Dear America, If This Bailout Fails, you will Fail. 2008 Financial Fear Mongering Tour.

As I eagerly await the bread and circus theatre to resume tomorrow, has anyone seen any details on the $700 billion plan? The plan ushered over the weekend by Henry Paulson was an absolute joke and mockery to our economic system. He back peddled and stated that he wanted to keep it as “simple” as possible so discussion in Congress would move much smoother. What in the world is simple about asking that any actions taken by the U.S. Treasury are not reviewable by a court of law? There was a quick firestorm from economist, bloggers, and anyone with an ounce of commonsense how absurd the 3 pages bailout was. Even with the additional modifications to the plan of CEO compensation, equity sharing, and oversight no one is asking the most important question. Why in the hell do you need $700 billion? The mainstream media seems to be neutral about the bailout.

Ben Bernanke, Paulson, and Bush went on their financial fear mongering tour basically saying that if you don’t pass this bailout, the world as you know it will implode on itself. Little do they know that in many cities people are already struggling and have very little to lose if they haven’t lost everything already. This is what the President had to say:

“I’m a strong believer in free enterprise. So my natural instinct is to oppose government intervention. I believe companies that make bad decisions should be allowed to go out of business. Under normal circumstances, I would have followed this course. But these are not normal circumstances. The market is not functioning properly. There’s been a widespread loss of confidence. And major sectors of America’s financial system are at risk of shutting down.

The government’s top economic experts warn that without immediate action by Congress, America could slip into a financial panic, and a distressing scenario would unfold:

More banks could fail, including some in your community. The stock market would drop even more, which would reduce the value of your retirement account. The value of your home could plummet. Foreclosures would rise dramatically. And if you own a business or a farm, you would find it harder and more expensive to get credit. More businesses would close their doors, and millions of Americans could lose their jobs. Even if you have good credit history, it would be more difficult for you to get the loans you need to buy a car or send your children to college. And ultimately, our country could experience a long and painful recession.”

Holy crap! If you put it that way, why don’t we raise the amount and give Paulson $10 trillion? God forbid you take my credit cards away. You mean we are going to lose additional jobs on top of the 605,000 that have already been lost this year?

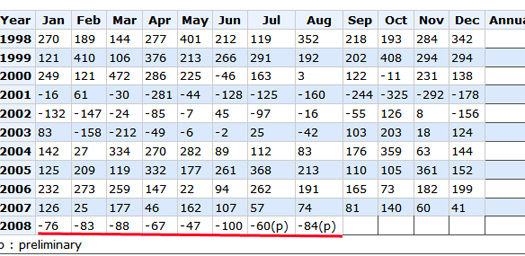

So this is something that is already happening. Now we get the ultimate fear mongering of seeing your stocks decline. Some Americans are living paycheck to paycheck let alone investing. Let us see the raw numbers here. How many Americans own stocks?

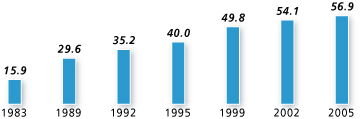

57 million households own stocks directly or through mutual funds. Given that there are 105,480,101 or so households, that means 54% of people will be impacted by a decline in stock values directly in their portfolio. What this also means is that 46% of Americans do not own any stocks. But how much money do American’s really have saved in retirement accounts? Given that the median household income for U.S. households is $46,326, let us run these quick numbers:

401(k) Median Amount

20 year olds

(Salary Range)$40,000 – $60,000 = Â Â 401(k) Median Amount $16,393

30 year olds

$40,000 – $60,000 =Â Â $38,693

40 year olds

$40,000 – $60,000 = $78,834

50 year olds

$40,000 – $60,000 = $99,932

60 year olds

$40,000 – $60,000 = $97,588

Sources: Employee Benefit Research Institute, Investment Company Institute

So let us assume that the market goes bonkers and it declines by 30 percent. How much do 20 to 29 year olds lose? $4,917. What about those in their 30s? $11,607. How about the hypothetical 40s family? $23,650. A 50s or 60s family looks to lose approximately $29,900. Is there any wonder why there is a big generational gap going on here? That is why the next big issue which in fact is bigger than this bailout is the entitlement programs that will be coming down the pipeline for the baby boomers. The median 20 – 39 year old household has probably lost more simply by inflation and stagnant wages. Certainly the amount of money being thrown toward Paulson and Bernanke is nothing to justify even a horrific 30% drop. The numbers simply do not pan out. In addition, if you retire say at 62 with $97,000 and live until 75, divided over 13 years we are talking about living on $7,461 a year plus Social Security. Try managing that one.

Again, those that stand to benefit the most are in the top 5% of this country. Why do you think there has been wide opposition to this bailout? Take a look at this L.A. Times and Bloomberg poll:

“(L.A. Times) Americans oppose government rescues of ailing financial companies by a decisive margin, and blame Wall Street and President George. W. Bush for the credit crisis.

By a margin of 55 percent to 31 percent, Americans say it’s not the government’s responsibility to bail out private companies with taxpayer dollars, even if their collapse could damage the economy, according to the latest Bloomberg/Los Angeles Times poll.”

As it turns out, a large number of Americans actually have the guts to stand up for what is right. Plus, they realize that the economic plan will do very little to benefit them. Take a look at the above numbers. Approximately 30% of Americans own their homes free and clear. Many of these people do not want to bail out banks that made absurd idiotic loans while they were being prudent. In addition, many other Americans are making their mortgage payments on a timely manner. Do you think they are going to appreciate dolling out assistance to lenders that gambled their future away? Of course not.

The problem with the $700 billion price tag is no one is bothering to explain why they need $700 billion. Why not $200 billion like the Fannie Mae and Freddie Mac bailout? The only reason we get is “it needs to be sizable enough to impact the markets.” Bull. After all, if this program as I read it is setup to continually recycle loans in a garbage in garbage out model, having a $200 billion pool should be enough to take in enough crap mortgages at a major discount, throw them back on the market, and repeat the process over and over until the crisis is over. Wouldn’t that make the most sense? But of course Ben Benanke keeps using the Roto Rooter argument that the credit markets are clogged. Good! That is the damn reason we got into this mess to begin with. The fact that the President tried to instill fear about having our credit cards taken away is a blessing in disguise. People shouldn’t be spending money they don’t have. People shouldn’t have bought homes they could never afford. Forget the auto loan. Time to clean up the balance sheet of your house. And the banks and Wall Street? If the buyers were the drug users Wall Street and the lenders were the drug pushers. Let them implode. This “I’m for the free enterprise except for the largest bailout known to mankind” is absurd.

If that is the case, I would feel more comfortable pushing through healthcare for all and investing in our crumbling infrastructure. At least we’ll get something for the price tag there. Instead we are going to use the money to bailout banks? Talk about massive hypocrisy. Let us run through the doomsday scenario since many don’t have the desire to look at this.

(a) No bailout. People and financial markets initially panic. Weak institutions will no longer be able to hide the sausage and will be exposed and will collapse. In fact, a few people have estimated that nearly half of the 8,429 commercial will fail.

(b) Systematic failure of these toxic institutions. They fail and their poor risk management brings them down. They knew the risk. Making $500,000 loans on 500 square foot boxes and pocketing beacoup money is gambling. Hope you enjoyed your reckless spending.

(c) Banks that do remain, will lend but to those that meet certain standards. What is so bad about that? What we are basically being told right now is that we have to continue believing that the Great Wizard of Oz really isn’t some shady banker behind the cape. In fact, they want us to continue this model of giving money to people that don’t qualify. That is simply unsustainable. But guess what? The United States itself is now becoming the debt addicted borrower on the world stage.

(d) Standards get better and we move our economy away from this model of flipping houses to one another and obsessing with remodeling our homes as a method of economic stability. Are we a world power because we watch HGTV and have an obsession with granite countertops? Of course not. The jobs of the future are in biotech, engineering, and IT and we are going to drop $700 billion in propping up a system that rewards flipping and rehabbing homes? You know what that will do for our future economy? It is going to saddle us with so much debt, we’ll be unable to focus on anything else.  Please refer to Japan to see how well it works when you zombify your banking industry after a housing bubble.Â

(e) The correction happens and we move on. New industries develop and new careers will come forward in time. This happens in any business cycle. When will this happen? It is hard to say but once we get back to more prudent standards we can get our country back on the right course.

So essentially that is how things will play out if there is no bailout. But say there is a bailout. What changes from above? My prediction is this is what will happen:

(a) Bailout passes. Initial euphoria on the markets which will give way to reality since Main Street has horrific balance sheets. The party will wear off quickly. We are still at record high foreclosures and nothing will stop this. Why? Because much of our economy was dependent on an incestuous relationship of, “I sell you home. I get commission check. I buy home with check. I sell other home. Use check to remodel and pay construction workers…etc etc.” It all depended on people buying and selling homes at a hyper accelerated pace. That will not continue.

(b) Once Main Street realizes that they were shafted, there will be an uproar but what will they do? Will they protest? Will they take to the streets? Who really knows. The deal at that point will turn into buyers remorse.  After all, the government buying the loan doesn’t remove the fact that the loan is still bad. Let us run a scenario:

-The government buys a loan from X bank. X bank claims the mortgage is worth $400,000. The government offers a minor discount of 10% and takes the loan. They now have a $370,000 loan. The borrower has received zero savings. The government can try passing the savings to the borrower but most likely they will still not be able to make the payment. What if they can only make the payment on a note of say $200,000. Will the government modify the loan to that level? If that is the case and the root cause is helping home owners, why not let judges use cram downs and force lenders to modify loans as such with equity kick backs to lenders. That is, if the folks sell the home in a few years for a profit that cash goes back to X bank. Why don’t they go for this? Because it exposes the drug dealer (Wall Street and banks) and drug abusers (home borrowers who want a free lunch). This would make the most sense.

-The government will most likely have a foreclosure on their hand. So now what? Are they going to try to sell the home in this current market with already tons of inventory? They are going to get screwed 2 times here. First, they’ll get shafted from lenders since I doubt they’ll be offering 30 to 40 cents on the dollar which they should. So they’ll over pay once here. Many of these borrowers will default. So now, you have a home and you need to place the home on the market. Guess what, the market sucks. So now, you have to drop your price (another price hit) and accept what the market will offer you.

-We can run this further and further but you get how absurd this is. It is like we are in Wonderland and doing the Red Queen’s Race:

“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else – if you run very fast for a long time, as we’ve been doing.”

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

There is a silver lining. The majority of Americans are seeing through this sham. Keep calling and writing your representatives since at least it stalled it long enough to keep comrade Paulson from turning this country into a crony capitalistic mortgage swap meet.

Here are the links once again:

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “Dear America, If This Bailout Fails, you will Fail. 2008 Financial Fear Mongering Tour.”

I wrote Boxer, Mrs. Frankenstein (yikes) and Waxman (funny looking, but lovable) to oppose the S&L crisis redux bailout. You see, every time there’s a Bush in the Whitehouse, taxpayers get robbed to bail out a financial crisis. 100% of the time we’ve had a Bush in the Whitehouse, we’ve been screwed.

There is a palpable sense that something must be done to stop the house of cards from falling. But here’s an important point about the $700 billion bailout that’s going unnoticed:

Let’s say you and I contract for something. I say I’ll pay you $100,000. I don’t pay you $100,000. You sue me. It turns out I don’t have $100,000. Never did. That’s where the problem ends. You might get a judgment. You might be legally entitled to get $100,000 from me. But you can’t. I don’t have it. I’m judgment proof. In a normal contract dispute the aggrieved party can’t then go to the government and get $100,000. It doesn’t exist.

But isn’t this exactly what’s happening here — bankers and investors are mad they’re not getting their hypothetical money that doesn’t exist, so they’re asking the government for it. The government would never give it to them in any normal kind of situation (except in the form of allowing corporate write-offs on the losses on their corporate taxes), except in this MELTDOWN there’s so much bad debt out there that the whole system has crashed.

The only reason this became a meltdown is because of CDOs and CDSs which magnified the fact that the hypothetical money that didn’t exist doesn’t exist. But why should we take REAL taxpayer dollars out of our pockets to pay for the IMAGINARY losses of the banks? If the banks owe money they can’t pay back because they thought they were getting the money from a blockbuster video clerk whom they qualified for a $600,000 mortgage, why is that my problem? The bank should sell the home for the $420,000 or whatever it is now worth, and the person who couldn’t afford the house should go find a house they can afford. Maybe their neighbor’s which is the same house but is now a REO.

And some might say, oh, but we need liquidity and loans or the economy will really grind to a halt. Well, okay. Let’s just let the federal reserve lend money directly for a while — instead of loaning it first to the banks as intermediaries through their “windows.” It’s their fault this all happened, let them pick up the pieces. Besides, we might need that $700 billion to fund the FDIC when the whole thing collapses anyway.

Can some of you smart people explain all this to me? Why are we going to use real dollars to cover imaginary lost profits amplified by imaginary derivative instruments?

P.S. Caps on compensation? How about fines and time in jail?

“How about fines and time in jail?”

After all this bailout is said and done, there may be no more money to run the prisons. Much better to just fine those responsible and take back some of their ridiculously inflated bonuses!

$700B? The government can invent as much money as they want. Why not? It’s not backed by anything precious anymore- like it should be.

Oh wait, it is. By gold and platinum…credit cards.

Sorry America, but we are financially FUBAR’d.

Thanks for posting the links as a reminder that each of us needs to let our representatives know we are pissed off about this “plan”

If the choice boils down to a thret of you better give me $700,000,000,000 or else, I’ll take my chances reguardless of the consiquences & not give in to the thret.

Has anyone noticed the simularity between this issue, 9/11 & the war in Iraq? The common thred is if you don’t do what I tell you, the world will fall apart. Bush’s pals must think congress are a bunch of suckers that can be easaly minnipulated into doing what ever they wanted, or it just semes that way

When it comes down to it this bailout can be summed up in 3 words, “Wall Street extortion” because that is exactly what it is, extortion.

it seems this all will boil down to: do you want to pull the band-aid off your hairy private area FAST or SLOW? Most prefer their pain quickly finished!

But they are a bunch of suckers. That’s why this bill will pass by this weekend. Instead of questioning the competence of Paulson, they’re gonna give him 700 Billion.

“Under normal circumstances, I would have followed this course. But these are not normal circumstances. The market is not functioning properly. ”

What a cretin. These are normal circumstances – these are the normal circumstances that follow a huge runup in credit. The market IS functioning properly.

My response to your question: “Will the government modify the loan to that level?”

Why wouldn’t the government reduce the loan to that level? Instead of being screwed twice, they would just modify the loan and let the person stay in that house.

Is 700Billion $ enough to force the gold price down to 35$ again…..

so we can by some more…..1$ silver……..

The ONLY thing that is not prohibited yet is to SHORT gold/silver.

Could the march gold high of 1035$ have beeen the death of BEAR stearns…?

Just like that oil fund that scambled to cover its losing bets, oil went from 125 to 147, and it collapsed….margin death call

Somebody has been PMetals short – from au300 to 1035$

2 banks….just shorted the life of many mining Co’s.

The FED (JP morgan owned & Bank of England(Rothchild owned)

haha ha

The us$ is rallying…again….

So if borrowing 700$Billion is good for the economy, why not go for 5Trillion

Print 10Trillion, and…pay of…..the debt……hahaha

Monty pyton …RULES… on wall street

” I have an offer, that you can not refuse”

H. Paulsen

Dr. HB,

An answer to your question of why $700 Billion:

Some pundit last night on FBN said that it is roughly 5% of all outstanding mortgages. So, someone convinced someone that 5% of mortgages will fail. Where I see fault in this is that this 5% of mortgages that fail will make up much more than 5% of the outstanding mortgage debt because these houses were bought during the bubble. This 5% that go bad could easily end up being 10-12% of the overall mortgage debt in this country.

I think the reason that $200 B wouldn’t cover it is because nobody in their right mind thinks that the government will be able to sell the mortgages for more than pennies on the dollar in the near term. To recoup the money, they have to be longer “investments”. If the government doesn’t pay close to what the banks have on their books, then it isn’t helping the banks much.

I currently want to buy a REO home, but banks won’t accept my offer for what I think the home is worth, because then they have to finally put the loss on their books. For the same reason, they can’t sell them to the government for their true market value, or else they are still insolvent.

It’s 700b because that is the sum total of all physical cash available in the United States (as per one of the other Blogs. Don’t recall if it was Mish or CR)

I’m in the fail, and let the chips fall where they may crowd. A lonely voice in the wilderness.

No one, and I mean no one, out there is willing to take a nice bracing dose of reality and wake up to how things are out in the real world. It’s becoming somewhat like the Morpheus “red pill or blue pill” choice for the deluded masses. Unfortunately they will pick the white pill, the cyanide of mass media news and simply lull themselves into a never waking state. Weep for what was the United States of America.

Comrades, what is happening as we speak in Washington is shameful. It is setting the stage for the calamitous final act of this modern Greek tragedy. We are about to give ourselves the world’s biggest shot of morphine to make the pain go away so that future generations will be left to fix the real problem. Oh by the way, the real problem is that we are not sowing any economic seeds that can be harvested and we are doing it on borrowed time and a borrowed dime (give or a take a trillion).

~

What is the final act? Cleansed portfolios of big financial institutions with no one to lend to ’cause we are broke. The dollar will be shot (see link below). There will be systemic failure. I have a name for this Greek tragedy: Apocalypse Now: Revenge of the Baby Boomers.

~

“More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly.” – Woody Allen

~

http://www.nytimes.com/2008/09/24/opinion/24grant.html?_r=1&em&oref=slogin

Wow! Joe Can’t Spend Money? http://activerain.com/blogsview/708940/Wow-Joe-Can-t

What can we do if the Bush Boys insist their lie and blackmail when politicians ignore the voice of American people?

Look at today’s stock rally market, you know the fate or result we are facing.

Take care of yourself.

here’s my rant that i’ve sent to all of my “representatives…” Feel free to plagarize as you see fit.

Senator Boxer:

I am adamantly opposed to ANY proposed bailout of financial institutions. If you support this legislation, you are directly subsidising those who made poor financial decisions at the expense of those who made prudent decisions. Companies, like individuals, should be held responsible for their decisions, not tax payers.

All of the legislative tricks in the world will not solve the current “crisis” because housing prices are not supportable by current incomes. he only way they got here was through the use of unstable exotic loan programs. The amount of debt supportable by people’s real incomes on a sustainable, solvent basis is too small to support today’s prices. Prices will fall to supportable income levels because they must.

The government does not have $700 billion dollars. WE, the TAXPAYERS, have $700 billion, and it is being taken from us. If this is passed then the next administration and the next will be extracting this one from the people who are supposedly being protected by this bailout.

Voting yes for a bailout bill will consign us to a fate much like Japan’s “lost decade.” Do NOT do this. Let those who gambled and lost pay their own bills, I’ll take care of mine.

This is now beyond mortgages, We are actually bailing out the $62T financial shadow world known as the derivatives markets. THATS why they are panicking.

I wish you would address that aspect of it.

Save America VoteNoBailout.org

I can’t get the term “FIRE sale” out of my mind.

~

I too perceived an extortionist element in last night’s statements by Bernanke, Paulson, and their trusty Pets.com sock puppet Potus. “If you don’t do what we say, everything will come crashing down.” Infuriating. I hate threats from rich bullies. Makes me wanna go all Tom Paine on their asses.

~

I share DanEric’s sense that this has gone beyond housing. I’d counter that housing has been a potent New World Order scam precisely because it cuts to the guts of so many people’s hopes and fears. We don’t buy houses anymore, we buy HOMES. What malarkey. But powerful malarkey, because it created the illusion of the one product that people are truly anxious about on this planet in diaspora and eco-meltdown…and then reoriented much of the US and global GDP around it. It’s been a brilliant scam. The more anxious people feel about belonging and being safe, the more they’re willing to risk for the nest. Then the nest is presented as the one way they can get money, i.e., security. Mix in the illusion that the crap you bought on credit = wealth AND that the more you’re in hock, the richer you actually are.

~

The ultra-rich and ultra-powerful have been reckless, using powerful social engineering techniques to politically polarize then sucker the average person into recklessness as well, playing on the fear and greed of people who perceive they simply can’t earn enough to live like postwar Americans no matter how hard or much they and their families have worked since 1978.

~

David Gergen observed on Anderson Cooper Tuesday night, the real issue is that incomes have not kept pace in the past 30 years. From where I stand, also at issue is that America’s productive capacity was systematically destroyed from the ’70s on. Job creation has been in stupid sectors (like too much housing and way too much war). We’ve pursued a short-sighted national religion of Suburbanization Uber Alles. Too many people have been schooled into PC stupidity, dumbassification, and abject uselessness. Superstition is at mediaeval levels, and rationality and intelligence are cuss words. Racism and money-worship have taken the place of a good hard look at class dynamics in America. Though that last one is about to change. Maybe.

~

Over supper last night we reflected: hasn’t our nation been rewarding gamblers for losing for awhile now? One can, after all, deduct one’s gambling losses. One cannot deduct wage losses when one’s employer offshores or bankrupts one’s job.

~

Anderson Cooper, whom I normally can’t stand, rose to the occasion, asking Gergen how come we can suddenly all cough up 700 billion for the FIRE industry, but things like health care, infrastructure, alternative energy, conversion to a more peace-based economy, environmental sanity, etc., have all been Oh No Way Too Expensive.

~

It’s time for leadership from the roots of the grass to the top of the brass. I don’t mean the corporate spectacle of duelling superheroes Captain Hope and Captain Gloom. I mean real renewal, of national character. My parents had the Depression and the second world war to test and hone their character. We had growing up under the shadow of the mushroom cloud…and now this. Let’s rise to the occasion.

~

In times like this, we are haunted our nation’s failure to make everyone read Marcus Aurelius.

http://classics.mit.edu/Antoninus/meditations.html

~

rose

Dr. — This post is a good common-sense explanation of where we’re at. I wish more people understood, but we’ve all been lied to for so long by TPTB, it’s a blessing any of us can still think! Thanks for your blog.

Today I spoke with an acquaintance who is just purchasing a new home. She told me that she and her husband had quit making payments on their current home in March, basically living rent free. They are using the money saved for some new furniture and things for the new house. The house they are leaving is in a parent’s name. That person is now passed away. During the last few years much money has been extracted via HELOCs and loans. This first home is now upside down… big time. They consider themselves very slick financiers. Who’s fault is this mess? Now we have a bailout plan for the “Wall Street” that encourages this type of activity. Anything to generate a commission and loan fees. $700 billion +++. In 2007 the 5 largest wall street firms LOST $74 billion dollars of the share holders’ money. That same year they paid themselves $39 billion in bonuses and executive compensation. http://forums.therandirhodesshow.com/index.php?showtopic=10258 We are a nation gone mad.

How about if the insted of bailing out these big guys, if the goverment can give that money back to people and will thet not help.

1. If some one foreclosed thier house, the goverment credit for that person can e sent to the bank directly

2. If you are being a good citizen and have been making payments on your house or you did not buy one dude to high prices, you will get the money from the Goverment.

Does not this help to make people start buying houses which have been already forclosed and make the market more stable.

Also does nto this help, if these big compnise close since the goverment did not bail them out.

Does this help to make the money flowing and economy keeps running.

Does nto this mean, we now rewared the ones who really did not do stuipd and greedy thigns during thies hosuign bubble and he punished the ones who lead this tradegy.

YES!!!

How about a WINDFALL PROFITS TAX on Big Finance???

I’m sorry but the bailout doesn’t seem like it’s that bad of an idea to me. We can already see the domino effect beginning with failing banks. The credit markets are freezing up, and this could easily turn into another great depression. Will it? I don’t know, but it’s really not something I feel like finding out about. You mention that things are already bad in many places, but they can get MUCH worse.

Also, if the pricing was properly done on the securities purchase this could provide much needed liquidity, without excessive risk of loss to tax payers.

I think to many people don’t understand the current crises, and they don’t understand the proposed solutions so they automatically rebel. But we should be clear, the bailout is not just of financials, it’s of the entire economy because that’s what at stake.

You can call it fear mongering, I call it being honest about the current risks.

Also you should check out

http://www.frontlinethoughts.com/index.asp

for a good explanation of how these securities and tranches actually work.

Thanks,

@ Aviking: To understand why I am opposed to bailouts you have to understand that 1) I don’t think it’s the subprime loans themselves as much as the CDOs and CDSs traded on top of them and 2) Hedge funds are getting a free ride from the blame right now, but I believe they stand to benefit the most.

If you want to see the situation from my perspective, read this about how much more money there “is” in derivatives than there is in all the GDPs in all the countries in the world:

http://www.webofdebt.com/articles/its_the_derivatives.php

Aviking, hello. You are, here, among people who want to know the worst news, who aren’t afraid of the worst, or are willing to face it for the sake of sanity returning.

~

That may sound reckless, and I can only speak for myself. But I’ve got skin in the game, I’ve been responsible and prudent all my life and lived through waves of ridicule and pressure to conform during booms/bubbles. I don’t want to lose what I’ve worked for with such discipline over the past 35 years.

~

At the same time, our nation’s economy was hijacked by–as stevejust well describes it–the new layer of abstract wealth called derivatives. This is poison, and it must be purged. The billionaires are saying the purge will kill the patient. Some of us are saying that we think the patient is stronger than that, and we’re willing to sacrifice to return this nation’s economy to health based on sustainability, rather than financial crack-pipe dreams.

~

There are a lot of banks out there that SHOULD fail. I will not be happy if the banks that fail are mine, or my banks fail late and don’t get bailed out, or I lose everything because FDIC’s been tapped out. Or if cash becomes meaningless, I lose all my savings, I lose my house (despite extreme prudence), and so on. I can get angrier about all this than anyone you know, because I HAVEN’T outbred or outmortgaged my income. This is part of why people get reckless–either there are no consequences, or they fall equally upon the prudent and the reckless.

~

But there’s more at stake here. This is quite literally a war for control of the nation’s economy, philosophy, AND CONSTITUTION. Don’t mean to sound melodramatic, but the New Whirl Odor mafia sees this nation not as the hope of free and enlightened people everywhere, a stunning evolution in human political and social being…but just another Brand to be bought and sold at will and whim. Concentrate profits, socialized costs.

~

Have courage! I believe we all have the strength and creativity to get through this and come out better…IF we stand firm. The ultimate sources of wealth are a) nature and b) human labor in concert with nature. All the rest is headgames, and we are learning that painfully after 28 years of Reaganomics, 60 years of MilitaryIndustrialCongressionalUniversitynomics, and 6,000 years of the rich believing that real things can be turned into abstractions for profit. Real estate is a very old organizing concept, right back to the first religions that offered to sell space in the sky after death. For some reason we have a hard time learning that and staying rooted in the concrete.

~

rose

I absolutely hate the bullshit that Congress is doing. Bailing out the airline pensions, then Fannie and Freddie, then Bear Stearns, finally AIG. I believe people should become violent, and simply terrorize the ones responsible. American patriots of old did this all the time. If this is not your cup of tea, do to a lack of cajones, then allow me to lend you some passive actions you can take.

Like David Letterman, here is my top ten list.

1. Convert your money to another currency. Owning U.S. money is like owning stock. If the U.S. is full of shit, then change toilet paper brands. The massive deflation of printing funny money to AIG is only going to weaken your dollar. A two dollar loaf of bread will become four or more. Change your money to buy bread in the future. Push to remove penalties and charges for changing U.S. dollars into other monies or standards like gold.

2. Write your congressman. Find their damn home number and call them at all hours of the night. Break apart the lobby system. Find out who is lobbying, and screwing up your life and never purchase from them again. Tell all of your friends to do the same.

3. Try to set up a system where the people’s vote usurps Congressional power like in state governments. We the people can amend amendments all the time at the state level. How many signatures does it take to undo the Congressional approval of AIG. How about removing the requirment that we have to buy insurances like those for our cars.

4. Remember this day, and engrain it in your mind. Never, ever invest in the stockmarket or America again. Allow the stock market to truly crash so that even the government cannot bail out the bullshit. Last time I checked people learn best through pain and suffering. Nationalize and government control things like energy, health care, and above all insurances. Use your head. You do not need to go overboard, and all we need is cheap basic standardized policies. For example, if people want million dollar transplants that will prolong a short period of life, then let them buy the expensive insurance. You will always be covered for being mangled in a car accident. Trust me, this would be cheap, and not even equal funding like socialized countries like Canada.

5. Act quickly because the world is poised to screw over us American’s, and they will soon be flooding us will all of our worthless dollars. Prepare for the Sith invasion.

6. Fix the Glass-Steagall act A.S.A.P. This repeal allowed banks to mix hedge funds with commercial or simply risk markets with solid investments. Banks never go under in any economy if their simply commercial. Of course they don’t make great profits either. The great depressions taught us this lesson and set the Glass-Steagall act up. The republicans, and the democrats for that matter overturned this wise approach in 1999.

7. The entire republican party has to be destroyed politically because they are the worst, and you need to watch the democrats and any new formation of parties until you can transition to a truly independent party. Simply choose someone off of the street. These people could not do as much damage as party politics.

8. Do not forget to break apart the monopolistic system. 50 seperate entities should be a good number. Microsoft is the only operating system for P.C. break the sucker up. Boeing and a few other national security and airline groups need to be broken up as well. Auto industries should be cracked to pieces. Banks should really be broken up and not be able to centralize over state boundaries like we had before. The Time Warner media giant that went untouched in its merger needs to fall. Smaller companies like Dentsply that control most tooth implantation are wrong. Do your part and ask where your money is going and support the smaller businesses until we get a congress that breaks up monopolies.

9. Make every aspect of what we pay for in the government open to the public. Finances, time, etc. need to be available at the click of a mouse, and there is always someone bored enough to check their records.

10. If all else fails, leave the country. Many people on these blog sites will tout you to just get the hell out. Leave the ignorant behind, and take your skilled labor elsewhere. When they cart America off to the auction block, you can come back and buy all that you lost.

right on steve just

here we are in oct 2009. sure wish we would have elected someone more than a ghost written speech reader. one year later, even the re-establishment of the buying and selling of farts and air wont solve anything. from an x businessman,destroyed by the new world order. happy 140 bucks a month paycheck you all. the playing field WILL be leveled with slaver nations.

I am 19 yet I had lost everything that I truly work hard for since I was 16 year old. This article is an eye opener to the young generations to come and to my generation.

Thank you.

Leave a Reply