California Financial Stagpression: Budget Deficit Hits $11.2 Billion Deficit 6 Weeks after Signing Budget. 5 Reasons Why California will see a Deteriorating Economy in 2009.

Leave it to California to first, stall a budget for a record 85 days only to pass a budget that amounts to kicking the economic shiny can down the pothole-filled road. We may want to save those cans for their redemption value since things are getting progressively worse. Only 6 weeks after being signed, the budget is now facing a stunning $11.2 billion deficit. It took longer to pass the first budget than it took us to once again drive off an economic cliff. What exactly happened here?

Well first, the initial budget passed in September for the 2008-09 fiscal year amounted to a buffet of gimmicks, illusions, and putting your hand in one pocket, taking $20 out and shifting it over to your other pocket deluding yourself that you are now richer. So how did they pass that budget?

*$3.3 billion in sale of authorized Economic Recovery Bonds

*$1.9 billion in changes to accrual accounting

*$5.1 billion of lottery proceeds

*$1.4 billion in other initiatives

*$8 billion in spending cuts

This is what it took to pass a $143 billion budget on September 23. More debt and accounting smoke and mirrors. Nothing really addressed the structural problems facing the state. Barely enough time to catch our breath but here is what awaits California. This comes from the Special Session 2008-09 report:

“Economic conditions have deteriorated dramatically since the Governor signed the 2008 Budget Act of September 23. This deterioration was reflected in General Fund revenue collections for the month of September that came in $923 million below forecast. As a result, California faces a revenue shortfall of $11.2 billion this year. Specifically, the Department of Finance estimates that General Fund revenues will be approximately $567 million lower in 2007-08, $10.7 billion lower in 2008-09, and $13 billion lower in 2009-10 than earlier projections.”

This coming from our government so you know things are actually worse. So where was this supposed and deceptive money going to come from? Let us look at the revenue sources for the state:

54% of the state revenue comes from the personal income tax. Another 26% is pulled from sales taxes. Corporate tax pulls in about 12%. So by and large, most of the state revenue comes from people paying taxes on earnings. Which leads us to our first obvious reason why this budget shortfall is not a surprise.

Let us now look at 5 reasons why 2009 will make 2008 look like a picnic for the state.

Condition #1 – Employment

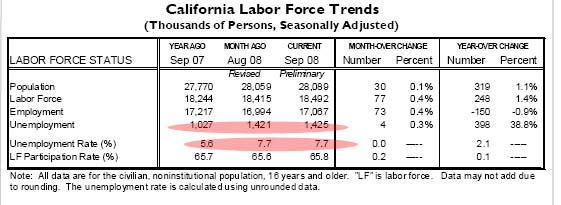

Hard to tax someone when they are unemployed. The unemployment rate in the state is exploding:

California’s unemployment rate stands at 7.7%. The last time the rate was this high was in 1996 and puts us at the 4th highest rate of unemployment in the country. Now, what we are seeing is a vicious cycle that feeds on itself where people get fired, they don’t spend, don’t pay taxes, and it feeds and reinforces itself. Remember these are state estimates which are always in the Pollyanna camp and are tantamount to asking a real estate agent if buying today is a good decision. It is highly doubtful that the state has even crunched the numbers for October since they lag. You thought September was bad? Just wait until the October numbers are processed.

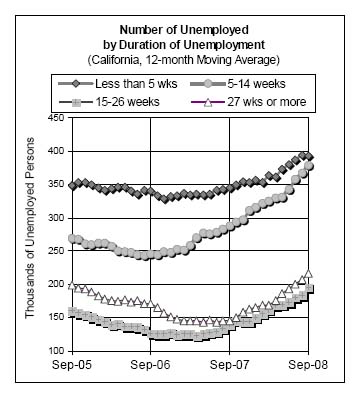

There is no economic fundamental sign as to why employment will suddenly explode once again next year. California was much too reliant on finance, insurance, and real estate for its health. We have tied our anchor to the biggest bubble in history and the industries that pumped the air into this bubble. And unemployment is getting longer and more painful. Let us first look at the duration of unemployment in the state:

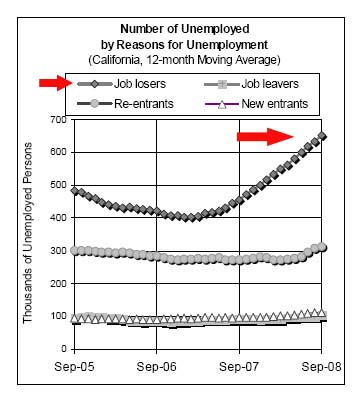

Currently, over 350,000 people have been unemployed 5 to 14 weeks. This a jump from September of 2006 when the number was 250,000. In addition, those unemployed 27 weeks or more has shot up in the last year alone. Currently there are over 200,000 people that fall in this category when only in September of 2007 there were 150,000. What does this tell us? It is much harder to find a job and more and more are losing their jobs unfortunately. Let us now look at how people lose their jobs:

This is probably a more revealing chart. Those considered by the state as “job losers” has jumped up exponentially. In September of 2006 400,000 people were categorized as job losers and now the number is well over 600,000. Why is this category important? These are people that lost their job and not by their own choice. They were fired, a company went bankrupt, or the company money just ran out. Overall, there are currently 1,425,000 people unemployed in the state:

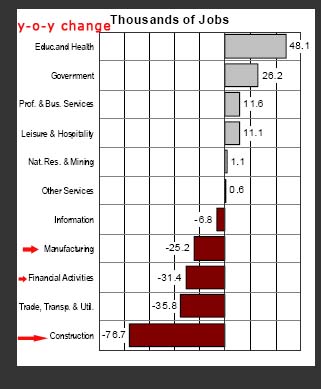

Going back to the budget, with personal income tax being the highest revenue source and job losses only growing, you can expect less money to come into the state next year. Let us take a look at the actual data and look at certain industries:

It should not come as a surprise that the biggest job losses are in fields related to the housing industry.

Condition #2 Housing

According to DataQuick the median price of a home sold in California for October was $280,000. The peak using DataQuick as our source was $484,000 for the state in May of 2007. What this now means is statewide the California median home price is now down a jaw dropping 42% in slightly over a year. I have very little doubt that we won’t see a housing bottom until 2011 and with this budget I am only more convinced that this will be the case.

Last month 51.1 percent of all sales were foreclosure resales. Given that 40,317 homes sold, 20,602 of these homes were foreclosures. That is a stunning number. You may think that the sales are starting to pick up pace. Do not kid yourself. This number is simply keeping pace with the amount of distress inventory hitting the market. Let us look at the numbers for the most recent dataset:

September 2008 Distress Indicators

Notice of Defaults:Â Â Â 21,665

Trustee Sales:Â Â Â Â Â Â Â Â Â Â Â 20,510

REOs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 27,373

It is highly likely that most of the 21,665 Notice of Defaults will go into foreclosure. For the 3rd quarter, only 20 percent were able to save their home once in this stage. Meaning, 8 out of 10 will lose their home. What that also means is there are more distress properties hitting the market each month than actual sales. Even with the new SB 1137 legislation the drop in NODs and foreclosures will be extremely short lived. Why? It only addresses one facet of this complex equation. It basically seeks to do for distress data the same it did with the budget. Sweep the problem under the rug for another day. Look at condition #1 regarding jobs and you’ll see why these measures fail to address the true problem. Employment never justified these prices in the first place.

We are also entering the fall and winter selling season which historically is always slower. When tax payments start rolling in the state is going to realize that the 2009-10 budget is simply unsupportable.

Condition #3 – State Budget Kicking Can Down

It is worth noting that the recent budget pass in September was the equivalent of putting a band-aid on a broken bone. Sure, it feels good because you are doing something but it failed to address the true magnitude of the problem. There is major revenue short falls. Something needs to be done. And that is where the hard choice is. Do you cut additional jobs thus fueling the perpetual cycle and adding more people to the unemployment lines or do you raise taxes and risk hurting some businesses in the state? At this point, it seems like a combination is necessary. A dogmatic approach to this will not take us anywhere.

The last budget split on this ideological perspective and look where it got us. 6 weeks and we are back to the drawing board. I have no idea how we still have an A+ rating but hey, some of those collateralized debt obligations had A+ ratings right before they imploded so take that for what it is worth. Take a look at the above revenue and you see where we are heading.

Also, just wait until folks do their taxes for next year. Big money comes from capital gains and you can rest assured that many people are a lot less wealthy today. The state better adjust quickly and gear up because we have less than 2 months before we enter 2009. After that, many will be claiming losses on their tax returns so that revenue is out the window. If unemployment keeps going up that is fewer that pay into the tax base.

Sales have fallen drastically as well. You need only look at the recent example of Circuit City, many here in California, which decided to close down 155 stores. We are reaching the endgame here. That is, we are now at the moment where we realize the full extent of this Ponzi financial system.  The only thing that kept things going up was simply the momentum itself. It detached from any economic or market fundamentals. It was by all definitions a bubble. Sadly, the state budget assumed a decade of bubble growth was somehow normal. Now, we need to quickly adjust to the actual reality. That bubble is long gone and big profits with it. Have we forgotten about the years of Real Homes of Genius plaguing the market?

Condition #4 – Global Crisis

I never understood why some folks believed so strongly in decoupling:

![]() : “California will never go down. Because guess what? Even if people aren’t buying here the world is doing fine and they’ll buy real estate here.”

: “California will never go down. Because guess what? Even if people aren’t buying here the world is doing fine and they’ll buy real estate here.”

These folks fall under the decoupling camp and they are largely silent and absent today. All you needed to do was travel and realized everyone drank the debt elixir. Some have modified their stance. It is unequivocally clear that foreign buyers are not snapping up real estate. In the few cases that they are, they are buying in Beverly Hills or Santa Monica and not the Inland Empire or other L.A. locations where the bulk of people live.

The fact that this is a global crisis leaves us largely to our own devices. Even by current measures, prices in California are still too high. People across the country view our prices still as bubbly. They certainly aren’t going to rush in and buy up these homes. Who are they going to rent them to? The unemployed? Makes absolutely no sense. It is much too big of a risk. Plus, most lenders now require solid credit and anywhere from 20 to 30 percent down for any investment property. You tell me how Americans have $56,000 or $84,000 sitting around for an investment property? Not many and those that do are buying out in other states where prices make more sense.

This global credit crisis is gigantic. It is estimated that current declines have wiped out over $10 trillion globally. This isn’t chump change. That is the size of our national debt.

Condition #5 – Consumer Behavior

Finally, people are more cautious. People are now psychologically scarred and realize that more pain may be coming down the pipeline. Why would someone want to buy a home if they are not certain about their job situation? Maybe they are getting their hours cut back. Maybe they’ve just watched their 401k lose 40% of its value and they are wondering how they will survive in retirement. Many have seen their home equity disappear. Everyone knows someone or is personally hit by this economic crisis.

This goes beyond simply a credit crisis. This is not just a subprime mess. This is hitting on so many fronts and simply shows how complex our global system is. Let us look at what we are battling with:

*Growing unemployment

*Deflation in housing prices

*Credit crisis

*Automobile sector on the verge of collapse

*Big ticket consumer stores going under

*Commodities bubble popping

*Commercial real estate collapsing

*Banks going under

Obviously, the above does a number on the psyche of the public. I would assume many are even holding off on buying say a new car, TV, or computer and making do with what they have. Many of the economic consumerist models relied on folks spending over and over and always replacing slightly old items with newer flashier models. We’ll be seeing more older cars on the road. This new paradigm of consumer awakening is hitting at the worst time, the holiday shopping season.

With that said, California is now forced to make hard choices. There is no other way. We are in what I call Stagpression. That is a situation where we are holding off depression with mountains of debt. Not exactly a method or recipe for recovery.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

14 Responses to “California Financial Stagpression: Budget Deficit Hits $11.2 Billion Deficit 6 Weeks after Signing Budget. 5 Reasons Why California will see a Deteriorating Economy in 2009.”

Stagpression>> Did you just make that up? I certainly believe we are in early stages of the next great depression. All of us diligent debt-slaves are tapped-out like an empty keg. We can’t make a beer run cuzz we are broke. I am sickened my town just voted in a big bond measure by significant margin. How the heck can property owners afford to pay more to cover it?

Does California have a progressive income tax? Mass. has a flat income tax due to its Constitution, I don’t know how common that is. If so, will they ever stop beating up the middle and lower classes with regressive sales taxes and tax the crap out of the wealthy? They are, after all, the ones with money.

Stagpression ©. You heard it here first. 🙂

After all, they keep making up new terms for the same stuff. Junk bonds are now high yield bonds. Negative amortization loans became wonderful option ARMs.

This is stagpression. Wages are stagnant, no inflation, yet the government is pouring capital into the system which you would think would cause inflation. What gives? Well you need to pump more and more since the currency is going lower and lower.

DrHB: Its called Deflation. Those above ground have never experienced it. That’s why, TODAY they can print money (bailout) and bread isnt $10 per loaf…yet. Its like a big algabraic equation, so many vairables that must eventually effect each other. One potential consequence of prolonged deflation is SHORTAGES (bread lines). So like you say, keep pumping, the printing press usually means inflation, but in this case they can get away with it, at least for a little while.

Somehow in all the governemnets discussion, lower state expenditures are never considered. The goal is to find money in the sofa and pay everyone out of that.

The state really needs to cut its ridiculous staff and salaries. Typical police and fire make over $130,000 per year with very fast retirements. There are far too many fire, police, highway workers and bureaucrats. It all needs to be outsourced.

If someone tries to tell me to tax the rich, then guess what happens? I can tell you. Venture capital money, the lifeblood of industry, comes from where? Food stamps recipients? Plumbers? Policemen? Firemen? State employees? Guess what, capital needed to build jobs and industry comes from the rich. Tax them and you have just starved the golden goose. The California rich are leaving the state in droves, and if you don’t believe it go to the Nevada side of Lake Tahoe or the Garderville/Minden valley in Nevada — those are tax refugees. Keep raising taxes on the rich and the trickle becomes a flood.

@Printfaster: By many accounts I’m “rich” and yet — I’m staying put. Obama’s going to raise my taxes, and the gap between what I’ll pay under him and what I would’ve paid under McCain is enormous. But I almost maxed out on contributions to his campaign. Imagine this: not every person who earns a lot of money is a myopic greedy A-hole. And imagine this, the money has to go somewhere. Venture capital doesn’t just pick up its marbles and go home if you tax high earners. Spend some time contemplating this cartoon:

http://blogs.venturacountystar.com/greenberg/qqxsgFiscalConservative.jpg

@Dr.HB — Stagpression is awesome. I wish you were on Obama’s economic team that’s meeting today. You know, you could go to http://www.change.gov and apply for a position.

CA has a so called progressive income tax but it reaches the maximum bracket in the low 40ks. There’s a small fraction of a % more on millionaires but it’s basically flat from 43k on up. So unless the brackets were changed raising the top bracket will deal it’s hardest blow to the middle class.

@stevejust –

I wouldn’t waste your intellect “contemplating a cartoon”. I looked at it. It’s just a cartoon. With an appropriately cartoonish and simplistic partisan slant. I keep hearing Democrats spout off about how Bill Clinton was “saving the country” with his budget surplus, but the facts don’t support the claim. Here are the facts of the national debt, plain and simple:

National debt, 1992 – 4.06 Trillion

National debt, 1993 – 4.41 Trillion

National debt, 1994 – 4.69 Trillion

National debt, 1995 – 4.97 Trillion

National debt, 1996 – 5.22 Trillion

National debt, 1997 – 5.41 Trillion

National debt, 1998 – 5.53 Trillion

National debt, 1999 – 5.65 Trillion

National debt, 2000 – 5.67 Trillion

So, as much as you want to believe that Bill Clinton was completely different than the Republicans, the fact is that there was an almost 40% increase in the national debt during his years in office. And in no year does the national debt actually go DOWN. So, from an accounting point of view, there was no actual budget surplus. Obviously, that so-called “surplus” got spent on something, and it wasn’t to buy down our debt.

And you’re right – money does have to go somewhere. I’m assuming that you’re not familiar with what’s going on in Hollywood right now. The taxes and fees to shoot films and television shows in Los Angeles are so pervasive that the money is going to: Toronto, Vancouver, New Mexico, Shreveport, Bulgaria and even Dubai.

As for me, as taxes continue to spike in California, I’m considering moving my business to Austin, TX. So I applaud you for continuing to live in California, but there are a great many businesses and individuals who are going to flee for greener pastures when our government starts to put the screws to us.

I remember an old quote from Arnold, from decades ago, When he was asked about paying income tax he said that he likes paying a lot of tax, cause it means he’s making a lot of money.

stevejust, the world needs to be a lot more like you.

It is amazing how many fixes there are out there.

PrintFaster…Bingo on the Tax refugee comment.

President of our company left CA for the NV side of Tahoe two years ago. For the most part we are only considering new hires who live out of state. When compared to costs of doing business elsewhere, CA can no longer compete.

Thanks Sacramento….and all the dopes that keep these chumps in office.

To TheOtherSteve

What I see is the remaining Californians are rich attorneys, trust babies, performers and financial types who frankly feel a lot of guilt associated with their unjustified gaining of financial status.

Those folks are too lazy to start industries, or donate time and treasure to charity and philanthropy. They are the guilt ridden rich who want government to ease them of their burden, kind of like the criminal who seeks to be caught and punished because overwhelming guilt.

I see California turning into Baja with a lot of really poor burning tires in oil drums for heat and cooking, and the rich behind their high walled compounds sipping fine wines. Of course like Baja there will be health care for all as they all wait in long lines at the government hospitals. The government hospitals keep the rich from feeling guilty — true government service for both rich and poor.

Doc,

I thought you might appreciate the bizarre story of Casa Simpatica in northern San Diego County. Feel free to re-post it.

Best regards,

W.C. Varones

I believe Clinton took office in January 2003. Have a nice day !

Leave a Reply