The California housing trend: Taking a close look at 30 years of housing data. Building a market on low inventory.

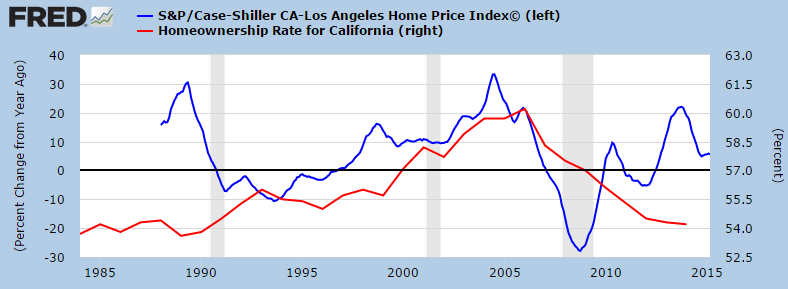

One thing to understand about California housing is that boom and busts are central to the market. It is fascinating from a psychological standpoint that today, many think that California housing is a simple and safe bet. Casually, they forget the massive destruction that occurred only a few years ago and the echoes of the impact are still around: low inventory, massive Federal Reserve intervention, and a shift to investors buying homes. Looking to buy? Gear up for a sizable down payment and maximum leverage on a low interest rate. Also, it is easy to forget that 1,000,000+ Californians lost their homes via foreclosure and many today are still underwater even with the recent boom in home prices. Even with the trend to higher prices, people have the choice to buy or rent. Unlike stocks, most households have to make the analysis of buying or renting. In spite of rising prices and the meme that home values will only go up, the homeownership rate in California has plummeted. The state is seeing a wave of households opting to rent. This trend started in 2005, while home prices held a plateau up until 2007. In housing, trends reverse slowly. Take a look at 30 years of housing data for the LA/OC markets.

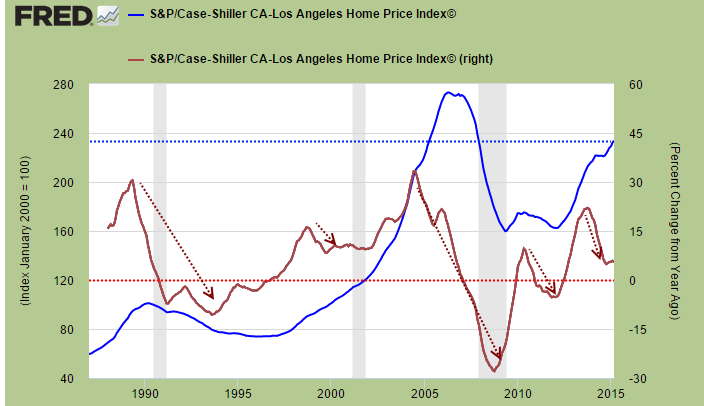

30 years of trends in the LA/OC market

The boom and bust cycle is simply part of the California market. We’ve had a nice boom driven by investors and low inventory recently. But investors (those with big wallets) have pulled out dramatically early in 2014. Yet momentum is shifting but the question is, what will come about this change? People also forget that the stock market is on a six-year tear and California, especially the Bay Area has a deep connection between the two. Stocks are up and real estate follows. It is interesting to see that the stock market this year is also unsure of what it wants to do.

It might be helpful to look at the Case-Shiller Index for the L.A. market. The index also pulls in OC data so it is a nice overview of a very big market. Here is data going back 30 years:

The blue line is the Case-Shiller Index with no adjustments. You can see the recent big bounce up. The red line shows momentum changes in the form of year-over-year changes. You can see that the trend is definitely heading lower. Of course, these changes happen over years. For those in the market looking at a $700,000 crap shack, you are really betting against the above chart. It is interesting that many in California will look at the stock market as some kind of risky proposition, even when placing a $50,000 bet. Yet some see no problem buying a $700,000 home requiring a $140,000 down payment to get down to a modest monthly mortgage payment. A small 10 percent correction (see chart above) would wipe out a nice chunk of change. Those going in with low down payments might be in a position where equity is at par (or below given selling costs).

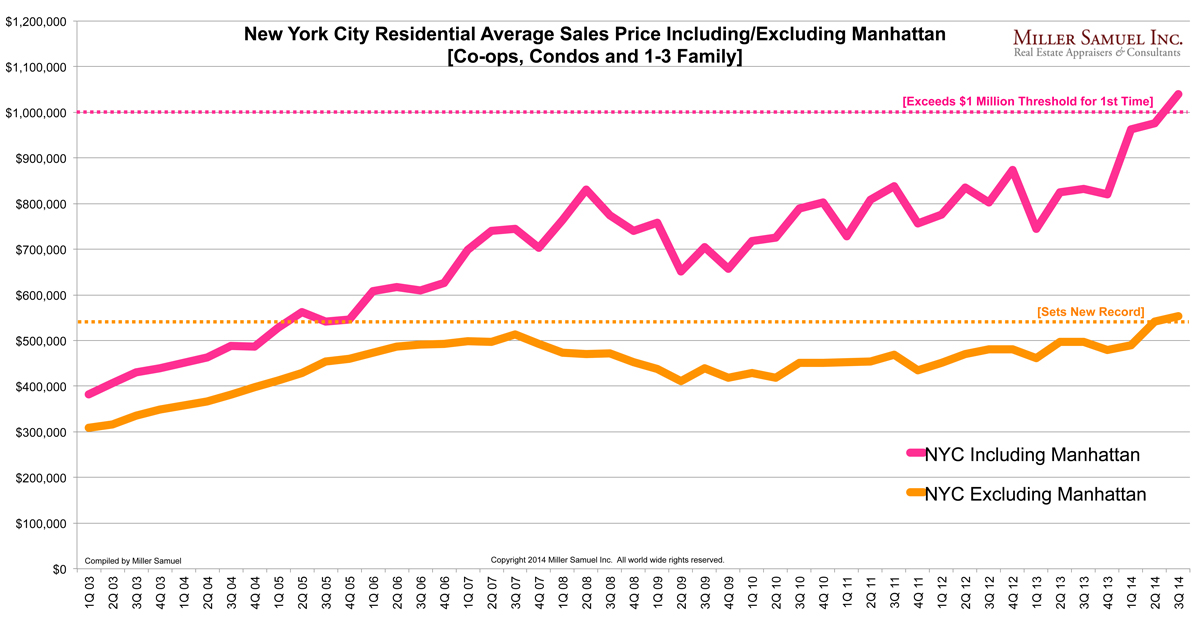

More to the point, price-to-income ratios are incredibly out of whack. It is interesting to see the justifications today for why prices are high. There is a reason why the LA/OC market is the most overpriced in terms of housing. Not New York. Not San Francisco. Not Chicago. It is the LA/OC region and you know why? Because relative to the other areas, incomes here are simply not that high. This is also a reason why we see more booms and busts here. Take New York City:

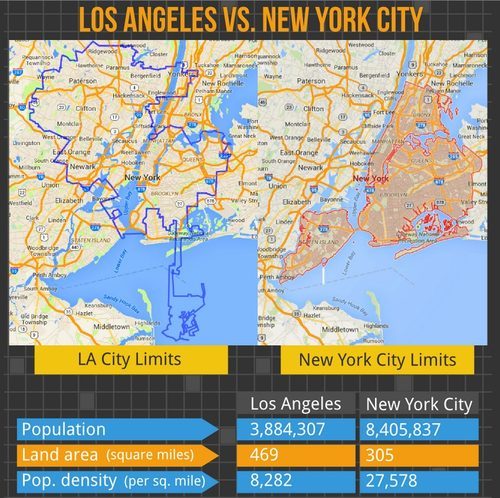

You notice how prices didn’t take a massive hit like the LA/OC area. You know why? Because unlike New York City, the LA/OC market is one giant urban sprawl that isn’t land locked.  That is a massively important point to note. Also, incomes in NYC are simply better than in L.A. and Orange County. Forget about population density:

And that is merely for L.A. the city. L.A. County has 10,000,000 people and many are looking to buy in L.A. County cities, not L.A. With that said, the homeownership trend for California has been moving lower over the last decade:

Simply put, this means more renting households and fewer buyers. This young group of future buyers is unlikely to materialize, at least with current incomes. We’ve already highlighted that 2.3 million adult Californians are living at home with their parents. Wages are simply not keeping up with price gains or even rent increases. The last boom was driven by low Fed rates, hot investor money, and a lack of inventory (you notice how higher incomes or booming sales are not driving prices up).

But if you want to buy, here is a nice and bright home in Highland Park:

6071 Roy St,Los Angeles, CA 90042

3 beds, 1 bath 1,231 square feet

This place sold for $90,000 in 1986 (the current tax assessment is $165,228). The current list price is $599,000 (in other words, $600,000). Just think, you’ll enjoy this bright colored home and you’ll have the privilege of paying property taxes 3.5 times higher than the current Prop 13 rate. This is a perfect hipster/Taco Tuesday home (make sure you get $120,000 for a nice down payment). In 2011 the Zestimate on this place was $366,000. Now you “need†to pay $240,000 more but for what? So how do you justify a $240,000 (a 65% jump) price move in a mere 3 years. For the privilege of living in Highland Park. And they say real estate isn’t a speculative market. Look at the historical data here and you will find out that California is all about boom and bust. The LA/OC market is the epitome of this.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

116 Responses to “The California housing trend: Taking a close look at 30 years of housing data. Building a market on low inventory.”

Housing To Tank Hard in 2015!

Are you really gonna start doing this again? How’d it work out for you last time?

When did it become wrong to have an opinion?

I am like Jim, I think the housing market will tank not in 2015 but 2016.

Of course, 2015 is nearly half over.

2008 also half over when the bottom fell out.

When the 2008 was half over we were at 4%+ interest rates, more over, we were coming from 5.5% a few months earlier, at that time it was already too late. The last time I checked we are still at 0….

In my area (Thousand Oaks), Chinese buyers have all but disappeared. Home prices are falling from 350 to 300/sf, inventory is increasing in the last 6 months. However there is a noticeable upsurge in the stupid money, the HGTV and AM radio speculator clowns and whatnot. Is there some new flipper show aimed at 30 year olds out? or are they all just like me, figuring that the 3% money is going away soon?

IT is the opposite here, on the Eastside (Bellevue, WA). The last Time I checked the demographics was 35% Asians, 50 % Whites four years ago, now it is %45 Asians, 45% Whites. Bellevue becomes a China Town…

Sleepless, you forgot to mention that % of east indians is increasing very fast in Bellevue.

Dave

We’re neighbors. I am a former Janss Corp employee. I even went to Jungleland as a kid. Leo, the MGM Lion, and Mr. Ed (the talking TV sitcom horse) retired there. Leo, is buried under the Civic Arts Plaza. TO is a mere shadow of its former self. The demographics is changing for the worse.

The housing to tank hard only when and only if the FED raises the interest rates from 0, to say, at least 200 bps and if QE4 is not introduced. That will be enough to tank the Housing Hard as everything else, pretty much. But what we see so far is that the FED has no intention on raising rates, moreover, QE4 will be coming later this year – beginning next year. No Hosing Tanks until this BS ends. I predicted 2016 for housing to tank hard, now I say it is when FED raises rates + one year. If the FED raises rates in September 2015 (which I doubt), then it is September of 2016. IF they raise rates in 2020, then it is 2021.

if that fed rate jumps 2% that is going to wallop some specuvestors where it hurts.

Yellen and the fed are too wed to the oligarch hedgefund market shapers. Hard to see it ever happening.

Makes sense to align disasters with new elections.

The Fed in very interested in raising rates. As I said in 2024 early rates will go up 1/4 % in June. I missed the mark because target time is Sept now. No ecomony can grow at 0%, iit will be very gradual with some meetings no raising rates at all. The Fed Funds rate will be comfortable for them at 2.5 maybe 3% in 2016. Will it make a difference, as a pointed out many times, mortages go up to 5.5% and pay will go up to meet the balance needed. You see banks lice long loans at hight rates, and corp America likes pay raises just to keep workers slightly happy not to comfortable, but better job secutity. It is the 10 year cycle and it was all planned this way several years ago.

Robertl – I have to completely disagree with you regarding rising wages. What metric/report/index would you like to use to track wages? I predict that they stay as is for the next two years. Employers have no reason to pay more when there are more job seekers than there are jobs. Plus all of the gov’t handouts to keep the masses semi-happy….

keep on truckin’! One of these years the bears will be right.

the debt bubble to tank hard in sept 2015

LOL How’d that work for you?

Its 2018… it will tank harder than people think.

Inventory is going up. I think people are trying to cash in. Question is…how high will it go? Will interest rates continue to creep up? What do sellers do in the face of both those trends? Do they start slashing prices, or do they pull their place off the market and hope for the next peak?

Inventory in OC going up up up.

http://i.imgur.com/C64IAZE.jpg

Inventory is all but down in King County, WA. We have just one months of supply… I guess, all those Kalifornians are now in Seattle. Is Northwest a new Kalifornia now?

Yeah, probably. We moved from LA to Portland at the end of last year, and it’s unbelievable how often we meet people that have recently moved from California. It also seems like every house that we see sell in the 400K-500K range has a car with California plates in the driveway. People who find work up here, or are able to work from home, sure seem to aiming in this direction.

Sleepless….Let me break the news to you very frankly since I have been in this Re game for along time, nobody at big boy meetings give a hoot about King County Wash. Decisions are made on both coast as to how to keep Ca and East Coast property from being valued and that subprime never affects them again in this century. The rest of the country just accepts it and hope they come along for the ride. No industrialist or banker who bought a 30 million apt in NY is making decisions based on what is best for overall America?

A lot of sellers coming out of the woodwork because they are not officially above water AND they fear that this is the last chance to sell before market crashes again. Their fear is justified and understandable because how in the world can you call price tripling of one’s biggest purchase in a short 20 years NORMAL.

There are still cash buyers driving up prices but those are dwindling in number. What’s still propping up the market is the fear for an imminent rate hike, but I don’t think that’s happening because the Fed has simply printed too much cheap money in last few years AND the govt has too much debt to allow even the smallest interest rate increase.

Ivan your Gov’t doesn’t worry about debt, matter of fact most are on a 30 day disaster in this country, live paycheck to paycheck just like Uncle Sam , if the debt was called in America would as broke as the guy asking for “brother can you spare a dime “on the corner.

Jim, I hope that you are right this time.

It’s not a question of if, but when.

Meanwhile, back in China, Uncle Yang and his prison gang are still making millions, even though the Chinese RE market is imploding.

Making LA & SF RE all the more attractive for hiding assets from the Chi-Com leaders.

And to have a place to land with $ bought citizenship.

Better do it now before they start up the firing squads.

But the weather is so perfect! Today it’s hot and humid with June gloom even near the beach. Perfect!

Got water?

Jim will be right at some point. Hopefully sooner than later. Keep the faith Jim.

I’m curious to know the average age of homeowners in California. I ask because 100% of housing inventory changes ownership over a period of 40 or 50 years as people die. In a normal situation where housing was affordable relative to incomes that wouldn’t pose a problem but in a situation where home ownership was heavily stratified by age and where property taxes have been grandfathered for 40 years it could pose a huge problem. Let’s take a house in California that was bought for $100,000 in 1975 by a 40 year old couple and is now worth $1,500,000, not unusual at all. Ownership changes and so does the tax basis. If its a San Francisco house there could well be estate taxes to be paid too as a 1975 $100,000 plus property could fetch over $3 million today! The county or city will be smiling if they have a lot of 70 plus year old homeowners today as they can expect a huge number of property transfers in the next decade but if local incomes are insufficient to buy properties at those kind of prices then property values are in trouble. That might not be problem in Beverly Hills or Pacific Heights where you have a global market to sell to but for less rarified communities, it most certainly will be.

There is also the issue of long term care. I don’t what the limit on assets one can have to qualify for medicare paid nursing home care but it is considerably below what a California house costs so many properties will have to be transferred before death to pay for long term care or avoid have the estate bled dry at a $8000 plus per month clip. So the demographic profile of California homeowners maybe a key metric in the next few years.

>> If its [it’s] a San Francisco house there could well be estate taxes to be paid too as a 1975 $100,000 plus property could fetch over $3 million today! <<

In 2015, the first $5.43 million is exempt from federal estate taxes .

Looking at that first chart, seems home prices about to plunge?

Plunge? Maybe a 1.5 million dollar house reduces to 1.2, but if think you are moving to ocean property for 250k I hope you live like Moses to 150 years old and maybe prove the Banks wrong since they control the values of everything. Up and downs happen but people who profess a total tank job can’t and won’t happen, America principles of not printing money went out the window years ago as long as America is the dollar currency of the world the funny money will be printed forever Unfortunletly but true. Take care

The Bible says that Moses lived to 120, not 150.

First 40 years as an Egyptian prince. Another 40 years as a shepherd in Midian. Another 40 years leading the Hebrews through the wilderness.

Sol….Nobody really knows how long Moses lived?

On the 30 year theme

10’s 2.47%

Channel is broken, watch for 2.66% and 3.04% high end channel levels.

Which means peak rates would be 4.5%

Longer term chart on 10’s right here, story line is that the housing cycles in the past has had a 2% to 2.5% move lower in rates in each future cycle

For that to happen in the future that means 10’s have to reach at base 0.95%

Milked this cow for as much as you can… maybe one more lower level cycle left

10 Year Yield Having A 2nd Taper Moment

Chart here very telling

http://loganmohtashami.com/2015/06/09/10-year-yield-having-a-2nd-taper-moment/

Something is starting to look fishy about how these properties are being sold

How can a place sale like this.

http://www.trulia.com/homes/California/Los_Angeles/sold/1077670-1213-S-Muirfield-Rd-Los-Angeles-CA-90019#photo-6

Date Event Price Source Agents

05/18/2015 Sold view detail $865,000 Public recordsPublic records

12/04/2012 Sold view detail $570,000 Public recordsPublic records

06/14/2012 Sold view detail $494,313 Public recordsPublic records

09/19/2007 Sold view detail $900,000 Public recordsPublic records

07/26/2004 Sold view detail $520,000 Public recordsPublic records

01/03/2002 Sold view detail $1,186,181 Public recordsPublic records

11/08/1999 Sold view detail $280,000 Public recordsPublic records

Money laundering. People from other countries have parked billions in US $. Buying property gives you a leg up if you want to request immigration status before your home country starts to uncover the source of the wealth and prosecute.

I live in a $700K crapshack. It’s a nice crapshack and you shouldn’t insult them so often. Of course, I paid $535K for it in 2011; if I’d paid $700K, I’d probably have a different perspective. (More luck than cleverness; I don’t expect to repeat it.)

The one thing that I learned from buying and selling any asset: IT’S NOT A GAIN UNTIL YOU SELL IT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

What if I take out more in loans that I paid for it to begin with, then walk away? Does that count? If I type in all caps, is my point more important? So many questions, so little time.

I didn’t buy it to sell it.

Its going to be interesting if we have another plunge. It is certainly warranted, but I think this new bubble may have further to run. Or perhaps we will see many many years of 1% home price change until the market comes back into check. I agree though there is simply no justification for prices in Southern California when you look at incomes. I’m just thankful I played the housing game reasonably well considering I bought my first home in 2006. I started reading this blog in 2008. Defaulted in 2009, bought a crap-shack for cash in 2010. Sold crap-shack in 2012 and put $150,000 down on a $285k house with a private loan. Refinanced FHA in 2015 at 3.25% 15 year and refied only $85,000. In 2008 I owed $400,000 on a $150,000 house at 7% interest with a 40 year loan. Today I owe $85,000 on a $400,000 “valued” house at 3.25%. Considering my taxes were $6500 /year on the 2006 $400k house and now they are $3500 on a way nicer house I am happy about that too. I went from paying $3000 /month 40 year PITI to $1000 /month 15 year PITI.

Why am I mentioning this story? With the current run in prices no one is going to help you unless you help yourself when home prices drop by 50% again. You can say its a moral question, but I have a family to take care of. Their well-being comes way before any bank. I would have been willing to work with the bank on a reasonable solution to the first house that they literally convinced me to buy by guaranteeing home values would never fall in Southern California (yes the lender not the real estate agent). I was dumb a naive when I bought in 2006. The bank never offered any solution other than a long delay foreclosure and I was better off for it. Many people may think I’m a terrible person for doing what I did, but I sleep really well at night knowing I am financially prepared for a 50% drop in the price of my home and that I can always take care of my family. I never wanted to get rich off housing, I just wanted a roof over my head which is why I will never buy an investment home. If I had it to do again obviously I wouldn’t have bought in 2006 at the peak of the market, but once in that situation I wouldn’t have done anything differently.

I agree that prices seem like they are high, but I can’t really imagine a scenario where prices drop significantly from here. If someone can play that out for me, I would be interested to read it. Maybe if we enter another recession, there will be some decline in average home prices, but if you take a look at the market activity in the prime LA neighborhoods, there is a severe shortage of inventory. In addition, one thing you are missing this time around is that the people buying these expensive homes are not subprime folks or people stretching to buy their first home, or people putting no money down, the folks who are buying right now are putting large down payments, have dual incomes in high paying sectors of the economy and are able to qualify for jumbo loans in a very different mortgage lending environment than the early 2000s. On top of that, you have foreigners from China, Latin America, Eastern Europe and the Middle East trying to park their cash in the safest markets on earth, and Los Angeles real estate certainly qualifies. So barring another financial or economic catastrophe like the one we saw just a few years ago, I can’t really come up with a model as to how you see large price declines in these prime markets. What is more likely to happen, in my opinion, is that in the next recession, you’ll see the normal rate of defaults and foreclosure, and everyone else will sit tight and ride it through, meaning, unless you lose your job and have depleted your savings, you’re going to hang on to your house for as long as you can because you put something like $200-500k into it. Also, since your mortgage rate is in the mid to high 3s, there is a huge incentive to just stay put. These factors will militate against a huge run up in inventory like what we saw in the previous down turn. Things might be less rosy in the IE and other secondary and tertiary residential markets, but that’s always been the case.

I know this is not what people on this board like to hear, but this is the sort of reality we live in and is a consequence of the state and local governments enacting policies that restrict or dramatically increase the costs of for-sale residential development. I was listening to NPR the other day and I heard a piece talking about gentrification of neighborhoods along the LA river. Someone actually commented in the clip that residents were afraid that building new housing stock in these neighborhoods would increase the cost of home ownership in these areas. So the solution these people want is to prevent any new residential development. Really? Like no one has ever heard of the law of supply and demand? The reality is, in the short term, new development probably will push lower income folks out of these neighborhoods, but the long-term consequence of these kinds of policies should be obvious to everyone.

And that right there answers your question. Financial catastrophe. That’s what will cause large price declines.

Fortunately the US and global economies aren’t cyclical, so there’s nothing to worry about.

While I agree that prices in SoCal are high, even if you see a significant drop, people complaining on this blog will still not buy for the following reasons:

1. they will say never try to catch a falling knife

2. the economic conditions leading to a major drop will be so freightning that they will be like a deer in headlights – paralized to take any action

3. the reason in number (2) most likely will lead to their unemployment or they will be so scared of loosing the job that they will still not buy.

That said, I am not advising anyone to buy in SoCal for the simple reason that values are so much better in other states. However, if someone wants to buy, be my guest – I am not stopping anyone from buying.

You defaulted because you were underwater. You were underwater because the Banks were granting loans to just about anyone who could breathe, in order to create high demand and run up the prices. They knew full well that it would all go bust, but they didn’t care because they would sell the loans a month later, oftentimes selling the same loan multiple times. That’s why all the notes were “lost”. There’s much more to this story. Bottom line is the banksters defrauded both home buyers and the investors who bought the loans.

Had the banksters done business prudently, home prices would have been much lower when you bought, and you would not have wound up underwater.

“Bottom line is the banksters defrauded both home buyers and the investors who bought the loans.”

You forgot about the taxpayers. They were defrauded, too. And the Attorney General is sleeping at the wheel. So far no prosecutions. I guess you just have one big happy mafia family and the AG and the president are part of it.

buying a house is a business transaction pure and simple. no morality involved. you can’t make the payments you give the house back and ruin your credit for a few years.

i had a neighbor in my old condo building who bought a 2 bdm 2 bth for 399,000 in ’06. it’s now worth 275,000. he should have walked away a long time ago

If others are impacted by the action, then there is a question of morality. Business and morality are not mutually exclusive.

Did you miss the part where DG claimed to purchase a home in cash the year after he defaulted on the loan?

>> i had a neighbor in my old condo building who bought a 2 bdm 2 bth for 399,000 in ’06. it’s now worth 275,000. he should have walked away a long time ago<<

No. Bad attitude. It's why today's American people are as much to blame for the housing bubble/crisis as banksters and realtards.

It shouldn't matter whether your house is underwater. A primary residence is not an investment, but a home. Not an ATM. Not a rental. Not a flip. It's a home.

If you like the house, like the neighborhood, if you want to LIVE there, and can afford the payments, then it's good deal. Whether its Zillow value rises or falls should not concern you. You have a home. Enjoy living in it.

If the 1% can get away with robbing the country and taxpayers I don’t see why the 99% can’t do the same thing on a smaller scale

If people buy and sell not on motivation anymore the whole market may just flounder for a long time or likely go down.

BEN…….

THE 99 percent would have their asses in jail if they tried what the 1 percent got away with!

“Their well-being comes way before any bank.”

The truth of matters is that your actions hurt other users of the monetary system (e.g. everyone else) far more than it hurt any bank. When you took out the loan on the 2006 property, new money was created that got transferred to the seller (and the transactional skimmers) on the basis that your future time and labor would be exchanged. When you defaulted, the money became debased. In other words, you stiffed those of us that pay our obligations.

Your actions are part of the problem.

umm, you “played the game” terribly..

Hello fellow patients. As our doc has noted, incomes do not support these prices but our beards grow long (you too ladies) waiting for real estate in so cal to tank hard. So what’s up?

We’ve seen the criminals at the Fed go QE crazy trying to keep prices up by dropping rates below 4% and then buying all of the government debt used to fund those mortgages with “money” they conjure from thin air. This not only puts upward pressure on prices by allowing a paycheck to debt service greater principal, but it has caused investors to take on single family homes as investment vehicles as they chase pathetic yields.

So what’s left? I think the wad has been shot on interest rates. I mean heck, a combo at Carl’s Jr. is pushing $10 now without commensurate increase in income these turnips can’t be squeezed for any more blood. But they can be squeezed physically.

I think the market is being propped up by density now. Think of a clown car. Have you noticed the burgeoning number of cars parked in the street? That’s because several adults are now sharing the homes formerly debt serviced by one… then two… and now 3 plus adults. I see this all around me.

On top of that, consider the open border policy. Where do you think those here illegally are living? They are occupying the lower echelon and the so-so neighborhoods forcing those here legally into fewer and fewer units. The quality of life measured by square feet per adult has got to be crashing. The doc of course has spoken of the adult children living at home phenomenon at length. I suggest that the last tool the bankster government is using to prop up prices is the open border.

Why does our own government hate us? It seems everything they do is to our detriment. I have a permanently wrinkled forehead trying to grasp the news of the day.

Our government has been taken over by the corporations (and the neocons). They write many of the bills, and buy the politicians during election campaigns. This is the definition of fascism.

Also, psychopaths are attracted to positions of power and care only about their own gain. Recent studies have shown that a disproportionate number of politicians and corporate executives are psychopaths.

So if you are trying to make sense of the news under the illusion that these people are like the rest of us…

Neil, it’s not just neocons, it’s also neoliberals, like Hillary. They’re ALL bought and paid for. Wall Street, banks, the MIC, and the deep state (aka the 0.1%s) are running things for their own benefit to the detriment of everybody else. Things are great if you’re at the top. If you’re not, well, too bad.

It is not just RINOs but liberals, too. Obama had 2 years of Congress all packed with democrats, he nominated the Attorney General, and he had exactly zero prosecutions for his buddies from Wall Street who paid for his campaign, over a billion dollars. It is a big club and you are not in it. Hilary is even a bigger fascist than Obama.

Ron Paul is not part of the establishment and for that reason he had zero chance for winning. The MSM in the hands of few guys shread him to pieces as anyone else who is not part of the club. Obama, Bush, Clinton, Romney and McCain are all part of the same gang. Keep voting the same pupets pushed by MSM and you’ll get the same type of policies forever. If you see a candidate who was part of CFR (Council of Foreign Relations), stay away from them. They are the biggest crooks you can vote for. You are free to vote for them, but don’t complaign afterwards.

The governement is by the FED and for the FED. All the decisions are for the best interest of Wall Street not Main Street. It doesn’t mater if you elect Democrats or Republicans they are there for themselves and their cronies not for you or me.

Just try to predict their moves, because you are in this game just for yourself.

Excerpts from the latest at MarketOracle on US Housing.

http://www.marketoracle.co.uk/Article50966.html

His projections for US home prices from 2013 and 2014 seem to hold true.

intro

The pundits in the mainstream press have taken the slowdown as further sign for the imminent demise of the US housing bull market by latching onto the likes of Saudi Arabia’s war on the US shale oil industry resulting in an economic slowdown or that the Fed surely must soon start to raise interest rates which is ignorant of the reality that central bankers will only raise interest rates when they are forced to do so by the markets, namely to prevent a wage price spiral, support a plunging currency and to halt a bond market panic, all of which are crisis events rather than one of central bankers signaling orderly intentions, as it should not be forgotten that zero interest rates are a PANIC measure. Therefore contrary to the Fed’s pronouncements, Fed policy remains in PANIC MODE, which means it will only be a greater panic that prompts actions to raise interest rates.

Again, I need to emphasis the point that interest rates since late 2008 have been in PANIC MODE, there is nothing normal about zero interest rates / negative real bond yields, and so the prospects for interest rate hikes should be viewed on as a result of a reaction to a greater panic for there is no free lunch as you cannot PRINT ECONOMIC GROWTH!

Therefore you can forget ALL of the noise in the mainstream press of the Fed RAISING US Interest rates because it is more probable that the Fed will CUT interest rates or likely manifesting itself in MORE QE i.e. the exact OPPOSITE of that which the mainstream press has been obsessing over for the whole of this year.

conclusions

Despite mainstream media persistent noise for an increasingly negative outlook for US house prices for a multitude of reasons, the ms-perception for which is supported by recent sharp drop in house price inflation to +4.7%, instead the continuing reality is for US house prices just oscillating around the central trend forecast of 10% per year as the long-term trend trajectory remains in tact for a rise of over 30% by early 2016. For which US house prices have about a years worth of price data to come.

Therefore I see no reason to undertake a more in-depth analysis at this point in time by delving into the fundamentals of the U.S. housing market such as looking at mortgage applications, housing starts, existing and new home sales data as the price has trended towards full convergence, thus U.S. home owners can look forward to at least another 9 months of a rising trend in house prices that I am sure will be accompanied by much gloom and doom commentary that I suspect will continue all the way towards NEW ALL TIME HIGHS for average U.S. house prices which I am sure will trigger much end of the bull market double top commentary by that time.

Right on track. The housing market today = stock market yesterday. The housing became an investment machine after “Greenspan Put” during dot.com bubble era. Since then, the housing has been all but the place to live, at least for “majority” of the “buyers” which are “investors”. Whatever keeps the housing prices elevated now, the very same force, which is the FED’s monetary policies, keeps the bond market, the stock market, the subprime car loan market, and all the other markets in bubble territory. The FED has proven to be a failure, it will fail again. We will not see any rate hikes any time soon simply because nothing has changed since the 0% rates were introduced. The economy is in worse shape than it was, we have more debt, we have fewer good jobs, we have more bubbles, and the too big to fail became even bigger. The FED will raise rate when we have a currency crisis, when the countries abroad will deny the US dollar, when no one will be buying the USTs, then the FED will have to raise the interest rates not because they want or can, but because they won’t have a choice. But it will be too late, as the US dollar hegemony will be over.

There has been lots of discussion on this site about Prop 13.

Today, LA Times posts this article that Prop 13 is due for an overhaul.

http://www.latimes.com/local/politics/la-me-prop-13-20150610-story.html

I believe Prop 13 will get the overhaul it needs but as the article says, it will be on commercial property first NOT SFH.

No one gives two chits if the State bans Foie gras, but if you think the 1% and Corporate America are going to allow moonbeam Jerry to stick it to them, you have another thing coming.

At most the only thing they might achieve is the elimination of just enough of the exemptions for ownership transfers for commercial property that have prevented reassessments to claim a victory.

Slippery slope. It always starts with taking an inch.

Maybe eliminate oo change 1031 exchange would be a start:

http://apiexchange.com/index_main.php?id=8&idz=26

Can’t wait for the bust so I can buy my first home. I’m self-employed and take a lot of deductions so I only qualify for a $350k loan with a 100k down payment.

Interesting how the Govt is helping the poor with their housing situation but the middle-class are left to compete with the cash buyers and investors.

No way in hell am I buying a POS house in Orange County for $550k. Infested with asbestos, needs a new roof, unpermitted additions, and just 1100 sq/ft. I can’t believe people are actually buying some of these properties. I guess they have no choice and cannot wait.

Oh, and the kicker, they buy these $500k properties, and 2 months later, list them for $575k and says “needs a little TLC, Make it yours!”. LOL

Oh, and everyone, please vote REPUBLICAN. That’s a sure way to get the economy to tank again. I will be voting Republican in 2016 for my own selfish reason. Even though it’s bad for Education, Healthcare, etc etc. I need my own place. So tank on!

@Andrew: Here’s a little secret for you: It doesn’t matter which party is in power- your life will remain the same or will be worse regardless. As Flyover noted, it’s a big club and you’re not in it, and Republican and Democrat politicians are all members of the same club.

What is the definition of insanity? – Doing the same damn thing and expecting different results… It never ceases to amaze me how clueless people are. Republicans, Democrats? It doesn’t f@kkin’ matter, two criminal syndicates, just like bloods and crips, two sides of the same coin. People keep voting the same crooks in and then whining about things being bad. Stop voting all together at most, or, at least, for the damn sake difference, try to vote some alternative candidate to see if it can make any difference – libertarians would be good example to start with, or someone who doesn’t belong to any party at all.

Left, right, left, right, the sheeple march over the cliff.

Republican/Democrat, two heads of the same beast. If they are from CFR (Council of Foreign Relations) they will pursue the exact policies of the predecesor regardless if they have R or D after their name.

If you want change elect the candidate which is most shreaded by the MSM because they are not part of the CFR. For the last 50 years all presidents come from CFR. Make sure they are against the FED because the CFR and the FED are the shadow government of US. Rs and Ds are just pupets representing the policies of the FED and CFR.

I know they’re working for the same master. Unlike Ron Paul who actually thinks for himself. Which is why he never had a chance.

However, statistics shows that every time a Republican is in charge, the economy tanks.

@Andrew, you would rather want the economy to tank so you can get your dream home? Be careful what you wish for, as, after all, if the economy tanks, you might not have a job to buy that damn house of yours….

Not worried about that, I have cash saved to purchase when the economy tanks.

I’m in the same position. I am about to be evicted from my rental for having cats. I have a good job and $ for a down payment but cash buyers have grabbed everything. I have decided to sleep in my car rather than buy at these prices. Commuting from the i.e. would not be worthwhile due to transportation costs. California has become unliveable for the middle class.

The only issue that matters is what the Fed does. They can’t raise interest rates. The USA has 20 Trillion Dollars in debt. But the Progressives will try to raise rates if they lose big in 2016. They really don’t care about people, just their agenda.

If rates rise, housing will crash. And it won’t take a large rate increase.

I believe QE4 is more likely. But sadly it’s all tied to politics. Washington does not care about the people…. only what they can get for when the whole system tanks.

Pray for QE4…. I know, it’s poison, but until we vote the idiots out of Washington, it can only get worse. And the crash is already part of the thinking in Washington. When Paul Ryan supports this nuts trade deal with Asia, in support of Obama, you know that China has a gun to the head of America. God only know what is in that deal. Funny how we can’t read it. If we could, I believe the whole system would crash… kind of like shouting “fire” in the crowed theater…..

Only God can help us now.

There are some delightful misapprehensions in your missive.

1) QE consists of the Federal Reserve CASHING OUT T’ bond and T’ note holders — in a loopy way — ELIMINATING the national debt. It’s been MONETIZED instead.

Translation: the astonishing top line US debt everyone kicks around is actually held by — drum roll : the US Government.

Rather like a snake eating its own tail!

FURTHER QE merely continues on this policy — perhaps until the US national debt has entirely vanished — straight into accounting entries back at the US Federal Reserve Bank — itself — de facto a US government owned agency. ( FORGET the nominal idea that the nation’s commercial banks ‘own’ the Federal Reserve. That silly notion is for PROLES and noobs. Their ‘ownership’ consists of PREFERRED stock shares. When did preferred stockholders ever run anything?)

2) 0-care is COLLAPSING the creation of new money.

New modern money is created by bank entries when new debt is incurred. The overwhelmingly large nature of first mortgages makes them — BY FAR — the dominant source of money in the economy.

The bills in your wallet are mere walking-around-money and are CONSEQUENT to the creation of money via the commercial banking system.

If any of this is new to you, go to college and get a four-year degree in economics… Or read all of the financial blogs.

BECAUSE 0-care taxes young, healthy, newly family forming couples at ultra stiff rates to pay for its largesse those able to take out a first mortgage for their first home purchase has COLLAPSED.

This means that — with each month that passes — the nation’s money supply MUST SHRINK.

The above mantra needs to be chanted 10,000 times each day for it to sink in. Across all pundit channels — no-one has the moxy to figure out something as obvious as this. So, yours truly has to do it.

THIS is why the US dollar is strengthening. It’s becoming ‘scarce’ compared to the tsunami of Yen and Yuan and Euros gushing forth.

&&&&&

So, where as YOU think that the nation’s debt is exploding — it’s actually CONTRACTING.

EVERY bond bought by the Federal Reserve Bank is destined to be held until maturity. At which point, the government takes money out of its left pocket and puts it in its right pocket.

The amount of US Treasury debt held by the public/ aliens is SHRINKING.

Should the Fedsury begin to hike interest rates, the long market will be sitting inside the US Federal Reserve Bank.

The OLD lid of 30% ownership in any given coupon has been REPEALED.

HINT, HINT, HINT.

I don’t know what Blert will make of this, but Assurant Health is shutting down due to O-Care: http://www.californiahealthline.org/articles/2015/5/11/assurant-health-to-be-sold-shut-down-in-2016-due-to-aca-related-financial-losses

This affects me, as Assurant is my health insurance provider.

Blert,

You make a lot sense. can you elaborate on the economy in the US as a consequence of all these? forget the rest of the world. A lot layoffs in the year in the coal and gas/oil industry now, a lot pressure for the healthcare industry too.

Blert- Are you saying there is no debt bubble nor a credit bubble?

And now we understand with clarity why the USA is 20 trillion dollar in debt. Do you happen to work for the Government, and sit next to some guy names Gruber?

Hi Blert! What you wrote is facinating! What do you think this means for the housing market in So Cal in the near future?

What are you talking about? This administration promissed to be the most transparent ever and you tell me you don’t know what is in TTP, TPP and all the the other trade agreements???!!!!…

Interesting comment

The fed is in a trap, they will raise rates to allow for your qe4 as it will be necessary..

External shock to debt markets will be cause for concern, risk is mispriced across the board and that liquidity could dry up fast in event..

I still don’t see much talk about water here. I almost think it still is undervalued as far as what happens in California next

I think a number of commenters have hit upon it, but it is the Chinese and huge pools of hedge fund money that have predominantly driven the market for the last 5 years in California! An article today suggested that banks are starting to put foreclosed properties back on the market in California as well which may add to inventory. But, large hedge funds have mostly gone, so it is a relatively small group of individual investors, and monied buyers, playing the market in California. Add to that the decidedly upward trend in interest rates, and the sellers market could end pretty quickly!

Sellers market coming to a end of course. Nothing just stays the same the same (?) On this blog how bad a drop will occur is the argument. To be blount about it, I don’t thnk most folks will still be able to buy a home there, the values will drop but not enough for a so called CA lifestyle.

Even if we could predict market direction I think the powers that be might be conditioning the naysayers from ever buying and be permanent renters. I wonder if a group maybe analyzing all the rentals vs owners just to see how many shift from one group to another to determine when the time is right to pull the plug on the bubble.

Texas keeps getting mentioned like it is some kind of paradise/escape from CA. Austin isn’t as expensive, but just as bad:

https://www.reddit.com/r/Austin/comments/38puzx/just_sold_our_house_in_78753_i_feel_so_bad_for/?limit=500

The mortgage interest rates are gradually rising

Few months back it was 3.5 now bit over 4

The Fed would increase interest rate sooner than later

This would increase the mortgage rate

The common people getting jobs are not that well paying jobs

The large investors are all gone. Small ones are now leaving at this evaluation.

Affordability is pretty low.

Let’s see how does the housing market do in next few years..?

I dunno. Looking at this chart, if you draw a line trend line through the data to flatten it out, I’d say we’re right about even. This last bust was pretty unique in that the entire financial bubble was built on housing. This new bust will probably be more like the dot com bomb circa 2000, and as you can see, housing did not budge all that much then. I’d say we are probably in the “new normal”. It’s too bad for the middle class, but the foreign buyers, hedge funds, and flippers are not likely going away. The population near the California coast is only going to increase as well. California housing is still a good buy, if you can afford it, I wouldn’t hold my breath for 2011 prices anytime soon.

If and when the bust arrives, why would the real estate market, hedge funds and Chinese investors, be immune? Never before has cheap money from the Fed circulated throughout the entire economic system like it does now. The search for yield during the era of ZIRP has forced investors to pile into risk assets transcending even the stock market. Real estate funds do have to answer to investors who many not withstand severe economic shocks. Chinese investments can dry up if their economy continues to struggle. Flippers went away during the last downturn and didn’t return in droves until prices stabilized.

I’m not saying housing will be immune, it will certainly take a hit. But nowhere near what happened in 2009. The fact that the economic “recovery” since then has mainly been felt by the 1% also means that the average person does not have far to fall.

Few facts my friends in 2007 told me in san diego to justify that the real estate prices in san diego would never go down. Those facts still remain intact:

1) SD is locked between ocean n desert thus limited land here

2) best weather , everyone wants to live here

3) a lot of rich people in san diego

4) awesome companies like qcom n now illumina

These facts are still facts even today.

But as everyone knows but a lot of people ignore that real estate in socal is a boom n bust thing.., it always was like this and it always would be like this..

>> 1) SD is locked between ocean n desert thus limited land here <> 2) best weather , everyone wants to live here <<

I've been to San Diego. I wouldn't want to live there.

“1) SD is locked between ocean n desert thus limited land here”

Is that true? Isn’t San Diego IN the desert? Irrigated desert, but still, IN the desert.

And irrigation — and housing — can always spread eastward, if water is available. Conversely, the desert can always reclaim San Diego should this drought continue.

“2) best weather , everyone wants to live here”

I’ve been to San Diego. I wouldn’t want to live there.

john… My wife and I can live anywhere we want and guess what boring, always freezing by the beach and to many lets say suspect people wondering around the beach, it was and never will be our choice. stay safe

In a previous article from Dr. Bubble on the topic of the CPI and its largest component “Owner’s Equivalent Rent,” I wanted to introduce now on this newer thread the the Chapwood Index, which reports the unadjusted actual cost and price fluctuation of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities in the nation) has been averaging more than 10% increase a year for the last four years.

http://www.chapwoodindex.com

Another 5 years of this 10% plus inflation and we’re looking at not being able to afford to eat (as a country), so the question is what is the FED going to do about it?

If other basic needs, such as water and food, were speculated on like housing is, there would be mass riots throughout those cities. Before then, I hope that the bond market forces the Fed to finally raise interest rates and burst the bubble.

They are. Hedge funds and asset managers buy commodity futures when other asset classes don’t look so good. Ever wonder why food prices go up in recessions when presumably people have less money to buy food?

I can tell you for sure that all the low unemployment numbers and highest numbers of jobs posted are all BS

Most of the jobs are low paying jobs , temp jobs, low/no benefits.

A lot of people gave up on looking for jobs and they are not counted as un employed

A lot of advertised jobs aren’t real jobs that they need people to fill. They’re sinecures for friends or the owners or other current employees. These “jobs” are usually left open until someone’s friend or kid becomes available to work there. Jobs are posted to get around Equal Opportunity laws and to get a sense of the competition. If there are so many jobs posted, why isn’t there an insane amount of hiring going on right now?

“Most of the jobs are low paying jobs”

The Santa Monica Daily Press reported today that the SM City County intends to follow L.A.’s lead in enacting a $15 minimum wage law.

That’s great.

So we think that anyone getting a minimum wage or a bit above minimum wage of $15/hr with little to no benefits would be able to afford a house in so cal ?

It does not really make sense to bring the topic of minimum wage when it comes to so cal housing

In fact, minimum wage should suppress socal housing. why ? If the minimum wage is increased, this is gonna increase cost of a lot of things which means that less money for monthly housing..

Here’s an abnormal flip. It’s for a Bel Air mansion.

Bought for $25 million.

Listed ONE WEEK LATER for $33.5 million.

http://variety.com/2015/dirt/real-estalker/sam-nazarian-flips-bel-air-manse-back-on-market-1201518635/

Most relevant (to us small players) in this article: “Is this spectacular increase in desired value for the Grey/Nazarian estate simply emblematic of a still exploding top-end real estate market or is it an overt signpost that the current real estate bubble is about to burst?”

Oh, it was “sold just weeks ago” rather than one week.

I could retire quite happily on the proceeds. If only I could borrow $25M to be able to do this once…

Real estate investments are swinging up and down, people should check the market before making a huge investment.

That overpriced shack is Pending Sale. wow….

Oh my gosh, so I don’t blame Dr. Housing Bubble when we lost about $250k for selling our home back in 2009 because, based on my own common sense from the economic outlook it just made sense that prices would keep dropping. I was reading all your articles, going, “bahahhaha!” when the economists were saying prices were gong to rise. Who knew the Obama Admin. would bail out the banks and they would hold on to the repos and leave them vacant or let people stay in their homes? There was no inventory to for anyone to have to compete for sales. I convinced my husband sell our home, even though he still had seven more years to retire. He retires in January. We are moving to TX, we cant afford to stay in CA now. Yep, we’re still renting and the home we sold for $525k, is going for about $775k now. I feel really bad but have to let it go. The past is the past, I want to enjoy what I have now and won’t look back, except I’ve learned a VERY expensive lesson.

Just an FYI the Bay Area is almost a mirror image of what you guys in so cal are experiencing. Tons of chinese buyers in 2011 but have slowed down now. Houses having 10 offers + over the asking price. Rent is outragious. Simply put.. I see a whole bunch of people buying these housing who just honestly cant afford them. This is almost exactly what happened in the last bubble.. An we all know how that worked out.

It certainly seems that way, with prices in this area reaching an all-time high. It’s representative of the rest of the country just more pronounced. While sudden spikes can be scary, there’s a fine line between danger and a positive trend. When you look at the US averages – http://www.thanmerrill.com/fortunebuilders-2015-real-estate-trends/ – it’ s tough to say which side of the line the positive direction lies.

2018… no bust yet?!! How much longer do I have to wait?

Hmmm….? Still waiting

No answer from Nostradamus…

And now that “taco tues” house is 1.1mil…

Leave a Reply