The California problem of making too many renters into home owners – Home ownership rate back to levels last seen in 1993. From 2000 to 2010 population increased by 10 percent but owner-occupied housing jumped by 25 percent. Prime Encino zip code with 6 MLS foreclosures but 96 properties in the shadow inventory.

The California housing bubble is still running roughshod over the economy of the Golden State. Bubbles of this magnitude take years and even decades to filter through the system. Even after a sizeable price decline many areas stubbornly remain in housing bubbles like a pouting child. As we have learned even with the financial firepower of the Federal Reserve home prices will fall to a level supported by local family incomes. The reason is obvious although severely underreported. Local area households need to pay for their home through the income their household generates. Given the state of the California economy with a headline unemployment rate of 12.1 percent and an underemployment rate closer to 23 percent household earnings simply cannot support current home prices in many cities. Now that people are looking at housing with a surgeon’s perspective instead of a Nothing-Down-Hawaiian-Shirt state of mind, we still have a way to go until we reach any semblance of a normal market. Let us look carefully at the overall picture here and see where we stand today.

California home ownership – making too many renters into home owners

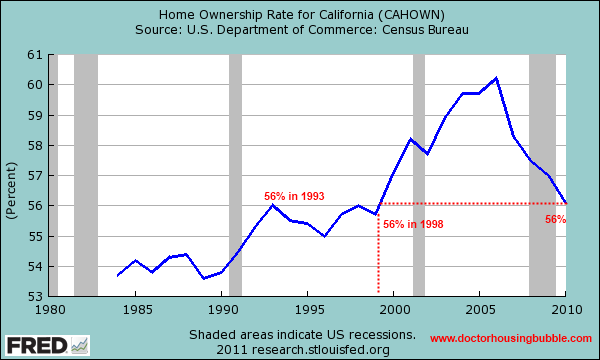

One of the most obvious problems with the California housing bubble was that too many households fit to be renters were lured into home ownership with nothing down, liar loans, Alt-A products, and other toxic leverage items like option ARMs. In short, an artificial bubble market was created. At the moment we are painfully separating those that should rent and those that can adequately support their mortgage payment. By the way, there is nothing wrong with renting but you won’t hear this on the mainstream media and last time I checked, there was no powerful renters lobby. In California you have many area code and zip code chasers that have beer incomes trying to live in champagne neighborhoods. Take a look at the chart above. The California home ownership rate is now back to levels last seen in 1998 and 1993. The Census data released in September only goes back to the end of 2010 so with all the current foreclosures going on, it is likely we are lower as we write this article.

This data without context may not be so useful. So let us look at the population increase over this decade timeframe:

California Population

2000:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 33.8 million

2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 37.3 million

Over this period the California population increased by 10.27 percent to be exact. So you would expect that home ownership would track a similar rate of progress:

Owner-occupied housing

2000:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5.5 million

2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6.9 million

This is an increase of 24.89 percent! In other words there was a giant push to home ownership over this timeframe that simply did not coincide with population growth. Interestingly enough, renter growth did track this figure rather closely:

Renter-occupied housing

2000:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4.9 million

2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5.5 million

The above shows an increase of 11.82 percent which is more in line with population growth. The economy today is much worse than it was in 2000 so it is likely the home ownership rate will continue to move lower while the number of renters stays steady or increases (remember you have many households doubling up). We have discussed the low tier market movements versus higher priced markets. Places in the Inland Empire for example may be closer to nominal bottoms while areas like Pasadena and Santa Monica may only be entering the early stages of the second phase of their correction. This data is rather clear when we segment out home prices by levels.

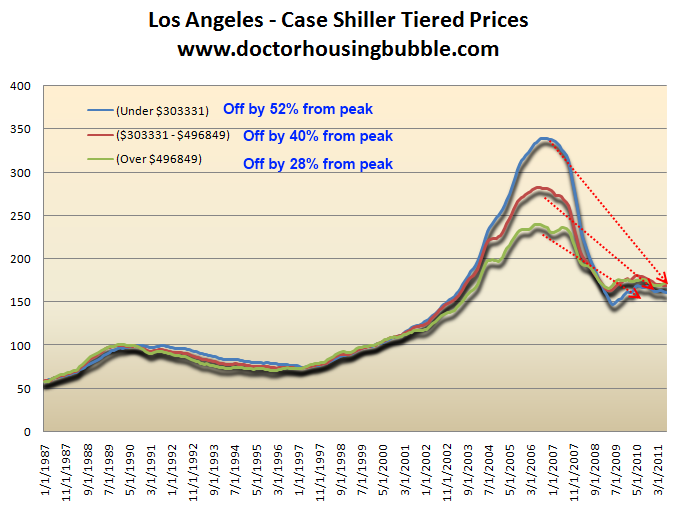

Low, mid, and high tiered home prices

Case-Shiller provides tiered home prices for metro areas and this is useful to see why some areas are still solidly in bubbles. The Case-Shiller Los Angeles data includes Orange County as well:

This is where you really see the multi-level correction. If you look at the sub-$303,000 part of the market this segment is down 52 percent from the peak. Take the market in between $303,000 and $496,000 and you see this range has fallen by 40 percent. But if you look at the upper tiered market, homes above $496,000 you will notice that prices are only off by 28 percent from the peak. Some may speculate that this is occurring because these homes are simply more valuable. I have repeatedly shown and data backs this up that banks are more reluctant to foreclose on higher loan balances. The shadow inventory in places like Beverly Hills is full of million dollar homes where people are making no mortgage payments.

When I look at the above what I see is a few things that coincide with reality:

-Banks were quick to move on lower priced foreclosures. This explains big movements in the Central Valley and Inland Empire of California. It also explains the glut of foreclosures in Nevada, Arizona, and Florida.

-Banks hoped that after half a decade of government bailouts and fleecing of the public, that somehow the mid and upper tier of the market would recover and they would be able to unload the properties. Today is here and home prices are moving lower.

-Banks now have to move on these properties. Losses have been mounting with missed mortgage payments and banks are slowly realizing that home prices may never come back to peak levels. At the moment, the market is looking more like late 2008 when deflation was the fear.

Now think this through for a second. Say a bank has a mid tier place with a $4,000 mortgage payment on it (PI). The place is underwater by $200,000. The bank can take the home over and sell the place and realize the $200,000 loss as it marks it to market. Or the bank can leak $4,000 a month ($48,000 a year) in missed payments. Your break even date quickly closes however. Banks now are losing more money here on lost opportunity cost. That is, they could have sold at market four, three, or even two years ago and taken in a new borrower that would be paying on a mortgage at market rates. Instead, you have banks hoping (wishing) for more bailouts.  Do you think the nation is eager to bailout California homeowners with $500,000 and routinely higher mortgages? Many Americans are struggling with mortgages of $100,000 so there will be little sympathy in this regard and rightfully so.

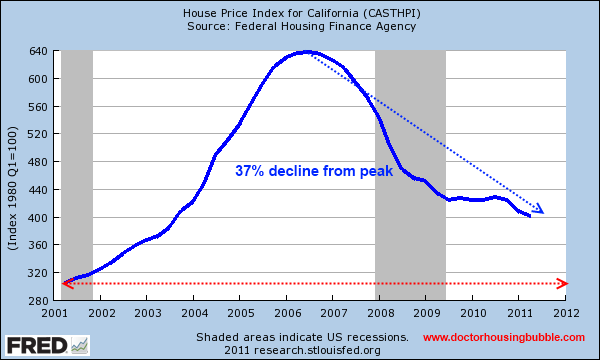

California home prices continue to make post-bubble lows

A few years ago I mentioned that California would face a lost decade in home prices similar to what occurred in Japan. That diagnosis has now come to date. Sure, we have many dramatic differences with Japan but our real estate markets, especially in California, share very similar patterns in regards to the bubble bursting. Home ownership rates are now back to levels of 1993. Unemployment is extremely high because hundreds of thousands of Californians shifted into careers that were only designed for a once in a lifetime bubble. Those high incomes addicted many who hope that a housing bubble is just around the corner. They project their dreams of Alan Greenspan onto Ben Bernanke and pretend that somehow this new magician will magically create another housing bubble. How can he? There are no more investors (pawns) that slick Wall Street bankers can unload CDOs, MBSs, and other toxic waste onto. The name of the game is de-leveraging and some upper tier markets are going to get rocked in the next few years.

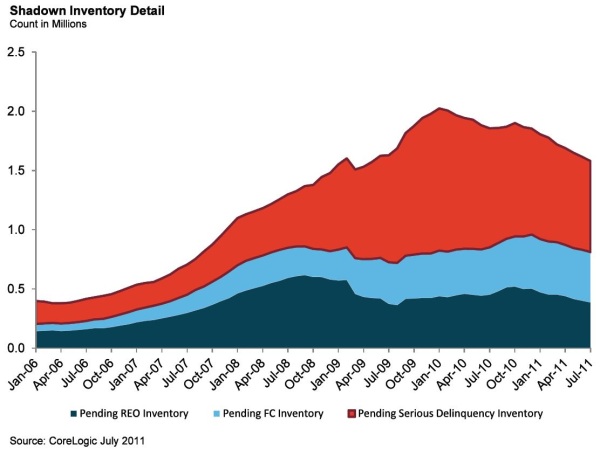

Shadow inventory declines but not in high priced markets

As we discussed previously, the shadow inventory is declining nationwide but there is a big difference between a $50,000 condo in Las Vegas selling versus a $5 million Beverly Hills home now selling for $3 million. The bank takes a $50,000 hit in the condo while the upper tier home will eat up $2 million (the equivalent of 20 condos).

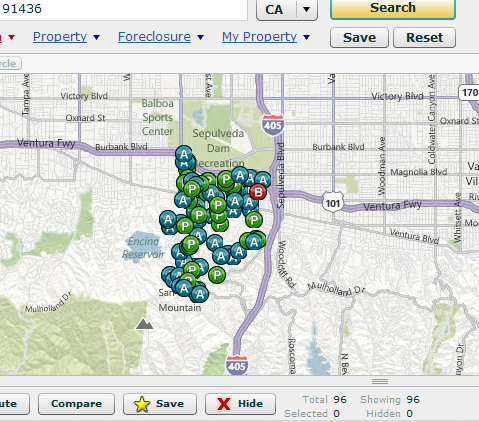

Let us look at a perfect example of this. We’ll look at the 91436 zip code in Encino. The MLS lists only 6 foreclosures for this market. What does the shadow inventory show for a zip code with a median home price of $1.1 million?

Looking at the data on these homes I see many with estimated values of $2 to $3 million. Some markets in California are going to face some dramatic price drops in the years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

40 Responses to “The California problem of making too many renters into home owners – Home ownership rate back to levels last seen in 1993. From 2000 to 2010 population increased by 10 percent but owner-occupied housing jumped by 25 percent. Prime Encino zip code with 6 MLS foreclosures but 96 properties in the shadow inventory.”

Two comments:

Re: “nothing down, liar loans, Alt-A products, and other toxic leverage items like option ARMs.” Besides home demand from hopeful buyers, what else was necessary for the explosion in these products?

Does your CAHOWN analysis include folks living in vehicles that they own?

I have to disagree with you Doc that bubbles that burst can take years and decades to filter through the system. Bubble bursts are usually quick and severe i.e. stock market and oil recently in 2008. With housing, the government and banks are manipulating the free market and dragging it out with massive shadow inventory, 3.5% down payment loan from FHA, and very low interest rates with Fed Reserve buying trillions in mortgage back securities. With free market forces we would have been back to 1995 level prices by now.

Mark – the doc is right; you cannot compare a real estate collapse to the stock market. Residential real estate is highly illiquid comparatively. One product of this is that the stock market can girate much more volatily over short periods of time, including crash and then have historic recovery periods (like that which began on a drop of a hat in March 2009). Homes cannot do the same; it is much more like a big, slow moving ship that needs to turn around in a narrow harbor. Sincerely, Tom in San Diego

“With free market forces we would have been back to 1995 level prices by now.”

No worries mate, we’ll be there shortly 😉

With the quadruple witching of; (1) negative employment due to wage arbitrage/outsourcing; (2) income for non-FIRE industry businesses/jobs back to at least the early 90s; (3) MASSIVE .gov parasitism/debt and entrenched Ivy League POLITEER corruption; (4) Ivy League BANKSTERS looting (i.e. extraction of ALL wealth) the country uncontrolled since the sheeple blew it on Perot.

Add to that a MASSIVE demographic shift that not 1 in a million even understand…

Here’s the problem (to be blunt): We’re currently staring headlong into the greatest population die-off in American history.

Here are the facts:

1) In the vast majority of cases, inherited homes are immediately sold following inheritance. This is because there are usually multiple inheritors per home, and adult-children of the deceased typically don’t live in their hometowns anymore. Selling the house immediately is in the vast majority of cases, the only solution for inheriting families.

2) The bulk (90%+ by some estimates) of total real estate value is owned by baby boomers. (ie: Most of the expensive real estate in America is owned by boomers. Why? Because boomers typically bought at the beginning of the great American credit boom, and traded up along the way.)

3) The baby boomers will begin to die in increasing numbers over the coming decades reaching a peak somewhere between 2020 and 2040.

4) The boomer “die-off” will represent the greatest return of real estate equity to the market in US history. We are about to be *inundated* with real estate.

Still think prices are going to ‘come back’ in 2020? LOL! When CNBC gives you bad news, its usually only because the ‘real news’ is much worse than the bad news they’re giving you.

There will be no recovery at 2020, or 2025, or 2030

You don’t just ‘snap back’ from the greatest credit bubble in a nation’s history. (Just ask Japan)

And the Ivy League Hermanos know it’s coming (been a top shelf issue in NYC afterwork Fraud St. watering holes since the mid 90s), thus the massive CON job, and the fact that this time there will be -0- prosecution, except of course for outsider scapegoats and morons like Madoff, who basically missed the boat and ended up turning himself in when his old-school Ponzi scheme failed (too soon).

Good post, we hear nothing from the MSM of what the effects will be of boomer RE liquidation. I think everybody is in agreement that the generations following the boomers will be poorer and won’t be able to buy RE at boomer inflated prices, this won’t bode well for future prices.

I think people are slowly starting to get it. I work with a younger guy who jumped in with both feet last spring to buy a place for the tax credit. His reasoning was that his boomer parents made a killing in CA RE (there was never a bad time to buy), so he will reap the benefits of this property ponzi ladder also. After talking to him recently, I think he might be on to something that his chances of winning the lottery like his parents WON’T happen. Interesting times ahead indeed!

The boomer die-off may come sooner than that. I fear a sort of ‘Logan’s Run meets Soylent Green’ scenario may be brewing as more and more young people become conscious of what, or rather who, stands between them and being relieved of the massive debt burden created for them by their elders. The first targets would be those who never had children and no close younger relatives and so nobody to defend them.

It may sound outlandish but the scope and horror of WWII would surely have seemed so in the early 1930s. But it happened anyway. It may not play out the way I fear but something big and ugly is coming. The idiots doing the OccupyWallSt. thing are an example of brewing anger looking for a focus. Europe hasn’t ripped itself apart for an unprecedented long time. And they’re teetering on the edge of a financial apocalypse. The big ugly could start there when the tap runs dry on their welfare systems.

(I have a vague concept for a Dirty Harry movie with Clint Eastwood playing a retired Harry Callahan turned vigilante when nobody in authority believes in the existence of the serial killer preying on retirees with cushy pensions far in excess of their lifetime earnings, using a defibrillator to fake heart attacks. Which was used in a ABC TV movie starring Alan Alda in his pre-MASH days.)

DR.HB is fundamentally correct. Housing bubble is different then stock market and oil. People LIVE in housing. Esp. in hi priced areas, you can default on your mortgage, live rent free for many months while it remains in the shadow inventory. The banks, Fed, et,al have been using gimmicks to keep this scenario going, but the gimmicks are running out and the Euro is about to collapse, which will cause the first of the “too-big-to-fail” banks to go under (BofA).

Then, overpriced areas the Dr. mentioned like Encino and BH will drop like a rock. Free market forces are being stalled off by our politicians and bankers. Just wait for the spring-summer selling season of 2013( post-election) and see how far prime areas in LA will have fallen.

yepp, I owe $500K> When my neighbor’s place goes up for sale for $300K, I dump mine, and buy his. Simple stuff. I WIN, the bank looses. Why do you think the dummies in charge are propping (attempting to) prices up? And they keep repeating the STUPID phase “Losing you home”…or “Saving your home” Lose? its still there! Save? From what, a fire??

What if the FED can keep interest rates this low for a full decade? Doesn’t that throw the whole theory of housing affordability out the window?

Buying a house 3x your income relies on the fact that interest rates averaged 8% historically.. If moving forward we are claiming a new paradigm where housing doesn’t appreciate… Then why can’t we have a new paradigm of low interest rates where rates never rise above 4% for the next 20 years too?!

The FED can do it… Then housing affordability has to be recalculated entirely. If cheap money for those with high credit scores becomes the NORM moving forward..then 4-5x your income for a home isn’t unrealistic if interest rates stay under 4% for the next few decades.

If interest rates are kept at 4% (say), and the economy (and especially housing) is imploding at 5% per year (like it’s doing now), you’re effectively paying a 9% interest rate. You’re throwing cash out the window by paying a mortgage, as it could’ve been put to better use.

I’d add that your faith in the Fed is unwarranted, given that they have been spectacularly unsuccessful in achieving their goals. And their track record for their predictions has been consistently wrong. Add to that they were one of the key players in causing the current economic disaster which is upon us. And then they claimed that “no one could see it coming”.

Those ought to be two very significant clues that the Fed isn’t in control, no matter how much they’d like to spin it that way.

yes…assuming you cna get FREE rent elsewhere. Where’d that be, Mom & Dad’s?

@Surfaddict:

You’re looking at rent all wrong. Via the old paradigm of the last century, when housing was going up. You need to shift your viewpoint to the current age.

When you pay rent, you’re not just paying for a place to live. You’re also paying someone else to take the risk of ending up underwater. Seen in that light, current rents are a bargain.

Q:

I’m with you, substitute Reasonable for FREE, same/same. Mortgage (cost) makes sense from cashflow perspective only, at least that is metric i always use. I always keep an eye on my local rents. i ASK how much my neighbors pay…don’t be shy, go-ahead and quiz everybody. If anything youll at least get to know who the open and honest people are you live around. I know who are the fools that are paying MORE than equivelent rents. That is straight-up stupid. I’m pretty sure about 80% of humans are stupid, so that is what keeps the game fueled, straight-up stupidity.

@surfaddict:

Thanks for the clarification. I just came up with another way of looking at things from a cash-flow perspective, which I find interesting, and might hopefully put things in better perspective for everyone.

Suppose one has a $500K house, with 0% down. With housing currently imploding at 5% YOY, such a mortgage-owner is losing $25K per year. That’s about $2K in month, which is comparable in many areas to the rent for a similar house.

So, in short, you have a choice. Toss $2K out the window to buy a debt you probably can’t get out of (if you’ve refi’d, which most people have), or pay $2K to live without the worry, and have the freedom to move if you need to.

Welcome to the modern world. And for those of you who really are in denial, you might want to look at what looks like a Bank run going on at BofA’s online site these days.

It all depends upon the holders of these mortgages. Many banks were originators of the mortgages and then they sold them, since banks do not like to keep crap on their books. The mortgages were sold to government(taxpayer) institutions and investors(a great many overseas). Now, many of these mortgages are bad. The investors(hold about 66% of the mortgages) realize that now is the time to sell them, foreclose, and sell the house. The banks are servicers of the MBS.

Thought provoking. However, the banks want short sales now (finally) and are doing a better job with underwater homedebtors, so that defaulted homedebtors aren’t foreclosed on as much or here as to Encino, perhaps almost not at all to speak of. The inventory is still there, the number who have stopped paying may be impossible to compute with the short sale issues. Comparisons to other areas with higher foreclosures is also now statistically impossible, as many of those areas also have varying short sales, many of which aren’t disclosed in the MLS or not appropriately. The best indicator of the trouble is still the median sale price for a comparable home over the years, and this can be estimated as the homes occupied by the 60-85% percentile of the average family income of the region. That all said, the thrust of the article is correct on one key point, where are all the buyers of tomorrow supposed to arise from? In an expensive neighborhood, presumably many potential buyers of that price home have the smarts not to get stuck on a new home purchase, and of course many potential buyers OWN a home and can’t get out of where they are or don’t even really want to try. One can project that Encino prices will decline until at least spring. Who is dumb enough to buy into an expensive rapidly declining market (yeah, I know…plenty of people think they aren’t the dumb one, someone else is). Zillow claims 150 expensive homes changed hands there in the last 90 days, I just don’t get how that is possible unless the bubble mentality applies to these buyers STILL…or these folks have so much money that losing several hundred thousand means utterly nothing to them.

RE is a leveraged credit asset similar to buying stocks on margin or auto’s for that matter. The issue is not the value of RE or the mentality of the buyer but the availability of credit for the bucket of new leveraged buyers. Your point regarding new buyers is now the current risk for continued sales as the bucket of FTH within the current credit risks is declining so the issues become similar to the auto markets, sell to lower credit risks and generate higher defaults until the default rate becomes unreasonable. The capital markets created another large fee opportunity similar to the used auto market as we now have the distressed home market. The used auto market and the distressed RE market look very similar as the distressed market creates a variety of jobs for the construction business, fees for the financial markets and money velocity for the FED. FWIW

IndyLew brings up a good point, if I search on home sales on Un-“Trulia’ or Zillow I see lots of recent ‘homes sold near this one’.

It does shock me how many home sales (showing closing price) are going on right now in WLA and Culver City, etc.

But perhaps best to ask what the sales prices were of foreclosures and short sales…

Oil has not been in a bubble and will never again be in a bubble. Today oil sources can no longer support an expanding world economy. An expanding economy requires an increased world wide source of oil and it is simply not available. Oil prices are not set by speculators, government or OPEC any longer; they are controlled by the size of world GDP. GDP is controlled by the amount of energy available. Today’s oil sources are depleting at a rate about equal to today’s new additions to new energy sources.

There are three things that control the destiny of man, Time, Energy and Mass. so you see oil is energy and not a commodity in the usual sense. It is the life blood of the destiny of man and of this world as you have known it.

Wrongo about the peak oil stuff.

Huge oil boom occurring in the Americas.

http://m.npr.org/story/140784004?url=/2011/09/25/140784004/new-boom-reshapes-oil-world-rocks-north-dakota

So much that in just the last few years, the US has gone from importing over 66% to currently importing less than half our needs. Read the NPR transcript. US set to outproduce Saudi Arabia. With recent tech advances, Canada, US and the Americas have over 3x the available reserves in the Middle East.

We’re going to be deleveraging out of housing overinvestment for years, but at least we aren’t running out of oil for quite some time.

My family has been farming the same land since the 1850’s, producing WTI oil since the 1940’s and I’ve been the third futures trader in the family since around the 1880’s. Starting in 1999, my second futures trade was oil, and the third trade I did was unleaded gasoline. Most people such as the poster I’m replying to have no real understanding of how the futures markets work, especially the energy markets. It all sounds like someone parroting what they read in “Mother Jones” or a “Rolling Stone” article. Commodity bubbles come and go all the time and most consumers never hear of them. Remember the great corn/wheat/soybean bubble of 2003? Probably not. Thanks for the laugh of the day!

Good input. If someone wants to see a speculation driven oil bubble, just look at 2008. Global GDP under massive threat, supply abundant, usage down, and what happened oil runs to nearly $140. Insanity. Non-economic/speculators piling money into the market to get exposure driving momentum madness. On the supply side, those guys just ride it out, a little uncomfortable but hey, pricing this stuff is hard as hell so go with it. AND THEN, the bubble pops and supply side sees the bubble for what it was, with speculative money on the wane and clear broken economy potential, supply side brings monster volume forward to lock in profitable pricing for a long period CRUSHING economic and non-economic demand. That is a bubble and bubble popping. That is an oil bubble. And it had nothing to do with world GDP or any fundamentals outside of technical money flow looking for a home to earn some rent.

As far as peak oil…that’s just outside the scope of this blog but suffice to say oil production is not binary and is completely determined by cost to extract (technology alone brings this down). Also the amount of oil profitably extracted at $160 vs $80 is not 2x or linear at all.

“Then why can’t we have a new paradigm of low interest rates where rates never rise above 4% for the next 20 years too?!”

No. As long as there’s a “We can change this contract to whatever we like”-statement in every mortgage agreement, there really is no such thing as “30 year fixed” loan: If interests rise too high, the bank changes the agreement (to much higher interest) and you either pay the capital back or agree to that.

Good luck for paying back, all at once: You are a debt slave and you’re treated as one.

Despite all the Fed and the govt has done, housing is still headed downward. Employment is the elephant in the room.

They can use all the tricks in the book, but without jobs, people cannot get loans. They also cannot pay back loans they may have gotten before they lost their jobs. Herein lies the real problem. Unless the govt and the Fed get unemployment back to about 7%, there will be no recovery in home prices.

“I have repeatedly shown and data backs this up that banks are more reluctant to foreclose on higher loan balances. ”

I suppose that is one interpretation. Another one would be that subprime foreclosed first, then the negative amortization ARMs, and now probably some loans that were actually low risk, but fell victim to unemployment. That is, are banks actually slower to foreclose on jumbos, or is it that the higher end foreclosures didn’t hit NoD until more recently. How would you tease that out?

In California the Notice of Default states the first date a payment was missed and what the cost of reinstatement is. By creating an index measuring the difference between the first date of payment default and the date the Notice of Default was recorded you could create a chart to see if the “filing lag” is growing or shrinking. I don’t know if anyone has done this.

You could also create a chart that divides the reinstatement quote on the NOD by the loan balance; a rising percentage would indicate that banks are letting delinquencies fester longer before pulling the trigger.

HOUSING: The bigger the loan, the longer to foreclose

California government income for the second quarter. April thru June according to the Rockefeller Institue of Government.

The percentage are compared for the second quarter of 2011 compared with the second quater of 2010.

Personal income up 7.4%.

Corporate income up 12.2%

Sales tax up 1.1%

Total revenue up 7.2%

The sales tax is an ugly number. With the reported inflation by the goverment of 3.8% and ShawdowStarts reported around 7%. A sales tax of 1% means people are saving and not spending.

The real U.S. economy for it’s citizens continues to spiral downward. No Jobs – No Housing. No Housing – No Jobs. Let’s face it, real estate was our artifical economy, and that has ended. We are one large bank failure away from a global financial crisis. Sooner or later, large bank shareholders (BOA?, Citibank?)will want to get out first, before all the dominoes begin to fall. The question is not IF, but WHEN?

Buying a house in this environment is financial suicide right now. Everyone is just trying to protect whatever reserves they have left. Nothing has been resolved since 2008 and we are headed for a global depression. ANY paper investment is at considerable risk, especially bank mortgages.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdown.blogspot.com

Buying a house in this environment is financial suicide right now. Everyone is just trying to protect whatever reserves they have left. Nothing has been resolved since 2008 and we are headed for a global depression. ANY paper investment is at considerable risk, especially bank mortgages.

Knew a debt-owner that was trying to become a RE lottery winner, so he thought he would get a terrific deal on a SoCal short sale. He purchased the house in 2009 for $600K – At the frothy top the house was valued at $875K.

His game was to finance 80% through a 30 year fixed and 20% through his home equity loan. He used the 20% home equity as the down payment, so no PMI.

Anyway, his idea was to buy it, rent it out and wait for it to go back up based on Obama’s recovery plan. At the time he stated with Obama’s the economy would be just like Clinton’s economy. He tried to rent the house for $1,900/month, waited a while, tried $1,800.00, then $1,700.00. He finally had interest at 1,500/month. So the house was unrented for about 7-8 months. He had a tenant in the house for about a little over a year and the tenant stopped paying his rent because he lost his job, so the owner had to get him evicted.

So much for making money on the house so far. He did get the house though for 0% down. This has been a loosing investment, other than having write-offs. (The house is now worth $450K and falling).

I also knew a realturd gold digger that was big on buying foreclosed homes in 2008 and renting them out. I warned her homes were going down another 20%, She looked at me like I was crazy.

She’s totally done, wiped-out, done, 1000% neg asset-to-leverage, and living La Vida Loca in her Beemer without making payments to banksters for at least 1.5 years – Her day to dance with the devil is coming…

In my neighborhood you can get a prop for 550-600 and rent it out for 3-4K. Yes, you can. So, you’re making money free and clear. The rental market is super tight and super inflated.

Sorry bad link for Santa Monica. Here is the correct one.

http://santamonicameltdownthe90402.blogspot.com

A real estate investor once told me “If you owe the bank $100,000 and can’t pay, you are in trouble. If you owe the bank $1,000,000 and can’t pay, the bank is in trouble…”

Somebody please define “housing recovery” for me. Are we saying that housing prices gets back to 2007 levels? That’s like waiting for the NASDAQ to get back to 5000 or tulip bulbs to get back to being worth an entire farm. I am not clear what is meant by the term “housing recovery” in this context.

It’s because a lot of people want to deny reality. After the bubble pops the correction comes. The market slowly but surely (for real estate) reveals what this stuff is really worth when there stops being a lot of stupid money chasing investments.

There are always idiots who thought the bubble was a good thing and want it back. Or a new bubble, which is even worse considering housing was the bubble encourage to replace the dot.bomb bubble. Predicting that implosion made unpopular in some quarters back in the 90s. They really wanted to believe there was such a thing as a New Economy and the old rules no longer applied. The fact is, the 2000 recession should have been a lot worse but if it had been allowed to play itself out we would have been saved the far worse pain happening now.

We’d still have other serious problems, like the the unsustainable entitlements tsunami looming.

it is worth what a fool is willing to pay…that might be MORE than material (2×4’s) plus labor…or it might be less. Most places are still priced WAY above material plus labor…think about what builder charges…it used tobe $100 sq ft…and 5 yrs ago the cocky ones were charging (and getting) $300/ft.

RE:” Or a new bubble, which is even worse considering housing was the bubble encourage to replace the dot.bomb bubble. Predicting that implosion made unpopular in some quarters back in the 90s. They really wanted to believe there was such a thing as a New Economy and the old rules no longer applied. The fact is, the 2000 recession should have been a lot worse but if it had been allowed to play itself out we would have been saved the far worse pain happening now.”

This is really the key point right here. We were going to deal with some painful deflation after the dot com bubble so instead they inflated a housing bubble to try to drive wealth and get wages to move up. Obviously it didn’t work but how completely irresponsible of the political machine to drive a ‘recovery bubble’ in what was most people’s single largest investment as well as being the most leveraged? Consider also that the consumer is 70% of GDP so trashing him/her out comes with massive consequences.

When I hear people argue for more central planning and regulation (and I’m not a zero regulation guy either) I want to scream that this entire debacle is the result of their meddling in the housing market and financials to facilitate it (removing leverage limits, making securitized assets super cheap from a cost of capital standpoint, and constantly bailing out these risky, overexposed, completely non-transparent public companies).

Dr. Housingbubble,

Are there any chance you’re going to do “Home of Genius” installments again? Simple pictures and a little editorial go a long way. The entertainment value is sheer brilliance and the message gets across much more effectively.

REgards,

Bubble Watcher

California Quits Foreclosure Talks With Big Banks

The state of California pulled out of multi-state mortgage negotiations with large U.S. banks, dealing a sharp blow to long-running efforts to secure a broad settlement over allegations of lending abuses.

Eight of the 10 hardest hit U.S. cities in terms of foreclosure rates are in California, Harris said.

You state that “inland empire homes may be reaching a nominal bottom” but I think they would fall further if areas such as Torrance, La Palma, El Monte, Anaheim, Long Beach or similar “lower prestige” areas collapse. If you work in OC or Downtown LA, these areas are much better commutes… if the start pricing competitively against Corona or other IE bedroom communities, what happens?

Like many DHB readers, I’m out of the real estate market for the forseeable future. Partly because the prices are still in bubbles in most areas, and partly because I’m stuck in the Bay Area for work in this wonderful job market. In the future, when looking for a realtor, ask them how many buyers they represented were foreclosed on. Too bad there isn’t some database you can go to find this out or verify. There are alot of “foreclosure and short sale specialists” that used to be “no money down specialists”. Jackals all of them! They need to starve to death.

Leave a Reply