Is another California housing bubble possible? Median home price up 16 percent over year reflecting mix of sales while income growth is stagnant.

California home prices experienced a big surge in 2012. This might fly in the face of stagnant household incomes but the incredible push for lower interest rates and reliance on low down payment FHA insured loans has brought many people off the fence. In Southern California home sales are up by 14 percent over the last year and the median price is now up by 16 percent. The median price is largely being pushed by the mix of home sales. Distressed properties are making up a smaller pool of sales. With low inventory, you have regular home buyers competing also with house flippers, big Wall Street buyers, and foreign money with limited supply on the market. The result has been to push home prices much higher making it more difficult for middle class families to afford a home. As we approach the end of 2012, let us look at the data for Southern California.

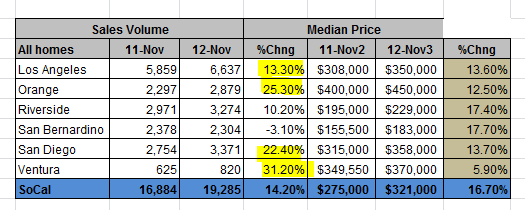

Southern California home sales and prices

The trend for higher sales and higher prices continued throughout the year:

Of the above home sales, 33 percent were all cash buyers. Cash buyers paid a median $263,000 for purchased homes, and this is up a stunning 27 percent from last year showing the massive pressure being brought on by low inventory. Of course all cash buyers are largely investors and they are consuming a third of the market.

Next you have about 16 percent of homes being purchased with FHA insured loans. This is down from 21 percent last year and about a third from two years ago. FHA loans are now becoming much more expensive products to take on with higher insurance premiums courtesy of massive defaults in the overall portfolio.

Jumbo loans are now back in fashion. 21 percent of sales last month were financed by these kind of loans (above $417,000). Short sales made up about 25 percent of the market. Activity is picking up but what you see is that investors are paying much less for the properties they buy while those looking for move in ready homes are leveraging up, many with jumbo loans or low down payment products.

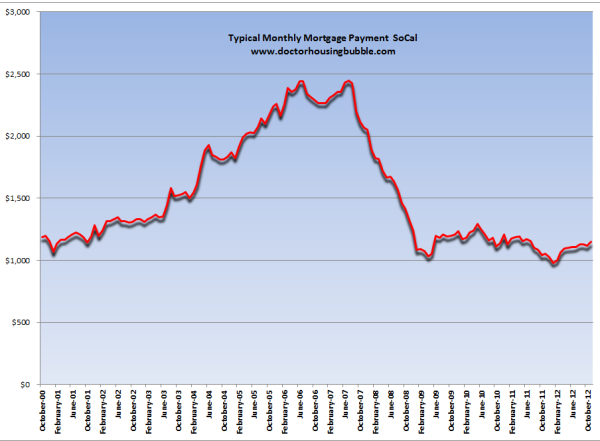

What is a more telling sign is the amount of the monthly nut for home buyers with a mortgage:

While home values are moving up largely because of low interest rates, low inventory, and investors you can see that those financing homes with mortgages still cannot afford higher payments. The amount people are taking on via mortgage payments is still close to half of what it was during the peak.  This is a better metric of what local households can truly afford based on their actual income.

Another bubble brewing?

It is hard to believe how quickly prices are rising but when you look below the surface, you realize that this rush is coming via cheap money and hot money from other sources. Many investors looking to buy homes to rent out are now turning away from places like the Inland Empire because the yields are no longer attractive. Flipping can only go on as long as easy financing is in play. Foreign money will only continue so long as our economic growth is in play. The Fed keeping interest rates low has given the market a major boost but how will life be after the boost?

The animal spirits did come out in 2012 at least for housing. Yet the economy is still weak and the young home buyer section of our economy is still in economic shambles. Unlike previous generations this group now approaches the home buying market with over $1 trillion in student loan debt. Many are unable to finance a home in high priced states like California. The figures of the last decade certainly show a large migration out of the state by the middle class.

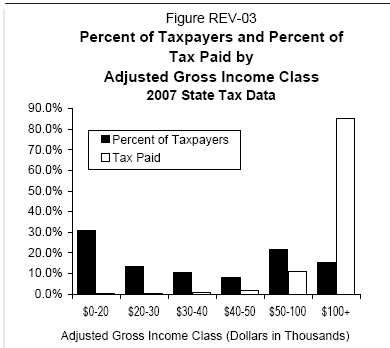

It seems like the economic split in California is only growing deeper. California is very much a boom and bust state. A large portion of revenues come from higher income tax payers, many who depend on the whims of the economy:

With higher taxes coming online and a recent bull stock market, can this continue? Many pay very little to no taxes and as we mentioned, the state is nearly half and half between renters and home owners. A more stable tax basis comes from property taxes and we are already seeing talks about Prop 13. If you take a look at Texas with incredibly high property taxes and strict laws on funky mortgages, they rode out the housing boom and bust with little issues. California going into another boom is easily understood when you compare taxes for example.

Say a home in California sells for $500,000. The taxes paid depending on the county will be about $5,000 to $6,000 per year. In Texas you are looking at annual taxes of roughly $15,000. This keeps a lid on massive price movement because those paying $500,000 can actually afford the larger monthly nut. California’s current rise is a matter of artificially low rates and investment buying. There are also stricter rules on tapping out home equity but it is interesting as a comparison.

The quick counter is that we have coastal regions and many prime locations. Of course. But what about the Inland Empire that is now seeing major price hikes? What is going on there? So something else is happening and it is certainly not coming from higher household incomes.

Is another bubble in California possible? Absolutely. Prices are rising disconnected from household incomes. The only way we keep moving at the current pace is if all of the above groups continue to purchase: investors, flippers, foreign money, FHA loans, low Fed rates. Missing from the equation is household income growth but then again, this is repeating the history of the first bubble run.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

68 Responses to “Is another California housing bubble possible? Median home price up 16 percent over year reflecting mix of sales while income growth is stagnant.”

Indeed the good Doctor echos a known theme in the twilight of all great nations.

Herd mentality and 1000’s of hours watching entertainment stuffed with propaganda has the masses chasing things they don’t need with money they don’t have. 9 & 10 year olds with high tech smart phones using 5 gigs of data + a month. Who pays for all the cell service with unemployment in the stratosphere. Who pays? We used to be a nation of savers now it’s quite the opposite. Indeed we are what we see.

buy an SFR for under $100K including fixup costs, rent for over $1000 per month, get financing based on new home value after stabilized, make sure you dont make your monthly nut higher than the rental income so you have a little cashflow, keep tenant in property, repeat 100 times viola you are a multi multi millionaire and if you cashflow $200 per home you will be making $20,000 per month in passive income. This is being done all day in the I.E. it’s crazy to see what is going on right now

Not in this corner of Inland Empire, Sun City section of Menifee. Property just sits. There are so many REOs (hidden, of course) that standard sales are forced to lower their prices to below last year levels and For-Sale signs molder in the wind.

Great and I bought here in sun city because I felt it would be a good investment at resell or if I rented it out to someone 55+. Figures! I’m starting to get the real feel around here now that I’ve been here going on 3&1/2 months. Very progressive areas surrounding but dying on a vine in my area. Economic prices geared for senior citizens? Sun city gas is higher than many surrounding areas gas prices. I suppose us senior citizens are to now sit at home and be content in our rockers? I see no truly cheaper items or services offered for real around here. And in sun city here you have so many HOA rules and restrictions I wish I’d done my home work better. Bad investment?

The whole point of having a mortgage interest rate in the 2% range is that incomes do not have to rise in order to afford the monthly payment/higher-house-price. Again, rent parity is getting a lot of people off the fence and investors as well. Mortgage rates are at an all-time low as well.

I’m not seeing rent parity in the higher demand locations. Wish I did, but it’s not there.

When talking about reductions in inventory, don’t forget HARP and Prop 13.

With more and more underwater home”owners” being able to re-finance at lower rates under HARP to better afford the monthly nut, it essentially keeps them chained to their current residence since they can’t afford to sell. Result? Reduced inventory.

What about Prop 13? It’s a clear disincentive to selling a property in favor of remaining and modifying or transferring to family members to avoid a new, higher assessment. Result? Reduced inventory.

Both of these sources of reduced inventory could in play for dozens of years to come.

First there are a very small percent of homeowners left (largely retired who could afford no more) who have stayed in their homes due to Prop 13. For them to leave their homes to their offspring likely keeps the offspring from having to rent. Prop 13 is a good thing for all new home buyers as it does keep the taxes at 1%. It is low wages that keep people from affording new homes.

You’re denying Prop 13 has any effect?

One study showed Average tenure length for owner-occupiers in California in 1970 was 10.76 years, compared to 10.68 years for owners in Texas and Florida in the same year. By 2000, these figures had risen to 13.44 years in California versus 11.69 years

in Texas and Florida (Brookings-Wharton Papers on Urban Affairs: 2005)

Sure, most of those homes purchased in 1970’s have sold turned over; but, forget about the 1970’s, what about those who bought prior to 2000? I argue that the wash-out of short-sellers and REO’s occurred in the 2000-2007 time-frame. Who is left standing (and holding onto their Prop 13 lottery home)? Those who bought pre-2000.

Boomers are notorious for not having saved properly for retirement. Why sell their Prop 13 lottery home when they’re the beneficiary of the Southern California lifestyle and climate and/or getting market rents while paying below market-rate property taxes?

Prop 13 has a huge effect in any desirable area in CA. I recently bought in the South Bay and have talked to several long time neighbors…their story is all the same regarding owning there forever. I won the housing lottery, I pay hardly any taxes, I can gift tax basis to my kids or rent it out for market level values…now why on earth would I want to sell? Prop 13 sucks and is unfair but won’t be changed anytime soon. Good luck trying to break into one of these entrenched neighborhoods!

Prop 13 might not be so sacred anymore. We have a Democratic super majority in California State Legislature in 2013, which hasn’t occurred for 80 years. Should make for an interesting year.

LB, I have lived various residential neighborhoods in the South Bay and have heard the same exact story. I’ve also driven through many Westside and South Bay areas and seen many a major remodel where one lone wall is left standing. Gee, I wonder why? They must really like that wall!

There are still lots of zero-down deals out there by combining various federal subsidies. But even at 3.5% down, the buyer has little stake in their house so the Bubble is perpetuated. Also, as realtors are fond of saying, “All real estate is local” and the Cali rise is definitely unique to that market. In other areas such as the Midwest and Central Texas prices are still dropping on ‘pre-owned houses.’

Not really. The wave of Californians who are inured to overpaying for everything keep moving to Texas and driving up the prices. The mentality seems to be: “In Texas, you only get raped once a week instead of everyday like in California! Yay!”

I’m getting a little tired of the false equivalencies people keep making between Texas and California. The two are not comparable!

Again, if all of these properties are going towards rentals and not a regular residency, what’s the problem? It will simply lower rents in those areas as there will be more compitition.

I’d much rather have the house occupied and not abandoned.

I’d much rather have the property tax being paid to fix roads, not starve infrastructure funding.

I’d rather the streets be filled with people, not a ghost town with tumble weeds floating by.

The problem is that if the market wasn’t being massively manipulated mostly at the behest of the privileged class, there would be folks of average means buying these homes to live in at prices they can afford.

brad delong is a gas bag!

Here is an example of what you can get for $445,000. Repayments with an FHA loan on this amount would be about $2900-ish a month with 3.5% down

To Buy:

This sold three days ago. With FHA $2900 (all in):

http://www.redfin.com/CA/Orange/583-N-James-St-92869/home/3415327

With 20% down and a conventional loan and no PMI it brings it down to $2100-ish a month (all in). Significant difference and brings the cost down well below what you would pay on renting it. How much should you budget for maintenance? Not including utilities as the rental doesn’t.

To Rent:

They have just listed it today. $2500 a month. Don’t know if that is a fair amount. Let’s assume it is.

http://www.homes.com/listing/178083608/583_N_James_St_ORANGE_CA_92869

So unless you have the 20% down it doesn’t look like a very enticing proposition. I don’t know how the mullets and monster trucks around there do it :p

Buy now or be priced out forever!

LOL!!!

Yes, buy now before the house prices drop another 20%. Get in on the Top Floor. LOL.

this market is being manipulated ,banks holding inventory, screw me once shame on you screw me twice shame on me. stay out of debt its a trap you have been warned

Very true…unfortunately, people parrot the pretzel-like logic they see and hear about why consumers over-leveraging is a boon to all concerned. They are Babbitts.

It does not matter. All bubbles pop. This is just a mini-bubble on a long decline down. Eventually what happens is you run out of buyers that can afford the higher price houses and then the decline resumes. Prices have to revert back to where they started. You can lower interest rates to 0% with no money down but it goes back to the same point that you run out of qualified buyers. Prices then have to go back down.

This is absolutely not a bubble. Where’s the hysteria? Where’s the get-rich mentality? I don’t hear it, see it or feel it anywhere.

Instead of buyer mania, this around it’s a simply a juiced marketplace. There’s a big difference.

In a world without Wamu, Countrywide, NINJA loans, Rating Agency malfeasance, unscrupulous appraisers, etc., we will, relatively soon, see a ceiling on this recent run-up. It won’t turn into a bubble. It’s a dead-cat bounce. Eventually, the hot money will find other targets. As prices rise, cap rates will shrink and investors will bail. Recent news saw a slight uptick in rates and new mortgage applications plunged. Incomes aren’t going anywhere in the face of a permanent global marketplace and a moribund U.S. and California economy struggling to pay its bills.

I’m seeing all the foundations of a bubble. Homes that are selling for rent parity or below are getting multiple offers the day they hit the MLS. I’ve seen this for homes as high priced as $730K. In Antioch, I’ve seen 20 offers the day homes hit the MLS. And the seller wants to have offers that include language saying that the buyer will pay cash for the difference of the offer prices and the appraisal.

With mortgage rates headed below 3%, this is bringing in lots of buyers. Owner occupied and investors. This game is on as frustrated owner occupied buyers will end-up bidding up properties out of frustration.

Our discussion hinges on what we mean by “bubble.” I’m talking more about psychology than economics; e.g., groupthink (“Home prices never go down!” and “By next year I should make another $200k on my home and will be able to move to Brentwood!” ) and herd mentality (“The secretary at work is getting rich flipping condo’s in Vegas and so am I!”).

Homes that are at rental parity getting multiple bids signifies a bubble, or even the foundation of one? What you describe seems more like eager buyers operating in the face of “real” economics: low interest rates and constrained inventory.

Sure, eager buyers will always over-bid: those people who have already made the decision to buy versus rent, have given themselves a limited time-frame to act, have narrowed down their desired neighborhoods and who have lined up the financing to pay more than what is “market price” will fall prey to psychology. That’s always been the case.

What we saw 1998-2007 was the whole nation (citizens, media) believing that home prices never go down and that buying real estate was easy money for everyone. Institutions accommodated the insatiable demand by either looking the other way or deciding to get in on the action while the getting was good (many financial “tools” custom-made for California). For awhile, they were all absolutely correct.

California median prices have always fluctuated from the National mean. We’re still in a period of disconnect from the Nation. But, this too shall pass.

I agree that we will probably not see the lending criteria like we did back in the early 2000’s. But I am seeing appraisals starting to bend to meet the offers and I am hearing people justifying the purchase of a home rather than renting. So it’s more than likely going to be a scaled down bubble or strong bump in housing prices to the upside. But I am seeing multiple offers and short time on market sales, etc….All indicators of a shift in the psychology of the populace about buying a home.

You can lower interest rates to 0% and give everyone who buys a new home a $50,000 cash move in bonus, but this market’s going down! As in, crashing! No jobs, $8 per hour jobs, poor economy, uncertainty, horrible returns on investments, an aging population.

The housing market is a rigged circus. It’s a complete joke. But the joke is almost over. The dollar will come under fire. Interest rates will rise to fair market value, and housing prices will crash!

Well Bernanke’s plan has worked, so far. But he is leaving after 2013 and Obama will still be in office, Whatever happens at the end of 2013, beg 2014 will be on Obama’s watch, it will go down in history. Hold on tight it’s gong to be a bumpy ride…..

IT’S A TRAP!

https://www.youtube.com/watch?v=XOSUKnnLXQg

I believe this rebound will be short-lived. This economy has too many problems for California home prices to keep escalating.

Bubblelicious once again. How soon people forget. About 5 years to be exact. Yes mortgage rates are attractive and rental parity is found in SOME areas. The reality is, are you prepared to live in the area you can afford for 10 years? At the rate banks are leaking out the shadow inventory, and that’s how long it will take to get it off their books. By that time, inflation should have taken it’s toll and housing declines will have been erased. Just hope and pray that the REAL economy doesn’t get worse and your job remains intact for the next 10 years. Otherwise it’s just wash, rinse and repeat for the banks. They officialy have carte blance to wreck the real economy whenever they wish now. There is no moral hazard for people without morals and government backing. Deadly combination.

So choose wisely my friends and be honest about the next 10 years. If your happy with the neighborhood, have steady income (not reliant on an employer), and can afford the costs of buying a house along with other inflating goods and services, dive in. If not, the costs and risks in the market are increasing for you every day. Don’t you just love a bubble/bust economy?

You can probably find a NICE house now for 2 million on the Westside SOMEWHERE. 1 million is again the the price of a STARTER on the Westside. Welcome to Japanese style economics.

http://www.westsideremeltdown.blogspot.com

Three thoughts…

One-Everybody should have their profession listed after their name.

Two-How many cities in the US need these low interest rates to keep alive their market? LA, the Bay area, NY-most home prices outside of these areas are fair correct (3X)? Home prices will only go down marginally when interest rates rise. So interest rates seem to keep a few select areas alive like our SoCal area which would mean we are in the minority I would assume. I’d be curious to see how many locales are in bubbles vs NOT and just what percent of the population that embodies.

Three-Prop 13 seems somewhat unfair to me from what I understand and especially being a renter. If your home gets appraised when you retire and it doesn’t increase after, that would be somewhat fair for the rest of your retirement. When I know people that are bragging they pay under $1000 in yearly property taxes and their home is worth well over $600k at least(more than that now in this bubble), that just doesn’t seem right. BUT, if I were in their situation I would be happy. There should be a happy medium to this right? I think long term homeowners should have a discounted tax to pay, but under $1000 for that long? That’s like numbers for rural Arkansas and doesn’t make sense in the the top three cities in our country.

Why?

If a house doubled in value, why should taxes go up?

Does the house suddenly need more, higher priced “vital services”?

It’s not those residents fault the state is infested with idiots hell bent on feeding the cancerous state.

They are heroes.

The best thing that could happen to the “Golden State” is to have some people who actually think become residents.

Hey Pat, I was trying to think when I left that response that was very open to discussion. I see all sides of this and am just stating something that doesn’t seem fair. So if the end of your statement was directed at me that’s rather ill spilt. In addition to everyone having their occupation next to their user name, it’d be great to see income and rent/own status. I just turned 40 and never owned a home and am a hard working film editor. I would like a modest home not an investment. Why should I have to pay several thousand more for a home when I get one than my neighbour who has owned for decades? I’m contributing more in income taxes than many home owners around me while renting. Should I leave the state when I’m gainfully employed and a union member? Where should I live to do what I do? I don’t begrudge people, I’m just asking in general what would be a fair compromise on this prop 13?

Here’s the rub–would the property owner who bought x number of years ago that is enjoying a subsidized tax valuation thanks to Prop 13 be willing to sell at the price they purchased the property for originally?

Probably not. Why? Because that property owner would claim that a devalued dollar and a (hopefully) appreciated neighborhood makes their property worth the surrounding comparables.

Given that likelihood, how is it equitable for the market that the Prop 13 subsidization properties enjoy a non-comparable advantage? If it is equitable, would it also be equitable if folks paid subsidized use tax based on their length of residency in a given locale?

My own personal view is that Prop 13 was an admirable attempt to force politicians’ hands but in the end it has achieved the opposite effect. Sacramento and local politicians have instead just pushed up taxes in other areas. The net effect is that those who are not in a privileged position of having the tax subsidy end up sharing a disproportionate tax burden while those in the subsidy enjoy the same if not more advantages of the community.

Daniel’s example proves my point and extreme cases such as this demonstrate how Prop 13 is allowing an unfair arbitrage of the market at the expense of the majority of us who don’t enjoy the subsidy.

Paul

Fair is simple

Drop taxes to Prop 13 levels for everyone.

Hello Paul I think my mothers home is a prime example of Prop 13 beneficiary. My grandparents bought the house in 1955 for $16K. The house was passed onto my mother and has not been sold since 1955. Her annual property tax is $1,900 per year. This is a 3bd 1ba house North of Montana Avenue in Santa Monica. The fair market value is approx $1.8M. Therefore, if and when the house sells, the taxes will go up 10x. This in part, is one of the reasons if me and my siblings inherit the house, we wont sell it either… we will rent it out and continue to pay $1,900 in annual taxes.

I think what you said makes prop 13 unfair. Keeping your grandmother who is retired from loosing her house based on taxes is one thing. Letting someone like yourself gain market value rent and not pay market value taxes is another. I think this is the compromise that needs to happen. Owner occupied units should be able to keep the tax rate, but it shouldn’t be something that can be passed down generation to generation. I don’t know how old you are, but conceivable you could pass this house onto your kids and maybe it gets sold in 2055. 100 years of ownership and the state is only collecting the taxes based on a house that would be 100 years old, let’s get real. Inflation is real and needs to be taken care of, not to mention as the infrastructure ages all of it will have to be replaced eventually and it should be the homeowners who are paying that bill.

Makes perfect sense and you are fortunate. We all definitely deserve breaks these days. My wife and I have just had a baby and even though we have a decent down, there’s no bright outlook when $500 k gets you a burbank box 🙂

Very well put Joe. Very well indeed!

Daniel, you just gave the perfect example of why Prop 13 needs to be overhauled. It was sold as “we don’t want granny getting taxed out of her house” and has morphed into something much more perverse.

I personally think Prop 13 should only be allowed for primary residences after people have reached retirement age…then granny truly won’t get taxed out of the house. No investment properties, no inheritance welfare, etc. If Prop 13 didn’t exist, your house wouldn’t be worth 1.8M and that’s a fact. Prop 13 has greatly benefitted several generations; however, the current generation will utterly get screwed by it.

Actually, I’m not so sure that it’s even fair that a resident owner has a locked-in tax rate even during retirement. The cost of services increases over time. Linking tax revenue to the value of property is an imperfect attempt to solve this problem. The typical (non Prop 13) ownership cycle if for retired empty-nesters to sell the large home they no longer need and move into a smaller home. This seems like a generally more fair solution to paying for the services provided to society by government.

Way to go, Daniel!!!

You are a true hero.

Let these other “fairness” idiots pay the taxes for their “vital services”.

They actually deserve a stuck on stupid tax.

Damn the torpedos(stagnant wages)…Full steam ahead(housing inflation)

Just who or what is/are greasing these wheels anyway?

Your articles past and present have done well in answering most

of the questions…thank you

Two things in this post I don’t understand. First, San Bernadino County had the largest median price increase (on a percentage basis) but also showed a DROP in sales. If prices are improving, I would expect Banks to try to unload their REO and for individuals to sell as they get back to level or better on the mortgages. An increase in price and a reduction in sales implies that the market is supply constricted. How is that possible in San Berdo (without assuming an anti-trust conspiracy on the part of banks)?

Second, I don’t understand the comment that increased property taxes in Texas prevented a property boom and bust. Obviously, preventing NIJA loans would have reduced the boom and bust but I don’t get the taxes part. Can anyone explain?

Hmmm…well………if prices are going up and income is stagant or falling…….that can really only mean a bubble.

It is only a matter of time until the Democratic controlled government does away with prop 13 and then property taxes will be like the promised land of Texas. Let’s face it folks, California has to pay its bills(unlike the Fed who prints funny money), and the only way is to shoot Prop 13 with good liberal guns. First, it will be the businesses, then they will come after you home owners. The beast has to be fed. Happy trails.

There is something to be said about homeownership in general in a shakey economy. Here is what gives me comfort: If I fail to pay my rent for three months due to my husbands unemployment, then a landlord swiftly comes a knocking and boots us and our children in what, 30 days? If I fail to make three months of mortgage payments I can squat rent free for two years before I am foreclosed and evicted. It takes a lot longer for the bank man to come knocking. No brainer for me, I bought in Sept of this year and I am glad I did.

Let us know how that turns out for you, when you stop paying the mortgage and how long it really takes the bank to evict.

I’d bet dollars to donuts that for most people, the stress which comes with being late on the mortgage is far greater than the stress of being late on the rent.

But seriously, it reads as if you’re stretching to justify your new debt anchor.

Perhaps she is. Yet, to an outsider you seem just as likely to be rationalizing your “rent for life” stance – no?

This website has been saying all negative things about california housing market but PICES KEEP going up. Dont listen to them.

Learn to spell then comment. The DR is simply writing about the issue with income growth, or lack their of, but the persistent climb in housing prices. I would advise some courses in economics to learn simple supply and demand fundamentals. This website is not negative, they voice concerns which are valid and should be thought about before committing to the biggest purchase of your life. Go look at interest rates, they are at historic lows – what do you think if rates were to move up say 2%? Will prices continue to go up, I don’t think so A.

Wow, check out US stock futures tonight…tomorrow might be interesting.

They might have to comprised on prop 13. Older people keep and younger people go into the highr assetment rates. Personality, which I doubt the Dems will do is lower some of the income taxes and corporate taxes to make the state competitive but get rid of some of 12. My mother who lived in Ca until 1994 only paid 350 in property taxes.

Taht’s what bugs me about Texas, it had a crashed about 25 years ago and the law was changed on lending with all the folks moving there some of it should go up in pricing not down. Austin though is no longer cheap by Texas standards its around 250,000.

Well, both Florida and Nevada are like Texas no state income tax and they make it up by high property taxes. But one of them were into the bubble. I think reforming lending in the 1980’s prevented a bubble in Texas.

There was a bubble in Texas in the 1980’s. Refer to the S & L Crisis.

It burst with oil prices.

The property tax “comparison” also makes zero sense. The $600K rat traps DR highlights would cost $70K-$100K in Texas.

You would pay a lot less taxes.

Big property taxes and no income taxes in Texas make sure that the underground economy is taxed. We need that for all the underground economy people in Glendale(you know who they are) who live in million dollar homes, drive the S series MB and 7 series BWM and get the welfare and pay no income tax because they are in the underground economy. In Texas, the state gets the money with the property tax, and the red necks cheat the federal government’s income tax with their underground economy. The state also gets lots of federal money. What a state the Republic is.

Both of them were into the bubble, Nevada and Florida

Prop 13 has been a real deal for CA corps since they just change ownership via shares and not title changes. But this may be the first thing about Prop 13 to change.

http://blogs.sacbee.com/capitolalertlatest/2012/12/assemblyman-wants-prop-13-change-for-commercial-property.html

Prop 13 again

Yes, I agree it is unfair for me to inherit my mothers house with its $1.8M price tag and continue to pay the $1,800 per year taxes owing to inheritance taxes. Apparently the tax law states that if and only if the house passes to direct children of the home owner that the Prop 13 tax basis also pass along. That being said, lets see what happens to rental income. The house will rent for $5.5K to $6K per month. On the prop 13 taxes, the monthly tax payment is approx $150 per month. IF the property was re-assessed outside of Prop13 rules, then the taxes would be approx. $19K per year ($1600 per month). Therefore, as future landlord I (and my siblings) would probably sell the house rather than make only $5500-$1500 = $4,000 per month rent (plus deduct some maintenance/management cost).

Proposition 13 is yet another example of trying to make taxes “fair” but instead makes them grossly inefficient and favoring one protected class over another. Time to throw it all out – flat tax on everything, no deductions for anyone, and that includes corporations. This idea was the genesis of the last honest tax reform during the Reagan era, when my hero (Senator Bill Bradley) put together a truly – reformed tax code that threw out most of the crony capitalism tax breaks that had made a mockery of the tax code back then. Bradley voiced his worries after the bill’s passage that in a few years the lobbyists would be back and eventually the politicos would go back to business as usual, and he was correct.

I have neighbors who are literally prisoners in their home due to Prop13 and their unscrupulous son. They desperately want to sell their home, and their son will not let them because he wants to inherit the home with tax lottery Prop13. They tried to sell it behind his back and when he found out he threatened the couple offering to purchase the home and said the sale would never hold up in court because his Father has dementia. The Father has 100% of his mental capacities.

Prop13 was a well meaning proposition that was poorly written. There is no shame in modifying poorly written propositions just as 3 strikes went back to the ballot box. Prop 13 disproportionately puts the tax burden on younger generations who already have enough disadvantages compared to older generations (huge college loans to pay back, astronomical healthcare costs, less employer benefits, etc). Ultimately, the children pay the price with schools that can’t afford normal size classrooms and other cuts, because of Prop13. It had its day and now needs to be modified or repealed altogether.

I am grateful for prop. 13. My brother and I inherited the family commercial property that was bought in 1963. I am disabled and it provides income to support me. It now belongs to us as of two years ago. We have no plans to sell. If taxes were reassessed, it would kill us.

This sight has been helpful for me to maintain ‘eyes wide open’ in my pursuit of home ownership. There are several factors that led to me now being in escrow on a home: a) my wife and I are self employed and will live in the house until old age (no children to worry about relocation). b) mortgage rates are lowest ever and if they do ever go lower, (slim chance) I can refinance, c) home prices have raised moderately but not scarily (bubbily) higher, d) I am spending $19K per year on rent which I will never see again, e) the house floorplan has a separate entrance/bedroom/bathroom that my wife can use for her therapy practice (foregoing the need to rent an office for $500 per month) f) my and my wife’s tax deduction for being a homeowner total $1000 less per month in taxes (this means that taxes and PMI and insurance are a ‘wash’). If prices drop 5%-10% over the next 2 years, then perhaps I have not made much progress. The alternative seems to me to wait and hope for significant lower home prices combined with a dwindling entourage of buyers… doesn’t sound likely. I will keep everyone posted, the home is in Baldwin Hills where the nice homes are in escrow within a couple weeks of first open house at over-asking prices.

They can’t keep the interest rates this low forever. Wait til they go up.

And watch the prices crater again.

Leave a Reply