Captain Credit Crunch: Homes Sales, GSE Love, and Neverland.

You know someone loves you when you post a $3.6 billion quarterly loss and you end the day up 1 percent. We are talking about the mortgage giant Fannie Mae. Incredibly, the action on the stock today was breathtaking. At a point, it was up 10+ percent on the OFHEO announcement of relaxing capital requirements but again, unless Fannie Mae and Freddie Mac get into the business of no income and no documentation loans, there may only be a slight relief in the housing markets. I think the markets realized this by the end of the day thus the 1 percent gain.

We also got more news that housing sales are in the absolute dumps. A few people are starting a market bottom whisper campaign but this won’t last once they realize that the amount of bad mortgages floating out there is simply breathtaking. You can understand the positions of banks if you really force yourself for a second. They realize that if they are made to mark to market many of their toxic mortgage products, they are going to face tough times and large amounts of write downs. Make no mistake about it, the bailout of the monoline insurers is more to ensure that the continue cover up continues and the day of reckoning is pushed a bit further into the future. If you have any doubts, do you think that any of these Real Homes of Genius will actually reach their peak value anytime in the next 10 years? If we use the rating agencies guidelines, these homes are rated AAAAA+++++ and will soon bounce off the current market lows.

I know many of you are bewildered by the market action. Home prices are tanking yet the market is up 500+ points in the last few days. We have so many bailout options on the table it is hard to keep track of them all. Let us put a list of some of the genius ideas to stop the housing correction:

FHASecure

Hope Now Alliance

Project Lifeline

Negative Equity Certificates

Lifting Mortgages Caps to $729,500

Wal-Mart Vouchers at $600 per person

Fed Funds Rates at Historical Lows

Foreclosure Moratoriums

There are more in the pipeline of course. For all the naysayers about comparing this mess to the Great Depression housing debacle I bring to you the following:

“There is precedent for such in effort: In the 1930s, the government created the Home Owners’ Loan Corp. to help borrowers avoid foreclosure. The corporation made more than 1 million loans to refinance troubled mortgages, and in 1937 owned 14 percent of all outstanding U.S. mortgages, according to testimony last month by Alex Pollock a resident fellow at the American Enterprise Institute.

In addition, the document said lawmakers are working on a separate $20 billion (€13.4 billion) in grants and loans to state and local government to help to buy up foreclosed and abandoned homes. Doing so would be designed to help stabilize neighborhoods wracked by foreclosures. Lawmakers are also proposing to spend $200 million (€134.5 million) more per year in grants for housing counseling.”

We are now using Great Depression remedies in 2008. It almost seems a given that there will be some sort of bailout. The real question is the magnitude and depth the American public is going to get reamed with. I’ve read through a few proposals and I keep reading “market value” in regards to purchasing homes and the price that will be offered. Of course, this raises many questions. Who will appraise the homes? Are government agencies going to rely on appraisals by the current mortgage holders? Which loans will qualify for buyouts? Clearly, in a rapidly deteriorating market, we see that today’s price will be much lower tomorrow. Already we have seen in a few months the median price for Los Angeles drop nearly $100,000 and the median drop $120,000 in Orange County. Given the trend, will they offer prices on the projected future value? As you can see, there are so many questions that need to be answered before we move forward. Given that the U.S. housing market is worth approximately $20,000,000,000,000 USD, even the recent announcement by the Case/Shiller Index showing a 9.1 percent drop, that means that in one year $1.82 trillion in housing wealth has evaporated if we are to assume that the 20 metro areas are reflective of the nation. Most likely it is given that most of the housing wealth (bubble froth) is held in these areas. Let us look at the home sales numbers further.

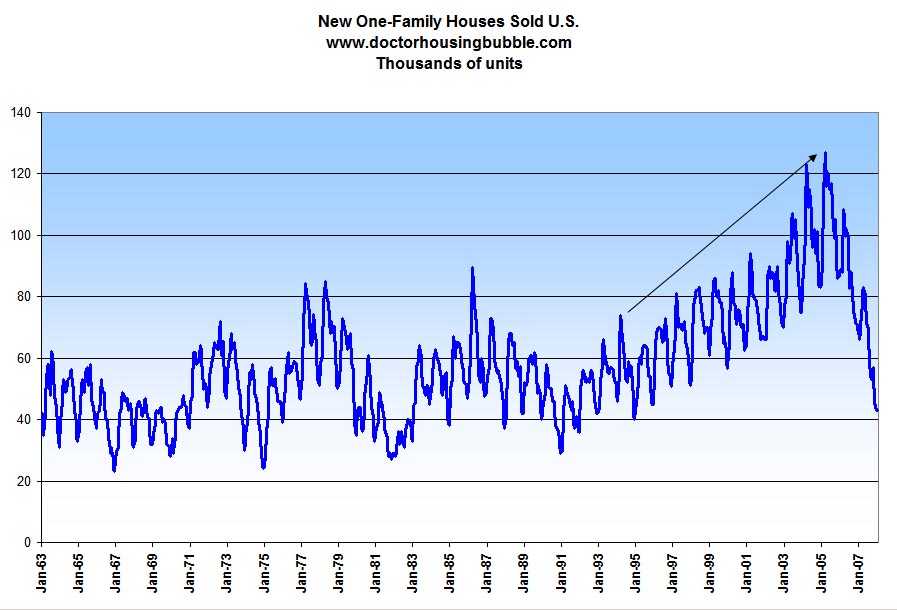

Home Sales – Party like its 1994

*click to enlarge

The current new home sales numbers reported by the Census Bureau are breathtakingly bad. We would have to go back to 1994 to find numbers this low. What you’ll also notice in the graph above is the amazing drop that occurred. You clearly see a trend from 1995 to 2005 of nonstop growth that has no comparison in this chart, which dates back to 1963. The magnitude and steepness of this correction gives me pause, and you know how bearish I already am to begin with. You’ll notice on the chart that every winter, the numbers dip which is typical selling patterns. But if you measure the drop to other seasonal drops we are clearly in a new pattern.

Then what really gives? Why is the market rallying on all this bad news? These things don’t unfold overnight. This is nothing novel and I’ll provide you with a few paragraphs talking about the great crash from a fabulous book by Frederick Lewis Allen called Since Yesterday which is free online:

“A few minutes after noon, some of the more alert members of a crowd which had collected on the street outside the Stock Exchange, expecting they knew not what, recognized Charles E. Mitchell, erstwhile defender of the bull market, slipping quietly into the offices of J. P. Morgan & Company on the opposite corner. It was scarcely more than nine years since the House of Morgan had been pitted with the shrapnel-fire of the Wall Street explosion; now its occupants faced a different sort of calamity equally near at hand. Mr. Mitchell was followed shortly by Albert H. Wiggin, head of the Chase National Bank, William Potter, head of the Guaranty Trust Company; and Seward Prosser, head of the Bankers Trust Company. They had come to confer with Thomas W. Lamont of the Morgan firm. In the space of a few minutes these five men, with George F. Baker, Jr., of the First National Bank, agreed in behalf of their respective institutions to put up forty millions apiece to shore up the stock market. The object of the two-hundred-and-forty-million-dollar pool thus formed, as explained subsequently by Mr. Lamont, was not to hold prices at any given level, but simply to make such purchases as were necessary to keep trading on an orderly basis. Their first action, they decided, would be to try to steady the prices of the leading securities which served as bellwethers for the list as a whole. It was a dangerous plan, for with hysteria spreading there was no telling what sort of debacle might be impending. But this was no time for any action but the boldest.

The bankers separated. Mr. Lamont faced a gathering of reporters in the Morgan offices. His face was grave, but his words were soothing. His first sentence alone was one of the most remarkable understatements of all time. “There has been a little distress selling on the Stock Exchange,” said he, “and we have held a meeting of the heads of several financial institutions to discuss the situation. We have found that there are no houses in difficulty and reports from brokers indicate that margins are being maintained satisfactorily.” He went on to explain that what had happened was due to a “technical condition of the market” rather than to any fundamental cause.

As the news that the bankers were meeting circulated on the floor of the Exchange, prices began to steady. Soon a brisk rally set in. Steel jumped back to the level at which it had opened that morning. But the bankers bad more to offer the dying bull market than a Morgan partner’s best bedside manner.

At about half-past one o’clock Richard Whitney, vice-president of the Exchange who usually acted as floor broker for the Morgan interests, went into the “steel crowd” and put in a bid of 205 — the price of the last previous sale — for 10,000 shares of Steel. He bought only 200 shares and left the remainder of the order with the specialist. Mr. Whitney then went to various other points on the floor, and offered the price of the last previous sale for 10,000 shares of each of fifteen or twenty other stocks, reporting what was sold to him at that price and leaving the remainder of the order with the specialist. In short the space of a few minutes Mr. Whitney offered to purchase something in the neighborhood of twenty or thirty million dollars’ worth of stock. Purchases of this magnitude are not undertaken by Tom, Dick, and Harry; it was clear Mr. Whitney represented the bankers’ pool.

The desperate remedy worked. The semblance of confidence returned. Prices held steady for a while; and though many of them slid off once more in the final hour, the net results for the day might well have been worse. Steel actually closed two points higher than on Wednesday, and the net losses of most of the other leading securities amounted to less than ten points apiece for the whole day’s trading.

All the same, it had been a frightful day. At seven o’clock that night the tickers in a thousand brokers’ offices were still, chattering; not till after 7:08 did they finally record the last sale made on the floor at three o’clock. The volume of trading had set a new record — 12,894,650 shares. (“The time may come when we shall see a five-million-share day,” the wise men of the Street had been saying twenty months before!) Incredible rumors had spread wildly during the early afternoon — that eleven speculators had committed suicide, that the Buffalo and Chicago exchanges had been closed, that troops were guarding the New York Stock Exchange against an angry mob. The country had known the bitter taste of panic. And although the bankers’ pool had prevented for the moment an utter collapse, there was no gainsaying the fact that the economic structure had cracked wide open.”

I think you know how this story goes. There were a few big players coming in and pumping added money but this was only throwing good money after bad. We are in a parallel situation so that $2.6 billion injected into the monolines will be gone just as quickly. Even after this “bold” move, the market didn’t bottom for another 3 years:

*image credit: oftwominds

If you look closely at the graph, you can see 6 bear market rallies but the trend is unmistakable. All the jawboning and perma-bull talk is similar to that of the past. Read your history or be cursed to repeat it.

Neverland – Foreclosed?

Now I’m sure many of you have already heard, but the pop singer Michael Jackson’s home Neverland is reportedly being foreclosed. According to the L.A. Times:

“Unless entertainer Michael Jackson pays off a $24.5-million loan, his 2,800-acre ranch in Santa Barbara County will be auctioned off next month. The sale involves the land, house and all personal property, including furniture, appliances, rides, toys and “all merry-go-round type devices.”

Anyone going to exercise carpe diem and utilize the wonderful cap-less Jumbos? After all, you will be getting rides and toys and who can argue with that? A place called Neverland seems to fit well here in California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “Captain Credit Crunch: Homes Sales, GSE Love, and Neverland.”

Actually, in 1928-29, the market had been just as erractic and irrational then as it is now. In late 1927 and early 1928, it was clear that stock prices reflected dangerous levels of speculation. The Fed was dropping the discount rate and borrowed money was flying into the market, while, at the same time, actual productive businesses and business activity were starting to struggle and slowing. (Does this sound familar boys and girls?). Through late 27′ and early 28′ the market had gone up and down in erratic swings – and then it exploded upwards in early March ’28. It shot up -and dropped -shot up even more – and dropped……and then went flying upwards until it collapsed in June ’28. It drifted along for a few months and then the market really took off in the fall around Nov. It backed off in December – more than it had earlier in the year – but then went flying upwards again. It dropped in Feburary ’29 only to have the ‘big money men’ come in to the rescue. Up and up and up went the market to reach its peak in Sept ’29. And we all know what happened after that – the next attempted rescue by the large financiers failed and the market completely collapsed. What made no sense to the financially conservative observors at the time was that the market was going up and up and up at the same time actual business activity and real incomes were going down and down and down. Businesses were not even close to producing returns that would justify the stock prices. LESSON Number One: If something does not appear to be rational or logical, chances are it is not and the fates will eventually catch up. LESSON Number Two: When people aare deeply attached to the idea of getting rich while doing very little work be it houses, stocks or other schemes), they are loathe to give up the fantasy, will seize on every will ‘o the wisp as a sign that their belief is valid, and will keep pouring good money after bad in order to sustain it. Did it in 28-29 and they are doing it now.

What do I think? I think my hard-earned tax money will be spent on buying 10 trillion dollars worth of crap mortgages as individual deeds or mashed up CDO’s and other alphabet instruments. The banks, mortgage companies, and hedge funds will be made whole. The “owners” will still default but the banks will no longer care since they don’t own the paper any more.

This won’t save prices, but will cost the US taxpayer (me) probably 6 trillion by the time it’s done. This does not include the generous fees paid to Goldmand and Morgan for arranging the sales to the government (pick a fancy new name for the program).

Frankly, these mortgages and alphabet financial instruments are so toxic, we could solve two problems by dropping them on Iraq.

There are many great reasons…

…to feel very good about Texas real estate…

As the housing market continues to make national headlines, I want to clarify that our strong economy in Texas is supporting a stable housing market.

According to the latest report from the National Association of Realtors®, seven of the eight Texas major metropolitan areas monitored had an increase in their median home price from the fourth quarter of 2006 to the fourth quarter of 2007. Those cities are Amarillo, San Antonio, Austin, Corpus Christi, El Paso, Houston and Dallas. Pearland is also following this trend. The price trend for Pearland real estate is still on the increase as well.

Other Factors contributing to a positive outlook for Texas housing include:

• A relentless growth in population will fuel the need for homes. In the next 15 years, enough people will move to Texas to create a new Dallas, Austin, Houston and San Antonio.

• Texas has one of the best real estate climates in the nation with affordable housing and affordable lifestyles.

• Texas has the best tax structure for business and will continue to outperform other states in attracting relocating companies and job growth.

Most media reports capture real estate at the national level, but our industry is very localized. As a member of the board of directors for the Houston Association of Realtors®, I encourage you to turn to a REALTOR® who is monitoring the trends and conditions in your community when you need real estate information or assistance.

With appreciation,

Danny Frank

Board Member, Houston Association of Realtors®

So maybe we’ll end up with almost entirely socialized housing by the time we are done. Will it work? Of course not, it will just decrease affordability, like most government intrusions (such as into medicine and higher education).

–

In response maybe some of us will just give up on the whole homeownership idea: “que sera sera”, and figure it was not meant to be. Homes still aren’t affordable and the government seems determined to keep them unaffordable. Maybe they will fail, but maybe they will succeed. And if they do succeed, why continue to play a rigged game brought to you by the powers that be, that think sustaining housing prices is more important than affordable housing. Why continue to play the game if 50 year mortgages become the norm to sustain unaffordable housing? There are certainly those who would benefit from people being lifelong “mortgage slaves” but it is not the slaves themselves, they would benefit more from affordable housing!

.

I sold short shares of Freddie Mac. I will profit as Freddie Mac’s stock goes down in price.

Why this stock didn’t tank yesterday is beyond my comprehension. Explain this to me: If Freddie Mac is now going to be FORCED to take on bad jumbo (up to $720,000) loans, then where does the optimism come from? When this stock finally does tank, those who sold short will reap rewards. In the mean time, I’m a little confused as to why anyone would buy this stock.

I think that DR housingbubble needs to go and help Ben Bernanke before he gives all Americans a million dollars.

This Bush Administration flagrantly disregards history’s lessons. They are motivated by greed and only care about lining their pockets. To all the naysayers who blame it on Democrats let me point out that the Bush Administration in eight years has pretty much destroyed this country. They allowed the housing bubble to inflate to take the focus off this disastrous war in Iraq. People spent like crazy thinking that it was real money. Individuals are responsible for their own actions and I am totally opposed to any bailout of anyone who signed on for a toxic mortgage. Prices in L.A. (and across the country) need to come down to a level supported by sound economic fundamentals. People are forgetting about the responsible and honest people who chose not to buy such an overpriced asset. And, they did “CHOOSE” because as it obvious to everyone, ANYONE who could fog a mirror could get a loan to buy property.

Read Bloomberg report on Cuomo in NY challenging FNMA appraisal practices. http://www.bloomberg.com/apps/news?pid=20601103&sid=avVZ3vQ.WSqg&refer=us. hat tip Calculated Risk (“FNMA new rules for appraisals”). This will fundamentally alter the lending landscape and is being floated on all loans back to September. In short – no more in-house appraisers (good by Landsafe at Countrywide) and no more broker ordered appraisals. I don’t know who is left standing in the appraisal world – there is talk of a national registry – but they intend to erect a firewall between appraisers and loan originators.

So given this history you think the market might just sputter along for another year or so? I’m impatient for a crash. Only in a crisis will real change happen. I certainly hope that it is obvious that this mess has not been brought about by a democratic administration.

I was quite shocked to see that the New Deal was passed four years after the crash of 29….And then 76 years to completely unravel.

The babbling of “Danny Frank” needs to be removed from this thread. Nothing more than a real estate whore pushing his used houses. He wants to advertise? make him pay for an ad.

And Danny? You could NOT pay me enough to move to Texas – the land of ignorant uneducated rednecks who actually think Texas universities are the equivalent of the Ivy Leauge, who are all barrelling around in their oversized pickups trucks with a gun rack in the midst of a barren wasteland of dirt and dust with a culture that is beyond vulgar, crass, tacky and stupid. Living in Texas without any avenue of escape would be an understandable and justifiable reason for suicide.

“Why continue to play the game if 50 year mortgages become the norm to sustain unaffordable housing?”

If I put on my paranoid cap, I see this as the end game of a nefarious plan. 100 year mortgages have been around in Britain for a long time and houses were ridiculously out of reach even before the most recent bubble. It’s just a way to make slaves out of people, as you say. After the cap raise, I’m not waiting to see if they start paving the way for allowing longer mortgages to be compliant too. It would be purely a gift to developers and no one else.

And thanks for the link, Exit. (you aren’t a musician, btw, are you?)

I, personally, liked Danny’s post. Let it serve as a lesson in where some people’s thinking is (or their marketing of their thinking, anyway). How did we get here? Danny illuminates the way.

Its commical to blame either political party. I wish i could insert a graph I built this week showing the gargantuan growth of our US govt since the new deal. its sickening. I guess its human nature to seek simple answer, and finger a scapegoat, Hitler had the jews, we have the dems and the repblicans, or politician’s favorite “Corporate America”

50 year loans? Hell might as well make them 120 year loans and call it a day. I wouldn’t mind having a 300$ payment.

@emmi

You’re welcome. No, I have no musical ability other than playing the radio. Maybe we can make like the musicians on the Titanic as it goes down, “It’s been an honor to play with you all.” Just no Celine Dion, please.

@AnnScott

Gross generalizations serve no function beyond illustrating the ignorance of the ranter. You otherwise have fairly coherent posts; may I suggest not painting an entire state with a Bush colored brush? I happen to concur that Danny-boy should pay for his advert.

To AnnScott:

I agree that all realtor blog/advertisements are not needed here and completely out of line.

However, as a resident of Austin, TX, I wish you would not paint all Texans with the same brush. Yes, there are parts of Texas that may fit your description, but there are parts which easily rival cities in California. I have lived in San Diego (5 years) and San Jose (12 years). I moved to Austin 3 years ago because I wanted to raise a family in a ‘sane’ environment. My wife and I had good paying jobs but all we could afford was a small condo with no yard. Now we live in a very nice neighborhood with room for 4.

BTW, I don’t own a gun, chew tobacco, or drive a big pick up truck. Just a normal American family trying to wisely navigate the difficult economic circumstances we find ourselves in.

And a big Thank You to Dr. Housing Bubble and other blogs that offer real information and analysis as opposed to the biased crap in the MSM.

@surfaddict:

Count me down for blaming “corporate america.” I think if I were pointing fingers (and I am) I’d point mine straight at CitiFinancial, CountryWide and friends. Some people assert we should blame the people making too little who were too stupid to buy houses they couldn’t afford. I think it makes more sense to blame the people who were stupid enough to loan them the money in the first place.

Either way, one of the two groups is at fault. A moderate person might blame both, but in a world where most people grew up in a world where banks wouldn’t loan people money who couldn’t afford to pay the money back, I have a lot more sympathy for the idiot masses who can’t do math than for the bankers who can.

The irony of all of this is that because polls are showing so many people intend to use their tax rebates to pay down debt, the banks seem to always have the upper hand.

And me, I won’t be getting a tax rebate. Instead, this past year I’ll have paid about $60,000 in taxes to support a war I never wanted, started by a guy whose business ventures included running Arbusto, Spectrum 7 and Harkin energy into the ground just like he did this country. Because while I blame the banks, it would have been nice if someone had come along and predicted this was going to happen and done something to stave it off about 4 years ago. Somebody like a president or congress.

Re: Gael “I’m impatient for a crash.”

I see a lot of sentiment on various blogs of this kind. People think that: 1) economic crash will be a problem only for the Bush administration, and 2) the crash will be confined to Americans, who got ‘greedy.’

In fact, the full effect of what you are seeing now won’t hit until around 2011, when the mortgage resets peak, oil production goes off a cliff, and the Boomers start retiring en masse. The 44th president will be planning his/her reelection at that point, and W will be a memory.

Also, this thing is not going to be contained in America. American consumption props up Chinese, European, and Candadian economies, which are export and manufacturing based. These economies all used securitization to create their manufacturing base, and now the cost of commodities, coupled with decrease in consumption, is going to absolutely kill them.

Democrats looking for some perverse vindication int the current economic situation don’t seem to grasp its seriousness.

Poo, poo. who wants to live in TX where they allow people to vote twice for the same candiadate in the same day; once in a primary then again that night in a caucus. No thanks Danny! You can keep your TX real estate!

I have been doign loads of research on the recent economic problems and the credit crunch in particular, floating around the blogosphere reading as many blogs as possible. I am almost at the conclusion that the current poor economic climate is been driven by the mainstream media ….. any thoughts on this ?

Leave a Reply