Countrywide and Pay Option ARMs on trial – The most toxic mortgage ever invented by mankind is now under trial by the SEC with Countrywide.

You may or may not know that Angelo Mozilo, former president of toxic mortgage superstar Countrywide Financial is fighting against fraud charges brought on by the SEC. Countrywide based out of Calabasas California was one of the original option ARM specialists. Option ARMs are absolutely the worst kind of mortgage ever devised and the current trial is merely a tiny glimpse into this shady underworld of mortgage finance. The fraud charges against Mozilo and others from Countrywide will provide a view of a mortgage product that never had any right to be in the market place. Keep in mind that billions and billions of dollars of option ARMs are still out there. Bank of America is now the proud owner of the Countrywide’s option ARM portfolio. But let us describe a little bit more of what is going on.

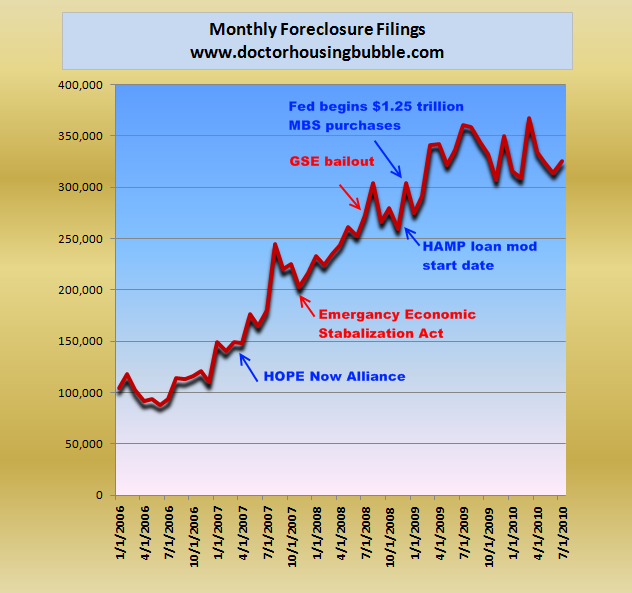

Option ARMs are merely one part of the toxic mortgage universe. As we now know, default rates on even supposedly secure FHA insured loans are now exploding. If we look at the current monthly rate of foreclosures it would appear that every government program has done very little in stopping the runaway train:

If these highly expensive programs designed to stop foreclosures did not help, where did the money go? The problem stems from loans like option ARMs that were made to people that had no intention or even ability to pay them off. As we have seen with the massive growth in strategic defaults, people have very little attachment to their homes especially in big bubble states. What should you expect when you had mortgage companies like Countrywide who had absolutely no respect for the long-term sustainability of their clients? Their main mission was to become one of the largest mortgage originators in the country. This was to be accomplished at any cost.

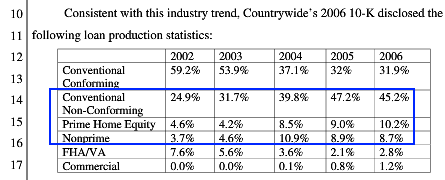

In court documents filed only a few days ago, you can see the obvious trend to more and more risky loan products:

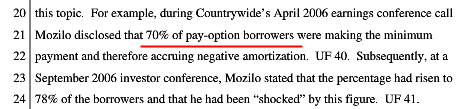

In 2002 nearly 60 percent of Countrywide loan products were conventional loans. But by 2006 over 45 percent of loans were non-conforming loans and nearly 10 percent were nonprime! The option ARM which is the most risky mortgage product ever devised was being made to people with low documentation and in many cases with no ability to pay the loan back. This is like giving a kid the keys to a Lamborghini just because he has the ability to turn on the ignition. Everyone knew these loans would blow up at some point. And to claim that no one saw this coming is not correct and even Mozilo knew about the problems way back in 2006:

By September of 2006 Mozilo already knew that 78% of his option ARM borrowers were making only the minimum payment. The minimum payment on an option ARM is disastrous because the actual balance grows. That is, the mortgage actually increases and this was happening at a time when housing values were reaching their apex. So you have a mortgage balances jumping up and home values collapsing. Keep in mind that roughly 50 percent of all option ARMs found their way into the California housing market. This was a much targeted mortgage product for extra inflated states. I recall some of the ads at the time talking about these loans as being for doctors and business leaders who simply didn’t want the hassle of filling out complicated loan docs. Of course it was the complete opposite. The low documentation and low teaser payment allowed those with weak incomes to over leverage and purchase incredibly overpriced homes. A $100,000 income is weak if you are taking on a $1 million loan.

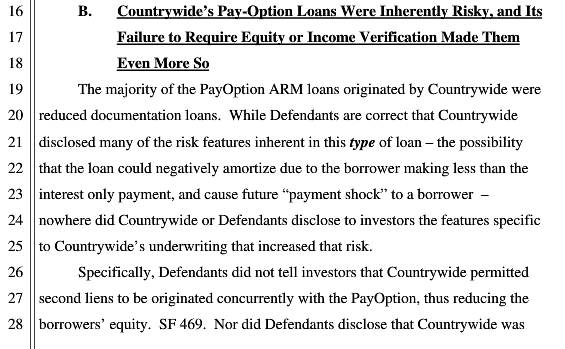

The SEC is arguing in one area that Countrywide knew the inherent problems with Pay Option ARMs but also didn’t disclose to investors that they were also allowing folks to get second mortgages thus crushing equity ratios:

Incredibly there is nothing illegal about the loan itself. The trial hinges more on whether Countrywide knew about the risk and didn’t disclose these risks to investors:

“(New York Times) The S.E.C. focuses on how Countrywide’s underwriting procedures deteriorated over time as it responded to market pressures by offering increasingly risky loans, like the “pay option ARMs†that involved numerous instances of misrepresentations by borrowers. As the loans became more problematic, Countrywide edged closer to collapse as problems developed in the financial markets.

This is very much the long view of the company’s prospects, and the S.E.C. essentially argues that the greater risks in Countrywide’s mortgage operation should have been disclosed to investors. In effect, the company should have revealed that the light at the end of the tunnel may well have been a fast-approaching freight train.â€

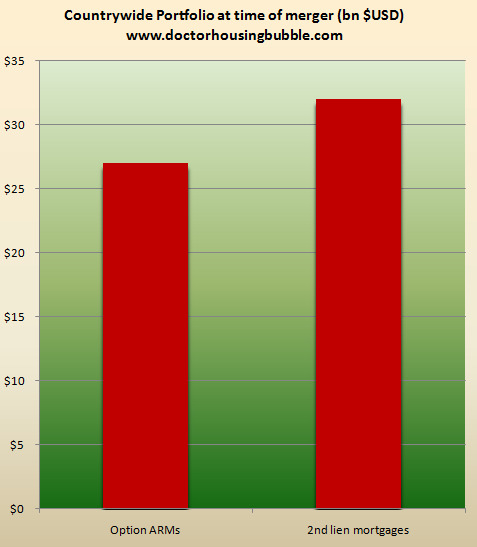

The point of this all is that many of these toxic deals still exist. Bank of America still has a large amount of these loans when it acquired Countrywide back in July of 2008. This is what it looked like at the time of the merger:

You don’t hear much about this being talked about because banks are looking for ways to dump this waste onto the taxpayer just like every other failed bailed out program above. For now, they have taken some option ARMs and converted them to interest only loans (default rates are still soaring). Of course, the core mission of helping homeowners stay in their homes has failed because home prices are much too high. Dean Baker who has been spot on about the housing bubble for years and had this to say yesterday:

“(CEPR) Virtually the entire economics profession insisted on ignoring the housing bubble as it expanded to ever more dangerous levels. Remarkably, even after the bursting of this bubble wrecked the economy and has given us the worst downturn in 70 years, most economists are still determined to ignore the bubble.

The basic story is very simple. For a hundred years, from 1896 to 1996, nationwide house prices just tracked the overall rate of inflation. This is a very long period in a very big market. If we see a trend like this persist for a hundred years it is reasonable to expect it to continue into the future, unless something big in the fundamentals changes. And, no one has produced any evidence that passes the laugh test that anything in the fundamentals of the housing market has changed.

This means that we should expect house prices to continue to fall, with nationwide prices dropping another 15 to 20 percent to complete the process of deflating the bubble. This price decline is inevitable and in many ways desirable. I don’t know why any of us would be happy if our kids had to pay more to buy their first house.â€

Pierce the bubble but have reforms in place to claw-back money from these banks. What is the point if the loans are merely shifted to the taxpayer? This trial will be interesting because those pesky option ARMs are still rearing their ugly little heads.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

46 Responses to “Countrywide and Pay Option ARMs on trial – The most toxic mortgage ever invented by mankind is now under trial by the SEC with Countrywide.”

It is certainly no coincidence that during the same period that Countrywide was flying high and could do no wrong in the eyes of Wall St., they were simultaneously darlings of the hand-in-glove lamestream media. The “celebrity” of Mozilo & Co. frequently extended even beyond the CNBC niche.

Yes, I’m suggesting that the Media-Finance-RE-Complex was herding the sheeple towards Countrywide.

It made me sick to watch on C-Span as Angillo Mazillo occupied senate chambers early in the mornings with his feet up on the desks! Day after day, just strutting his stuff! I knew there was payolla involved!

Apparently, the taxpayer will be the one hit with this as well. No one in our current administration or financial secotor has the gonads to do anything other than let things implode and force a bailout of these ARM’s- because it again will benefit THEM.

What is the real underlying crime in this is that those of us who do pay on time and do keep to the terms of the mortgage are going to be penalized yet again. All of those who say “let the prices go down” neglect to weigh the effects of the outright stealing of someone’s PAID FOR amassed wealth, simply because it fits the masses desire for cheaper housing. I think that housing prices need to stablize a bit on the expensive side, and the ratio of those who own vs. rent go back down to realistic levels. When I was younger, you wouldn’t dream of obtaining a mortgage with 20% down and decent credit. There’s no reason on this earth that we should not be applying this same mentality to the current market. Those who CAN afford to buy SHOULD, and those who CAN’T shouldn’t expect the rest of us to take it on the chin in order for them to afford it.

Quite simply, if you can’t afford it, DON’T BUY IT.

Ohiogal,

You do realize that if people only buy what they can afford, prices will go down a lot. Put together the pieces of the Dr.’s many posts, and that is the conclusion. Take away Fannie, Freddie and FHA, and you’re really going to see prices tumble. It’s unfortunate that some people overpayed for their houses, but they’re going to take it on the chin and the massive failures of government intervention have proven that nothing can stop it. I say let the prices fall, because that is the least costly way out of this mess.

Not really. As assets (houses) fall in price, banks lose megabucks on inventory and will want more taxpayer bailouts and will no doubt get them. Drop in asset prices is what banks fear the most and so should we! Banks are still real shaky.

Why should house prices level off on the expensive side? And should the government manipulate the market to achieve this? At MY expense, when i’m a non-subsidized, market rate renter?

Get the government OUT of the housing market altogether, and let the Invisible Hand decide where prices will be. That hand will guided by the fundamentals underlying house prices- incomes and rentals. I don’t expect the government to work to make housing “affordable” nor should anyone else expect the government to work to make houses more expensive…. which is exactly what our leaders have been doing with my tax money and yours.

I’d like to see every single government sponsored housing affordability program and every government assisted prop to the housing market utterly ended. No more low income housing projects of any description. No more Section 8. No more mortgage interest tax credit. No more Fannie, Freddie, Ginnie, or FHA. Sunset the HUD, an agency whose commission expired long ago, to the extent it was ever legitimate to begin with. Let people make their choices in keeping with their means in a market that has not been manipulated by lenders, bankers, realtors, home builders and others who feed off the financialization that is collapsing our country.

Amen Laura!

Ever hear of the law of unintended consequences?

Be careful what you wish for…

I read your message of frustration. the problem with your thinking is this. There is no such thing as pure capitalist free market in the U S . we need to adapt our language of economics to fit what we really are…. we are hybrid capitalist economy built on the foundation of the industrial military complex. We have just been informed a few weeks ago of all the money Mr. Buffet and Mr Gates and others have put into NON PROFIT CORPORATIONS.

please tell me what NON PROFIT means to you.?? Pure capitalist

free market dream on. website http://www.theomnisgroup.com to see how your free market is not working. the banks are afraid to take a phone call from an private investor like me trying to buy there toxic notes at a discount. They would rather be closed down than admit they don’t know what the hell they are doing period. government involved or not.

Well I’m glad no one is going to take your misguided advice.

It’s funny to see the sheeple still bleating the lamestream media lies about the market not working unless the government is involved. The markets have worked since the beginning of mankind without government propping up prices. One of the main causes of the housing bubble was because the GSE’s bought up half of the toxic mortgages produced by Wall Street. Every time the government gets involved, there is either a shortage or prices go through the roof.

I AM VOTING FOR YOU! WOOHOO…

you are so right, but sorry to say it will never ever happen.

Too many fat cats getting fatter.

I stood by for a decade and watched morons who I damn well knew could not really afford their houses crow and crow how they had found the magic font of free and unlimited prosperity, and now those same idiots, in combination with their pusher, pigmen banksters want to to support their over-priced homes via my tax dollars. No, the prices must not settle on the expensive side, they must collapse back to x2.5 annual income and stay there.

You had me up until that nonsense about “stealing wealth.” Wealth is not realized until assets are transacted.

It is also important to realize that supply and demand and sales volume are all intrinsically related. To state that people should buy unless they can afford some huge down payment would necessarily reduce your number of buyers. Supply would exceed demand, and prices would plummet. If you want prices to remain high, you would have to allow more dangerous loans to be written to increase demand by enlarging the pool of potential buyers (and the past decade ought to be lesson enough of why this is a horrible idea) or maybe decrease supply.

The decreasing supply option is interesting. I would not expect to see bulldozers leveling foreclosed neighborhoods anytime soon, but given the preponderance of foolish ideas from our legislators, it would not surprise me if this solution is eventually proposed and implemented. The likelier option is that properties could be held off the market for extended periods. The doc has written extensively about this shadow inventory.

Anyway, what it comes down to is that the sentiment of “if you can’t afford it, DON’T BUY IT” is correct. We would not be in the mess we are currently in if this maxim were followed. BUT concurrently lamenting that prices should somehow be supported above their market equilibrium and demanding a decrease in the size of the buyer pool is as pure an example of doublethink as I have seen. Those two desires are completely mutually exclusive and if any sort of policy or legislation is generated to address them together, its ultimate failure would cause more harm to more people than if we were to simply let prices stabilize where they may.

What you said makes no sense. The theft is from those of us who rented, stayed out of the market. You have no right to expect your property values to increase or even stay the same. Every act taken has been to prop prices up. Every step possible is being taken to make sure your bubble-gotten gains remain, against every bit ever economically rational behavior. I don’t know how you get “theft” from a market correction, but, given that, I have no idea what color the sky is in your world.

Since when is market adjustment stealing? If I lose money in the stock market because my stocks go down is that also stealing? If I invest in gold or oil futures or the Euro or whatever, and my investment loses value is that also stealing? Would you agree with someone who argues: “The government should bail me out, my investment in Icelandic Kronas tanked!” Or what about someone who paid for a degree and can’t a job, maybe they should be reembursed every penny they spent at the community college? The special breaks for housing and only housing get really old really fast.

By the way Ohiogal are you actually living in Ohio or are you now residing in SoCal? Because if you are in Ohio I wonder if you even know what leveling out on the expensive side means.

While I track with the replies to Ohiogal, please see my comments below.

There is more than one way to steal from the prudent. It’s not just our property values plummeting–I agree, an asset is worth what it draws at point of sale.

The real stealing going on here is of quality of life for regular people, as the rich, the poor, and the scamming middle class all try to bleed dry the last pool of money in the nation: all the responsible middle/working class has worked for, budgeted, and saved over the past 30 years, while resisting temptations to make a fast buck.

To Josh, I would say, you have an inflated view of your role in your local economy. Which doesn’t run on YOUR, the renter’s, taxes, it runs on the taxes of property owners. And as you renters expect more and more services, like the increasingly full-service day care centers laughably called “schools,” who is paying for them? You aren’t. We are.

Our housing values historically have gone up to track inflation. But it was Baby Boomers who initiated both the skyrocketing housing prices AND the financialization Laura speaks of. Once Reagan started letting cats out of the bag to let the ultra rich get ultra richer, all bets were off.

rose

If your house is paid for, what do you care what some other person sells his house for? Its a place to live. Get over it.

I’ve been hearing from more and more prudent, hard working people–who bought what they could afford when and only when they could qualify and pay for a dull old fixed 30–living in hell because of the scum now destroying their neighborhoods. Nurses, police, firefighters, teachers–solid people watching their housing developments get turned over to Option ARM and Section 8 freeloaders, gangsters, and various exploiters of the Great Society. People who come into a nice, modest house, run it and the neighborhood into the ground, complain, demand something better, get it…and stick the rooted, committed people with the tab one way or another.

Thank you Compass Rose, my point exactly. I was interested to see how many of you were quick to bash me when in reality, people like me ARE the market now, not the scumbags who rode the wave looking for a quick profit or a killing in real estate. It IS stealing from the people who built America the honest way, when you force prices down. Just ask the elderly who need their homes to survive or provide for income for their extended care in the future, and they have to sell.

Unless housing prices fall more there is no way for nurses, police, firefighters, teachers to afford to move into those houses as your new neighbors. I mean do the math: figure out what the average teacher and nurse earns, look at the average cost of housing in Los Angeles. The math just does not add up.

Thank you for another sentient post.

.

I too am especially bothered by the so-called experts who failed to warn of the impending crash; and continue to minimize the true severity of the situation.

.

You knew it was going to happen. I knew it. Nearly everyone around me knew it. The fact that the ‘experts’ didn’t bother to mention it publically would indicate that either their judgment was flawed, or (more likely), that they knew the crash was going to happen but decided to cash in even if it did ruin the country. Either way, they have proven themselves to be untrustworthy.

.

And now that the term ‘strategic default’ has been coined to absolve what we used to refer as ‘credit criminals’, I think the other shoe is ready to drop. For all the trillions of dollars that they are willing to throw around to help refinance these bad mortgages, no one wants to face a simple reality that spells doom: A person who is willing to lie on their mortgage application cannot be expected to honor a contract when it is inconvenient for them.

Malcolm wrote: “A person who is willing to lie on their mortgage application cannot be expected to honor a contract when it is inconvenient for them.”

Amen. But hasn’t this been the apotheosis of the Playboy/Boomer culture since the 1960s? When we saw elevated to a national ideal people reviling responsibility, and breaking contracts, in order to Follow Their Bliss?

I am a liberal person…yet always found it hard to comprehend this culture, which plagued people of all political and social views. I’m getting mine. Me me me. I can only assume that people were so scared by the Cold War, and the prospect of nuclear annihilation, mixed with the unfolding eco-crisis, that “the future” has no meaning whatever. Get in while the gettin’s good, and get your share, and to hell with anything else.

rose

Back in 2004 at the gym, I overheard a part-time, personal trainer talk about how he was going to buy a house and “get rich”.

I thought that was the peak.

Little did I know that G.S. was already putting together tranches of loans “designed to fail” for certain clients of theirs to short.

I would like to see the interlocking connections between Countrywide and Goldman Sachs and other investment banking scammers.

Back in 2004, I was searching for some vehicle to short RRE. I found none other than simply not biting into the bubble, like everyone else.

Little did I know the “gathering storm” of players who intentionally wanted it to fail and made money on both sides of every transaction.

Ahhh, good old Mozilo. Let’s not forget this tanned turd was the one who stupidly replied to one of the many “little people” who were emailing all of the execs they could at Countrywide to try to get some attention to their cases. Here was Mozilo’s accidental reply to one of them:

“This is unbelievable. Most of these letters now have the same wording. Obviously they are being counseled by some other person or by the internet. Disgusting.”

That tanned turd deserves to be behind getting his ass pound every night. Unfortunately that will never happen because all the colluded fraudulent entities that were involved in this are the so called leaders of this country. Wall St., bankers, many politicians and special interest lobbyists would all be joining Mozilla in the big house. I always thought this country did the right thing and was held to a higher standard. We are 1000x more corrupt than any banana republic or dictatorship. Enslave the people by lettiing them think they are free…

Yep – except I’d prefer to see them all drawn and quartered, hanged, etc.

I bought the condo where I live with a mortgage through another company that Countrywide subsequently bought. I had actually visited a Countrywide office first but the pressure of their guy’s sales pitch completely turned me off.

When I did a refinance to a lower rate a couple years ago just before B of A took them over, I was going through all the exasperating paper work and finally remarked in frustration to their representative, over the phone, “You know, I’m more solvent than you guys are. You should be the ones jumping through hoops for me.”

Ahhhhhh, the halycon days of “exotic” mortgages.

In addition to Mozilo, don’t forget Daniel Sadek and Roland Arnall (R.I.P., criminal).

This is another example of the ultimate destruction caused by thoroughly deregulated and unregulated markets. Oh, it’s great fun for the people at the top of the pyramid who make billions before the game is up, but then the collapse always comes, and the ones most hurt are the middle class, the vast majority of whom had no part in any of it. They’re the ones who are out of work, frightened and dispirited; at least partially as the result of the utter greed and amorality of the people at Countrywide and other such loan companies such as WAMU and Wachovia.

I don’t want to get too political here, but when I turn on the business channels, and I hear an endless queue of laissez-faire types decrying the Fin Reg bill, or anything which hints at government oversight, I am stunned anew at their incapacity to learn anything from the past. Or more likely, it is that they know, but don’t care, and they are only looking out for their own right to make more billions at our expense. If any government body had done anything to track what was going on with the immense loans being made to people who could never pay them, maybe it could have been stopped a year or two earlier. Before the greedy banks collapsed and we had to bail them out; before another ten million people became unemployed.

But the scary thing is that there are people right now who are trying to find ways to game the economic system, get very rich very quickly, and then get out before the house of cards tumbles once again. And as we all know, the people who didn’t take large loans that they couldn’t pay unless the housing market kept skyrocketing; those who paid their own mortgages and rent on time; people who just wanted to “work hard and play by the rules,” are the ones paying for the virtually impossible cleanup of the loan orgy. And that’s if they’re lucky and still have a job to pay taxes with. Punish Mozilo, absolutely; but there are hundreds of others who will never be touched, never be called to account for wrecking the American economy. I guess they are considered to big to fail.

This industry was, and still is, the most regulated industry in the world. That should give anyone second thoughts about the effectiveness of “regulationâ€. This is not a political rant, just a fact. After half a century of rule making, more rule making, supposedly better rule making….it’s clear it just doesn’t work.

How many government agencies oversee financial companies? How many agencies regulate (and make up) the “housing†market? Too many to name.

Just an FYI – a few of the regulations/government involvement that helped cause this mess:

1) Government efforts to push housing onto the general populace with specific efforts to force lending into redlined areas and subprime borrowers

2) Financial regulation favoring “securities” vs. “whole loans” – allowed banks to leverage vastly higher on the same underlying residential loans if they were securitized vs individual loans held and serviced (whole loans). Additionally, being able to create a AAA security from relatively poor loans enabled this even more.

3) Government bureaucracy which allowed Fanny/Freddy to be advantaged in multiple areas of the markets and repeatedly ignoring warnings that these things were going to blow sky high and attacking anyone who said such a thing.

4) Housing related tax advantages such as interest and lack of capital gains takes to encourage ownership. Housing becomes a favored asset.

5) Unwillingness to take deflation lumps post-tech crash and using housing/low interest rates to try to get out of it which only encouraged rampant speculation.

6) We won’t even talk about the effectiveness of government regulators monitoring all of this….

Honestly I think there are a few things that should be regulated specifically leverage levels and banking activities which can jeopardize the entire system. I’m in favor of something basic there – kind of like we had post Depression until the boobs ripped it apart recently (didn’t take long to blow it up either but they were very much doing what the government wanted them to do also in helping to get out of deflation). That said a free market works pretty well if allowed to be free. Housing has been an interefered with market for a very long time and the government has been heavily active in promoting it to use it as an economic driver – most recently blowing it and the financial system up. I’m not blaming any one person or either party, nor only the politicians but they and the government/regulations had a huge role to blowing this up and creating the problem. I’m highly confident when I say that if all mortgages were done privately on an open playing field and those loans were held to maturity but never insured by the government in any way…we would never ever have gotten here. Not saying it would always be a perfect world but what happened had some very very clear drivers from direct government involvement. They were a huge part of the problem and pretty clearly are not the sole answer or any kind of panacea.

I disagree, William. All the regulation of markets in the world can never protect the financially naive against the folly of debt. We spend more time teaching our young tolerance of gays (not that we shouldn’t) than we do about how personal financial security is achieved. So, they grow up to be Gomer Pyle’s, fumbling and bumbling their way through life (financially speaking) loading up on credit card debt and mortage debt. Is it any wonder that when they do become unemployed, particularly in the numbers we’ve seen in the last couple of years, it is an instant crisis?

It’s not just toxic mortgages, but predatory credit card companies and payday loans that are designed to be marketed to the financially uneducated that are destroying this country. It’s hard to get ahead and save for emergencies and help your neighbors when there is someone else’s name on your paycheck. Our great grandparents thought debt was a sin. Our grandparents had some debt. Our parents loaded up on the stuff. Now we think it’s a necessity of life. Tragic.

I’d like to know why Mozilo is not in jail. The amount of fraud that Countrywide and Mozilo engaged in is beyond any scope and measure. This was not business, this was outright fraud.

And there was Mozilo and that dipshit Cramer on TV talking about what a great company Countrywide was. And SEC filings showed that Mozilo was dumping stock like his house was on fire. He knew it all the time. Look at when his sales start. Months perhaps years before the meltdown. This dude almost singlehandedly bankrupted the US, while the SEC was watching porn on their computers. This was the grand finale, the coup de gras. I hope Mozilo rots in hell. I mean that.

Doc,

You stated:

Of course, the core mission of helping homeowners stay in their homes has failed because home prices are much too high.

You meant to state…are much too low…

In this Great Depression 2, home prices should eventually get to much lower levels. The % used above only takes us down to historical norms (with a normal growing economy). I think that house prices are headed down to levels that will shock many people, prices lower than the market bottom of 1996.

I recall reading stories where Mozilo actually e-mailed his vice-presidents and stated these option ARMS are terrible products. Eventually, he got caught up in the greed and profited highly. I am sure he is sleeping soundly at night.

It is illegal for banks to issue credit cards where the minimum payments dont cover the interest charge (no negative amortization).

Since the 30s, it has been illegal to lend more than 50% of the value of public stocks.

When i bought my first house, the rule was 20% down or go home.

So when did it become a good idea to give 100% lending on an illiquid asset like real estate, with loans that have negative amortization? Heres the source of the bubble. Free money to speculate causes . . . speculation.

Let the market correct. Let the speculators lose their shirts. Stop the principal forgiveness unless you want to reduce the principal of people who actually PAY their mortgages and other debts as they promised . . . .

Several states actually prohibited Option Arms. Not california, arizona, florida or nevada though. But gamblings been legal in nevada for some time.

I have one neighbor who bought in 2006 with an option arm. His house is on the block and he is in the middle of a divorce. Likkered up on debt. Sorry to see that happen, but its nothing new under the sun. People get addicted to lots of things, inlcuding debt. Time for rehab.

PP

Couldn’t agree more. Of course, if the banks were cut loose to sink or swim on their own merits and ability to responsibly conduct their business, the bad lenders would quickly go out of business and disappear. The big problem comes when those lenders are instead propped up by the government, reinforcing fiscal irresponsibility and making all tax payers and future tax payers foot the bill. Thievery, plain and simple.

The U.S. was faced with, essentially two choices about what to do about banks circa 2008-9 and there were two precedents for how to handle things. One was what a country seen as largely socialist did and the other is what a country seen as strongly capitalist did.

One country that had a clearly failed banking sector was Sweden. The other was Japan. And in direct contrast to expectations, Sweden in the early 90’s let banks fail, nationalized a few, cleaned up the books and sent them back out into the real world. Japan, at about the same time, did essentially what we did, indulged in propping up failed enterprises enough so that they didn’t officially fail.

There was another option and the Sweedes took it. Sadly, we didn’t.

It would be interesting to see how many of the Countrywide mortgages ended up in default. You could almost follow their trail and predict which houses will default and possibly foreclose next. My guess is you could look at a certain radius around Countrywide headquarters and it would look like a spider web of defaults.

http://www.westsideremeltdown.blogspot.com

I found Option ARMs are not “negotiable” instruments in accordance with UCC, sec 3(?). Only “fixed” payment notes are. So I am not so sure I agree with the premise that these mortgages are legal….Some foreclosure attorneys are making this case. If you’ve seen one of these mortgages or rather the “note”, you can find all kinds of “riders”. So in essence the borrow is executing several contracts at once. How can that be legal? If so, then there are definitely conflicting conditions and performance measures. Also, for their clients to succeed this defense is being used in the hope that the note holder will negotiate in earnest which they generally are not (re: failure of HOPE, HAMP, loan mods, et al). Even if they can produce the note (usually lost) the servicers have to provide evidence they had the note at one point in time.

Lastly, one has to think about how this is a legal way of credit creation for the sake of housing ownership doesn’t boder on ponzi scheme and money laundering. I mean these notes passed thru so many hands, leveraged, CDOed, CDMed to death, shorted, sold/leased back, bailed out, and now subsidized thru unemployment pymts (NEW!). Wait for the latest twist…bubbles need to correct to 90% of there high value then the healing can start

Aaaha!

From 2005 to 2007, Banks were buying CDO’s from….themselves!

“Over the last two years of the housing bubble, Wall Street bankers perpetrated one of the greatest episodes of self-dealing in financial history.

Faced with increasing difficulty in selling the mortgage-backed securities that had been among their most lucrative products, the banks hit on a solution that preserved their quarterly earnings and huge bonuses: They created fake demand.

A ProPublica analysis shows for the first time the extent to which banks — primarily Merrill Lynch, but also Citigroup, UBS and others — bought their own products and cranked up an assembly line that otherwise should have flagged. The products they were buying and selling were at the heart of the 2008 meltdown — collections of mortgage bonds known as collateralized debt obligations, or CDOs. “

A Crib Sheet on Wall Street’s Self-Dealing Money Machine

http://www.propublica.org/blog/item/wall-streets-money-machine-the-short-story

Everyone complains there is red tape and over-regulation. What is the alternative? Hope people will do the right thing? Always some that never have and never will. All the legitimate businesses will be overwhelmed those who intentionally do the wrong thing and get away with it. As long as the heart of man is inherently self-interested and blind to evil, there is little hope.

MP –

Human beings are animals. We look after our survival, i.e., self interests, first and foremost.

That’s why captialism is the best economic model yet instituted….it addresses a basic animal instict to compete for survival, and the results are better efficiency, better products, better productivity.

But, there is no “free market.” People who use that phrase are stupid. We have a market-based economy.

We are also a nation of laws. So, there’s a balance between “the right thing” as you call it, which is represented by laws, and our basic survivalist insticts, which are represented by capitalism.

The problem is that those who make laws (legislators) are in constant campaign mode because the cost of winning elections continues to escalate. Now, with corporations having the blessing of the U.S. Supreme Court to contribute unlimited funds to political campaigns, the drive to follow the money will be stonger than ever for both parties.

So, what we have is the foxes (legistators) in charge of the hen house (our economy). The result is fascism and plutocracy.

In our two party system, there is very little incentive for one party to differentiate from the other….what are disenfranchised people going to do? Go to the only OTHER party.

In the end, capitalism has run amock. There is no meaningful regulation. The disparity between the rich and everyone else has never been greater, even in this recession, which should come to no surprise to anyone who has a basic understanding of the Depression (hint, see “Annie”).

Ultimately, there will be an uprising. The Tea Party is an early incarnation, yet still just a marionette of the Republican party. At some point, Democrats will split. Class warfare will ensue. You’ll see poor Dems, Tea Baggers and Repubs joining forces. The enemy will be the Wall Street/Corporate plutocracy.

Should be fun to watch

This whole Countrywide unwinding is socially, as well as fiscally, toxic.

~

I was talking to a friend who shared how his small but solid neighborhood of working families is plagued by a seriously pathological household that bought in with a Countrywide ARM. FHA (you and I) now holds their mortgage. They bought in before the big local peak, now are infuriated that property values are declining. Considering the amount of stuff they bought at the time of the remortgaging, when values were still up there, and the upturn in seriously scary drug-related problems, the friend guesses that they took on additional debt to fuel those parties.

~

Whose fault is the downturn in property values in their view? Not the market. Not their own failure to maintain their property. Not their county’s reassessment. The fault is their neighbors, whom they hate. Their neighbors are prudent, responsible people who got their houses the hard way, working, budgeting, saving. They also don’t care to associate with scammers.

~

The friend says that, having gone down like their gangsta sugar daddy Mozilo with the “eternal housing appreciation” balloon, these people are now hoping to file litigation/ liens against against everybody in creation for a wide variety of imagined wrongs. Hey, there’s always some hungry lawyer out there! And isn’t litigation the new bubble industry, along with corporatized “health” “care”?

~

Friend says that he and neighbors pray for them to default…but even if they did, they’d probably be allowed to live there interminably without paying or foreclosure.

~

I have to wonder how many other neighborhoods suffer this. I’ve been hearing from more and more prudent, hard working people–who bought what they could afford when and only when they could qualify and pay for a dull old fixed 30–living in hell because of the scum now destroying their neighborhoods. Nurses, police, firefighters, teachers–solid people watching their housing developments get turned over to Option ARM and Section 8 freeloaders, gangsters, and various exploiters of the Great Society. People who come into a nice, modest house, run it and the neighborhood into the ground, complain, demand something better, get it…and stick the rooted, committed people with the tab one way or another.

~

Progressives have no compassion for these working people; in their view the scammers are virtuous downtrodden heroes stickin’ it to The Man. Or the scammers don’t exist. They’re all Victims. Conservatives pretend to have compassion for the working people, but join in the reaming.

~

Meanwhile the ultra rich continue to get ultra richer (as has been the whole point of the economy these past three decades), the banks serve them faithfully, and anything you and he and I work for is destroyed for the sake of electioneering (Keep Americans In Their Homes!) by corporate-created Blue Pepsi Man versus Red Coke Man.

~

I’ve read nothing so far about the social pollution of the Mozilo Model: good solid neighborhoods/areas poisoned by people with no concept of what housing/mortgages mean outside of winning the “Fog A Mirror, Win A House” lottery. They aren’t letting go of their expectations of something for nothing, and everybody else paying them for existing. And now everybody from the Prez on down stands up for their absolute right as Americans to do this. The empire of “What can I get away with?” and “What does everybody owe me?”

~

rose

Our country has been ruined by the greed of the moneymen. I don’t see any way to fix it.

I’ve seen it reported that over 200 members of Congress are in

the “Friends of Angelo” club. Do you really expect anything to

happen here?

I read many posts, including some on this thread, from people seething with indignation about how responsible they were and how it’s the irresponsible people who deserve the mess that they now find themselves in.

Let’s be clear on one thing: crooked behavior by Wall Street, the ratings companies, lenders combined with lax oversight by the Fed, SEC and various other agencies contributed to this disaster. Not to burst the bubble of “responsible” people but if you find yourself above water and doing OK then you were most likely lucky in your timing of getting in to the real estate market, and/or bought your place well before the shenanigans of the mid-2000s came to a head. Yes you are a responsible person, and you deserve to be in good shape. But please get off your high horse acting as if you are somehow better than the irresponsible masses. You are not, you are just lucky.

I have owned two homes, one I bought in 2000 and sold in 2006 for great positive equity. I then purchased an equivalent home in 2006 and have since seen its value drop by 38% and projected to fall another 5% this year. I did nothing exotic, but I am deeply underwater and have lost all the gain I ever made in housing. I was lucky the first time, and unlucky the second time. I am no more or less responsible now than before, and I never dabbled in risky loans. I put all my money in at the worst possible time and now watch in dismay as values continue to slide due to multiple downward pressures including foreclosures in the neighborhood and everything else.

Housing has a long ways down to go, we are not even close to bottom. There’s a good reason why banks have resisted mark to market efforts. If they had to declare the real valuation of their assets they would collapse. It’s going to get a lot uglier before it gets better, and everyone, responsible or not is going to take a further hit. So let’s just have a little more empathy for the collective community of people unwillingly caught up in this mess and look forward to a day when we can past this…. together.

Leave a Reply