The Unaffordable Golden State: Only 1/3 Californians can afford a home. How a minor jump in interest rates and a big rise in prices has thrown off affordability. Price reductions at highest level in 3 years.

The housing market is definitely softening. Sales are slowing down, price reductions are increasing, and affordability has decreased dramatically because of spiking interest rates. The problem with relying with artificial stimulus is that the market becomes conditioned to easy money. A recent survey found that only 1 out of 3 Californians had the means to purchase a home, down from 49 percent one year ago. The big change has come from spiking prices, weak wage growth, and of course a 100 basis point increase in interest rates. So it should come as no surprise that inventory is up and more sellers are facing the need to reduce prices. This QE experiment has ‘worked’ but now bigger action is needed to keep the gig going. The Fed owns the mortgage market but with a job report that appears to be solid on the surface, the Fed is now having more pressure to taper. Of course looking at the evidence there will be no taper but perception is the name of the game. One thing is certain and that is, it looks like a tipping point is here.

Price reductions soar

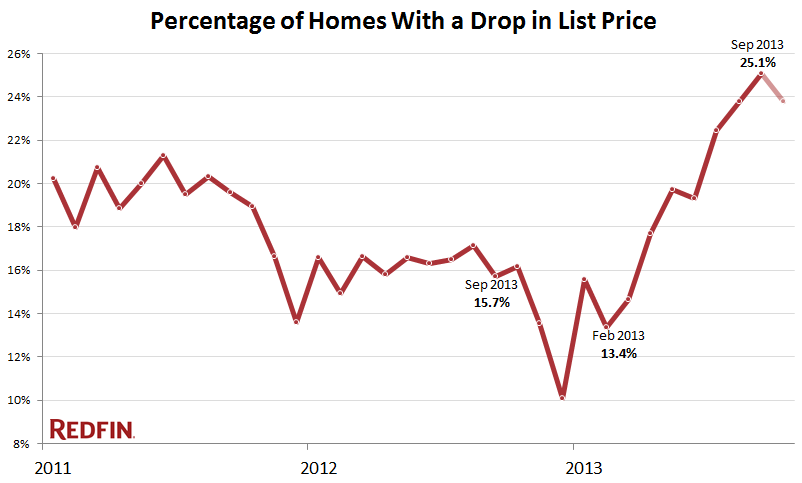

One of the biggest indicators of a tipping point is when sellers need to reduce prices. That is now in full motion:

Source:Â Redfin

1 in 4 sellers are now forced to reduce their asking price (the highest in three years). This is a dramatic reversal when only early this year, sellers were getting nearly everything they wanted. Agents were recommending contingent free offers and bids over asking. You may have even had the recommendation to provide a personalized PowerPoint on the awesomeness of your family. Today, the market is different. Very different. Of course, tipping points don’t happen overnight. Since the summer mortgage rates rose by 100 basis points. The Fed has made a big bet on low rates and even with $85 billion a month in MBS buying rates and a balance sheet of nearly $4 trillion rates still went up.

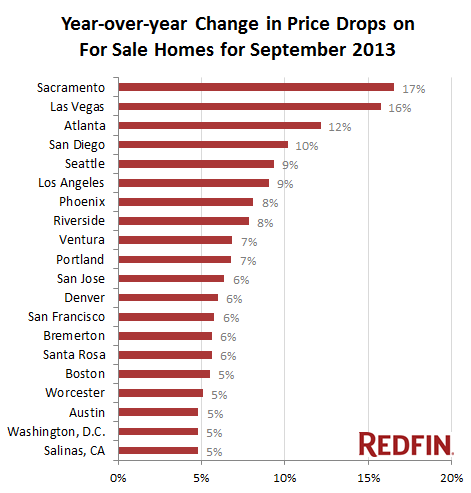

Price drops are also happening in the expensive state of California:

Source:Â Redfin

In 2007 similar trends hit before prices started softening: more price reductions, more inventory, and shifting buyer sentiment.

The unaffordable state

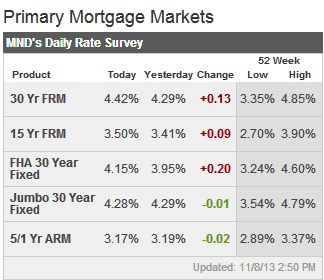

Two major things happened this year to tip the scales in this manic housing market. The first one had to do with the big rise in rates but the other had to do with the crazy like increases in home prices given the lack of inventory. Inventory is now rising, home prices are softening, and we hit a lower bound on interest rates (which has gutted the refi market). When only 1/3 of Californians can afford homes, you need an abnormal amount of investor buying to make up for the rest of sales:

“(MortgageNewsDaily) Home buyers needed to earn a minimum annual income of $89,170 to qualify for the purchase of a $433,940 statewide median-priced, existing single-family home in the third quarter of 2013. The monthly payment, including taxes and insurance on a 30-year fixed-rate loan, would be $2,230, assuming a 20 percent down payment and an effective composite interest rate of 4.36 percent. A year earlier it required an annual income of $65,828 to purchase a median priced home of $339,930 in California with an interest rate of 3.64 percent.â€

This is the problem when you rely on artificial low rates and rigged markets:

A California household to maintain the affordability of last year would have needed a $24,000 increase in household income just to purchase the median priced home (and this assumes they have a 20 percent down payment of close to $100,000). Even professional households making $100,000 a year have a tough time saving $100,000 because they end up blowing most of their money on rent, cars, and all other sorts of gimmicks that are popular in California. This is why everyone goes bananas when they even mention requiring a 10 percent down payment (when 20 percent was typical a generation ago).

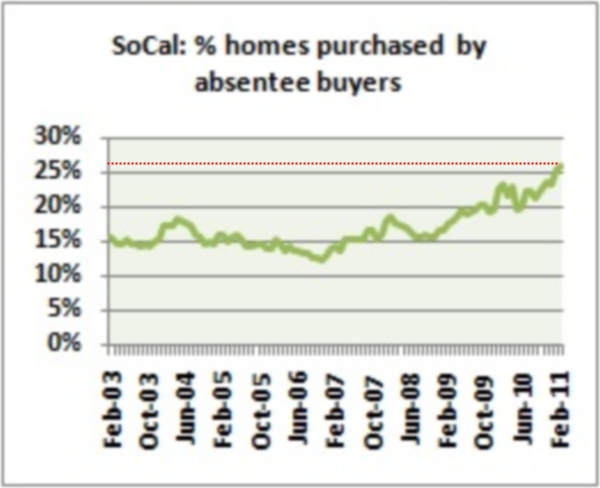

California is addicted to boom and bust real estate cycles. The last few years were a definite boom. So why are we to expect a suddenly “normal†market? We’ve had a couple of solid years and now a tipping point appears to be formulating. What can accelerate this move is if investors suddenly decide to pull back from the market. This level of investor buying is not normal:

This chart only goes out to 2011 but it is useful for historical reference. Absentee buying peaked at 32 percent early this year. Last month it was at 26 percent for SoCal so it is certainly moving lower but still incredibly high. A good portion of this market was buying because prices were going up. Like a Catch-22, will there be interest if prices are moving lower? Cash buyers have been the wild card since 2009. With higher rates and a blistering stock market, hot money may not be so interested in real estate especially if it is harder to squeak out gains. The fact that only 1/3 Californians can afford a home tells you an adjustment is on the way. To what extent? We will shortly find out.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

118 Responses to “The Unaffordable Golden State: Only 1/3 Californians can afford a home. How a minor jump in interest rates and a big rise in prices has thrown off affordability. Price reductions at highest level in 3 years.”

A family that buys a $433,940 house with an income of $89,170, even with a 20% down payment, in committing financial suicide. This is not only a textbook case of personal malinvestment, it also rewards the useless, non-productive financial “services” sector. It has come to the point that the US is a place where instead of doing each other’s laundry, the “economy” is now based on one debt stoked bubble after another followed by the consequent crash.

The most a family making 90k should consider mortgaging is 270,000. That is if they want to have a life.

Sorry dude, but the old adage that home price should not exceed 3x your annual income was based in an era when interest rates on 30 year mortgages were 10%.

With the Federal Reserve determined to keep the 30 year mortgage rate in the 4% range, the correct multiplier is 6X not 3X. So a family with a household income of 90,000 should not pay more than 540,000 if they expect to have a normal lifestyle.

Long term, this is financial suicide, but short term (i.e. less than 7 years) this is the way it is.

Ernst – it’s 2.5X your income, not 3, and it does still stand today.

Only an idiot would go above that. At least I can vacation and go out to eat whenever I want by not spending my whole check on a house.

I completely agree with you! Sure if you want to be a dumbass you can buy a house that cost 2,200 bucks per month when your take home pay on a 90000 per yr. salary after taxes Social Security 401 K Medical etc., you end up only getting about 2500 dollars net twice a month so you’re (as in whoever comes up with these formulas) telling me you want to spend 2200 bucks a month for your shelter!? Its crazy I would never want to spend almost half my take home pay for my shelter alone that’s crazy who comes up with these stupid figures? it’s about as dumb as a story an atty friend of mine told me the other day where the bank on a modification gave a 70 year old man a 40 year mortgage really? A 40 year mortgage? So he can pay it off when he’s 110! What a racket.

You guys crack me up. The example of $2230 PITI is reasonable. Accounting for principal and tax deductions, it’s likely less than what most people are paying for rent per month on this blog. I would hardly call that financial suicide. I’ve said it many times, most people suck at math. And being stuck in a rental sucks big time also.

@Lord Blankfein

You seem to be the one who “sucks” at math. The comments were referencing an income of $89,170 for the purchase of a house value $433,940. Take home pay of around $5,500. Mortgage and other expenses on home well over $3,000 a month. This is with a 20% down payment, which is totally unrealistic. Your glib bullshit gets old.

$433,940 house with an income of $89,170

If you consider the rule of 2.5x income back when interest rates were 9%+, the equivalent if you can lock in rates around 4.5% is about 4x your income. Some people would rather cling to the old rules just to be on the safe side, and that is fine, but I could also argue PITI of 2200 on a 90K income is doable. Budget is tight, but if owning a home is that important to you, then so be it. In the end, it’s whatever makes you happy.

@ Fulano:

Thanks for confirming that you were sleeping in math class also. Here is the monthly breakdown for Dr. HB’s example:

Principal: $470

Interest: $1264

Insurance: $100

Property Tax @1.2%: $435

Maintenance: $200

Total: $2469

Using some general assumptions, monthly tax savings relative to standard deduction would be the following: married: $300, single: $400.

On a purely monthly basis, owning this house would not be any different than:

a. Married couple renting for $1700/month and being forced to save $470/month.

b. Single person renting for $1600/month and being forced to save $470/month.

Does this sound like financial suicide to you? Do the math again for conditions that existed 18 months ago when prices were 20% lower and rates were 3.5%…any questions why that was one of the best times to buy in recent memory?

Regarding saving 20% down. It doesn’t happen over night, it might take a decade here in CA. Those who sacrifice and are disciplined are rewarded. Those who can’t need to rethink their life decisions and finances. Any other questions?

Saving for a decade then embarking on a 30 year journey is idiotic.

Seriously? I fell for that trap and am now stuck in a house an eight minutes’ walk from the beach in a quiet, surprisingly uncongested beach neighborhood, paying 16% DTI. The house next door rents for $500/month more than my mortgage, and my quality of life has really suffered, what with my 18 minute commute and all. All I had to do was to save money for, yes, eight years and not “buy high, sell low.”

Maybe it’s me, but a single person that takes home 5500/mo should at least be able to save 12k/year EVEN if they have a monthly housing payment of 2300/mo.

So that’s about 7.5 years to reach a 90k downpayment if they just put it into a checking account. If they put in some investments that turned out well it could be 5 years or so.

Imagine if they renting a small place and only had payment of $1400. Save $25k/year and have that downpayment in less than 4 years.

So I’d say it’s not impossible and doable with a little luck and discipline.

MB, stop it you are making too much sense.

The entitlement mentalitiy here is ridiculous:

“I am entitled to owning a desirable CA propoerty. I don’t want to pay that much for it and certainly don’t want by lifestyle cramped by actually having to save for a downpayment. How can I be expected to save anything after paying for my smartphone, 300 cable channels, my nice car, weekend fun, yearly vacation, etc. And the thought of having to take out a 30 year mortgage is nauseating.”

There are winners and losers in life. Those that work hard, sacrifice and plan for the future are generally rewarded. Buying in today’s housing market is no different.

>The most a family making 90k should consider mortgaging is 270,000.

>That is if they want to have a life.

No private mortgage lender would loan $270k to a family with a household income of $90k without government guarantees. Likewise, no investor is going to buy a San Jose, CA 3/2 ranch home with a mortgage payment of $5k/month, and turn around and rent it for $3k/month. California housing is over priced, and without fed.gov support it would likely result in the largest asset crash in financial history.

The numbers look like that is a 30% DTI ratio. While that’s relatively high for comfort (20-25% usually much better), that is pretty much par for the course for many places, especially ‘prime’ areas. Bubble-era financing of 40-60% DTIs were financial suicide.

I wish that prices were lower and that housing made up a smaller percentage of income, but in the modern climate, I think that 30% is merely “expensive”.

RE is always location, location, locat

ion , location. Any dip is just an opportunity to buy, even if one buys a smaller, less attractive place. Think Rome, Paris, London, Manhattan, etc. Prime CA RE is no different, just newer. Some people can’t handle change….’gloomer doomers.’ Heck, Twitter just instantaneously created a boatload of millionaires/billionaires. Waiting for $50k SF homes? Sorry. Even if that happened, just an opportunity for the successful to buy most for cash.

London, Paris, NYC, Hong Kong and even San Francisco make more sense for housing to go up as those cities are main finance hubs (with high paying jobs) or SF is the main tech hub. Los Angeles, the OC, San Diego, IE, etc in CA is based on what someone is willing to pay for a sun tax premium. They are more like playgrounds, often for people who come for a few years and leave, by choice or because they couldnt make a salary that meets the costs. The world changes very fast and maybe CA real estate is only going up, up, up while most local folks salaries don’t. That would ignore very recent history of course where the best properties in CA got crushed less than 7 years ago. Also, we had a dot come explosion as well less than 15 years ago. I mean history doesn’t always repeat itself, but to not see any similarities or to think the sht can’t hit the fan again quick (especially if the fed does slow down QE or maybe even if QE stops working) is a tad naive. Who knows. You’d think regardless of QE or what anyone really thinks about the true current state of the US or the world, one would expect a cyclical downturn by now just do to timing before the last one (the govt allowed us to go through at least).

FTB: What do you suppose the price:income ratio is for London, NYC, Paris, HKG, SF? LA is a bargain compared to those cities.

LA has a very diverse economy and is basically the US’s gateway to Asia, both in trade and commerce.

I bought my first house in SD in 1974 for $31k for only one reason…. I loved SD so much I wanted to own part of it (I moved to SD in 1973). My goal now is the set my kids up for life with homes in SD. I did that a year ago with one.

MB-I’ve lived in NYC for many years and LA for a little under 4 years (just left a few months ago). IMO, LA’s economy is nowhere as robust or strong as NYC, London, etc. and most of the new jobs that come out are not as high paying as they are in the other cities mentioned. Finance, tech and oil/natural gas is what is driving the US and will continue to do so (and the world as well (replace oil/gas with green energy if that makes you feel better), and finance and tech pay the most (along with a few other professions). I dont have stats on the amount of trade done by Asia specifically in California or LA, but if you say its the gateway for trade and commerce I dont doubt it as I would assume Cali ports are closest to Asia. I don’t know what that means in terms of dollars however. I do think it means Asian people are more likely to buy homes in Cali bc its closest by flight and there are already a lot of Asians there if that’s what you mean. I think we also agree that LA property should be a discount to places like London, NYC, etc based on your “ratio” comment. So I guess we just disagree on how much a difference there should be between LA and those cities in terms of housing costs. You think LA is trading at a discount currently. I do not.

Sorry, MB should have said trading at a discount, but all currently overpriced, some markets more than others. QE is making a lot of dumb people rich currently around the globe. I’m not smart enough to predict the future, but it will be interesting if we do get a real stock market correction to see how well the newly rich citizens of the world have their wallets and confidence shaken and if they pull back all their crazy investments like buying homes based on zillow prices thousands of miles from where you live or NY wall street traders buying second homes to stash hos in. Part of me says things are different this time because of globalization, homeowners are now better qualified, there’s less other safe investments, etc…then I wake back up to reality. It’ll be just like the end of Trading Places…”Sell! Sell! Sell! Turn those machines back on! Turn those machines back on!”

Ranked by GDP, Los Angeles is anywhere from Top 3 to Top 5 in the world, behind Tokyo and NYC.

Price/Income Ratio

LAX – 5.5

NYC – 9

SFO – 7

HKG – 17

LHR – 15

CDG – 15

FCO – 25

NRT – 15

Having lived in both areas, I’m sure you’ve seen the stark difference in housing prices in NYC vs LA.

MB-interesting stat on LA GDP. I didnt know that. However, I don’t think GDP is the leading indicator of housing prices. Lots of factors, local and global at play. You’re a smart guy so I’m not going to waste our time listing them. See aspen, San Fran, palo alto, greenwich ct, palm beach, even sections of Detroit, etc. In terms of gauging the economic strength of a city, GDP is only one measure, especially when trying to tie something to housing. One might want to also look at unemployment levels and if salaries are increasing compared to home prices over a period of time; the things that matter to buy a home. GDP can be measured differnent ways, but its really the total value of goods and services produced over a period of time. That includes tshirts made in sweatshops in LA by people making slave wages and then sold at American apparel by retail people making $10/hour to tourists. Once again, I think LA has a real economy and housing should be expensive there, but we disagree on what the spread should be and the fact that I think pretty much all of these cities are overpriced currently.

FTB: My point with GDP is that LA is an economic powerhouse, by any measure surely on the same scale as the other cities you listed.

Yet its home price:income ratio is far less than the other cities. There are sweatshops, minimum wage workers, and beggars in every city, and though not a perfect measure, price:income ratio does a pretty good job of expressing affordability.

By that measure you get more “bang for your buck” in Los Angeles.

This tracks with what I’m watching in north San Diego County. One place I was watching priced at $539k is down last week $39k to “$499,900”. It’s a 4/2 2640 sf on .61 acre built in 1979 but in good shape. That’s down a bit over 7%. This is the same area where about a month ago I noticed three properties being sold by obvious investors who had never lived on the property. I haven’t seen more of that in the listings recently, but have noticed more lowering, usually about $10k so that $39k down is unusual.

So far, this time is truly different. Unless NINJA negative-amortizing loans make a comeback, or wages skyrocket, Californians will “vote with their feet” and leave the state in droves, searching for the elusive American Dream elsewhere. Every month I hear of another family doing that, packing up and moving out of state. SoCal is a beautiful place to live, but if you feel like you could never afford to buy a home, why bother? It costs enough to raise a family here, even without this insanely over-priced real estate.

Only ersatz Californians leave CA and good riddance to them.Real Californians know CA is special.

Haha. It’s “special” here. Keep telling yourself that. I’m sure you’re a “real” Californian, driving your leased luxury car and living the dream!

And for most people that live in Cali for a few years, the problem with California is…..the Californians. Go to places like Colorado, Texas, Oregon, etc, and listen to the locals and how they complain that CA people are moving in and ruining their neighborhoods. Like a virus, tons of CA people move to places and instead of assimilating, many bring their annoying totalitarian, smarter than everyone else (maybe too much sun rots your brain?) attitudes. So go put on your wetsuit in mid July for a dip after driving 2 hours in traffic to the beach on a Saturday and the rest of the world will just we to live in utter jealousy.

I recall (from a friend living in Boise Idaho) talking about the problems of Californians moving to Boise 20 years ago:

a) they were moving to Boise, mostly from the Bay Area with lots of money… which meant all cash purchases which drove up home prices; b) taking jobs in Boise without negotiating higher salaries (the Californians were so happy to get away from smog and traffic, they were happy to just have a job). This slowed down wage growth. So, the people of Boise (and probably Portland, Eugene and other cities in the NW) with more californians, higher home prices, less salary growth.

$hit rolls downhill, right?

You have wealthy Americans and foreigners buying homes in Los Angeles. Then you have Angeleno’s complaining about that and buying homes in LV, PHX, or Boise. Then you have those people moving to the midwest or to Mexico, Costa Rica, Thailand etc.

Nice choice of words, MB. What do you mean exactly by ‘sht’ flowing downhill? Are people with a brain that make money and do a cost benefit analysis and leave CA sht? Ae people who dont make enough money for whatever reason sht because they cant affird CA? Are wealthy people are foreigners who come to CA automatically not sht because they have money? You mention in another post that you bought a house in the 70s in San Diego and now are trying to buy some for your kids. I’m assuming they might be a tad crappy, but not full-on sht, because they aren’t paying for the homes themselves; its family helping out at least.

“$hit rolling down hill” is a term popular in the military to describe when problems occur on the top of the food chain, the problems keep getting passed on to ranks below.

It’s ironic to hear Californians complain about foreigner’s buying up RE and pricing them out, when other people in the Western US have had the same sentiments about Californians for quite some time. Of course there are plenty of people in 3rd world countries that complain about wealthy Americans pricing them out of their property too.

” You mention in another post that you bought a house in the 70s in San Diego and now are trying to buy some for your kids”

You have me confused with someone else.

Ha, ha, with the reactions to the s#$t runs downhill metaphor. Here’s another: Everyone thinks their own money doesn’t stink…

so what if Californians leave. There’s an endless stream of Chinese and Indians coming in for the tech jobs… and these folks with professional jobs are the competition to everyone wanting to buy a home in a middle class neighborhood. Who cares about the fresh Mexicans coming in. they are buying homes in IE or Bakersfield, where most of you don’t want to live anyways… the Chinese though… prime location for jobs and family raising…

Homesugar,

Do you work in the tech industry? It doesn’t sound like you do.

I work as a systems architect (Web 2.0 BS)f and at my firm, when someone quits, they almost always are leaving California and most of them are Indian and East Asians without family roots here.

Most are moving to Texas, Midwest, Pacific Northwest or the DC metro area.

I have a Chinese co-worker, awesome developer, who is so stressed out about housing, he wants to move out of state but can’t because of family. A lot of my co-workers (nearly all Asian tech workers) want to get out of California.

Me I’m working on leaving as well, guess I’m not a real California, unlike Russian and Chinese oligarchs and pornographers.

There isn’t more inventory in my area, unless you’re talking over 300k – nothing decent for under that.

Bay Area life-long resident working in Medical Device Industry. Company just announced 500-600 person layoff over next two years, all Bay Area mfg moving out of US, only R&D staying, for now… Wife and I are starting a family soon, looking to leave Bay Area for more affordable living elsewhere, heard Colorado is nice :). Can’t image staying, blowing the $100k saved up on down payment for a $600k 50’s rancher in a crappy neighborhood. Only way to survive in the Bay Area is to have a multi-generational home with multiple incomes, or have two large incomes, good luck if one earner gets laid off… Bay Area is nice, but the rat race is getting old.

I feel you!!

I’m in the north bay, early 30s, single, no kids, working professional (probably make 68K this year)…and seriously thinking about moving out to Sacramento. Been dating a girl out there, it’s not that bad, midtown is fun, hot weather, Tahoe is super close (I love to ski)…can still shoot over to the Bay for a Giants game…

I can’t pull the trigger on a 350K Condo in Marin and tack on some ridiculous 300/month HOA…screw that nonsense. Definitely nice parts of Oakland but it’s getting pricey quick.

Prob a good idea. I have a lot of friends that live in SF, make good money, 60-150k, and every single one rents. It’s just too crazy there.

On the flip side, I just closed a loan for a buyer in Sacramento for 186k, and he absolutely loves it! Sure it’s not the city, but, it’s a house w/ a backyard and close to his work.

Pro’s/Con’s to each.

Young “professional” in the Bar area and you make $68,000? That is less that the average garbage collector make in San Francisco. I do not mean to denigrate your salary but there is no way one can live “a professional” middle class life on that amount of money in the Bay area. You would be better off with $40,000 in Houston, Dallas, Boise and many more.

well, making 50K to 70K for some professionals is true in the Bay Area. People think that every professional in the BA is making 100-150K on average and the well off people 150K to millions…

Tank this market soon!

If the couple has any financial setback, they will lose everything. Loss of one job for more than a few weeks will cause foreclosure. This is retarded. Also, If RE values drop, they will owe more than they can get for selling the place. I’ve been there, it’s a horrible situation.

I can tell you in the East Bay Area, my rented house has appreciated 130,000 in three years. Given it was a short sale and the chump before paid almost 700k for it new. Nice house but I wouldn’t pay 400k for it. And 90,000 a year to buy a median house in Cali? Ridiculous. There is no way a household can afford that median on 90k a year. Not with increases to medical insurance, raising food costs, student loans-kids. The rental properties bought by investors are already taking a hit. I bet that in the next twelve months, you will see many selling even for the 10% reduction the last three months. There’s your inventory and lower purchase prices. Going down, down, down.

I agree the run up happened too fast… But it is because of low rates and a hard bounce off rental parity bottom.. I have mentioned rental parity so many times and people called me stupid. We dropped below rental parity in fall of 2011… That plus low inventory and low rates was a recipe for a hard bounce… If enough people refinanced and dropped their PMI the past two years, well, we will not drop below 2011 prices… May revisit shortly, but the bottom was in.

2011 rental parity was an illusion as well. 2011 rents were based on a market that didn’t include (and still doesn’t but will in due time) the shadow inventory. Now let’s also look at incomes and family formation in the ensuing 3 years. The consumer is hammered and Johnny is staying at home working part time. Even if prices reach parity with 2011 rents soon, they have a ways to go to reach parity with the likely rents of 2015 when this debt bubble pops.

I know people in Palo Alto whose house was worse 2 million – it sold for less than 400.000 USD!

Most of the the houses in the Bay Area are Plywood shags which do have lots of structural problems.

Can somebody please translate the above message?

Something is not adding up:

1: Only one-third (i,e. 33 percent) of Californians can afford a home.

2: Last I looked approx 53 percent of Californians own a home.

3: From the above it appears to follow that approx 20 percent of Californians are in default on mortgages and/or property taxes.

“From the above it appears to follow that approx 20 percent of Californians are in default on mortgages and/or property taxes.”

Faulty math?

That would only be true if their mortgage tracked housing prices. Fortunately most people have a fixed mortgage, allowing them to live in areas they would no longer be able to afford. That’s pretty much the way it’s always been.

Terry, I think close to one third of Californians own their home free and clear. Also take into account anybody who bought prior to 2000 who likely couldn’t afford to buy their house today. Those people own a goldmine, they aren’t going anywhere. Welcome to supply and demand 101!

Welcome to research 101. In Los Angeles and Orange counties, only 20.7% of homeowners owned their properties outright, reflecting the region’s pricey real estate. You are only off by 30% in the prime area we are referring to on this blog.

http://articles.latimes.com/2013/jan/10/business/la-fi-free-and-clear-20130110

Fulano, welcome to reading comprehension 101. I specifically said CALIFORNIANS, did I mention LA/OC anywhere?

Yes, you said Californians because you could include inexpensive areas and come up with a distorted number like 30% when we are taking about Southern California. This is typical of your modus operandi shill. The rate that counts is 20%, period.

Regarding the math and the purchase above, if you think a person who brings home around $5,000 a month should be paying well over $2,000 (and this only possible with the ridiculous 20% down payment you propose), not including utilities, homecare, maintenance, etc. for a home you are a complete fool. I think the readers are well aware of where you are coming from and discount your propaganda.

As a CA native living in Bay Area, we (wife & I, no kids) are pretty done and have our eye on the exit. Don’t own RE currently and wouldn’t buy at these prices. Although we make decent income $200k+ We live within/below our means but prices are mostly driven by stock optioned techies. Not complaining as these are my clients, however their inflated incomes distort everything. CA is getting left with very wealthy and those not so, mostly living off the system. True middle class is getting shut out. We feel exhausted just trying to “break even”. We are aiming to take our work mobile within 3 years, that is non-dependent on the location we live in. It’s funny to me how people get caught up in short term appreciation of their home value. Until and unless you can pull that appreciation out, it doesn’t mean anything. Paper gain can turn to paper loss or break even at best. In addition, as we saw last housing bubble, people blew their equity trying to live beyond reasonable levels. I don’t see that mindset has changed in any way.

If you’ve traveled at all, you understand there are lots of beautiful, inspiring, reasonably affordable places to live. I think people are in a “bubble state” in more ways than one. If you observe what’s going on with CA taxes, regulations, social programs and governing, you know the glory days are in the past. That’s my perspective as a 50+ year native.

BTW – Thanks Dr. Housing for this forum. It’s nice to learn about other people’s perspective!

I hear you about the Bay Area. It’s the one place that makes LA housing look sane by comparison.

I went to grad school on the Peninsula back before the tech boom and my occasional visits back since have been like a time lapse movie showing the horrifying effects of vast wealth on the local housing scene. All poor and middle class families neighborhoods destroyed/gentrified. High tech micromansions in their place. Ever further commutes for what’s left of the middle class – Stockton and Modesto became bedroom communities over a decade ago and by now I’m sure it’s metastasized all the way out to Sacramento and Merced. Makes the commute from the high desert to LA look like a cakewalk.

Might as well take a compass and draw a 100 mile circle on a map centered on Palo Alto. Anything inside isn’t worth considering unless you win the latest IPO lottery.

As someone who travels internationally very often, the only thing that always stuck with me was how affordable housing in the US was compared to the rest of the world.

In nearly every other international city, people are happy with 800 sq ft condos or cottages, and the price / sq ft. is unbelievable. In LA, people seem to feel they are entitled to “above average schools, above average neighborhoods, 3bd + 3ba, 2000sq ft and a 5000sq ft lot” all within an hour’s commute to major employment hub.

Do you know for sure that they are happy, or are they conditioned to not demand better?

I can tell you with 100% certainty that a family making $100k in Cali can not save up $87k for a down payment and still live anything of a life worth living. If that’s the case, you would have to cram the kids in a 2 BR apartment for 5 to 7 years, never take a vacation, and never be able to do any activities around town because you are too busy stacking $1000 a month away forever.

And then, when the savings is said and done, you get to start a 30 year adventure on a $2000 PITI every month? No wonder the middle class is fleeing in droves.

@PapaNow wrote: “…a family making $100k in Cali can not save up $87k for a down payment…”

+1 for this piece of trolling flamebait

This hypothetical family has a serious spending problem much like the state of California, and the Federal Government.

Ernst, you are 100% correct. Most responsible people today don’t start families the instant they become an adult…it’s called planning for the future. I live in the South Bay and can tell you that most people starting families are generally in their mid to late 30s. Hmmm, what were they doing the past 10 years? Likely establishing their careers and saving money for a down payment. People who did that and they were handsomely rewarded by buying in the past few years. If you think you are entitled to the white picket fence neighborhood and want to start a family at the ripe old age of 25, go to the Midwest. It is possible there, forget coastal CA!

Wow you sure have some axe to grind with that entitlement concept. I’m not aware of any commenters stating deserved benefits.

Joe, maybe I had a poor choice or words. How about not willing to sacrifice and save, essentially not paying their dues. Happy now?

Back in March of 2013 I was warning CNBC, Bloomberg and the Wall Street Journal that housing inflation without rates rising already had priced out 2/3rd of the buyers in Orange County, CA Median Income to Median Prices.

Then rates rose… However, the places like Zillow and Trulia are only now realizing that housing inflation in this economic cycle is very impacted to those outside the top 10% income bracket in the U.S.

California as always has been leading the bubble economic charge.

Warned the NAR in May that housing inflation is what you should worry about

http://loganmohtashami.com/2013/05/07/housing-mammoth-stuck-in-tar-has-bigger-problems-to-worry-about/

You are correct. I was doing the same challenging trulia and zillows assumptions on the housing recovery since April When I spoke to CBS marketwatch they were still infected with the hope that “household formation” and “historically low” rates would keep the recovery going

It didnt. You cant have sustainable housing price appreciation without real economic and job market and wage growth

this is why short sales and foreclosures etc will be around forever. We should mirror what Canada does.

Prices in silicon valley/sf have risen for the same reason stocks and bay area companies like Tesla, Trulia and Twitter go public with massive losses and still attain billion or multi billion dollar market caps- speculation caused by Fed easy money

50 million people are at or below the poverty level and the labor participation rate is at 30 year+ lows. The most recent jobs report sounded good but most of the ojbs created were in retail and bars and restaurants.

Nationally the housing “recovery” is already over.

The stock market bubble is still supporting the bay area home prices.

When that collapses unemployment in the bay area will soar.

Unprofitable Companies with declining stock prices fire employees by the thousands.

Your correct Papa, saving up the 20% down is tough. Kids either need big help from family or need to buy a more modest place, which in turn is typically in a scary area.

I do believe that owning real estate is a smart long term goal, as not having a mortgage/payment in your 50’s is pretty sweet.

My children are in their mid to later 20’s and I have been encouraging the oldest to just rent while prices have been going up for the last 2 years and she thinks I am an idiot. I can only hope at some point the FED gets out of the markets, prices likely tank 30% and then we can help them buy.

I took the plunge last year, purchasing a mid century home in Baldwin Hills around Christmas time when many buyers were busy with holidays. My wife and I income is around $160K and we purchased a home for $470K. If it were not for the fact that we are both self-employed (little chance of needing to relocate for work) and that we bought in a neighborhood we can live in the rest of our lives, we may have waited this bubble out, but we didnt. Wife n I both contemplated moving elsewhere, however, we are ‘addicted’ to the SoCal lifestyle: friends and family live w/in 20 min drive, 15 min drive to the beaches, nice weather, etc. So far there is no indication of a crash coming, prices have gone up 10%-15% in the past year, since I purchased, I have a tax deuction of approx. $10K per year and am no longer spending $20K per year on rent… just my 2 cents. BTW – population of California increased by 280,000 in 2012..

http://www.sfgate.com/news/article/CA-population-grows-to-37-9-million-4480348.php

“So far there is no indication of a crash coming, prices have gone up 10%-15% in the past year…”

Contradicted yourself in one sentence 🙂

First question: Where would home prices be without the UNPRECEDENTED MANIPULATION of the financial markets. I’d say 30-40% lower than today (SoCal). Second question: Can said manipulation continue? The bond market, unemployment, EXTREMELY nervous financial professionals, etc say no.

Crash 2.0 is inevitable. The smart will hedge accordingly…

What you say is true, however, the problem is when will the manipulation end? When will inventory be forced to market? When will the Fed end QE and rates revert to normal levels?

Lastly, when will foreign money flow slow down?

1 month? 1yr? 10yrs?

Nobody knows, and so it leads to frustration (including myself).

Seems like they can play this game forever.

RE: bmd

They can play the game forever but they can’t fight gravity. Lose control of the bond market, lose control of consumer inflation, have nationalistic and protectionist governments get in your way. The central banks of the world are fighting and losing all these battles. Once the banks have cleared enough inventory of toxic MBS to the FED and the Hedges and REITs cap rates get crushed the end will be nigh… The game will continue, but the REfire sale will be on. The economy cannot function with RE prices where they are. There are no move up buyers. No one tapping equity to boost consumer spending. Nothing. Velocity of money is crap. FED stagnated the whole economy to save the banks from insolvency. Now that the backdoor bailout that is QE has done about all it can do they will have to let the chips fall. The longer they wait the worse it will be…

@bmd, during the real estate crash of the 1990s, prices peaked in 1990 and would continue to fall all the way through 1996/1997. Those were in the days before the Federal Reserve engaged in massive manipulation of the real estate market and the Fed allowed the market to function without interference.

We are in the worst season for home sales, so it makes sense that the market is softening.

33% can afford to buy a house at this time. That’s a good indicator for prices to keep rising. By historical standards in CA.

At 4.5% for a 30 year, we are still at historically low rates. Anywhere that there’s rent parity, there will be continued price support. I don’t think this bounce is quite over yet, maybe it will top this coming spring? But, the big money can afford to pay for this and they will continue to buy in the highly desirable areas. The rich are clearly getting richer.

The big money doesn’t care about rental parity

California is definitely in a squeeze. Southern Cal was great in the 70’s, 80’s, even 90’s.. now its so built out and crowded its barely even worth the trip. Norther Cal still have potential but prices are just as high .. and have the same unbalanced labor and rental markets with massive illegal immigrants warping our reality

It will take a while, but when US is approaching default in a decade or so, the repercussions will result in massive housing default as well from the withdrawal of govt subsidies… then a new system will come in

Single income family living at our means (no debt except low interest student loans and one car payment) in the north bay in Cali. I don’t know how everyone up here makes ends meet. Ugh, if I’d known how hard I’d have to work to have so little I would have done things differently! We sock away 500 a month towards a down payment, but home prices just keep rising. No way I’m going to fork over FHA fees, so I guess we’ll keep paying our over-inflated rent. I love raising the kids here, but it’s just hard sometimes.

Don’t get distracted, keep expenses low, don’t keep up with the neighbors, and (important) evaluate whether you actually want what you think you want. Almost all of the happiness in my life comes from family (sometimes expensive), friends (ditto), learning, reading, reflection (nearly free, nearly free, free). Here’s something you get in California to partially compensate for the higher cost of living: tolerance, multiculturalism and somewhat of a pioneering spirit. Yes, there are other places that have these traits; you should consider those places (as I have), but if you’ve got family ties here, well, here’s pretty great.

I’m not gay, but my gay friends don’t live in fear. I am biracial; for the half of my family I’ve never meet, it was a dealbreaker. In NYC (1960s & 1970s) it was A Thing, in Chicago (late 70s) it was Not Good. In Los Angeles it’s Not Noticed. To me, that’s pretty great.

As a San Diego native in my late thirties I’m in agreement with those frustrated folks when it comes to the seemingly ridiculous valuations of Socal property. I battle back and forth on whether I should stay or find a new city to call home. The one constant that I’ve witnessed in San Diego is that the people keep coming. When I take in a football or baseball game it’s disapointing to see that 30 to 50% of the fans are cheering for the opposing team (transplants). The word has been out for a awhile about Socal and San Diego. People keep coming because there is a demand to be here. Supply and Demand. Lack of affordabilty will continue to remain as long as that equation is out of balance.

American Dream = Financial Independence

SD Native, you definitely get it. It took me a while to understand this dynamic also. Knowledge is power in this case, profit from it! The nice parts of Socal will ALWAYS attract folks from around the country…no matter what. Many will come, a large majority will wash out after a few years. But you always have a revolving door letting in more transplants. As you mentioned, it’s simple supply and demand at work. The prime locations are built out, couple that with short supply and much demand…and you get expensive CA RE. It’s really not that complicated!

Using that oversimplified supply and demand explanation, all past prime area SoCal price level deflations were a result of less people coming here to live than there were people leaving. That would directly conflict with the idea that SoCal has and will always command a premium. Unless of course, one is to believe that prices only move in one direction – up.

Joe, there are peaks and valleys in every market. The long term trend is up, especially for the desirable areas where you do have severe supply and demand issues. Sure Manhattan Beach is expensive today, but do you honestly think it will be the same price in 10 or 20 years? This is not rocket science that we are dealing with…

@ SDNative -You’re crazy! The only people coming to California anymore are Asians who hate American’s (but like what having an “American’child born here can do for them) and Hispanics who have no desire to be a part of this country.

I’ve lived here for years, own a home in PV and can’t wait to leave! Why anyone (who isn’t Hispanic or Asian) would want to buy in California now is beyond me. Who wants to be STUCK only along the coast (which sucks unless you can afford a 3 million or more house but the ‘issues’ make it NOT worth it!) only to find that if you choose to ive along the coast you have to ‘travel inward’ to do anything (forget swimming, I’m not into frostbite) and the areas away from the coast (oh say a mile… JUST A MILE!) are dirty, falling apart, crime ridden and unfriendly.

The only people I see on DHB are those who are either:

1.) A REALTOR and YOU buying a home here (no matter how sh*tty or overpriced) keeps THEM in business.

2.) Someone (like me) who owns along the coast and is looking to cash out and could care less how much money you will lose and how lousy your life will be because you overpaid for a house that forces you to shop in areas where you could easily get shot, the schools are falling apart, the schools are NOT getting any better and now dear Gov. Brown wants to give OUR tax money away to people who don’t even pay taxes to fund THEIR schools.

Yeah, that’s what I want – more sucky schools. More crime, lousy roads, mean people and just an overall – who cares if this state is polluted and not worth it – who cares if our air is the worst and our water may make you sick and our schools are quickly becomming some of the nation’s worst.

Jez, I can’t even finish here because justin thinking about how terrible CA is now makes me depressed.

Good Riddance. 90% of my family has left this state and I’m following! (I will have only ONE child here after we move and that’s only because she has her own show.)

After reading this, all I can say is ” talk about getting lucky”!

I really want to know where you’re moving to if you find classify PV as dirty, crime-ridden with failing schools.

This person has posted this rant before. Its funny to me to picture them nervously driving down from the safety of the PV hill, and constantly looking over their shoulder while shopping at Target in the ‘slums’ of South Torrance.

Sounds like you’d be happier living someplace rural. Population density isn’t for you.

so only 33% have negotiation power over the seller who needs to sell? good things could happen if your smart.

Last year when I was looking to buy in the IE, I got pre-approved for a $300K loan on a 3.5% interest. I have close to an 800 credit score, an annual income of $85K, with zero debt and I am single. Even then, I knew I would be financially struggling if I took on the whole loan amount, which would likely cost me about $2,100 a month.

Now with interest rates around 4.5%, I don’t even bother anymore. It doesn’t make sense. Pure insanity if you ask me. Meanwhile, I will do the right thing and just wait until home prices fall. These high home prices is not sustainable.

1. I agree with those of you re keeping your income-to-purchase-price multiplier low but the fact is there are so many in SoCal who are willing to blow that multiplier as high as they can and that drives up prices, so to compete you have to blow it out or go much smaller/less desireable area. Know thy competition.

2. The desireable areas in SoCal are known nationwide and worldwide and there is a whole other level of competition for property. For instance if you want to live in Carmel Valley San Diego you are bidding against heavy Asian $$$ that just keeps coming in. Pricing now above peak ’06. You have a serious Pacific Rim competition issue if you live on the west coast, and its not getting better. And it doesn’t stop with Pacific Rim, not even close. Lots of serious money looking for SoCal RE. LOTS.

3. Just like other superstar areas – SF, NYC, DC, etc – you have to go way outside the core areas to get affordable housing. In SD you are looking at heading south to Eastlake or north to Temecula where you get a ton for your money comparativley speaking. That is what people do in superstar cities and thats what you have to do if you want a big house for a small price in SoCal.

4. The Fed is going to keep rates low and keep printing. QE to infinity.

5. If you do not have bank or make bank you are not buying in the better areas in SoCal, same as not in SF, NYC, etc. Not now, not ever. See #3 above.

6. Cali is the Entitlement State, where the liberal middle class kept the state liberal with their votes and to show for it we have crushing taxes across the board that ironically has played a role in driving the middle class out. Classic.

I think it is pure fantasy to wait around for a housing crash in the desireable areas where you think you are going to snap up a bargain. If there is a big crash it will be because of serious systemic problems that will likley effect your finances or at least your appetite for buying property if not also your ability. Good luck waiting but I doubt you will get what you are waiting for for all the reasons I state above.

4. The Fed is going to keep rates low and keep printing. QE to infinity.

The FED influences the Bond market. It does NOT control it. Beyond that the world economy is hanging on by a finger. If (when) it seizes up the oligarch class and the top 20% that is carrying these mortgages will feel it most of all. This happens after EVERY inflationary cycle ends. Early 80’s, Mid 90’s, 2007 the only thing different this time is the enormity of the credit bubble and it’s proximity to the last.

If central planning worked the Soviets would still be around and South American nations wouldn’t have the problems they do.

If you think the ruling class and the wealthy are the ones that will suffer I could not disagree more. It is these people that are becoming wealthier and more powerful and more insulated. If you cannot already see that the machinations of “government” and quasi-“government” are designed for the benefit of this class, perhaps you need to look more closely. It is the middle class who are exposed and will suffer the worst, as has been the case in their slow death over the past several decades. Small elite wealthy class with power and large underclass, that is the model.

I was talking with middle aged guy I’ve known awhile; he moved to SoCal a decade ago, drawn by weather, culture. Rented a beach apartment; loves the ocean, nightlife. Steadily employed over the years at a variety of jobs, loves SoCal, but keeping up with the high cost of living put him on a financial hamster wheel. He spends what he makes, and feels he’s now on a slippery slope.

He’s middle aged with little savings, dwindling job security in a mediocre labor market coupled with a high cost of living, living paycheck to paycheck. I know so many like him. Surf shirt, flip flops, on the surface appear to be living the dream.

One thing he said struck me…he was drawn to SoCal by weather; he said Spring becomes Summer, Fall, Winter, like one seamless season. One year become another, then ten; he lost track of time. East Coast seasons reminded him of the significance, importance of the passage of time, an awareness of what each season brings, to prepare. It reminded me of a tired kid at a county fair; slipping hands into empty pockets after spending savings playing games of chance. The carnival lights blink on, luring a new bunch of fresh faced kids who stream in with big hopes, eager to try their luck at winning The Big Prize.

Poetic truth!

The repeated self congratulatory posts bleating about their RE buys (oops, “home purchases”…say it in a radio announcer voice) increasing. Embittered posts from non buyers waving white flags increasing. A belief that SoCal (especially “desirable areas”) is a magical land unaffected by the real world economics is growing. Investors snapping up multiple SFR’s to use as rentals in areas with high unemployment. It’s different this time! Get a foot in the door! More foreign cash buyers on their way! Bidding war! Buyers pitching emotional stories to sellers…pick me to be the mindful steward of your termite infested 50’s rancher! I’m worthy! It all feels so…2007.

I smell a top. Just my opinion.

Interesting that you write “top” instead of “will soon fall hard.” I think your “top” guess is hard to argue against, but “will soon fall hard” is a hard case to make in desirable CA.

@DFresh – Desireable??? WHERE?????

This place is a dirty, run down sh*thole and EVERYBODY knows it!

Anyone who advises you to spend more than you have is obviously a realtor or a seller looking to cash out.

Thank god I sold mine – SEE YA CA! You stink (literally!)

Great Country this is. They’ll do anything to enslave people and high tax. squeeze the middle class and protect the rich.

“This week, Wells Fargo (WFC, Fortune 500) advertised a 30-year jumbo mortgage at a rate of 4.125%, significantly lower than the 4.5% rate it is offering for a 30-year, fixed-rate conforming loan. US Bank (USB, Fortune 500) is offering a jumbo for 3.875% this week compared with 4.25% for a conforming loan.”

nice huh?

@Homesugar wrote: “…Wells Fargo…advertised a 30-year jumbo mortgage at a rate of 4.125%…”

That is a sign a desperation by Wells Fargo.

Since almost all LA-Orange County SFRs are jumbo loans Wells Fargo is hoping to snare some jumbo buyers with +800 FICO and +20% cash down payments to help out WF’s struggling loan originations. At 4.125% WF is right at the break even point for profitability (i.e. the yield on the 10 year U.S. treasury note closed at 2.8% today, add 150 basis points for cost of operations, that puts the WF pricing near break even).

This is my first time posting, although I’ve read this blog for a few years and really appreciate the content. I live in Venice Beach with my wife (baby on the way), have an income of approx $200K/year, have plenty of money for a down payment, yet I still wouldn’t dream of purchasing real estate in SoCal. I sat through real estate bubble 1.0 while virtually everyone I know talked about how home prices could never go down because of limited supply, low interest rates, population growth, desirability of the area, the security of having something tangible, etc etc. When I mentioned the problem of compounding and that it was mathematically impossible for asset prices to rise forever at a faster rate than income growth (i.e. people’s ability to service the payments) people didn’t want to hear it.

Thankfully I didn’t take the bait and buy something in 2006/2007, as the crash would have wiped out my entire net worth and then some. Amazingly just a few short years later we’re in the same situation again, with the same chorus of morons chanting how real estate is a “no brainer”, although the rationalizations are slightly different (foreign investment, QE 4eva). Despite the fact that only 33% of households in California can afford a house, barely anyone can even imagine a correction in housing much less another crash.

My take is that housing in California will likely fall 15% – 60% in the next decade. 15% if interest rates stay relatively low and there aren’t any major market disruptions and 50% – 60% if rates rise faster and there is a major earthquake on the San Andreas fault or the Newport Inglewood fault (which are both overdue for a catastrophic quake). For some reason everybody seems to have forgotten that Los Angeles lies on one of the most risky areas in the world for earthquakes and many of the buildings in the area were built in the 70s or earlier when seismic building codes didn’t exist. Historically the San Andreas fault line has a major earthquake every 150 years and the last one occurred in 1857 (we’re six years overdue). When the San Andreas fault line finally slips, it’s going to collapse a lot of structures and leave the city’s infrastructure in ruins. Think Katrina X10. It blows my mind that people keep paying million $+ price tags for crappy little properties when this isn’t just a possibility, it’s an inevitability.

Just to compare with the ’90s in SoCal. Home prices were already falling from a peak in ’89 when we had: Riots in ’92, Major fires in ’93 and the Northridge quake in ’94 (which trashed a whole lot of both Santa Monica and the San Fernando Valley). During this same period the great aerospace swoon was occurring, as post cold-war tens of thousands of high paying jobs left the area permanently. In the face of all this house prices dropped by something like 1/3.

I’m just saying that anyone who thinks that any natural disaster short of a Hydrogen Bomb is going to suddenly pop the bubble is ignoring history. Prices will only drop a bit and an epic land grab and rebuilding will commence. I’m no real estate cheerleader, but I’ve seen it happen before – in a much high interest rate environment than this one.

>> mathematically impossible for asset prices to rise forever at a faster rate than income growth (i.e. people’s ability to service the payments) <<

The great divide on opinion here seems to be WHOSE income growth is the correct metric for analysis?

Is SoCal RE's value determined by the income growth of Americans?

Or is SoCal an international market, such that its RE's true value is determined by the income growth of the world as a whole?

My opinion is that SoCal housing prices will continue to increase for at least another generation, despite some dips along the way. And because of this, I can only afford a decent house if I leave the state. Which I hope to do early next year.

At which time I also hope to unload my condo onto some sucker (a sucker, because condo prices don't rise as quickly, or with such certainly, as do house prices — and because it sucks to live in a condo, with their paper thin walls, and shared washer/dryers, and authoritarian yet capricious HOA).

The biggest problem in analyzing the market and making predictions is doing so broadly as opposed to focusing on individual sub-markets and specific neighborhoods. Not all LA area property is created equal, nor in San Diego. I stretched to buy a condo in Mission Beach in the early 90’s at the start of the recession that is long since paid off, large cash flow and worth 4 times what I paid for it. Lived there for 5 yrs then bought another condo in PB that is now also paid off, cash flowing nicely and worth 3x what I paid. I do have one property just east of there that I bought at peak and is currently worth $75K less than purchase price and break-even on cash flow.

What will be the longer term effect of a natural disaster on an area – IF it happens in your lifetime? Ask the people that own property in the Marina neighborhood in SF what effect the last quake and fires have had on their values today.

Anyway I have always viewed Socal coastal RE as gold and as a very worthy investment to diversify from stocks, bonds and other asset classes. You have to pay through the nose to get the good locations but in 20-30 yrs you (and/or your heirs) will be sitting pretty if you buy in a quality area and you will look back and say I can’t believe I only paid X for that property, at the time it seemed like alot but I am so glad I did. That is my story and the same story for every old-timer beach area property owner I know and I knoe alot of them.

You’d think an old timer would appreciate that past performance is not an indicator of future results.

Venice Renter, comparing the RE market in 2006 to today is not very relevant. Anybody who could fog a mirror could get a loan back in 2006, this is what created the havoc that we saw and blew the bubble to epic proportions. Today’s buyers are much more qualified. We have all cash and large downs that make up a huge segment of buyers…these people aren’t simply going to walk away if the market takes a dive. Additionally, the powers that be have made it clear that RE (especially in expensive areas like LA) will not be allowed to go down. I’m sure you want to own in one of desirable areas, as we have there is a pricing floor for these areas. Every percent these areas go down brings more and more buyer interest. And if you are really worried about the big one hitting, move somewhere where no natural disasters exist…that could be a tough one. Good luck whatever you do.

So weigh in here people. We did a short sale with our house in 2010 it had lost 50% of its value (We purchased for 660 with a loan of 440 and sold for 330) and our insurance had gone from no cost to 1200 a month and it was just more than we could afford. The bank would not consider us for a loan mod Said we would have to stop paying for our daughters college or our sons therapies that were not covered by insurance so we opted for the sale. We have saved 20% down. We are both in our early 50s We are in a small town an hour from San Jose. Prices here have risen 40% from the bottom but are down still about 1/3 from 2006. The house next door to my parents is a short sale. It sold in 2006 for 605. They are asking 399. The exact same house sold two years ago for 275 in an auction (not in quite as good shape but a better lot). We have an income of 140k. Our rent is 1800 for a similar home. (about 100 square feet larger) We plan to stay for at least 15 years. Should we just go ahead and do it? I am so conflicted. We offered 392 and they accepted (waiting to hear from the bank) but we can still cancel without penalty. The pros… being able to help my elderly parents and hopefully allowing them to age and die in place. Help for us with my Aspergers son. (He could stay home alone for short periods with grandma across the street) which would be huge for my husband and I to have a date night or go to lunch alone without him having a big meltdown at having to leave home. Our worst case payment is (4.5) is around 2250 with taxes etc. I have figured at our tax rate the savings initially is around 300 dollars a month. Do you think if there is a decline it will not appreciate to at least a break even scenario in 15 years?. We want to retire to where our children are.

400K in a small town away from city Jobs… what town is this?

if homes were selling for 275K, 285K last year… I’d be careful…

Sadly, we’re in a bubble yet again, just when I was planning to move back to SoCal after a decade back east. Damn near every listing I see in the areas I’m searching is a a home purchased within the last few months by a flipper, “upgraded” with cheap, big box store kitchens and floors, then re-listed at a 50 to 75% markup. I can’t compete with their cash offers on lower priced properties, yet in the long run the banks are screwing themselves. You’d think the banks would find buyers like me me more attractive, as I’m investing long term in a place to live rather than to flip and dump back on the market at a ridiculous price. Now the flippers and banks have to watch as their cheap flips languish unsold and buyers back off. I’m certainly backing off until reality returns to the market, if that ever happens.

After the quake, then we can buy our Santa Monica shack! (Given it doesn’t fall off the bluffs!).

Though I would love to say we are at a top we have at least another year of these crazyincreases. Real estate agents keep jacking up prices because fools think they are geniuses. Beach cities like PV are up 30 percent in less than a year. Normally not a big deal. In some cities that is over $1 million bump due to ridiculous frenzy. Anyone want to join me in starting a movement against stupid? We have to educate folks this craziness needs to stop listening to unscrupulous real estate agents.

Consider this when contemplating if we are in a bubble.

I did a HARP 2 refinance for a local homeowner here in Temecula that required an appraisal on 9/2012. It appraised at $260,000. We reduced his rate and payment by $500/month, yet still has monthly PMI if $150.

Same homeowner calls me October 2013 wondering if he can refi again to get rid of his $150/month PMI.

I do some research and his home is now valued at around $380,000! His home increased in value by $120,000 over a 13 month period.

No wonder only 1/3 of Californians can afford to buy a home after this recent run up in prices.

Being from Minnesota and living here for 10 years, it’s obvious California (more so in certain areas), will always be prone to extremes in real estate cycles.

Can you imagine how worse it could have been if we still had Stated Income or No Doc loans Interest Only ARMS like back in the ‘good old days’?

In my opinion this housing boom feels like the dotcom boom-bust where you had interest rates that were a little low back in 1999 when the nas and dow went way up. Fueling this was all the IPO money going into homes that were bidded way up. Some people would always add another grand on top of another bid just to compete for homes. I even heard someone bought a house for around a half million and then sold it to a dotcomer for several million in short period of time. If what is happening is part of the interest rates then I really think it might be more because of the SoCal’s tech boom which is really fueling these high prices in homes. The tech boom really instigated the buying spree which obviously puts a new floor on home prices due to address this new class of buyers along with your foreign investors as well. However, with all things tech bubbles do pop and when they do be ready to cash in before it craters.

Checking in with you folks from Colorado! I bumped into this blog a few months back. We’ve been trying to find a home (investment property for us) for my elderly Mom and Sis to live in for 5 months in the Denver area! We’ve been outbid or out maneuvered on every home we’ve attempted to buy, whether a short sale or MLS listing. Unfortunately, we’ve been trying to find a fixer upper, undervalued etc., prime targets for flippers and cash investors. We were told our only “problem” is we have to utilize traditional financing (ie mortgage, OMG!) and they’ve gone with cash offers lower than our bid= Pro Investors. It’s a corrupt system everywhere. Our Realtor has refused to admit we’re in a housing bubble and keeps a chirpy attitude that “if it’s meant to be” mantra. Starting to see more listings with price reductions here also. I don’t envy you folks with the perpetual real estate mania in Cali, tho’ I love to visit and chill by the ocean : ) …it’s all relative, glad I don’t live in Detroit where bulldozers are busy!

Inventory in San Clemente is actually down 10% or more since the summer, prices haven’t risen much but there’s certainly no increase in inventory here!

Written 6 months ago about the So Cal economy, etc. from someone living there for 40 years.

http://www.newgeography.com/content/003741-southern-california-economy-not-keeping-up

Perhaps VC investment in So Cal, besides long beach apparently, will pay off per below though; Snapchat better hurry and file to go public before the IPO markets freeze and people realize exploding nudie pics aren’t worth a $4 bil valuation.

http://la.streetsblog.org/2013/08/22/the-tech-boom-comes-to-everywhere-in-socal-but-long-beach/

Hi everyone from Los Angeles, this is my first post. I believe we are in a bubble driven mainly by the glare of optimism that Wall Street is emitting. However, the value of US economy, including real estate, at this point is over estimated and it’s driven by sentiment and speculation rather than fundamentals. At the root of this trouble is the Fed which has created a mirage with the quantitative easing policy, dragging it far too long and now it doesn’t know how to break it to the people. Sure the economy is recovering but it doesn’t justify at all, for example, the Dow at a record high of 15,821 (about 9,000 points increase in less than 4 years!). Just look back at when in May a faint hint to tapering was sufficient to give convulsions to the stock market and push interest rates 100 basis points higher. Next thing you know by September we had a 1.9% drop in existing home sales and from October into Q1 2014 will probably be flat. These are just years of great speculation driven by investors. We need solid employment reports and a sensible increase of higher paying jobs to set the current economy in stone or we are bound for another bubble. My gut feeling is that Fed will begin tapering softly in April 2014 (even if not 100% ready for it) just to set the mood and of course Wall Street will slip a bit. Housing will continue to lose its momentum and sales will remain practically flat or dip a bit due to sluggish payroll reports until mid 2014. Once the Fed will begin the tapering only then the economy will really be tested. If it will sustain its pace, then we may begin seeing higher paying jobs and increasing home prices by end of 2014 into 2015 and another tapering by September 2014. If the tapering fails, then prepare to hold your breath for a roller coaster ride with stock prices losing 10-20% well into Q1 2015 and home values back down to Q4 2012 or Q1 2013 levels (it will be sort of like an undo button has been pressed). China and Europe will also be playing an important role next year, if they’re economies will dip, so will the US.

Well, i had a friend that went to Houston and unlike you his job only pay 20,000 a year Many jobs Houston like Orange County are taken by immigrants without papers. He went to Utah and made about 80,000 a year. Salt Lake is a nicer place than Houston not as many poor barrios or ghettos. You are lucky you live in a nice suburb but many people I knew that went to Texas didn’t get the professional job and end up living in a tough Hispanic neighborhood.

Leave a Reply