data provided by the Hawaii Tourism Authority.â€

“Honolulu Mayor Kirk Caldwell estimated there are 800 legal vacation rentals on Oahu and another 8,000 operating illegally. ‘As we come back to new normal, (they) should be in resort areas and not in our neighborhoods,’ Caldwell said. Maui Mayor Mike Victorino said he would like to keep visitors in the resort areas of his county without ‘utilizing our residential facilities.’ Hotels and resorts should open first and reestablish themselves, he said.â€

“‘We have a large number of illegal vacation rentals, and many are closing them down,’ Victorino said.â€

https://www.youtube.com/watch?v=u7jFsH5QbsE

If You Just Bought in CA, You Can Always Take In Renters- From Curbed San Francisco in California. “Zumper, the San Francisco–based apartment-rental site, just released its latest rent figures and, according to CEO Anthemos Georgiades, the ‘price drops are unprecedented’ in the seven-plus years the company has published rent reports. ‘All this talk of people leaving S.F. for a future of remote work is now backed up by hard data.’â€

“Georgiades isn’t being hyperbolic. Per Zumper’s report, one-bedroom rents in S.F. fell 9.2 percent year over year in May, the largest S.F. drop ever in the history of the company’s monthly reports and the lowest price point in over three years. The average price for a one-bedroom in S.F. stands at $3,360; it was at $3,700 the same time last year.â€

“The plummeting numbers fell even further down in Silicon Valley. In Mountain View the price for a one-bedroom home dropped 15.9 percent in consecutive years in May. Menlo Park saw a 14.1 percent tumble, while Cupertino and Palo Alto saw prices plunge 14.3 percent and 10.8 percent, respectively. Georgiades says that these rent drops may be even higher than the company’s published data, ‘since some landlords conceal price drops in ‘lease specials’ like six weeks of free rent to move in.’â€

“A cursory glance on Craigslist reveals major price cuts, with landlords all but begging you to sign a lease: ‘Newly Reduced Rate’ reads the headline for a new East Cut studio offering eight free weeks, while this contemporary SoMa loft dangles ten weeks of rent-free living to interested takers. ‘I’ve never seen anybody giving that much free rent as an incentive the whole time I’ve lived here, since 2003,’ Bay Area property manager and landlord Carlos Carbajal tells KQED.â€

From Livable on California. “Median rent prices across Los Angeles continued their downward slide in May, making it the third month in a row that one- and two-bedroom rents have declined on a year-to-date basis. The city ranked as the seventh priciest rental market nationwide, according to Zumper. One-bedroom rent dropped 1.4 percent from April to May and 3.6 percent over the same period a year ago to a median price of $2,170. Two-bedroom apartment rent experienced a more modest decline, falling 0.7 percent month-over-month and 1.7 percent year-over-year to $2,980.â€

“One-bedroom rent in San Diego decreased 0.6 percent month-over-month. Two-bedrooms saw more pronounced declines, falling 2.1 percent between April and May and 1.3 percent over 2019 levels. ‘As more and more companies move into remote work, many renters don’t want to pay the big city price tag when they are unable to use the amenities and are looking for more affordable options outside of large, metropolitan areas,’ wrote the report’s author, Crystal Chen.â€

“This, combined with a record-shattering unemployment rate of 15.5 percent in April, could slow the demand in California’s urban rental markets even further, causing landlords to cut their prices or offer incentives to attract new tenants.â€

Sure is sunny out today, you can see the homeless for miles.

Are you JamesJim Posting under another name? Seems like it.

Stick a fork in it!! CA real estate is done!! 🤣🤣🤣

Good article. Yes, I agree – low inventory will make home prices very sticky even as demand will start drying up, once the waves from the drop in consumer demand starts impacting middle class and upper middle class jobs.

Remember, the corporate leadership still needs to see post COVID-19 demand for goods and services, before they budget for next year and decide they need to let go X% of workforce or not rehire X% of furloughed. Similarly, governments will also be letting go people as they start planning for the new normal, lower tax revenues and a whole lot more debt service costs.

I won’t even be looking at supply and demand stats for real estate until late 2020. Right now a few house horny optimists are hunting the very few houses on the market, so owners have few reasons to drop the prices. A lot people are still pretending that we are about to go back to normal roaring economy. I doubt that very much, although I do wish I was wrong.

I work for a midsized company in San Diego that wasn’t impacted by the shutdowns. We are working from home through at least the end of the year for 90% of the workforce. This is a cost savings measure for the company. We have reduced the amount of parking/commuter benefits we pay for, utilities, and all the office accoutrement that goes with having people come into the office. We’re also looking to start dropping commercial space as we downsize the amount of office space we need per person employed and are looking to go work from home for the majority of the company going forward. The shut down forced many companies to field test having their employees work from home and for most cases, it seems to have been successful.

This has also started some of the people I work with to start moving outside of the city (since they no longer need to commute) and, in some cases, outside of the state. We did a layoff a month ago. Annual increases have been canceled for the year and senior management took a pay cut. There have been many other cost saving measures done as well that means other companies are no longer going to be receiving revenue from us.

My company is not the only one taking these measures and we’re a company that has maintained 100% of operations during the shutdown. My friends who are small business owners have also had credit lines reduced or shut down. Buying power is disappearing from the market. You’ve got to be delusional if you think everything is going to be fine 6 months from now. The measures taken early on have managed to delay the reckoning but it’s not going to save this market.

I also don’t see the riots and pandemic lock downs helping matters and will only drive more people out of the urban areas. They no longer have to commute and their house being close to work also means their house is smaller, has less outdoor space, and is close to areas prone to urban unrest. You’re going to see a flight to the suburbs an hour or more outside of the city or even further, especially for people with families.

@ JR Yes, you are right – what the Fed and the governments are doing is just slowing down the speed with which this recession is unfolding.

Yes, lower demand for commercial real estate, addition of formerly short-term rentals to the long-term rental market, frozen pay increases, layoffs, and other cost cutting measures by corporations and large not for profits, disrupted auto-dealership industry (see prices Hertz offering on used cars), disrupted fitness industry (a lot of people including me not going back to gym for a while), disrupted education industry (3rd tier colleges will for sure have massive permanent layoffs and/or will go out of business – already in plans from my friends in leadership positions), etc.

San Diego does have some positives that I see – biotech industry will remain strong, especially since a lot of them repurposed operations to COVID-19 testing, the Federal Government jobs and defense industry will keep jugging along. So not everything is doom and gloom.

However, the headwinds to the economy that I see are just too strong and that is why I am preparing for a major recession beyond COVID-19 (was just a catalyst to expose structural economic problems).

I know the regular commenters will post some irrelevant supply and demand stats from Zillow because they are desperate to feel good about their alleged recent home purchases. 🙂 I hope they are right and I am wrong. Then I will throw in the towel and buy an “overpriced crapshack” next year. Be assured though that I will not be coming here after that to try and feel better about my decision.

Lol, talk about understatement! LA and other big cities are not just toast, they are going to be the new city states for Wakanda or whatever comes out the other side of this civil/race war. The blue states/cities will form their own nation – they’ve already taken away most of your gun rights – and those remaining will either be killed or enslaved. They’ll lay off cops, hire Antifa and muslim brotherhood instead and it will be open season on the white middle class. This isn’t my fantasy, this is what those who planned this have been writing about for years and the foot soldiers echo on social media. Just look at santa monica now: https://www.youtube.com/watch?v=yWaVREhLw_E

But everyone one wants to live there! Such great weather! Yeah, keep checking Zillow to see how rich you are while looting and violence engulf your neighborhood. Some of us tried to warn you for years but your greed blinded you to the reality that is about to crush you.

Perpetual growth with construction in high cost areas is just not sustainable long term as now with the ability to work from home appears to be the new trend and maybe new normal for future employment. Why move to different states or counties if you like living where you are but can still get a good pay with anyone that needs someone to do specific work that does not require being in front of a client or a colleague. There will be a percentage of the population that will likely never enter an office at all and means cost of everything about funding these jobs will be potentially less going forward.

The positive is more rural towns may likely see a surge in people moving away from the city establishments just to get back to normalcy.

The negative large cities will have a harder time justifying their growth numbers with less buyers needing to stay in crowded cities. In addition, surrounding towns near the epicenters will be potentially impacted as well.

All those wealthy Santa Monica liberals who claim they love diversity got a good wake up call last weekend. They love diversity as long as it is in somebody else’s neighborhood or school. I think SM is also a gun free zone, but bad guys can still own them because they don’t follow laws or rules. Let this be a lesson for the future!

Couldn’t agree more Lord B!

Limited Inventory: Homeowners learned in the housing collapse, the safest place was in a home. They can pay no mortgage for years. Can’t get that in a rental. They all know this now. If bank’s didn’t kick the can down the road historically, people may selling their properties now and fleeing to a lower cost of living. Big picture though market is way over-priced, and the silver wave of baby boomers selling in coming years does not have enough new market participants that can afford the homes that will be sold.

All of the government intervention of the last 50 or even 70 years to fix our housing market is coming home to roost. Neighborhoods are a mess ,prices are through the roof and areas become gentrified Air BnB enclaves.

I’m sure a couple more laws will fix everything.

Would you possibly have a chart that could or would potentially describe the Covid-Induced movement of urban households to lower priced (but still expensive) suburbs in California and its impact, of any, on the prices of the suburbs? I wonder if we have any speculation or data on that yet. I suppose the volume of the demand for lower priced housing has yet to be seen. But this would make an interesting addition to your collection here.

“Market remains steadyâ€

Lol

A bit of an understatement….purchase application data is 18% up YOY.

Yes, we have more people buying houses than a year ago.

Lol fuc*** lol

Sry crash boys, the big collapse has been delayed.

Maybe the reason is NO inventory and historic low interest rates…..and maybe the FED printing money like there is no tomorrow?

Have you looked at stocks lately. Gosh I should have bought more. Some companies just make an all time high….in midst of the covid recession.

This time is really different.

I would have never expected such a heated housing market. I can put my plans on hold to buy a rental anytime soon

shocking how strong the LA market still is given Covid. But lets give this 6 months, as there is no end in sight to the falling dominoes such as what San Diego CPA has alluded to that businesses are just beginning to assess the fallout and ensuing layoffs.

I am trying to encourage Snowflake to buy a house and move out of my home. Yeah, a little self interest here, and I will give him 20% for a down payment. He asked when prices will drop…..I told him “Right after you buy, just like the stock market”

QE,

Less than 4 months until election and then it will crash. People rarely live to 100+ years so rarely the economy can expand to 100+ months.

In El Segundo we have seen the failed Airbnbs show up as long term rentals on zillow. Homeowners that bet they could cover their mortgage by making 2x as a short term rental are freaking out. They are in a delusional panic asking for rents that cover their mortgage (way above market rates) because they can’t afford to only charge market rate. Not to mention if they find a long term tenant they now have a storage bill or I expect some yard sales as fully furnished homes and condos are emptied as people leave the short term rental “business”. Homes are still selling, quickly and at the usual ridiculous prices at or above $1000/sqft.

I just sold a home in Las Vegas. There is a program called Home Is Possible that lets you buy a home with no downpayment (more specifically, the downpayment is financed by a second no-interest loan that will be forgiven if you stay in the home for 2 years or something like that). In addition, you can ask a seller to pay the closing. The person who bought my home probably paid nearly nothing to buy and move into the home. The key requirement for the Home Is Possible program is a credit score of 640, so not everyone qualifies. The monthly cost, including PMI, ends up being lower than the rent. When I think about it from a risk-reward perspective, why wouldn’t you buy rather than rent? In fact, is there even a rule to prevent people who just bought from making a forbearance request and avoid paying the mortgage altogether? If you can get 1 year rent free and then wait until the home is foreclosed on, then you might be able to enjoy several years rent-free. As we witnessed in the 2005 US housing bubble, the punishment is ridiculously lenient. Wait a couple of years, rebuild your credit, and they let you to go right back and buy another house.

The data-lines lately have been absolutely terrible for our bears. It seems like posting more data is somehow not fair. I feels like dancing on someone else’s grave. They got so excited about me being able to afford to buy at the peak. A sure signs the market would crash. And now? Not even our good housing doctor is agreeing anymore that the crash is upon us. A V shape turn.

V shape in housing, v shape in stocks.

Looking to refi under 3% when the time is right. When I started my buying process I locked in the price in an environment that had high 3 to low 4% rates. Shaving off almost a % point translates into significant monthly savings.

Not Good for CA HomeDebtor, Rents dropping followed by Values, NO END INSIGHT- From Bisnow on California. “Residential rents in some Bay Area submarkets have fallen by double-digit percentages compared to the same period last year. Though the longer-term effects on the region’s multifamily market are unclear, it is possible that both lower-end Class-B and Class-C properties, as well as luxury units, end up faring worse than average, according to Strada Investment Group Vice President William Goodman.â€

“As many of the Bay Area’s residents working in tech or other remote-friendly industries have carried on work from home, its service industries have been decimated with job losses. Farther down the Peninsula, developer Anton DevCo has seen leasing slow and some tenant departures that Managing Partner and Chief Investment Officer Trisha Malone said are tied to new remote work policies in the tech industry.â€

“She said collection is nearly its normal rate, but that some of the company’s Menlo Park residents started leaving the day after Menlo Park-based Facebook announced its shift to remote work. ‘Right now, something we’re seeing in the Bay Area is the effects of Facebook’s work-from-home policy,’ she said. ‘We’re seeing an uptick in tenants who are paying the breakage to get out of leases and relocate. There’s a lot of them moving out of state.’â€

From Variety on California. “Though coronavirus chaos has hit all sectors of the economy hard, the luxury real estate market has been especially affected. Jumbo mortgages have dried up, many would-be buyers backed out of escrow, and even Jeff Bezos decided to back out of a $90 million deal to buy one of the late Paul Allen’s Beverly Hills estates. And many for-sale properties have been price-chopped or sold with big discounts.â€

“Apple’s Mike Markkula is hoping the exodus will finally sell his massive Carmel Valley estate. He’s listed the property, known locally as Rana Creek Ranch, for the third time. Now carrying an improved pricetag of $37.5 million, the estate was initially put on the market in 2013 with a sky-high and profoundly unrealistic ask of $59.95 million.â€

Home prices are sticky. Rent is fluid. The 1990-91 recession hit, home prices did not bottom out until 1996. The 2008 recession hit, home prices did not bottom out until 2011-12.

GSE backed single family mortgages can have up to 12 months of forbearance due to CV-19. Then it takes 6 months to 12 months to foreclose. That’s 18 months to 24 months of no mortgage payments due to CV-19.

Multifamily mortgages can get up to 3 months of forbearance. So rent can potentially plunge like a rock in the next 6 to 12 months.

Single family residences should see no price plunge for at least two years. Exception, people moving out of California and wanting to sell quickly.

Just like that…. regained 2.5m jobs. As people said multiple times here. Those low paying jobs can be re-hired in a minute. Still don’t believe it? Where are all the people foreseeing the Great Depression 2.0? It got quiet quickly 🙂

Just watch while my stocks skyrocket and housing pushes higher.

2.5M down. 40M to go.

They forecasted 7-8M additional unemployment and instead we gained 2.5M.

That’s a 10M miss to forecast! Let’s go! The recovery has started.

And how much of the jobs gains are from the PPP (Paycheck Protection Program)? I would like to see 3rd and 4th quarter jobs report before throwing rocks inside a glass house!

Businesses were forced to rehire in order to get their PPP loans forgiven (have to spend 75% or more on payroll). Unless you think there was some organic growth of the economy in May? Lol please. The government is simply delaying the inevitable contraction that was coming even before C19.

Once PPP funds dry up, and Q2 earnings show a huge dip – the stock market will crash again. Unemployment will go up. And housing will finally see it’s correction. I don’t think it will be 50% to 70% like you predicted for so many years, but it will likely still be in the 25% to 40% range. Unless unemployment lingers for 3+ years, then the housing dip may very well test your previous predictions.

But hey, you keep coming back here with your cheer-leading if it makes you feel better!

So Q3/Q4 will See a correction in housing?? Is that 2020 or 2022?

I can almost say with certainty it CANT be 2020. Purchase applications (up 18% YoY) are a forward looking indicator. Extremely low inventory and extremely low rates mean prices will go up.

Where do you live? Are you trying to buy your first house or what? With good credit and 20% DP you can easily Get 3%-3.25% for 30y. Your payment already went down significantly. How much do you need it to go down in order to afford to buy?

In 2008 you had 115k active listings in SoCal.

A month ago we had 31k and now 30k.

It’s going in the WRONG direction. You need more inventory not less.

You are betting against the US money printer and lost out on this buying opportunity. Now you are predicting a 25-40% haircut in housing. There’s no way we see this anytime soon. prices will actually go up.

If you believe a stock market crash in July during earnings season then get ready to short stocks. You will make a fortune if you are right.

“As people said multiple times here. Those low paying jobs can be re-hired in a minute”

That is true, in this Trump economy, there are masses of people who are waiting to be hired at minimum wage as dishwashers, burger flippers, receptionists, etc.

As everything re-opens, millions will be hired back Likely at a pay decrease due to the generous unemployment.

They aren’t buying houses at minimum wage and never were.

The people buying houses have been fully employed during this time working from home. They were not roaming the streets looking at open houses. Now they are emerging.

A friend put a house on the market in Colorado. On the first day, they had a full-price offer and an offer with 7K over with some contingencies. IMHO, the house was priced at about the comps in January so it was priced about right. Tract homes are easy to find comps when thousands have the same floorplan. The house was vacant so both buyer and seller had no Covid fears. The inventory is low.

add essential healthcare workers such as CNAs and LVNs to your list of min wage workers who were never going to buy a house and are getting more on UI and can be rehired in a minute or what not. What will our economy do when our essential healthcare workers are in the same shoes as the burger flippers?

nurse,

Here is a link for LVN salaries locally:

https://www.salary.com/research/salary/listing/lvn-salary/los-angeles-ca

And here is a link for fast food cooks:

https://www.salary.com/research/salary/benchmark/fast-food-cook-salary/los-angeles-ca

Why post that LVNs are in the same order of salary as fast food cooks when a simple search would show you that they make over double the salary? You can live on $50K but God help the schmo who makes $25K.

Unfortunately, at 25K or 50K, neither can buy a house in S. CA.

Yes, but a married couple both working as LVNs could afford a house in some areas around here (or at least a condo). A couple working in the fast food industry below management level wouldn’t have a prayer.

Do I hear Dow 27K! Thank you rich uncle Fed. Just 60 days ago, the world was going to end and stock market has gone up 50% since. Anybody still here who thinks they can outsmart or outlast the Fed. Forget about it, the Fed holds ALL the cards. The Fed is a speeding freight train and you are a penny on the track.

Anecdotal evidence is that housing in desirable coastal CA is red hot. A house went into escrow the first day. An acquaintance of mine recently tried to buy a home (no competition right), try eleven other offers. To think you will get fire sale prices in desirable coastal CA ain’t gonna happen. And 2.X rates are on the way!

Lord B.

If I keep borrowing, I can last a long time also. I dream of borrowing trillions to buy what I want.

Then I wake up and realize, I will owe it all back.

However, when I die, my heirs will not be responsible for my reckless borrowing.

Will the heirs to the current US debt be responsible for 10’s of trillions of reckless borrowing? Likely not if the US dies.

I was wrong. I expected all time highs in Q4. Looks like we will see that in Q3.

Oh well, buy buy buy. Stocks are skyrocketing.

Poor Poor CA – San Ramon, CA Housing Prices Crater 15% YOY As Bay Area Rental Rates Plummet

https://www.zillow.com/san-ramon-ca-94582/home-values/

*Select price from dropdown menu on first chart

As a noted economist stated, “If you have to borrow for 15 or 30 years, you can’t afford it nor is it affordable.â€

A House in my friends neighborhood had a “coming soon†sign.

They Tried to contact the neighbor but they had already moved. Sign disappeared and now it shows as sold. It sold within 2 days of the sign going up (“coming soonâ€.

Gathering more detail as I cannot believe it.

Other than that I barely see any existing houses for sale in my neighborhood. The new construction buildings in my community are selling like hot cakes

A recent news segment talked about Boomer wealth transfer to Millennials. The dollar amount was staggering – 38 trillion. The transfer is happening via gifts and wills. This will help keep demand going as Millennials are itching for space and homeownership. Thought it was especially appropriate to share as we have anecdotal proof of this on the blog!

A recent news segment talked about Boomer wealth transfer to Millennials. The dollar amount was staggering – 38 trillion.

That’s good. Because according to Wikipedia, the national debt currently stands at nearly $25 trillion: https://en.wikipedia.org/wiki/National_debt_of_the_United_States

As of May 1, 2020 federal debt held by the public was $19.05 trillion and intragovernmental holdings were $5.9 trillion, for a total national debt of $24.95 trillion.

And that does not include unfunded liabilities, which, together with the national debt, comes to $62 trillion.

Adding this to the national debt and other federal obligations would bring total obligations to nearly $62 trillion.

And this still does not include the debt or unfunded liabilities (e.g., employee health & pension benefits) of state and local governments.

All federal, state, and local government debts and liabilities should easily come to over $100 trillion. And these debts and liabilities will only continue to increase exponentially as Millennials reach retirement.

Finally, there are many poor Boomers out there, so a whole lot of Millennials will inherit nothing. These Millennial Have-Nots will deeply resent the Millennial Haves, and will demand ever higher taxes, to fund ever more entitlements. Either that, or they’ll burn down the cities.

These current riots are but a practice run for what our Milli can expect before he even reaches 50. Hell, maybe before he’s even 40.

The looting will soon stop. Unleash the national guard.

Btw if the looters decide to come to my neighborhood I will greet them with my friend Remington.

You got to have home protection and I thought I’d start with a shotgun 🙂

M: The looting will soon stop. Unleash the national guard.

Trump wanted to bring out the Army, but the Deep State generals refused his orders — ignoring that Trump is Commander in Chief. As for the Guard, they’re unarmed, and the rioters know it, so unleashing the Guard does no good. The Deep State sent a signal, rioters welcome!

M: Btw if the looters decide to come to my neighborhood I will greet them with my friend Remington.

That’s nice. Some store owners tried that. They were arrested by police for brandishing a firearm, and face felony assault charges. Meanwhile, looters who are caught in California are arrested — then released with a citation.

Your guns won’t protect you if the legal system isn’t on your side.

You have a choice. Stand aside and be looted. Or resist and go to prison.

When I stop posting you know I’m sitting in prison for shooting at looters.

Hey Doc, I’m glad you finally defrosted from perma-bear to aware. I’ve been saying this for YEARS. This is a NEW AGE in ownership. Serfdom here we come! Look at the macro picture I’m talking over centuries and it’s sure to come. We can always look at recent history and draw conclusions but it’s quite misleading. I’m not saying this time is different I’m saying it’s the same thing thru centuries of human existence.

YUP- Real Estate is a BAD Investment- Why buy a house when you can rent one for half the monthly cost? Buy it later after prices crater for 70% less.

Seattle, WA Housing Prices Crater 13% YOY As Demand Plummets On Skyrocketing Inventory

https://www.zillow.com/seattle-wa-98102/home-values/

*Select price from dropdown menu on first chart

As a leading economist advises, “Mortgage debt is the most toxic and damaging debt of all. Avoid it at all costs.â€

The “peaceful protesters” are coming to Idaho: https://www.politico.com/news/2020/06/06/protests-after-floyds-death-reach-rural-america-303892

In Boise, thousands of people attended a peaceful vigil this week honoring Floyd, the black Minnesota man who died after a white police officer pinned his neck for almost nine minutes, and others who lost their lives to police abuse. Demonstrations after the Tuesday evening vigil lasted until 2:30 a.m. for the third day in a row. …

Demonstrations of more than 50 people in Sand Point, Idaho Falls, Ketchum and Twin Falls have also taken place over the last four days in the conservative state. Ketchum, with a population of about 2,000, and Twin Falls the with 86,000, saw up to hundreds of people gather to march, block traffic and mourn Floyd.

Even Flyover’s beloved Sandpoint, ID is not being left alone.

SOL, I grew up under tyranny where protests of any kind were not allowed. I don’t mind if people protest peacefully; I cherish that right guaranteed by the Constitution. You can never have a society where all people think the same. As long as loonies don’t have the power to impose their lunacy on others, as long as loonies are not in power, then all is good. Crazy people can be found anywhere; what counts is the percentage and if they are in power or not.

I don’t agree with rioters and looters – that should never be tolerated in any civilized society. I have a problem when cities are talking about defunding the police department. Without police, why do you have laws and judges?!?….Without laws you have Mogadishu.

I did not hear about any looting or riots in Idaho. If that happens in the near future, it will be in Boise which is under a continuous process of Californication. Many who move from CA continue with the same bad habits expecting different results. Eventually they get what they run from. That is why I told Karin to stay out of Ada County. Big cities attract lots of loonies and crazies. Seeing 50 people who protest peacefully because they watched too much CNN, is OK. There are some people relocated from Seattle in both, Sandpoint and CDA. They will continue voting Democrat, but they are a minority and they will continue to be a minority for the foreseeable future.

I don’t agree with police brutality when there is no point in what they are doing. Most reasonable people are on the same page with that. However, going to the other extreme of defunding the police department is a different type of crazy. Jumping from one ditch into the other ditch does not mean you are not still in a ditch. For everything it should be common sense which is not so common these days. In WA the rioters and looters destroyed lots of malls and businesses while the police had orders not to interfere and the politicians were encouraging the rioters and looters. In ID, the politicians encouraged the population to use open carry guns and protect private and public property. That is the difference. Regardless of how liberal or democrat someone is, everybody saw in the past week that police does not interfere and if people do not protect themselves and their property nobody will. How many black and other minority businesses were destroyed this past week? How many black police officers and how many hundreds of black people were killed just in the last year in one city – Chicago? Does the media says anything? Do those black lives matter? Apparently they don’t matter to the MSM because they do not serve their agenda. They always single out when a black person is killed by a white police officer and they run away with it. If thousands of blacks are killed by other blacks, it is not news worthy and they don’t publish anything regardless of the number of deaths. If a black police officer is killed by other blacks, they do not consider that newsworthy. What they want, is to leave the cities with black people with no police (defense), no stores and no businesses to create employment. They want to keep all poor and dependent on Democrat plantation.

In Minnesota, the governor is democrat, the mayor of Minneapolis is democrat and everyone there was democrat for a long time. They hired the chief of police responsible with the training and hiring of police officers. Why are people protesting against the occupant of the White House instead of protesting against those in MN responsible with all of the above?!? All this mayhem is organized and instigated with very evil purposes, but that is another subject for another time.

In the previous thread I stated on May 30th:

“My guess is that the police union has protected this bully for years. And the DFL may love Black folks but loves public employee unions more.”

Diversity in the Minneapolis City Council is having one Green Party member on it. Oddly, that person might just be the only one not beholden to public employee unions. It can take years to get rid of bad cops like one in Sandusky Co. Ohio:

https://www.thenews-messenger.com/story/news/crime/2018/09/13/oconnell-sentenced-two-years-prison/1281907002/

Flyover: I did not hear about any looting or riots in Idaho. … Seeing 50 people who protest peacefully because they watched too much CNN, is OK.

The problem is, the Deep State and its agents (e.g., Antifa, BLM) have Sandpoint and CDA on their radar. These are test protests. How far people can be pushed in this city, how far in that city? How much are people willing to take?

The Deep State is collecting intelligence, taking note where the soft spots are, and what areas of the country need further diversity and refugee settlements before they’re ripe for revolution.

The Deep State has Northern Idaho on its radar. It won’t be left alone. The protestors and activists will be back someday, in greater numbers, with greater resources.

The FBI is kneeling to BLM/Antifa protesters: https://theconservativetreehouse.com/2020/06/07/fbi-pledges-allegiance-to-black-lives-matter-antifa-nation-of-islam-and-new-black-panthers-protesters/

And yet Trump expects the FBI to investigate Antifa as a terrorist group?

Flyover,

We all agree looting should be punished severely. So should murder done by suffocating a person while kneeling on their neck. You can’t say all police officers are doing this just like you can’t say protestors are all looters.

“Why are people protesting against the occupant of the White House”

This one is easy. If you believe in the Constitution and First Amendment Freedom of Speech why are you asking this question? Trump/Stalin sent his troops into a peaceful First Amendment assembly in a park and dispersed them with pepper spray and rubber bullets. Are you Anti-Constitution now? Do you believe Stalin tactics are justified? You are losing credibility. The ACLU is bringing a lawsuit based on a thousand witnesses. Why would a sane President do this?

Also, as I have said multiple time before, people are protesting because they are part of the 99% who work for minimum wage and are very similar to the serfs under the Tsar who eventually took matters into their own hands. The Illuminati should do something about this before it is too late. Good thing we have elections and can vote in a Democratic Socialist like FDR again.

Flyover – been reading and agreeing with your insightful and well-informed posts for a long time. Keep up the good work.

Watched the youtube video referenced by Erika regarding the rioting in Santa Monica. Utterly disgusting. California was once a wonderful place, then the people started arriving.

Bob: people are protesting because they are part of the 99% who work for minimum wage and are very similar to the serfs under the Tsar who eventually took matters into their own hands.

Alexander II freed the serfs in 1861.

Thus, serfdom had already been abolished for 56 years before the 1917 Bolshevik Revolution.

Seen it All before Bob, pretends he didn’t understand my post in order to create a straw man argument. Please read it slow and careful! You will not notice my total support for peaceful protests.

My point was that I didn’t see the people protesting against those in Minnesota were the murder occurred. It was not Trump who elected the socialists democrat governor, it was not Trump who elected the socialists democrat Mayor of Minneapolis, it was not Trump who hired the socialists democrat chief of police and it was not Trump who hired or trained the criminal police officer. It was a democrat issue from the top to the bottom and it has been a democrat issue in Minnesota for a very long time. It is a state and city issue.

Those protesting today are the same people who elected those illustrious leaders and put them in power. You are free to choose, but you are not free to choose the consequences.

The future of Minneapolis is the same as other former prosperous cities like Baltimore, Detroit, Chicago and others. Those same illustrious socialist democrats from Minneapolis now they came up with something smart again – no city police. I am sure all the property values in Minneapolis will increase and all employers will want to do business in the city. When the city will look like Mogadishu, at fault (like always) will be Trump and those evil republicans the MSM is accusing; it is so predictable with the socialist democrats. When you elect socialist democrat leaders brought from Somalia (see Omar), then expect that your city is going to look like Mogadishu. Of course, you don’t need too much brain to connect the dots of cause and effect.

If you want to eliminate the politics from the comments, then focus on the FED who created the wealth inequality.

Regardless of who or what is behind the looting, riots, and protests, I think the underclass is sick and tired of the gross inequity between rich and poor in this country, as well as the three-tier legal system (one for the ultra-wealthy/elite, one for police, and another for everyone else). So even though some or many of these events may have been organized with nefarious intentions in mind, there is a clear motivation for people to participate in them. I don’t think there would have been many eager participants if not for the current degree of societal inequity. I don’t have the answers, nor do I pretend to. But I do see the problem. I believe the problem is cause by both sides of the aisle, including allowing so many manufacturing jobs to move overseas resulting in a job dichotomy of sorts (many low end service jobs, many high tech jobs, but not much in between), excessive corporate welfare and cheap money which only makes the rich richer, the list goes on and on.

I think criminal conduct by police can be mitigated to a significant degree by the following:

-Abolish qualified immunity so that police are personally accountable for their actions in civil court, just like every other member of the public

-Separate the cozy relationship between judicial, prosecutorial, and policing entities so that none have an incentive to cover each other’s back

-Eliminate useless police (most traffic enforcement, enforcement of victimless crimes, and general patrols which generally results in harassment and very little positive effect on crime overall); police need to focus on violent crime, not handing out $600 traffic tickets for rolling through a stop sign or attending to drug overdose situations and throwing a person in jail who needs medical and psychological treatment

Flyover,

I responded exactly to your post. Perhaps you didn’t understand why they are protesting against Trump?

Trump sent his Stasi through a public park with with rubber bullets and pepper spray to disrupt a peaceful First Amendment protest. Just so he could get a photo op. This is a criminal act and Trump should be prosecuted. It is a tactic Stalin used. You are defending this?? Wow! I thought you were anti-Stalin?

Responder is replying with mostly what I believe: Thank you!

-Abolish qualified immunity so that police are personally accountable for their actions in civil court, just like every other member of the public

Yes! The police should not be immune to the responsibility for their actions. Nobody should. Especially our President Trump.

-Separate the cozy relationship between judicial, prosecutorial, and policing entities so that none have an incentive to cover each other’s back

They are all in the Executive Branch and appointed by someone in the Executive Branch. Cronyism is happening and should be stopped. Flyover and I hate cronyism so he should agree.

-Eliminate useless police (most traffic enforcement, enforcement of victimless crimes, and general patrols which generally results in harassment and very little positive effect on crime overall); police need to focus on violent crime, not handing out $600 traffic tickets for rolling through a stop sign or attending to drug overdose situations and throwing a person in jail who needs medical and psychological treatment

The entire Defund Police movement is mostly driven by a desire for Community based policing. When Bank of America burned in 1970 in Isla Vista CA near UCSB during protests, the Sheriff’s department founded a foot patrol with community interaction. No more banks were burned during that time before the end of the Vietnam war. It worked. More of this needs to happen for multiple reasons.

1) The police should tied closer to the community. The police are hired within the community.

2) China utilized external police very effectively to quash Tianammen Square protests. Rural police “rednecks” were brought in to shoot and kill the city protestors. We should not let this happen in the US.

As far as traffic citations, we need to enforce laws. I have seen people driving 120 MPH drunk on the interstate which later resulted in an entire family being killed by an idiot. We need traffic enforcement. However, we should not rely on funding for the police to be driven by 5 MPH-over $400 speeding tickets. This leads to abuse.

People who have an addiction to drugs should not be thrown in jail. They should be provided help.

Flyover~

You were so right about Ada County. Thank you for the head’s up:

https://www.idahostatesman.com/opinion/editorials/article243057911.html

Sex education for pre-K students? Free abortions, eliminating juvenile detention centers, developing green infrastructure, etc. If this is creeping into Idaho, pretty soon there will be no place to run.

As for BLM and Antifa, the lower day to day operations are run primarily by upper middle class white people. Notice how black businesses are burned down even when their owners stand in front begging the protesters not to do it. And yes, there is a much bigger agenda, that you know about as well. The coronavirus lockdown and BLM looting was just the intro. People will look back on these days as the manageable part.

Btw, Flyover, are you familiar with the Deagel Report?

son of a landlord~

I agree about the Deep State having Idaho on its target list. Particularly when I saw militia lined up on the streets of Couer d’Alene during the BLM lootings. They will not let that stand.

Also, they are always beta-testing to see how far they can push the public. That’s what the 2009 H1N1 scare was all about. America pushed back that time. But not much any more.

Bob: Trump sent his Stasi through a public park with with rubber bullets and pepper spray to disrupt a peaceful First Amendment protest. Just so he could get a photo op.

Police in the Uber-Progessive city of Santa Monica used tear gas on “largely peaceful” protesters. The protesters even claim that rubber bullets were used, though I can’t confirm that from a reputable source.

https://www.youtube.com/watch?v=s8q0rcKq4C4

https://www.youtube.com/watch?v=-u9JBdge0Dw

https://pagesix.com/2020/06/01/madison-beer-says-she-was-tear-gassed-at-santa-monica-protest/

https://www.latimes.com/california/story/2020-06-05/santa-monica-mayor-and-police-chief-face-anger-from-protesters-you-called-in-the-national-guard

If Trump is guilty of sending the “Stasi,” so is Santa Monica’s police chief and mayor.

BTW, Antifa is decades old organization. Many of their German members went on to work for the Stasi after the Soviets set up the East German government.

https://en.wikipedia.org/wiki/Antifa_(Germany) – in East Germany the Antifa groups were absorbed into the new Stalinist state.

Ketchum is full of spoiled, bored rich kids so….protesting was something cool they could post on social media.

In the previous thread, I mentioned a house in my neighborhood that was going up for sale. I mentioned that it sold the weekend it first came on the market to a family with young children. The street is a cul de sac, and that was a big selling point. Now I’m hearing that someone we know wants to sell their large 2 story house on a through street (not a major thoroughfare) and move further out into the Orange Co suburbs to a house on a cul de sac. They also have small children. As millennials’ kids get old enough to play in traffic, we may see a rush to the quiet suburbs with lots of houses on cul de sacs. I’m not planning on moving out of my place a cul de sac. But values may be going up even more if more people with kids flee to the suburbs due to urban disintegration and want houses like mine.

Bidding wars are back…..

I guess I can stick a fork in it.

I Won’t be able to get a good deal on a rental unless I find a fixer upper without competition.

The Cesspool CA is Toast, Stick a Fork in it, IT’S OVER – A report from the Sonoma County Gazette in California. “Some communities have established Vacation Rentals by Owner (VRBO) Exclusion Zones to keep housing and their neighborhoods protected from commercial use of residential homes, while others have tried and failed to to establish Exclusion Zones. It’s a complicated process, requires entire neighborhood agreement, and costs fees many cannot afford. In Sonoma and Marin Counties, some residential neighborhoods have more VRBOs than residents.â€

The Los Angeles Times in California. “The average asking rent for an apartment in Los Angeles County fell last month from a year earlier, according to RealPage. The 3.3% decrease to an average of $2,254 for units of all sizes followed a 0.8% drop in April and reflects how the coronavirus-related economic downturn is sweeping through the rental housing market.â€

“Some landlords and property managers said they’re giving concessions such as a month of free rent or dropping their asking price to get units filled as concern over the economy grows. According to RealPage’s data, the last time rents declined was in 2010 in the wake of the Great Recession. ‘We’ve had a big dropoff in overall demand,’ Greg Willett, the company’s chief economist, said, citing the coronavirus.â€

“In addition, RealPage’s numbers cover professionally managed apartments and thus leave out many mom-and-pop landlords who charge lower rent. The RealPage data showed declines were focused on the middle and high end of the market. As president of property management firm Eberly Co., Chuck Eberly manages about 2,700 units in the Los Angeles area across the market spectrum, from high-end properties to working-class apartments.â€

“Eberly said he’s had to offer a couple of weeks of free rent and in some cases dropped rent outright, mostly for his more expensive properties. Although he called the rent declines ‘small adjustments,’ he expects he’ll be forced to make more cuts down the road. ‘I see a lot of product right now and just not a lot of lookers,’ he said.â€

From 6 Sq Ft in New York. “The summer months are typically the busiest when it comes to real estate in New York City, especially the rental market. But with the city still not out of the woods of the coronavirus crisis, and with so many facing job and financial uncertainty, the idea of signing or renewing a lease becomes increasingly complicated.â€

“It’s also important to note that rental listings are in high supply right now, so by many accounts, it’s a renters’ market. As was previously reported, ‘Listings website CityRealty saw 7,793 rental listings in early January. Buy mid-April that number had grown to 8,244 and as of May 15, it was 10,641.’ However, as Douglas Elliman agent Eleonora Srugo noted in a recent email, this could all change come the fall: ‘The seasonal rental market has been impacted by the pandemic with large discounts and incentives being offered on all new leases.’â€

The Wall Street Journal. “Greystar Real Estate Partners LLC said it is acquiring a business that manages nearly 130,000 housing units, a deal that extends Greystar’s position as the country’s largest operator of rental apartments. The Charleston, S.C.-based firm is buying the business from Alliance Residential Co., the country’s fourth-largest apartment manager.â€

“‘This is how consolidation is happening in this industry,’ Greystar Chief Executive Bob Faith said. ‘A lot of real-estate owners that own and manage their properties look up one day and say, ‘I’m not making a lot of money [at management]. I’m going to give it to Greystar.’â€

The Real Estate Journals. “Just look at the most expensive rental market in the United States, San Francisco. Zumper reported that one-bedroom rents in San Francisco are down 9.2 percent this June when compared to the same month a year earlier. That median monthly rent is still high at $3,360. But that figure is the lowest median rent for one-bedroom apartments in this city since March of 2017.The next three most expensive rental markets in the country — New York City, Boston and San Jose — also saw one-bedroom median rents fall on a year-over-year basis.â€

“In the Midwest, Milwaukee saw a big drop in its median one-bedroom rent, falling 4.7 percent on a year-over-year basis to $1,010. Chicago, not surprisingly, ranked as the most expensive Midwest rental market, with the median one-bedroom rent coming in at $1,510 in June and the median two-bedroom rent hitting $1,810. The one-bedroom rent was down 3.8 percent from a year earlier, while two-bedroom median rents in Chicago were down 4.6 percent.â€

From Mortgage Professional America. “According to a new report by Lease Lock, first day rent payments in June saw a 2% drop in total rent collected compared to May and April, and a 6% drop compared to the pre-COVID average. ‘This decline is a foreshadowing of what’s to come if we don’t see some more government intervention,’ said Rochelle Bailis, vice president of marketing at LeaseLock. ‘This issue will progress without more comprehensive relief.’â€

“According to the report, rent payments at Class C properties continue to decrease, which Bailis warns could trigger a ripple effect. Traditionally, Class C properties house working class residents, who were more greatly impacted by recent service industry lay-offs and after slipping downward for the last two months, Class C properties saw another 3% drop in first-of-the-month rent payments.â€

“‘When service workers get laid off, the industry suffers and executives begin losing their jobs as well, affecting Class B and Class A residents as well,’ she said. ‘If renters can’t pay their rent, then owners can’t pay their mortgage, that affects the banks and that’s really what the multifamily industry is trying to stop. We are trying to prevent those dominoes from falling.’â€

From Multi-Housing News. “With June’s rent payments now due, a voice in the wilderness is questioning whether statistics showing how many residents made their April and May rents are accurate—or if this month’s numbers will be, too. Jonas Bordo, the founder of Dwellsy, a 15-month-old rental search engine, doesn’t think so. Bordo bases his claim on an admittedly random, unscientific poll he took on May 21 and 22 in which he asked renters on Twitter if they will have difficulty paying their rents this month.â€

“More than 4,600 responded. ‘I was shocked,’ Bordo said in a phone interview. ‘It clearly caught people’s attention.’ More stunning, perhaps, is that less than half—48.5 percent—said they were not confident they’d be able to meet their June obligations. That compares to the 87.7 percent who paid their rent in May, according to the National Multi-Housing Council, and the 89.9 percent NMHC says paid in May 2019.â€

“Bordo decided to query renters because he couldn’t square the fact that 38 million people are out of work and that 39 percent of all households don’t have $400 on hand to cover an emergency with the NMHC’s rental figures. ‘How on earth is it possible that more than 38 million Americans, many of whom had little to no emergency funds, all lost their jobs and were still able to pay their rent?’ he wondered.â€

“The Dwellsy founder doesn’t doubt the NMHC’s figures. But he doesn’t believe they tell the entire story. He supposes that because of the way they are sourced—from five property management software companies that serve the largest management companies, Bordo says—they are skewed toward luxury properties.â€

“‘The apartment communities that those property managers operate are overwhelmingly higher-end properties,’ he said. ‘As a result, this data is representative of the more affluent end of the market, where apartment dwellers are far more likely to be working from home than unemployed.’â€

“What the database does not include are the millions of rentals owned and operated by Mom and Pop investors who don’t use sophisticated software. Bordo pointed out that according to the Department of Housing and Urban Development, 75 percent or so of the U.S. rental market is comprised of properties owned by individual investors who only have just one to four units.â€

The Houston Chronicle in Texas. “In May, 7.15 percent of commercial mortgages that had been bundled into securities were at least 30 days delinquent, up 481 basis points from the month before, according to securities data company Trepp. That’s the biggest month-over-month increase Trepp has recorded since it began tracking the metric during the Great Recession in 2009. Another 7.6 percent of commercial mortgages that back securities missed May payments, but were less than 30 days delinquent. Even more are in forbearance.â€

“‘Everybody who invests in commercial real estate has felt the pinch in one way or another,’ said Manus Clancy, senior managing director at Trepp. ‘Texas has a double whammy of COVID and the oil and gas issue, where the price of oil dropped so sharply that firms in Houston are pulling back in terms of their space needs and the number of employees.’â€

“Commercial real estate investors are confronting issues similar to those faced by investors in residential real estate in the years leading up to the housing bust of more than a decade ago. As with homes, most commercial properties are purchased with mortgages, which are then bundled into securities and sold to investors, whose returns depend on property owners making their monthly payments.â€

“Cash-strapped commercial tenants are missing lease payments and their landlords missing mortgage payments, undermining the value of the mortgage-backed securities. If the debt goes bad, it could blow a hole in the balance sheets of investors, dry up the capital needed to revive the commercial real estate market and hurt the returns of institutions, such as pension funds, on which millions of Americans depend.â€

“The most heavily hit sector, according to Trepp data, was lodging. Nearly 20 percent of hotel loans packaged into securities were at least 30 days delinquent as of May, and Clancy said he expected that number to rise in June. Lodging was followed by retail, which had a 10 percent delinquency rate, multifamily with 3.3 percent and office with 2.4 percent. In February, before the pandemic became strongly felt in the United States, the overall delinquency rate for commercial mortgage-backed securities was 2.04 percent.â€

“Investors who own commercial mortgage-backed securities have seen the value of their holdings fall. Banks that had agreed, pre-COVID, to make commercial loans that would be packaged into securities and sold to investors are facing significant losses.â€

“For example, JPMorgan Chase & Co., Credit Suise Group AG and Macquarie Group Ltd. agreed to lend more than $7 billion to Eldorado Resorts, a casino business, before the need to social distance, according to a Bloomberg report. The sudden change in the company’s financial stability made it difficult to find investors who were willing to take the debt off of the banks’ hands, meaning they may have to offer the debt at a discount or even come up with the cash themselves.â€

Translation = things are a lot worser than the industry is admitting.

JamesJim, why do you post such long pieces?

And why did you change your name?

I think he cuts & pastes entire articles from HousingBubble.blog.

Next the bulls will tell us that rising mortgage interest rates are good for housing prices lol.

https://www.ccn.com/dow-surging-awful-news-for-housing-market/

Bawahahahaha have you actually ready your article!

“ The average interest on a 30-year mortgage was 3.18% this week, up from 3.15% a week ago, according to a report released Thursday by mortgage buyer Freddie Mac.â€

That is the most desperate attempt I have ever seen or read to fool people into thinking that historic low rates at 3.18% is somehow decreasing demand.

It’s pathetic

Zillow economist Matthew Speakman said:

“After Treasury yields rose in recent days in response to some favorable reports on the labor market, service sector and factory orders, mortgage rates did the same. As reports continue to emerge that show the economy may be beginning a modest recovery, suddenly there appears to be upward pressure on bond yields, and thus mortgage rates.

It’s going to be ugly. Today is the first time since the Covid-19 market reaction settled down in March that interest rates truly have a reason to panic. Until further notice, this looks like liftoff. Things can change, but until and unless they do, you have to treat last week’s all-time low rates as the bottom of the market.”

Have not read a housing blog since I sold my home in Valencia, 10/2005. I found the last fool, he worked for Countrywide…He sold at a loss in 2018. I rented around SoCal for 10 years after that and then moved out of state and bought in 2015.. Everything is so much cheaper and easier. I see some of the same comments, everything is great, blah blah, I was reading before I sold. It will be worse this time..

Inventory in 2007/2008 in SoCal: 115k active listings

Inventory in May 2020 in SoCal: 30k active listings

Interest rates right now: 3-3.25% for a 30y Fix

Rates in 2008 were like 5-6%?

Back then you had NINJA loans. I recently bought and they required a ton of documents (paystubs, credit score, Origin of large down payment).

In my neighborhood (new construction) are many well paid professionals (doctors, executives, vp’s etc) do you think they give a crap if the market goes down or up?

Most of them can work from home. I haven’t seen one laid off waiter or stewardess who bought a house lately. Sry but some people will remain renters for a looong time.

And just like that, the nasdaq made an all time high.

I predict we will see Mr Landlords comeback in the very near future.

Poster realist should have listend to me and bought stocks. He could have made a pretty penny with this monster rally. My 401k recovered and is higher than right before covid. What a giant buying opportunity this was. I am glad I bought stocks in March and April but man do I wish I would have bought much more.

Remember when people here were predicting we won’t open the country until 2021?

Remember when they called the Great Depression 2.0?

Remember the housing market was supposed to crash in the second half of the year?

And Just like that…. the mega bears have disappeared again.

Yeah, I remember. I am still making that prediction, because the fundamentals still point in the direction of a severe recession. I could still be right, but of course I don’t know what will happen, so I could also be wrong. If I knew the future, I would not need to try and save money on my house purchase.

That leads me to point out the really annoying thing about your posts. You act like you know it all in a very smug, self-congratulating way, a true investment guru, who only was able to buy a house after inheriting money. But the things you post indicate that you are just guessing and making uninformed bets, and, moreover, you mostly just try to justify your ALLEGED actions in hindsight. In fact, I think half of sh!t you say you bought or sold is made up. I think you are a compulsive internet liar.

Good post, San Diego CPA. I’m really not sure what m’s deal is. It’s very strange, to put it mildly.

I, like you, am thinking there will be a recession because all signs point to one. Every market top ever has ended with the exact irrational exuberance that we’re seeing now.

As a cpa you should have known better. Don’t fight the fed. Don’t bet against the us money printer!

But don’t beat yourself up. There will be more buying opportunity in the next 5-10 years

Just remember, buy the dip in stocks. Also it’s always a good idea to buy RE as a place to live in. Don’t try to be a market timer. Have cash on the sidelines

It worked well for me

He’s just a troll.

😄 couldn’t agree more

Lol couldn’t agree more

M, I am a real estate bear and I am still posting here occasionally. I just sold my investment property in Portland, OR for $367,000 which was slightly befow its asking price. It really appreciated since I paid $150,000 for it in 2004. I have decided to pay my capital gains taxes rather than try to make an exchange–unless home prices suddenly start to fall soon. That means that I am expecting to see a large drop in home prices in coming years–greater that the $45,000 or so I expect to pay in capital gain taxes.

I think M is making very valid arguments. They are the same arguments Mr Landlord used for the last few years for a perpetual Bull Everything Market. M’s arguments are just a 180 turn from his alter-ego, Our Millennial. I find this amusing. It keeps the conversations going.

It could be worse. He could be saying the Illuminati with the Rothschilds have teamed up with the Lizard People to forma a sinister cabal and are controlling our brain waves with Sonic Screwdrivers while either intentionally killing us all with Covid OR possibly Covid doesn’t really exist since they control the MSM.

I wouldn’t know how to respond to that. That’s what I like about this blog compared to Zero Hedge.

Back to the point.

The Fed has promised to do ANYTHING to keep asset prices high. Negative Interest rates?

I am getting calls offering sub 3% 30 year loans and low 2% 15 year loans. These are still high compared to some other countries (Europe and Japan). This will stabilize housing prices

They also have to keep the 401K/IRA pensions inflated or there will be pitchforks (or worse).

Also, Cronies will be upset if assets drop too much.

Finally, based on history, the Spanish Flu pandemic in 1918/1919 killed 600K+ US citizens. Given the population then, even more horrific than Covid. Same economic business shutdowns during that time as now.

By 1921, the virus was magically gone or herd immunity developed. That was without a vaccine, antibiotics, respirators, etc.

I think we will have a rough 2 years with massive instability. Another Covid spike will happen just like when the cities reopened too early in 1918. Businesses will be shut down again and the stock market will re-plunge. The weak businesses will die. That’s my worst case if we don’t have a vaccine.

The housing market has a low-pass filter so I don’t think we will see that kind of instability but may drop 20%

After 2 years, we will recover and have another Roaring 20’s just like what happened in 1921.

2 years is a short time to own any investment. Especially a house.

Oh, Dear, Real Estate is Toast, Numbers Don’t Lie- CA Numbers show Markets Are Crashing Harder.

Oh, Dear, Real Estate is Toast, Numbers Don’t Lie- CA Numbers show Markets Are Crashing Harder. A report from Go Banking Rates. “The pandemic has caused people to slow down and rethink their approach to the homebuying process, said Rebecca Brooksher, an agent with Warburg Realty. ‘Everyone has a new perspective, so you are less likely to find the pushy broker or the buyer who will overbid because it’s the perfect house,’ she said. ‘Everyone is on their best behavior. People are grounded and know their priorities.’â€

“‘There are certainly prospective buyers who were actively scouring the market pre-pandemic that have now endured severe financial hardship, and may be forced to hold off on buying until they recoup funds that have been lost,’ said Jeremy Kamm, an agent with Warburg Realty. ‘The demographic of first-time homebuyers has likely shrunken to a certain extent, and therefore there is that much less competition, i.e. room for opportunity.’â€

“As competition shrinks and real estate inventory rises, homebuyers will have the upper hand. ‘As inventory that appeals to these buyers begins to increase as restrictions are lifted and business resumes, those buyers that remain active and interested will hold much of the bargaining power,’ Kamm said. ‘There will be opportunities for great deals to be made with sellers who understand the new environment that we are in, and are genuinely realistic about selling their homes.’â€

“In addition to having more realistic expectations, some sellers may give great deals to new homebuyers out of desperation due to their own changed financial circumstances. ‘First-time homebuyers may run into sellers that must sell to get their cash out,’ said Brett Ringelheim, a licensed real estate salesperson with Compass. ‘In these scenarios, the buyer might be getting a better deal due to unforeseen circumstances that occurred in the seller’s life.’â€

“In addition to low mortgage rates, buyers may be able to get better loan terms due to the smaller pool of buyers. ‘Lenders will be more likely to negotiate their fees and costs when issuing loans because there is a lower number of qualified buyers this year compared to others,’ said real estate attorney Rajeh A. Saadeh.â€

“‘The pandemic is making it easier for first-time homebuyers to find the right house,’ said John Castle, a realtor with Keller Williams. ‘The demand for short-term rentals has collapsed. Consequently, a large number of condominium apartments have come on the market, and condominium prices in the most expensive cities are down substantially.’â€

From Realtor.com. “As more people struggle to find their footing amid financial and economic uncertainty around the COVID-19 pandemic, many prospective first time homebuyers could be dipping into their down payment savings to cover their everyday expenses. Because of this, millennials — who make up the majority of all mortgage originations — may find their dreams of homeownership delayed until long after the coronavirus situation is under control.â€

“In fact, the average millennial would take 9 months to recoup a single month’s expenses that were taken out of their savings. If millennial renters are forced to dip into their down payment savings for several months, their transition to homeownership could be delayed by years.â€

“Adding to homebuyer challenges, some lenders are tightening their lending criteria by requiring higher credit scores and minimum down payments for certain types of loans. Major banks have recently changed their criteria for home lending by requiring borrowers to secure 20 percent down payments, significantly higher than the millennial median down payment of 8 percent. The 20 percent wall is likely too far out of reach for many prospective homebuyers, especially first timers, meaning these buyers will have to look for supported loans such as FHA, VA, USDA or Fannie and Freddie loans. The national median listing price in April was $320,000; a 20 percent down payment would be $64,000.â€

“Even though San Francisco has the highest millennial incomes in the country, it also has the highest expenses, primarily due to the very high cost of housing. Therefore, saving money becomes even more challenging in that market. In addition to the tight balance of income and expenses, homeowner hopefuls in these markets also face listing prices often much higher than the national rate. Eight of the top ten toughest markets had a median listing price higher than the national price of $320,000 in April.â€

“Moreover, if more major lenders increase their minimum down payment to 20 percent, millennials in San Francisco who were aiming for a target of 10 percent would need to save for an additional 16 years to meet that new lending criterion.â€

The Arizona Republic. “Banks across the nation felt headwinds even before the coronavirus pandemic hit, and a new, more rigorous accounting rule isn’t helping. Banks could face eroding profits on a scale they haven’t seen since the Great Recession. The October-December report marked a second straight quarter of declining profitability. Then the coronavirus pandemic hit, pushing the nation into a recession and raising the specter of loan delinquencies, defaults, bankruptcies and other fallout.â€

“Profits already are tumbling. Three of the nation’s biggest banks – Chase, Wells Fargo and Bank of America – reported combined net income from January through March of about $6 billion, down from about $21 billion in the same period one year earlier. The economic ramifications of the coronavirus outbreak weren’t fully felt in the first quarter. The impact for April through June will be larger.â€

“Many banks have started to adjust their earnings lower, reflecting a new accounting standard that requires them to estimate credit losses over the lifetimes of their loans, not just as losses accrue. It’s a big change that will require executives to factor in future losses under various scenarios and incorporating many factors.â€

“For the first quarter of 2020, Chase, Wells Fargo and Bank of America included roughly $17 billion in combined provisions or charges for credit losses, well above the $3 billion or so they had reported one year earlier and explaining much of the profit erosion.â€