Crowd funding the real estate bubble: Looking to participate in a San Francisco housing flip for only $5,000 while sitting in your pajamas?

Investors have been the rocket fuel of the housing market. Starting in 2014 however big money started exiting the market in a methodical fashion. Now, the large investment money is coming from foreign buyers into targeted parts of the country. Every time something gets so hot, there are ideas floating around trying to make things accessible to the masses so they can jump in and party like a hedge fund rock star. Usually the gig is getting close to a top when you start seeing hot money trying to seek a home in any investment possible. There is now a democratization of information for people including things like Zillow, AirBnB, Uber, or robo-investment software as well. Ironically, something like Zillow is merely showing people how priced out they are in certain markets unless they want to drop $700,000 for a crap shack. I ran into a site that actually allows you to crowd fund into real estate investments that in the past, were the realm of hard money lenders with deep pockets.

Crowd funding into real estate

Hard money lending is an interesting market. I remember in the previous housing bubble that if you didn’t want to lock cash down, it was fairly easy to get hard money loans to cover down payments. For example, say you wanted to buy a $500,000 investment property requiring 20 percent down. Instead of locking up your own cash, you could get a hard money loan from a private investor for a high interest rate covering the 20 percent down and getting the other 80 percent financed via a traditional bank loan. Many people effectively went zero percent down this way. For hard money lenders, this is a good way to make a high return in a hot market. Of course this is all built on real estate going up.

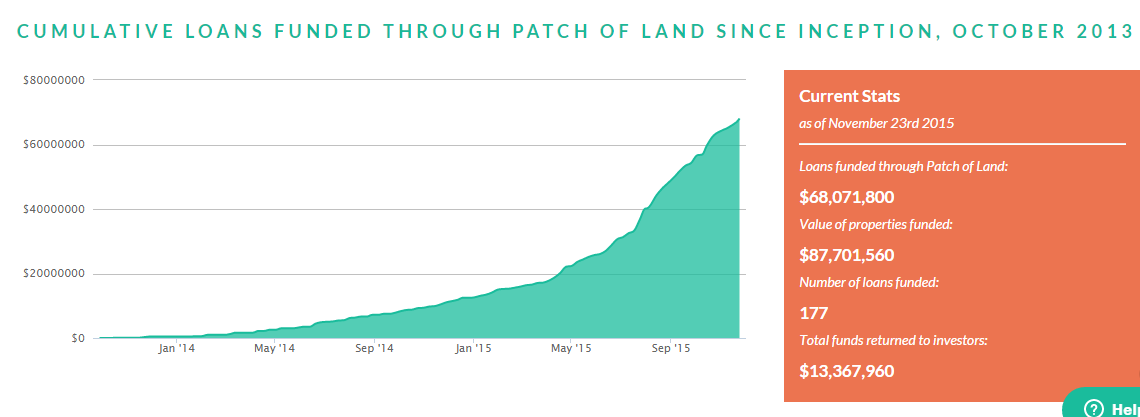

There is a website called Patch of Land that looks to crowd fund real estate deals. It is an interesting concept that seems to fill the role of hard money lenders to some degree. If you want to play the role of banker, here is your chance and it looks like you can get in on some big deals with a minimum of $5,000. It also appears that foreign investors can participate in this crowd funding. Think this is a bit risky? Well money is flowing into this in a steady stream:

Something is going on here. Let us look at a couple of examples.

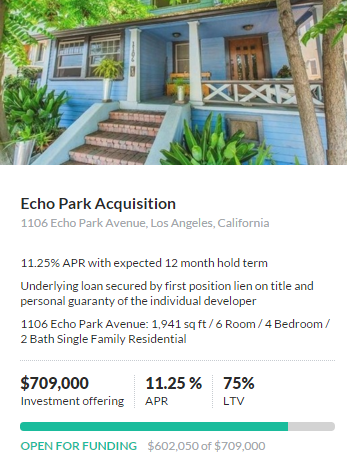

Take a look at one investment in Echo Park:

This property just sold for $945,000:

Not sure what they are going for here with this loan. Possibly to convert into a rental? Angry at the big investors? Here is your chance to play ball. You are looking at getting 11.25% on this deal.

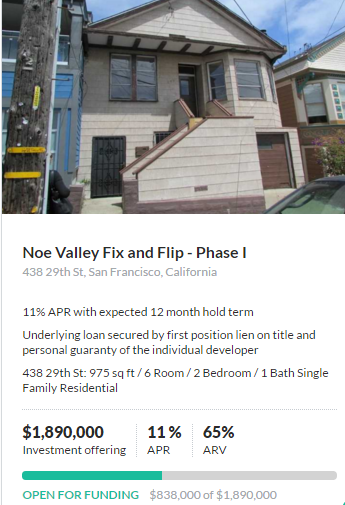

Or maybe you want to crowd fund a flip in house humping tech crazy San Francisco:

Here is another clear picture:

This place sold back in July of this year for $1,100,000 and is listed at 975 square feet.  The loan deal is seeking out $1,890,000 and has already found $838,000 of funding. This is a flip by the way. As an investor, you are looking at getting 11%.

Of course all of these deals are predicated on the market continuing to go up. We’ve just noted that it looks like a top is forming. In many counties of California, home prices are already softening leading into the slower winter season.

Things seem frothy as well because these returns are insanely high for rehabs and flips. 11% returns simply for making a few clicks on the computer and then hoping investors take care of the real estate work and find a willing sucker buyer to offload onto at a much higher premium? I can understand making some “sweat equity†by rehabbing a place but all this involves is literally a few clicks on the mouse. This was the same logic in 2004 through 2007. Big money and returns for little real work. All of this works so long as prices continue to go up. As we all know, California home prices never go down.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “Crowd funding the real estate bubble: Looking to participate in a San Francisco housing flip for only $5,000 while sitting in your pajamas?”

http://www.wusa9.com/story/news/2015/11/24/slide-home-ownership-threatens-american-dream/75918110/

yet another article about the slide in home ownership rates and the threat to the american dream

Why do people think it is their God given right as an American to own a home? No where in the constitution does it state that all citizens must own a home. In reality owning a home is a privilege not a right. In many metropolitan European cities only a very small fraction of the population own real estate, with the rest renting. That appears to be the way large American cities like LA, NY, SF are headed.

Hunan its certainly not a right but when the Constitution was written, you had to own land to vote. So there’s that..

Historically and culturally home ownership has been one of those things that has been common and normal in the US. It carries with it some social cachet too, much the same way fancy cars or watches do, and for many is a way to save wealth outside of the stock market or bank.

That and renters are often and frequently screwed over in the US. Both in terms of rent and rights. In much of the EU, particularly Germany from what I recall, renters have much stronger rights and often an effort is made to either keep rents from going up too much or at least provide low cost rentals to the population.

I’ve never heard people claim it is their “right” to own a home. Where are you getting that from? Do you have something to lose if housing becomes more affordable?

@Hunan

About as much legitimate as the right to exponential real estate appreciation is due to economic welfare programs from the Fed and government.

This isn’t the first time that people hide behind the veil of capitalism to rationalize high prices but beg for socialism when prices go down. Hence, the concept of too big to fail institutions that once again threaten our economy.

What should be my right, though it clearly isn’t, is to NOT have the value of my savings inflated away by the FED which is the only thing that prevents me from entering the housing market. We are all railing against the disgusting monetary interventions that have artificially made housing so un-affordable. These same interventions are destroying price discovery across the entire economy and fostering worse mal-investment than during Housing Bubble 1. To the few that benefit from the FED’s malfeasance I say get ready to reap the whirlwind, no monetary expansion has not been followed by a contraction. The signs of recession are everywhere. Those relative few that benefited from the expansion can join the rest of us down here in the muck of our so called economy.

Re: NihilistZerOWhat should be my right, though it clearly isn’t, is to NOT have the value of my savings inflated away by the FED which is the only thing that prevents me from entering the housing market

……………

No not really. The big problem is wages, or lack of them. If wages were higher the FED’s actions and home prices wouldn’t be that big of a deal. Generally speaking though the FED and employers don’t like to pay workers more. The FED doesn’t like it because it can create rapid amounts of high inflation and the employers don’t like it because it cuts into their profits. Not saying I agree with their positions but that is what they are.

Personally it looks to me like the easy money policy has helped blow another boom in housing an the stock market but thankfully not a bubble. At least here in the US anyways. I think we’re starting to see it pop and I think its mostly been the investor class, either directly or indirectly, who’ll get hurt by this and not the general public.

If I’m right then by waiting a couple of years you’ll be able to get a more affordable house.

@tts

Historically, prices have increased at the rate of inflation and closely tracked wage growth. This and the fact that real estate prices have risen by close 100% while wages have stagnated for over a decade should tell you that the Fed is generating artificial inflation. Also, ZIRP encourages corporations to buy back their shares back or acquire other companies cheaply instead of re-investing or expanding their own business.

As been stated before, the bubble lies in the pricing, not in the quality of loans. During the last downturn, the majority of defaults were from prime borrowers — not from subprime borrowers as popularly mis-reported. Morgan Stanley and other corporations were among the many strategic defaulters. With their debt at an all time high, corporations will be the first to line up for a taxpayer handout during the next downturn.

“The reason they call it the American Dream is because you have to be asleep to believe it.” ~ George Carlin

Up is down, and down is up (thank you DC to NYC egomaniacs)…

Nouriel Roubini: “Positive Impacts of Paris Attacks Modest Unless More Attacks Follow”

http://www.marketwatch.com/story/nouriel-roubini-says-paris-attacks-could-boost-the-eurozone-economy-2015-11-17

Obviously the heat map of San Francisco and hot tech money has created a bubble in relationship to main street economics.

In general thought, you if you look at the data curve on existing homes on a national basis it shows that headline existing home sales is even more misleading as the extra $$$ cash buyers have held up existing homes from having a not to far from the Great Recession Lows in terms of demand from main street

Existing Home Sales: 2015 report Card

http://loganmohtashami.com/2015/11/23/existing-home-sales-2015-report-card/

Today another new home sales miss but backward negative revisions once again. In fact it looks like now years 5, 6 and 7 will have under 500K in sales which makes today’s number

– 51% below the 1963 levels in terms of new homes sales when adjusted to population and headline -16%

Something if you look revisions of new home sales was forecast months ago

http://loganmohtashami.com/2015/10/26/new-home-sales-miss-was-forecast-months-ago/

Logan Mohtashami: Just an idea, but maybe you could post something directly relevant to the article. Your posts are always a plug for your website, always seem to be copied and pasted text, and are generally confusing because they rarely directly relate to the article being discussed, and because they are just confusing in general.

Here are a few excerpts from your post: “Today another new home sales miss but backward negative revisions once again…” and “…the extra $$$ cash buyers have held up existing homes from having a not to far from the Great Recession Lows in terms of demand from main street”.

Seriously dude? Who is going to strain their brain trying to decode and make sense of that? I can’t be the only one that virtually always ignores your posts. There might be some useful information in there somewhere, but I’ll never know because it’s too much work to try to figure out what you’re saying. Imparting information in a clear, comprehensible and concise manner is probably a necessary aptitude if you want to attract readers. I’ve never seen that in your posts.

Anyway, just a little observation by me. See ya!

It’s spam, plain and simple, and I’m surprised the mods let it through.

Logan,

As much as I respect your views and you as a person, I have to agree with responder. I honestly have no idea what you are talking about much of the time. I know the info you have is useful and I try my best to understand but it is over my head. I really want to know what you are saying. If you could uust pretend we know nothing about the subject and you are talking to a bunch of high schools students I would appreciate it.

Thank you for your words, duly noted. Have a wonderful Thanksgiving

I agree with Responder. I wish you’d go spam elsewhere.

Reports like this make me think that crash is coming sooner than later but then again another investment vehicle will just prop up the market or not?

In other news my parents are putting their home on the market in Orange. I told them to sell earlier this year if they were going to go that route, they could have probably gotten $800k plus with good advertising now I am not sure they will get $730k. I will let you all know how it goes, one thing for sure though is their home is not a crap shack and location is great but sales in Orange are drying up.

Future Buyer, that’s how things were in 2006. People were griping about how they waited 6 months to sell and did themselves out of $50k.

Yep that is true what you say. I did have a talk with them but it appears it is mostly for health reasons so the timing is what it is. They do realize it probably costs them money but ultimately health is more important.

Health *is* most important! But the RE picture is smelling more and more like 2006…

Price cuts all over the place where I’m looking in Redondo beach and Belmont heights, long beach. I mean the asking prices were out of this world ridiculous, and still are. I put an offer on a house with a $1m asking that’s been on the market for 250 days and $200k in price cuts. Offered them $950 with $350 down… Agent said I’m not serious and my offer was an insult.

That’s a really peculiar response from the realtor. Were you going to let the realtor double-end the deal (as in, you don’t have your own realtor)? Otherwise, if you do have your own realtor, I can see why the seller’s realtor might shy away from that offer (however unethical), since a potentially higher commission is at stake.

seriously? I dont know the area but a 1M list price with a 950k offer seems more than legit.

I would have offered 900K actually and your offer of 950K seems generous actually. Market is soft, these realtards will eventually figure this out…

Did you tell the realtard to go F himself?

price cuts all over so then why would you put your $350K at risk? that makes no sense.

not to mention, i just did a back of the envelope calculation and that’s a $600K loan.

$600K @ 4.148% = $2,915 + property taxes of $989 /mo = $3,904 + insurance/maintenance/upkeep ~$200 /mo = $4,104 a month, each and every month.

using a decades old metric of 30% of your income for housing costs and …….well i’m speechless…

This is a good way to test the waters and see what the reactions of these realtards are like. Makes for good discussion like here to gauge what the market maybe telling us. Seems if they ignore they maybe expecting a drop and are holding the line, are concerned about their commission, maybe they think prices Wil go higher or worried their property will drop in value. -all imo

Thank – Just wait for it to fall in price some more, and ma!e the offer again. 😉

I actually like the crowdfunding Idea. A way to invest in real estate without going all in. But I think a REIT would be safer. That said I am not interested in either until after HOUSING TO TANK HARD SOON occurs :):):):):):)

Really…? You want to invest in real estate? A lot of investment is required (better homes/standards) but I think it should be done for minimal investor returns. Not yield chasing real estate crowd-funding that isn’t even building any new supply.

I know of many people (I am one) who could easily have loaded up on real-estate speculation in earlier years, but not done so out of distaste for making money through hoarding a vital resource and damaging the chances of future generations. I would rather get my investment returns out of “win win” situations.

Wut? Its a terrible idea. If you or others want a easier and safer way to invest just use REIT’s.

I have a realtor so not using that guy… Wanted to tell him to f-off. But now I wish I would have offered $900k like someone mentioned above.

As a buyer, why bother having a realtor unless s/he has access to insider deals? The seller’s realtor is likely going to be more interested in an offer if s/he can double-end the deal.

Honestly, what does a realtor do for you as a buyer that you can’t easily do yourself? Look through MLS listings? Call to schedule a viewing of a house? Make an offer? Get an inspection of a home you made an offer on? This is all stuff you can easily do yourself, with probably less hassle than having a realtor representing you. For instance, if you see a house and are going to call your realtor to look at it, you might as well just call the seller’s realtor directly and save yourself the hassle of calling your own realtor. When negotiating a price, if there is no buyer’s realtor involved, you can negotiate directly with the seller’s realtor (that’s one less person that can collude against you).

In my mind, a realtor on the buyer’s side is a definite hindrance to you as a buyer, unless that realtor has some outstanding value, such as access to access to insider deals.

@Responder I think there are merits of using a buyers broker. I used a buyers broker for my home search in 2012. He scouted out all the listings each day, knew which brokers were sleeze bags, called the listing agents (many times agents will have an internal dialogue about the seller, their motivations, the price the deal will close at, etc) in order to determine if even looking at the house would be a waste of time. He arranged meeting me at 15 homes over a period of 3 weeks. Many listing agents dont want to run buyers all over town to look at homes and an upstanding listing broker doesnt care about double ending the deal – he wants to list and sell as many houses as fast as possible, many listing brokers love the idea of taking a listing and sitting back and waiting for the buyers brokers to go through all the headaches of vetting buyers, driving them to homes, loan qualification, etc. Besides the listing broker is under contract to work for the seller NOT the buyer…. During our negotiations, my broker went back to the listing agent and got 2 price reductions through the process (that was in 2012 when homes were getting multiple offers)…. I will definitely use him again if I buy a house, but fortunately I bought a home in a part of LA I can live in the rest of my life.

Dan – I agree; realtors aren’t really motivated to find the best deal for buyers, but I had a very good experience using an independent broker. He’d routinely point out flaws and possible remodelling opportunities from the first moment we walked into a place, and he was incredibly patient during a long search, during which my goal gradually increased from a “nice townhouse” to an SFR as prices dropped and my savings grew.

On an unrelated note, regarding the currently favoured perspective that it’s better to rent, a worry of mine as a renter was that my landlord was subject to the same problems as any other homeowner, and I could easily find myself having to move out on short notice (particularly since his less “focused” son was on track to inherit the building, and from some conversations which him, I think he viewed it as winning the lottery). Just a thought; I don’t think owning a house its a right or a privilege — it’s just a decision with pros and cons.

Responder,

What you say is true in more than three quarter of houses. There is a saying that 20% of the agents make 80% of the money (I am talking about a single market). There is a reason for that – 20% of agents are good and 5% very good; about 1% exceptional.

I bought and sold many properties in my life and some agents were outstanding. I consider those gold mines. You can not generalize, although for the most part you are right.

Responder that is incredible advice. I could not agree more. The realtors commonly will talk between each other to find out where they can talk down or up their clients respectively to complete a deal.

Some will completely work against their own client by giving away info such as they can pay more, or will accept worse terms than asked for.

Constantly they will say, “just tell me what number we need to come in at to get the house”

When I buy I probably will buy through the listing agent as you have suggested. They will be motivated to select your offer as it doubles their commission. So they will push it to the seller more than another offer from another agent. Also even if you offer is less than others they can agree to reduce their commission from seller. This way they still get a higher commission because its a lower rate x2, and the seller is happy to save on commission that he can lower the price a bit and still make more money. So you can actually get a house for less this way not having an agent!

People say you don’t pay for a buyers agent so you might as well use one, but since they are getting a commission off the purchase of the house that 2.5% really could have been taken off the purchase price if the system wasn’t setup the way it was.

Another horrible example is an agent saying he has a client that will buy a property, but he will not present it unless the seller increased the commission to him. He said they could even raise the price to compensate for the higher commission! How is this working in the best interest of his client.

Bottom line: If you have a highly experienced agent that you absolutely trust and are very incapable of doing your own research then I think that is a good way to go. If you are savvy at all and understand the process I think going through the list agent will actually save you time by getting you direct to the source whether your offer has a chance to get the house or not and if you do proceed likely at the lowest cost.

Even better you can try and find an agent that will just “write the offer” (And perform the whole transaction) and will likely credit you back a portion of the commission like redfin. So really just research on your own and when ready either try to get an agent that will credit back commission if the home does not have a lot of competition, but in a market with multiple offers go straight through the listing agent so you won’t have to grossly overbid.

If you take nothing else away it is that the realtor will do everything they can to increase their commission rates no matter what. A double listing is their ultimate goal and they will really work hard to get a good price for buyer to make it happen. So as shady as a lot of it is in the industry, understanding it can help you not to get hosed completely.

I am normally a buyer of Real Estate and the process is quite straightforward, you make an offer, you get a check, sign some papers, and 30 days later the house is yours. I am now in the process of selling my mother’s home in Lompoc, 100 miles North of here, and the experience is quite different, so many decisions to make….choosing an agent, deciding on an offering price, choosing which offer to accept. Allow me to share my experiences so far…..

After interviewing a few agents I selected a successful full service agent with a good sales history and agreed to pay her a full commission. I live 2 hours away and I needed someone to handle all of the details, a discount listing agent wouldn’t do much more than list it on the MLS and let other agents sell the house. Another decision that I made was that a quick sale was more important than getting top dollar, nothing worse that accepting a high offer, and finding out that the appraisal is low, and the sale falls through. We decided on a listing price at the low end of the market, and had a solid offer at 5% above asking price within 24 hours.

So far, so good, we should close in 2 weeks, I have no problem paying full commission for a smooth transaction. I am not a big fan of “used house salesmen” but if they do a good job, they are precious.

PaulA – Long ago I dealt a bit with a couple of lady RE agents based in Corona del Mar, about getting into a condo in OC. I should have gone ahead and done it. In any case, they were un-organized, sloppy, and didnt even have a decent cell phone.

Anyone can become an RE agent. The school is simple and aimed at average people. I could become an outstanding RE agent and the thought has crossed my mind more than once. I’d need a new car, some decent suits, and a schtick: I’m not on the large size of human beings so “The little guy who gives you a little more help” comes to mind. Each client gets a folder. Things are systematic and organised. I study the hell out of all I need to know, and memorize all I can. I take classes and go to seminars. I swear in my experience (knew a RE lady growing up) people go into selling RE like they go into being a Sunday painter.

I disagree with Responder. A good buyers agent can be invaluable in saving you time and money. I have a good agent that always inspects properties before showing them to me. Often she will say “You don’t want it.” or “It’s not for you.” but I will insist on her showing it to me. And you know what, she is always right. That’s not to say all agents are like this, many just chase commissions. But having a relationship with a good agent that knows your likes & dislikes can save much time. A good agent will also give you straight talk and not just tell you what you want to hear. They will advise you on what to offer and how to make your offer the most attractive, even if it’s not for the most money. A good agent is someone who other agents want to deal with and will steer their clients towards those offers. My agent and I have closed on 5 of the last 6 properties we bid on. That’s a pretty damn good average. The only reason we lost one is because I didn’t listen to her.

You made the right offer.

A $900K offer is a complete waste of time.

I am not seeing any softness in beach cities. None. Instead, what I see is very few listings. The few available are usually overpriced so they go slow, but most of them do eventually go. When a new listing hits the market at a price that is not too much higher than where recent sales have been, it becomes a multiple offer situation.

The upper bound in this cycle for South Bay beach cities has clearly been met at this point and therefore things are softening.

When you say the 700k crap shack you mean Culver City, Burbank, and Pasadena? Are you referring to the crap shack that is a 90 year old vintage piece of property? The walls are thick, to withstand a 9mm. Redwood planks on the outside, covered with heavy stucco, inside thick oak lath strips and heavy plaster, all makes for better amour than the modern home that can not stop a 9mm. I rather live in the vintage Tudor home than the modern crap shacks that have cheap materials(made in China) and construction that is put up in these modern developments and looks like a monopoly house, nice and square, aka , the cracker(jack box) look.

The only reductions I see are those sellers who are starting with insane over-inflated prices to begin with. Those are the same properties that are sitting for 100+ days. Generally most everything priced within the realm of reality is moving briskly. I’m focused on Southern Riverside County & Northern San Diego County areas.

I like these investments. I sometimes question their LTV’s though, I think they are inflated. I dont think I’d do one unless I truly thought the LTV was 60% or lower. I’m involved in a couple great ones, but seeing more like 8-9% return, not 11%

I don’t think crap shacks are the 1900-1930’s houses– I think he means the crappy 50s and 70s p.o.s. houses. Btw, I use an agent as a buyer because he kicks me back 1.5%. Otherwise I wouldn’t

Another big political move in the United Kingdom (England) against all property investors (including foreign) announced the other day (Wed 25 Nov 2015) in the Chancellor of the Exchequer’s Autumn Statement to Parliament.

Any individual (also appears to affect most company purchases) who buys an investment property/rental property (From April 2016) or a second-home (so many areas, such as pretty coastal areas, are full of second homes which have priced out locals)…. is subject to a big hike in Stamp Duty (which is a tax) = they have to pay an extra 3% of the purchase price (Stamp Duty). Hehe.

Potential owner occupiers just have to pay the normal lower rate. That should cool investor demand quite a bit more, and leave many bubble landlords/second home owners much more in limbo for potential proceed-able buyers (at ponzi high valuations), meaning some will have to cut prices in order to find buyers. Lower prices set on the margin, between a buyer and a seller, lowers the values of other surrounding homes. That’s how markets work on the up, and the down. Values set at the margin.

Just letting you all know, as it goes to show how in one part of the world political measures are being taken to tackle the bubble, to the squeals of bubble owners / landlords. Gov has good reasons; needs the money and because landlords with lots of properties only have one vote, where that landlord’s tenants (many of them) have lots of votes and reason to be grateful for opportunity ahead (lower prices so they can buy). If it can happen in UK (and thus London bubble central), it can happen in overvalued bubble US states.

Brain England,

3 % Tax is NOTHING for the rich foreign noble elite.

30% might slow the bus a little.

England is no comparison to US.

Banks and the National Board or Realtors, want that foreign money coming in to keep the party going,along with the States and Cities to fill their coffers with tax money.

Crowd-funding house-company investing been on the rise for a a few years in the UK as well.

I’ll leave a you with a couple of comments from ppl in the UK about crowdfunding real estate investors/companies.

_____

~ Chump investors entering at the top end of the market. Good sign for HPC (house price crash) when these sort of harebrained ideas are around. Suspect many investors will find their investment is very illiquid.

~ This sort of “business opportunity” is bubble-licious for us renter-savers. Shoe shine boys being enticed in at top of market an 99.9% to get burned while spivs make off with the cash. The “investors” deserve all they get, to be honest.

http://www.theatlantic.com/business/archive/2014/12/millennials-arent-saving-money-because-theyre-not-making-money/383338/?utm_source=SFFB

yet another article as to why millennials can’t buy houses or anything else

It’s also called being young. When I was in my 20s I didn’t think about saving either, the big money was going to come later.

Truth is, I’d be sitting pretty now if I’d stayed the hell away from college campuses and gone into a trade, and saved, saved, saved. I’d have a very nice house in Manoa Valley now.

Honestly I’d have probably done better as well if I hadn’t bothered to get a PhD. Colleagues of mine who only have a Masters have ended up in the same pay grade as I am, but started a few years sooner. They started saving/investing sooner, bought their houses earlier/cheaper and got better benefits because they were grandfathered into plans that vanished by the time I arrived.

Those extra 4 or so years in school and not working have probably ended up costing me several hundred $K over the course of my career. Pretty expensive for bragging rights.

I had a discussion with some friends who indicated homes are being bought with 5 year mortgages down in LA which I am assuming are ARMs. If that is true then these buyers must be buying on the hopes of a small flip. The friends obviously knew it made no sense in buying based on what they are seeing. However they do see housing starting to slow down or dip but renting prices are going up.

https://research.stlouisfed.org/fred2/graph/?g=l6Q

labor participation rate for prime working age people 25-54

it just keeps getting worse

http://www.nytimes.com/2015/11/29/business/international/chinese-cash-floods-us-real-estate-market.html

the invasion of chinese money has been in texas for awhile

ben,

That was a good article about the Texas asian land grab.

Too much money leaving China, something gonna give,

Chairman Mao is rolling in his grave.

I’m not normally into making predictions but the writing is on the wall that once prices begin to drop, a lot of these Chinese will rush to cash out in a state of surprise that America isn’t the sure bet they thought it would be.

It reminds me of the 1980s when the Japanese were buying everything. Having a healthy hatred of the Japanese, I was discussing this with a friend one day and he said, “If it gets to be a problem, we’ll just nationalize the properties. It’s not like they can take the land and with them to Japan.”

@Hotel California

Supposedly, Chinese real estate purchases in some overpriced markets have ground to a halt due to the recent turmoil in the Chinese economy and stock market. Chinese money indeed does not grow on trees like many real estate bulls would have led you to believe.

While I think most of the Chinese buying is mostly a plain old speculative mania, to the extent that the “safe haven” theory is true, those from China betting on it are seriously underestimating our government’s will and powers of confiscation. It’s simply a kinder and gentler form than they are familiar with.

@Hotel California

Confiscation through the inevitable busting of the bubble I assume.

Back in the 90’s, I joked that China could use their huge trove of U.S. treasuries to buy an entire state to accommodate their population growth. How closely prophetic that was.

http://www.zerohedge.com/news/2015-11-29/its-official-chinese-buyers-have-left-us-housing-market

the chinese invasion is over according to zerohedge

apolitical scientist stated: “(a PhD is) pretty expensive for bragging rightsâ€

Outside of gullible students on a college campus and underlings at a place of employment, I think that the vast, vast most people couldn’t care less if someone has a PhD, and some might even think it laughable if a person with a PhD insists on titling himself or herself “Dr.†Therefore, I would guess that actual bragging (subtle or otherwise and without annoying people) is probably very infrequent.

More related to the topic of not being financially savvy, I blew through the entirety of my 401k about 12 years ago during an extended period of intentional unemployment. I’m still reasonably financially secure and have plenty of working years left before a planned early retirement (or at least having a sufficient amount of FU money to be financially independent), but I certainly wish I would have left that money alone so that I could have sooner financial independence.

I intended to type the “vast, vast majority of people”

If my uncle’s experience at JPL is any guide, a PhD is great for bagging on those who only have a masters and making them feel like shit. I guess that’s worth a few hundred thousand, isn’t it?

Leave a Reply