The mix in California real estate – Did the median price go up by 28 percent in one year?

The median price for a home is a useful measure in more stable markets. However, this current market is anything but stable especially for California. That is why according to the California Association of Realtors, the median price for a home in California went up 28.2 percent in one year. Even DataQuick has the year over year jump above 20 percent. This jump in the median price is on par to what we saw during the high powered early 2000s. Yet the current jump is coming more from the shift in the homes being sold. Fewer foreclosures are being sold and thus the mix is made up of higher priced properties overall. Foreclosures in general sell for much less than non-distressed homes. Yet the median price for a home gets quoted in the press and causes a self-fulfilling prophecy similar to when home prices start moving down. It is worth looking at this data since it is telling.

The shift in market mix

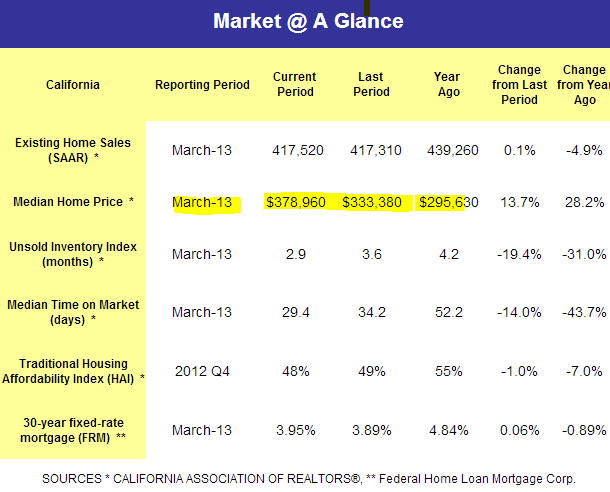

Here is the current California real estate market data:

The median price has gone from $295,630 in March of 2012 to $378,960. This is a one year gain of $83,330. I often said during the bubble days that you could leave your job and simply live on the continually growing equity in your home by yanking out equity every year that it went up. Apparently many people live by this mantra. What is interesting in the data above is also the big jump over one period. In one period the median price went up by $45,000. Obviously this is not sustainable.

The amount of inventory is also very low. A normal market will have about 6 months of unsold inventory. Today it is down to 2.9 months. Sales are not booming and this is obviously a case of a market being driven by low inventory, rock bottom mortgage rates, and an insatiable demand for properties by investors.

Non-distressed sales

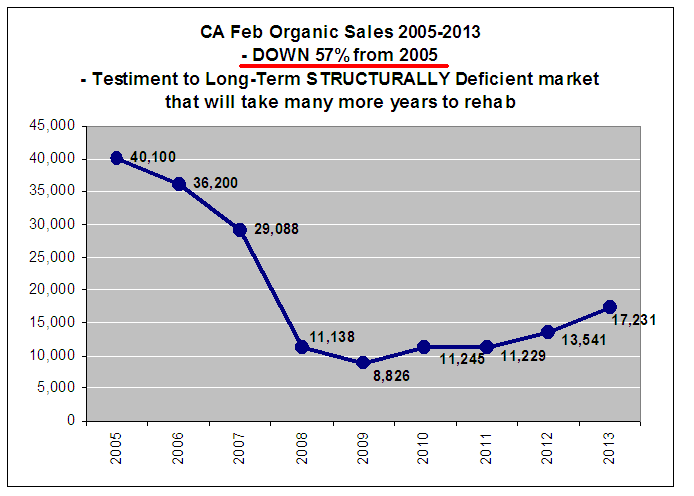

An interesting chart that I recently saw broke out the number of non-distressed sales for California between 2005 and 2013:

Source:Â mhanson.com

Even though foreclosures are now a small part of the re-sale market, short sales are still a good part of all sales. Yet in midst of two year momentum, the actual number of non-distressed properties being sold is still rather low for a large state like California. The chart above highlights the case of a low inventory housing push.

Will inventory bounce back? That is really the question as we are now into the spring and summer selling seasons. There does seem to be some inventory hitting the market but it is tiny:

And not all areas are seeing inventory move up:

The median price data will begin calming down over the next year simply by sheer momentum. It is important to understand why the current housing market is acting the way it is. Amazing that some people actually want to compete in this mania where personal letters to sellers (plus a big offer over list price) are status quo. In prime markets you need to come to the table with a big down payment or all cash.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

42 Responses to “The mix in California real estate – Did the median price go up by 28 percent in one year?”

Housing appreciates 2 – 2 1/2% annually, historically. From 2003-2007, in some areas houses rose 200%.

Will housing return to its average? We have another big leg down as far as I can tell. There is something wrong with the financial system when it prices Americans out of their own housing market. When this happens it becomes clear that the system is being run for the rich, not for the rest of us. The rich have enough benefits in life. They really don’t need to own the government so that ALL the benefits in life go to them.

We have enough ‘playgrounds for the rich and famous’. No more country clubs; no more golf courses. No more playgrounds for the Phillistines. Let’s build a real culture based in depth and human compassion. We’ve had enough of the superficial culture based in the worship of the material (dead) object. We’ve had too much worship of quantity, and not enough worship of quality.

If housing prices are too high for the citizens in the country to afford, then housing prices are too high. Ben Bernake is spending trillions to try to keep housing prices too high for Americans to afford houses in their own country.

We have another big leg down as far as I can tell.

Who are these “rich” people? Please define the group.

Our government is OWNED by business interests and the banks who are deathly afraid of seeing their inflated assets return to reasonable prices. Wall Street bankers and their friends, they are the ones our FED Chief Ben Bernanke is trying to protect.

The banks are paying nothing now to borrow our money and invest it for their profit. That’s the immoral part. The government is forcing interest rates down to try to force Americans to invest in the stock market or buy another house or find something to do with their money INSTEAD OF SAVING. As if saving was a sin.

If every American had $100,000 more savings and $100,000 less debt, we would not be in this mess.

Saving doesn’t serve the consumer economy; debt does. The government wants us to be debt-slaves. That’s the message I’m getting from this enforced low-interest rate policy.

Deflation forces prices back to their natural levels — it is a part of the law of gravity. Bubble-creation is what business is good at — forcing prices higher and higher. We don’t need higher prices now. Wages are going down; jobs are being lost. Without lower prices, every working family in the world faces bankruptcy. Yet the government is laboring to try to inflate prices once again.

Our economists told us we could ship all our high-paying manufacturing jobs overseas and develop a clean information technology economy…everything would be fine. We were told it would be ok to send our jobs to Mexico. We’re taking care of everything, our leaders said.

Big Business was pulling all the levers, the little man behind the screen. And now look where we are.I’m not pessimistic about America’s future….IF Americans start thinking for themselves, instead of believing with a kind of religious faith that their leaders (simply by invoking the concepts of ‘patriotism’ and ‘religion’) will never let them down. America’s leaders HAVE LET THEM DOWN. It’s time to wake up. It’s time to begin THINKING again, instead of following by rote what the banker tells us is good for us and believing that keeping up with the the Joneses is the only viable way to live.

Americans need to respond to the current crisis by helping to deflate prices: stop borrowing money; stop buying things you don’t need. Say no to the government-inspired self-indulgence, to the government-inspired inflation of the undisciplined consumer (and consumptive) mania.

Really? How about the hedge funds that require a 10 million dollar buy in that are out there buying up everything for less than 500K?

How about the Banks and the people who own the banks who have been put into a position via zero rates and suspension of market to market where they can hold a delinquent property on the books for 10 years and make a profit in doing so?

How about those people?

“Our economists told us we could ship all our high-paying manufacturing jobs overseas and develop a clean information technology economy…everything would be fine. We were told it would be ok to send our jobs to Mexico. We’re taking care of everything, our leaders said.”

It would be fine of you left you manufacturing job, went to school another 5 years for college + masters and got a job in IT. You’d be paid more and have better benefits. The problem happens when people think they can just go get another job without training for it. Those days are gone. Skilled labor gets the $$ now.

The other problem is that while manufacturing can be / was labor intensive, IT need not be. As much of it as possible is driven by automation, and where human effort is required, the work product can be easily replicated over millions of machines. There many not be as many IT jobs.

Alas, greater automation is inevitable. It does matter what politicians say. Eventually, we will all be put out of a job, even the sex workers, and the welfare class will win — at least until SkyNet decides to conserve resources by shutting down unnecessary functions.

Agreed there should be but will Bernanke do anytHing to help Americans afford a house? I believe they will only be interested in their own profits since he is chairman of a private bank. His goal are not synonymous with Americans goals.

“Housing appreciates 2 to 2% annually, historically?” This may be true on a national level, but coastal Califonia has seen much different returns over the last few decades. This can’t be refuted.

“There is something wrong with the financial system when it prices Americans out of their own housing market.” Housing on a nationwide level is very affordable, hell it’s even affordable in many desirable areas (monthly price to own is at its lowest level in decades). You are mad that highly desirable areas are not affordable and blaming this on the financial system? That is supply and demand at work.

“Ben Bernake is spending trillions to try to keep housing prices too high for Americans to afford houses in their own country.” Again, you are fixated on highly desirable areas because you think the price of admission is too high. Forget about nominal prices, you need to look at real prices…aka monthly payments and they are very low right now. And Ben isn’t just helping out his ultra rich buddies. The majority are owners in this country, he is helping out the majority…good luck changing that anytime soon.

I was one of the biggest bears on this blog for a very long time. I finally accepted reality that Fed and government policy isn’t changing anytime soon regarding home ownership, this is what you should be basing your decisions on. You should not be basing your decisons on “how things should be in a perfect world.” If it all hits the fan again soon, who gets helped out? Banks, homeowners, etc. What have renters get? ZERO. It’s really not that hard to predict future outcomes when past behavior is so obvious. Learn from this.

(monthly price to own is at its lowest level in decades)

i see someone is drinking the coolade…..not in my town not even fuggin close, i’m still renting for 1/3 the cost of buying in my “desirable area” ….all your missing in your post is a reference to PPSF then i’d know which infomercial you’ve been watching.

It seems like for the most part you are both (wiz and lordb) correct. The system is definitely rigged against savers/anti middle and upper middle class and its bs and it sucks….but why/how would that change any time soon? The Internet bringing enough people together or some middle class superpac maybe, but I’d say pretty close to nil on the odds board. I mean the Internet would get censored before that happened or they’d get rid of superpacs probably.

That being said, the fed is playing a dangerous all-in game and they may actually increase QE. To think normal supply/demand is a play and Cali housing is ‘properly priced’ with not a lot of downside risk when dollars (and soon to be euros probably) are being printed ad naseum PLUS the lowest interest rates of a lifetime PLUS no housing supply due to HARP, foreclosure laws, expensive building supply, etc PLUS huge returns in the stock market so wall street investors are flush PLUS Chinese housing bubbling so invest here PLUS hedge funds have no where else to get returns a this moment (but that will change) PLUS the fact that there has been no construction for years unlike any time we can remember, but humans always go too far so we’ll overbuild supply in a couple years PLUS stagnant wages/incomes. Now some of those factors could change for the better, but if some of the factors change for the worse, I wouldn’t call Cali real estate a safe investment.

So you lock in your payments, but the downside in home value could be bad as it just skyrocketed based on circumstances that are not just interest rate related in the past 18 months. What if interest rates don’t go up and inventory comes out a little more, even if its new construction of condos (which takes away some demand)? I mean who knows?! Anyone predicting higher wages or lots of new jobs soon?…crickets…..bottom line is that its all guessing on what happens and the govt will do all they can as you both said to prop assets up over cash, but keep in mind, there is only so much they can do. There isn’t a magic button to press….and now watch LA real estate go up another 30% in 3 years. 😉

PS: someone on this board told me to wake up, you’re about to spend a million on a house as I was close to buying in LA about a month ago. Made me think more and more and wifey and I are now thinking Texas or Florida. More humid-check. Worse topography-check. Better taxes, better affordability, less traffic, owning property big enough for a pool (and maybe a 4 wheeler of to shoot a bow at a target), less $$$ pressure in a VERY uncertain world-check. That being said, both states have frothy real estate markets at the moment per friends that live there.

“And Ben isn’t just helping out his ultra rich buddies. The majority are owners in this country, he is helping out the majority…good luck changing that anytime soon.”

The Fed is helping out the banks, period. It has nothing to do with the majority. On the contrary, the Fed is killing the majority with its zero interest rate policy. Low mortgage rates artificially push up home prices. This helps the higher priced property the most, obviously. This is to bailout all the bad paper floating around the banks. Most of the majority owe money on credit cards and they do not pay 3% on the debt or less than 1% like the banks. The entire system is predicated on DEBT to promote consumption and make the few very wealthy. The average wage in this country has been going down for decades in real terms. If you want to see a good chart, look at inflation since Nixon destroyed the dollar. It is a 45 degree line since then. The Fed is also screwing all savers, especially the retired, and now SS is going to “chain inflation” numbers and screw them more. There has been a radical change in this country since Nixon and it has accelarated in the last ten years. The banks through the Fed own this county. You are a modern day serf, you are just not smart enough to see it. Keep believing the crap and you will be fine.

I so get you. I am in the same boat….I truly believe now that Fed is not going to change…they will come up with another plan to protect banks. There is no ideal housing market. People who save will get punished again n again.

@Lord Blankfein wrote: “…but coastal Califonia has seen much different returns over the last few decades. This can’t be refuted…”

Translation: This time is different. And tulips smell wonderful.

@Lord Blankfein wrote: “…Forget about nominal prices, you need to look at real prices…aka monthly payments…”

Translation: While this is a good concept, it ignores the notion of “reversion to the mean”, after all, this time is different. It also ignores future value (this time is different, you know).

Let’s pretend the U.S. turns Japanese and inflation goes to zero and annual wage increases go to zero. The historical 30 year mortgage average is 9% interest. These 800K homes in the coastal areas at 3.5% (in 2013) have the exact same monthly payment as homes priced at 450K at 9% (in 2043).

So if one wants to discount future value, then by all means focusing on the current nominal monthly payment is acceptable. The short-term monthly payment ideology works very well if one lives from paycheck to paycheck.

Jeff, I don’t even know how to respond to a comment like that. We all know what the Fed is doing, YOU need to be smart enough to financially benefit from this. Ask the tens of millions of people who bought prior to the bubble, I bet their of the Fed isn’t that bad. Again, I’m hearing people preach on “how things should be.” Your little financial utopia is not going to happen anytime soon!

Ernst, pull your head out of the sand, it’s almost pointless arguing with some of you. Real estate in coastal califorina IS DIFFERENT. Do you honestly think the value of this land “will revert to the mean” and be same price as flyover country? NOT IN OUR LIFETIME. As long as there is an endless supply of people and money that come here (and I see no end in sight), things are not going to change. There was no tangible value to owning tulips during that mania. There is plenty of tangible value to owning desirable CA real estate. This is not rocket science, it does not take a huge IQ to understand this!

@Lord Blankfein

You missed the very subtle point I made about future value and how home prices are a function of interest rates. If you plan on dying in your home, then future value is irrelevant.

If the Fed managed to get interest rates down to 1% on a 30 year mortgage, then these $800K homes at 3.5% interest would be selling for $1.1MM at 1% interest. The monthly payment would not change but the selling price would.

If the Fed loses control of inflation and the 30year mortgage goes up to 12% interest, then these $800K homes will plunge in value down to $345K.

The monthly payment will remain at about $3500 per month in all the scenarios outlined. And the total cost of the mortgages over a 30 year period would be the same. Ultimately, the monthly nut is what interest rates will pivot around and moves the price of a home up or down.

We’re back to: If you plan on dying in your home, future value is irrelevant. So what if your $800K home is now valued at $345K because the Fed lost control of inflation and interest rates on mortgages are 12% in the future.

I do not expect to ever find an “economic utopia”. Just one that does not blow up at the beck and call of the Fed for the benefit of the insider few. This is exactly what happens when you have a small group, unelected and in secret control the money supply, printing by digits. This has created the most inequitable economic system in the history of mankind.

Buy of all that coastal property that never, ever goes down in price but be sure to build a moat around it to keep the starving hoards out.

your absolutly right.it (the systm )is deigned for and by the rich.The federal re.serve is trying too re-inflate ousing prices as muc as possile.Lending free money too wall street too buy these homes and giving the rich ownership of them

OK folks. Let’s keep it simple. My wife and I have been looking to buy a little starter home since November.

We’ve put in 6 offers in the last 2 months and none have been accepted. The last offer was for a little 2 bedroom 2 bath condo listed at $240K. We offered $265K. No luck.

I’m so disenchanted with what’s going on right now. My agent can’t tell me what it takes to buy a home. Only praying and hoping. I refuse to believe I have to just let the chips fall where they may…..

This is utter BS. I’m done with this market and will continue to rent until this madness subsides. Do you think think I’m foolish?

BV

As Adam Smith pointed out 235 years ago, housing is not capital no matter how much the owner is flattered by it. The talking points of California real estate appear to be aimed at the geezer population who only want warmth and convenience per the title of the Dead Kennedys album, “Give Me Convenience Or Give Me Death.” If weather is at the top of your priorities, your life is already over so why not bake in the sun and listen to the Beach Boys. But if spending a lifetime in California means you end up looking like Francis Ford Coppola, George Lucas, or Harrison Ford, I’ll take my chances in Alabama (just to start at the top of the alphabet)! Does anyone at this blog know what “supported by fundamentals” means? If there’s no income growth (as there hasn’t been for 40 years, adjusted for inflation), there is no fundamental support for an increase in housing prices; you might as well have an economy based on trading baseball cards.

Your last sentence about trading baseball cards is how our nation has been conducting business since the early 2000’s. At some point in time, the house of cards will come down. When it happens is anyones guess.

if income was the only ingredient in the home ownership recipe, maybe that is true. but we’ve manipulated interest rates to support higher home prices. once we decided long ago that taking on massive debt was ok, we threw ‘fundamentals’ out the window. after all, whats the diff paying 2k on mortgage on a 300K home vs 2k mortgage on a 500k home? as long as you live there long enough to endure the troughs and sell higher, does it matter to the typical homeowner? if it does, then either you are a professional investor, or just plain delusional for thinking you are one.

great post. unfortunately the folks at IRHB are advising their readers to buy. then again, they do have a realtor’s contact info and ads on their site.

Using the median does not account for inventory shift. More expensive houses can sell one month, rather than the last, thus shifting “the median”. It does not necessarily mean the prices increased.

But other than that, there has been some legit increase in prices, and I’d guess to say between 10% and 20% depending onthe neighborhood. I believe that came from the low interest rate mentality finally kicking in, and fence sitters moving forawrd. Maximum levarage at the current 3.5% rate. But without income growth, we should have reached a maximum right now.

The white elephant is what Wall St investments have done to the market. We wont know fully for 3 to 4 more years until they begin to dump them.

If you don’t like what is currently happening in the SoCal RE markets, just wait a year or two for it to change. It’s like mountain weather.

I averaged 1167% gross per escrow sale from 1999-2008. 198 sales of my real estate.

I bought 5500 acres from 2010-2012 at the bottom. I think I can yield about 1500-3000% per acre from 2017-2020 after Obama leaves!

Higher interest rates will kill real estate or housing interest AND will kill our baby recovery. When will housing reach a bottom: when interest rates are at 20%. Keep your powder dry.

Higher interest rates will force prices down rapidly.

The best time to buy is when interest rates at at the top of their arc and prices are at the low of their arc. Buy a house at the bottom with a high interest rate — and then begin to refinance as interest rates fall.

It is INSANE to buy an overprice house when interest rates are low. Where do you refinance too? You can’t refinance when interest rates start rising and housing prices fall.

Good Luck!

I think I’ll be too old to care when interest rates finally hit 20%. And given the current situation, I’ll have learned not to let my home be my core asset for retirement. I’m on board with Lord Blankfein to a certain extent. The US will kick the can down the road until it can’t, and the pretend game will go on for a long long time.

For some reason, a lot of people on this board believe that fundamentals clearly overrides manipulation. It’s in line with the old adage that good will prevail. It’s what we all hope and want, but will it come? I’d like to say someday… but that someday aint comin anytime soon

“When will housing reach a bottom: when interest rates are at 20%.”

And when will this occur? What are the signs/circumstances that interest rates will begin to rise? How fast do they rise?

Math & IRR Genius… I think you might just be making 1500 – 3000% profit after Obama leaves office because the US dollar would have been so inflated and devalued due to Bernake nonstop printing of all these funny money out of thin air from Quantitative Easing to infinity and beyond. The US dollar would be like what the peso was to mexico… worthless. There’s been talks about the US dollar collapsing around that time as well. I hope you don’t go broke when nobody can afford to buy anymore because the federal government don’t believe in American saving money.

You know there’s a mania when there are ads on the radio for house flipping opportunities. Reminds me of Carlton Sheets et al. from about ten years ago.

At least Don LaPre ending up offing himself …

I’ve seen a 2/1 and 1/1 in my town go pending in less than 10 days. The 2/1 was offered at $470K and the 1/1 was offered at $340K. I’m pretty sure they went for at least $20K over asking. These same houses just a year or so ago would not have sold for $300K and $200K , respectively. The game is on!!

If so, then it is soak the boomers 3.0. First, soak them in the tech bubble for stocks. Then get them with real estate. (Then maybe get them with bonds/gold. Soak v2.5) Then go for the KO with REITs that invest in real estate bubble 2.0.

Since giving the demographic bubble it’s fair per-capita share of production is “prohibitively” costly once they no longer produce, we may cynically predict that it is inevitable that the invisible hand will devise a scheme by which the excess accrued wealth of the elderly will be taken from them before it can be spent on real production. Expect unearned income yields to be low and labor costs to be high until the situation improves and Grandma is on beans and rice.

non distress sales went from around 8k to 17k, so they doubled. this is great for inventory, if they keep on doubling, pretty soon, they will be big again.

Silly me… I just realized how the income redistribution is occurring rapidly again just looking at this listing.

http://www.redfin.com/CA/Los-Angeles/4857-Granada-St-90042/home/7078597

1,200 s.f. lot in a fairly low income area with low home values and this house pending at 450K +…probably with a panicked buyer thinking they are missing out again, stretched out with an FHA loan that they will default on. Bailout FHA???

It’s time to wake up and face the reality. Debt is the problem. Debt as a problem has to be faced, head-on. Instead, the Fed and the banks are fueling a fake housing rally, fake stock rally, they are singing praises of worthless companies to try to get Americans to join the party on Wall Street, believing that ‘positive thinking’ might cure the problem. It’s the only thing they see that they can do, delay the onslaught with subterfuge and misrepresentation. It’s their system — the system that makes them rich and powerful — and if it goes down, they go down with it.

Politicians and bank executives aren’t out to get ordinary citizens. They are out to line their own pockets, without regard for anything else. And now, as it is all coming apart at the seams, they are stalling for time, praying for some miracle, because they don’t really know what else to do.

We have two paths: one is to face the truth now, and the consequences — massive deflation and economic depression; or, to lie, deceive, and play for time. And try to extend the time before we have to face massive deflation and economic depression.

The current problem of American leaders is that they are afraid to face the truth. Why are they afraid to face the truth — because the truth is that they are in danger and they destroyed the goose that laid the golden egg because they could not control their greed.

We need higher rates; we need defaults and bankruptcies.

All those Goverment mimics and manipulations won’t work. We have too much debt and we need to destroy that debt. When the debts become too large and powerful nothing else can grow. Debts need to be eliminated so we can enter another growth phase of the economic cycle. How do we eliminate debts: we encourage saving, debt unwinding (in ALL meaning of the word); and we need a fed that discourages more loans at the moment. We have a Fed policy that is begging us to borrow more ann more.

Deflation is the poor getting even with the rich. Is it any wonder the power center in America (Wall Street and Washington DC) will do ANYTHING to protect their inflationary doctrine? They would rather destroy America that have to give back any of the money they’ve successfully stolen already.

At the end Deflation will win and FED will be defeated. Deflation is God’s way of punishing the rich. Deflation is a form of justice. When the fish aren’t biting, the fishermen go hungry.

Good Luck!

Housing prices went up 100-300% in the three years of the housing fraud boom in many areas of the country, not just the ground zero states like Nevada or Arizona. Whose income went up 100-300% in that same time.? Of course, no one could qualify for a real loan when prices inflated 150% in two years — so the housing cartel hauled out liar loans, cheater loans, and loser loans to destroy their clients lives and try to escape with their fees. The banks and Wall Street came up with a plan to bundle loans together so that anyone buying the new securities would not know what loans they held. The prisons should be full by now — except the government is pretending that nothing illegal happened. They think they just need to keep interest rates at zero, encourage more borrowing and home-buying and everything will re-inflate and save us from ourselves. But they are wrong.

We are heading down from high tide and all the bodies and the trash are going to be exposed at low tide. All the crimes will then be revealed.

American wages and salaries are going down, jobs are vanishing. How can we afford houses we could not afford 10 years ago except with the fake loans that destroyed the system?

Housing prices are unduly inflated still and are holding America hostage. Housing prices need to come down even more, back to salaries. If that destroys a lot of banks, well that’s the price we pay for our orgy of fraud and criminality.

wisdom of oz-you definitely preach what a lot of us feel. Im in my upper 30s, saved cash my whole life and now finally want to buy, but i see everything you do and personally i think LA itself (where i currently live) and a few other cities in the US are a tad too frothy. However, lordb makes man valid points in that why would good prevail now? I think at its core lordb is saying dont hate the player, hate the game, but the game ain’t changing, whether you partipate or not or whether you like it or not. Ed could even agree with you (and me) that we need ‘austerity’ basically, but is saying the fed wants to keep interest rates low, so how are we getting to 20%, let alone 6% any time soon. Essentially recognize the game and act within it.

All that being said, real estate is hyper local. There are many cities I personally would rather wait two-three years to see what happens before buying, but my hunch is there are some deals in Midwest that make sense for sure. Its real hard to time it where someone (Ed?) said and time buying with higher rates/lower prices and then refinance, even though that is the best move….and the one I’m praying for, but not counting on.

So in other words, averages can be deceiving. It’s the old: “If you put one foot into a bucket of ice water and the other into a bucket of boiling water, the average temperature should be comfortable” theory!

Real estate prices go up and down, always have always will, and its always different this time.

How many times did Greenspan and Uncle Ben and our Gov. the NAR, say it would be a soft landing, (wasn’t even close).

All they know is they need to raise asset prices, homes, stocks etc… to make us feel rich and start spending our heavily taxed dollars. They admit they are not sure what will happen and have no exit plan (talk about a hail mary pass).

This is exactly how bubbles form, over time 3 to 5 years as the ship slowly turns and starts to sink by its own weight. The news changes (again) and you start hearing more and more people talking about another bubble, as rates hit 4.5%, now affordability is not, and the market stalls, others say not this time, the Gov, NAR etc… manipulate data until its obvious to everyone and we all rush to the exit. (starting to hear those stories, but we have time)

But I’m pretty sure they fixed it now and we should be back on track because they spent 3 trillion+ fake dollars on building a fundamentally sound structure that can support jobs, growth and a healthy long term economy while paying down the massive debt.

Nothing about this market healthy, normal, solid, fundamentally or structurally sound or predictable.

do wish people would talk about when this bubble will pop? 1 year, two years 5 years? I have a 2 year old and need to get out of San Francisco and want to buy up north so she can go to school in a good school district… I can wait I guess and rent til houses crash again! Just wonder when?

Nobody around here (or anywhere else) knows when the bubble will pop. Many folks here (including our gracious host) predicted 2012-2013 would be the year when the “Option ARM tsunami” would hit, and look how well that turned out for us. Most of us here now realize we talked ourselves into missing an opportunity 2-3 years ago.

Leave a Reply