Collapse in Southern California home sales a sign that prices will fall in 2011? The 2005 and 2006 collapse in sales led to prices tanking in 2007. Home prices still inflated after years of bank and government intervention.

Southern California home sales have collapsed for July and August. These are typically strong sales months. The summer is usually a solid time for sales but the introduction of government intervention, banks stalling, and toxic mortgages lingering on bank balance sheets have thrown a wrench into the typical home sales patterns. This August was the weakest month on record since August 2007, right when the California housing market was first entering the major price correction phase of the bursting bubble. It is interesting that many are blaming the tax credit for this collapse yet the tax credit was an artificial stimulus. It wasn’t designed to be permanent since it actually costs taxpayers money and is highly inefficient. The problem with home sales collapsing in Southern California has to do with home prices being too expensive. Back in 2005 and 2006 when we were in the early days of the bubble, we saw the collapse in home sales as a sign that prices will fall later. Is the collapse in home sales a leading indicator that prices are to follow in 2011? Let us examine the trend.

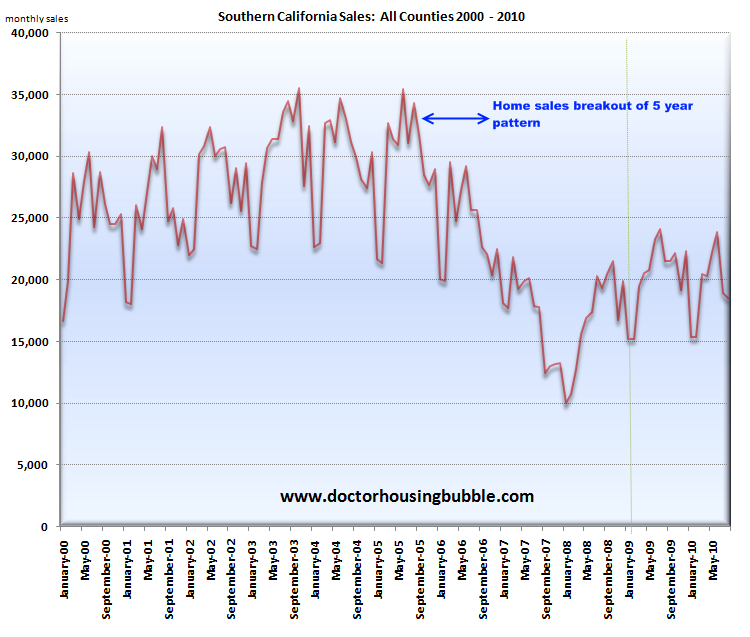

From 2000 to 2005 the home sales pattern for Southern California was rather clear and predictable. Home sales would spike in the spring and summer seasons and this is typical. This was then followed by the slower fall and winter seasons. Yet in late 2005 the winter season took a big hit and the 2006 spring and summer saw no bounce. This set the stage up for the collapse in prices in 2007. The lag from sales to prices was one year. And this makes sense. With fewer sales the market was suddenly building up a large amount of inventory. The toxic mortgage appetite was then gone so financing options were off the table thus reducing the base of potential buyers (i.e., everyone with a pulse to those with verifiable income). It took one full year for prices to suddenly adjust. The collapse in home sales this summer is more than merely the tax credit expiring. The economy is still in bad shape especially in California. With no budget in place and a change in leadership coming soon, it is hard to say what we can expect in the next year. The general sentiment in the market is the public is now completely focused on jobs and everything else is secondary.

Focusing on housing and keeping prices inflated has actually hurt the economy. We have given banks and politicians three years to do it their way and look where we are now. The mission has been simply to focus on keeping home prices inflated but in the end, this is bad policy because people with lower incomes due to the economy can only afford a certain mortgage amount. By keeping prices artificially high, you effectively stifle demand and we are now seeing that. In essence this is a complicated price floor. The tax credit subsidy actually made home prices cheaper but through an expensive mechanism that cost taxpayers billions of dollars. Wouldn’t it be simpler to simply let the market adjust prices to what people can currently afford? If we are going to blow billions of dollars why not focus the money on jobs?

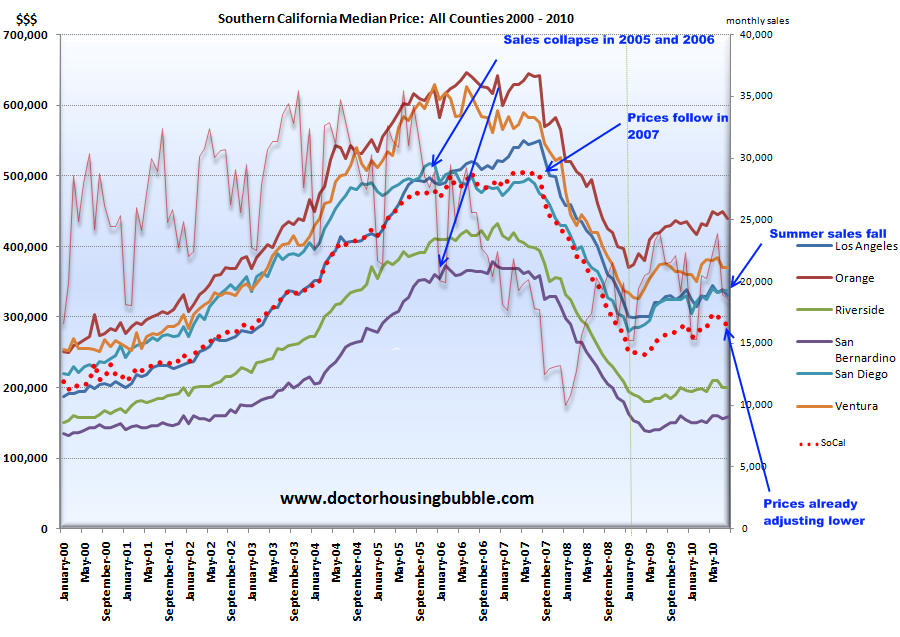

Home prices in Southern California have now fallen for three consecutive months:

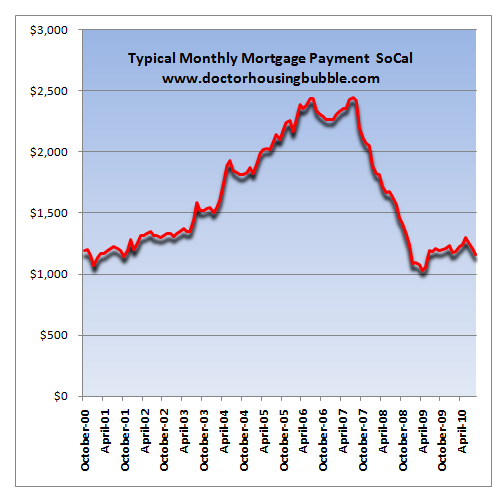

This is actually a departure from the trend back in 2005 and 2006. The lag was much deeper back then. It is also a very different market. Back in 2007 the foreclosure pipeline was only being built up. Now, for over 2 solid years foreclosure resales account for 30 to 50 percent of all monthly sales (last month it was 34.7 percent). So a large portion of the market is being driven by distressed properties. Much of this used to come from toxic mortgages but now we are seeing a good portion of defaults with folks with vanilla 30-year fixed mortgages. FHA loans still dominate the market. Over 36 percent of sales last month came from FHA insured loans in Southern California. By looking at the data on FHA loans in California we know that many only go in with the lowest down payment possible and that only requires 3.5 percent of the purchase price. Is it any wonder that FHA defaults are growing exponentially? Even with this easy money, they typical payment Southern California buyers can commit to has consistently dropped:

Southern Californians can only commit to so much and the typical mortgage payment last month was $1,158. This is a far cry of the $2,400 peak in 2006. So for the monthly nut, it is already obvious that California home buyers can only afford half of what they could in 2006. The toxic mortgages during that time allowed for additional leverage that is now completely gone. What does the above tell us? That home prices need to come down in many areas.

If you think about what the Fed has done they have rigged the system in every way possible trying to keep prices inflated while keeping the monthly nut low. For example, forcing mortgage rates lower gives more leverage on the monthly nut for buyers but allows banks to keep prices inflated. What use is that? If interest rates go up and there isn’t much room on the downside, then when you sell in a few years the new buyer won’t have the leverage that you currently have. In other words, you are buying for the absolute long run right now with very little flexibility. The tax credit? Don’t expect that to be an option in a few years. In other words, it is all about the short-term right now and as we are now seeing from actions of 2006 and 2007, those policies did nothing to improve the health of the economy or the housing market unless you believe financial media hype and actually think the economy is good right now.

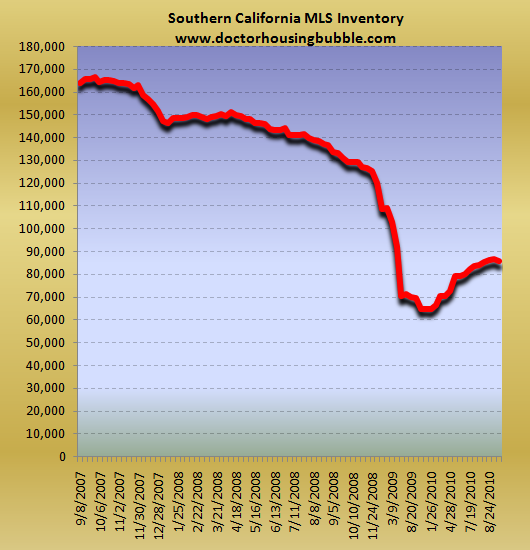

And because of this, supply is now growing:

Even basic economics would tell you that more supply with less demand (because of the economy) would push prices lower. Even Bank of America earlier this year stated they would increase foreclosures by December of 2010:

“(IHB) I attended a local Building Industry Association conference on Friday 26 March 2010. The west coast manager of real estate owned, Senior Vice President Ken Gaitan, stated that Bank of America, which currently forecloses on 7,500 homes a month nationally, will increase that number to 45,000 homes per month by December of 2010.

After his surprising statement, two questioners from the audience asked questions to verify the numbers.

Bank of America is projecting a 600% increase in its already large number of monthly foreclosures.â€

Now I’ve been following shadow inventory for Southern California very carefully for years and right now the amount of shadow inventory is twice the size of the MLS data. Given the current collapse in sales, you wonder if banks will follow through with their own stated goals. Banks are at the root of the problem so don’t expect them to do as stated. The government isn’t enforcing anything when it comes to streamlining foreclosures so right now, the foreclosure process is basically whatever banks feel like doing which is absolute nonsense since this is the industry that created the toxic mortgage asset bubble in the first place.

If we actually practice capitalism and don’t have more interventions, prices should go lower because that is what people can afford. Southern California in general is still in a bubble in many areas. When there is a bubble, things usually pop and prices come down.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

51 Responses to “Collapse in Southern California home sales a sign that prices will fall in 2011? The 2005 and 2006 collapse in sales led to prices tanking in 2007. Home prices still inflated after years of bank and government intervention.”

Mark-to-myth is allowing lenders to survive right now. I doubt BofA will be throwing 45,000 houses a month onto a falling market. Especially when they dont have to do it.

If they don’t have to flood the market with potential foreclosures…what exactly will they do with them? Will some people get to live in BofA mortgaged houses for free indefinitely?

Yawn. Wake me when prices in (congested, high crime, overtaxed, unemployed, bankrupt failed state) are down to the construction cost of $50 per square foot typical of other undesirable areas in North America. Seriously. In the “Happy Days” of post WW2, single teachers could buy nice new tract houses on Balboa Island in Newport Beach for the same price as a comparable house in North Dakota or Houston. As late as the early 1970s Palo Alto houses were the same price as comparable houses in Gainesville, Florida. And this was when California was still desirable, with top public schools and nearly tuition free state universities.

Why any place on California should command a premium now is beyond me. Schools are at the bottom, sales and income taxes are at the top. Fiscal outlook as bad as Greece. As for the beaches, how about those E. coli counts?

The only reason that California could still cost more than Kansas is a mass delusional cargo cult belief that the generational California housing Ponzi scheme of 1975 – 2005 will return soon, just like John Frum’s plane of presents returning to Vanuatu. Maybe Californians should start sculpting effigies of Angelo Mozilo out of old orange peels to bring back the HELOC loot, while singing, “California Girls” – either the dreadful new one or the classic. Meanwhile, Octomom is the real 2010 California Girl – clinically insane and sucking millions from the public teat as her 14 children threaten to become equally unproductive citizens.

Hehehehehe…your tone may be a tad world-weary and over the top negative, but your points are right on Monsieur Kiwi!

NewZealandRenter, I got a good chuckle when you mentioned Balboa Island in NB. My former inlaws told me that they had a chance to buy on Balboa Island back in 1970. They decided not to because it was about 10 grand more than inland neighborhoods in Costa Mesa or Huntingon Beach and also wasn’t that great for kids. And no, my former father in law was not rich…he had a high school education and worked for the phone company. How times have changed!

Hi Mr Z – I can tell you why some homes cost more than $50 sq/ft to build in California as I was a developer back in the 1990-1999 time frame – not single family but smaller sized condo projects (15-25 unit) in San Diego. Ours usually cost ~ $150-$200/ft to build if you include:

land, pollution mediation, permits, fee’s, quality materials, labor, overhead (ie the management of the labor) loan servicing, 15% return to the people that put up the capital to get the loan, etc

If you can do that for $50/ft the more power to you. Our garages cost more than that.

@HappyHomeOwner – You have just described why California is a failed state. Construction cost $200 per sqft in the 90s – all due to overpriced land and excessive fees. OMFG! Check out newhomesource dotcom and you can find 2010 new major builder’s detached and town houses all over the N American interior for sale to the public at retail prices well below $100/sqft. I assume the builders are making a profit.

I understand that the Auto Club of Southern California moved their offices and hundreds of jobs to Arizona recently. This story will not end with recovery of California house and land prices.

Mr Kiwi you are a great writer! I love it even if what you r saying is all bad news you say it so well!! Wish more people understood what really happened as well as everyone does here! We should have. 62 million man march on washington! Everyone that got BS deed naming MERS as the beneficiary on their Notes! Tell me how can the “WALL” that the banks hid their sales of our Notes be the beneficiary? Answer? It can’t. Its fraud all around as the banks have no right to foreclose on 62 million mortgages in the US alone! The “wall” i.e. “MERS” had nothing to do w the transaction. Didn’t loan anything, didn’t collect anything, it was just a wall the banks could hide the sale of our Notes behind and we would never know who we owe the money to! Since the original bank never actually loaned anything either and merely acted as a broker they too already got paid and still when the borrower defaults onthier now underwater less than zero property, MERS (the wall) assigns the Note back to the original “pretender lender” and the banks steal your house. It’s insaneand judges, atty’s and courts across the land are only beginning t see the truth behind this epic fraud hell the whole “fractional reserve banking system” is based on fraud! Of course nearly every country including ours, is bankrupt!

We still have the California girls though!

Funny thing is that the “California” girl is no longer white since she’s moved out of state. She’s now Mexican, and comes with three kids.

Yep despite Lawrence’s completely false ugly racist response.

Kiwi, I can get you some good deals on homes in Burbank, the media capital of the world. You got to pay to live in Toon Town(see Roger Rabbit film). You have earthquakes like us. It does not rain all the time in Burbank like in Kiwi Town.

“NewZealandRenter

September 16, 2010 at 10:46 am

@HappyHomeOwner – You have just described why California is a failed state.”

I think it is a “failed state” because it spends more in the budget than it takes in – moistly on social services for the people unwilling to work and all the illegal immigrants here, but I digress.

“Construction cost $200 per sqft in the 90s – all due to overpriced land and excessive fees. OMFG!”

That certainly contributes to the final out the door cost, however so does paying local labor cost (it’s double here compared to the Midwest if you do not hire illegals) and putting in something other than Home Depot Builder spec parts tends to drive up the costs as well. Fee’s we can’t do much about, but land costs what it costs, just like gold or any other commodity, it goes up and down with demand, and availability and desirability determines what people are willing o pay for something. A 1 oz Gold Eagle in my safe went from $50 to $800 to $240 to $1275 in the last 30 years – is it the same gold coin at $1275 as it was at $50? – looks & feels the same to me.

“Check out newhomesource dotcom and you can find 2010 new major builder’s detached and town houses all over the N American interior for sale to the public at retail prices well below $100/sqft. I assume the builders are making a profit.”

I would assume they are trying too, however slim. Just curious but have you ever built anything anywhere so that you are familiar with the process?

Do you want to live “all over the N. American interior?” – I don’t, and I’ve driven cross country 3X, and lived for a short period of time in the NE, NW, SE and ended up here. The average temp where I live is 70F. We do not have Winter, or Summer, we have 6 months of spring and 6 months of fall. Even though I have a dual zone heater/ac system I only turn it on for 30 minutes once a month to circulate the refrigerant and make sure that it still works.

Getting back to the overpriced units we built, we could have put in $49.00 toilets and $29.00 sinks with $19.95 faucets sets, instead of Kohler for 5X the cost, or particle kitchen board cabinets instead of 7 ply birch plywood cabinets with real veneer faces, or 4 piece “appliance sets” in the kitchens for $1200 instead of the $4000 sets too. Using double hung, dual pane low e glass windows and 2X6 instead of 2X4 costs a bit more as well. When you put a roof on a building you can get 10-20-30&40 year roof “systems” – which one costs more? Which one do you want to buy if you have a 10 year latent defect exposure? Ever dug an underground garage for 40 cars where the CARB requires a ventilation system so that no one will ever know that you actually drove a car in or out??? ever dug a hole for said garage and run into a layer contaminated earth (courtesy of our government operations in WW2) that it is now your responsibility to remove and replace with fresh soil and then put in a residual vapor recovery system in case you missed anything? None of that ads up to “builder basic for $50 a square net.

“I understand that the Auto Club of Southern California moved their offices and hundreds of jobs to Arizona recently.”

They night have moved some kind of administrative phone center out of state to save $ on something, however all the other 5000 local offices that provide walk in services are still where they were – how would they operate otherwise? Lots of companies outsource what they can to more cost efficient areas – that’s life int he era of globalization.

“This story will not end with recovery of California house and land prices.”

I’ve lived here in SoCal long enough to see 2 peaks and 2 crashes and have heard all of that before (like twice), and it would not surprise me to see another one or two cycles in my lifetime. However, you do have to live somewhere – and I do not think all people buy based on price as a #1 motivator, at least for us it was, 1) location, 2) quality/features, 3) price. If you want to get a killer deal on a house in the middle of nowhere – awesome, let me know how that works out for you in January when you are having an ice storm and I’m eating lunch by the pool…

That said – you would not see me even considering any of the LA area homes that Dr. HB features in his “overpriced genius homes” – those prices are really insane you’d really have to be a genius of a different sort to buy one..

The issue here is the price of the land – house is a house but the large increment in CA housing is not the cost of building materials/labor, it is basically the land/location and what people have been willing to pay for it. The argument here is that 1) people were already stretched far too thin on their finances before this even began 2) long-time rolled equity facilitated the trading of properties between owners 3) creative and highly unsustainable financing helped push this up even further.

Those are all pretty negative fundamentals for increasing land values. Now bring in state/munis of CA government/fiscal conditions, always increasing taxes etc…Best case scenario is that the land factor in that equation stays steady for a long time while people gradually heal. The way I see it anyway but the argument is less about actual construction/material differentials than about location/land.

Great entry my friend…Dennis Miller couldn’t have said it better.

Prefect description! Have you visited recently? LMAO!

NewZ you hit the nail dead on regarding CA home prices especially in Palo Alto.

http://www.bloomberg.com/news/2010-09-15/u-s-home-prices-face-three-year-drop-as-inventory-surge-looms.html

I thought I’d share this link with you. It’s a cnn business news story about the rebound and recovery in California home prices. This is the crap the MSM feeds us.

http://money.cnn.com/2010/09/15/real_estate/california_home_price_rebound/index.htm

CNN states that “Most of the subprime-related distressed properties have been flushed from the system. ”

What? These guys have been taking lessons from Göbbels (The propganda minister of Nazi Germany), who said that “People always believe a part of what you say and no-one believes small lies, so lie big and people will believe you”.

CNN is obviously a modern propaganda machinery.

Göbbels, or maybe Baghdad Bob. “There are no foreclosures in the states of California, Arizona, Nevada, or Florida. In fact there never were! Things are great! Maybe a couple of foreclosures in Michigan and Illinois, but who cares about them?”

Actually, come to think of it the NAR spokes-holes Lawrence Yun and the other couple of them also sounded like this all the time around the peak and first couple of years of the meltdown.

> These guys have been taking lessons from Göbbels (The propganda minister of Nazi Germany), who said that “People always believe a part of what you say and no-one believes small lies, so lie big and people will believe youâ€.

You are lying. Goebbels never said any such thing, and neither did Hitler.

http://www.geniebusters.org/915/03_postnazi.html

When Hitler wrote about the Big Lie in Mein Kampf, he was not advocating it, he was complaining about it.

Defaulted mortgages as of July took an average 469 days to reach foreclosure, up from 319 days in January 2009. That’s an indication lenders — with the help of the government loan modification programs — are delaying resolutions and preventing the market from flooding with distressed properties, said Herb Blecher, senior vice president for analytics at LPS.

“The efforts to date have been worthwhile,†Blecher said in a telephone interview from Denver. “They both helped borrowers stay in their homes and kept that supply of distressed properties on the market somewhat limited.â€

Why does he call this worthwhile? If unemployment is so high and the economic recovery not happening, why does maintaining the over-inflated price of real estate equal “worthwhile”? If someone making in the upper 75% of incomes in California can only afford to buy slum in a crime infested run down neighborhood how in the world do you call that “worthwhile”?

This is good news. People can stay in their home , on average, some longer, some shorter, of 1 and 1/4 years for free. This is a great deal. The price is no more FHA loans for three or four years, but who cares. With this real estate and job market it is best to be a renter. The people staying rent free use the mortgage money to keep on spending which is good for the economy.

Well the government has run out of options. The interest rate is the lowest it has been for decades. Personal income tax rates are also the lowest it has been for decades-despite the outcry. The fed already has a trillion dollar+ junk bonds in their balance sheet.

Really, pretty much all the ammunition has been spent. Jobs ain’t coming back unless wages become competetive with the likes of China . I think patience is a virtue and prices may actually correct lower-just a matter of time.

Now a few other alternatives may actually cause prices to rise-a dollar collapse leading to competetive wages and massive inflation. But in today’s weak demand environment-deflation looks likely. Lets just see.

NewZealandRenter: the basic answer as to the why Calif became more expensive is jobs and very good paying jobs along with an very interesting Hi-Tech culture but time flies so to speak and so has the jobs which along with the Hi-Tech culture can be found in other far away lands.

I recently tried to assit my daughter & son-In-Law the ones that bought in 2007 no matter how hard I tried to talk them out of it, in getting a refi for their overpriced townhouse in Redwood City. Basically they are screwed along with millions of other Calif overwhelmed young homeowners, very sad to see what the criminal banking system has done to the younger generation.

California is a wonderful place to live.

And happily, even though we do make it a bit harder than it should be to open a small business, it is STILL far more easy to do so here than in some of the socialist societies that some of my relatives live in (my sister lives in Canada, and it’s really sad to see how pathetically excited they get over the teeniest new tech business that manages to stay afloat and doesn’t run to the US for an easier chance at start-up. . .). So we Golden State natives are a resilient, optimistic bunch. After all, Hollywood, Television, Silicon Valley, Biotech….all these came of age here in CA, so we’ve got a historical precedent of being the place where people have the brains, initiative and originality to build new worlds out of nothing.

Yes, our state government is a bunch of idiots, but that’s nothing new. We survived the Great Depression, and will come out of this eventually as well.

But speaking as a native who has seen several real estate bubbles come and go, the sooner the government just lets this die-off HAPPEN so prices can drop and the market recovery naturally, the better. Just like when a big shade tree dies off in the forest, the economic die-off of the artificially sustained giants companies will make room for new, smaller businesses to get some sun.

Yes, a lot of fools bought during the high cycle (some of them were folks I love) but once this all shakes out, the prices will correct and more “normal” folks will be able to buy homes again.

I like Susan’s message. California is a beautiful place to live. It’s not only the government. The central bank, Bernanke is also the big problem. If the 30y mortgage rate is 4%, a lot people want to speculate and buy, even they cannot afford. why 4%? if the bank don’t lend, 4% doesn’t mean a thing. The central bank try to control the interest rate so low. it doesn’t make any sense. If you cannot afford to buy, it really doesn’t matter how low the interest rate is.

**But speaking as a native who has seen several real estate bubbles come and go, the sooner the government just lets this die-off HAPPEN so prices can drop and the market recovery naturally, the better.

As another California native who lived, worked and owned a home in Canada for 10 years, I wholeheartedly agree with this and pretty much everything else you wrote.

Thank goodness the Canadian banks stayed out of the toxic mortgage business. I was able to sell my home there in a market that is still very strong. Now, the money is just sitting in the bank and I am just sitting on my hands trying not to make an emotional decision to buy too soon. I hate being a renter after 10 years of home ownership, but I really feel strongly that I need to tough it out for another year or two. Prices here in Orange County are still, simply put, f’ing ridiculous in all but the most grungy neighborhoods.

There are quite a few rumblings that the canadian housing market is a tremendous bubble about to pop. Perhaps the canadian banks didn’t behave quite as poorly as ours did, or perhaps the canuck housing market is only about where the american market was in late 2006.

It’s sadder to see the American population putting up with all this crap and ending up paying to support the banksters.

When will we demand prosecution of the criminals. How much more bs are we willing to take. What will it take for people to stand up to this?

Sad state of affairs America is in these days.

Why thank you, Mike. Clawback the extortion money called “bailouts” for the “too big to fail” white-shoe boys, cuff em and make em start singing during their prosecutions. Only then will we be able to even start talking about a recovery. CNN? Why single them out? It is all of cable television. The same people that own the banks own the media medium. Their message to you and me is “it’s xyz’s fault (not outs) so start bickering amongst yourselves, just don’t come sniffing around here.

The California legislators through stupid ideas such as promotion of “green jobs” exported many of the mid to higher paying jobs through higher taxes and regulations. They are left with a high percentage of illegals and lower earners. These groups are not able to sustain or initiate a mortgage and pay taxes that support local and state government. “Go GREEN JOBS”

More insanity.

http://www.dailybreeze.com/latestnews/ci_16085804

I want to throw up! What they want to do with this last bailout? The prices are actually has been going up in CA for the last year or so and they stand up 10% higher from the alleged bottom and by any stretch of imagination before they was able to correct to historic norm. What they want to do, more support for delusional public in California in order to get 20% gain in RE prices for 2011? Somebody, please, explain to me?

Bank of America is full of it. I know multiple people including myself who have done little or in my case nothing to delay foreclosure and haven’t paid in closing in on 2 years and Bank of America won’t take the home. I have begged them to take the home so I can move on and get restarted with my credit and finances, but they still refuse. I have moved out of the house and informed them that the house is vacant in hopes they would move faster and that was 4 months ago and still they don’t move. I can only imagine people with Bank of America who want to stay for free 3-4 years would probably have no problems if I am begging them to foreclose my home after nearly 2 years of non-payment and they won’t.

why moving out? you have to pay rent, and you have to pay taxes on the house even you move out. you just got your bailout, why not use it?

Actually you don’t have to pay the taxes typically they give you 2-3 years until they foreclose. Since you are going to loose the house anyway who cares who does the foreclosing.

DG: I’m sorry to hear about your frustrations with Bank of America. This probably provides no solace, but B of A has been one of the worst banks throughout this crisis.

I’m not sure why you said you are “begging them to foreclose my home after nearly 2 years of non-payment” although I suppose it’s so you can “move on.” The problem is whether B of A forecloses and holds a trustee sale (assuming B of A does a non-judicial foreclosure, which it probably is), the real issue for you is whether they’re going to pursue you for the deficiency. If you never refinanced, then B of A probably can’t go after you for the deficiency.

John Corcoran

Author, The Foreclosure Legal Guide

http://www.calawreport.com/ebook

Oh that’s ripe, try and put a lil scare about banksters coming back after the money. It’s not going to happen. California is non-recourse, purchase loans and re-finance are NON-RECOURSE. If you take money out i.e. HELOC or re-finance for more than purchase price, sure they can push it and try and sue you, but then there’s always BK, and they will flush even more money down the drain.

Don’t be scared of the banksters, their lawyers, their CPA’s, and anyone else.

For those of you scared by John’s post, I defaulted on a 40k HELOC, a 20k Credit Card, and forced a loan mod in the last 2 years. A few calls is all…no big deal. If they get real aggressive, I chapter 7 everything, and still end up living in my place for free for who knows how long.

Wow! What’s up DG? I was hoping you would have stayed in the house for as long as possible, but eventually, we need closure. Be careful about that house, you are still responsible for it if something legal happens…it’s precisely why the banksters don’t want to foreclose on it.

I actually got a loan mod, but didn’t get any principal reduction, that will only happen when the banksters reclaim it (banksters get 85% of losses payed for…gotta luv them Bailouts, responsible owners get nothing…unless they default and live for free, gee, hard decision right?)

If I knew for sure I could get 2 years with no payment, I’d default starting this second. As it is, I’m estimating I’ll get 6-12 months living for free. Of course, I’ll abide by all laws and sell all my nice appliances, fixtures, AC etc, but replace them with quality chinese made Home Depot or Walmart products.

Does anyone have one of these vacant foreclosure homes in west L.A. that the banks refuse to foreclose on? I would be willing to pay $400 rent. You get the money, I get a house to live in and the bank gets the shaft.

It’s the banks, stupid!

Unless you are wealthy enough to buy by cash, you won’t be able to get a loan. There are not many banks out there to give loans. The banks sit on a lot houses without foreclosing them. They have to write down a lot, and maybe insolvent if they foreclose all the houses waiting to be foreclosed. all these cash sitting in the banks kind of nonsense is to fool people. The banks are waiting to get some kind of government help AGAIN to repair their broken balance sheet. If the accounting rule is not changed, all these banks are broke.

to buy or not to buy, it’s up to the bank.

I worked for Wells Fargo foreclosure department in early 90s when banks actually had the loan on their books and could foreclose without too much problem. This time I have been told that the shadow inventory problem has more to do with the fact that loans were sold off in tranches. In order for the bank to foreclose they have to buy back the loan. Since the loan was sold off in tranches this is taking time to get the loans back on the banks books. The loan mod programs have had little affect because so many borrowers are under water and have no cash. The loan mod programs have caused some shadow inventory but not significant.

I am not sure how Wells is handling the fees generating from selling the loans initially but this too is another cause for shadow inventory.

From what I am hearing we have a long ways to go to clear all this shadow inventory and downward pressure on prices will continue.

Good luck everyone!!!

I’ve read and heard the same thing. This is not your father’s financial disaster.

So, if I’m understanding this correctly, then what should have happened was that the banks should have been forced — as a condition of receiving bailout money– to buy back the loans, and then foreclose… but they didn’t. They just invested it, made record profits, and paid it back instead?

The following quote is from this article referenced by Daniel:

More insanity.

http://www.dailybreeze.com/latestnews/ci_16085804

Dustin Hobbs, spokesman for the California Mortgage Bankers Association, said it supports the plan.

“It’s one more tool in the toolbox to help homeowners stay in their homes,” Hobbs said. “It’s not going to be a silver bullet, but it will certainly help a significant amount of borrowers and that’s a good thing.”

I think Hobbs mixed up his B words. I think he meant to say Bankers not borrowers.

Gael you’re a jobless catherd and need to go away.

Another thought to consider that I read is that if there were some improvement in the home valuations, those interests that are stonewalling the foreclosure of many properties would go ahead and foreclose if they felt they could gain anything, so even if folks stick it out, work out to become current again, the moment there is any seizable equity in the home they will pull the rug out from under the owners. There are no fairytale endings in store it seems. Unless you are on the win side of the great Manhattan Transfer, which very few are.

The government broke me down. I am finally buying after 7 years of waiting. But I know what I am doing. I am buying to live in it because my family is growing. I told my wife to expect a 20% drop in value before any increase. But it doesn’t matter since I plan on living there for 15-20 years and will not have to sell even after that. I plan on passing it to my daughter when we are too old to live there and move back to my smaller house. Like DHB said, everyone wants to be a Trump Light. A home is to live in. Grow a family. You buy what you can afford. It is not a profitable asset. Learn from this crisis.

Boy, am I glad to hear someone saying what I’ve been thinking for a long, long time. The real estate industry and the government are keeping prices artificially high here in Southern California. I can’t see how most people can afford to buy now, even though prices have fallen. We sold our house in 2006 and have been waiting and waiting and waiting until we can afford to buy again. Not. What we’d have to spend for a crappy little nothing would get us a palace in a lot of other places. Are they kidding?

Leave a Reply