The California renting tsunami: In the last ten years California has gained nearly 1 million renter households while seeing a decline in the homeownership rate.

Does it feel like more renters exist in California? It should feel that way because over the last ten years we have gained a net of 1,000,000 households that rent while seeing homeowners decline by over 200,000. California has always been one of the states with a large renting population. In fact, in places like San Francisco the ownership rate is in the 30 percent range.  In the last 10 years there has been a dramatic shift in the number of households that rent in California. In the last 10 years we have gained 500,000 households in California. However, most of this growth has come in the form of renter households. What are the implications of this change when it comes to voting or even how residents view their neighborhoods? We have 2.3 million adults living at home with parents because they can’t afford rents let alone venture out and purchase a home on their own. If we look at the raw figures, what we find is that renting has been trouncing home buying for the last 10 years in California.

The renting tsunami

In total, we have 12.6 million occupied housing units in California. So when you see a swing of 1 million, that is a big change. In 2005, 41 percent of California households rented. In 2013 it was 46 percent and the trend has continued well into 2015. In fact, with the run-up in 2013 driven by investors we’ve seen more people having to get creative when it comes to renting. Roommates are a very common living arrangement for those in Los Angeles.

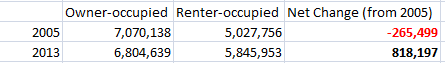

I went ahead and dug up Census data for California regarding homeownership status:

Source: Â Census, California household data

We have 265,000 fewer homeowners today than we did in 2005 even though we have gained 552,000 additional households. Of course this shift has come because of the net add of 818,000 renter households. Census data lags a bit but we know given buying trends that this only accelerated in 2014. If the rate of change held steady, we are looking at closer to 1 million additional renter households today than what we had back in 2005.

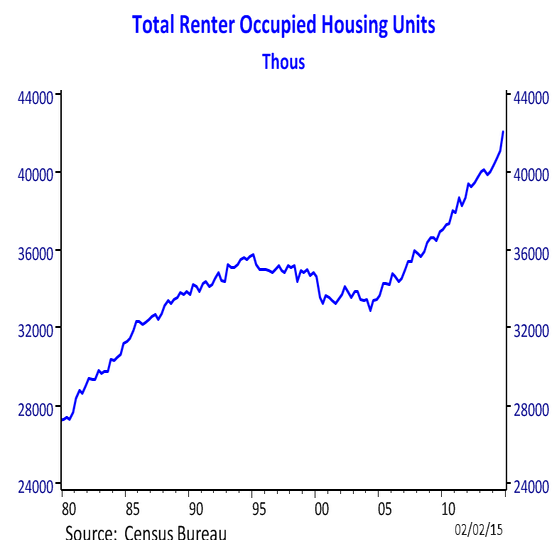

The renting trend has been occurring largely by the hollowing out of the middle class in California. While this is more pronounced in California, this is a nationwide trend:

In the last 10 years the US has gained 10 million renter households while the number of homeowners has remained stagnant. This is a nationwide phenomenon. For many Californians, the options have been:

-1. Purchase a home and funnel every penny you have into the mortgage

-2. Rent but deal with constrained inventory and rent hikes riding economic waves (i.e., SF tech boom)

-3. Live with parents

-4. Live with roommates

-5. Move

-6. Live in poverty

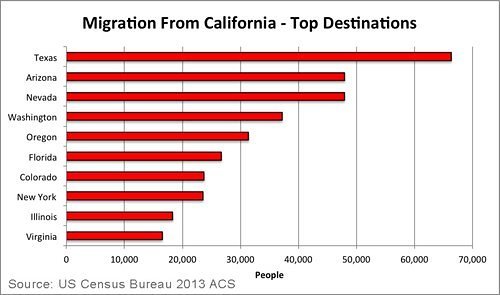

Now these aren’t presented as good and bad choices. Everyone lives under one of these conditions, either by choice of necessity. For over a decade we have been seeing a net migration out of California from domestic residents:

The majority are going to Texas. It is also important to note that most leaving the state are households making $50,000 or less. If you want to own and this is your income level, it is going to be near impossible to achieve this in California. But fortunately we live in a country with 50 states and if this is your number one goal, it is very doable. If your goal is to live in Beverly Hills on a beer budget that is never going to happen.

So what we find in California is people fighting over crap shacks like hyenas just to own a piece of real estate, even if the home has the personality of a drywall prison. While it may appear at least with readers of this blog that everyone is looking to buy or already owns, the raw Census figures show that the bulk of the population has been shifting to renting. The reason buying in California isn’t clear cut is that current prices assume big appreciation going forward. This is the only way you can justify current crap shack prices. But as we have documented before, California booms and busts over and over. For some crap shacks, a 10 or 20 percent adjustment means $100,000 or $200,000. That is no small amount.

So why does it feel like more Californians are renting? Because adding 1 million more renters will do that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

97 Responses to “The California renting tsunami: In the last ten years California has gained nearly 1 million renter households while seeing a decline in the homeownership rate.”

Renters or borrowers are same prisoners paying warden – inflated debt holders of the drywall prisons. DrHB. Your humor is top notch the best comedy is truth !

Correct, whether renting or buying, you’re still just paying for a place to live.

In fact, renting is more flexible. If you lose your job, 30 days notice and you’re outta there.

With a house, you’re trapped in a debtor’s prison…

You speak the truth. If my husband gets a better job elsewhere, guess what? We can move with little to no consequences as renters. Sure, we’re throwing our money away (as my *charming* in-laws continue to remind us), but we have this great thing called FLEXIBILITY. And I think that after the last recession many people my age are thinking twice about owning a home. Job loss is a real thing and a 30-year mortgage is BIG DEAL. Gotta plan ahead.

It’s smarter to rent right now. With the California drought, it would be unwise to buy a house out in the desert.

You’re only trapped if it’s underwater or wouldn’t cash flow. I have an $884/mo mortgage on my primary 4/3 SFR, bought from the start with the idea that it might become a rental (2009 prices, backs to private park, community pool, $46 HOA and low taxes, great school district, etc.). It would easily rent for $1,900. Are we “trapped” there? Of course not. If wifey and I both lost our jobs and had to relocate, not only would it not hinder us, the cash flow would be a huge help. We could rent in the new location until prices were reasonable.

Mortgage holders can sell in 5 days

What are you dummies smoking?

There’s a difference between a years probation on a lease, and 30 years sentence in debtor’s prison. And when you get out, you have an “asset” with 30 years worth of wear and tear. Imagine what all these poorly built crap shacks will look and smell like in 30 years. How long does it take Chinese dry wall to metabolize into whatever mystery chemicals went into making it? A lot of people will be finding out in the decades ahead.

“…Chinese dry wall to metabolize into whatever mystery chemicals…”

Not to mention Lumber Liquidators formaldehyde laced flooring.

Be the first on your block to have your home declared and EPA super-fund site!

Good luck selling after meeting California Mandatory Real Estate disclosure requirements.

If one goes on Redfin and input either Plano or Frisco TX its amazing how many homes listed are “hot homes” (Redfin predicts the home will sell in days, etc.)

I spent a week in Frisco TX a few years ago. Friends kid had school function I attended; it seemed every other person I talked to was a middle class CA transplant who moved to Frisco for job transfer, better schools, buy a house, etc. They missed CA weather but employment, quality of life, wanting to buy house, etc. deciding factors to relocate.

I think these two examples of Redfin “Hot Homes” reflect why some middle class families are fleeing SoCal. A Redfin “Hot Home” in Huntington Park CA, asking $270K:

https://www.redfin.com/CA/Huntington-Park/6817-Plaska-Ave-90255/home/7425499

A Redfin “Hot Home” in Frisco TX, asking $269.9K

https://www.redfin.com/TX/Frisco/2818-Spanish-Moss-Trl-75033/home/33139297

Yeah, I know, save your breath…Texas ain’t California. No Surf and Ski, no Hollywood. But if you are middle class (especially with kids), want to buy a house, value good public schools and safety, sometimes choices must be made.

For all those who want to relocate to TX from CA, be my guest and persuade as many others as possible to join you. Matter of fact why don’t you have about 20 million to follow you. That would make it much better here in CA. You have a right to prefer TX, but as for me, TX Sucks big time. Most depressing place on earth and I have lived from Asia to Europe. I visited a relative who lives in Frisco, TX when I was down there caring for my dad. Awful place — yuck, yuck!! I can think of many states much better than TX, i.e., Utah, Idaho, Wyoming, etc. comes to mind. I have relatives living in many other states, but I like Utah and Idaho since I have lived in those states and have relatives who still live there. Travel to Utah, Idaho or Wyoming you will find what has been lost in most other states — America.

What an eye opener… The property in HP comes with original contemporary wall art, complete with common neighborhood jargon.

@wedon’tmake

There was a woman who worked for me in a professional tech position. She was originally from LA and worked for us here. She wanted to move to Frisco and we kept her on. She works remotely…not a big deal in some tech industries. Anyway, her salary was about 90% of what she would have made in LA. Her nice house in a nice area of Frisco cost about 30% of what a house in Westside of LA would have cost. You do the math. Sure I personally wouldn’t want to live in Texas, but it works for her and the wage disparity is far less than the housing disparity.

I’d think twice before moving to Texas right now. The Oil boom in Texas is over…. get ready for the economy in Texas to get hit hard with all of the layoffs coming.

Why , yes, California people are coming to Texas as refugees, fleeing from that mental disorder of liberalism, as Dr. Savage has said(of course he lives in Marin where people are really out of touch with reality, I am told).

Nothing wrong with Texas, you just have to understand that it is different. It is a low tax state, and you get less in services than here in California. I married a woman from a small Texas farm town, Wolfe City, and until the relatives died off, we would visit every other year. In this town you do not get sidewalks, curbs, or good pavement, and in the city park, the playground had a steep metal slide and jungle gym, like I remember from my childhood, somehow I survived, but you just don’t see this anymore in California.

Liberalism has also invaded this town, the city closed its Black Cemetery long ago and now allows everyone to be buried in the main cemetery.

I know what you mean. I lived in the little town of Westlake, north of Fort Worth, and we did not have sidewalks either. The homeowners association gave me trouble about my attempt to raise some cattle on my 5 acres. That is why I came to Kerrville. Sometimes I do come out to California and go to Zuma.

There are neighborhoods in L.A. with no sidewalks, curbs, and have terrible pavement. High taxes to boot.

Then, there is the big question mark … what about all those homeowners not represented as people moving to /from California? What happens as they age …. do the live at home kids simply get the house? Will those who are nearing retirement or who are retired need that equity in their homes and suddenly need to sell, or will they all do reverse mortgages? And, what happens when all those aging Boomers staying put die in those ‘golden homes’ … do the kids want those homes, or will the responsible ones who have careers, simply sell the folks’ home? What happens when all those millionaires from abroad no longer want California real estate … so many scenarios!

Another question mark: who is going to pay for all those bond measures the public loves to saddle homeowners with every time there’s an election ?

As has been noted here, many times, not all homeowners are rich land barons.

Years ago when Colorado was the place of choice to escape from Ca. Many sold and return to Ca or moved to Az. The grass is greener not really, more to moving then just a nice house, many variables are involved, always set up shop if you can first, to make sure you want to wake up in that state?

There’s nothing wrong with California. In fact there are many beautiful places in California.Unfortunately Los Angeles is just a sh*thole.

There are many beautiful places in Los Angeles. It’s not all sh*thole.

Indeed, some of the best homes to live in — in the entire world — are in Los Angeles. It’s just that you need A LOT of money to afford Bel Air, or Hidden Hills, or the beaches of Malibu. But if you are worth tens of millions, then you can’t beat Los Angeles, New York City, San Francisco, or London for quality of life.

But if you’re middle class, then yes, you are struggling to own a crapbox in a (hopefully) soon-to-gentrify shi*thole.

@SOL, if I had tens of millions of dollars, Los Angeles would be in my rear view mirror. Vail, Aspen, Denver, Geneva, Zurich, Prague, Milan and Miami all rank higher than LA. The worst parts of San Diego and Temecula are better than most of Los Angeles. Most of Orange County is better than most of LA.

I wish I could buy a home in safe coastal neighborhood. Does anybody think prime real estate will cool of this year?

No, no one does.

@Stacey Dridahl, Prime coastal real estate is funded by capital gains. Regular real estate (normal folks) fund their real estate with earned income (their jobs). There is a huge difference between prime real estate buyers (the top 5%) and regular real estate (the bottom 70%) buyers. So no, prime coastal real estate will follow the stock markets.

Sure – im seeing 300K off houses in Palos Verdes, and at least $100K off houses in the Palisades

According to Forbes, Los Angeles ranks #14 among cities with the most billionaires, with a total of 22 billionaires calling L.A. home.

New York City is #1, with 78 billionaires.

http://www.forbes.com/sites/liyanchen/2015/03/04/billionaire-havens-where-the-worlds-richest-live-in-2015/

Moscow is #2, and Hong Kong is #3.

And that is important how? I think you’re suggesting it impinges on housing values in some way? I don’t think billionaires are too much of an influence on the type of house I want to buy – unless they buy up all the stock – which I think is unlikely. Property investment can sour.. many a story out there, including re New York.. that markets topping out. It’s already pulled in many at ever higher prices in hunt for yield against ‘dead-money’… paying ever higher prices last few years. Don’t rely on billionaires to buy up all houses… rents still depend on incomes, and market can turn.

“If real estate was a publicly traded company and I could short its stock, I would very happily short 57th Street,” said Ofer Yardeni, CEO at real estate development firm Stonehenge Partners, referring to the stream of high-end towers popping up along 57th St.’s “Billionaires’ Row.â€

http://www.nydailynews.com/life-style/real-estate/top-developer-new-york-real-estate-market-bubble-article-1.2001958

Several dozen billionaires are an iceberg tip, indicating that you likely have 100s of “hundred millionaires” and 1000s of “ten millionaires” in L.A. No, I don’t think they affect overall housing prices, except in the truly prime areas. (Which will not dip in price.)

But my main point is that L.A. is no sh*thole, as some have said. Among those who can afford to live anywhere, many choose to live here. (Or at least, have one or two of their many homes here.)

Seems to me that you’ll continue to see a lack of family formation in SoCal even well through the oncoming bust. I’m curious how that will affect things like school district budgets. Many weren’t/aren’t keen on having kids as RE makes it unaffordable. I don’t see how 2 booms and busts within a 15 year period will do anything to convince people that starting a family here is a good idea. This should have long term effects on buyer psychology even after the next downturn in prices. The large home isn’t really necessary without a family to fill it with. It’s another negative headwind for prices going forward.

Fewer foreigners looking for a laundromat (and our .gov actually giving a shit if you take the birth-tourism busts last week at face value). No specuvestors. Little family formation. Can’t wait to peruse the spring selling season numbers. I don’t think the luxury market will he able to mask the price reductions everywhere else. Inventory is exploding with late arrivers to the Bubble 2.0 party. And every sale that moves the median down this year removes a viable buyer from the pool as more inventory is coming on line. The feedback loop has reversed polarity.

Love this blog but wish more solutions were offered. A big part of the problem is knowing it exists and step 2 is doing something about it. I’m specifically talking about personal finance choices. Is it better to rent or buy for middle class families? If buying is better then under what conditions? Debt to income, how much down etc…We know homes here in CA are really expensive. We know the cards are stacked against us. How do we deal with this on an individual level?

I totally agree! We all know the problem, what should we do about it. Right now I am saving like crazy hoping that the prices fall again someday, but so far this has been a poor strategy. The prices have incresed MUCH quicker than I can save. I tried to buy when the prices were lower, but always lost out to cash offers.

Joe…this is a good solid blog and like many folks today posting the world of real estate is a mine field of do I purchase or rent or just lay low.

One size fits all doesn’t apply, back when it was easy, buy then sell, and make a profit move up the ladder, today the world is pretty much a 24 hr, what bad news can we make so the general public stay’s confused with little direction.

You must look at your situation only, if you have 20% down, solid job, some money in bank and credit of 680 or better then buy a house in the best zip code you can find and don’t be afraid as many say to drive to buy a house if you have to.

Renting I believe for most not all should be a short term roof over your head till you see where you can afford. If you have to be worried about taxes and insurance and maybe HOA dues then it is not the time to buy for you.

The word comfortable in your decision means, is something goes astray you can handle it with losing your home. Making a home purchase is much more then does it have granite and stainless steel, this two upgrades have ruined many a folks they aren’t important in the buying process.

Go over all your checks and balances in the process, if you have to lower your sights on a smaller house no problem, but for value always try to have at least 3 bed 2 bath, a attach two car garage, gas appliances on a public sewer system.

It may take you some time to find the house and location or even moving to another state, only be influence by what you can afford, who cares about Navigation the car still starts and drives to a location.

We make our own decisions – note the disclaimer on the ‘About Us’ regarding actions you take in the wider market.

Joe,

This is still the most sensible way I’ve found (section 2) to judge financially if renting is favorable over buying and vice versa: http://patrick.net/housing/crash1.html

We’re Gonna be rich!…Patrick has professed renting on his site for many years now, he just doesn’t like mortgages Example… when the market in 2007 saw as much as 50 to 60% drop guess what don’t buy. In 2015 don’t buy, in other words wait for the million dollar houses at the beach to drop 40% and inland 60% then guess what he will say wait till they drop even further. Gonna be rich, just a side note, I made lots of money buying and selling in hot and cold markets like I posted it is about you the buyer to seek out the house in the best zip code you can afford. Wait it out making equity, not throwing it away by building the landlords equity?

The crowd gathers to watch a fire, somebody says, it can’t come close to us unless the wind suddenly shifts NE, guess what , I don’t wait for any wind I leave the scene, same in buying. I see a good buy I don’t act because a so called guru tells bloggers world wide 50 reasons renting is safer. I don’t need 50 reasons not to buy, need 1 one good reason to buy, that it makes sense to purchase a property that is ripe for the picking, happens everyday in buying and selling anything? take care

Having patience has always proven to be the solution and this too shall pass. As Doc says, California is boom bust, boats go out and boats come in. Only a fool paddles out to sea on a raft.

Patience in a sea of day traders paddling works out even better…

Buy a house near water, it will be much more important as this drought drys the non believers up….

Well, you won’t find a primer with bullet points but it’s been covered here ad nauseum for years. If you plan to stay put over 5 years buying might make sense, if you can pay the P&I with 1/3 or less of your gross income ditto. Then it’s matter of finding a deal you can live with that’s priced fairly on a house you like in a decent neighborhood. All the blather we toss around here becomes less important as you own for longer periods.

At this time I’m in the North Bay and we pretty much had to buy because it cash flowed for 30% less per month for similar houses – really upside down. Of course you need the cash for a down and we may not stay 5 years but with the market like this renting should be easily a profitable endeavor.

I find it amusing that people would chose to move to Texas for housing, schools, etc when there are plenty of areas more inland that fit the bill pretty darn well in CA. Perhaps it is their political stance weighing in also???? After all, the two states could not be more different from each other philosophically speaking. People that leave CA, God bless them, as there are to many people here as it is and Texas has plenty of room for them.

I find it amusing that your ignorant comment was actually posted? Why do you think people move – if not for “…housing, schools, jobs, etc…..”! Have you ever moved? Why ? Truly you are one of those really “deep” thinkers!

jstad6, Jim is not ignorant, but you are. For your information I have lived in many states and two countries and I know what I like. Some places like Texas, Kansas, Louisiana and Massachusetts depress me deeply. Waking up in those places brought me to tears.

The last time I was in Texas was from 2003 to 2007 when I was in Houston caring for my father. Sorry to say, but I thought he’d never die so I could leave there. Finally, he passed away in 2007 and I left there without waiting to sell his home. I had my cousin sell it for me. I didn’t care if I lost money — which I needed. That is how much that place, Texas, depress me. I don’t care about what it has to offer. For those who like TX, God bless them and more power to them. But for me, even though I have relatives there, I do not even want to visit the place again. I wish more people felt that way about CA and would leave here.

@OMay, when you say California do you really mean the prime parts of SoCal or the Bay Area? The areas of California outside of Los Angeles, Orange County, San Diego, the Bay Area and Santa Barbara are largely interchangeably and identical to Texas and the Midwest. Culturally, politically, socially and economically much of California, outside of LA/OC/SD/SF/SB is indistinguishable from the Midwest and Texas. If it weren’t for license plates with “California” embossed on them you wouldn’t be able to tell the difference.

Jim, what I find amusing about liberals is that “acceptance” and “inclusion” are so important yet when someone dares question liberal ideology, well best that person leave CA? Hmmm. I’m not sure how many places in CA have vibrant, diverse economies and solid job markets where a nice house in a 8-10 rated school district can be bought for sub 300K without a horrendous commute, but perhaps there are “plenty”, as you state.

I’m sure many Dusty Liberals who bought RE decades ago, retired w/pension, rent controlled apt, etc. agree that struggling middle class families who do not embrace the CA liberal agenda should GTFO, but remember those families pay LOTS of taxes; their future contributions may be missed. Perhaps when CA consists of 5% wealthy elite surrounding by ghettos of working poor, welfare recipients, illegal immigrants, people forced to live 10+ to a residence to make ends meet, CA will truly be Paradise.

It’s a misconception that all of Southern California is liberal. There are many places in Southern Cali that are conservative, such as OC, Temecula/Riverside, and Northern San Diego County. It’s the liberal majority in LA that has turned it into such a sh*thole.

I no longer believe in the existence of “liberals” or “conservatives.”

TV and radio pundits are like professional wrestlers. They play good guy vs. bad guy (take your pick), scream colorful soundbites and non-sequiturs at each other, put words in each others’ mouths, and ignore anything of substance.

Both “liberal” and “conservative” pundits only care about their book deals and TV/radio show ratings. They “fight” each other in public, then go out for drinks afterward laughing about their fans.

Nor do “liberal” or “conservative” politicians intend to implement the ideals they espouse. They make their talking points, then implement establishment policies.

There are no “liberals” or “conservatives” in media or politics. Just performers hired to divert our attention — and to frame the issues and policy proposals within acceptable boundaries. Anyone who offers solutions outside the liberal/conservative mainstream (e.g., Ron Paul, Ralph Nader, Pat Buchanan, Cynthia McKinney) is branded a kook or extremist or “beyond the pale.”

@son

Amen, brother. Any moron on cheerleads for one or the other is just like a pro wrestling fan. That’s all it is….

Son of L.,

Good observation and comment regarding the liberal/conservative paradigm.

“Perhaps it is their political stance weighing in also?”

I think the fact that a guy upthread considers it a sign of “liberalism” having “invaded” a small Texas town that they now bury black and white people in the same cemetery, kind of answers your question. 🙂

Numbers stated in article:

1,000,000 new Renting households

Negative 200,000 owner occupied households

= 800,000 new households.

Article states there are 500,000 new households in California.

What happened to the remaining 300,000? Part of shadow inventory? Bad numbers?

Hi Doc. on your point #6, about living in poverty. I heard the other day on the radio that California’s homeless population is around 135,000 people, I think most are in LA or SF.

Seems to be backed up by this data

http://www.nationalhomeless.org/factsheets/hatecrimes_factsheets/california.html

Good schools in Texas? I thought they were still fighting to allow intelligent design to be taught or some other form of creationism that may or may not have a dinosaur saddled by Jesus (not the gardener).

RentalLurker, you may use your outstanding schools from SoCal where kids are taught that they come from monkeys. Then the “elite” in charge of the school system wonder why their students act like monkeys. Don’t worry about the schools from TX because for the most part are doing better than LA public schools on less money spent per student.

And without Obama’s massive immigration policy to the point of overwhelming the public school system in TX, the schools in TX would do even better. Enjoy your bastion of liberalism while it lasts. Pretty soon it will colapse under its own weight.

It really doesn’t matter whether kids are “taught” evolution or intelligent design, because an awful lot of American kids graduate high school illiterate. So it’s not like they’re paying attention to whatever’s being “taught.”

I read a poll taken long ago which said that a third (or two thirds?) of Texas high school seniors didn’t know which foreign country was on Texas’s southern border. I forget whether it was one third or two thirds, but even one third would be shocking.

When I attended NYU as an undergrad, all freshman were required to take a full year of creative writing. I privately asked the professor if it was because many NYC high school graduates lack basic writing skills, and he agreed that that was the reason for the course requirement.

I know everything is all Obama’s fault. It has to be, right? But try educating yourself even a little bit about immigration. I am no fan of unrestricted illegal immigration, but here’s the reality: net immigration in 2012 and 2013 was DOWN about 25-30% from 2001

http://s.wsj.net/public/resources/images/BN-BF357_IMMIG_E_20140123154314.jpg

Don’t like those facts? Submit your own. Note source: well-known liberal rag

…because a common ancestor among primates is so much harder to believe than a universe originating from a Bewitched nose-wiggle.

The chart shows Texas was the most popular destination in 2013 — when oil was $100/bbl. Now that the price of oil has collapsed and the layoffs have started, Texas won’t be as big a draw like it was in ’13. In Jan. 2015 Texas added 20,100 jobs vs 67,300 jobs in California.

your post is right on, energy dependent states like Texas or Colorado although more diverse then in the past will be hurt. Lot of Texas people go up to Denver and the license plates around town are probably diminishing as I type. That is the problem with these states like Co, Texas, Mont, WY, ND etc. they have great runs then dry up so fast you head spins out of control and so does your investment namely your house which you can’t give away when the real crisis hits.

PS I also worry about Reno, the state gave the farm to Tesla who everybody on the known earth in the auto business would love see fail or taken over and completely make sure the car fails and company isn’t a future player. I would be scared to move there,buy a house based on a battery factory, heck they can’t even get sates to give them a dealer to sell there cars.

To Reno’s credit, they have been working to diversify their economy beyond just casinos and tourism. They’ve been able to draw more tech firms to the area in addition to the Tesla factory.

I hear what you’re saying but are people moving from CA to TX en masse for oil industry related jobs? Everyone I’ve known in the past few years who have done it are in tech. Many cases they took CA profits and bought at TX prices. Perhaps TX has a more diverse economy than in oil busts past?

Austin area is diversified…. the rest of the state is highly dependable on the pumps actually moving. Relatives all over Texas and spent three weeks RV’ing to visit all over TX this past September. I’ve seen the booms and busts over the years and my last trip I saw it booming. Construction all over the place…. Kind of reminded me of Riverside back in 2005. Pretty sure TX will soon be moving to the bust phase if oil prices remain at their current levels for much longer.

if you’ve been reading these comments as long as some of us

you’ll notice a shift has occurred in the narratives of the people who troll this site

bullish

robert’s ghost…”It is only a fool who doesn’t see change and change their mind”

Is it that we’re more bullish or simply that we’ve capitulated to the realities of the seemingly endless money available for housing in SoCal. Maybe there’s little practical difference…

Texas has had it’s share of booms & busts. They are not exclusive to California.

I really like doctorhousingbubble and follow it religiously, but any advice on how to translate the raw facts presented here into actionable decisions? I’m not sure whether it makes sense to continue renting or buy? If the trend follows and there are more renters; supply/demand would seem to dictate that rents continue to rise which would make owning a rental property in California more attractive with each passing day. Thoughts?

It seems like the advice is to leave the state of California. The problem is that most readers of the blog are trying to figure out how to stay in the state.

Take it from me, in general, you shouldn’t be taking financial advice from blogs on the interwebs!

The older I get, the more I think that the random walk is all there is. It is nearly impossible to predict the direction of any relatively efficient market to any degree of actionable certainty. Most people just get lucky. I suggest you work hard, save money, live below your means and just enjoy your life!

BB – plenty of actionable content is given. Figure out what it’s worth to you to stay/live in CA. What’s the cost for you to buy in CA? What’s the cost to rent? How does that compare to your income? If the alternative is to move, what are your employment prospects and housing/renting costs at your alternative location? How do the intangibles change for you?

I chose to leave, but put in the effort first to secure a job that would keep me with my CA employer even after I left the state. I effectively took a demotion but get to work from home from another state.

Jeff – assuming I don’t want to leave California, which I don’t; I don’t see an issue with buying right now with such low interest rates even at current valuations. Economically I’ve calculated that purchasing my current home (just purchased) that is my primary residence with an FHA loan is the equivalent of investing that same money in the stock market and getting an 11% annualized return… I’ve only modeled 1.5% price appreciation and have factored in things like a 1% allowance for expenses each year as well as the mortgage interest deduction. I feel that the information here is great but can result in analysis paralysis, but certainly not enough to make a decision to buy or not. Also tough to beat 11% annualized return in any locale. This doesn’t mean that housing price might go down in the short-term, but I don’t care it’s just short-term. And if the market goes down; great I’ll just double-down and buy another house on the cheap and rent out my current one.

@BB LOL 11.5% annualized return. You are one of the people this blog is poking fun of. You are in a house you can’t afford as evidenced by your FHA loan, and most of your income is going towards housing costs. Enjoy your crap shack and hopefully you already have a plan in place for when your overpriced sardine can inevitably goes down.

Ahhhh yes…. The ole supply and demand myth… Now how does this myth work again? I remember something about straight line demand myth crossing over the straight line supply myth determines the the price myth. Can I get an amen?

Learn how to use the Rent vs. Buy calculations for your scenario / wishes — that’s what really matters. All the rest is just speculation…

throw your life away trying to sustain a lifestyle that amounts to one big joke.. Can’t wait for the water to run out, the money to run out, and the image to finally reveal it’s true self.

California is going to price it’s self right out of existence. If the taxes to support it’s appetite for Government. doesnt do it first.

Why would you wait for (or wish upon) such a terrible thing? Because you cannot succeed here?

The Neighborhood I grew up in the San Fernando Valley was nice from the 60s through the 80s. My dad paid $4 or $5,000. I went back and what a shack my childhood home looks. Every home needed paint and just looked old and worn out. My Mom sold in the mid nineties for about $150 thousand. It went as high as $500,000 then was repossessed, what a joke. Three bedroom one bath that needed paint and landscape. Last I looked, still in the same condition and sold for $340,000. The entire neighborhood needs to be torn out to start fresh. I have never owned a house, would like to but they are just out of reach. I missed the reset but I don’t want to pup every dime I have into something that if I lose my job I lose it all, struggling and doing without all the time. About to take the jump from Palm Desert to Boise ID or Spanaway WA. California is unsustainable. No water and no room. The State Government making it known I am not wanted here. I could transfer to Texas. Had a girlfriend from Grand Prairie, she was friendly…….

https://www.redfin.com/CA/Los-Angeles/1853-Clyde-Ave-90019/home/6901479#property-history

So that’s what a >50% haircut looks like for a bank. Wow.

~$200K price drop in four months on a sub $1M property. In a “very desirable area.”

The problem with this property is the squatters. It appears that the previous owner refuses to leave or has rented it out. Getting squatters out of a property in LA is a nightmare. That is what I suspect is driving the price down. And the fact that you have to purchase it sight unseen.

Yes; just been reminding myself. Owners can find themselves in tricky situations; can become a civil matter if squatter/’tenant’

Increasing phenom in Europe too. Been reading about playgrounds of the rich in Europe where they have second/third homes (which by the way, no one else can afford.. a few on market but no buyers)… it’s all in the Euro press so can’t see harm in posting it as comment here… some entity comes along and puts a bit of tape over the doorlocks. They come back a week or so later, and if tape still there, they find a way to make entry, and then get the locks changed, and then get paying tenants in – and in some Euro countries, in those circumstances, law protective of innocent tenants and owner/landlord has to find civil remedy.

What’s going on there?

Interesting, but there’s also this house (slightly better external?) asking not that much more; same location

https://www.redfin.com/CA/Los-Angeles/1845-Clyde-Ave-90019/home/6901477

Although inside it’s full of chintz-chintzy furnishings. Honestly; I look at US listings for homes and don’t know how you can even cope with the furnishings for the most part.. so many kitchens with kitchen units with bevelled 1980s surfaces (the kitchen unit surfaces should be absolute flat, non-decorative, for easy wipe down cleaning with disinfectant wipes… bevelled designs just trap grease and dirt and make for harder cleaning).. the draw units in kitchens should be autoclosing/silent cushioning modern types… All these listings asking crazy high asking prices that are dumps inside.

https://www.redfin.com/CA/Los-Angeles/1845-Clyde-Ave-90019/home/6901477

IKEA 1996 Advert (Europe/UK) – Chuck Out Your Chintz

https://www.youtube.com/watch?v=cpk1BVkfh3w

That doesn’t strike me as “a very desirable area.” I wouldn’t even call it mid-tier.

It seems a bank foreclosed on it last year at a paper valuation of over $1.2 million, but I don’t see how that can be the house’s actual market value, even without the squatters.

The 1800 block of Clyde, along with all those streets that are South of Venice Blvd and North of 10fwy (east of Fairfax) are in a rough neighborhood. Those homes in the above links are dumpy as is the neighborhood. To say it is ‘near Beverlywood’ is a joke…. stark contrast in aesthetics, crime, etc.

In any case, these Western edges of the 90019 and 90016 zip codes are where the professionals are moving into who cannot afford Culver City or Beverlywood (and therefore a given that they cannot afford anything west of Culver City or Beverlywood also).

I accept your info/points made, QE Abyss – thanks.

Just hope there’s ever fewer professionals pushing-and-falling-over-one-another for these shack-houses at such prices. I won’t settle for anything less than prime / good area.

Renting is definitely the way to go. All of the financially savvy and successful people I know are renters. Lots of them post on this site. I wish I had avoided buying property in SoCal, just plain stupid move on my part. Scrimping and saving and sacrificing and sinking money into SoCal coastal RE was a terrible idea, but 25 years ago lots of people were saying that SoCal coastal RE was golden and I needed to get in the game because it was only going to get more expensive. Those people were IDIOTS.

Hopefully some people can learn from my mistakes and avoid buying RE in SoCal. If you buy now, in 10 or 20 years you will be very, very sorry that you own RE here. I would advise you to get to Texas as fast as possible. Do not buy anything when you get there. Month-to-month Texas lease is the only way to go. Now get off this blog and get on the phone with U-Haul immediately!

hahaha…in the last paragraph, it sounds like falconator is trying to free up some space for himself on the 405.

Sarcasm? (25 years ago / Idiots).

If not, then this doesn’t sound like the falconator I’ve read many a comment from, with the need to be in the game, billions of Chinese etc.

falconator..yes move to Texas folks and yes rent because my experience with Texas and it is citizens, you probably are going to move to another state in a year or so?

my parents own commercial property and their house both free and clear. you’re a fool if you think all the posters on this board rent. falcon the village idiot who says idiotic things to make himself feel better about himself

Ben,

Aren’t you glad your parents (or their parents) jumped on the hamster wheel and amassed some assets so that you could spend your time whining about So. Cal. RE prices?

Brazil- I am semi-retired because I have no wife no kids. And yes I am thankful for my parents common sense in buying real estate

The Sacramento Bee knows best!

“New home sales in the Sacramento region jumped in February to their highest level in seven years, offering new evidence that the real estate market locally is moving past its recession blues and prompting builders to say they expect solid spring and summer sales.”

The very next headline was “unemployment jumps to 6.7% in Sacramento region”

The strategy for the first time home buyer has shifted inextricably.

Goal is to buy an exit-level home not an entry-level stepping stone.

http://www.builderonline.com/design/the-rise-and-fall-of-the-entry-level-home_o

California is on a one way track, straight up, and it ain’t stoppin’ any time soon. Glad to see most on this board finally realize it.

Oxnard has everything. The smell of salt air from the beach. The sound of the surf. It is the place to be, at a fraction of the cost of Santa Monica. You come here and tell them that Carlos sent you. I will be hanging out at the Marina in my boat.

Seems like they just keep pumping in more foreigners to keep supply and demand up.

Leave a Reply