Banking Solution to Financial Crisis is to Ignore Distress Inventory – California had 1,200 Foreclosure Filings Per Day in 2009 – The California Real Estate Foreclosure Machine. Countrywide Financial, WaMu, and Wells Fargo top Foreclosure List in Q4 of 2009.

Even in the best of times foreclosure is a financially traumatic event. And these are definitely not the best of times. Yet you wouldn’t know that by watching the financial cable shows. In that corner of the world, everything has miraculously improved and their solution to foreclosure is to simply ignore it. Those Alt-A and option ARMs lingering around festering a rotten mess in California, just pretend they aren’t there. Banks are in many cases even ignoring missed payments on homes and not preceding with foreclosure. So they are helping with HAMP right? Not really. Consider it a form of bailout inertia. Yet somehow those in the tiny realm of the world that ignore economic reality somehow now think that by doing nothing they are now solving the crisis. In fact, mark-to-market, that absurd notion that you don’t need to value assets at their current worth is somehow permeating through the entire housing market.

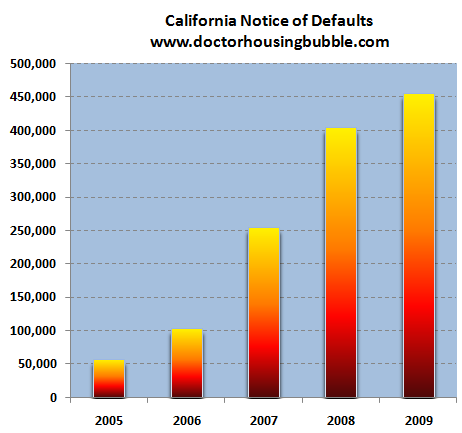

If banks had to value assets at their current worth, the entire banking system would become insolvent overnight. So they choose to purposefully ignore the reality on the ground. And for those that think things have improved let me present to you exhibit A, California notice of defaults for the last few years:

Last year, as in the year that saw the stock market rally with the momentum of a bull stampede, California witnessed the largest number of notice of default filings ever. Worst year ever. California had 450,000+ notice of defaults filed in a year that supposedly saw recovery. Now this data does reflect the new world order where banks choose to ignore bad data and pretend Alt-A and option ARMs turning into platinum bars. How bad is this?

1,232 people per day in 2009 received a notification of default because they missed at least 3 mortgage payments in California.

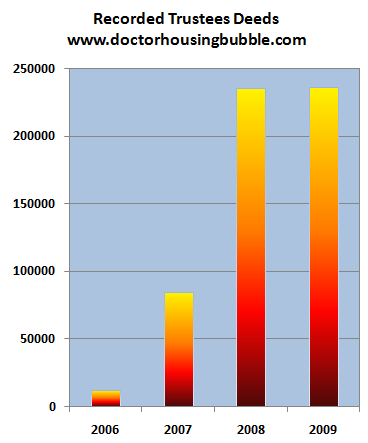

Now this doesn’t seem like a healthy market in my book. In fact, last year saw nearly a record amount of actual foreclosures, closely resembling 2008:

Now just look at 2006. We went from nearly no foreclosures to quickly approaching 250,000 in 2008 and 2009. In other words, the market is horribly unhealthy. As in today. When I look at the California budget and our 12.4 percent unemployment rate it should be apparent that no housing market can boom when the real economy is floundering. Can we sell homes in the short-term? Of course. Can we get people into homes with low interest rates and tiny down payments? Absolutely. But did we not learn with the Alt-A and option ARM fiasco that getting people into a mortgage is only half the battle? Ideally you want people to have the ability to service the mortgage for years to come, not only for a short period of time.

And that is largely where the California housing market has gone off track once again. I was listening to the radio and heard a mortgage broker empathically say, “we need to get mortgage rates back to the low 4% range to get housing going again!â€Â I think globally we are far beyond ever seeing those ridiculous rates. The average 30 year mortgage rate for the past 40 years is 9 percent and a rate at that level would cause housing to come to screeching halt. A rate that was fine for many years and when households earned less income is now somehow unpalatable. It is hard to envision because our economy is running on the exhausted fumes of debt. Just think about every program we have done to keep housing propped up:

-The Federal Reserve buying $1.25 trillion in mortgage backed securities to keep rates artificially low (coming to an end)

-The home buyer’s tax credit (isn’t too much home buying what got us into this mess?)

-Massive taxpayer subsidies on interest rate deductions (why penalize those who choose to rent?)

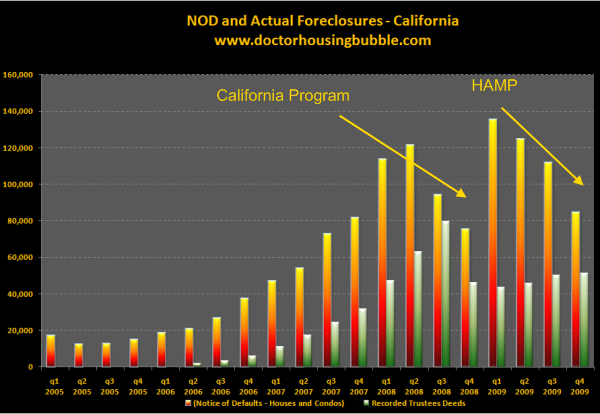

-Foreclosure delays – HAMP and statewide moratoriums (refer to charts above to show success rate)

-Banks stalling and massive build up of shadow inventory (the new mark to market stalling tactic)

And after all of the above, foreclosures are still raging and homeowners are still unable to make their payments. Just look at the trend:

California tried a foreclosure moratorium in 2008 and look what that did. Once that program was over the can was punted into Q1 of 2009 where HAMP was there to pick up the slack. Even with that, notice of defaults were still rising because of an unemployment rate of 12.4 percent. If you can’t pay your mortgage does it matter that your payment is $2,000 instead of $4,000? Many families and individuals are simply unable to pay their debt. There isn’t any gimmick to fix that. The only remedy to that is something called a job. Is our financial system so twisted that we think of jobs only after every measure above has been exhausted to create a transfer of wealth to Wall Street?

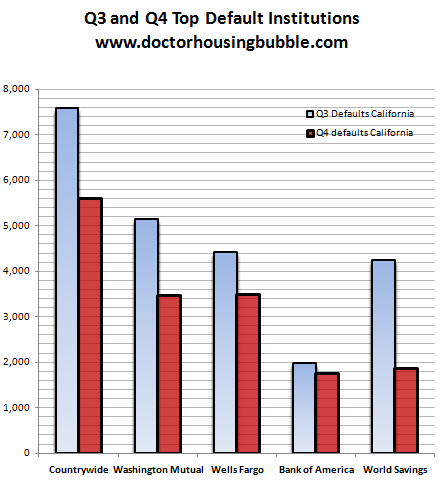

And if we look at the top defaults in Q4 of 2009 we find a list of very familiar names:

Names that will go down in infamy and will always be associated to the housing bubble are still causing problems today. The subprime and option ARM crusaders. They have littered California with these surprises and we know they are going off. Just look at those notice of defaults. You don’t get a notice of default for paying your mortgage on time. Yet the amount of foreclosures on the market does not even reflect what the NOD data is projecting. Banks are merely holding off the debt and pretending all will be well. But employment is still in the trough of this cycle. What industries are hiring large numbers of people? Or what industries are paying people enough for some of those inflated neighborhoods? No wonder why FHA insured loans with a 3.5 percent down payment are now the rage in California and all across the country.

Now think of this. Of the 5,290,000+ homes with a mortgage in California 35 percent are underwater. 1,850,000+ homes are in a negative equity position. Walking away is now picking up steam because why would you continue making the payment on a home that is now so severely underwater? To keep the bank current? And the bulk of people not paying, those 450,000 NODs in 2009 got that way because of the economy.

Now if home sales were booming because jobs were coming back and our real economy was growing then I can understand the trend to a certain degree. But if home sales are only going up because of gimmicks then we know this story all too well since we just lived it a few years ago. Hard to believe we are creating housing bubble 2.0 but this time, we may not have the same inflating power as we did in the last run.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Banking Solution to Financial Crisis is to Ignore Distress Inventory – California had 1,200 Foreclosure Filings Per Day in 2009 – The California Real Estate Foreclosure Machine. Countrywide Financial, WaMu, and Wells Fargo top Foreclosure List in Q4 of 2009.”

The Missing $6.3 Trillion

We keep hearing, as in this New York Times piece today, that “Fannie and Freddie were effectively nationalized” when the government placed them into conservatorships two summers ago.

How is it then that we’re still not accounting for their liabilities in the federal budget?

This is an election year. Both parties have a vested interest in keeping the balloon afloat until Nov.

Public employee pensions will bankrupt most cities, but no politician has the will to take on the unions. see

pensiontsunami.com

It’s painfully frustrating to watch this mini-bubble right now. It’s one thing to see bubbles happen with 20 year gaps in between them, because it’s a new generation of people and the “it’s different this time” mindset can justify everything, but to see the same people making the same mistakes only a few years later…it’s just brutal.

What I wonder is if the policymakers in DC know these are crappy ideas and they are just attempts to shut up the majority (who have no understanding of any of this), or if they legitimately believe these programs will fix everything.

When I try to explain this to the layperson, I always give this analogy. Say you’ve been given a year’s supply of food. Instead of spreading it out equally, you eat all of it in 6 months. Now you are fat and don’t have any food. You are going to lose weight because there is nothing to eat. Well, despite having overindulged, you can’t go the next 6 months w/o food…you need something to survive. Consider the gov’t subsidies right now, your ration of food for the next 6 months. The problem is that instead of giving you just enough food to survive and get you down your normal, healthy weight, they are saying we need to give you enough food to keep you at your unhealthy, current weight….or best case, drop you to down to slightly less overweight. We gotta help keep the fat people fat because fat is “normal”

When you put it in these terms, people seem to get it. It’s universally understood that being fat is bad, and the only way to fix it is to consume less. Right now, America is fat. We’ve trimmed down a tad, but we’ve still got a set of man boobs and big old gut. Instead of buying vegetables, we keep buying chips and brownies. And with high unemployment, there isn’t a treadmill in sight.

Great article, it all makes perfect sense pointing that prices in CA have a ways to fall. I just wish the Govt. would stop trying to prop them up..

I live in the Agoura area and have been renting for three and a half years. Sold a condo in 2006 and have been trying to wait out the market to jump back in. I’m feeling like I am missing the boat by what is happening around me, there has been multiple offers on homes that we are interested in buying in the 500 thousand range. Should we still continue renting or should we jump back in now?

Dr. HB, great post as always. Although, I have to admit, that considering the means and thereby the power and perseverance of Washington (which serves here as a synonym for the political powers that be all over the world) in collusion with Wall Street (again serving as a synonym) and the economic power elite it is not unlikely that this strategy of spend, mend, deny and pretend will at some point pull in enough gullible suckers into the real estate, equity, and debt markets to make a quick buck by which the bear market rally of 2009 will look like a walk in the park.

I bet that this will not end pretty in the long run. The problem is that I have no idea what this long run means. 2, 5, 7, 10, 15, 20 years? Any substantiated suggestions?!

This whole fiat currency system is a system for suckers anyway one way or the other. Which doesn’t mean some “suckers†won’t get rich. Just look at Wall Street today. And I wouldn’t mind if it were a system for suckers, if for sure the most stupid ones get hurt really badly. It only pisses me off that in reality innocent bystanders will always pay the price for the mess created by the not so bright “Masters of the Universeâ€. This system ensures that some people at the pivotal places in the system (FED, Wall Street, Washington) can game the system in a sense to tell the gullible “majority”: If you don’t buy today you will be left behind tomorrow. Just repeat this message loud and long enough and the sirens of Bernanke, Geithner,GS & Co. will work its magic. That’s called money illusion, because numbers on paper don’t make you rich, but it feels really good and this is what counts for our little mind. The productive capacity of the property you own only count in the long run. As Keynes note a long time ago: In the long run we are all dead! But nobody wants to really know this, we are masters at spend and pretend. This is how the whole system works. Lower interest rates and throw in the implicit “to big to fail” insurance policy from the Gov. and you have the ideal environment that everybody rushes for the door, but this time in order to enter the party not in order to leave. I almost can’t watch and listen anymore what the pundits, politicians and biased professionals on the MSM have to say. It sickens me and sometimes I wish the responsible minority and/or the mob would pick up its forks and teach the obvious culprits of this disaster their lesson. I believe on this Blog it is unnecessary to mention any names, only a little hint “On the Brink: …â€. But then again, I believe that too many people still benefit from gaming the rest of us or still are able to spend money they don’t have on things they don’t need in order not having to face reality.

Thank you and keep up the good work Dr. HB and fellow commentators!

Very good article to the public. However, it is not good enough for me, some one like me watching the situation very closely, to say “excellent.”

I have been working on distressed real estate market since 1991. The worst foreclousure happen in California was 1996 when the record showed about 64,000 cases in a quarter. Back then, housing dropped so quickly as a rocket. I bought a condo for $58,000 compared to $190,000 sold at the time as new construction built in 1991. But now look around, where we can see the BIG discount in the same city and its sourrounding areas.

About a year ago, a 1 bedroom 1 bathroom condo was listed for about $180,000, and now the similar condo in the same complex was listed yesterday for $319,000. A year ago, a smiliar single house was listed generally for $250-289.000. Now they ask for $340,000-389,000. In this area, almost everything is going up dramatically. Where is the area located? Go Check “Diamond Bar” for the condo.

Yesterday MNBC put a video out inviting some experts like Truila’s CEO expressing their opinipons on the current real estate market. One thing they seem agreed upon is “low end real estate is stabilized.” Yes, it seems very true from my observations on some Western cities. But look more deeply. It is not a true picture.

Why? I happened to present my offers to buy some those properties. I even had a chance to open an escrow. There are something bothered me so much. Could you be kind to look into some cases and tell me what is going on. For example, it seems some banks are not holding their REO inventory. Instead they sold those properties to some group, maybe it is called “whole sale,” for a dire cheap price. I witnessed so many cases like bankers are doing its “short sale” to easily take advantages that a home owner has difficulty to get. For example, one REO was foreclosed for $240,000 (countrywide loan made in 2006) and it was sold to “E” investment group through Chase for $17,000. Are those bankers holding the bag ad take a huge loss?

NO is my answer; but I don’t want to speculate on the issue at this moment unless DHB can point out some lights for me.

All I can say is the whole system help banks and the only victim is American average taxpayer JOE.

I doubt the FED will stop buying MBS anytime soon. If they stop, mortgage rates will skyrocket. The FED is now the mortgage lender for the entire nation. I would guess when they get close to the $1.25 trillion figure they’ll either extend the planned amount or invent another way of buying up all the mortgages.

Much of the MBS paper is being purchased by the Fed. The “implicit” guarantee of the U.S for GNMA and FNMA bonds is now “explicit” as the writedowns has already made Fannie and Freddie insolvent. The stock is worthless, although it continues to trade like an option due to the miniscule chance that the a concocted buyer will come along.

“For example, one REO was foreclosed for $240,000 (countrywide loan made in 2006) and it was sold to “E†investment group through Chase for $17,000. Are those bankers holding the bag ad take a huge loss?”

Maybe for $170,000? Could be a typo? No bank will take that deep of hair cut..

I was listening to Bloomberg today, and Kathleen Hayes had some very savvy Fed watchers and experts (Meltzer of Carnegie Mellon was one) who all concurred that rates will start to rise about June with small, easy increments. It’s pretty much inevitable.

Luke,

Congrats on getting out of your condo in 2006…. I’m assuming you made a tidy profit on that and hope you didn’t plow all that money into the stock market in 2006-2007. Agoura homes have fallen a decent amount… Condos have been brutalized the most in areas like Tarzana and Granada Hills. But Agoura has a great school district so it’s faired better…

I was looking to purchase in the $500K range also in Woodland Hills.. But then i noticed the pickings were getting slim at this price point and being swallowed up anytime they dipped into the $400s… I still believe the selection will improve in the next 2 years.. More homes will foreclose and more will be put back on the market. No need to rush out and “settle” on a $500K home now…

In my humble opinion, Best-case scenario home prices will remain flat for years to come… So your not gonna miss the boat.. You might just have more boats to choose from at that $500K price point your looking at.

Now if we have hyper-inflation due to all this printing of money… then home prices could rise… This is the only thing I believe will cause hard assets like homes to rise in the next 5 years. But i believe an higher interest rates or even a fairly devasting earthquake are more likely than true hyper-inflation… So that would drive prices down considerably..

Remember unemployment isn’t predicted to go back to the normal 4% range until 2020!! That’s 10 years away… In the meantime I don’t believe companies are going to be giving out raises when they have such a huge pool of salivating, cheap labor on the sidelines willingly to work for half what their current employee is wilingly to work for…

So, yeah, rent for cheap.. and wait…

Jack

I know firms that offer REO Pools to large investors (over 10M blocks of properties at a time) and they are routinely marked at 30 to 60% off the CMV/BPO price.

They bundle them into blocks and sell them off in lump sum and they guarantee a certain major dicsount across the board – I could see that in that scenario a few houses actually drop that low.

I also know there is a crap load of selling of the bad paper – and now even the delinquent already foreclosed paper is showing up in collections all across the country – see today’s CNN Mondy article here: http://finance.yahoo.com/news/Mortgage-lenders-pursue-cnnm-3107909798.html?x=0

so there is always another avenue for the banks to make another round of profits and keep the write down on the loss on the books for their benefit as well.

Sickening. And still the world turns and no one says a thing except ‘this is happening’ and ‘borrowers should seek counsel’ bla bla bla.

Walking away on a ReFI or non owner occupied purchase money was never a great idea but with the banks showing their true colors (they are going to collect that debt no matter how overvalued the loan was) it is scarier than ever. And if you alredy filed a BK to try to salvage your situation, when that deficiency comes there is no place to run and no place to hide and they WILL Garnish wages and take other assets – because they CAN.

When will we have had enough?

God forbid we have a major earthquake in Southern California, as most don’t have earthquake insurance. Talk about denial, the truth is Southern California is riddled with literally hundreds of earthquake faults. People should pay more attention to the local geology and type of construction they are buying. Stay the hell away from older condos with subterranean parking as they can collapse in a major earthquake. Those paying high prices for Santa Monica Condos could be in for a big suprise, as it was hit hard during the Northridge Earthquake in 1994. Exactly how many people even have earthquake insurance anyway? Very very few.

http://www.westsideremeltdown.blogspot,com

It is all about jobs. People need well paid secure jobs before they can take on the responsibility of a 30 year payment. With the economy sliding, unemployment and underemployment rising, wages slashed, fees increased, and jobs looking more precarious the market will not return.

But hey, we should go after those unions. Cause after a lifetime promise of a pension we should rip it away from them, right Mr. Crane? That should help the economy. Kick grandma to the curb and make her compete with college students for work at McDs for ever decreasing wages. In the meantime banks can hold on to lots and lots of empty houses in the hopes the market will turn and they can make back their fantasy money.

If I had to choose an occupation at this juncture, I’m sure that being a “collection agent” would surely be a growth industry, or repo man, or working for the IRS,.. or a “fraud investigator”, or any of a thousand occupations, whose job it will be to squeeze blood from turnips. (And there is an ever-growing swarm of unfortunate turnips out there) Or maybe I could manufacture small cameras (which will soon be on all traffic lights, so that they can raise more revenues by ticketing thousands)

What I’m trying to say is, where does one place one’s self in this kind of environment?

Here is an article on forbes magazine’s opinion of where it makes sense to buy. They come to some pretty bizarre conclusions, such as that now is a good time to buy in San Francisco. However, Los Angeles/Long Beach/Orange County are not on their list of places where it makes sense to buy now. Well duh!

http://www.forbes.com/2010/01/21/buying-versus-renting-lifestyle-real-estate-homes.html

Anyone who pays on a mortgage that is more than 40% underwater(mine was 60%) while banks dish out record bonuses to their employees needs to wake up. This is a capitalist society and while I hate that fact, the only way to thrive is to act like a capitalist. Do what is in your best financial interest. If you stop paying on your home you will live for a minimum of 12 months without paying rent. I’m at 14 months and the bank hasn’t even called in 2 months, I actually really want them to complete the foreclosure at this point so I can move. I know 95% of you think I’m a total A-hole and should probably be put in jail, but the fact is if enough people did this it would help the economy in the long run. When someone is paying $4000 a month for a home they could rent at fair market value for $1500 this actually hurts the economy(through less consumer spending). Its nothing but a massive transfer of wealth to people who need it the least(bank executives). More consumer spending = more jobs.

Geekgirl,

CA is a non-recourse loan state…. Unless u took out a home equity loan the bank is just bluffing trying to scare people out of walking.

It might not have been a bank taking the loss. It could be in a MBS which is not guaranteed by fannie, freddie or fha. Sometimes homes which are part of those securitizations are sold in bulk. In some cases, they don’t even allocate the sale prices to individual units, partly to keep from pulling the comps down.

Here’s a must hear link to “Guns n Butter” interviewing Dr. Michael Hudson

Financial Economist and Historian. Click on this and listen. Get past the into to the show and listen to this guy. He is a wealth of knowledge and explains not only the housing bubble but what is in store!!!

DG

We’re all just renters anyway. “Twenty-four hours, maybe sixty good years, it’s really not that long a stay”. That we would sacrifice the best years of our lives to pay for a glorified cave is perplexing to the objective time-space traveler. We have lost our collective minds so that now reason sounds absurd. We want something to hold onto, but it just slips through our hands. Everything ends up in the Great RHG trashcan on the curb of the highway of life…

We should be listening to Jimmy Buffet instead of Warren Buffet.

Denninger said it pretty well this morning…..

“We will not see true economic progress or recovery until we rid the system of the parasitic vampires that are literally draining the blood from our economic system. While some degree of embezzlement and fraud is always present in an economy when you reach the point that so-called “lending” has turned into a Ponzi-style circus with everyone looking for a greater sucker to offload their latest piece of trash upon at a profit (for them) you’ve also reached the stage where that nation’s economy becomes subject to outright collapse.

We stared into that abyss in 2008 and early 2009, but rather than learn from it, revoking the business and banking licenses of the worst offenders, breaking up the monolithic businesses that threatened to blow up the world unless their demands for (even more) money were met, banning the opaque products and jailing the principals we have instead coddled them and saddled our children and grandchildren with the costs of bailing out the (proper and appropriate) detonation of these bogus transactions.

We have fixed exactly nothing that led to the implosion. Instead we erected a wall around the burning building claiming that the building inside the wall is not really on fire and then piled up barrels of nitroglycerine around the outside! Unless we get off our duffs and address the actual underlying cause of the mess – the rampant and outrageous scams throughout corporate America we will have not just another collapse as we witnessed in 2008 but a worse one, and it will come sooner rather than later.”

I’m affraid greed and incompetent government have pushed it over the edge. There are much bigger problems coming than wondering whether it is the right time to buy a house in a still over inflated, ponzi scheme market.

Rent, so you can run when the s__t hits the fan.

In the San Francisco area

. Bought my home for $236,000. in 1986.

At the heigt of the market, same model was selling for $850,000 (2006).

Same model now selling for $725,000.

ET,

I live in Diamond Bar and I know exactly what you have experienced. Prior to purchasing my house, I made several offers on many foreclosures and nothing happened. Several of my offers were as much as 50K more than what the house eventually sold for to the bank months later. It appears that: As you stated, either the homes were sold in a packaged deal to a corporation or the listing realtor or bank involved got greased under the table. I subsequently bought a house the old fashioned way, a private sale. I had to pay full asking price. After the deal was signed, there were 6 backup offers. Recently, my house was appraised for 5K more than I payed for it just a little over one year ago regarding a refi. Go figure,,,,,,,

EARTHQUAKE

To those who think a nasty earthquake would bring down realestate, think again.

I use to think the same thing but all you need do is look at history. The undamaged housing stock becomes more scarce when a disaster strikes. Meanwhile billions of dollars flow to the damaged area for rebuilding causing local prices to rise. People flow into the area looking for jobs..

Check out New Orleans as the latest example.

Good take, Sabin… very existential, and ultimately, very right on. As Dennis Miller would say, “I like the cut of your jib.”

Trey,

re: “CA is a non-recourse loan state…. Unless u took out a home equity loan the bank is just bluffing trying to scare people out of walking.”

Under California law, recourse loans are not limited to HELOCS. A mortgage is a recourse loan when it is a 1) refinance, 2) a HELOC (as you said), or a 2nd mortgage after the purchase, 3) for non-primary residences like vacation homes and investment properties. Mortgage debt is “non-recourse” only when it is purchase money debt for an owner-occupied 1-4u property or if the seller financed all or some of the purchase price. If the debt wasn’t claimed on the BK (geekgirl’s comment), it’s not wiped.

I don’t hate you DG, I applaud your ability to have enough intelligence to THINK and then PERCEIVE what is actually going on here. This was massive fraud from the top down and I would *hope* the majoirty of people who got screwed, would wake-up, stop paying a single red cent, and just squat. In the meantime those same people should SAVE their money to get some security and when the time comes to move, find a rental that fits the budget and start the long haul to save a mere 3.5% to re-purchase your home (or equivalent) for less than what you owed.

The system is making all this garbage up, and they expect that “moral and ethical values” will keep people tied to the millstone dragging them to the bottom of the sea. It needs to be a level playing field, and damn it, if the corrupt congress won’t hold them accountable, then WE THE PEOPLE need to level it by NOT PAYING. Go ahead, foreclose on 4-5 million more homes…DO IT!!! It will correct the market or it will collapse, and both would be good to start over.

Remember, there are NO bad investments,…. just bad prices. The banks WISH. THEY ARE INSOLVENT. There is no way out of this without liquidation, not in 2 years not in 200 years. The piper must be paid this time.

So what is the solution to these challenges?

Good God, I hope not.

Leave a Reply