Capital Assessment Program: 19 Qualifying Financial Institutions Each with $100 billion or more Assets Compete to Steal More Money From you. Who Will Win? Not you!

I finally had a chance to pour through the Capital Assessment Program which is going to be overseen by the U.S. Federal bank and thrift supervisors.   These are essentially the stress tests we’ve been hearing about. Yet last night as I sat down viewing multiple sites and digging into numerous PDF documents, I realized that what is written even in legislation can only be taken with a grain of salt. I made the same mistake when I sat down and dug deep into the $700 billion TARP legislation skimming over hundreds of pages only to realize that we left one utterly stupid program of buying toxic assets, to a dumb program of giving capital to toxic institutions.   The main crux of the legislation never panned out. That is, we never bought those bad assets (fortunately). It might seem that you are sitting on some hyper-speed carousal with all the information flying at you like a ton of bricks but it is important to understand the context in which this is happening.

Even though we managed to dodge a calamity by not buying overly priced toxic assets, we have done something maybe 2 rungs lower on the ladder of bad ideas by giving these same institutions capital while those assets still sit in limbo. How is this really helping? In fact this is the exact process Japan underwent and ultimately produced a lost decade for them. And many of you may be impressed by people shamelessly dropping trillions here and there as if they can scare the market with big numbers. Japan spent $6.3 trillion on construction-related public investments from 1991 and September of 2008 according to their Cabinet Office. During these two decades, since their lost decade actually hit in the early 1990s, Japan managed to accumulate the largest public debt ramping up their debt to 180 percent of their $5.5 trillion economy. We are going down this path and the Capital Assessment Program is eerily familiar.

First, 19 banks are going to undergo this stress test. These banks each have more than $100 billion in assets and make up two-thirds of U.S. bank holding companies. This stands in stark contrast from the Great Depression where yes, we had thousands of bank failures but the money was widely disbursed. Now one IndyMac or WaMu is the equivalent of hundreds of smaller banks. The stress test is going to run two different scenarios measured against a baseline figure and an adverse scenario. As I was reading the document, although I appreciate the transparency it is still a rip off to taxpayers. We are basically doing a nationalization-lite which in the end, will cost us more (think Japan). The idea is that they are going to run these two scenarios looking at housing prices and unemployment and determine whether a bank has the adequate capital to withstand these external shocks.

Of course the answer is that many of these banks cannot take these shocks. That is why we are even at this point! Did we run a stress test on Circuit City? Of course not. The market is the stress test. Yet the premise of course is the banking industry is absolutely vital to the country. My counter would be that yes, credit is vital to the country and our economic stability but why trust the same institutions that have led us into this mess? We are now talking trillions and trillions and with that, we could have developed a parallel good banking industry that would be lending money instead of hoarding it and trying to offload toxic assets onto taxpayers.

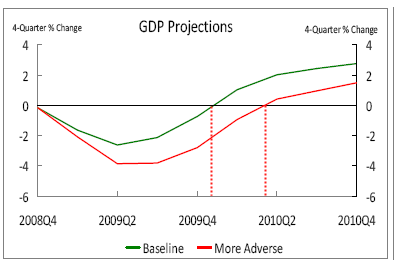

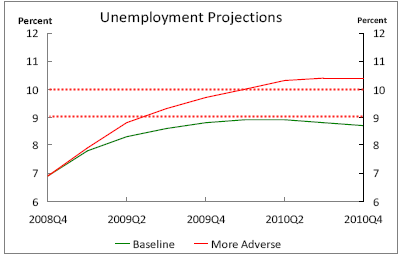

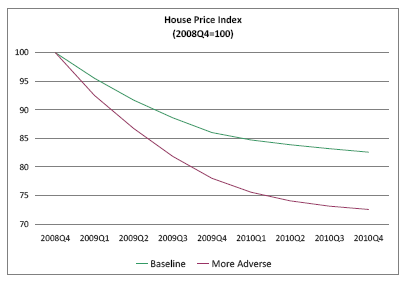

First, we should examine the two scenarios proposed in the CAP program:

The first chart we have is measuring the impact based on the baseline GDP scenario. The average baseline that we have is -2.0 for 2009 and 2.1 for 2010. I’m sorry but that is much too optimistic. The more “adverse” scenario has GDP at -3.3 for 2009 and 0.5 for 2010. That in my opinion would be the optimistic scenario! Consumer spending is tanking and that makes up nearly 70 percent of GDP and we actually think we’ll be up and running by next year? I just don’t see how this pans out and would venture to guess that GDP will be revised higher and unemployment numbers out next Friday will be stunning once again.

Plus, the baseline scenario is looking at “professional forecasters” who have been more wrong than a box of burritos. Last year, the vast majority of these professionals didn’t even realize we were in a recession and they were standing knee deep in it! So take the above for what it is worth. If some of these banks fail the test as if your high school teacher was administering the exam, then the worst that happens is these banks can take preferred shares to shore up their capital position. These shares are convertible to common shares. Which again draws my ire. This is nationalization-lite! We get the worst of all worlds here. According to the plan each institutions will be permitted six months to raise private capital in the public markets to cancel the CAP commitment without penalty! Bwahahahaha! These suckers can’t even lend money and we’re expecting broke institutions to get money from other broke institutions? These banks are going to be sucking on those convertible shares. Japan here we come.

I think the figures for unemployment are more in line with what will happen yet they are already taking a flawed figure and transfixing this on the CAP assumptions. The average baseline figure is for 2009, unemployment will be 8.4 percent and for 2010 8.8 percent. The more adverse scenario is 8.9 percent for 2009 and 10.3 percent for 2010. We will hit that adverse number. And keep in mind that the broader measure of unemployment U-6 is already at 13.9 percent which is a more accurate number.

The point I am trying to make is these assumptions are too generous and poorly reflect the current market. What they do setup however, is that a few of these institutions will buy a few more months of time and hope that somehow the market bulls will somehow come back and boost their stocks through the natural system of the market. In fact, I would argue that the only reasons these banking stocks aren’t heading to zero already is the market views this as an implicit guarantee in the short-term. The people paying the banks insurance is the American taxpayer. This is a raw deal. Heads or tails they win while you lose. Is it any wonder why homeowners are moonwalking away from homes?

The one good thing is that they are using the Case-Shiller in their assumptions but why they are using the 10 city index as opposed to the 20 is somewhat curious. Maybe because there is more data for the 10 city index? However, the scenarios are once again too optimistic:

The baseline is assuming an additional 14 percent drop in prices for 2009 and 4 percent in 2010. That scenario is a guaranteed. We will hit that. As I have predicted, we will see a 40 percent nationwide drop before we hit bottom and we’ve only gone 28% of the way. The adverse scenario has a decline of 22 percent for 2009 and 7 percent for 2010 which seems to be more realistic. Essentially, we can expect from the CAP program that many of these 19 banks are going to be undercapitalized and we gear up to do TARP 2, 3, or 4. And if you think that I’m joking in the CAP FAQ we are told that they will draw some from TARP 1 funds.  Now why would you need to call it TARP 1?

What is the timeline for this? We are told that they will try to conclude their work as soon as possible but no later than the end of April. So expect more shenanigans for the next 2 months. If this plan stays and we go forward with this, we can forget about nationalization since so much money will be given into the furnace that is our financial sector. That is, we will burn through our capital and it will be too late. That is why Japan after so many injections could not support the cost of nationalization after so many commitments. It would be best to simply wipe them out from the beginning, take the pain, and move on. We all know what is on those books. Why hold up the pretenses any longer?

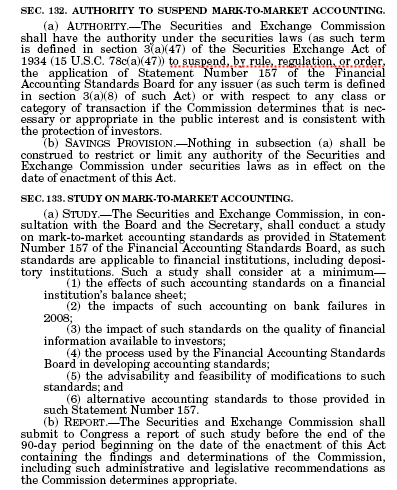

I was looking at the Emergency Economic Stabilization bill more carefully today as well and I’ll leave you with this nice piece in HR 1424 at Sec. 132:

The fact that Bernanke was talking about mark-to-market this week just makes me wonder how long we have before they enact this part of the legislation. The financial sector of our economy is robbing the entire population blind. I can’t help to think we are gearing up for a major sentiment change of some sort but seeing how docile Americans were during the Great Depression, I’m not sure it is in the nature of most to hold those responsible accountable and bring them to trial. In fact, when I see people screaming about subprime borrowers causing this mess I just wonder if people really know who is controlling the financial purse strings of our country.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

18 Responses to “Capital Assessment Program: 19 Qualifying Financial Institutions Each with $100 billion or more Assets Compete to Steal More Money From you. Who Will Win? Not you!”

Thank you for another good post Doctor.

Seems the government started by taking away our interest income by dropping interest rates to ridiculously low levels.

Then they took away the equity in our homes by allowing and encouraging highly leveraged trading of mortgages.

Then our 401K’s went away with the fall of the stock market.

Now they are taking away all we have left; the dollar.

i had a total breakthrough while watching “the view” yesterday. some “money expert” came on to attempt to dumb down the lastest nonsense and basically said that we need to do this because consumers stopped spending. i thought, “oh my god, they are just going to mug us now!” they are just going to take our money! so our choices are spend money we don’t have & over-leverage or they’ll just take it? i get that the bottom line is debt holders want the debt paid back guaranteed, but who does that? and they keep saying it’s too complex too understand…..oh, i think we can understand…..

btw, i think i have been reading this blog since late-2006 (is that possible?) & i am grateful for all your hard work. i posted in dec. that my hubby had gotten laid off and was on maternity leave from my own company. because i had seen what was coming (from your blog), i did everything i could to save and grow our cash & get rid of unnecessary expenses. this put us in a very good position when the bad news hit. i am very pleased to say that hubby has a much better job now, but i will still continue to operate from a cautious position. so i thank you for making sense in these crazy times & being the lighthouse in the storm-at least for me!

good luck to all!

You would think that Congress would at least have the decency to add a provision to distribute free Vaseline to every American to make this whole process just a little easier.

Oh, wait…I am assuming they actually give a shit about us.

Those are pretty interesting facts to ponder on. Needless to say, even if we don’t completely agree on things, I do admire your skills. I was never good at economics, but somehow you made things easier for me to understand. Sure, I’m a supporter of Obama. Sure, I’m a positive thinker. But as my mom puts it, you have to face the harsher parts of reality sometimes… I just hope America and the rest of the world will be able to rise from this terrible economic crisis soon before things get even way worse.

They’re a bunch of thieving scum and should be executed, like they do in China. I keep repeating this, hoping that my mantra will catch on. Just kill ’em.

What a great post. There is a quantum political and social structural shift coming for this country. The FEDS are going to gain more control through the financial sector. The average hard working American will be relegated to going to the government for everything. The markets are worried about socialization of the banks. This has already happened. Your comment about docile Americans is supported by their voting record and history. They will not act on this as a group. The current situation is exacerbated by the fact the the government is in the control of one party. The news media does not seem to be holdng their feet to the fire. The situation seems to be spiraling out of control. Something’s gotta give…..

probably later than sooner.

I suggest a two part stess test:

1. Require all assets be “Mark to market”.

2. Close all bailout/handout windows.

And see who is standing on their feet at the end of 30 days.

Of course they’re going to suspend mark to market. They’ll never accept the fact that the assets they’re holding are worthless. It’s like someone that overpaid for beanie babies back in 99′ refusing to sell them for less than they paid but they can’t get anything more than 5 cents on the dollar.

I’m sorry but could someone explain Mark to market Accounting and how it applies to this economic situation to me in laymen terms. I looked it up on Wikipedia but it still made no sense to me. Just the short version so as not to annoy anyone. Thank you.

Br HB and All:

We had the dotcom bubble burst in 2000-2001.

The housing/derivative bubble is bursting.

What and when is the next big bubble/burst?

That was one passionate review of capital assessment program. Thank you for making it clearer(i’m still a bit confused but way less than before I read this post).

“Japan spent $6.3 trillion on construction-related public investments from 1991 and September of 2008 according to their Cabinet Office. During these two decades, since their lost decade actually hit in the early 1990s, Japan managed to accumulate the largest public debt ramping up their debt to 180 percent of their $5.5 trillion economy. We are going down this path and the Capital Assessment Program is eerily familiar.”

Japan, here we come! Richard Duncan already talked about this in great prophesiacal book ” Dollar crisis”

-Joe

http://RenoHomeBlog.com

Fred: My understanding is that “mark to market” means an asset on an institution’s books is valued at its market value. If this is “suspended,” these assets can be assigned any made-up value.

.

In practice, it would work this way: A bank is holding a collection of mortgages with a combined face value of, say, $100 million. Since they’re mostly the product of option ARM and NINJA loans, their real combined value is $10 million. So if they have to “mark to market,” their books take a $90 million hit to the bank’s assets. However, if they “suspend” this rule, the banks can take the whole lot with the made-up value of $100 million to the Fed’s window and exchange them for $100 million of taxpayer money. This is ostensibly a “loan,” but it can be “renewed” indefinitely. That means it’s a gift of your money to the banks in exchange for their worthless “asset.”

Comment by fred

February 27th, 2009 at 2:41 pm

I’m sorry but could someone explain Mark to market Accounting and how it applies to this economic situation to me in laymen terms. I looked it up on Wikipedia but it still made no sense to me. Just the short version so as not to annoy anyone. Thank you.

___

Pretty simple. The banks have this stuff they are holding – loans, CDOs, SIVs, credit default swaps. To figure out how much the banks has in assets (the + side) veruss debt (the minus side and what they stand to lose it the laons go south), you have to put a value on the ‘stuff.’ Now that is where the fun starts.

>>>

Mark to market is what every single one of us does when we say “My car is worth XXX$$$” or “My house would sell for YYY$$ becuase the house nect door sold yesterday for ZZ$$$. We are “marking” or putting the price at what the market (buyers right now today) would probably pay for something.

>>>

The banks so do NOT want to mark to market (value a loan or CDO) at what a buyer would pay right now to day. If they went out and tried to peddle those CDOs, SIVs and stuff to a buyer, they would be lucky to get pennies on the dollar because while no one would know exactly what would happen to that bunch of loan being offerred for sale, it is a pretty bet that a lot of those loans could default.

>>>>

The banks want to ‘mark to model.’ They had these fancy mathematical programs that guessed (and pretty much regularly guessed wrong) as to whether the loans in a bundle would default and what the losses would be. The model values the loans over the length of the loans – 20, 30 years or whatever. The value they give the loans is made up based upon hopes wishes and fantasies. They couldn’t find anyone to buy the loan/CDO/SIV at the value they put on it based upon the models. Call it ‘fantasy land’ pricing.

>>>

If the bannks have to stop ‘marking to model’ and instead ‘mark to market’, their balance sheets goes off a clliff. They put on the book that the bunch of loans are worth $100 based upon mark to model. If they have to value the loans at what they could sell them for today, that $100 turns into $1 or $10 or something else really low. Kind of turns the banks net worth into negative territory.

Comrades,

Let’s see, we have Bernanke, Geitner, Summers, et al, running the show. Should one wonder why the current playlist looks like the last one? Put another way, they are using a wrench when we need a hammer. Either these guys have bought into their own Keynesian BS or they don’t know their economic a$$ from a hole in the ground. Either way, it is insanity and as the good Dr. has pointed out, it won’t be pretty when the music stops.

As for Obama, he is a smart guy following the advice of a bunch of other smart guys. Unfortunately, the smart guys are wrong! It took a whole lot of MBAs to get us into this mess; I seriously doubt we can count on them to get us out. Market forces are blind to educational level, political stripe, race or religion.

Be Brave Comrades!

Regarding smart guys being wrong, did yall see this piece at Debt Deflation?

The failure of academic economics

http://www.debtdeflation.com/blogs/wp-content/uploads/papers/Dahlem_Report_EconCrisis021809.pdf

~

I like farmboy’s test, though I think it’d lead to some real ugliness as people got that shock treatment. Clawing on the decks of Titanic, like that.

~

Mark to market is bad enough: nobody knows what the market is till someone buys what you have to sell. Mark to mania is even worse. The problem comes in when people want to speculate ahead of time on what the market will be X period of time in the future. Then start trying to cover their bets. That’s not mark to anything. Mark to greed. Mark to illusion. Nothing under it but the hot panting breaths of greed and moneylust.

~

On Doc’s GDP scenarios, I largely track, though note that we can all expect GDP to get seriously redefined in the next few years.

~

I’m seeing a pot-, sex-work-, and chocolate-based one.

~

We’re watching CALPERS closely. No skin in that game…but yeesh. What a mess. We have quite a few neighbors now, retired boomers who cashed out at the peak, bought their houses at way inflated prices, and now don’t talk as much as they used to about eco-cruises and stocking the wine room….

~

rose

Thank you PSPS and AnnS. Although I think sometimes ignorance is truly bliss.

@ wincompetent

February 27th, 2009 at 4:06 pm

Br HB and All:

What and when is the next big bubble/burst?

————————————-

US treasury bonds are the next big bubble to burst… and when this happens it will be tectonic shift in the global financial markets…

Mark to market is in reality what is on the books; a car bought in 2006 for 30K is mark to market at that time as 30k. Once you drive it off the lot, M2M is not relevant; the car depreciates each mile.

What the banks want to do is drive a car 60K (and have a few fender benders) and then pay for the car as if it’s original worth is 10k…we all wish we could do this, no?

Leave a Reply