California Underemployment Rate at 24 Percent – 100,000 Workers Will Lose their Unemployment Insurance. No Housing Recovery can be had without Employment Recovering.

California has reached another unfortunate record. The headline unemployment rate pushed up to a record breaking 12.6 percent. This translates to 2.3 million Californians completely out of work. We also have a large number that are working part-time but would like full-time employment. When we look at the California budget and economy we cannot separate out jobs from the condition of the housing market. California’s big error during the decade was that the health of real estate was the health of jobs. That is, many jobs (too many) depended on the housing bubble. As the bubble burst so has the economy. Yet the current strategy seems to rely on real estate recovering again instead of building up jobs in other industries. If we look at the underemployment rate we are quickly approaching 24 percent. We also have many toxic mortgages that are still sitting in the balance sheets of banks but more are making their way to market.

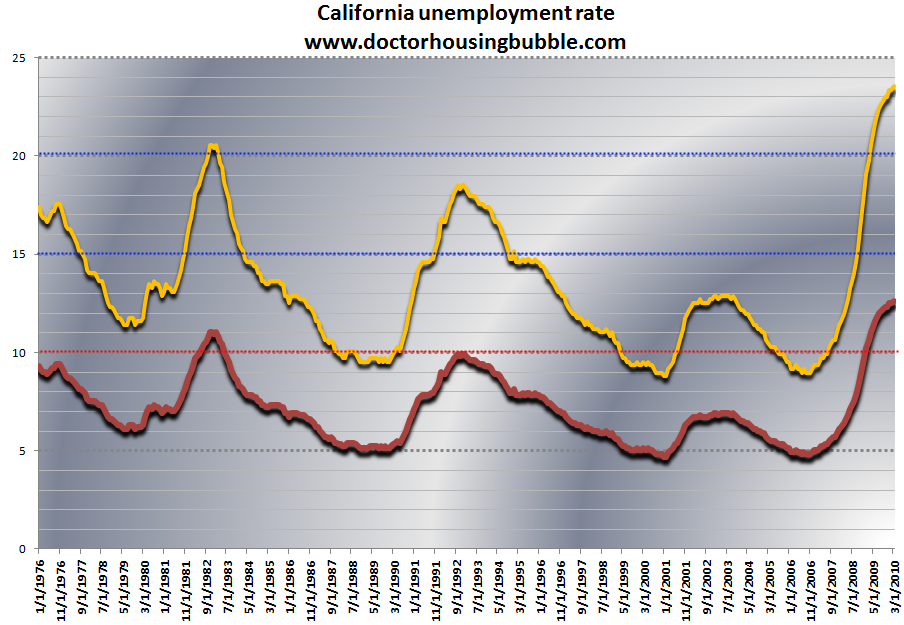

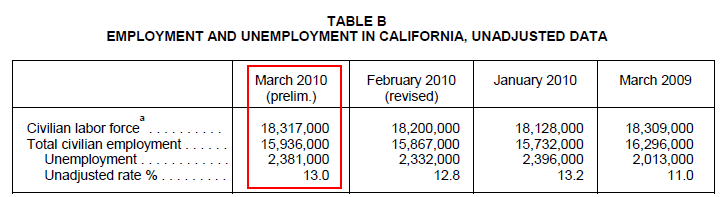

Let us first examine the employment situation in the state:

Source:Â BLS; Yellow modified U6

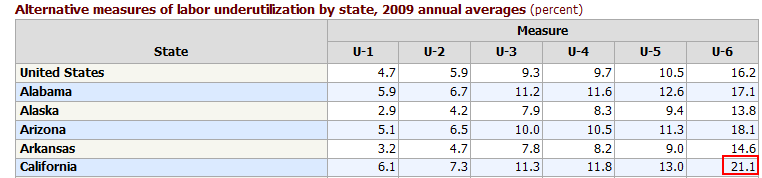

I’ve been putting together this chart for a few years now. The red line is the official BLS headline unemployment rate for California. But with such a large number of Americans working part-time but looking for full-time work, I’ve also added a line that reflects the underemployment rate. This data was created from averaging out the difference over the years between U3 and U6 for the state. The ratio is fairly accurate. In fact, let us look at the official 2009 average for California:

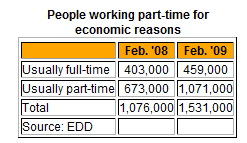

The average U6 rate for the state in 2009 was 21.1 percent. But keep in mind and look at the above chart. The headline rate (U3) has been going up all through 2009 and now in 2010 we’ve had a rate of 12.5, 12.5, and 12.6 percent. In other words, the average is now much higher. And we actually see this in the current part-time rate:

Source:Â OC Register

In the last year we’ve increased the part-time for economic reasons number by 456,000. It is difficult to envision any housing stability without the employment situation improving. How are people going to afford any sort of mortgage payment if they have no job or are working part-time with lower wages? At the moment, we have seen a movement in home sale activity but much of this seems to come from a couple of unsustainable groups:

-a. Investors

-b. First time buyers using the tax credits (federal currently, state next month)

-c. Low mortgage rate push

-d. Pent up demand

All four groups are currently dominating the market. In most healthy markets sales come from people selling homes to move up/out and first time buyers. We are missing a large healthy group of home sales that come from the move up market. After all, what are you going to move up from when one-third of California mortgage holders are underwater?

What is even more challenging for the current economy is we are reaching the end of the line for many. In the next few weeks we are going to see roughly 100,000 people lose their unemployment insurance:

“(LA Times) Despite hints of an economic turnaround, some of the 2.3 million unemployed in the state found March the toughest month yet. That’s because tens of thousands have been out of work so long that their unemployment checks will be cut off within the next few weeks. They’re not helped by the $18-billion measure signed Thursday by President Obama that extends jobless benefits for many Americans through June 2.â€

Many of these people are part of the 2.3 million unemployed:

Source:Â EDD

The recession has been so long and deep, that even 99 weeks of unemployment insurance with combined extensions is not enough for thousands of California residents. A current extension signed by the President will not help this group. And with budget battles looming for cities and the state, it will be a struggle of priorities. Why choose to give a $200 million home buyer tax credit when our employment situation resembles the above is beyond me. It is a purely political move because economically it makes absolutely no sense.

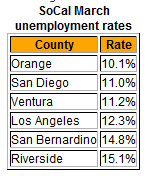

And Southern California is in really tough shape. Many of those investors have been buying out in the Inland Empire:

Source:Â OC Register

The Inland Empire is made up of Riverside and San Bernardino Counties with headline unemployment rates of approximately 15 percent which means their underemployment rate is 25 percent or higher. I’ve been following this market closely and have seen an explosion of rentals hitting the market.  Yet the economy is so tough here, that many rentals seem to languish or if they do get rented, investors are finding a hard time collecting rent. This might be because the underemployment rate is 25 percent! It should be obvious to most that we can have no housing recovery without fixing the current employment situation in the state.

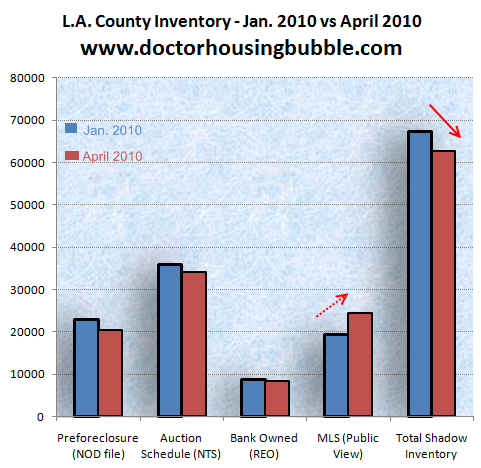

And here in Southern California, we are seeing some shadow inventory move from the dark hidden corners of a bank balance sheet to the MLS:

So what we see is a decrease in shadow inventory and a bump in actual MLS data. This trend has been going on for a few months now. Yet the properties making their way look to be hand selected. For example, banks seem to want to move shadow inventory in the Inland Empire fast and at lower prices. In other areas, not so much (i.e., Beverly Hills, Culver City, etc). It would appear that banks are already giving up on certain areas and crossing their fingers that in other markets, things will recover quick enough and then they can unload properties at face value.

The California budget battle is going to give us two choices. One includes raising taxes to generate more revenues. The other will include cuts which means additional job losses. These are not good choices but this is what we have ahead of us in 2010.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “California Underemployment Rate at 24 Percent – 100,000 Workers Will Lose their Unemployment Insurance. No Housing Recovery can be had without Employment Recovering.”

California has already raised taxes. “Fees” , which are really taxes, have gone up business licenses, entrance to parks, car registration, cell phone bills, utility bills,etc,etc.

Most municipalities are also adding parcel taxes of up to $1,000. on single family homes, to “save the schools,once and for all.”

Personal income taxes will also be bumped up, once our fabulous legislature gets around to it.

Since 45% of people pay no federal income tax at all, the burden lands on the other 55%.

And don’t forget all those furloughed State, City, and school employees. Their earning power is going down, so their purchasing power is going down, even though on paper it looks like they are employed full time.

CA housing price movenement is very closely correlated to the unemployment level. Anything above 7% starts to put downward pressure on it. This level is huge and means downward pressure on RE prices for a long time to come.

If it werent for the huge level of govt interventing and involvement in the economy, we’d be in a full-blown depression.

We went to see 2 foreclosure houses in Hacienda Heights yesterday. These 2 houses just came out on the market. They are in bad shape: holes in the wall, leaking roof, cracked paint (maybe the wall was cracked and covered up by paint), cracked tile floor, malfunctioning bathrooms, etc. One is listed at $424K (claiming 1700sf, don’t feel like it) and the other is listed at $415K (2050sf). Without seeing inside of the houses, they seem to be priced reasonably because they are both in the same real nice neighborhood and good schools. But after factoring the cost to fixing them up, not so much. Over a week ago, a foreclosure listed at $492K (2800sf) in much better shape in the same neighborhood is in pending sale now. It is encouraging that we finally see some foreclosures in the nice neighborhoods. We just don’t think it is enough unless the foreclosure listing like this is streaming to the market in this pace or faster. Hope it will put some pressure on the prices. We have not seen any foreclosure activities on MLS in the north side of Chino Hills. Just short sales. Probably still have to wait for another year or two.

the earth has reached and, just recently, passed the point of peak oil. oil provides the “gain” in human activity – obviously that includes fundamental economic activity, it’s a “multiplier”. Speaking in approximate terms this makes “recovery” essentially impossible. We have had a shift in the ground.

Recently BofA anounced it would be moving ahead with foreclosures by 600% this year. Is BofA telling us that it expects re prices to fall and wants to offload at today’s prices while it still can? Beat the other banks to the punch? Hmmm. The banks have this dribble homes on the market strategy, but why is BofA seemingly bucking the trend?

As our good doctor has noted in numberous posts, for the banks there maybe a fly or two in their healing ointment. Hoping to keep returns coming in they’ve tried renting them out. This has probably turned out to be rather cumbersome and just hasn’t produced the mark-to fantasy returns they believed they were entitled to. Banks are comming to grips with something called fundamentals. In addition, all the cash investors buying cheap houses and doing a little fix up and ether renting them out, or putting them back on the market for sale. The last one really puts a crimp in the banks plans. This means that the rate they dribble homes on the market is decreasing. More red ink flows. Maybe BofA has come to a realization here. Like someone who has been on the wrong side of a trade and decides to get out while they still have a shirt. Oh well, this is how it looks to me.

Lisa points to the critical importance of oil price/availability to our economy.

We could be in better shape wrt oil had we not virtually stopped drilling for the last 3 decades, but worldwide there has been a tectonic shift.

Many peak oil predictions in the past turned out to be premature, but conditions have changed regarding Worldwide demand (China, India, and other rapidly growing consumers of petroleum) rendering all previous predictions moot.

It is a virtual certainty that we will never see cheap oil again, barring a devastating Worldwide depression.

We should be pursuing every available domestic energy source, but we are not, and we will pay dearly for this stubborn refusal to address reality.

High energy costs:

Another massive burden on home prices.

In the San Francisco area, houses are still selling like hotcakes.Open houses are still crowded, and buyer seem oblivious to the fact that the state of CA is in a recession.

Based on conversations, many of the buyers are firemen,police, and teachers, with seniority, so they are not subject to layoffs.

I think the so called investors in IE will start to panic very soon. I think also that the RE statistic is detached from reality as much as it could not be more. I haven’t been looking at the market at Las Vegas (in my case pure theoretical interest), but it seems that prices have been falling for the whole 2009 (not like LA where they have gone up 10-15%) despite the statistical “stabilization on low endâ€. 2 days ago I opened the MLS for Vegas and was shocked that practically every city in the LV metro SFRs start from $30K. even Paradise city, which seems to be one the best place there, starts at $50K… $30K for house!? Probably renting in LV is more expensive than owning even considering the owning expenses… (What is probably the normal situation if you have populace with normal attitude toward RE , not the hysterical buyers hordes of American “investorsâ€) What I am saying is the “investors†in IE will have a hard time to compete with this and yes this is relevant because a Riverside resident is more likely to move to Las Vegas ( or Phoenix) than Santa Monica or Culver city and probably this what they do in droves . Same demographic, same jobs pool, same weather… Discrepancy between 150K in Riverside and 30K in Vegas will trigger tsunami waves of exodus out of California. How it will work out renting 150K house in Riverside when mortgage on the LV 30K house is $300 a month!? How this will work out? Prices in LV will suddenly jump? As I said panic is coming.

Clay-

Sells here in the Diamond Bar-Walnut area are brisk as well. The superior school district has much to do with it. There are pocket ares that are still selling well.

So let me get this straight….

Will California raise state income taxes? Property taxes? Municipal Taxes? All of the above? State income taxes are already the highest in the nation. Property taxes are 1.25% of ridiculous values.

And will education continue o bear the brunt of the additional state budget cuts?

I ask, not because I’m a teacher. I’m not a teacher, but I have three elementary school-aged children. California’s K-12 is already ranked 46th in the union. More staff and program cuts, higher teacher-to-student ratios, and more national testing failures is not how this “Golden State” is going to stay ahead of the stellar performances of Louisiana (47th), Alabama (48th) and Mississippi (49th).

Children in Germany, India and China are laughing their assess off that Nevada has better elementary schools than California.

Great post, but after reading this my thoughts keep circling back to the same question as to how these dolts in Sacramento get any sleep at night.

To Doug/Lisa, I agree with your peak oil sentiments but this will only open the way for NG which is huge in supply. This can be transitioned relatively quickly as most people are already supplied with natural gas as a home heating agent. You are right we should be looking at all alternatives however we are not NG will be the big winner here.

I agree with the overarching point of this article – unemployment and underemployment in California is the 800 pound gorilla in the room. The Tsunami of people coming off of unemployment (exhausting their benefits) over the next 3 – 6 months will be devastating to the California economy. Furthermore, the increased foreclosure numbers over the next 6 -12 months will not bode well for real estate demand. Pricing wise, I have no idea what metrics people are using in their buying decisions when it comes to housing, and agree that the move up market is dead today.

Mish’s Global Trend has an excellent commentary: How public unions broke California. The prision guards union and the teachers union have made sure that the bulk of increases in the state budget, went to increase their salaries and pensions. Any politician who dares to question this, is targeted for defeat at the next election, by spending millions from the union coffers.

The issue in CA for real estate in the last year or so has been a huge drop in inventory. This is because foreclosures are not being processed. So demand, especially at the low end, has been soaking up inventory very fast. But, if the BofA executive is not lying, 600K foreclosures in late 2010 will start the flow of inventory. And if other lenders believe this, they may get out there and start foreclosing more homes as well. No one wants to be late to a sell-off.

As for energy. I agree. Look at commodity prices since 2000. 300% to 500% increases and holding. 6.5B people on the planet. Cheap, high density energy has been the turbo charger to the 20th century economic growth and development. Peak oil will be a paradigm shift that no one alive has ever experienced.

Los Angeles Times headline: “California foreclosures drop 4.2% as lenders work with troubled borrowers.” Are the banks just delaying the inevitable, or maybe I’m missing something? Which one is it? What am I missing? Link: http://www.latimes.com/business/la-fi-foreclosures-20100421,0,7066382.story

California is no place to be. Why don’t you people accept the fact that 50 years of unrepentant immigration (both legal and illegal) has ruined your state? It isnt the outrageously paid public servants that have destroyed California, it is Immigrants. Excuse me, I forgot, most of you are Immigrants. Good luck!

As someone once said; maybe we should sell California to Mexico. That would solve the immigration problem AND the budget crises. Ha!

Leave a Reply