Baby boomers are refusing to sell and will age like a fine wine in their homes. The dominant force in the housing market.

Older Americans own half of the houses in the market. Many are simply refusing to sell and others have adult “kids†moving back in since they can’t afford a place to rent or buy. It is a Catch 22 and many people are looking at countries like Italy where the number of adults that live at home is enormous. Multi-generational families just don’t coincide with the “rugged American†worldview where you go out on your own and you make it with your own two hands. Of course, many house humpers had mom and dad chip in but that doesn’t make for such a sexy story. In the end, however there are many baby boomers that simply are not selling. This is actually an interesting problem that is not going away.

Refusing to sell

Housing used to be a young person’s game. The U.S. housing market and to a large extent, the economy was driven by home buying and big ticket purchases. But that has definitely changed since the housing market imploded with the 2000s. It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.

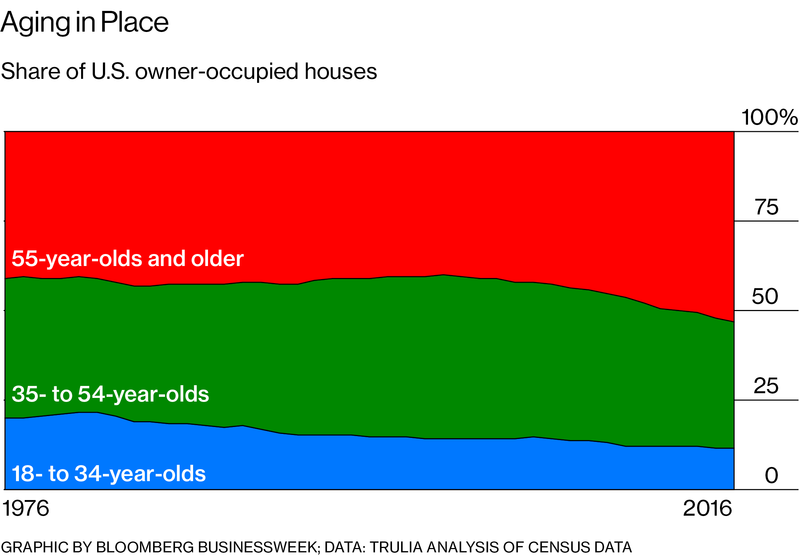

The oldies but goodies are now occupying a larger share of housing:

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

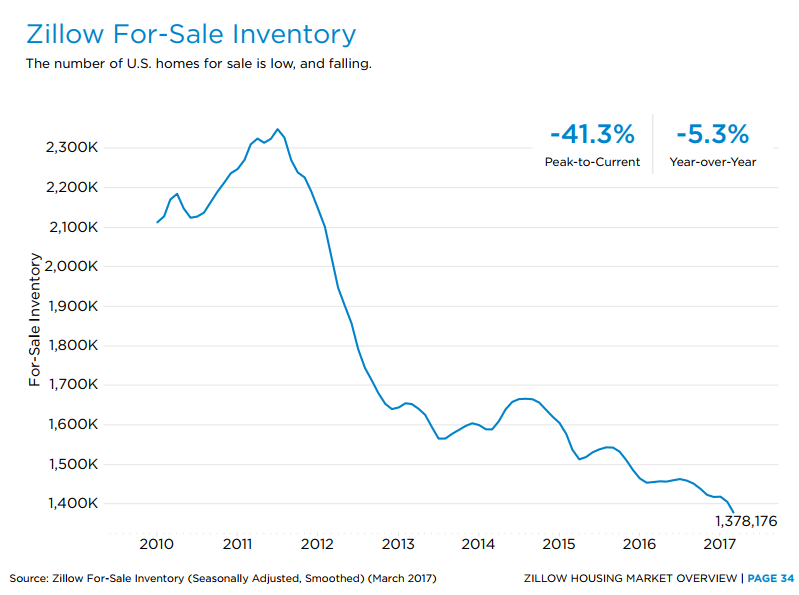

But housing has gotten more expensive across all U.S. metro areas so this is a much larger trend. It has absolutely crushed the available inventory out on the market:

Inventory still remains near record lows. This is a problem for those looking to buy especially when people are competing with investors, foreign money, and house lusting individuals that simply don’t want to wait any longer even if it means buying a crap shack. Yet all of this assumes the economy continues on this 8-year bull market.

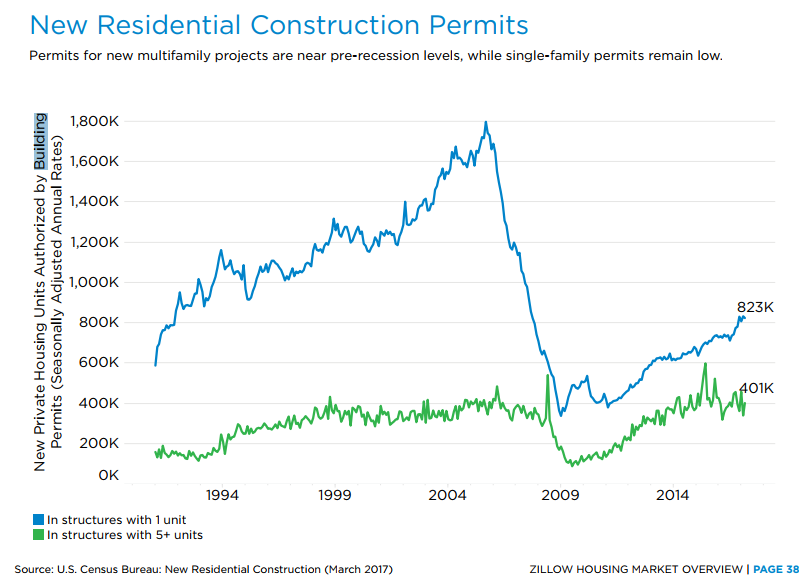

Also, while home building has picked up, it is still historically weak given the demand:

At the peak we were humming at 1.8 million housing units being built per year. We are currently at 823k. That is one million short from the peak days of the housing bubble.

So why are baby boomers not selling?

“(Bloomberg) The system is gridlocked,†says Dowell Myers, a professor of urban planning and demography at the University of Southern California. “The seniors aren’t turning over homes as fast as they used to, so there are very few existing homes coming online. To turn it over, they’ll have to have a landing place.â€

In Lexington, Massachusetts, a Boston suburb, broker Dani Fleming offers pizza and refreshments to entice the mostly elderly homeowners to attend seller seminars on “how to unlock the potential of your home.â€

In other words, these Taco Tuesday baby boomers are staying put. It is what we talked about in the sense that they are house rich and money poor. You need to sell to unlock that equity. And right now, living in a crap shack and buying tacos is much more appealing than unlocking cold hard cash.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

267 Responses to “Baby boomers are refusing to sell and will age like a fine wine in their homes. The dominant force in the housing market.”

I agree with the good doctor on this. I don’t see this changing anytime soon.

Inventory in So Calif. is at an all time low. Way too much demand for the supply on the market. Which leads to all time high RE pricing.

Whats to motivate the homeowner to move? If they have bought 20-30 years ago, the house has a low mortgage and thanks to Prop 13, the RE taxes are manageable (unlike Illinois, Texas, etc.)

So the only motivation for retirees to go to cheaper states is what? Higher prop taxes? Worse weather? Which is the opposite of what they want at retirement.

It will take a lot to get the army of oldsters outta California.

So they’d rather eat dog and cat food, stay in their homes, and die in that sarchophagus. To each their own! I traded the ‘California Dream (nightmare)’ for 2 homes, one in the Denver area and one in the inland northwest near a large lake that combined, cost about 1/3 of a nice neighborhood in L.A./O.C.. I traded the ‘California Dream’ for the ability to travel extensively, and to not have to worry too much about finances. I pay about a 4.5% personal income tax rate, get a $24k exemption on retirement income, and pay property taxes no more that a Prop 13 exemption, on each property. I have access to high quality healthcare in both locations, and filling up the tank is nowhere near as expensive as California. It snows, but that is a small price to pay for the flexibility and freedom!

I doubt they’re eating dog or cat food.

Yes, their houses are badly dated — kitchen and bathroom from the 1970s and even 1960s. I’ve been to the open houses.

But if you’ve lived in a house for decades, it’s not dated for you. It’s home. The neighborhood is home. The streets and stores are homey. You’re comfortable.

Why move to a strange city, even if there is a beautiful lake? Why live in a shiny new mansion, when you feel at home in your old house and city?

I’ve more respect for people who’ve put down roots, than I do for the house flippers.

So you claim to be a resident of Washington State (no income tax) and also live part year in Colorado.

After buying 30K house 30 years ago and paying them off while having to pay $1K/year Prop 13 property taxes, I doubt the older Boomers are eating cat food. The older boomers probably also retired with 30K-80K pensions. What do they do with all of their money after the kids have moved out (or even if they don’t).

My Depression Era grandma lived in her house for over 50 years and maintained it very well but barely updated it. She resisted updating to shag carpet when it became popular and had to live with her beautiful hardwood floors until she passed away.

As in another comment, as a grandson, I liked it that way. It always was comforting that grandma stayed the same.

So I’m 52 years old and I have sons who are 10 and 13. My wife is 47. I have to work another 10 to 12 years before I retire. Even if I had no children and I was able to retire in 3 years. Who the hell says I have to sell my home? I almost had it paid off, but then I refinanced and now we are replacing the garage and putting in an ADU above the new garage. My wife and I will stay up there and the kids will have the other 2 bedrooms. If I sell and buy another larger house I lose Prop. 13 tax status. Instead of paying $2,500.00 a year if I bought an 800k home I’d pay about 10k a years in taxes. With the remodel I’ll pay 3.5k in taxes.

Plus, they would have to pay federal income tax on anything over 500,000 plus the 50,000 they paid originally. With homes going for over 1,000,000 the taxable “profit” would be 450K. So, they take a hit right away. Then, where will they live?

If we were to go back to the old “roll-over” for selling and buying a home, there might be some increase in supply.

Don’t forget the 9.3% California income tax. There is no capital gain breaks in socialist Cali, unlike Trump America that allows Capt gain treatment for now.

Yes, for single people with no responsibility, like myself, the home exemption is only $250k. After you pay the 100k plus in income taxes, you just have to borrow that much more to buy another place, and retirement income could be lower for some folks, so they can’t get the necessary mortgage(banks look at 3x income). But on the bright side, 71 year old’s have the RMD from their 401ks, which can increase their income substantially(as long as the stock market stays high).

Heck, I only bought 5 years ago in LA and what would motivate me to move? Only by force .

MS 13

Amazing to see those inventory numbers. And sure we haven’t built as much in the past 10 years as to the previous 10 but jeez. What a mess.

LOTS of mega-mansions being built north of Montana Avenue, and even north of Wilshire. In both Santa Monica and Brentwood.

It seems every other block north of Montana Avenue has a house currently being constructed.

I live in Westchester, 90045, near 77th and Kentwood. Almost every house that goes on sale sells quickly and is replaced by a 2-story lot-filling one. We’ve lived here over 35 years and we ain’t moving.

Same here in the South Bay beach cities. There is construction on virtually every street. The 1000 sq ft old shit box is being replaced by new 3000 sq ft mansions with all the bells and whistles. And all these monstrosities sell…

If you are a lucky boomer, you stayed put in your Costa Mesa or Fremont house that you bought in the 70’s. If you were smart and did use the house as a piggy bank, it is paid off. A paid off house is what you want in retirement. Some sell and move to Idaho, but most stay put because of family, and don’t forget prop 13, so why move? But if you are a boomer like me, you bought and sold many houses in many different parts of Ca. Unfortunately life happens and things like divorce and job changes, force you to sell. Moving around was easy up until the new millenium, before the foreign money and hedge funds appeared. Now it is just too expensive to buy in this market. Smart money says stay put if you can.

One of my tenants, in Idaho funny enough, bought a house in Pasadena in the 70s. Sold it in 2016. KA-CHING! And now they are retired and renting. I mentioned on another thread that to make money as a landlord you need good quality tenants. These people are **THE** tenants you want. They pre-paid a year’s rent in advance. I jokingly asked them if they have any friends in Pasadena who also want to sell and escape, I could make a fortune on that pipeline, lol.

Idaho income taxes can be more than California for some people. The winters there are bad. WA state has no income taxes. Spokane, less than an hour’s drive from Idaho.

So true, this is still America and as long as I can keep my house I will. I’ve thought that if you get to the point we’re you can’t afford to maintain it you should sell though. My neighbor who is 83 moved her granddaughter in with her. She since had a stroke and is in a home. The granddaughter is fixing up the home and I’m sure will make it her home. I don’t know if they could keep it on the grandmothers name for the Prop 13 tax status, but either way the family has a home free and clear. I

Houses are so freakin expensive. I live with my parents and will never move out. I dont understand how people rent or buy in this market. I pay zero rent and live a normal life. My mom likes it but my dad keeps asking me about moving out buying a house etc. I am like, a nice looking house cost like 700-1mio!!!! Insane. There is no way I pay somebodys mortgage and there is no way in hell I pay that much for a house?! My dad can keep dreaming about moving out but I am not going anywhere. If a house costs like 200k I would go to the bank and get a loan. Until then I’ll stay in my room I grew up in. Lol

Wow. Based one your housing preference, how will you ever get laid? At least rent a room from someone on the peninsula? I wouldn’t be too proud nor advertise your situation.

Prime example of “Failure To Launch”. Being a mooch is Nothing to brag about.

I had no issues with my sex life so far. Lol. I am a surfer and in badass shape. If you think you need to have an expensive house to get laid, I feel sorry for you. The chicks i surf with and date are living with their parents too (mostly). One chick even said to me, you are lucky, you can live with your parents….my rent is damn expensive. So its more like a pro rather than a con to live with parents…..you got more money!

All you gotta do is relo to a flyover state if you want to stop living like a leech.

But I’m guessing this is a troll… In which case you really should be under a bridge.

Don’t see any problem if this works for you.

Take advantage of this opportunity to save money and/or work on your education. Your parent’s won’t live forever, so just make sure you have a plan

I can’t be too hard on someone who has moved back home. I know a few people who have valid reasons to move back.

1) A co-worker’s 24 year old son moved back home to save money for a down-payment on a house. The son is working 60 hours per week and saving a huge percentage of that and has a plan to move out in a few years and buy a house. He also helps his aging parents around the house.

2) Another co-worker was renting an apartment but moved back home when his elderly parents needed someone to help in the evenings due to medical conditions. We are a generation that cannot have their parents move in with the kids to get help. Especially if the millennial kids are renting an apartment.

I know a few teens who would love to live at home and surf all day and play video games all night. In my opinion, that is not a valid reason to live with your parents.

As Anna said, your parents won’t be around forever.

Nowadays its totally normal to live with your parents. Especially in Cali. I do have a bachelor and a decent paying job but I am not gonna waste my $$ on rent or mortgage. If you are very old, it was probably easier back then. Everything was cheaper in the good ol’ days.

Sorry. Your parents are pathetic losers.

“Cali” ???

Eeeeek. *shudder*

#1 way to spot a non-native.

Randy,

“your parents are pathetic losers”

Why so angry Bro?

Why are people hating on this guy? I am a young too and I wish I my parents lived within 50 miles of my job. so I could live there rent free. paying 2K for an apartment ain’t fun. in like 3 years I’d have 100K down-payment.

People are just JEALOUS *** ENVY….

If given the chance, I would have totally lived with my parents post college for a few years to save a down payment. I think people are hating on some of the “live with parents” posters for several reasons:

1. Dude even said in his first post: “I live with my parents and will never move out.”

2. If life revolves around surfing, going to the gym and video games, people have a right to call somebody out.

3. A few years is one thing, for adults who have lived with their parents for decades…they are not serious about growing up and starting their own lives.

If a young person is serious about saving a down payment, I would definitely recommend living with your parents for the short term.

AlisioViejoGuy,

I am glad you have the opportunity to stay with your parents and save money. Don’t let these haters get to you. All they want is you buying that overpriced crapshack as soon as possible. These people don’t give a crap if millennials are deep in debt and suffer from these bubbles. All these people want is millennials to pick up the slack and keep the bubble going because it increases their wealth on paper. Don’t give in….stay at home and save your money. Wait for the economic collapse.

Son, you come on over to Kerrville TX, me and Kinky will find a place in your price range. I can even get you a job at the ranch. Your dad is right, your mother, like all mothers is spoiling you.

One thing I’ve seen with other people is that their kids go to greener pastures outside of Clownifornia (or any state with a high cost of living and/or that is hostile to business), start a family and then the now grandparents move to be closer to their offspring and provide free day care. Another factor is some of these folks have taken out loans/heloc to pay off their kids’ education debts or have even come out of retirement to help pay those school loans off. This may affect prices when the downturn gets going in earnest – lots of 6 figure loans out there for law school, masters in under water basket weaving, etc.

In my neck of the woods lots of idle land thats been in families for generations are up for sale since the owners no doubt heard the market is good, but all of it is way too high and nothing is moving. Lots of high end vacation rentals too, in some beach areas some of the blocks have maybe 40% up for sale, one after another sign.

Where do you live junior-kai?

Gotta keep that on the down low, but suffice to say it is very “flyover”.

We must be pretty close to this whole #%&* show blowing up, I’m hearing back to back commercials on the radio advertising how to flip. Also seeing ads on craigslist for money lenders or people who want other peoples money to “get rich flipping”. Yeah, this will end well. Thanks Yellen, Bernanke, all the big scum banks and the folks behind Fannie, freddie, VA and FHA – helll isnt hot enough for you clowns.

I’m up in Big Bear right now and it feels like Huntington in early 2008, the number of places for sale is insane, signs *everywhere*, but many apparently stuck on trying to capture that bubble high price, and therefore on the market for 100+ days. Blood in the water…

Blood in the water in Big Bear because nobody wants to drive down the hill for work especially during the winter. I had a friend that did that for two years and finally bought down the hill. Said it was the best decision hes made.

“It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.”

I’ve been hearing about the death of suburbia for 20+ years. It’s the dream of leftists everywhere to have everyone packed like sardines in apartments, a la Eastern Block countries. But it simply isn’t happening. People still like having a plot of land to call their own, a yard, a pool, a garage, greenspaces, etc.

Yeah at 24 everyone wants to live in the city and have 100 bars within walking distance, and be close to nightlife.

But the 24 year old eventually turns into a 34 and 44 year old with a a kid or two or three, who doesn’t need 100 bars within walking distance, but wants a little peace and quiet.

What is a leftist?

What is a leftist?

A person who pretends there are no such things as leftists.

Dream of the leftists – I’ve often thought so, but never understood why.

Why, why do some people want others to live in rabbit hutches?

It has been said that conservatives want you to live your life, but liberals want you to live theirs.

Those 24-year-olds live under the delusion that they will always have a 24-year-old brain, and that they will always want to live in a hipster loft downtown, and that their girlfriend will always share that dream, and that everyone else should too. And then biology happens.

This is a very good point and once one couple chooses to buy and have kids many others follow suit and before you know it all your friends have houses bought and starting families.

Domino effect

Since the last 3 -4 years we have been hearing: “this is the year when millennials move out and buy in droves”.

Leftists everywhere —. Another paranoid Trumper loon who probably thinks Geoge Soros is sleeping under his bed.

Yeah Danny Boy, no such thing as leftists, Bernie and Fauxcahontas are right wingers, lol. I always wonder if people like you actually believe your bullshit or you just lie. I’m not sure which one is worse to be honest.

Different Dan there.

So what do you call the ’empty-nesters’ whose children have come back home? I think we need a new name for that.

The kids are called Boomerang Babies.

Extended family nesters? Multi-generational nesters?

we call them mother’s son. The sons stay at home into their 30’s because no other woman can take care of them as good as mama. Not all women consider these adult children to be prime marriage material.

You call it Empty Nest, in the 80s there was a Golden Girl’s spin off with precisely that, a widower with two daughters both of whom moved BACK with him

Every year a Boomer lives in a house, it is a year older and needs more repairs. Also, property taxes are going nowhere but up. Some say that property taxes will double or triple because municipalities have no other source of income to pay for unfunded pensions and other liabilities.

Some say, that sounds like Donald talk. My property taxes have gone up very little, but my equity surpassed the last bubble. I work for a local water dept and the tax revenue for that city comes mostly from car sales. As hey restructure the pensions the liabilities will drop too.

If millennials are set to inherit Boomer property, what’s the big deal?

Exactly Samurai, this is still a free country.

Most will have to wait another 30+ years for that to happen. If it hasn’t all been spent on assisted living, or in-home care via a reverse mortgage, by then.

you are right dear, you will get very little. The old egg trick, looks good on the outside, but the inside has been all sucked out through a little hole. The old folks have home equity loans or reverse mortgages to maintain the lifestyle(sound familiar, 2007), the creditor’s will take the rest. But hay, you get free rent in the meantime(that is all you will get), so don’t complain. When they die, you will then have to get a real job.

@Jed. They are called Boomerangs

You dopes, you’ll never understand RE like I and Daddy. Because of technology and globalization, RE is now a global market, and prime locations are in demand like never before. Plus, throw in booming stock and bond markets, and the greatest wealth transfer in history (US Baby Boomers dying and leaving estates to their beneficiaries), prime locations like SoCal will remain in demand for a long time, unless some unexpected event inserts a pause.

Call it gentrification or as wise people do, progress, but even many of these millennials living in their parents’ homes will end up owning these homes or upgrading to better homes.

You dopes are still paralyzed by the 2008 crash to have any idea what is happening.

We will see who the dupes are when Housing Tanks Hard Soon!

I agree, Ivanka. A lot of people on this blog trash the state because it’s much more affordable in flyover country (which is true) but people still flock here. It’s still desirable despite the crowding, traffic, pollution, etc. The demand isn’t going away.

LOL SoCalGuy. Yeah people still flock there, primarily illegals. And you also forget about the people flocking out, primarily middle to upper middle class people. California is turning into a S. American country where 20% of the population is ultra rich, 10% is middle class and 70% is in poverty.

Mr. L.,

If you’re set and doing your thing in Idaho, or wherever, and you hate brown people, why do you hang out on a blog about Southern California? Haterism? What’s your deal?

Boxes

@Boxes,

I’ve asked the same thing from a couple of the trolls on here but never get an answer. It’s like going on the atheist blog telling everyone they are going to burn in hell.

I believe they are seeking validation. They only wish they invested here like my family has for the past 50 years. Now they missed out so they want to convince us how nice Charlottesville is… loooool

Only 50 years in SoCal? Recent immigrants compared to my family.

A real estate dynasty can end quickly. Ask any of the private property owners in Russia, China, and other countries around the world have been taken over by Communists and have seem their private property subsequently confiscated and “owned” by the communist government.

This can occur in the U.S. too if Bernie the mooch and his fellow Communist Democrats have their way? Bernie the mooch will probably hypocritically make sure that he would continue to own his three homes?

No doubt SoCalGuy’s family tree will end with him? Feminized self hating white eunuchs can’t reproduce?

As I said earlier Mr. Landlord is a paranoid Trumper with delusions that everything he doesn’t like, in this case So Cal anything, is a vast liberal plot directed at him and “real Americans” like him. He most likely believes that 10s of thousands of inferior brown people are being bused in from Tijuana to vote and collect welfare checks and it his duty as a ‘merican to expose them. If he doesn’t live here, doesn’t plan to come here in the near future or didn’t live here in the recent past, he is indeed a troll with his head in a garbage can screaming and thinking the echo is come from other like minded people. I’ve lived her for 50 years and my wife’s family has been here fo four generations. We’ve seen the state go through all kinds of changes and the conclusion still is that this is the best place on earth. If you don’t like it stay the F away and shut your f’ing mouth.

Dan,

There is no paranoia. It is a fact that there are more registered voters than there are adults in US.

Vote, and vote often. Take your dead friends with you, too.

How to debate like a leftist in 3 simple steps

1. When you lose an argument call your opponent racist

2. Repeat Step 1 until the argument ends

3. Go to Whole Foods

It’s a only global market in countries like the U.S. that has no restrictions on non-citizens purchasing property.

Many countries don’t allow non-citizens to buy property such as Thailand, Greece, Turkey and Vietnam.

In Mexico, Article 27 of the constitution prohibits non-Mexicans from directly owning land within 31 miles (50 kilometers) of the coast and 62 miles (100 kilometers) of the Mexico’s borders. Ejido land (land granted by the government to Mexico’s indigenous people) cannot be owned by foreigners.

Communist countries like China don’t allow non-citizens or Chinese citizens to purchase and own property. They can only lease property from the government only for a specific term of time such as 30 years.

“They can only lease property from the government only for a specific term of time such as 30 years.”

Common in EU too: Towns won’t sell you land, you only may rent it, often 50 years. When that time is up, it’s time to hike the price to 10-fold. (And it has been inflation adjusted yearly, it’s not that, just stealing.)

If you don’t like it, you can move your house somewhere else. Legalized robbery and only now people are realizing it.

I guess the FED and bankers will need to have an algorithm tailored to determine when baby boomers will eventually become deceased and/or have no siblings to inherit their house. Maybe there will be hope for millennials when the supply meets a certain percentage point imo.

Hi,

I know this is slightly off topic but I thought I would describe my experiences of moving to flyover country in the UK. Its a very small population of 20000 that I have moved to. I moved here a year ago.

Advantages:

1) Financially I have a secure future here. I can afford a good house. I should be able to have a good pension. Also I should even be able to help out with my children’s university. I know flyover and Mr landlord have been very successful but you don’t need their success to do well.

2)My job is less stressful. Still busy with big demands. However alot less red tape and politics. Maybe I am lucky but I now work at a place that is about getting the job done.

3)People are friendlier compared to a big city. They are decent people who will go out of there way to help you. It has a real community feel. Cant emphasis how good that has been in.

4)My children have a good life. Outdoors more. They aren’t exposed to some of the problems that other children have to face in challenging neighbourhoods.

Disadvantages

1)Far from family. We have been back home twice this year and relatives have come to see us. So we still see family on regular basis. Not a problem at the moment but will be when parents get older.

2)Less entertainment. We don’t have the big sports clubs, rock concerts and trendy bars. You have to make more of an effort to enjoy yourself and take up a hobby/sport. But when you have a family you don’t go out as much anyway.

3)Everyone knows everyone. People have been very supportive in our move but people i have never spoken to know me!/? Being a private person i can find that challenging.

The plan is to stay here for two more years and then either commit forever or going back to working internationally. I have a job that pays very well internationally but not so well in the UK. Staying in flyover country is the only way I will stay in the UK.

Congrats on your move! Reading your comment reminded me of this: https://youtu.be/meF7NmfnXZ0

Lol.

Well the local butchers meat tastes really good…..

The UK is too small for flyover country. What are you talking about?

If you are a boomer, why would you sell our home? Over the long term, the value just continues to go up. Better off taking a reverse mortgage since the amount you can take out just rises with the value. Then, after you pass, no taxes on the gain when the house goes to your estate ( up to 5 million ). If you sell, you lose your best investment, prop 13, and you get taxed on gains over 500K. The only boomer that should sell are those with no equity and they can’t afford the payments.

Also, a boomer with a home that is a poor investment should sell.

Currently, you can only borrow up to $625k on a reverse mortgage even if the home is valued at over a $1 million. You may also have to pay an MIP premium and will pay interest on the money! Not sure what all that adds up to! And, you leave your heirs to deal with squaring with the lender upon your death! If you own the home outright, sell, you get the full cash value out of your home, plus up to a $500k capital gain exclusion. And, no one seems to consider the constant increase in utilities, taxes, fees, etc. required to sustain out-of-control government spending, debt, decaying infrastructure, and pension liabilities! And the kid’s, well prop 13 may not be such a fantastic deal to live in Mom and Dad’s old house if all the other utility bills, taxes, fees, etc., keep going up, up, and up!

Actually, Jumbo Reverse Mortgages have much higher limits than 625K. The key is jumbo.

Yes, reverse is now administered by FHA/HUD and therefore the loans absolutely have MIP or aka PMI

On December 1, 2016, the FHA announced that it will increase the loan limits for HECM reverse mortgages to $636,150 next year, up from their current level of $625,500. This higher lending limit will take effect January 1, 2017 and will continue through December 31, 2017. The increase is 150% of the national conforming limit of $424,100.The MCA is the lesser of a home’s appraised value or the maximum FHA lending limit. This means that if your home is appraised at $700,000, your MCA under the HECM reverse mortgage program will be the max lending limit of $636,150, since this is the lesser of the two values.

“It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.â€

This is a very short sighted statement. On the east coast, homes near public transportation or in the urban center sell for more. But, self driving vehicles that you use like an Uber service will result in non central locations to become more attractive.

Beware : China is cracking down on capital outflows. Foreign real estate buying drops 82%.

http://www.zerohedge.com/news/2017-08-10/look-out-manhattan-chinese-foreign-real-estate-spending-plunges-82

When do you think we’ll see the results this Zigzag? I’ll get see my wife more often.

Yeah this was bound to happen.

Here’s another article on this topic:

https://medium.com/@dataramatech/chinas-capital-controls-set-to-send-ripples-across-country-a0d13066b834

LOL @ naive people who think a Chinese “law” will stop Chinese people from doing something.

Could be a secret article to scare boomers to sell? I guess Realtors need to make their commissions some way or another.

In my humble narrow opinion, the Baby Boomers who stay are the norm.

1) My wife and I had Depression Era grandparents who all stayed in their houses for over 50 years until they died. They all had private pensions with a paid-off house and while not living as royalty, they lived very well.

2) Our parents were Silent Generation and have been living in the same house for nearly 30 years. Low Prop 13 taxes and again, had comfortable private or public pensions. Many leave the house, AND several million in the bank for their Boomer and GenX kids when they pass.

3) Many Baby Boomers are doing the same as their parents due to Prop 13 taxes and boomerang kids. Some, but not most Baby Boomers will have a pension. Some older Boomers have a pension and stayed in their house while others have cashed out, become instant millionaires, and moved closer to their GenX and Millennial kids in Flyover Country.

My point is that both the Depression Era and Silent Generation stayed in their houses for 30+ years. Many Baby Boomers are doing the same. This isn’t a new phenomena but the volume of the Baby Boomer population and the lack of new home building, may be amplifying the affect.

Whether these Boomers are eating cat food or not, depends on whether they are: Still working (reason to stay), retired with a paid for house and conservative with low Prop 13 taxes in S. CA(anyone can live well on SS in S. CA with 1K per year Prop 13 property taxes), retired and adventurous when they cash out ( become millionaires in reality, and move to Belize or Flyover Country to be closer to their Millennial kids), or have rented all of their lives and are eating cat food in a trailer in Bakersfield (Buy Now! And hold for 50 years!).

I firmly believe the Boomers who bought houses 30 years ago are not eating cat food and are going to $1 Taco Tuesdays because they are thrifty. The poor are the Boomers who did not buy a house.

Or the Boomers who bought a house in 2006 for more than they could afford and either had to foreclose due to their jobs, or foreclosed because they panicked when the house went underwater. Either way, if they had held for 30 or 50 years, they would have been wealthy today.

“Boomers who bought houses 30 years ago are not eating cat food and are going to $1 Taco Tuesdays because they are thrifty.”

Nailed it again! Our goal is to have lunch for $10.00 – and most of the time we make it or come danged close! And that’s not because it’s all we can afford. We’ve been in the habit of watching our pennies for so long it’s just the way we roll. And let me assure you, we are much happier with a sack of $2.00 Tuesday Tacos then we would be with dinner at Flemmings.

Seen it all before Bob – or just make it up as you go along Bob?

A $1k property tax bill implies a $80k assessed value. Maybe a mobile home in east Hemet? maybe and that might be on leased land?

Most of the people in Socal have seen dips get surpassed in future years. Its been a great way to accumulate wealth tax free while living in the home. Don’t see that changing either.

I never tell a lie. If you bought your house in 1976 for 40K, your Prop 13 tax bill is about 1K per year today. Do the math. and weep

You need to read up on Prop 13. I have recently seen houses sell for over 1 million dollars with $1000-2000 property tax bills.

Well, I am sure this is going to affect most boomers very soon. When it comes, it is going to come like an avalanche (domino effect):

http://www.ocregister.com/2017/08/10/bull-stocks-cant-stave-off-california-pension-crisis-forever/

All the government and banks need to due is to crank up inflation to the optimal level. The value of the pensions and the national debt will become insignificant.

I predict that is the next step.

do not due

The Boomer who bought the 30K house in 1976 before the huge inflation of the Carter/Reagan era while making 10K per year is happy now while gliding into retirement with a 100K+ public retirement package. Until inflation happens again and that 100K+ becomes worth 10K again. If they still own a house, they are protected from rising rent but that new $20K 42 inch TV $30/gal of gas, and $10 bananas may be a problem.

But hey! Our national debt problem will be reduced by a factor of 10.

I think you’ll find that most CA public sector pension recipients have cost-of-living adjusted (COLA) pensions. So inflation alone won’t get us out from under that debt load. I know a number of retired boomers with these $100K+ pensions COLA’d to infinity. They’re not going anywhere.

PS. Buying an annuity with a payout equivalent to these pensions would cost $2-3M, so all of these “Taco Tuesday pensioners” are effectively multi-millionaires. Despite the vengeful fantasies promulgated on this site I don’t think they’re hurting even a little bit.

There is a much higher chance for CA to raise the personal income tax or eliminate Prop 13 for all owners than to see the inflation at national level to the levels you dream.

First of all, this is a CA problem and DC is not going to fix it; look at Illinois.

Second, that level of inflation is not going to solve the problem; it is just going to compound the problem due to COLA on most of those government offered pensions.

In conclusion, there are ONLY two real solutions: massive tax increase for all Californians or a bankrupt state. There is no other REAL solutions without compounding the problem. In either of the 2 scenarios, it is going to be bad.

The last lines of that article say that doom and gloom is not inevitable. My cola nowhere near covers even the modest inflation we have had in the 20 years I have been retired. But I own my house outright, live in a smallish Northern Ca. Town wilth most of my needs able to be met within two miles of home and by Amazon delivery. I figured out how achieve this many years ago, the next generations will have to figure out how they want to live then do what they can do to achieve it. There are no guarantees, life isn’t aways fair so deal with it here if you can or somewhere else if you have to. P.S. – prop 13 ain’t going anywhere in my lifetime but on the off chance that it does I will deal with it.

Darn COLA. I used to get that as part of my yearly raise in the mid-1980’s until someone correctly determined that it was actually driving inflation higher.

The COLA is maxed out at 2%, some 3%, so inflation above that eats away. The Legislature traditionally keeps it at 80% purchasing power of the original amount.

Why buy expensive house? Live with your parents rent free and inherit. Winning

What if your parents don’t kick the bucket until 90? If you plan on being single your whole life and never want to grow up, that may be a good idea. If you want to get married and start a family and live a normal life, you better have a Plan B.

“What if your parents don’t kick the bucket until 90? If you plan on being single your whole life and never want to grow up, that may be a good idea. If you want to get married and start a family and live a normal life, you better have a Plan B.”

I want my parents to live until 100, why would that be an issue? Single life is great, no plans to get married. And yes, I am fully grown.

“Why buy expensive house? Live with your parents rent free and inherit. Winning”

I would personally call that “losing”.

John, can you explain what i am losing by doing that? Just name one thing.

Pride. But that’s me – I’ve been on my own since I was 16. Being a leech may not bother you at all, in which case keep it up. I feel sorry for your parents, though. Not because you’re living with them, which I’m sure they can handle, but because you have no desire to be independent, and that reflects badly on them.

I am totally independent! If I purchase real estate at these ridiculous prices I would be a debt slave. I am debt free…that’s freedom!

Yeah, “free”, except for that whole livin’ under the parent’s roof issue. Do you still have a curfew?

“Do you still have a curfew”.

That’s funny! Living with my folks is much different than you might think. For me it’s the best thing. Imagine it more like being a renter except you don’t pay any rent! I often feel like a homeowner because I grew up in this house and I give advice when it comes to remodeling. I will be the only one left at some point.

The key is to maintain a good relationship with your parents. You get many perks by doing just that. Don’t bite the hand that’s feeds you.

Fat chance for the government to bail out the Social Security with 46 Trillion dollars shortfall and baby boomers living forever in their sarcophagus:

https://www.sovereignman.com/trends/social-security-requires-a-bailout-thats-60x-greater-than-the-2008-emergency-bank-bailout-22241/

The next crisis may be the sovereign debt.

https://www.thebalance.com/what-is-a-sovereign-debt-crisis-with-examples-3305748

US population continues to grow and Ca. now stands at about 43 million. These figures tell me that new cities in Western states with small population should be where the growth occurs. We are seeing more companies relocating back to America and overseas corp. want to shift to the USA.

Old Eastern cities and Ca. folks who want a better life would flock to these new urban centers. Housing would be affordable, with many gov land turned over for growth and new build, kind of like land rush to get people to move West.

Would establish major cities protest of course, but 21st Century like any turn of Century sees change. I can see it now, Montana, Wyoming, New Mexico the new NY, Ill, Ca. it should happen and can happen all you need is visionaries, people like a Walt Disney, Vanderbilt’s, Rockefellers etc. anybody left like that today, probably not?

It’s funny you mention that. I took a road trip through Wyoming, Montana, Utah, Arizona, etc last year. And I had this thought that any of those small cities could have become major metro areas. It was kind of pure luck that Denver became the Denver we know today. It could have easily been Cheyenne, Wyoming or Bozeman, Montana or Flagstaff, Arizona. So yeah in the next 50-100 years who knows, a Bozeman or Cheyenne could explode and become a 1M resident city.

Denver was always a decent sized city for a Mountain Time anyway. It was located in a great spot about halfway between San Francisco and the Midwest. Salt Lake City had the Mormons. Before A/C those were the only two real big cities in the MT zone area. Phoenix didn’t even have a 100K in 1950, nor did San Jose. Both are over a million now. No, cities in ID, MT, WY, NE and the Dakotas will never reach a million or even half a million (city proper).

I was talking 1M for metro. That’s what matters, not city proper. Boston city proper is only 600K after all.

And Boise isn’t far off from 1M. Right now it’s at 650K and growing quickly. It was only 300K in 1990. That’s some crazy fast growth for a city to double in size in 25 years. It will hit 1M easy in the next 10-20 years.

In the digital world, people don’t need to all be clustered together. There’s no need for everyone to be in a cube farm in Los Angeles or San Francisco or Denver. You can have a significant chunk of that workforce distributed across the country (or the world). And it’s something companies will want to do as well. Why pay someone $150K to live in SF, when that same person will take $100K to live in Boise or Missoula or Santa Fe? It’s win win for everyone. The employer saves money, the employee has a higher relative income.

This is where the big population growth will be in the next 20 years, I think….small to mid sized cities in the Mountain West.

Never say never. Natural disasters like earthquakes or an EMP attack can cause people to move. People may be soon fleeing lawless Democrat controlled sanctuary cities.

Good Day Doctor and company! Can you please explain to me why you blame the old people for holding onto their houses as the reason for the shortage in inventory and not the big banks changing the rules of the game back during the crisis allowing them to keep foreclosed homes and non-performing loans on their books for decades instead of forcing them to sell? My humble opinion is that these institutional owners who do not live in these houses and keep them off the market are causing the inventory shortfalls we are experiencing. Your thoughts…And THANKS! always for another great article!! Do ENJOY your day.

Consider that many of those older homeowners are also from an era where things like “unions” and “pensions” and “full healthcare in retirement” were real and substantial. Combine that with social security, I am very pleased that my older parents own their home outright, have a fixed income, have made some decent investments, and it allows them a comfortable and secure life. Kaiser for decades has worked out just fine for them. We as a culture don’t respect our elders or build infrastructure that treats the elderly and feeble with much support.

And the adult “kids” are the heirs. Perhaps the property tax rate should reset at that point, in CA I don’t think it does (not sure).

no, it does not.

It’s not that Boomers WON’T sell, it’s that they CAN’T sell. They are broke, little to no retirement savings or maybe a HELOC on their mortgage headed into their 70’s. Most have no options – it’s not that they have a choice. The choice is made for them!

Quit acting like Boomers are some model of economic success.

Not really Sean. About 1/3 of all homes are owned free and clear. And of that 1/3, 1/2 of it is people 60 and over. Are there 70 years olds with a huge mortgage? Sure. But that is far from the norm.

“Nationally, there were over 73 million owner-occupied housing units in the U.S. in 2015. Of these, around 46 million had home debt such as mortgages and equity loans, and nearly 27 million were owned free and clear. The Urban Institute calculates that there is about $11 trillion in total net housing wealth across the country, and about $7 trillion of that could be turned into cash through lending products. Age is big predictor of net housing wealth. The report found that those over 60 hold 52% of all home equity. Those under 50 hold only 23%. Meanwhile, owners under 40 owned 17% of all owner-occupied housing units but had only 6% of accessible housing wealth.”

Ridiculous blanket statement based on nothing.

Sean,

I think part 1 of your statement is just way too broad and over the top. Sure some boomers may be “living on cat food” but some are on the opposite such as our esteemed member Flyover who never misses an opportunity to tell us about his world travels and huge retirement bag with a $ symbol on it. So; in this case just too broad of a statement.

2nd part you may be partially correct. I think boomers had the magic formula: go to college, get out and have a nice job offer, stay at said job for decades with stability, buy low priced house and then retire with pension while house has continued to increase in value significantly over that time frame. End result is paid off (or close to it) house, pension and SS income.

Definitely a different world for millenials, gen Xers and whomever else as the above no longer exists. Doesn’t mean the millenials 70% crash is tomorrow though; could just be the new normal or new paradigm by which RE and life exists.

Bottom line; i do agree in that boomers may have a had an easier blueprint to follow to get to current high net worth retirement status and remains to be seen what happens with their kids.

Dr. Housing Bubble, a request. I did a web search for your blog the other day and up popped a 10 year old REAL HOME OF GENIUS you did in 2007, It might be fun if you would revisit those properties today and see what they actually sold for back then and if any of them have been sold since and for how much!

Everybody hates on Prop 13 and baby boomers but i managed to get into the market in 2012 for 650k in a great neigborhood. I already pay 8k in property taxes, why should i have to pay an extra 5k because the market is nuts ad my house has gone “up” 400k in value?

Can I just ask about prop 13? Is it a state tax based on property that doesnt increase in size? So the property tax stays the same throughout the time you own the property?

Prop 13 is real simple. It was passed in the late 1970s. The bottom line is this. When you buy a house in CA, the maximum property tax can only be increased is 2% per year no matter how much the home appreciates in value. Needless to say, homes in coastal CA have increased well above 2% annually. This is why new buyers can pay 10x the property tax compared to the old folks who just sold the home…and nothing was changed on the home.

And some icings on the cake. Prop 13 applies to any property, primary residence, investment property, etc. And to really piss people off, the tax basis can be passed on to heirs. This is exactly why certain highly desirable coastal properties will be kept in the family for generations. This has to do with the supply end and certainly doesn’t help inventory.

My family has a nice property on a lake. My grandfather bought it way back in the day for a few thousand and built a cabin on it. It was a family get away for his family (with 2 kids, my dad and my aunt).

Fast forward, my grandma wants to sell it everyday but cannot because it is in a land trust setup by my grandpa. When my grandma dies it is half my dads and half my aunts. Since my aunt owes lots of money due to welfare fraud she will likely want to sell her half and dash. Cabin is valued at close to $1M. Since my dad has been very smart with money he can probably buy her out (if he even wants to $$$ property taxes). But fact is most people are not like this. I think most cases family would sell and leave each other. If my dad DOES buy it my sister and i will have to duke it out over maybe $1.5M property? Unless you are in a situation like that you just wont get it. Maybe 10% of families out there are all happy kum ba ya. And since they are so happy the probably don’t make much to afford primo property lol.

The solution to that is to sell the property early to someone who wants to live there. Easier said than done. My pension/Depression era grandparents bought a cabin near Crivitz WI in the early 70’s for $12K on a few acres. When they got to their 80’s, they sold it to my uncle for 80K who retired there. Now it is worth $300K, but we know who owns it, improved it, and maintained it, so no problem. Otherwise, the heirs will have to sell it and free up another house on the market.

My other point on the decline of this country, is who can afford a primary home and a lake second home in this generation? Why could our Depression era grandparents do it but we can’t? BTW, Trump is giving tax breaks to his buddies who own 3 homes so that is not the answer.

Prop 13 is a state law that locks in the assessment at time of purchase to 1% of the house’s purchase price.

After that, your annual property tax increases are capped at 2%.

When the house is sold, it’s reassessed at 1% of the new purchase price.

Details: https://www.californiataxdata.com/pdf/Prop13.pdf

HOWEVER, there are often other taxes on your property, such as parcel taxes: http://www.caltax.org/ParcelTaxPolicyBrief.pdf

And also Mello-Roos charges (which sound similar to parcel taxes): https://www.californiataxdata.com/pdf/Mello-Roos2.pdf

So while Prop 13 reassess your property tax at 1% of the purchase price (with 2% annual increases), you should really expect to begin paying at 1.25% of the purchase price.

Mello-Roos charges typically relate to infrastructure. This is homeowners directly paying for some improvement such as roadway, freeway interchange, etc, that would typically be paid for by the developer and the cost reflected in the home price. This transfers some of the risk from the developer –

Prop 13 did two things. One it limits the property tax rate to 1%. Two is limits the increase in property taxes to 2% per year. Another law allows people to inherit the tax assessment with the property. This also applies to corporations.

What this means is property taxes are too low[1] in California. Home owners don’t pay enough in property taxes to pay for the government services they use. That has a bunch of negative effects on the state. For instance in increases the cost of new housing because cities extract money for services up front as large fees.

[1] And also very inequitable. Two people owning the same 1970’s tract house can pay wildly varying taxes. My dad pays $700/year in property tax, neighbor pays $7000/year. My sister when she inherits that house will pay… $700/year in property tax.

The other way to look at this is the state spends way too much. They know how much tax revenue is coming in with the Prop13 caps, so over the years, why do they continue to spend more than the taxes they take in?

Thanks for the information everyone.

Speaking as an outsider. I think its wrong. However glass houses and stones….. Look at leasehold in the UK.

So Prop 13 is basically a form of rent control. Like rent control locks how much your rent can go up so does Prop 13 with your taxes. Those who are in when it passed never move, like with rent control. It’s like a lottery winner.

The rate on MFD properties in LA are just over 1.19% of assessed value plus Direct Assessments. The assessment increase is limited to 2%/year. I suspect Proper 13 will be removed on C&I and other investment properties.

Still, pretty lame to hear people say the taxes are TOO low.

I am in my 40s and retired. Some people my age who are well entrenched in a home ar comfortable and see a path to retirement . Still, others who are still renting are alarmed because they feel they will be working till the day they drop. How can you retire if you do not have a paid off property? In general you can’t.

There is a lesson here. You need to start thinking about retirement from the day you enter the workforce. And, a key part of retirement is a paid off house that you can live rent free and is available for a reverse mortgage. People in there 20s and 30s should draw a housing game plan now. Once you hit 40s, it might be too late, especially if you are unlucky and purchase a home just before a downturn.

jt, I have said the exact same thing and gotten ridiculed to no end. I will repeat: If you plan on staying in CA for the long run and you don’t own a property, chances are almost 100% you will work until the day you die. This is true since most Americans are lousy savers, paying a mortgage is nothing more than forced savings. As you said, get a plan from Day 1 and stick to it!

How can you retire if you do not have a paid off property?

Your property is never “paid off.” There are always property taxes, parcel taxes, utilities, sanitation and other city service fees, insurance, maintenance, etc.

“Your property is never “paid off.†There are always property taxes, parcel taxes, utilities, sanitation and other city service fees, insurance, maintenance, etc.”

That’s just silly. It’s like saying you never have a paid off car because you have to pay for registration, insurance and maintenance. Any major physical asset you own will have costs associated with it.

Mr. Landlord,

The car is one of the worst examples you could use. It is an endless money pit. Ride bikes/mass transit/walk instead.

I agree. That is silly.

My mother pays $250 per month for a paid off 3 bd 2 ba house in S. CA that covers her Prop 13 property taxes and and insurance. She bought in the mid-1970’s.

She has no plans to move and I can’t think of any reason for her to move at this time.

Her millennial neighbor is paying $4,000 per month to rent the same size house.

You will always have expenses for a house but the largest expense is paying it off.

If you rent, you had better be paying a huge discount over owning and have the willpower to invest the difference or eventually inflation will make you work for the rest of your life.

Exactly what Bob said, owning a paid off house is WAY cheaper than renting forever. I can only imagine what rent will be in the year 2040. You can sleep well at night knowing you are sitting on substantial equity that you can do many things with: use as primary residence, rent it out, leave to heirs, sell if you absolutely have to, etc.

Oceanbreeze:

If you want to take the bus and pay someone else’s mortgage forever, be my guest. I will gladly take your rental money and drive over in my personal car to pick it up. Whatever makes us happy.

Thanks JT, that one will make it to the list of reasons why we need to buy now.

Buy now or you’ll never retire.

Retiring is silly, why pay off a house – just find a landlord that will never raise your rent, ever, like Millenial – that’s the ticket to retirement. It’s simple, duh…

I don’t understand why everyone keeps paying higher rents. Just get a place that doesn’t raise it! Jeez…

Exactly! You rent during the bubble and buy a house when prices collapse (50-70% below todays prices). If no crash happens, you just keep renting. Your hedge is inheritance. Technically, you could just rent until you inherit RE but I feel like I have to buy when prices collapse by 50% because I would be almost certain the FED would try to re-inflate the bubble 3.0. Its just boom and bust cycles. Not hard to understand and time.

Inheritance isn’t an option for most millennials, though. People are living longer and so need more money for retirement. What do you do when your parents have burned through the average $100k retirement savings, have reached 90 and reverse mortgage their house in order to pay the $3-4k/month (each) for assisted living? And that’s assuming they manage to reach that age without a medical catastrophe.

I think young people need to switch Plan A with Plan B – assume you’ll end up going it alone, and think of an inheritance as icing on the cake.

@Millennial

And if your parents or whomever you are expecting an inheritance from had followed your advice of renting into perpetuity you would not have an inheritance/hedge, ironic much?

Oh yeah…I forgot about inheriting RE – that’s also good advice. Just rent until your inheritance comes in! Quite simple, really… just hang in there, I bet starter homes in Mar Vista will be 400-500k next downturn!

@Dan,

Of course that’s very different. I would have encouraged my parents to buy and not rent. Back then when they bought, there was no artificial housing bubble like nowadays. Nowadays, the market is do overpriced that the median home in SoCal costs like 10times the median household income. Back in the days when my parents bought it was maybe 3-4 times the median household income.

In today’s market you rent and wait for a crash. No crash no purchase.

John D,

How about a little bit more optimism 😉 In about 30 years, in case you are still alive, I will let you know if it worked out for me or not.

My parents have government pensions and government health care. I think we are fine.

That reverse-mortgage comment made me smile. I keep hearing this from RE cheerleaders when I mention my inheritance. I don’t think reverse-mortgage is still a thing is it. That sounds more like an ancient scam like Timeshares. But who knows, maybe someone is still so silly and signs up for reverse-mortgages. Considering there are still people out there buying overpriced crapshacks during the bubble peak nothing really surprises me anymore.

Falling back on “the inheritance” from parents with pensions is a very specific argument that doesn’t affect a lot of society. Great, so a few parents out there have govt pensions and presumably won’t have to pay for long term medical or assisted living, they got theirs you’ll get yours. A lot of my parents friends who were union workers, have the pensions, have the medical coverage, literally had to spend most of it to take them through the final decades of life dealing with a lot of health stuff (everyone smoked back them right??).

If ppl do have a rental that has an acceptable price point and good landlord, by all means keep it longterm. I lived in a rent-controlled in a “transitional” neighborhood (Koreatown) that gave me the stability to stay there for 13 years, until I stumbled into the market the first time post-crash 2012. Sold it for 150k more.

CA living, especially nearer to the coast, requires Plan A, Plan B, and Plan C. It’s a jungle out there!

I have one word for when property values will tank in SoCal, boomers will be desperate to sell, and y’all will take another look at glorious flyover where I now reside: Earthquake! Survivor of 1994 Northridge quake here. The Big One or even semi-Big One will have lots of you saying buh bye.

AND..after the Northridge quake , homes were available for the taking. If you were quick enough , had a cashiers check for $1000 and a quit-claim form and a nearby Notary , more than a few people that were heading out of town with their belongings packed in a Rent-a-Van heading out for Kansas or Oklahoma , or other parts East , were willing to sell their equity. But , they returned after the first cold winter , a season of ice storms and tornados , and they missed the warm California winters with just a smattering of rain. Every storm cloud has a Silver lining for the individual who is willing to stand against the wind and rain.

And today Oklahoma experiences more earthquakes than California! LOL!

http://www.cbsnews.com/news/oklahoma-now-more-quake-prone-than-california/

I was here during the 1994 earthquake. It was scary, but I stayed. I’m still here.

Earthquakes in Socal never depressed home prices nor did a horrendous gas leak in Porter Ranch depress home prices beyond a blip on the radar screen . ie short period.

Interesting; haven’t heard about Porter Ranch in awhile. I do wonder what happened with RE prices there during the gas crises.

Northridge survivor. You and a bazillion other Californians. I slept threw it.

I lived in Van Nuys at the time. I didn’t sleep though it. My bed had wheels on it and I literally rolled across my bedroom. Then I saw a wave of water from our swimming pool shoot out and dump onto the grass. I know a few people that left California immediately afterward.

Nobody slept through it. Anyone who claims they did is lying. Trying to sound cocky, but still lying.

I slept threw it.

And it’s through and not threw.

I had just gotten back from a late night meal at Denny’s. My roommate had a complete nervous breakdown. Good times!

This has to be the most biased, real estate industry funded article I have read in a long time. For example, where are your statistics to support the notion that these elderly homeowners are cash poor.

Chinese get creative when the Chinese government imposes stricter capital controls.

Bitcoin has been a popular alternative in China because people can easily cross borders with vast sums of money encrypted inside their mobile phones.

But there’s a new tactic that Chinese are using now: internet domains.

The domain business used to be a thriving industry. No doubt, people made huge sums of money in the great “.com land grab†more than a decade ago.

But all the good domain names have been gobbled up, which means that domains can now be very expensive. It’s not unusual for a domain to sell for millions… and a five or six figure price tag is nothing.

But… Chinese aren’t looking to make money. They’re not buying domains as investments– they’re using domains to TRANSPORT money.

Think about it– if you have $50,000 that you really need to get out of China, you can buy an expensive domain today.

Naturally there are no restrictions (for now) on buying a .com domain. So the sale goes through without any problems. Domains are international. Almost anyone in the world can buy or sell a .com domain.

So later, you travel overseas, open a foreign bank account, then sell your domain to someone else. The proceeds of that sale get paid to your new bank account abroad. And, presto! You’ve just moved a lot of money overseas, completely circumventing capital controls. There are costs involved, but for Chinese citizens whose alternative is to let their savings remain trapped within a failing system, they’ll gladly pay a few percent to move their money abroad.

https://www.sovereignman.com/trends/heres-the-ultra-clever-way-that-chinese-are-circumventing-capital-controls-18521/

Buying and selling domains? Are we back in the 90s? loooooooool.. this is what happens when really old out of touch people read articles written by other old out of touch people thinking they discovered something new.

Bitcoin, Ethereum, or any other cryptocurrency is waaaaay easier. Why pay a few percent when you can do it all for 1.49% (and from your knockoff Iphone if you live in China)

I’ve made a killing in the last few years. Block chain is the future. Bring on the Chinese money launderers! Loool

No that is just wrong, buying and selling domains is not worth anything now. Especially since there are now literally thousands of new top level domains available. Unless the commenter means doing something other than buy and selling, like using those sales to launder money

+1 to cryptos

Read the article. The Chinese aren’t looking to make money with domain names. They’re not buying domains as investments– they’re using domains to TRANSPORT money because of capital controls. The Chinese government has put restrictions on Bitcoin trading platforms. There are no restrictions (for now) on buying a .com domain. So the domain same sale goes through without any problems.

Samantha AKA Reality Bites, quit trolling and take your meds.

SoCalGuy doesn’t read, he just spouts.

Why would any old person sell? If they own a $1 million home outright… reverse mortgage that puppy until they die. You don’t need to sell… unless they plan on living until they are 100.

Hi there everyone,

I’m a 31 year old living in SoCal. I lease a new BMW every 2 years, I have the latest iphone, I drink $6 Starbucks cappuccinos every morning and $12 martinis after work. And I eat out every single meal at gastro pubs that charge $18 for a gourmet hot dog. Also, I majored in BullShit Studies at UCLA and have $120K in student loans. I have no savings, and $19K in credit card debt.

I can’t afford a house and probably never will. But it’s not my fault. No sir. It’s those damn boomers who are to blame.

LOL

Relax. Be happy. You *deserve* a long , expensive vacation.

Most millennials wouldn’t qualify to rent a 1 bedroom apartment by themselves just based on their income alone and you are going to pretend like having a flip phone instead of an iphone would turn things around for them?

“This is the year when millennials go out and buy in droves” heard that since 2014.

maybe it will happen in 2018? Or 2019, but def. by 2020!

http://www.sacbee.com/news/business/real-estate-news/article167030782.html

These 55+ communities have been around for a long time. They’re all over the place in Florida and Arizona. Personally I’d rather live in Phoenix than Sacramento, but that’s just me.

Sacramento (aka Sacraghetto) is a big government sanctuary city controlled by leftist Democrats that is filled with low income and Section 8 rentals many of whom are owned by people from the Bay Area. Crime has become a major issue. Who in their right mind would retire in Sacramento (or California for that matter) with high taxes and cost of living no to mention all the problems?

Arizona is a good retirement option. Nevada has no state income tax and there are many retirement communities now in Las Vegas and Reno.

bbbbut bbbbut bbbbut there is so much great Mexican food and the weather!!!!

Retire to a retirement community built on a major floodplain in Sacramento’s North Natomas that is full of crime and gangbangers? No thanks. Only clueless people from the Bay Area would do that.

How much of this can be explained just by the fact that people 55+ are a substantially larger fraction of the population than they were when their ownership started increasing around 2000? I don’t think it’s a coincidence that that’s when the boomers started hitting 55.

Good point. It’s a generational thing.

BTW, as more and more boomers come into SSA age and collect benefits, the more the market will become recession resistant.

That would be true if SS wages of 22K would even come close to providing rent at 3K per month.

With rent at 3K per year, the SS beneficiaries are eating cat food in a trailer in Bakersfield with a 1K per month rent. Unless they bought a house in the 70’s/80’s.

As Trump says, “Sad”. However, I have not seen any effort from him to fix this.

My Facebook Boomer rental friends are still vocally supporting Trump. Boomers are too optimistic or something.

Sorry, 3K per month

I think the large majority of homeowners have more than just SS income. Obviously almost everybody from 55-65 has more, for starters, and *somebody* has to own all those stocks and bonds.

Bob,

Who is talking about renting? These Boomers all owner houses free and clear or have relatively very low mortgage payments that are almost paid off so 22k per year in Social Security is plenty to survive in their 3/4 million dollar house

Good news for consumers. Car prices crash to 2009 levels. This is another indication we are headed towards deflation. Nice!

http://www.zerohedge.com/news/2017-08-14/used-car-prices-crash-lowest-level-2009-amid-glut-lease-supply

As usual, zerohedge doesn’t give the full picture.

In the last 2-3 years there has been a big swing in buying, from sedans to SUVs and crossovers. As gas got to $2, people started shifting away from the small sedans to bigger SUVs. So really what’s happening is a glut of smaller and CHEAPER sedans on the used car market. Compare that to what was happening in 2008 when gas was $4-5 a gallon….the exact opposite. People were trading SUVs for small sedans.

So even though on a dollar bases today’s cars as as “cheap” as in 2008, in reality it’s the same price for small sedans vs price for SUVs 8-10 years ago. Which means on a relative basis, used cars are much more expensive today than they were 10 years ago (and this is accounting for inflation since the index is already inflation adjusted).

I agree here. Personally, I’ve been in the market for a new car. I don’t see any really great deals in the used market (at least not for Honda / Toyota SUVs). I know cars depreciate a lot the first couple years hence the arguement to buy a 3yr off lease vehicle. However, when I look at the savings it’s not there in the used market.

I prefer to buy new and keep a long time.

SoCal,

What you should look for is a loaner/demo vehicle. This is still technically a new car since it hasn’t been titled. So you still get he full warranty starting on the day you buy it. But since the car has a few k miles on it, you can get it for 15-20% off MSRP. So you have essentially a new car at a used car price.

I had to replace a car (Subaru Outback) that was totaled in a crash. Used equivalent cars (3 years old) were selling for $2,000 below what I originally purchased the car for. I bought new. If a car is only going to depreciate $2,000 in 3 years, I’ll spend the extra money and not buy someone else’s wear and tear.

SoCalGuy would like to buy new, but for now he’ll depend on his mommy hauling him around in her 1995 minivan.

Samantha, it’s weird you create two usernames and troll on here. The voices aren’t real. Go away.

That’s kind of my thought JR. Even if it depreciated $5K or more I’d buy new. I plan on keeping the next car a long time and the depreciation averages out. If I buy a 3 year old car and run it into the ground I just end up getting rid of the car that many years earlier.

Buying the 3yr old off lease car is good if you can get a decent discount and you change cars every few years. Let the original owner take the hit but sell it again while it has some value (and before you have to spend a lot on maintenance, replacing wear/tear items, etc).

A 41-year-old TOWNHOUSE, asking nearly $2.4 million, has gone pending: https://www.redfin.com/CA/Santa-Monica/129-Alta-Ave-90402/unit-13/home/6781925

Sold for $1.7M in April and sold again for $2.4M in August?

That is a hell of a flip.

Who are the buyers and sellers? This seems like a great way to launder money or pay someone a bribe.

Wow!

Jan 12, 1977 Sold (Public Records) Public Record $120,000

It was even expensive back in 1977 when 4 bedroom 2000 sq ft houses were going for $50K.

JR is correct. That townhouse is a prime candidate for money laundering by drug dealers or foreigners (like from China) seeking to park money smuggled out of their countries.

FACT: Baby boomers have not had an original idea since stuffed crust pizza. They’re effete. Used up. They peaked when they were coke hounds in the 80’s.

FACT: We’ve now had 25 solid years of baby boomer nesting. Now all the world is a Pottery Barn.

FACT: We’re more indebted than ever. Boomers will have to liquidate their homes over the next 10 years to buy paper towels and depends. They will move to Barstow and live with Circus people. In coastal Southern CA those homes will continue to be bought by mixed race couples, white guy/asian girl, with their one overindulged child who goes to Montessori Academy and is expected to be a neurosurgeon.

stuffed crust pizza…..dude I was literally laughing out loud at that.

I’m in my early 40s. And back in the olden days, when I was in my 20s, I can’t remember anyone I knew who lived at home, that was out of school. That was pretty much the stereotype of a loser on TV sitcoms, the guy who still lives at home with mom. And it was true. I’m sure there must have been people at work or whatever who lived at home, but nobody advertized it. They would have been mocked mercilessly, and good luck getting a woman to give you the time of day.

Fast forward 20 years and living with mom and dad is the new badge of honor for 28 year olds. It’s sad. It’s also the movement to keep childhood going forever. Live with mom and dad and play video games all day. This shit can’t be healthy for a society in the long run.

I had a great relationship with my parents and still do. But as soon as I left for college, I never wanted to come back. Even when I came home for winter break or in the summers, I couldn’t wait to get back to being on my own. And when I graduated, the idea of moving back home was unheard of. There was a better chance of me moving to the moon than moving back to my bedroom in my parents’ house.

I just don’t get how someone knocking on 30 can wake up every morning and think, yeah living with mom and dad is a pretty sweet gig man.

It is sad but true. It’s disturbing to read people bragging about mooching off their parents well into adulthood, seeming to have little if any drive or ambition to set out on their own. Often when I interact with younger generations I get a feeling of entitlement, placing blame on others for their deficiencies while they play on Facebook or other social media distractions and cry about perceived injustices while wishing doom and gloom on the generations that came before them. It all makes me wonder about the future of this country.

WheelinDealin,

I think you are misguided. You cant fault the millennials for staying at home with mom and pop and saving money. Its much tougher nowadays to find affordable housing than it was back in the days. You probably cant really understand it unless you are in that situation. The smartest thing to do during a housing bubble is stay home until the bubble is over. I would live with my parents or in-laws in a heartbeat but unfortunately, they don’t live close enough to my well paying tech job.

And from the sounds of it there are a couple peeps on here pushing 40 and still w/ ma and pa.

Mr. Landlord, you obviously do not live in California.

In California, over 2,3MIO adults live with their parents. It’s the new normal here.

I assume when we get a housing crash it will get better. Most millennials wait on the sidelines for price drops. I call that smart. They don’t repeat the mistakes previous generations made and rush into overpriced housing. We had 7MIO foreclosure during the last bubble. If you can stay with your parents to save money for the next buying opportunity you should absolutely do that. That’s the best way to save and fight the system.

The next housing crash is not going to meaningfully help the boomerang generation, because for every house picked up at a foreclosure sale somebody else got kicked out. It’s just musical houses. The combination of not enough housing and the tax + personal incentives to stay in a house even after it’s far bigger than you need is a killer. As a group, the boomerang babies can’t move out until housing is built for them, and that’s not happening nearly fast enough, and probably won’t for some time.

Yes, while I respect your opinion from a late Boomer/early GenX point of view, we never had 100K in student loans because we were of the generation of $1K per year college tuition. I worked a minimum wage job to fully support college. Try that now. We also had high housing prices but never had the level what we are seeing now. My co-worker’s son will be working a 60 hour job while living at their parent’s home for at least 3-4 years just to afford a down payment on a crap shack.