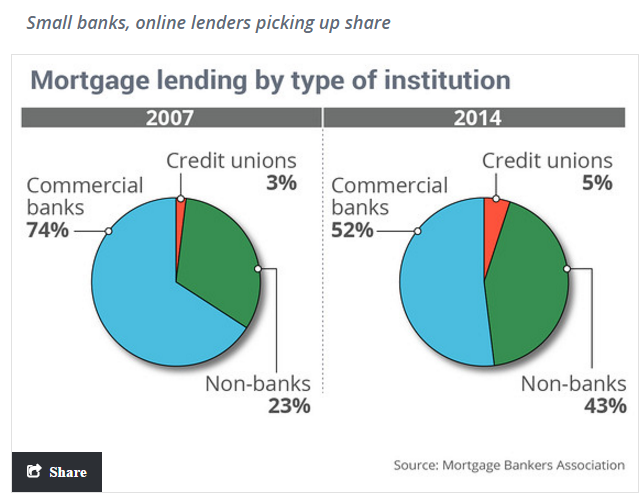

Big banks are leaving the building when it comes to the mortgage market: In 2007 commercial banks made 74 percent of all mortgages versus half today.

Big investors and hedge funds have largely left the building when it comes to investing in residential real estate. They started in 2014 and largely made a full exit in 2015. Today you have a bunch of aspirational house humpers trying to make their money on the edge of a frothy housing market. Flippers are flipping and families are overextending. While the tech sector hits a snag, you have the median priced house in San Francisco selling for $1.2 million. Many Millennials, the next large group of potential house buyers, are unable to buy because they are simply broke. They are living with parents as grown adults or have become one of the 10,000,000 new renter households over the last decade. With low rates, commercial banks have seen little need to beef up their lending. In fact, big banks are not growing their mortgage lending operations. Struck by low margins and new regulations (that should have been there in the first place), many non-commercial banks are taking up the slack. Now you can get a mortgage while sitting on the can or going zero down up to $2 million. What can possibly go wrong?

Big banks play a smaller role in the mortgage market

Leave an open space and you can expect it to be filled by something. At this point with sky high home prices, house lusting families are willing to do anything to buy even if this means they are setting themselves up for the next wave of foreclosures. They are betting big on housing with the size of mortgages being taken.

Commercial banks know this story and are letting other players take up the slack:

The trend is unmistakable. If this market was so safe and full of unlimited possibility, the big connected banks would be in this like a pig in slop. Yet they realize the margins are low and moderate regulations are keeping their slobbering financiers from crafting up toxic mortgage ideas. But non-big banks are unencumbered from these restrictions and they are filling the gap:

“(MarketWatch) In 2015, four of the top ten originators were such entities, according to data from Inside Mortgage Finance – Quicken Loans, PennyMac Financial, PHH Mortgage, and Freedom Mortgage. Those institutions, also known as “independent mortgage bankers,†made up 43% of all originations in 2014, according to the Mortgage Bankers Association, a share that’s stayed steady or grown every year since 2007, when it stood at 23%.

While Quicken drew some fire for a Super Bowl commercial that seemed to suggest getting a mortgage should be as easy as it was during the housing bubble, nonbanks must operate within the same rigorous underwriting framework that banks do post-crisis.â€

Quicken Loan is pushing the Rocket Mortgage which you can “push button, get stuff†– sounds about right for a marketing slogan for a Twitter addicted audience that probably has totally forgotten the sins caused by the first Great Recession. You might as well be talking about horse and carriage and Plato. The last housing crisis is ancient history like the pyramids.

This is being played out in the media as banks being too heavily regulated. Yeah right. There are modest regulations in place that should have been there in the first place. The problem of course is the requirement for down payments. Broke Americans can’t save. For example, in 1996 the typical median income to home price ratio for the LA/OC area was around 4. Today? It is up to a solid 9 and approaching 10. What was it in 2006 before the market imploded? 10 as well. Millennails with massive amounts of student debt and lower incomes are finding it hard to buy a $700,000 crap shack.

Banks have a very clear understanding of what is going on. This is why we are seeing many non-commercial banks entering the mortgage game at a point where things seem extremely frothy. So feel free to sit on the toilet and buy that $1.2 million shack in San Francisco with a 30-year $1 million mortgage. I’m sure that startup will be around in 30-years.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

104 Responses to “Big banks are leaving the building when it comes to the mortgage market: In 2007 commercial banks made 74 percent of all mortgages versus half today.”

And almost every day one hears some Republican jerk off complaining about and trying to repeal Dodd-Frank.

That’s old news. The latest news is those same jerk-off republicans will be voting for Hillary Clinton !

It’s either Hillary or the drunk uncle. Do we really want our drunk uncle in the white house?

Hillary? Do we want a corrupt pathological liar in the White House who is owned by Wall Street bankers, Hedge Funds, corrupt billionaires, and foreign dictators? NO!

Seismic,

Alex wants Hillary because if he is down he wants to make sure everyone else will be down and poor. Misery loves company.

“Do we want a corrupt pathological liar in the White House who is owned by Wall Street bankers, Hedge Funds, corrupt billionaires, and foreign dictators?â€

They’re all pathological liars and arguably sociopaths. The benefit to the “drunk uncle†is that he’s not owned by anyone (that we know of). It’s plausible that he could actually do something that’s in the best interest of the people/country without his decision being dictated by his masters. With all the others, you can be absolutely positive that any action they take is in the best interest of their masters, which may or may not be in the best interest of the people/country (usually not).

In 2008, I had some semblance of hope that Obama might be slightly less of a puppet than his predecessors. Turns out, he was the same as all the rest, undoubtedly due to his corporate overlords. Although I do appreciate what happened to housing in 2009-2011 or so, regardless of his direct association with the matter.

RE: Obama…anyone who knows anything about Chicago politics could tell you he was captured by the Machine a long time ago. These days, only real action is an indicator of future performance. ALL of these rascals in the race are being spoon-fed the things that people want to hear, save one.

The recall of Davis in CA and the installment of the Govenator should be required reading for the Establishment. It made everyone feel good for a time but in the end Arnold got marginalized by party politics and outflanked by special interests. In the end we’ll need some other tool to cut back the weeds.

I happen know a lot about Chicago politics. Obama wasn’t caught in the Chicago machine as much as everyone thinks he is. He is not a Chicago Politician, he’s a product of the state of Illinois government.

Who we really need is Sanders, or Gore to run again. But chances are, we’re going to be stuck between Hillary and Trump, and while Hillary is evil, Trump would be an utter disaster.

I’d rather be down and out than glowing radioactive.

I need to get the hell out of this country.

dems, reps, same thing

That’s the truest message I’ve seen in my life…. Dems, Rino’s… they are truly all the same.

democrats and republicans, same poop, 2 different piles

Only a Democrat jerk-off would defend the big government fiasco known as Dodd Frank which created more unaccountable government bureaucracies which are unaccountable to taxpayers.

Dodd-Frank was touted as going after large banks – “Too big to fail†institutions – but all of the too big to fail banks are bigger now that before the great recession.

Despite all of its new bureaucracy, it is still unlikely that Dodd-Frank would have done much to prevent the 2008 economic collapse. The regulations do little to address the cause of the crisis, which was government-backed support for bad housing loans.

The regulatory costs of Dodd-Frank are crippling small banks, which have shrunk by 19 percent in total assets since the law’s passage. The loss of so many small banks shrinks consumer choices and decreases competition, which adds additional banking costs and hassle to consumers wishing to receive loans.

They can’t even agree to implement some of Dodd-Frank….most of it is mothballed based off we just can’t handle that right now attitude…

Are REITs taking business away from banks? Because at least up here, I’m hearing about REITs actually having massive apartment buildings built new, to rent out.

It sounds like a lot of specu-bubble entities that are not officially banks are becoming major players.

There’s also a lot of lending in general being pushed, at least up where I am. From enough to buy a house to enough to I dunno, start a hot-dog cart. I’d consider borrowing my way out of trouble myself, except there’s no way I’d do it unless I knew of something that’s a total slam-dunk, and if I know of something that’s a total slam-dunk, I’d probably not need a loan to get it going.

Because they can’t make money with mortgages @ 3% . And the Blood sucking financial companies like Quicken will originate those that are 3.5 DP and other types usually to the dumb people, then they package and sell them… why not the FED is backing it and guaranteeing it. Let it be a problem for taxpayer… suckers

on another note.

Bloodbath at network appliance in silicon valley… not exactly stat up…. but not to worry they all will find jobs a higher salaries at google or apple…

https://www.thelayoff.com/network-appliance

The Market is up… everything is well. Oil will reach 80 by year end… so put that down-payment and buy that flip.

NetApp’s been around for years. I remember seeing that big blue “N” shaped thing in front of their building *before* the crash.

And buying a flip is being a piker … buy TWO flips.

House flipping hits a 10-year high in many American cities !!

http://www.csmonitor.com/Business/2016/0303/Another-bubble-House-flipping-hits-10-year-high-in-many-cities

The banks rule of thumb is three times income, even if you put 40% down.

No, banks do not have a “three times income” rule of thumb, even with 40% down. Clearly, you are completely fabricating that assertion.

Banks will lend based on your debt to income ratio (and upon verification of income, etc.), which generally can’t exceed 45%.

That was a good rule of thumb when interest rates were 8%+. Throw it out the window with sub 4% rates.

If somebody makes 100K and borrows 3x or 300K at 4%, the mortgage payment would be $1432/month. That is peanuts due to the insanely low rates.

In bumfuk, Iowa, maybe. In California it’s 10X

Housing TO Tank HARD SOON!

In your dream jim prices here in la specifically in the san fernando valley are in 400 and 500 and stilll receive multiple offer stocks are iver the correction period but housing i dont think so

oh boy, multi offer on 400-500k…….yep i lived in that during 2004-2006. the only reason those markets are any where above 250k is FHA high Balance loans. i say those markets tank hard. no money to put down. money from proceeds of sold overpriced former primary home that some other sucker used FHA high balance to enter. that market will crack, the people are debt slaves. 45-50% debt ratios are a joke. you run a net income budget and they fail all day long..

Jim’s is right… it won’t last. don’t you remember 2007 thru 2009? I do… and even more I remember 1980’s… Jimmy Carter and 18% interest… my first mortgage was at 10.5% and I got a deal….

Jim’s is right on. It’s about to hit the fan, and both the Dems and Rinos will blame Trump.

It won’t be Trump’s fault, but he’s going to get his butt kicked if elected for what happens.

Let’s hope so, Jim. Hopefully, 2017 (post-election period) will repeat 2009. I loved it. My wife and I were both lucky enough to keep our jobs and we bought a place for literally half of what the prior people paid in 2006, 2-for-1 restaurant coupons everywhere, we both bought really nice late-model sports cars in early 2010 for a fraction of what they cost new (zero demand at the time which worked to our advantage), and it was generally a pretty decent time for us! Not sure if we’ll be so lucky next time around, but I’m hoping for the best. The only screw-up we made was being too timid to invest in the stock market. We wont be surpassing that opportunity again if it presents itself. Buying up rentals would also work, but that’s more hassle than I want to deal with.

Glad to hear of people like you that made hay during that time frame. I was opposite…had the ambition but not the money. Was building up a nest egg with 3 young kids. Hopefully we all get another chance shortly.

It is all about liquidity and money velocity. Housing will tank if liquidity dry’s up.

Right now there is still liquidity. It has moved from big investors (2010-2013), to mom and pop flippers (2013-2016), and eventually home owners not wanting to get priced out.

Liquidity could dry up if people quit borrowing. How does that happen? Either you run out of new customers or lenders get tights. Remember back during the housing bubble in 2006-2007, it started with the small brokerages going out of business as they ran out of new subprime customers. Home ownership spiked to its highest level ever. We really ran out of new borrowers. Then as those teaser adjustable rate loans expired and house prices quite rising, the subprime borrows could not refinance anymore to a new rate and they fell behind on their mortgages. That is when the contagion spread to wall street, (Lehmans, Bear Stearns), and the banks holding those mortgages.

Neither a borrower nor a fucking lender be, how simple can it be?

My policy is to stay far, far away from bankers. I dunno how, if I ended up making a first-world income, I’d buy a house, maybe just save up or buy raw land and build it. Maybe join the Amish or a kibbutz.

Hah! Don’t make me laugh !! San Francisco home prices will never, repeat NEVER “tank”. So if you buy into the Bay Area, even when the market is on the high side, you will never, repeat, NEVER lose money, in the long run. And, it always, repeat, ALWAYS goes up, over time, NEVER down. So don’t get your hopes up waiting too long and being priced out – FOREVER. Hah! LOL.

@Jason: Sarcasm, I assume? If not, are you intentionally ignoring what happened just 4-5 years ago? SF prices may not have tanked as much as say, Vegas, but they definitely tanked by a significant amount. An exception might be the $1.5M to $2M+ market which tanked a bit less (as others here have pointed out previously), but most people here presumably cant afford that anyway, so that market not all that relevant to what most people can afford.

So did you put in an offer to buy today? Let’s look back in 2 years and see how you do. I don’t think you will be as arrogant as you are today.

@Forever

Really sounded like sarcasm. Especially with the “LOL” at the end.

I’m going to save your post…. it’s going to be priceless by 2020.

if and when interest rates rise, which the current political establishment is of a course reluctant to do, since it would cause their giant jinga MBS / CDO debt to topple. Plus you have all the muni bonds that are only viable with current home values, and the resulting property tax. It will be interesting to see what happens to all the household protected by Prop 13 when they leave their homes / this plane. Because if not interest rates, then it will because there is a flood of new inventory which I only see happening under a few scenarios-

a) Massive job loss / foreclosure

b) Baby Boomer exodus

c) HELOC / balloon payments that have started to come due (assuming they bought at the height, and proceeded to suck out too much equity and haven’t been able to re-fi or willing to short sale)

I think the latter is going to play a fairly significant role, since I am still seeing properties go on the MLS that were purchase in 2005, where they finally are able to sell without having to cut a check at closing, but am also seeing a lot more properties that are heading for foreclosure;

http://www.zillow.com/homes/make_me_move/Irvine-CA/69257966_zpid/52650_rid/any_days/globalrelevanceex_sort/33.708812,-117.715287,33.657817,-117.791677_rect/13_zm/

AUG 5 2015 Home in default $23,120 past due, owner served a NOD

OCT 19 2005 Loan issued A loan was issued by WELLS FARGO BANK NA

OCT 19 2005 Previous sale $668,500 This home last sold for $668,500.

Or other properties where they bought 10 years ago and still haven’t been able to sell it at a break even point-

http://www.zillow.com/homes/for_sale/Irvine-CA/fsba_lt/69259172_zpid/52650_rid/any_days/globalrelevanceex_sort/33.715737,-117.732797,33.664747,-117.809186_rect/13_zm/0_mmm/

DATE EVENT PRICE $/SQFT

02/16/16 Price change $680,000 +0.7% $348

09/18/15 Price change $675,000 -0.7% $346

08/19/15 Price change $680,000 -0.6% $348

08/05/15 Price change $684,000 -0.7% $350

06/09/15 Price change $689,000 -1.4% $353

04/20/15 Listed for sale $699,000 +49.0% $358

01/14/11 Listed for sale $469,000 -27.1% $240

10/20/05 Sold $643,500 $330 Public Record

Keep in mind that on a 30 year mortgage the first 10 years you are barely touching the principle…. In short, this is the absolute worst time to buy. Realtors and people are desperate though, so the charade goes on while the music is still playing.

The timing of the RE tank will shortly follow the beginning of the broader recession.

This is how it always happened up until 2007/2008 when the RE crash was the leading indicator. Central planning doesn’t work. It has NEVER worked. Sooner or later the bill comes due. Why do you think the FED finally bit the bullet and raised? Because they know that the longer they waited, the worse and more unmanageable the downturn would be. Though it may be the most INSANE and overbought in history, what we are in is nothing more than a credit cycle. One that is nearing its end. EVERYTHING that is leveraged will adjust.

Even hyper-manipulated markets are still markets. Entities will not pay more for commodities and assets than they have to. In the abcense of the punch bowl the “have to” is about to be lowered significantly. The adjustment could be more protracted than than 2008-2011 peak to trough, or it could be quicker (think of the deflation of Regan’s first term), but it is coming either way.

And I must say that the upscale areas of the Inland Empire are seeing lower asking and closing prices than late 2014. I believe the market top for these “exurbs” was reached in that year. Once the adjustment in outskirts picks up further steam, expect near metro areas to follow.

250K sure doesn’t buy what is used to…..

https://www.redfin.com/CA/Chino/13289-16th-St-91710/home/3956866

I feel like I have to take a Hazmat level shower after just looking at the pics of that place in Chino! 250K!? Freaking nuts!

I had a friend in Huntington Beach whose house looked like that, at least almost like that. It was gross.

Yeah, and you know people (plural) have died in that home, and with street view, why would some even bother going there. I like how you can see a bunch of sheds in at least one backyard. Must be a tight-knit hoarder / hot bed community.

Building should be leveled.

Gross, of Pimco fame, says that banks are finished.

Banks were finished years ago.

Banksters figured the safer lending bet was subprime energy loans when oil was hovering at about $100 a barrel ! Wrong again !!

Auto loans and student loans are getting into risky territory as well. It pays to keep an eye on them.

“Quicken will originate those that are 3.5 DP and other types usually to the dumb people, then they package and sell them.” Sounds like FHA; so companies like Quicken issue FHA loans? Have we learned anything from the last mortgage crises?

Not a Solid $ making business anymore. Also, 190 Billion dollars of lawsuits still pending as well. Liability cost to profit margin, not great. Plus, most mortgages are bought by Freddie, Fannie and insured by FHA

ZZZZZZZZZZZZZZZZZZzzzzzzzzzzzzzzzzzzzzzzzzzz……………….

Your just as boring and like to post about your low paying job….go drive for UBER or something….

you post more than the cereal company and none of it is new….

go walk to Gilroy or something

Owning a car for me is like picking up an umbrella with a parrot-head handle and flying to the Moon to homestead.

I *could” become a pedi-cab driver, since pay for 99% of us in “silicon valley” is so low, it’s only $30 a night to rent a pedi-cab then it’s up to you how much you make … I”m hearing of people coming out ahead by $50, maybe $100 a night, that’s big money here.

Trouble is, I can’t do the heavy physical work I could in my 20s, so when I need money in a pinch I hustle handicrafts I make, I won’t go back to panhandling although it pays best because I’d rather be useful (you can tell by this I’d never make a good banker or yuppie) and for me right now, the future lies in getting the hell away from the electronics shit and into something that actually pays, art or entertainment of some type.

To be honest Jim san fernando vally house are overpriced now but i do submit an offer to multiple property But no seller accept our offer since last year And the prices went up this year by almost 30k-50k which is really puzzled me

Jim are you sure that in two years the housng market will tank hard but i think the inventory is the main culprit of this ridiculos prices here in southern california

Fatima, yes Jim is sure. But don’t believe him.

Trust me, since they don’t build more land and because this time is different you should really buy now. Otherwise you’ll find yourself priced out. Why not buy a nice house for your family now and watch it double in value within 20 years? Smart, successful people buy two houses and retire in just 20 years. /sarc

:))) hehe. I am expecting nut case Chinese to visit my property today that is not for sale…..but they promise to pay so much cash, that I just want to see them….seriously….I want to see who is whiling to pay $700K for the condo purchases in 2014 for $425K. They are running fast here, what if they get priced out and someone calls me up with 800K offer looooooooool

That’s what I’m doing now I don’t have to wait till I priced out and make my landlord richer

I know someone that was talked into signing some documents (basically buying condo’s directly from a builder with $0 down) by their cousin who worked for either the builder, or a mortgage originator in the last bubble. They were basically loaning their credit to their cousin, who also had a couple condos as I understand, and never made a single payment on any of them, or even tried to rent them out before DESTROYING their credit, and their cousins, which if your going to do, at least do it tactically. Rent them out or steal the copper. This movie summed up how to make a killing (literally) in a real estate crash-

http://www.imdb.com/title/tt2891174/

Escape, regarding the Chinese folks interested in purchasing your home for cash, you might find this interesting – http://www.theglobeandmail.com/news/investigations/the-real-estate-technique-fuelling-vancouvers-housing-market/article28634868/

Basically up in Vancouver, there appears to be quite a few real estate agents representing Chinese “buyers” in “cash” deals using straw buyers combined with sale contract reassignments in one hell of a scheme. This lends some credence to my theory that the Chinese buying foreign real estate story is probably more about speculation above all else.

Escape – Time to put out the hors’d’ouvres with blue cheese on ’em and make a sour face if your Chinese visitors/victims don’t eat ’em.

Lets see in a couple of years jim if we priced out or the house tank hard as you predicted

Oh… yes. houses will drop… you can take that to the Bank.

The Layoffs have started everywhere (company have been doing it quietly and media is not so eager to report because we are in a “recovery”)… a whole lot of people will be laid off… this year2016

.. Feb and March have been a bloodbaths. May and June will be also big lay offs months. depending on the company but it takes 3 months or so for it to be felt. Less than 25% of people will get a job that pays at current or above rate. A lot of people will find no job that pays enough to pay the mortgages. People who are older than 45 are too expensive… and companies will hire young millennials and HB1 foreigners at 60% discount.

Older americans: spoliled:

“Leave early to take their dog to the vet”

“Don’t come to office to run errands”

“Have some kind of illness and don’t perform good”

“Go out for lunch and disappear for 2 hours”

“Take it easy at the office, call their friends etc”

“Leave early to Pick their kids up from school, take them to soccer, baseball, etc practice”

“Employees with familes cost more. Gotta pay the family health care plan (as opposed to younger)

First most people will deplete savings…then will work any job… before they put their beloved house on sale at a price nobody will want to pay…

It’s a cycle but people live in a fantasy that it things will always be peachy… highly leverage people will always choke. people who have low mortgages and not debt will always survive…very few of those.

People don’t believe that recession happen over again… it’s call economy… whether manipulated or not it is an economy… and forever growth does not exist.

-low interests

-96 mo auto finances no credit stated income no social security

-Health care costs too high.

So yeah housing will drop!

P.S. The other day went to Kaiser after 2 years of not being there.It looked like WAL-MART

overweight people with tattoos that seems that don’t even shower to go see a doctor…thanks Obamacare

Yakk…and do much truth in the post!

‘Older americans: spoliled:’

“Leave early to take their dog to the vet†[Check]

“Don’t come to office to run errands†[Check]

“Have some kind of illness and don’t perform good†[Check]

“Go out for lunch and disappear for 2 hours†[Check]

“Take it easy at the office, call their friends etc†[See a few of the people here do that]

The key is being slick about it. Put something on your calendar, people may think you are in a meeting. Or wear a jacket, put it on the back of your chair and then slip out for no more that an hour during the first, and/or second half of the day.

As for the H1B1 visas, that is going to do what NAFTA did to the manufacturing sector.

People need to get out and vote or die! It’s all fun and games until I lose MY job…. /sarc

No wonder companies are shifting from employees to independent contractors. The latter get paid by output and productivity, and not by how many hours spent warming a seat behind a desk.

The thing is, if you’re rich, you own a car and can take 1-2 hours off for that dentist appointment, normal people like me can’t own cars and have to take the whole damn day off.

job report are in a positive note stocks goes in a positive territory out of correction territory unemployment are at a lowest so is there a manipulation here

It’s all manipulated. The Jobs that pay enough for people to buy a home or pay these fvking crazy rents are shrinking and the jobs that pay you to leave with roomies are increasing.

Lots of middle-age people will be laid off and then younger millennials with students loans and lower starting salary will be hired. Rinse a repeat. These rich people are psychopaths…the middle class has disappeared… there a few lucky that bought a home at the right time and haven’t been laidoff the rest are SOL…!

The new Jobs don’t pay enough for people to buy a house.

the stock market is up… buybacks, buybacks with money saved from layoff people…fucking charade

I’m 53 and at $15/hour as a 1099 I’m too expensive?

No kids because I (along with my 4 siblings) could not see bringing children into a world where they’d have to dig through trash piles to eat.

The Hosing market will tank hard when the Jobs market tanks hard…

There is no other way around it;

– there is no more land being made in LA

and

– lack of inventory (homes for sale in my zip code is about the same as it was in 2012)

and

– pent up buyers

and

– relaxing of lending requirements

and

– influx of people with money into LA

and

– a stronger than expected jobs report

and

-no NINJA buyers

Ergo – housing will crash when the jobs market crashes.

All this foo-foo about an earthquake crashing prices, or a methane leak in Porter Ranch or a drought causing a housing crash is nonsense.

I think Thom Hartman nailed it when he came out with his book a few years ago-

http://www.thomhartmann.com/blog/2014/07/crash-2016-gets-closer-every-day

https://www.youtube.com/watch?v=039Zh9KBCqY

I have a signed copy that I can hopefully give to my grandchildren, while showing them old timelapsed gopro footage of building community gardens in parks (best case scenario) or homemade mad max re-enactments (more likely scenario)

Sheeeeet… can you imagine where we would be without debtors prisons locking up people for not paying the fines / doing the time they got when they were committing some kind of survival crime, hence the largest prison population in the world (our only competitive labor w/ China and SE Asia)-

http://www.salon.com/2015/07/07/23_cents_an_hour_the_perfectly_legal_slavery_happening_in_modern_day_america_partner/

Or what would happen if peoples EBT cards stopped working, I don’t think you could get 40+ million people to stand orderly in bread lines-

http://www.trivisonno.com/food-stamps-charts

Stalin at his *worst* was not as bad as the USA is now for putting people into gulags.

There are people in Russia who *miss* Stalin and I think I miss him too.

That is half of the equation. The other is liquidity. During the housing bubble people without jobs and stated income were getting loans. So housing can go up in price even with stagnant income growth if interest rates and easy money is abundant.

But in the long term you need job growth, salary growth, and inflation. As reported on this blog before, I also think foreign investments is fueling some of this latest bubble. U.S. real estate looks cheap and safe in the eyes of Asia.

Erm, there are NINJA loan offers on the sidebar on this very page.

Wow, talk about a Greedy Flipper! Check out this house in Palms: https://www.redfin.com/CA/Los-Angeles/3709-Tilden-Ave-90034/home/6751562

Bought in 2012 for $475,000.

Listed in 2016 for $1,245,000.

Seeking a $770,000 profit after only four years!

Yeah, I know it’s been upgraded. And the photo-shopping is real nice. I especially like the usual twilight photos of the warm glowing lights, illuminating a clean, wet concrete driveway. But still…

The listing also describes the location as Palms/Mar Vista. C’mon, east of the 405 is Palms and NOT Mar Vista.

I often see posters on this blog used the term “greed” when referring to flippers and/or sellers. Why is it considered greedy to try and get top dollar when you sell? I’m sure if you were selling a property you would want to get every single dollar you could out of it. Why do you feel that people should sell you their property for less then asking?

Organic sellers probably are making a replacement purchase, they are stuck in the position of having to get top dollar in order to move. Although these days things have become so out of hand, many are stuck not in a position to sell, thus low inventory. Can’t really blame those who do sell. The ones that sell and bug out to lower cost locales, raising prices in those areas, it’s an unfortunate reality and reminder of how interconnected every place is to every other place.

Flippers on the other hand… basically speculative arbitragers of several inputs which results in government subsidized profits (FHFA/GSEs/Fed asset purchases), all on the backs of people who need a place to live.

It’s greed because that house is a POS in a crappy location–only greedy idiots who are looking to make huge speculative bucks would consider that house. I grew-up a few miles from there and lived over 40 years in that part of town. The noise from the 405 will drive you mad. There is absolutely no reason on earth why this house is worth this amount of money, except for the fact that we are witnessing a bubble of historic proportion.

And it’s occurring all over the world. So when this historic bubble pops (which it is already starting to do), don’t say that you were surprised. People are funny, they make the same mistakes over and over and over, and they never learn.

The mistake is called “greed”. Look it up, it’s in the Bible.

@zzy, Palms (90034) is hipster central for the Westside. I lived most of my life within walking distance of that house. There will be some hipster Silicon Beach / Playa Vista couple who will leverage themselves to the eyeballs just so they can live in that neighborhood as they are largely priced out of almost everything else on the Westside.

buyer need to be smart at that price i think they have a lot of option

Seems to me that the RE market is revving up once again. I made calls on four small condos in S. Riverside county yesterday which just got listed that day. Out of the four two already had accepted offers over asking SIGHT UNSEEN, the other two properties supposedly had so many incoming offers the agents couldn’t return my phone call. I don’t see any tanking in the near future. In fact it seems like the market is just getting ready to run hard again this spring/summer.

life is too short to wait for the housing market to crash the lending process is different compare to the first bubble @Hunan that’s what I’m telling to Jim the housing markets are heating up. Enjoy life now if you can afford to buy now buy now. Don’t wait and wish the housing market will fall. @jim I will submit an offer again this week ill keep my finger cross

What doesn’t make sense is Riverside County’s 34% price reduction rate. If it was so hot, why would ask need to be reduced? It would suggest there is a ceiling which has been met after all.

Hotel California, care to share where you found that info? I do not see any price reductions on decent properties in the Temecula/Murrieta area. In fact, all I see is bidding wars for more then asking and prices significantly higher then last year.

Data is from Redfin the day I posted the response, filtered out land only listings.

After nine years of living in sunny San Diego, CA, my girlfriend and I moved back to even sunnier Phoenix , AZ a year ago. We were both so over the incredible density of people crammed together next to the coast, the overpriced everything and incredible Southern California narcissism. California is one of those places that is great to visit, but has become an oppressive place to live with all of the high taxes, regulations, density of population and lack of quality housing; paying upwards of $500K for a 1200 sq foot shack built in the 50s or 60s is not my idea of living the California dream. So we are out.

I was fortunate to have been able to find a position with a software company where I am now making about 20% more than I did in San Diego, and which combined with about a 5% lower state income tax has really increased our household income and ability to save. Gasoline is about $1.50/gal cheaper and we enjoy the space that comes with not having everyone living on top of each other. Arizona is not for everyone, but it works well for us.

I have been renting a 2000 sqft house with pool for the last year ( for only $1400/mon),so I could get a sense of the local market before I bought something. It appears to me that the Phoenix housing market, which was a poster child for the ginormous foreclosure crisis and the subsequent large block purchases by investment and hedge funds, has resulted in the current market having limited inventory and prices would seem to be about 15-20% higher than they should be by historical standards. Here is a link to some great historical data on the Phoenix housing market: http://www.valleywidehomes.com/phoenix-housing-tracker/phoenix-housing-tracker-ppsf/

I think that a huge global credit bubble has formed and there is another crisis on the horizon, so I am in the process of battening down the hatches for a while. I cannot bring myself to buy a large home in this current climate, so I am in the process of purchasing a nice 3 bedroom townhome about a mile south of the Arizona State campus for around $230K and am getting a 15 year mortgage with a 3.2% rate. The annual property tax is around $1900 a year. I figure I can pay the place off in less than 15 years and even when the market goes lower again, I am not going to have that much invested and can ride out the storm.

My plan is to wait for the prices to bottom out once again which I think will happen in the next year or two, and buy a home more in line with where we want to live and then use the townhome as a rental property given its proximity to the university campus. Meanwhile, we take trips a couple times a year to visit friends in southern California when we so desire and are not stuck paying all of the higher year-round taxes.

Life is too short to wait around for things that might happen or to chase some imaginary dream manufactured by the home and financial industry which ultimately leaves you overpaying for things you can get for half the price elsewhere.

“Gasoline is about $1.50/gal cheaper…”

You pay $0.75/gal for gas?

My experience, paid $1.29/gal at Arco in Phoenix last week, $2.39/gal at Arco in OC yesterday.

“Life is too short to wait around for things that might happen or to chase some imaginary dream manufactured by the home and financial industry which ultimately leaves you overpaying for things you can get for half the price elsewhere”

Agreed! Congrats to you and your girlfriend; best wishes for your lives in AZ.

Good choice, especially if you did not loose anything salary wise. I believe many clear headed people are doing about the same right now and packing to move varies locations out of California. Thats so funny….pretty soon there will be no one around to hire, employees can not make living on Google salaries haha. Silicon Valley will be just a history one day…how silly…

I lived in Feenix for a bit, Tempe/Scottsdale actually.

“Hot wheel” is a thing. Get a white steering wheel cover or some driving/golfing gloves.

There’s a cool downtown district called the “Willo” district, neat older buildings, hipstery and neat.

The main downtown library is really cool.

ASU is pretty damn cool – they have an outstanding collection of meteorites!

Tempe Lake is a thing. I remember when it was an ongoing dust storm there, miserable. Well, we humanz decided to make a LAKE there, and now there’s small boats and it’s really nice. Would have been a good place to buy.

That is insanity!!! It’s only 1550 square feet. I just can’t any more.

I can live *very* happily in 500 sq. ft. including kitchen, bathroom etc that leaves 1000 fq. ft. for an art, signs, etc business. Easels in the living room!

:)) Alex I like you. You are one of very few down to Earth people left…your would fit in real well in Fairfax CA.

But I’m willing to bet ZERO jobs in Fairfax. I need to be near touristy areas so I can sell people shit.

I’m saving up for the genetic test then perhaps depending on what it tells me some work from a real geneologist, I’m pretty certain I’m joooooooowish from my mom’s side. What this means is, I can move to Israel; watch YouTube videos of Eilat and Tel Aviv, all those people I can sell shit to!

Curbed LA says housing is expensive in CA. No sh*t!

http://la.curbed.com/2016/3/4/11159938/california-housing-shortage-homeownership

Here’s the deep dirty little secret: Housing is expensive everywhere in the US. Where housing is cheaper, there are no jobs.

While everyone is focused on L.A. and S.F. real estate on this site, pay attention to what is happening in America’s 2nd tier cities and in places like Iowa! Yes, the middle of fly-over country. A recent article touted that 2nd tier cities such as Austin, Denver, etc. are growing much faster than their California counterparts due to lower costs of housing, and growing concentration of hi-tech. Iowa is becoming the data center capital of America. There is enough critical mass and expansion happening in places like Austin with Google’s increasing presence there, the northwest suburbs of Denver with a large Oracle presence, and both Google and Microsoft investing billions in putting up data centers where corn fields once stood! Silicone Valley and Silicone Beach aren’t the end-all, and sound business practices would probably side with increasing investment outside of California where costs may be significantly lower!

I’d happily move to Bumfuct, Nowhere if there were JOBS.

I’ve lived in Bumfuct, Nowhere and there are no JOBS.

If I could get something going on-line, where I could live anywhere, I’d probably leave the US.

This site has a interesting diagram showing where and to domestic migration is going from Califonia.

http://www.sacbee.com/site-services/databases/article32679753.html

Seems like TX, AZ, & NV are the big winners with the most incoming migration from CA. The people I know in LA with the means have already left for Oregon or AZ. Those that are still in LA keep talking about their plans to leave due to cost of housing. As the middle class exodus from CA it will only exaggerate the have and have-not dichotomy which has become so prevalent in CA.

Yep, moved to OR from LA over a year ago, although we’re waiting to buy here, too, because the whole west coast is in a bubble.

“Yeah! Everyones got a plan…Then you get punched in the mouth!” Mike Tyson

Correction to my name. too dark to type

Have a Tamoe Ame, yes you can eat the inner wrapper.

Leave a Reply