Real City of Genius – Substitution effect – Culver City real estate inventory highest since 2008 as median square price declines. Selling bigger homes for less and condo sales dominate.

In a market economy we are fortunate to have substitutes. Having trouble affording Grey Goose vodka? Maybe a Smirnoff will do. Mercedes Benz out of your league? We have a nice Honda for you. In the housing market, we have a clear substitute for buying a home and that is renting. Yet some have a massive desire to own especially in some niche markets and a cheaper substitute includes condos and townhomes. Culver City has seen this substitution effect take place since the housing market tanked. This kind of city is the next to take a dip in the housing adjustment. The subprime market has taken it on the chin and we need to only look at places like the Inland Empire to see what a real correction can bring on. Culver City is a desired location but doesn’t have the brand that a Santa Monica or Marina Del Rey carries.

Today we salute Culver City with our Real City of Genius.

A Condo Will Do

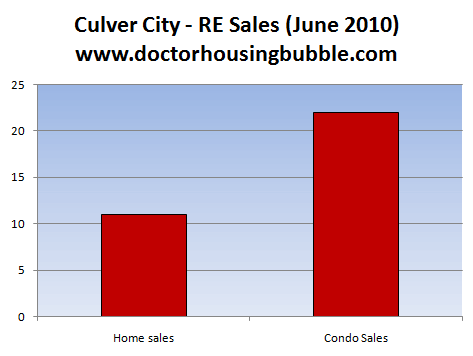

The substitution effect is taking charge in Culver City. We need to look at June sales to see the trend:

Source:Â MLS

In June Culver City had 11 homes sell but at the same time 22 condos were sold. Before someone tries to say that all cities operate like this, take a look at Diamond Bar (31 homes sold and 25 condos sold). So why the big divergence? Well for one, the median price of homes sold in Culver City for both zip codes were $605,000 and $775,000. At the same time, the median condo price was $330,000. There are two markets within one city here.

The shift in the makeup of sales has caused the median square foot price to plummet:

Source:Â Redfin

The cost is falling because the shift in real estate sales for Culver City is being dominated by condos. Home sellers are still holding out for insane bubble like prices and the amount of homes selling is falling. That is why inventory for Culver City is now at a high not seen since 2008:

Source:Â Redfin

What exactly is happening here? I think Culver City is one of those markets that can draw a large number of people that one would call “aspirationals.â€Â You know what I’m talking about; these are the people that registered their iPhone cell numbers out in the 310 while living in an apartment or go to fancy restaurants and simply order off the appetizer menu. Since owning has a strong pull even after the market implosion we have seen in California, many are willing to skip owning a home and substituting it with a condo. At current prices, you have a good amount of people willing to pay and given easy FHA insured financing, buying a condo or townhome isn’t so tough.

I find this trend incredibly fascinating because it signifies a tipping point in the market. People are starting to pull back on buying the incredibly expensive homes thus home inventory is up while buying up the condos at a much brisker pace.

Let us break down the current market:

MLS listed inventory

Condo/townhomes       -             97

Single family homes       -             63

We have 4.4 months of condo/townhome inventory and 5.7 months of single family home inventory. We shouldn’t forget about the shadow inventory here. 173 homes are listed as distressed properties with the bulk not making it to the MLS. Of the distressed data we have:

63 single family homes

88 condos and townhomes

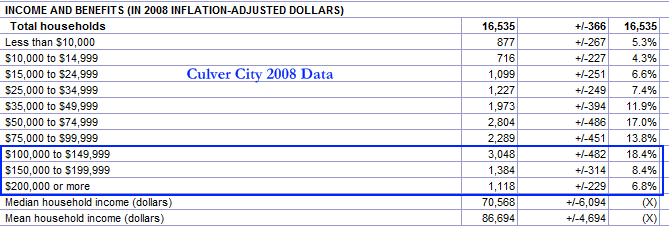

The other properties are a mix of commercial, multi-unit, and land. But you can see that we still have a large number of homes sitting in the back for an area like Culver City. If we want to understand why condos are dominating sales we should probably look at the income data for the city:

Source:Â Census

The median household income is $70,568 with an average household income of $86,694. The current median home price for single family homes just doesn’t compute with current income data. To purchase the current median priced home a family would need an income of $200,000 or more per year. Only 6.8% of the entire area can go for that level of price. And what does $885,000 buy you in Culver City?

This is a 4 bedrooms and 3.4 baths home. It is listed at 3,377 square feet so it is certainly a good sized home. Yet does this look like an $885,000 home? It has been listed on the MLS for 428 days and has a sale pending. People are still willing to buy in these markets but again, the bulk of the sales are coming from lower priced units. This is similar to what happened in lower priced markets back before they tipped over. You see expensive units stall and sit idle while inventory builds up and lower priced units move. You can’t stop the momentum unless incomes double overnight. What other markets are seeing a big jump in condo sales?

Today we salute you Culver City with our Real City of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

12 Responses to “Real City of Genius – Substitution effect – Culver City real estate inventory highest since 2008 as median square price declines. Selling bigger homes for less and condo sales dominate.”

4 bedrooms and 3.4 baths? What is 0.4 of a bathroom?

Did you really just compare Culver City against Diamond Bar?

The prevailing thought is “My home used to be worth $100,000 MORE, so I am not going to lose money by selling it”.

The fact that you bought before the bubble, and are not actually losing anything, does not register. It is still worth more than what you paid for it.

It seems that FHA is slowly tightening its rules for loan qualification. When people have to have 10 or even 20 % down payments, the prices of houses in Culver City and other middle class areas will have to drop, or the number of sales will drop. I also read that the regulators are putting increasing pressure on banks to clear their books of shadow inventory. Let’s see how fast this happens.

You not painting the entire picture. 10 Single Family Homes were sold in June at an average sale price of 720K when the average home price for the year is 669K, also the days on market for these 10 homes was only 25 days instead of the annualized rate of 44 days on market.

Best

Mike

I live in this area, and DHB is right, the sales prices on SFR’s are still out of control. Most people don’t realize that there is lots of Section 8 and low income housing in Culver City and Santa Monica, with the requisite drug and gang problems that come with these types of areas. It still amazes me that people will drop $600k on a 2 bed 2 bath in one of these aforementioned.

Waiting – somewhat impatiently – for prices to drop to realistic levels… but still waiting.

I have seen a similar pattern developing in Yorba Linda. There are plenty Real Homes of Genius in the “Land of Gracious Living”. The good doctor would have a field day here.

Section 8 housing is another form of blockbusting, basically. Anyone who buys in an area with a lot of it needs their head examined. I actually don’t know what landlords get out of it because it basically ensures that their property will be worth a lot less over time. Maybe someone more knowledgeable on here can explain it.

Strivers, aspirationals – whatever you want to call them – haven’t gone broke enough yet to get the message. Just wait. Their improvident spending habits ensure that in a few years they’ll be back in with their parents and their BMW keys will be returned to the leasing office.

Hi, Doc.

Got another “Real Homes of Genius” for ya.

Check Blockshopper for 10322 IIona. It’s north

of Cheviot Hills park. A 2 bedroom/1 bath

1936 clapboard, 1280 sq. ft., asking $1,089,000!

That’s about $850. a square foot. I think that

beats any seller’s pipe dream you’ve dug up

in Culver City.

Thanks for the great blog.

An open window.

@Mike King

How do you see things going in the next few months. Do you believe that housing will soon stand on its own without the massive government training wheels?

“You unlock this door with the key of imagination. Beyond it is another dimension: a dimension of sound, a dimension of sight, a dimension of mind. You’re moving into a land of both shadow and substance, of things and ideas. You’ve just crossed over into… the Twilight Zone. ”

You can throw all the metrics into an RHG photo-prop trash can because we are the victims of a giant Ponzi Scheme. The ‘Walls’ are the modern Kings and Nobles and we are the peasants. We have traded all of our financial freedom for security from the toobigtofail dragon. An unpayable mortgage is just the bondage the Walls want us in. A car that costs about what a home should. A student loan that may be leg irons for the rest of a peasant’s life. It’s so obvious, why can so few see it?

Yes, these CA house prices defy any logic. The whole state is crumbling in debt contraction, but folks think it’s a blip on the screen we’ll be past any day now. History may not always repeat, but it’s the only clue we have to the future and debt explosion-contraction always ends badly, and this is the MF of all debt contractions. If you think Ben, Blankfein, Sommers and the rest of the Walls have your back, you are a fool. Ironic that the governor’s psuedonym is the Terminator. Poetic justice, cuz this looks like the end of the scheme.

Leave a Reply