Bipolar Housing: Lessons from the Great Depression: Part XI. Understanding the Impact of Asset Deflation and Consumer Inflation.

Middle class Americans are quickly finding out the difference between wants and needs. During an era of financial decadence, many are now finding it difficult to adjust psychologically to the new realities that confront us. There are many examples that we can use to cite this shift in consumer psychology. First, you don’t need to own a home but you do need shelter. This can be met by leasing a place. You don’t need a gas guzzling tank to drive around perfectly paved freeways. There are much more accessible and fuel-efficient ways of getting around. You can hold off on buying that massive plasma screen television. Maybe a 40″ regular flat screen will do. This is our new reality.

I still get the sense from many people that this will only be a temporary bump in the road to more consumption. This couldn’t be anything further from the truth. What we are now facing is here to stay simply because years and years of financial irresponsibility are now crashing down upon us like a ton of bricks. This was predictable and a consequence of spending beyond our means. The political jockeying is now going forward to once again cement this idea of a new paradigm. Some want to continue to drill for more oil as if saying, “vote for me and you can continue frolicking in your F-150s and Hummers as if the world hadn’t changed!” It is absurd and economically speaking, drilling off shore would only decrease prices by chump change measured in cents but apparently, this is logic that jives with a large portion of our population. This is probably the same segment of the population that thought lower interest rates on housing and easier lending standards were excellent ideas.

In May, the Economist pointed out in a rather quick and to the point article that the nominal nationwide drop in housing prices of 14.1% is the worst drop ever. Even more painful than the drop in 1932 when home prices fell nominally by 10.5%. In this article I am going to demonstrate that the 14.1% drop is even worse because of inflation while the 10.5% drop in 1932 was reflecting an actual deflationary climate of the time. This is part XI of our Great Depression series:

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

8. Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear

9. A Bubble That Broke the World

10. The Sham of our Current Unemployment Numbers

Bipolar Housing – Keeping the Mania in Maniac

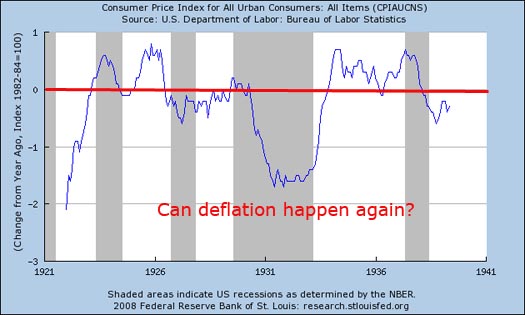

First, we should take a look at inflation numbers from the Great Depression and compare those to our current economic climate. The major phenomenon that occurred during the Great Depression is that of deflation. An overall decline in prices was prevalent. Wages and asset prices across the board were declining. Take a look at the graph:

Since that time, we have never seen a sustained deflationary period. We’ve always had inflation since then but the major boogeyman that no one really wants to confront is that of deflation. In fact, knowing that Ben Bernanke is a major student of the Great Depression I’m sure we’ll fire up the printing presses before we fall into a deflationary spiral. Unfortunately, he may have no control over this. Let us now take a look at the broader historical range of inflation:

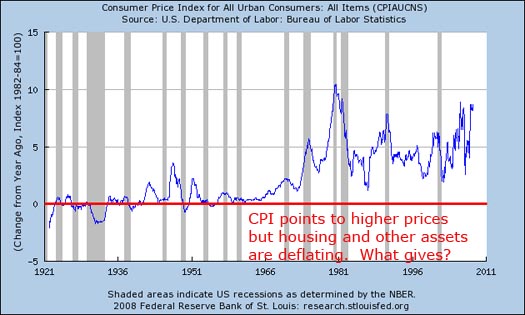

As you can see from this graph, inflation numbers at least measured on a year over year percent change basis are radically increasing even after all the hedonic adjustment mumbo jumbo that the BLS does to the data. Yet during the past decade we have a few things going on:

-Wages stagnant

-Housing Boom/Bust

-Massive growth in credit (to make up for lack of wage growth)

-Increasing fuel prices

-Dollar is no longer backed by gold (since 1970s)

-Major part of our economy based on consumption

-Major part of our economy based on consuming real estate

And now, we are seeing the consequences of an irresponsible Federal Reserve policy that brought us negative rates and thus fueled the specter of future consumer inflation that we are now all facing. Now the needs are more expensive (fuel, food, education, healthcare) while the wants (SUVs, HDTVs, McMansions) are seeing incredible price deflation. If you think deflation isn’t possible, let us read an excerpt from an article published in 1932 in Harper’s Magazine:

“As the great depression advances into the fourth year it becomes increasingly apparent that the mortgage crisis involves something more than the “little fellow” struggling to keep his home. It is not only the function of “shelter” that is involved. The mortgage structure is a part of the whole economic scheme, into which is woven the intricate system of social inter-dependability which allows us to live and carry on. When the customary flow of credit is seriously interrupted at any one point many diverse processes are also interrupted upon which we depend for both the comforts and the necessities of life. Since the War the civilized world has experienced the greatest economic upheaval of which we possess a recorded history. The mortgage crisis is perhaps the final phase of this world-wide dislocation of our credit system.”

Welcome to history redux. Unless you consider Ed McMahon and Jose Canseco as “little fellows” we now know that this housing bust is impacting everyone. Many are now realizing that prices do go down especially when you have a government complacent in allowing our currency to fall through the floor like a rock. Take a look at this US Dollar index chart:

Source: Stockcharts.com

The U.S. Dollar has lost over 20 percent of its value over the past 2 years. This is simply irresponsible and the policies of the government are partially to blame for this. But given that in the Great Depression prices were falling across all areas, the 10.5% decline was more like an 8 percent decline once we factor in the overall CPI numbers. Given that the CPI over the past year is around 4 percent, we can say that homes in real terms are off by 18 to 19 percent nationally. Let us read a bit more from the Harper’s article:

“…In 1929 the national income for the United States was 85 billions of dollars. By the year 1932 this figure had fallen to 36 billions. The most conservative figure for mortgages that I can find shows that in the year 1929 the combined total of urban and rural mortgages in the United States amounted to at least 46 billions of dollars. It is difficult to determine how much this figure has changed between 1929 and 1932. The first effect of the calling of outstanding loans was to increase the amount of money borrowed against real estate. It is safe to say, however, that any general increase in the total of mortgage loans has since been erased by the calling in of outstanding mortgages and the constant demand for the reduction of principal. I, therefore, assume that the total present mortgage indebtedness is about 43 billions of dollars.

The reduction of the national income has had a drastic effect upon the rents which it has been possible to pay. In other words, the yield of real property has suffered a sharp decline. The best estimates that I am able to gather indicate that this decline amounts to as much as 35 per cent. Yet the fixed mortgage charges have declined hardly at all.”

We are in a similar state of affairs. The rise in unemployment and stagnant wages given inflation, are actually a yearly drop in real income. You feel it simply by the rise in all cost of living items. Also, the calling in of these now defunct mortgages are forcing further writedowns thus reducing the balance sheet of many businesses. That is why the $500 billion in option ARMs that are gearing up to reset is such a nail in the coffin for our economy and surely by that time, even the most ardent deniers of the recession will come around.

These are the mind games the government is playing with people. They realize that the connotation of “tax” makes it politically a hot potato so they rather encourage policies that gouge Americans through the hidden tax of inflation. After all, most Americans would quickly answer that inflation is the rise in the price of goods failing to ask the next question, “is central banking policy actually causing these price rises?” Of course it is. Yet the Federal Reserve is now stuck. They never saw an oil boom that would come on so quickly forcing their hand to either halt cutting rates or even start raising rates. Which of course would be like kicking the housing market while it is down. But what choice do they have? Either that or face a dollar that falls further and consumer inflation that will continue to grow. They have brought this on in large part and now will be impotent in fixing the mess.

And if you think that the current logic is modern, just take a look at the 1932 article again:

“For example, two friends purchased adjoining identical houses in 1926 for $30,000. A certain bank placed a $15,000 mortgage on each. In 1929 the first owner paid off $10,000 on his mortgage. The second owner, when asked to do likewise, requested a reappraisal of his property. When a value of $40,000 was placed upon it he was able to induce the bank to lend him an additional $2,000, which he explained he needed in his business. In 1932 when both mortgages again fell due the bank needed liquid capital and, therefore, asked for full payments. Neither owner was able to meet this call. A reappraisal indicated that the value of the houses had fallen to $16,000 each. On one, the bank held a mortgage for $5,000, on the other for $17,000. What did the bank do? It commenced foreclosure proceedings on the strong mortgage for $5,000 and allowed the weaker to stand. Why? It could readily transform the smaller mortgage into an asset on its books, whereas the larger mortgage would inevitably show a loss if the property were taken over.”

Why do you think REOs are flooding lenders to the point where they simply do not know what to do? In fact, the frustration that is emerging is many short-sales are simply not going through because some lien holders are blocking the deal since there is no incentive for them to stay. If you think about it, the junior lien holder “should take one for the team” but how likely is that? So in the end, it becomes a lose-lose proposition and that is why we will continue to see massive asset deflation in housing. At the same time you can expect consumer inflation to continue upward.

The few things that can offset this are not present. A strong, sustainable, and robust employment market would push wages higher but is this really what is going on? So rule that one out. You can also have a market where prices are stabilizing but this is not in the cards either. What you can do is eliminate debt and figure out the difference between an economic want and need. Take a look at the article from 1932 one more time:

“When dollars begin to rise in value, that is to say when prices in general begin to fall, fixed obligations such as bonds and mortgages and other forms of notes offer an opportunity for a quick profit. This is a phenomenon that has long been common knowledge among shrewd investors. If, however, the fall in prices continues to the point where general earning capacity is inadequate to meet fixed obligations, then these special advantages begin to break down.”

That is why debt is absolutely destructive in a down market. Nothing exemplifies this more than being in a negative equity position on a home. As your home falls in value, the mortgage does not move. In fact, if you have a toxic option ARM your balance may even increase! It would be one thing if mortgages were pegged to yearly price values and adjusted accordingly but that of course isn’t how the system works. These option ARM mortgages functioned essentially like call options. If your home went up in price during your intro period, good for you. All you needed to do was sell the place and pocket the difference. Now that prices are declining, you simply let the option expire worthless (walkaway) and take the hit on your credit. It is a small price to pay for massive gains and that is why many played this game. But make no mistake about it, this was speculation on its purist form and will ensure continued asset deflation. We can learn by examining the past but many choose to ignore it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “Bipolar Housing: Lessons from the Great Depression: Part XI. Understanding the Impact of Asset Deflation and Consumer Inflation.”

Awesome once again, doc.

Doctor Housing Bubble for President! Anybody second the notion?

He can run on the common sense platform……

So, can banks still call in mortgages like this (ask for full payment) when they need to, or have the rules changed?

I’ve been toying with this notion of intentionally getting into a fixed rate 15 year debt just to bet on deflation, so the answer to that would be good.

Thanks for another illuminating post.

The Doctor claims that the major phenomenon of the Great Depression was deflation. Maybe of you were an economist. For most people, the major phenomenon was the depression! Unemployment and falling salaries spring to mind. As a consumer — and we all consume — why should broadly falling prices be a bad thing? Doesn’t everyone love a bargain? In a truly fee economy, unadulterated by monetary shenanigans, prices in general would fall over time as productivity increased, and new inventions enhanced the production process.

In any case, if you are looking for a type of investment to carry you through the tough times, this chart gives a strong hint http://www.gold-eagle.com/editorials_98/homedjia.gif .

Here the issue is not one of economics but of power.. the “state” is not going to let go of its power without some kind of wrenching gut pulling adjustment…

The depression saw “Emergency Laws”, stealing of lawful money “gold” from common people and a attempt to pack the Supreme Court with 15 judges to get around the Constitution…. these were and will be the same type of things we can expect in the Great Depression Act II.

Those of you who think of this as a economic downturn should do well to remember that the words of today don’t have the same meaning as 1930’s.

Debt=Slavery.. to our forefathers this was true then as the last 6000 years.

Usury is interest upon issuance of legal tender… not money which is gold..

Mortgage=death grip… this word root in Latin meant then what it means today but we would not know it…

To sum it all up… the taking on of a mortgage is literally means to sell oneself into slavery which in Biblical times was done if the master was good and benefited the less well off who worked willingly for the master.

Next time you enter into the mortgage but don’t have the funds to pay it off think about who owns the mortgage.

Walking away from a mortgage may have consequence in the future that logically one should think about before he or she takes on a mortgage…you may find that you need the “credit” to get your “needs”.

I agree that additional oilwells, and low mortgage rates will have a nominal effect on overall price, but isnt that move in correct direction?? Governments or beuracracies artificially limiting supply is bad for the consumer. The AMA slashed acredidation on medical schools a generation ago, for example, to limit the doctor supply, to prop-up doctors “price” = salary. 4.0 biology students are rejected in droves due to limited classroom seats in medical school. Durring same time, the soviet union had bread lines, but absolutely no wait to see their doctors.

In an answer to Emmi’s question regarding a banks ability to call in a mortgage; I would recommend that each and all who now hold mortgages go to that old file cabinet, pull out your mortgage agreement, and read it – line by line.

I think very few owners that occupy their house will walk away from their mortgages if they have any choice. Only speculators are doing this currently. I think that the banks will do their level best to work out a deal to keep them paying something… anything to stay in the house (and tack on extra priciple or payments to the end of the mortgage). The reason the banks will do this is to avoid the hit to their balance sheets for the short term and keep some positive cash flow. The real fire sale will only happen when the banks collapse and their assets are auctioned off in a court ordered fire sale.

There is a lot to ponder in these Great Depression articles. One can note just how stable the CPI was up until we chucked silver coinage and the silver certificate and finally closed the gold window during Nixon’s presidency. That, if I recall correctly, came about because the US was kept running trade deficits with Europe and the Europeans kept coming to the ‘gold window’ with dollars they wished to redeem at the rate of $35 for 1 oz. of gold. Our dollar had become overvalued and in a not entirely unrelated adjustment OPEC formed and we felt the first ‘oil shock’ in 1973. Of course the US was a superpower and our currency was the world reserve currency so the effect of our weakening dollar was masked both by our geo-political position and by the fact that our real economy was so much larger vis a vis any other nation on earth. We had strong

trade unions too so workers were not without bargaining power in the postwar era and corporate America wasn’t able to control the allocation of wealth. As well, the ‘global economy’ consisted of only North America, Western Europe and, by the 1960’s, Japan with the US being over 50% of the total. You really couldn’t ‘outsource’ as the infrastructure of the third world was totally incapable of either absorbing or sustaining the kind of capital flows we have today and that’s assuming they were even willing to allow it. Only Taiwan, South Korea, Hong Kong and Singapore were interested but that’s another story. The comparison that ought to interest us is that of another great power, the United Kingdom. When it emerged from WW2 it was broke. Rationing did not end until

the 1950’s. It had to earn via exports the money to import the things it wanted to consume. It also had imperial responsibilities it could no longer afford. The result

a long period of decline in which capital controls were introduced to try and support the currency, which was always under attack, and their industrial base withered away as the government siphoned away investment capital to redistribute to a shiftless working class and bloated public sector. This, rather than a Great Depression maybe our future.

Drilling for offshore oil may not lower gas prices but don’t forget the money well stay in our own countery not to the unstable suppleries we now have and well help the doller.

Paul’s comment about the advantage of domestic oil vs. imported oil is spot on. In my comments about the United Kingdom the reforms of Margaret Thatcher were important but it didn’t hurt that North Sea oil and gas came on line during her term in office and made the UK self sufficient in energy. From the ‘sick man of Europe’ Britain soared passed France to be the second largest economy in Western Europe.

Okay, I gotta ask about the drilling thing.

How does sinking HUGE upfront fixed costs into a project that will not yield meaningful productivity for at least a decade lower your price at the pump? According to the best-case scenario for ANWR (I know, that’s not offshore…), production would not peak until 2028, and then at a pace of only 1.44 million bbl/day (or a third of that in the worst-case). Drop, meet bucket. In the mean time, someone has to pay for the obvious costs–exploration, rigs, high wages (offshore workers get astronomical premiums for taking astronomical risks)–not to mention the costs of externalities. Say a rig or two is destroyed in the first Pacific Hurricane ever to hit the south coast of California–who pays? (Hint–it will happen at a pump near you).

Instead, we should cop to the notion that cheap oil is dead, and get on with using the substitutes. Demand turns out to be lots more elastic than our wise old oil companies predicted, and lots of other costs might go down as well. I’m betting on deflation in the US in the next decade, and hard, hard times for large sectors of the population in the adjustment. Those sectors? Net debtors. Put another way, nearly everyone.

“Do more with less.” will become the new marketing mantra, and we will begin to normalize our consumption to world levels. That will be pretty damned uncomfortable for most, but I can’t see how else we’ll continue to survive.

Waslkawaymyth –

So Ed McMahan is a speculator? Jose Conseco a speculator? That piece of crap California congresswoman a speculator? They are walking away, as will many others that purchased homes over the last 4-10 years.

Keep in mind that: Many took out HELOCs, or originally purchased with very low down payments. Either way, many that purchased over the last 4 years are already underwater, and it will only get worse.

Add to this job losses, especially many high paying Real Estate industry job losses, many/most of which will never show up on the unemployment figures. Why? Because they were not employees of their firms, but instead self-employed, not paying unemployment. They are called “1099” employees. Almost every Realitor/Mortgage broker, appraiser, that isn’t selling near as much, nor has savings, and is overextended on their primary residence falls under this catagory.

As the Dr. mentioned above, why would the holder of the Second mortgage (the sham that allowed many to purchase homes with 0% to 5% down) “Take one for the team?”

Bottom line is that when the house up the street sells for $350k, and you own $550k, and a spouse loses her job, or medical issues, or ? Also imagine that the mortgage payments (1st and 2nd) may equal $3400, while renting the same home next door only costs $2000 or less? What will keep this person in the home? ESPECIALLY when there are not debtor’s prisons anymore. So what if your credit is shot for 7 years!!!! BFD

All of this is unfolding just like the Dr. has predicted over the last two years.

Reread the Dr’s article entitled “Moonwalking away” about this very topic of walking away from a mortgage. It is so easy to do. See the website “Just walk away”. This is only the beginning………………….

The off sure oil thing is a pipe dream, Bush is grand standing & off his meds again.

Get use to living closer to where you work, because the days of long commutes by car are gone. Citys better be investing in transit, that is the future along with development at transit stations with retail, commercial & residential uses. Dallas, Denver, Salt Lake CITY & Portland OR are doing this, they’ll be ahead of the pack.

Happy summer, everyone.

It’s going to be in the mid 90’s today in SoCal. The birds are tweeting, the girls are in bikinis, and that sound you hear in the background is the last, dying gasps of the aspirational generation. You know, the one where *everyone* could be rich (flipping real estate), desirable (botox, breast augmentation, beemers), brilliant (see rich), and cool (boardshorts and sunglasses).

Clutching desperately to the totems of their aspirations – pergraniteel kitchens, 40″ flatscreens, D&G handbags, Hurley boardshorts, hulking SUV’s – we watch our neighbors traipse lemming-like towards the cliff, trying vainly to divert their attention from the distracting baubles they’ve equated with “wealth”.

To no avail.

My grandmom always recycled paper towels and aluminum foil on the dish rack until they were too thrashed to save. It had nothing to do with being poor – it had everything to do with utility. Why waste the money on replacing a still-useful product?

Until and unless we are rid of the aspirational social stigma of living simply, the current recession and coming depression will be long and drawn out. Perhaps, one day, we’ll be lucky enough to aspire to a different social code than merely accumulating trinkets.

It’s refreshing to see that at least some people “get it”.

Some media stories are really hilarious: http://www.denverpost.com/breakingnews/ci_9582827

“One family said they’ve stopped using their gas-powered leaf blower, instead using a broom after mowing. And moms who once whizzed through drive-throughs to feed the kids before playdates are packing lunches instead.”

[…]

“‘I am cooking at home, and I watch the kids for my daughter-in-law when she gets work so they don’t have to pay for a babysitter,” she said. “It’s hard for everyone right now.'”

Wow, cooking at home!! Times are really tough.

Leave a Reply