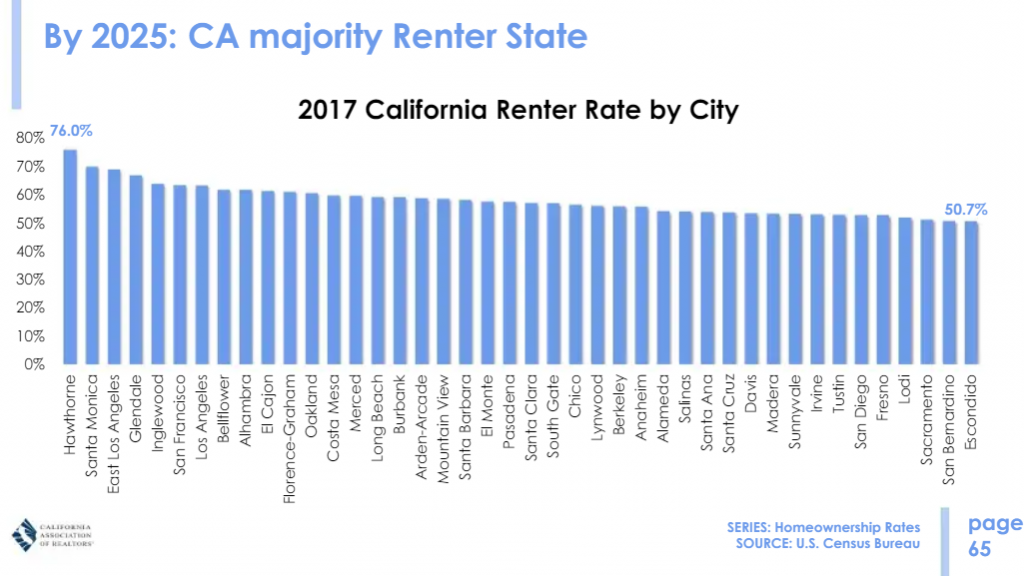

California heading to a majority renter state: How will this change the way Californians view housing?

The trend of having the most populated state in the United States becoming one where the majority of households are renters is on track. California is morphing into a renter’s paradise. This reality isn’t a surprise and we have some sizable generational shifts that are occurring. We have millions of adult Millennials living at home with their parents. You also have an interesting situation where home prices are high relative to what people can support but sales volume still remains low. Looking at the California Association of Realtors (CAR) for some data you can find that this is also perplexing the group. Ultimately you want sales volume to be high to churn those commission checks but that is not occurring. Builders are building more multi-family unit housing to satisfy the market demands. Yet in the end, it is clear that most Californian households are unable to afford a home and are opting to rent.

California heading to renting majority

California is steadily heading to a renting majority. We called this trend a few years ago and now the CAR is also calling it:

Cow why this is important is that voters are going to perceive issues like Prop 13 becoming something less about them and more about the “other†and in our political climate, this is going to be an issue. Affordability is important and many in California are stretched thin on their budgets. The amount of debt flowing through our economy is troublesome. Even a minor recession at this point can unlock some potentially devastating economic waves in our economy. Waves that will undoubtedly hit housing.

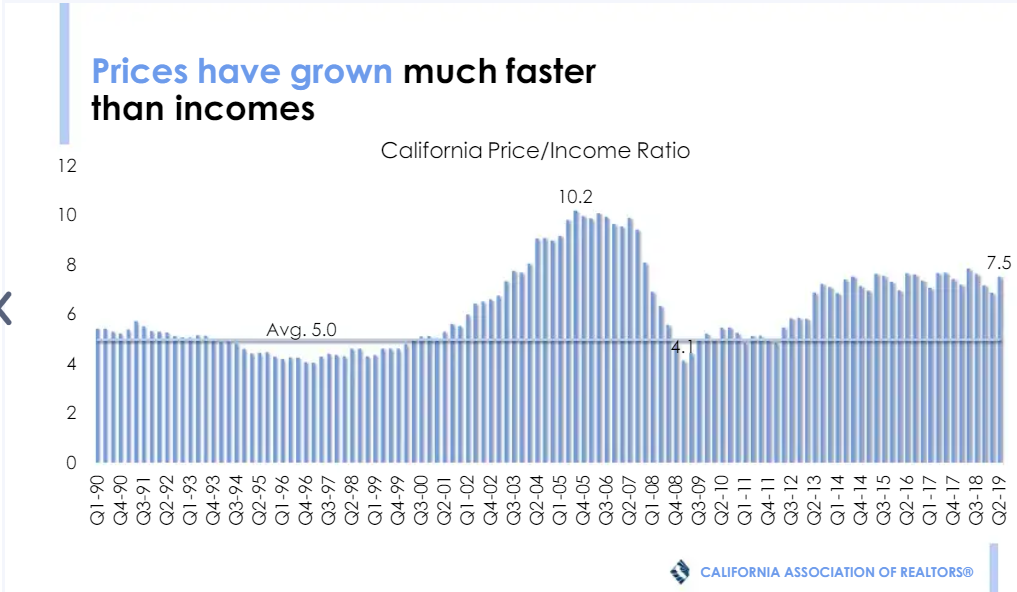

People at this point are stretching their budgets to get into homes with low mortgage rates. Yet we’ve already seen selling volume stagnate and price reductions becoming more common. Take a look at some ratios that may be of interest:

Prices again seem out of line with the trend here. While not as high as the previous housing bubble they are high nonetheless. If you want to value a home like a business, things at this point seem a bit inflated. I’m sure there is a desire to buy a home but builders have pulled back on single family homes and have focused more of their attention on multi-family units. This is creating supply issues but when we look at households, they are opting to rent over owning.

A changing mindset is also happening with Millennials. As mentioned before, many live at home with their parents and for many the next logical step is an apartment, not purchasing a crap shack. Also, the stigma of renting is probably going to be less when the majority of the state rents. I’ve seen in many prime neighborhoods where rentals are popping up in large numbers for single family homes. These are areas that were largely owner-occupied regions but something is now shifting.

People have also gotten savvier that there is an opportunity cost to buying a property. Just because you bought a place does not mean you “own†it in the sense of how it is marketed. You typically have a giant 30-year mortgage that serves as fixed rent. Also, once you pay the place off (aka mortgage), you will still continue to have expenses like property taxes, insurance, and maintenance that will continue for as long as you live.

What this means is that people are now wiser to other options. Maybe the only thing they can do is rent. Some will buy and it will make sense. Some will opt to rent and invest the difference in stocks or their business. And like many others, people will move out of the state to more affordable locations.

With California heading to a renting majority state, expect to see perceptions on housing change. Â Â Â Â Â Â Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

340 Responses to “California heading to a majority renter state: How will this change the way Californians view housing?”

Can you imagine sometime in the near future with a 80% of population renting their home?

This will modify the way people is voting on elections.

One day one politician will start the speech of rent regulation/socialism and people will vote him/her…

Capitalism is destroying itself. Wait a few years.

It’s not just a millennial versus boomer issue. Sure, housing costs are high for millennials, but hospital costs will eat the Boomers alive. Hospitals are extra expensive in CA: http://www.clinicpricecheck.com.

They are already looking to go after Boomer housing equity.

You may be right about the end to capitalism.

https://getpocket.com/explore/item/the-end-of-capitalism-is-already-starting-if-you-know-where-to-look?utm_source=pocket-newtab

This is more globalist propaganda in order for people willingly to embrace a global totalitarian regime. Concentrating more and more power in the hands of few mentally deranged is not going to bring people higher standards of living and more freedom (imagine AOC president with Maxine as VP).

Presently we do not have a capitalist economy. A capitalist economy implies a free market. For example, the interest is set by free market forces, people are not coerced to buy a product from a private sector company (see Obamacare). The FED has as much power as the Central Committee of the Politburo and act as such, planning the economy. Banks under free markets are allowed to fail when they make stupid decision; TBTF is not a feature of capitalism but communism. The moral hazard will ensure more of the same in the future, on a larger scale.

Rent control is not a feature of free markets and capitalism (it is practiced state wide in OR and many cities controlled by communists – I mean democrats). If we control prices for housing (in the name of human right), pretty soon will have price control on food (even more so a human right). At that point, you will see empty shelves and no farmers (see Venezuela).

Capitalism is the best form of economic system devised to date, but US, in gradual steps is eliminating it, by brainwashing the younger generation.

Churchill made an accurate assessment of capitalism and socialism:

“Socialism is the philosophy of failure, the creed of ignorance, and the gospel of envy.â€

“The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of Socialism is the equal sharing of miseries.â€

As someone who lived for decades under socialism and decades under semi-capitalism I agree that he was correct 100%.

Given the concerns about our Republic I think it is important we hear arguments from the other side to reveal the holes they have in them. I agree the story is still out what becomes of the future for the economy. However, in order to maintain capitalism we need to keep reminding ourselves why we have it and how it has allowed the world to work more free-minded.

Flyover is correct.

Concentrating more and more power in the hands of few mentally deranged is not going to bring people higher standards of living and more freedom

However, the Mentally Deranged Communists did quite well in Russia, Cuba, Vietnam.

Flyover is blind to the danger here. When the majority of the population is pushed by extreme capitalists into situations where not even the majority of people’s income is providing for basic needs, rent, food…, then there will be a huuuge political change.

That is the failure of capitalism. It is like the great game of Monopoly where there is only one winner. The rest are starved to death. Unlike Monopoly, there is a Democratic voting system in the US and the majority react by voting for Socialists like FDR, Warren, and Bernie. In Russia, Cuba, Vietnam, there was no voting. Look how that turned out.

True capitalists are like lemmings and will march themselves over a communist cliff with no regard for all of the warning signs. “Let them Eat Cake” as one failed ruler said before she was beheaded.

It does remind me of a memorable comic strip from the 1960”s

https://starlogic.ca/2018/12/13/the-peasants-are-revolting/

It is the arrogance of the capitalists, crony capitalists, dictators, monarchists, that will bring about change. Whether it is by democratic voting in the US or violent revolution like Flyover has seen, it will happen.

Even the true capitalists like Flyover see the change is coming and now blame crony capitalists. I agree. However, what are they doing about it to prevent the obvious outcome? Absolutely nothing! Rents continue to rise, and wealth disparity continues to increase.

Like Nero, they will continue to fiddle while Rome burns.

Capitalism needs to destroy itself, or at least evolve into something that works for everyone.

Its hard to blame the younger generation for not wanting to support something that is so skewed to benefit a privileged minority.

Exactly, why should millennials support this market. Instead we want a beautiful economic crash so we can buy stocks and houses at a discount. 50-70% less would be a good number to buy in. Why overpay now just so some old fart gets rich. It’s very likely that old fart received freebies all his life already (cheap housing, prop13 scam, free tuition). Doesn’t make any sense to support the inflated housing market that only screws younger generation and benefits boomers.

Jesus christ Bobc, your comment is so irresponsible.

We haven’t had a pure capitalist economy in ages now. You’re mistaking capitalism with crony capitalism or corporatism and as such spreading horrible misinformation that is truly damaging. If you’re old enough to think for yourself, then I pity you. Critical thinking is only lost on the Millennials, or so I thought.

Capitalism in this country has changed because we have allowed those in power to grab more power. In turn they grow the size of government and inherently you get big biz in bed with big gov, which of course favors those in power. Why do you think they want to stay in office? Nancy Pelosi doesn’t do this for her botox injections. Look at all those perks. Power is addicting like drugs. Absolute power absolutely corrupts. What did you think would happen with such a recipe? The answer isn’t socialism which will destroy us all and the life we are used to. History will not reflect well on this period in time. Instead, how about we go back to basics and figure out how we became the great USA. It was free markets, free speech, free trade. Less gov, less taxes. All we need to do is literally throw this thing in reverse and put a hard cap on political careers. I would even go so far as to make representation a volunteer position, therefore these idiots must maintain a day job and get a W2 like the rest of us peons. You get Obamacare too so any federal law you pass you get to share the burden.

I’m almost 40 years on this planet and I’ve realized over the last 10 or so years that I’m witnessing idiocracy. People are F’n dumb. They can’t think. They can’t rationalize. They can’t even have dialogue without TDS. They have have never faced adversity or anything that breeds character. The younger generations are walking ignorant zombies offended at the sound of a pronoun. They deserve and will own this disaster and hopefully I’ll be dead before it hits rock bottom.

What the current millennials don’t realize is that the Boomers also paid for the generations before them. It is how the system is set up. For example, social security.

I just heard what the current generation, teenagers and early 20’s, is calling themselves: Zoomers! They believe they are here to clean up (including the environment and global warming and all) the mess the Boomers made. They are even recycling the name Boomers into Zoomers!

Unlike big-ego millennials with their oversized….name! 😛

What have we been saying for years and years and years. Long term renting in places like socal is equivalent to financial suicide. If you can’t afford to own here, it’s in your best interest to find cheaper alternatives. Nobody is forcing anybody to stay put in California. As times goes on, the wealth divide between haves and have nots grows and so does the price of desirable CA RE. But what do I know. Listen to the Millie, the blog RE expert…the 50% to 70% will be soon!

For the past 30 years Los Angeles has been 60-70% renters.

Nothing has changed.

In the future expect more landlords and more renters.

More landlords or just landlords with more rentals?

I let my kids stay with me. Why have them pay horrendous money for rent if they can live with us. Sure, they are in prime age for starting a family but the world has changed. In California, the wages are not enough to support the cost of living. A recession might be painful but needed to move the moron out of the White House and to lower asset prices. I am all for it.

Rents are also high due to democrats importing millions of illegals (many times they pool together the financial resources of few families) in their sanctuary state and failing to cooperate with ICE. The high rents give a higher ROI to investors. A higher ROI push up RE prices. The extra millions illegals make also the commuting time an inferno. Absent the extra cars, would allow the commuters to still buy homes further from their job and still have a decent commute time.

All these high RE prices, rents and long commute times lower the standard of living for everyone, with or without money. It is good only for the largest banks who give lots of money to politicians. But keep voting democrat every election expecting different results – that is the definition of insanity. I agree that some republicans are the same when it comes to immigration, being paid by the same crooks – they are RINOs. A true conservative wants strong borders and the illegal immigration eliminated.

You may disagree with what I am saying, but you are the one to suffer the consequences, not me. I live in a small town where I don’t have to deal with all of that. I truly enjoy high quality of life. I bailed out from CA years ago. I gave up fighting millions of stupid and brainwashed voters. There were millions of other smart people who did the same – moved to other states when they could not deal with CA politics anymore.

Amen to this. There is a very simple solution to the illegal immigrant problem in my opinion, and one that doesn’t even require a wall.

1. Eliminate birthright citizenship

2. Eliminate all forms of welfare (including free school and free medical care for illegal immigrants

3. Enact strict enforcement and very stiff penalties for hiring illegal immigrants

If we were to do the above, they would leave on their own- no wall required, no ICE required. And the ones that stayed would actually be productive and would not be a drain on society.

So why are you on this blog constantly if you don’t live in California? Get a life.

You and I are both Ron Paul fans. As a California resident and someone who is trying to figure out an escape route, please share some info about where you currently live.

Incognito, where I live is irrelevant. What works for me does not work for others. On top of that WA state, where I live, is become more and more like CA (not there yet). Those communists in Olympia try to impose their communists ideas on the whole state, even if Eastern WA is conservative. I am thinking of moving again to a more conservative state, maybe in 2 years.

There are lots of places I like one way or another. In general I like small towns; big cities stress me too much. I can live pretty much anywhere; I am not tied to any place. I can take my business with me, therefore I am not looking for a place with high paying jobs.

In terms of climate, every person is different – some people like it hot and some people cold, some people like it wet and green and some like it dry. You know what you like.

As states, I like ID, TN and UT. I used to like AZ, but it’s getting too purple/blue.

Unless we have massive money printing, the RE prices in CA will go down (same for NY, Chicago and NJ). The communists in these states discovered (surprise, surprise) that higher taxes send the wealthy to other states which tax less. That causes them to collect less taxes not more as they expected. Pretty soon they have to make an iron curtain like in Easter Block countries (during communism) to keep these wealthy by force so they can continue to tax them.

https://www.foxbusiness.com/money/california-tax-hike-significant-migration-of-millionaires

Hopefully we can send all the entitled arrogant rich people I don’t like to other places. Appalachia and the South could probably stand to have more rich people–and those states generally have low taxes.

Don’t worry; the rich people leave by themselves -no need of your encouragement. The crooked ones who get rich by stealing, will stay there in CA to suck you dry (governor Newsom). He will increase all your taxes till there is nothing else to tax.

In the 1990s homes were actually more expensive with 8-10% interest rates and a 5:1 price to income ratio.

With 3.5-3.75% interest rates a price to income ratio of 7.5:1 isn’t that bad. The future of interest rates will obviously have a huge impact.

We are nowhere near the 10:1 ratio we had in 2004-2007… despite what people say here.

Low and behold we also don’t have 5 different blogs anymore dedicated to SoCal Housing with hundreds of comments a day.

We are really down to one dedicated SoCal bubble blog… this one. The 1990 housing correction which was 18 years before 2008….. not 8-10 years like Milllenial likes to quote… is the correction to study here. One caveat is SoCal defense Company layoffs caused a ton of local job loss. That may be a big difference in the next recession…in 2008 there were a ton of local mortgage banker job and income loss. Will there be a major local industry hit? If I had to guess it’s Tech but that is much more dominated in NoCA. SoCA tech could get destroyed though.

Oh and rents just keep going UP UP UP

Are you saying less housing bubble blogs means that it’s less likely we are in a bubble? I have seen lots of stupid comments from you before but that would trump it all.

Btw, didn’t you promise there are houses in soca that show rental parity? We are still waiting!

8-15% interest rate is a dream come true for buyers. Boomers got freebie after freebie. The higher the interest rate the lower the purchase price. You simply re-fi when rates go down. Tank in sight has little to no experience when it comes to the real estate market.

In the 80’s real estate was dirt cheap. We live now in boom and bust times with 8-10 year cycles. The next crash will be much bigger than 2008. You will be able to buy nice homes at 50-70% less.

Millennial,

As per usual you never post any facts. In the face of facts you just post the same nonsense over and over again. No matter how many times you post it, it will never be true.

Try to be more useful here the act is a yawn fest.

More WOMP WOMP WOMP for you:

Phoenix Real Estate: Sales up 10% YoY, Active Inventory Down 14% YoY

In Seattle, sales were up 12.3% year-over-year, and inventory was down slightly year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (2.6 months). In many areas it appears the inventory build that started last year is ending.

Las Vegas Real Estate in September: Sales up 14% YoY

Black Knight Mortgage Monitor: National Delinquency Rate near Series Low

As per my usual advice, buy at rental parity…. knock yourself out Millennial:

https://michaelbluejay.com/house/rentvsbuy.html#mdt

I’m not doing the work for you

Agahahahahaahahaahhaah tank in sight! Rofl

Tankinsight: there is rental parity in California!

Millennial: oh really, why don’t you show us your finding?

Tankinsight: I am not doing the work!

Millennial: huh? If you haven’t done the research, how do you know they are at rental parity???

See what’s happening here? The RE shills have nothing left but to blatantly lie.

Millenial,

I said to buy at rental parity. I didn’t tell you there was a property for you at rental parity. That’s your job.

Here is an idea use the calculator to show us how inflated your dream 2 bedroom condo is in a decent SoCA neighborhood.

Use the calculator, show us, let’s see the facts.

SPOILER ALERT: it’s not 50-70% inflated. Not even remotely close.

A great question is why did you not buy in 2016 when it was easy to find properties at rental parity. 2017 got a little harder. Today you can find rental parity in some area but it’s few and far between.

Good news is that with 60-70% of SoCA renters you are not alone.

Tank in sight, yes you said there are many!

NoTankinSight

September 2, 2019 at 6:10 am

QE Abyss,

“That is an an excellent rent vs buy calculator. I would recommend using that one or create your own in a spreadsheet.

Always buy at or below rental parity. Many areas in CA are already at rental parity or below. I would forget the premium coastal areas, completely unrealistic… but the very nice areas 5-12 miles from the ocean in Orange County are either right at rental parity or about 10-15% above.

Don’t make the mistake Millennial is going to make.. waiting it out and letting it pass him by. Once you get rental parity… jump on it and never look back.â€

I am not asking you to find me a property. I am asking to show us an example of rental parity. Obviously, that should be an easy exercise for you as you have claimed tonfound many! So show us, just one. Or two. Out of the many you have found. (Your words).

Prices are way out of whack. Buying is not even close to rents. Even if you massage your spreadsheet in your favor. Renting is much, much cheaper.

Houses in the 80s were still much cheaper, even with the much higher interest rates… which I wish we still had.

Higher interest rates not only keep house prices lower, but they reward savers and pension funds, who can realize a decent return without resorting to high-risk investments.

A home buyer is better off paying less for a house and more interest for his mortgage, because you can always pay down the mortgage- make extra payments against the principal, or pay it off altogether. However, when you pay more because you are getting a lower-interest loan, you are stuck with the high price you paid, and are also more likely to take on more debt, making yourself more vulnerable to recessions and downturns in the housing market.

The only people who benefit from low interest and the speculation, asset inflation, and debt creation they foster, are lenders, speculators, and government workers who are guaranteed COLA raises in both their salaries and pensions.

It’s funny how liberals always drone on how CA is the 5th largest economy, the mostest richest state in the country, blah blah blah. When in fact it’s a quasi 3rd world entity with a small ultra rich elite, surrounded by poor people, aka renters. Adjusted for cost of living, CA has the highest % of people living in poverty. It’s basically Brazil.

I’ve lived in Cali most of my life, but spent 4 years living in Sao Paulo, Brazil from 2010-2014. We are not Brazil. Not by a LONGSHOT. Give me the 3rd World Hellhole of SF or LA anyday of the week. Compared to the majority of Brazil, even the worst ghetto here feels like Beverly Hills.

I spent a lot of time in Brazil. You are correct we are a long way from Brazil! That said in 50 years things may be getting closer.

Statistics still suggest that the housing market will be strong next year and that home prices will not decline next year despite what common sense would suggest:

https://tradingeconomics.com/united-states/housing-starts

There is no sign of a real estate crash on the horizon. Housing starts and permits tend to be a leading indicator which means that a RECESSION IN 2020 is extremely unlikely.

The good Dr. is strong and wise if even a bit less prolific these days. In my demo. we have massive imbalance of multi unit development, it’s like a pandemic. If it’s going to be like that in the 805 along the coast, I can only dry sweat thinking about places like the 909 and similar Inland, soon to be acutely water deficient locals.

It’s incredible how short sighted the capitalistic investment cycle is.

“Scientific method, hell! No wonder the Galaxy was going to pot.â€

Good article.

The last graph in the article clearly shows CA real estate is overvalued at ratio of 7.5 vs 5.0 historical. I don’t buy the argument that the 7.5 is the new normal. So a 25%-30% drop would put things in line for me, where real estate in CA would still be ridiculously expensive, but where I would still clench my teeth and buy a house for long-term.

You need to take into account interest rates.

Mortgage rates in the 1990s were 8-10%.

Now mortgage rates are 3.5-3.75%.

A 7 price to income ratio at 3.5% mortgage rates is actually more affordable than a 5 price to income ratio at 8-10% mortgage rates.

Mortgage rates will play a big role going forward as will inflation. If you have inflation like the 1970s it won’t matter that mortgage rates go higher. If you don’t have inflation then it matters big time. The interest rates cycle is very long, like 50-100 year long. We may not even be near the bottom for interest rates. Other countries like Japan and the Netherlands have 0-1% mortgage rates.

Yawn, now he’s coming again with the “inflation is coming inflation is comingâ€!

We heard that BS for years now. People aren’t that dumb anymore tank in sight.

They don’t buy your overpriced crapshacks. Just get a real job and stop trying to find the next sucker for a commission check.

Low interest rates are terrible for people trying to buy. It artificially pushes house prices up. The only winner here are the old farts who bought a long time ago and received freebie after freebie in their life. Younger generations are now supposed to support the bubble by buying at the peak? Lol…. nice try!

Just goes to show you that artificially low interest rate inflate asset values – so we have a Fed induced asset bubble. Any shock to economy – like even a moderate recession – this bubble pops.

Been following this blog for a few years and it seem to be the same story: prices too high to buy and not comparable with rent. Makes sense. For those who can afford it, why buy?who can afford to buy in the city centers close to high paying jobs? My kids are in their mid 20s and it seems unattainable for them to buy. Their rent is high but the cost for them to buy with a sizeable down payment, insurance,property taxes and maintenance on a home is outrageous.

Look for the millennials to move out of California or wait until we are ready for the nursing home and take over our family home.

Hey Doc:

What shocks me is if you look at the cities on the far left of the first graph, you see a very high percent of renters who are in both ends of the income spectrum right next to each other (East LA and Santa Monica). Of course through the rest of the graph you see others like San Fran and Inglewood next to each other also.

However, I think there is some skewing here because cities like Santa Monica and San Fran have massive apartment building development whereas cities like East LA or Inglewood are not as dense with apartments as the former.

In my experience, people who I think of perma-renters tend to be working class. They live in terrible areas and have blue collar jobs. That being said, individuals who are high earners will only rent for so long until they get married/co-habitate and then they start looking to buy. A crap shack won’t look so bad when you’re willing to put in some money saved up to make the upgrades. Finally, you have a home that a flipper isn’t bilking you for plus the interest on the new flip price.

I think renter’s HELL is more like it. Rents may be a better deal than the hyper-inflated houses available to purchase, but it is still high enough for most Los Angeles renters to be severely rent-burdened in rental housing that no way can be described as luxury, if it’s even adequate.

Young people are not exactly “opting” to rent- they’re lucky if they even can make the rent, what with the college debt; low-paying jobs for most, or unstable “gig” work, a decent down payment and a mortgage on a relatively-affordable $400K-$500K house, are both out of the question.

As for Prop 13, methinks it will have to be rejiggered. It’s obscene for people to be taxed out of houses they spent their lives paying for, but the law as it stands really is atrociously unfair to young people, and first time buyers, and it needs to be rejiggered. For starters, nobody should be able to inherit low Prop 13 taxes- as long as Grandma is in the house, her tax base can be frozen at the low level she bought the place at, but when she passes, the taxes should be immediately adjusted to reflect the current value of the property. And only the primary owner-occupied dwelling should be eligible for the freeze- no second homes or rental properties.

I daresay Prop 13 wouldn’t be necessary, or even thought of, had it not been for the monster inflation of the 70s, and that which has occurred since, thanks to our destructive, inflationary monetary policy.

It’s just a matter of time until prop 13 gets repealed. It’s the biggest scam in history. A new buyer of a condo pays 7-10 times more in property taxes than someone who lives in a mansion (just because that old fart bought in the 80’s). That scam has to end. Let these old farts pay their fair share. They had freebies all their live. And let younger generations pay for it. End the scam

Milli: Let these old farts pay their fair share. They had freebies all their live. And let younger generations pay for it. End the scam

The older generations paid for your FREE 1-12k education, and every other freebie you enjoyed as a child.

Because of Prop 13, parents had more money to buy food, health care, travel, and other goodies for their children.

Prop 13 benefits have always trickled down to the kids, including inheritance rights.

You talk as if you had to work for a living ever since you were a baby. As if nothing were handed to you from the moment you rented your first crib.

I’m so glad I have prop. 13 and you don’t. Haha.

I own my home outright and you don’t. Haha.

So let’s hear you whine, you little baby. When our old landlady dies, your tent wil double when her heirs inherit the house. Poetic justice, you self-repeating troll.

Whenever you call out the prop13 scam, the scammer who take the freebies and don’t pay their fair share get upset. You would think they gladly pay back what they owe, but nope! They are spoiled and are used to the freebies they took. Isn’t it time we end the scam? End prop13 and the bubble ends tomorrow. Boomers can easily pay 1.1% in property taxes based on current market value. There is no reason to give out freebies that younger generations have to pay for. Why are we doing this? Think about it people 🙂

Bill, why would you think I am a troll? I am just a realist that hopes for a nice crash so I can buy a dream house in all cash. And, I am younger than you. Much younger 🙂

I noticed our RE shills get a bit angrier each month since the bubble is slowly deflating. Now imagine how they act when we have a full on crash. It’s going to be very entertaining here soon!

I am one of the PROP 13 inheritors of Grandpa’s 2,000 sqft home, which he purchased in 1955. My mother inherited it in 1989. Now, me and my siblings have inherited. The tax base is $2500/yr and the land value is $3M. We rent it out for $9K per month. If Prop 13 was abolished, the taxes would be $30,000+ per year. We would sell it. It doesnt matter much to me. I would take the money and invest elsewhere.

If and when Prop 13 is changed, I believe it will happen in the following manner;

1) Massive changes to Prop 13 for commercial properties (but then the tenants of those Triple Net leases would be stuck paying, which means you and me in every retail shop would get hit with higher prices for merchandise).

2) incremental increases on residential properties (again passed on to tenants)

3) incremental increases on SFH

I might be wrong – but if Prop 13 is abolished on commercial property dont we all suffer with higher retail prices?

I think you maybe right, but my guess would be like the article I posted. It would probably hit businesses first. Question would the FED/banks let homes start deflating slowing or fast if they know what is coming?

I think the Prop 13 change now would likely prompt people to lower prices to avoid the repercussions going forward. Most likely people will not want appreciation on a home if it is going to be too expensive to maintain along with new tax hikes.

Another question what are these new tax assessments going to be funding? Calpers, Unions, city/county jobs or lining pockets of politicians?

NOt all NNN leases allow for full pass-through of property tax increases or increased assessment. BUt I agree that MFD and commercial will be repealed first.

Prop 13 might have not occurred if Nixon did not agree to the FEDs terms to get us off the gold standard imo.

However, now it looks like Prop 13 could be stripped of it’s powers.

https://www.hjta.org/legislation/major-threats-to-prop-13-and-homeowners/

Just a matter of time.

This is a natural migration as housing prices outstrip wages. Southern California will be compared to Singapore, London, Paris, Rome, Tokyo and other cities around the world. You can barely afford to buy a property in any of those cities too.

The gig economy and internet connectedness makes for an easy comparison if you can work online.

Once they clean up the trash and homeless one could easily compare Southern California to London and determine that the weather is better and traffic less than London so $1M on a house here is a better bet than there.

As long as our borders are so porous many foreigners can also make the reverse comparison and compete with you for the $1M house.

“…A changing mindset is also happening with Millennial’s….” “…many live at home with their parents…”

Yet another unstoppable force keeping Millennial’s at home is the ever increasing [un-affordable] cost of elder care.

Millennial’s stay home, care for parents, and [presumably] inherit residence when parents pass away.

California Prop 13 keeps the property tax rate in check.

Arrangement is Win-Win for everyone except the REIC agent who is not generating a commission check.

You’ve got the generations wrong. It’s the boomers, in their 60’s mostly, caring for their parents in their eighties and nineties. The parents of millennials are still relatively young, and are not yet incapacitated.

RE shills, RE cheerleaders, lenders and realtards hate, hate, hate when adult millennials live with their parents. They hate this more than anything for a simple reason: there is no script for it. There is no sales pitch. You can’t say “buy a house now or continue to waste money on your landlordâ€. There is no landlord. You can’t say “buy now or rent foreverâ€.

You can’t say, “stop throwing your money away by renting. Buy overpriced houses now!â€

These smart adult millennials don’t waste any money on renting and they already live in a nice house. Their parents home, which they will eventually inherit anyways.

That’s why you see bitter comments about adult millennials living at home by those that can’t get a commission check off of it. You can see the hate. This isn’t supposed to happen, right? The younger generations are supposed to wanting to buy your crapshack that’s overpriced by 50-70%. And it’s supposed to be a bidding war because there is “no inventoryâ€. (Remember the laughable “there is no inventory lieâ€?)

Everything is going wrong for our RE cheerleaders. Sales volume is down, price reductions left and right and people have no issue waiting it out because they stay at their parents home – FOR FREE.

How do you “force†someone into overpaying for rent or forcing someone to sign the purchase agreement for a highly inflated price just so the realtard and seller gets rich? You can’t. You simply can’t. The only thing you can do is watch this ship go down and be bitter about it. 🙂 doesn’t sound like much fun to be a RE cheerleader.

WOMP WOMP WOMP

https://www.calculatedriskblog.com/2019/10/seattle-real-estate-in-september-sales.html?m=1

In Seattle, sales were up 12.3% year-over-year, and inventory was down slightly year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (2.6 months). In many areas it appears the inventory build that started last year is ending.

More news that the cycle is ending and the crash is coming

https://www.zerohedge.com/markets/bostons-commercial-real-estate-market-hints-looming-recession

Milli: How do you “force†someone into overpaying for rent or forcing someone to sign the purchase agreement for a highly inflated price just so the realtard and seller gets rich?

You don’t have to “force” anyone to buy or rent. Increasing population creates ever more demand — and higher prices — for housing, whether to rent or buy.

No need for real estate “cheerleaders.” Inflation and a rising population guarantees increasing profits for realtors and landlord alike in the coming decades.

No, Milli. Nobody hates Millennials who live at home. They’re not worth hating. Only mild contempt for those who post the same message, with autistic repetition, a couple of dozen times per article.

Lol, as if prices can only go up. You must have forgotten the last few recession/crashes huh? No worries, that’s why I am here, to remind those that have a short memory..

And yes, RE shills hate it when adult millennials house hack….living with your parents is smart, saves a lot of money and prepares you well for buying opportunities. And there is no sales pitch for it 🙂 as you confirmed, you can’t force them out.

Instead of playing it smart, you could be like son of landlord: buy at the top and tell yourself it can only go up because of increasing population! Rofl! Please don’t go anywhere, we need those laughs!

Milli: you could be like son of landlord: buy at the top and tell yourself it can only go up because of increasing population!

You’re not paying attention. Whoever said I “bought at the top”? I bought my Santa Monica, Ocean Avenue condo 32 years ago. It’s now worth several multiples of what I paid for it, no mortgage on it, and the Prop 13 taxes are ridiculously low.

I began looking to purchase a house in 2013, but I foolishly listened people like Jim Taylor (an early version of you) who predicted another crash. My mistake. I missed a great buying opportunity because I was overly cautious. I wish I had bought.

Don’t worry son of landlord, the next crash is coming. In fact it’s right around the corner. You saved a lot of money during these years. The gains in housing are just on paper and vaporize during the crash. You should be able to pick up a nice object for 50-70% less during the next crash.

How will the government prop up the economy the next time and bail out the large investors in RE? Freeze pricing on RE if the market tumbles? The neverending manipulation of Fed monetary policy through free money rates will end up inflating every price, but where will the single family home buyers come from? Incomes are not on the same trajectory and never have been except in bubble economies as the bay area has experience though various tech booms.

The only ones who will suffer will be the individual home owner the RE lobby and crony capital will figure a way to shelter the big RE money from the ultimate downside. RE is the ultimate bubble that has deflated slightly (correction), but refuses to pop.

This time its forever. Serfdom for renters and the rest of the riff raff and rabble who weren’t hard working and smart enough to bootstrap themselves into home ownership. Let them be priced out forever as the landholding class profits until armegeddon.

Thanks Doc for the insightful post, but the winds have yet to shift strong against the contiuous rise in property values in the desirable locations along the coast.

Housing Bubble 2.0 Already Popped-October 8, 2019

A report from the California Globe. “While driving down a few streets in the suburban Orange County city of Fullerton, an unusual by-product of the housing crisis presented itself. Rows and rows of large houses known as ‘McMansions’ built within the past 20 years lined the streets, many with ‘For Sale’ signs pounded into the front yard. A small stretch of street nearby the California State University – Fullerton campus brought a succession of three houses with signs out front.â€

“â€There’s another,’ said ‘Mary Jo,’ an Orange County realtor who did not want her name used, pointing at another of the large houses, this one advertising over 4,000 square feet. ‘I had a showing there last week and some people left without walking out of the foyer.’ ‘Younger people just don’t want them,’ she added, shaking her head as another large McMansion came into view. ‘That’s why so many of these houses are empty.’â€

“Many McMansions also have a stigma of being cheaply made. Mary Jo has been selling houses throughout Southern California for years and notes that older houses she sells come in much better condition.â€

“‘I’ve shown houses, both in Orange and LA, where ten year old houses were literally crumbling apart,’ remembered Mary Jo. ‘A lot of these houses were built so quickly, or had unusual parts on them, that builders were often rushed or couldn’t make heads or tails of what to do next. So some buildings have cracks in them ten years later. Some don’t have insulation because it was simply forget. Odd angled walls are coming apart because the construction crew didn’t know how to handle it. High ceilings get mold or permanent stains because they couldn’t be reached. Cheap plaster, cheap wood. Thin walls. You name it and chances are at least a few houses I’ve seen like this have had it.’â€

“All of this has spiraled to a large number of hard-to-sell homes that are overvalued, expensive, that the owners don’t want to take a loss on, and younger people don’t want to buy. It’s difficult to estimate the average number of unsold McMansions, but real estate agents have reported that McMansions are hard to turn around. So much so that some neighborhoods are estimated to have half of their McMansions unsold or in foreclosure.â€

“‘Some of our buyers only hang on to them for a year,’ said Mary Jo. ‘It’s the crisis hitting us. People can’t afford these, raise the money for a decent down payment, but then after a job loss or plain can’t affording it do to other higher costs, they foreclose or they sell the house. I can’t say how many are unsold in California, especially since many of them go in and out of being sold or on the market. But in Orange County it’s at least 10 to 15 percent of McMansions in states of not being sold in some developments, like if it’s in foreclosure or escrow. But it depends, become some neighborhoods have a much higher rate,’ Mary Jo explained, motioning to the row of houses with signs in front of them down the street.â€

My Daughter was smart to trade her recently built (2006-2007) 3 Br townhouse for a large tri-level from the 70s. it was about $140K more at the time.

Always wondered why anyone would want to maintain 4000 square feet, unless they intended to house multiple or extended families.

That is a good point, Dennis. However, due to corporate cost cutting and flexibility, many work from home now.

I work from home and my wife has a home business. With 3 kids, 4000 sq feet is kind of cramped.

I see more of this in the future. Corporations are cutting costs and putting people in home offices. Online home businesses are popping up that don’t need storefronts.

Essentially, the future is replacing 500 sq ft of cube space/meeting space/coffee space per employee from corporations and moving it to the home. Also, to run an online home business, you may need 1K sq feet of inventory space. 3 kids are an 18 year temporary thing but we are living it.

A 2000 sq ft house would be very cramped for all of this. This kind of puts us all in a 500 sq foot living space for a family of 5.

Just my thoughts.

A wise RE agent friend once told me: ” Never buy a house in the era where there was a housing market boom.”

1) The houses are slapped together so fast in the cheapest manner to satisfy demand.

2) Skilled labor with experience is in extremely short supply so the slapping together is being done by people who have never done it before.

I rented a “boom” house about 20 years ago. It was appalling. Walls were crooked. Outlets and light fixtures were crooked. Cracks were forming even though the house was only 1 year old. I hate to think of what it looks like now.

Always check the build years. Avoid 1997-2000 and 2004-2006 in CA unless it was a custom build.

As a millennial, I wholeheartedly agree that the current housing situation is unsustainable politically and financially,

However, I also wonder about the ability of boomer’s to afford healthcare and nursing home care in California. Hospitals will look to California Boomer’s houses to pay medical debts.

Hospital costs are extremely high in CA, check out http://www.clinicpricecheck.com.

I also wonder about the ability of boomer’s to afford healthcare and nursing home care in California. Hospitals will look to California Boomer’s houses to pay medical debts.

Good point. I suppose many Boomers will opt for reverse mortgages, thus destroying their children’s hopes of inheriting.

OC homes below $1,000,000 are selling like hotcakes. There is NO sign of a real estate top. It remains a seller’s market accept for expensive homes.

LOL Thats like 5 houses for sale under $1 million in the hood of OC! I guess the sales number for houses over $1M is cratering so bad to discuss it here.

A crash is unlikely. I am living with my parents since 34 years now and I don’t think i will ever move out. I mean, unless there is a crash. I talked to a realtor and a lender and I would have to pay 3.5k more than now just to buy. PLUS a 20% downpayment! That’s insane. My current monthly cost is about 50 dollars that I pay my parents for the additional electricity. I convinced them to get solar panels for my Tesla and help them pay for the increase in electricity.

Dude, what an incredible smart guy! 50 bucks a month for rent! That’s called house hacking, winning, killing it! Congrats!!!!

LOL….great story. Must be hard coming up with that $50/month considering you got that $100k Tesla in their garage. I bet they thoroughly appreciate you throwing bills there way even though most other adults would think you’re a loser. Have you ever gotten laid? If not go try it out, it’ll make you a man!

This right here folks is the epitome of the Millies. What a bunch of losers!

Paying only 50bucks a month to live in a house that he/she inherit one day sounds like losing to you? It sounds a lot like winning to me! I feel bad for RE shills who can only get laid by woman that think these RE shills “own†a house. You are renting it from the bank.

This person, paying only 50 dollars a month has virtually no expenses and saves all of the income. Who would you rather date? Someone who bought at the peak and has no money left (house poor) or someone who lives with their parents as an adult and has lots of cash? I would say it depends on that person 🙂 but in general, woman like people that are financially savvy/independent. Not someone who invests all of the money in real estate at the wrong time and is tied to an overpriced mortgage for 30 years. That’s not very sexy. Maybe that’s why our RE cheerleaders are so angry? They thought by buying at the peak their single life would end? As I said before, some learn the hard way.

Congrats again to the person who lives with their parents for 50 bucks! You scored. I am jealous!

LOL typical Millie thinking….pay $100K for a depreciating car but don’t buy an appreciating home. This may well be the dumbest generation ever. Like going back thousands of years.

Slumlord, I am not sure he bought the Tesla. Maybe he got a good deal on the lease. Anyways. Housing isn’t really appreciating. It’s losing value during the next crash. Experts believe housing will lose 50-70% in value which I agree with.

No need to move out from mom and dad’s. Why would millennials move out? They aren’t that silly to spend all their cash on an enormous mortgage. I can’t blame them.

Housing bubble popped.going down from now on.

Expect 30-35% crash in prices

It there any correlation between percentage of renters and the economy? From what I gather, there doesn’t appear to be much association and perhaps even an inverse association based on these rather older data showing Germany and Switzerland have one of the lowest rates of home ownership.

https://qz.com/167887/germany-has-one-of-the-worlds-lowest-homeownership-rates/

Not leaving hotel mama until crash. F u lol

LOL…..some day you got to get off yo mamas teets? Maybe next year will be your year right? Baby steps dude. Just think you’ll be out by your 40th bday, congrats!

I am waiting for a collapse

“Looking at the California Association of Realtors (CAR) for some data you can find that this is also perplexing the group. Ultimately you want sales volume to be high to churn those commission checks but that is not occurring”

The realtor we worked with when we bought our place and our daughter’s place has been buying up bargains for years and is as much a landlord as a realtor. Also real estate professionals often manage rentals for others who can’t do it themselves. The smart ones will try to grow that business with a lot of Californians moving out of state but keeping the house they bought on the cheap years ago (or during the crash like my former neighbor). Managing rentals brings in a steady stream of income unlike the boom and bust of selling houses.

Just like last time…..people that are heavily invested in the RE market tell us: this time is different. Until the shit hits the fan

You know, I hate to say it but I’ve been tellin’ y’all this for a few years now and I’m glad the Doc is acknowledging it. IT’S A NEW AGE OF HOUSING! If you want to look at it through the trends of the last 100 years then you’re not doing yourself a favor. The last 100 years of civilization in America has zero resemblance to today. Lets take a look at it from a macro POV.

In the old days, taxes on the wealthy were much higher leading to few ultra wealthy individuals, there was a overwhelming middle class, very few that live below the poverty line, and the upper middle class was almost non-existent. Today it’s damn near the opposite in every category. Far more ultra wealthy individuals that own tons of real estate and rent out to their ever-increasing poverty stricken serf tenants, almost no middle class (the “middle class” of today is actually quite poor by comparison) and a considerably larger upper middle class tech white collar tech employees.

What has this translated to? Exponentially more renters coming from the lower serf class that change jobs like they do underwear and need a cheaper alternative to buying a home, the consolidation of RE ownership to the hands of 21st century lords, and a housing market that doesn’t quite make sense but is sustainablely fueled by working professionals and DUAL INCOME HOUSEHOLDS (that didn’t exist back then, did it?) that simply want a house because they can afford it even if it’s not the best financial housing option. And mind you these guys are extremely rate sensitive.

When interest rates peaked late 2018, the housing market dropped considerably and when rates dropped, the market picked right back up like nothing happened. And rates aren’t going anywhere. Everything in finance depends on interest rates. Do you know what else happened in late 2018 when rates peaked? Oh you know, just a 20%+ drop in the stock market. And do you know what happened when those rates dropped? A rally and a new all time high. So we can all agree the financial future of America depends on these all powerful interest rates and if we let them get too high, then policymakers run the risk of collapsing the economy to an ultra-bear market that is near impossible to come back from.

So what’s the forecast you say? Well since I have a amazing track record of making educated predictions, here’s what I think will happen:

1. Interest rates are not going up. Not because of the reasons I mentioned above but because there is no reason for them to go up. Inflation is much lower than expected and the dollar is much stronger than expected and an increase in interest rates would alleviate high inflation and a weaker dollar both of which do not exist.

2. Interest rates WILL come down to historic lows. The economy is in limbo right now, it’s not weak but it’s not strong. It’s not going up but it’s not coming down. And with low inflation and a strong dollar, we can afford to lower interest to keep the party going. And global interest rates are MUCH lower than America’s. Meaning we can bring them down and maintain steady, healthy inflation and a solid Greenback. This will have a positive market impact on RE and put much more money in the hands of home-owning Americans when they re-finance their appreciating homes. Asset prices (stocks, RE, even gold) shoot up in low interest rates environments don’t even attempt to argue that with me. It’s a fact.

3. The housing market will fluctuate between +/-10% for the next few years. Don’t expect a “50-70%” discount for the next decade. Just please don’t. There’s literally no evidence based on the current economic climate that something like that would happen. If you still believe that would be the case, go to a psychiatrist and show the doctor where the big bad 2008 recession touched you and they’ll probably prescribe you some happy pills. The +/- in price movement largely depends on two factors: wage and interest rates.

4. Commercial real estate is a great investment right now. If you can buy a property with cash flows that cover mortgage, taxes, insurance, and repairs buy it. You might break even the first two years but will gradually be growing your investment value as cash flows increase. Some think that CA’s new renter laws that limit rent increases to 5%+inflation will inhibit growth in this sector of RE, I think it will do the opposite. You’ll have a steady stream of quality long term tenant to choose from and will not be competing against freshly built apartment complexes because it’s no longer lucrative to build those anymore. And when the tenant moves out, bring rent back up to market and enjoy the YOY increase in rent. In 10 years, sell for double.

Take it to the bank and cash it. You’re welcome.

Well said.

Whoever could have thunk the stock market would approach 30,000?

That alone tells us something is different.

I think a housing correction is in our future 2021? but a correction not a crash.

Logan Mohtashami (US Housing) and Bruce Norris (SoCal housing) still have optimistic views on housing. Bruce says the best place to invest in SFH is in Florida in cities with major medical centers, because medical care for senior citizens is recession-proof.

New age,

So your bottom line is

Interest rates will go down (no shit Sherlock) &

Somehow this is a magical new age without any downturns anymore?

Lol. You have never been through a recession before right? This will be a rude awakening for some RE shills that are highly leveraged with their flips and hope for sunny days until the rest of their life.

His advice, buy rental investment property. Oh wow, that’s a new idea! Have you been in California lately? If not, I can catch you up. At the peak of the market builders are building multi family homes like there is no tomorrow. Drive through the inland empire or coastal areas. My rent has never gone up, yet they are building additional units everywhere. Something isn’t adding up for the RE shills.

At least our shills acknowledge the slowdown….that’s a good first step. 🙂 they still can’t mention the R word. Because everyone who prepares for a Recession is a doom and gloom guy. They simply missed the 101 economy classes that tell you that economies move in cycles and nothing goes up forever.

NewAge,

Or you could have just said “this time is differentâ€.

We get those people during every bubble. No need to write a book.

Translation: “This time is different.”

Lol, was about to write the same…..the old “this time is different†who is this joker trying to fool here?

CA = 3rd World Schitthole- The Desert Sun in California. “Hemet residents adorned their vehicles with ‘Hemet is Heaven’ bumper stickers to express their love for the city in the 1980s, but today the’ Inland Empire community is mostly known for high crime rates, unemployment and vacant homes. Hemet was one of 10 California cities to appear on a list of the 50 Most Miserable Cities in America published Sept. 28 in Business Insider, reflecting the struggles that continue to plague the city more than a decade after last decade’s Great Recession.â€

y sort of offer, up 19.3% from one year ago.â€

The Desert Sun in California. “Hemet residents adorned their vehicles with ‘Hemet is Heaven’ bumper stickers to express their love for the city in the 1980s, but today the’ Inland Empire community is mostly known for high crime rates, unemployment and vacant homes. Hemet was one of 10 California cities to appear on a list of the 50 Most Miserable Cities in America published Sept. 28 in Business Insider, reflecting the struggles that continue to plague the city more than a decade after last decade’s Great Recession.â€

“After decades of economic growth and housing construction, the city of tract homes and trailer parks located in the middle of Riverside County was hit hard by the 2007-08 economic downturn and the housing crisis that followed, which rendered many homeowners unable to keep up with their mortgage payments and ultimately forced them into foreclosure.â€

“Despite its location between wealthy communities in the Coachella Valley and coastal California, today, 17% of the city’s 86,000 residents live below the poverty line, according to census data. Zillow estimates the city’s median home value to be $272,000, which is still 20% lower than it was in 2006, before housing values plummeted. “

Nice, beautiful!

The job market is starting to slow!!! Woooohoooo

https://www.zerohedge.com/economics/job-openings-plunge-17-month-low-slide-hiring-quitting-confirms-job-market-slowdown

This is from a website that does excellent research and is not manipulated by the NAR. (National association of realturds)

So many price reductions across the board. Love this time. Remember when the RE cheerleaders told us a couple of years ago that prices won’t ever come down? They can only go up?

This is a lot like the previous crash cycle. Shills are in denial even though the housing market is about to fall off a cliff.

General speakin Im fine buying house but first need crash. I willing to pay half of house asking price. If house one million I pay 500k. Sound good? Make deal!

Not in midtown, downtown, east or land park Sacramento! Prices are SKY HIGH still, wtf? Why?

California is already split between renters and owners. The poor areas are filled with renters while wealthier areas are owners. I notice how so many renters drive expensive cars and they pretend they have money in the bank. But, renters are just a paycheck or two away from homelessness. Most homeless people were renters. Sad state of affairs.

Jt, the exact opposite happened. During the last crash we had 7 Mio foreclosures in the US. Zero of those 7 Mio were renters because a renter cannot foreclose on a home. Only people who realize they are WAY underwater leave the house and stop paying for a ridiculous overpriced mortgage. Wouldn’t you do the same if you bought at the peak and then a renter comes in and buys next door for half the price? These 7 Mio learned the hard way. But renters who saved and had no debt could easily buy a nice house for a great deal during the last recessions.

Experts (like me) predict the same will happen again. Renters who have a nice war chest can come in and buy once the market is reasonably priced (50-70% below today’s prices).

I probably have to explain “underwaterâ€. It means you owe more on the house than what someone is willing to pay for it. That happens every 7-10 years during the boom and bust cycles. Therefore, experts keep saying, housing is all about timing. I tend to agree and have been saying this as well.

Let me know if you have any questions. I am here to help!

Ignore.

Jt, if you would just listen and willing to learn, we wouldn’t have to explain the same things over and over. Ignoring educational posts (by me) just because you don’t like them isn’t helping you. I am here to help, utilize it!

Some night have done a strategic default. In hindsight I wish I had. However, most people who foreclosed did so because they lost their jobs due to the recession and couldn’t make the payments. Like you’ve mentioned before the gains are unrealized until you sell. Same with losses. It’s just on paper unless you have to sell. People didn’t sell just because they were underwater. When you don’t have a job, you may have to short sell or foreclose even if you have equity.

No way we have a 70% drop. Impossible. The average cost per sq ft of a house in the U.S. is $123. That would drop to $36 sq ft. Even 50% drop would be $62. Those are 1970s prices when minimum wage was $2.10

Inventory of homes decreased by 2.5% in Sept, following a decrease of 1.8% in August. Now I realize math is hard, but class….what happens to prices when supply shrinks? Anyone? Bueller? Simone? Anyone?

OK fine, I’ll give you the answer….prices go UP!! Median price in Sept increased 3.4% to another all time high of $305,000. Neat how that works huh? Supply down, prices up.

Womp Womp. Perma bears lose out once again.

Renting long term is financial suicide, don’t do it kidz!

NoTankingInSight has twice made the point of looking at interest rates when computing ratios. I’ll add to that. a $1M mortgage at 3.25% costs as much as a $400K mortgage at 12%. I know this is too hard for Millie to understand, but it’s worth mentioning again.

For real estate, price is almost irrelevant, what matter is interest rate since almost everyone finances their housing purchases. What you need to look at is monthly cost of owning the same house (same zip code, same sq ft, same bedrooms, same home age, etc) in 1980, 1990, 2000, 2010 and today, in inflation adjusted dollars. And when you do that, you’ll find the cost of owning hasn’t really changed all that much over the past 40 years.

However in real dollars (ie inflation adjusted) rents have skyrocketed, exponentially.

Which is why I always say…renting long term is financial suicide.

All good points Mr. Landlord. We hear so much whining on this blog that previous generations had ultra cheap housing. As you mentioned, just look at the monthly payment…that is all that matters.

A home bought today in socal is likely a factor of 3 or 4x more expensive than 30 years ago. When you factor in 30 years of inflation and interest rates going from double digit to 3.5%, simple math supports this increase. And rent has skyrocketed in that time period.

Rofl! We have a new one for the list! “Price doesn’t matterâ€

Yeah, the slumlord from Spokane-istan aka great mathematician comes up with a new theory. Price is irrelevant. Makes sense, doesn’t it? That’s why the luxury market is seeing declining sales

https://www.cnbc.com/amp/2019/05/01/luxury-home-sales-see-biggest-slump-in-nearly-a-decade.html

If price doesn’t matter why aren’t people choosing the nicer homes mr slumlord? Remember price doesn’t matter? Well of course he won’t answer that.

This happened in real life: there are two identical houses. The first house has a price of 1 Mio with 3.5% the second one 400k with 12%.

There are two buyers who “competeâ€. Mr slumlord and Millennial.

Millennial says, you go ahead, make an offer, and remember price is irrelevant.

Proudly, the slumlord offers 1m and gets the offer on the first house excepted. He sat a new record for the neighborhood and closed in 15 days. He thinks he got a great deal since 3.5% is much lower than 12% interest. And it’s for 30’years fixed! Boy, time to celebrate!

The millennial laughs all the way to seller and signs the purchase agreement for the second house. (400k)

Now it’s time to pay the 20% downpayment and think about property taxes.

Mr slumlord pays down 20% (to save on PMI )of his 1m Dollar home: 200k. Property taxes are about 12k per year (1.2% property taxes for the sale price).

Millennial has to pay only 80k down plus 4.8k in taxes per year. The millennial was a renter and never overpaid for real estate. Subsequently he is loaded and chooses to pay down 200k as well.

Now it’s time to pay the mortgage. For his 800k loan at 3.5%, mr slumlord pays about 4659 monthly. (Includes property taxes, insurance and P+I).

The millennial would pay for his 12% interest loan about 2526 a month in PITI.

Even if the loan would be at 20%, his PITI would still be much cheaper compared to what the slumlord has to pay.

Both buyers are very happy. Slumlord still thinks: hahaha I got a 3.5 % loan, that fool next door pays 12%. Millennial thinks: thank the universe for RE shills like the slumlord. It would have sucked to get into a bidding war for the 400k house. One can only hope we actually have more people thinking that price is irrelevant!!

Now the story has not ended yet. The millennial has way, way more cash available per month and decides to buy another house at 400k. Again, he pays 12% interest.

He rents out the second house because it’s at rental parity and cash flow positive.

Here is the kicker, millennial can re-finance his two houses for a lower interest.you ask, so isn’t it always better to buy at a lower price with higher interest rates because you can refinance later? Psssshhhh don’t say this too loud. We want people to buy high and think price is irrelevant. Do you think slumlord will figure it out? Maybe, but he is already tied to the 1m dollar house. He’s already out of option and won’t compete. That’s what we want. As many people as possible buying at the peak. They won’t be your competition when it crashes 🙂

Bro it’s time to give up on these morons. “Price doesn’t matter” lol I can’t. As if incomes don’t rise over time, or people get married and now there’s a 2nd income, or debt is paid off which frees up more capital to pay off housing debt.

“Price doesn’t matter” is about the dumbest thing I’ve ever read on any blog, ever. I used to sell cars and I would salivate at the customers who came in talking only about monthly budget. You could make the price anything you want, extend the terms out as far as possible, and they’d be happy because you got the payment you wanted.

Give me a lower price point and higher interest rate ALL DAY over the opposite. More interest to write off, and less principal to have to pay back over time. I can’t even believe I have to type those words for these clowns.

The next crash will be devastating for boomers who are greatly invested in overpriced houses and stocks. But it will also be a great buying opportunity for those who are sitting in cash.

Great advice!

However, if a major crash happens every 80 years like it has historically (1928, 2008), in 2088, the only cash I will be sitting on will be 6 feet under.

My point is:

1) Just frackin buy a house if they drop 20-30%. That is typical during the last 100 year boom/bust cycles (not counting 2008 or 1928).

2) Sometimes the 20% drop can be insidious. ie like in the 1980’s and 1990’s where housing prices were essentially flat but inflation was at 8-13%. If you are getting enormous COLA raises but housing is flat or slightly oscillating, buy.

History does repeat itself and 50-70% 6 sigma disasters only happen every 80-100 years.

My cash does me no good if I am 6 feet under.

The problem with your thinking is that the 2008 crash was never allowed to hit it’s natural bottom. The Fed started pumping funny money into the economy and lowered interest rates to artificially low levels. Because of that, people in this country (and really the entire world) are WAY over-leveraged with debt. The last 10 year dead-cat bounce fueled by bango bucks has only delayed the inevitable deflationary cycle. It’s coming, buckle up.

Boomers will get absolutely destroyed in the next recession and Millennials will prosper !!!

That’s the most ridiculous thing I have ever heard in my life.

Granted I am not a Millennial nor a Boomer and I’m not a real estate expert like you Millennial Lo-Effen-L

Let us all know when you run the rental parity calculation and confirm we are no where near 50-70% inflated. Not even half of that.

We are all waiting with baited breath!

Until then live on a prosper at mommy’s house Millenials!

TA TA !

Yes tankinsight, rental parity is key. Right now we are light years away from it. So we buying makes little to no sense at the moment. The good news is that the crash is basically around the corner. All you need is a bit patience and discipline.

@Millie, I hope you are right. Been patiently waiting for Sacramento, California real estate prices to drop and inventory to increase.

Didn’t anybody tell you? Millennial is a troll, doubles as a troll on Zerohedge also. Nothing he has ever said has proven true. This self proclaimed expert, is an expert at nothing but typing the same thing over and over and over and over….

Yo Millie and Scott ; TaDa , I’m back . Had a great VaCa touring the East Coast and talking to people who are seriously considering moving to a more hospitable area. Here in Sacramento and the surrounding counties , all within 30 miles of the KKKapitol we have either 30,00 homes under construction or land clearing and preparations for new construction. Prices in Sack-A-Tomato are level and after looking at the AdVert’s in the weekend paper , I am seeing the asking prices on New Construction being reduced by the builders. Brand New-Never lived in – still under construction homes, because the Sacramento area is awash in new construction. Sure , Millie and his friends want to live in a nice condo, then they get married and have children and then they start looking at a single family home with a yard for the kiddies and their poodle , but they find the homes are now out of their reach or they are already to deep in debt to qualify. So as long as I keep my rental homes close to rental-parity , they can park their high-dollar SUV in my garage as long as they can pay the monthly rent. For Scott , think long term and capitalize on your holdings and stop trying to impress the neighbors and friends. they are counting pennies just like you. As for me , I just want to impress my Wife , my banker , and my CPA. Remember – Happiness is a Positive Cash Flow .

“Yo Millie and Scott ; TaDa , I’m back . â€

As if anyone would have noticed you have left or

As if anyone would remember you

😉

Housing Bubble 2.0 Already Popped-

Keith Jurow: The Housing Market Recovery Is An Illusion

(the video is worth a listen too)

excerpt:

The so-called housing market recovery is an illusion built largely by panicked lenders and mortgage services, according to real estate expert Keith Jurow.

The housing market is on shaky ground from redefaulting mortgages, long-term delinquencies, declining sales, and a growing number of properties for sale.

As a result, Jurow advises against buying property right now, and says homeowners should seriously consider selling before things get worse.â€

Keith Jurow???

That guy is another crackpot who will lose you a ton of money.

In December of 2011 right at the bottom in housing he was saying there was no bottom in sight L-O-Effen-L

https://www.businessinsider.com/keith-jurow-housing-market-new-york-city-and-california-2012-12

Keith Jurow: Goldman Is All Wrong, There Is No Housing Bottom In Sight

Dec 6, 2011, 10:47 AM

Goldman Sachs released a report saying it expects a 2.5% fall in the Case-Shiller and a bottom in prices by mid-2012.

In an interview with the Wall Street Journal however, Keith Jurow, author of the Housing Market Report at Minyanville, said there is no housing bottom in sight.

——————————

It’s fun to go back in history and see how wrong the Jim Taylor’s and Millennial’s of the world were.

Why oh why didn’t Millennial buy at rental parity in 2016???

Why didn’t Keith Jurow buy in 2011 or 2012….. Keith Jurow is still renting folks… after the largest housing crash in history Keith Jurow is still renting calling for the next crash!!. Permabears will lose you a ton of money.

@tank in sight,

So your story changed quickly?

“NoTankinSight

September 2, 2019 at 6:10 am

QE Abyss,

“That is an an excellent rent vs buy calculator. I would recommend using that one or create your own in a spreadsheet.

Always buy at or below rental parity. Many areas in CA are already at rental parity or below. I would forget the premium coastal areas, completely unrealistic… but the very nice areas 5-12 miles from the ocean in Orange County are either right at rental parity or about 10-15% above.â€

Beginning of September you said “many areas in CA are already at or below rental parityâ€. Now it changed to 2016 and we can barely find any now?

That’s what I appreciate about this blog. It’s so easy to dismantle the made up stuff.

In his defense did anyone think the Federal Reserve would do this?

https://fred.stlouisfed.org/series/WSHOMCB

They went from 850 billion in mortgage backed securities to 1.75 trillion in two years. Somebody may understand the fundamentals of the economy but when there is massive artificial stimulus the models no longer apply. Guessing the whims of the central bank has historically been difficult.

Woody, we no longer have free markets – we have a central planned economy by the FED and for the FED. Consequently, you no longer make decisions based on market fundamentals, but based on the whims and interests of the FED (trying to guess their next move).

It is funny when the socialists say that capitalism failed; capitalism always fails when you no longer have free markets (the very foundation of capitalism). What we have is socialism and socialism ALWAYS fails.

There was no bottom in sight, had the Fed not stepped in and artificially inflated every asset there is. But as I’ve mentioned in other comments, they only delayed the inevitable.

You cannot abolish the free market. You can however suppress it for awhile but eventually all that pressure explodes.

Housing Bubble 2.0 Already Popped-

Keith Jurow: The Housing Market Recovery Is An Illusion

(the video is worth a listen too)

excerpt:

The so-called housing market recovery is an illusion built largely by panicked lenders and mortgage services, according to real estate expert Keith Jurow.

The housing market is on shaky ground from redefaulting mortgages, long-term delinquencies, declining sales, and a growing number of properties for sale.

As a result, Jurow advises against buying property right now, and says homeowners should seriously consider selling before things get worse.â€

here is the link to the video

https://www.youtube.com/watch?time_continue=191&v=anVN3xzlmcg

If we move from GA to CO, i’ll wait till we see a 20-30% in 2021

Milie gets another 50% off-Historic San Jose mansion for sale. Price cut over 1/2 off from dream price list.

https://www.zillow.com/homedetails/7871-Prestwick-Cir-San-Jose-CA-95135/19800118_zpid/

As has been stated, repeatedly, that is NOT a 50% crash. It’s 50% off the asking price.

They initially asked for $3,288,000, and are now asking $1,500,000. But look at the house’s most recent actual sold prices:

* August 2007 ….. $12,500

* September 2003 ….. $210,000

* June 2003 ….. $200,000

That $12,500 sales looks way underpriced, so perhaps an inside deal there?

It seems the last legitimate sales price was for $210,000. So if it sells for the current asking price of $1,500,000, the owner is still way ahead. Hell, the asking could drop to a million and the owner would still come out way ahead.

one thing worth pointing out regarding these inflated house prices and million dollar crap shacks. You can take a home right now thats in a ghetto gang and drug infested neighborhood in LA, these homes are selling for 400k plus. Yet the majority of the people that live in the neighborhood are not homeowners, they arent even renters, they are on section 8. So if you bust your ass to buy that crap shack for a half a million, the rest of the neighborhood is getting it for free. But dont worry, because you cant afford that crap shack anyways!! If your not ultra rich, and your middle class or lower middle class, your pretty much screwed. You want that million dollar crap shack?!?! just quit working, have a bunch of kids, go on housing and section 8, and youll get that million dollar crap shack in a drug and gang infested neighborhood…….for free!!! instead of slaving your life away for it. As others have said, california is a 3rd world shithole, with small elite ultra rich pockets, the rest of california is pretty much mexico.

Hello from san Diego,

I am not sure where the home prices are going but I vividly remember in 2006 before the home price crash, there were severe shortage of homes and there were bidding wars.

I also remember the euphoria that home prices would never go down.