Are You a Bitter Bubblehead Renter? The Evolution of Housing Psychology.

Over the past week, so much has been thrown back and forth over the “bitter” comments Senator Obama made about small town Americans in Pennsylvania. When I first heard of this while flipping through the radio news circuit, I wondered to myself, “what in the world did he say?” Bitter this and bitter that they kept saying. My initial gut response was that he had said something horrifyingly demeaning. But after reading the text of what was said I am now completely convinced that the media is a flat out tool wanting to discuss bathroom gossip topics.

Here we have oil going over $114 a barrel, housing tanking, jobs being lost because we are in a recession, the war still sucking us dry financially, and they want to discuss this? Do they think Americans only have the attention span of a gnat? Apparently they do since they don’t discuss anything that requires more than two minutes of analysis and like putting up enough graphics to put anyone into an epileptic shock. Ticker tape on the bottom, multiple graphics in the background usually floating an American flag, and a talking torso telling you what to think. Here is the exact text referencing what Senator Obama said:

“But — so the questions you’re most likely to get about me, ‘Well, what is this guy going to do for me? What is the concrete thing?’ What they wanna hear is — so, we’ll give you talking points about what we’re proposing — to close tax loopholes, you know, roll back the tax cuts for the top 1 percent. Obama’s gonna give tax breaks to middle-class folks and we’re gonna provide health care for every American.

But the truth is, is that, our challenge is to get people persuaded that we can make progress when there’s not evidence of that in their daily lives. You go into some of these small towns in Pennsylvania, and like a lot of small towns in the Midwest, the jobs have been gone now for 25 years and nothing’s replaced them. And they fell through the Clinton administration, and the Bush administration, and each successive administration has said that somehow these communities are gonna regenerate and they have not. And it’s not surprising then they get bitter, they cling to guns or religion or antipathy to people who aren’t like them or anti-immigrant sentiment or anti-trade sentiment as a way to explain their frustrations.

Um, now these are in some communities, you know. I think what you’ll find is, is that people of every background — there are gonna be a mix of people, you can go in the toughest neighborhoods, you know working-class lunch-pail folks, you’ll find Obama enthusiasts. And you can go into places where you think I’d be very strong and people will just be skeptical. The important thing is that you show up and you’re doing what you’re doing.”

Of course people are bitter! They have reason to be angry and frustrated. Have you seen the Real Homes of Genius we have been featuring since 2006? I’ve written nearly 300 articles examining this from Wall Street greed, broker malfeasance, and flat out speculator boondoggles that we are now dealing with the fallout. All of us are now being asked to support poor financial decisions by many through taxpayer support. You can arrive at your own conclusions after reading the text above but if you are going to the mainstream media for your investment and political advice, I simply would ask you try to dig deeper beneath the surface.

What does this have to do with housing? Actually a lot. The first time I started thinking something was wrong was when in late 2000, home prices in Los Angeles County hit a whopping get this, $209,000. You need to remember that $200,000 for housing at that time was actually a high median price for a county. Yet I really started to question the economic fundamentals when in late 2001, the median price for Los Angeles County hit $233,000. I thought to myself, “how can housing go up if we just hit a recession?” Then the wheels came off and I knew something was utterly wrong. From 2002-2004 the median price in Los Angeles County went from $235,000 to $418,000. During this time I knew 100 percent that we were in a bubble. I started going on alternative media sites for information and went on various sites to discuss the housing market. One of the main places I would casually go to was Craigslist in their housing discussion forum. It is a fascinating place. Suffice it to say that a raging battle was going on between so-called “housing-heads (HH)” and “bubble-heads (BH).” You need to remember this is during 2003, 2004, and 2005. A conversation would go something like this:

HH: Prices will keep going up because mortgage products make your monthly payment extremely low. You can sell in a few years and make a nice profit. There really isn’t a better time to buy.

HH: Prices will keep going up because mortgage products make your monthly payment extremely low. You can sell in a few years and make a nice profit. There really isn’t a better time to buy.

BH: But what about incomes? The only way you can buy a home in the current market is if you get an exotic mortgage product and become a speculator. There is no guarantee prices will go up.

BH: But what about incomes? The only way you can buy a home in the current market is if you get an exotic mortgage product and become a speculator. There is no guarantee prices will go up.

HH: Nothing in life is guaranteed! If you don’t jump in right now you’ll be tossing your money as a renter. That is flushing money down the toilet. Why not build equity and have a place of your own?

HH: Nothing in life is guaranteed! If you don’t jump in right now you’ll be tossing your money as a renter. That is flushing money down the toilet. Why not build equity and have a place of your own?

BH: We all need a place to live. But again, current home prices are not justified by current incomes. I was looking at an inflation adjusted chart and prices are way out of line. Prices need to correct. Plus, renting is much more affordable.

BH: We all need a place to live. But again, current home prices are not justified by current incomes. I was looking at an inflation adjusted chart and prices are way out of line. Prices need to correct. Plus, renting is much more affordable.

HH: You’re just a doom and gloomer. Fine, leave money on the table you bitter renter. Remember, the 1st of the month is when rent is due.

HH: You’re just a doom and gloomer. Fine, leave money on the table you bitter renter. Remember, the 1st of the month is when rent is due.

BH: Isn’t that when your mortgage payment is due as well? Keep on being a delusional housing perma-bull.

BH: Isn’t that when your mortgage payment is due as well? Keep on being a delusional housing perma-bull.

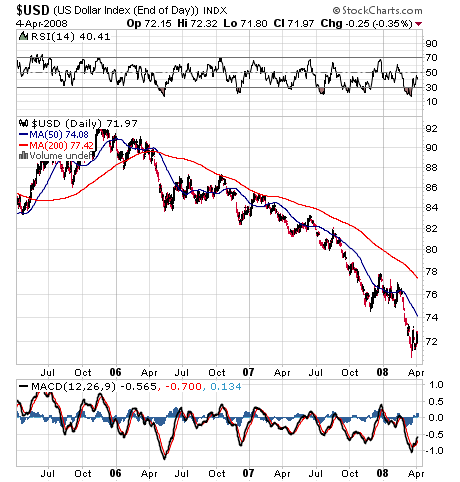

Of course this conversation has many variations but you get the gist. This went on for years and of course, each subsequent month only solidified the argument for the housing bulls. But the reality is we are in a decade long bubble. Simply because prices kept going up did not mean they would go on forever. The argument many times got heated and I would simply read and chime in sometimes but you could sense the absolute anger and frustration with many. If anything, I learned more about bubble psychology by reading the forum in those past years than actual housing economics. Of course, many lied but really there wasn’t anything to gain either way. This was a tipping point for herd mentality and many people bought into the argument and decided to buy a home. At this point I decided to start the site to have a place trying to expose the lunacy of the housing market which I felt the media was not covering. Of course once you own a home, it is hard to be impartial since of course you want your home to go up in value. Heck, I want to say a few of my sports cards are worth thousands but in reality, I know they are not. I’m actually a renter and an owner of multiple investment properties. Maybe that explains my cognitive dissonance. I’m not delusional to think that an overall correction will not hurt property values throughout the country and possibly even hurt rental rates but again, if you invest conservatively you have a much larger cushion. Plus, it is the best thing for our country to get back into a saving mentality and put aside this crack addicted hamster on a meth spinning wheel spending addiction we currently have. Having an economy based on massive debt is not good for our long-term prosperity and the U.S. Dollar is showing this:

Here is a common article of why so many of those that stood firm in the bear camp became bitter during these years:

“Posted 6/10/2005

Why there is no housing bubble

The sky is not falling. Yes, home prices are sky-high, but we really don’t have a housing bubble that is anywhere near bursting. Here’s why.

Housing bubble? What housing bubble?

With the 10-year U.S. Treasury bond yielding below 4% and 30-year mortgages available at 5.1%, there isnt a housing bubble

Mind you, I’m not saying that U.S. consumers don’t have too much debt, or that the U.S. economy isn’t dangerously dependent on the housing sector for growth, or that all the money sloshing around the globe isn’t encouraging dangerous speculation.

But those are different problems from the one getting all the headline attention at the moment.

It’s just that, for all the teeth-gnashing and pundit-moralizing, we really don’t have a housing bubble that’s anywhere near bursting. Current 10-year interest rates are just too low. And I certainly don’t see interest rates rising enough in the next year or so to burst a bubble, either.”

If you are not aware, the 10-year U.S. Treasury bond is still below the 4% mark and you can still find conforming loans with good credit for 5.75 to 6.25%. Clearly the argument at this time was that rising rates would be the main culprit of a bursting bubble. Well rates didn’t rise and the fact that he dismissed crushing debt was completely wrong. This isn’t a credit crunch but a debt crunch. Nothing exemplifies this more than our negative savings rate. People lived on the edge and had no safety cushion. Here is more of the argument:

“What we’re seeing in the housing market is monetary inflation. Pure and simple. Economic theory says that when more money chases a limited quantity of goods, the price of those goods increases. So nationally, cheaper money drives up the price of houses — which does lead home builders to increase supply at higher prices. In areas where adding supply is harder — the land for building a large number of apartments in Manhattan is scarce, as is land to build in Silicon Valley, on the Miami waterfront or in the core of San Francisco, to name a few other super-hot real estate markets — new supply is extremely constrained at any price and prices for existing housing soars as a consequence.

Of course, this is all an extreme generalization. Adjustable and interest-only mortgages, as they become a bigger part of the mix, increase the supply of cheap money and drive up prices even faster, for example. Demographic trends increase prices faster than average in areas with more jobs, for example, or where cheap land lets builders construct new housing for the country’s growing population of retired (or semiretired) workers.

But you get the idea: cheap money drives up housing prices.”

He uses cheap money various times in the article. What we now realize is that it wasn’t cheap money but fraud, no documentation mortgages, no down payment products, and flat out ridiculous toxic financial instruments. He called it cheap money. I call it fraud and market manipulation. But this is the reason so many people were fed up and angry hearing this logic over and over being blasted by the media. Of course being cautious he hedges his bets in the article:

“None of this means that the housing market can go up forever, or that we won’t have a day of reckoning someday. And I think any sensible person should use the current drop in interest rates as an opportunity to get his or her own financial house in order. It would be unwise to expect that another, and then another, of these refinancing opportunities will come along in the future.

It’s just that those who are predicting a housing bubble and its bursting may have much longer to wait than they expect right now.”

Well two years in the scheme of things isn’t too long especially given that prices in Los Angeles County are now back to 2004 levels, even prior to the 2005 article. Here is a post from a Google Group discussion in August of 2001 which you can already see the seeds of speculation forming:

“Aug 29 2001, 8:08 am

You guys really ought to do some studying.

There are more people than housing; the population keeps increasing, as well

as immigration. There is no real estate bubble. There are all kinds of

deals to help people buy real estate; there is a shortage of apts.

everywhere. Robert, you should know about Florida. Do some reading, man.

Go over this weeks Barron’s, not for the opinions, but for the provable

statistics. There won’t be a burst; if there is a decline in prices in

certain areas, there are still increases in other areas; especially Florida.

And overall, no burst, maybe a decline in prices, but still a demand. It’s

not like the overvaluation situation with stocks.”

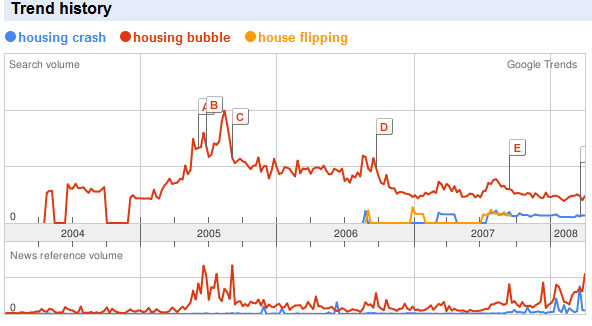

A little early but some areas in Florida are now quickly approaching prices of 2001. If you are interested in seeing how the trend morphed in the last few years here is a good measure of consumer sentiment, the oracle otherwise known as the Google Search box:

The peak year for the search “housing bubble” was in 2005. Incredibly, the search terms “housing crash” and “house flipping” look identical which is probably another tidbit of information showing how poor some people timed this market. Even still, the search for information regarding the housing market on the downside still seems to be leaning towards, “how can we keep prices propped up further” and this is only reflected by the multiple bailouts being thrown out in the current arena. Unfortunately it looks like we are going to have a few bailouts. But we need to voice our concern (click on the box on the right sidebar to find your representative) and make sure that no money is allocated to those on Wall Street, builders, lenders, and the main greasers of the bubble. If we have a choice between helping someone in Pennsylvania or Michigan to keep current on their $120,000 mortgage or helping a Wall Street investment firm stay solvent with $30 billion, I choose to help the owner. Do I support a bailout for California? Absolutely not. In fact, I would go as far as putting a cap near the median home price for the United States at $200,000. Anything beyond that and you have the option of reworking your note with your lender, selling if you have equity or short-selling if you are underwater, or if the circumstances warrant a foreclosure. It seems like we don’t have option C which is to let the market correct on its own. Adam Smith is busting windmills in his grave each time these Wall Street firms go hat in hand to Washington when times get tough.

People are angry and many are bitter. Is there a problem saying the truth? Should we close our eyes again and pretend there is no recession? Maybe if we click our slippers hard enough and believe in the Wizard of Oz (aka Ben Bernanke) then all will be better tomorrow. There is reason to be angry and frustrated given the current health of the economy and the horrific policies that got us here. We didn’t get here overnight and we won’t solve the problem by sending Wal-Mart vouchers of $600 to the American public to go out and spend on Chinese products and thus reinforce the behavior that put us here in the first place. Take a look at the current CPI. I was amazed to hear on NPR today someone say, “energy and food went to record highs but the good news is apparel costs are down 1.9 percent.” Bwahaha! Who needs food and gas to get to work when you can dress yourself up in Gap clothing and run around the neighborhood screaming how bitter you are?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Are You a Bitter Bubblehead Renter? The Evolution of Housing Psychology.”

I don’t think this is entirely on topic, but not off topic either. A commenter over at Calculated Risk posted this link the other day. It’s long, but well written, persuasive, and in some ways I think speaks to the dissonance so many of us feel. This disconnect gnaws at many of us, I think, which in turn gives rise to the feelings of frustration and even bitterness, as we recognize that the system is royally out-of-whack, and that we are likely, royally screwed.

http://harpers.org/archive/2004/02/0079915

Bloomberg Radio is interviewing top people at banks and brokerage houses who are assuring listeners that everthing is fine, a bottom has formed, and no more significant pain should be expected from the credit problems in the big institutions. It is very hard to believe, isn’t it? Problems of this magnitude are oceanic and will require much more time to settle, perhaps years. I agree with these posts. There’s a lot more mess to come. Not only California, but New York is shouldering massive debt at a time when decling revenues will be unable to support the just-adopted bloated state budget. School Districts will be voting on their budgets in 700+ school districts in May, and the votes will include state aid assumptions that are built on sand. Later in the year, budgets will need to be slashed when the anticipated revenues are unavailable. There’s huge debt everywhere. Crushing state debt, mortgage debt, credit card debt, car loans, rapid inflation (no one believes the numbers the government provides), a declining dollar, increasing unemployment, Iraq spending, when taken together, spells disaster-in-the-making. Such problems may require a decade to ameliorate. I certainly don’t see large pockets of productivity and high growth to allow for more and more spending. There will have to be a significant crash of some sort to end this crazy cycle. People will need to be scared to make them stop and change behaviors. I recall my uncle telling me that in the Depression, among other things, he even peeled matches in two (he showed me how) to save money.

The feeling of anger and insecurity are ubiquitous. The only thing that could stop Americans from feeling this way is a sudden drop in home prices. If the correction doesn’t happen quick there will be plenty of agony until it the bottom.

Another great post Doc. I just about wet my paint laughing with the forum discussion and the nice little cartoons for HH and BH. Anyway….I would suspect that there will be some Govt involvement at some point, however, I think the MASSIVE damage has been done. If this storm all comes together with will be in another year or so, we all my be faced with a depression. I hope that does not happen but will be in good shape since we live within our means and have done so for sometime.

Here is a good link to an article in the Sac Bee you and the readers may be interested in taking a peek at: http://www.sacbee.com/103/story/868932.html

it all spells trouble up here and I would guess the rest of the country may be in the same boat.

Keep you the good work…I am enjoying reading the posts.

Totally agree with you Doctor…

I have walked around, and sort of interviewed people, nothing scientific… but most people are highly frustrated… but apathetic at the same time.

I believe we are in the calm before the storm…. as things continue to slide, I believe that more and more rips in the curtain will start showing, as more and more people get to the point of “nothing to lose”…..

I’m glad to see someone else in 2000 was thinking “these prices are nutty.” It was a lonely seven years until I found this forum.

Anyone praying for some massive bailout is going to be sorely disappointed. The government just doesn’t have the money to bailout the trillions that will be lost and they can’t print it without sending prices of food and energy much higher than they are now! There will be a few small handouts here and there but nothing serious.

Have you seen angryrenter.com? A lot of people are bitter because they tried to do the responsible thing and save for a 20% downpayment, and while they saved they saw housing prices spiral into the stratosphere. I am one of those people and now I am so glad I didn’t put down every penny of my savings for a shack.

Now that the “Housing Bubble” has broke and insane lending practices have come to an abrupt halt we find ourselves laguishing in a sea of financial despair.

The economic fear and citizen displacement brought on by the fiscal irresponsibility and lax enforcement of regulations by the fed and other agencies of this government, will be viewed in history as this nations greatest( internal) blunder.

I’ve been a lurker for the most part, but being a resident in LA I’m closely monitoring the housing situation to see when a good time would be to purchase that home. I was in college the last time housing was affordable, but I guess I should be glad considering I would’ve been hopping on the housing bandwagon had I worked a few years sooner. This whole situation has benefited me greatly through much learning not only in real estate but simply finance in general.

Anyways, I was wondering about the correction in housing prices in LA/So-Cal. While prices are indeed going down, and unemployment/recession is further fueling the flames, do you think the prices will eventually correct back to prices seen back in 01~02?

Would the bubble have popped if prices held in the 400K range back in 04? While LA’s a very diverse place, I’m wondering if maybe people are richer than we think, and the correction won’t fully adjust back to those base levels from 01~02 [adjusted with inflation]. I guess this sort of conflicts with your many posts pointing to negative savings and debt, but I still get this gut feeling that there’s still enough demand in LA supported by a sizeable number of residents who can afford the bubble-like prices around 03~04.

I don’t have as much experience here as some of the other posters who leave comments or nowhere near as yourself who has seen all of this unfold, but I’d like to hear your thoughts on it.

Having lived for a couple of years earlier this decade in a small town with no economic prospects save a new state prison to replace the closed furniture factory I think you miss the point of Obama’s remarks entirely. It is not the small

coal mining town in Pennsylvania or the tobacco growing regions of Virginia and North Carolina that are full of bitter people. It is the big cities where bitterness reigns. The little town I lived in was 75 miles from the closest burg with 100,000

people, up in the mountains and people didn’t sell their home they auctioned it because there were no buyers. They worked in the textile mill or the furniture factory for the most part and raised cattle and cabbage on the side. They hunted,

they went to church and they wouldn’t let the local tavern open on Sunday. The next county over was dry. No alcohol save moonshine. It was how they had always lived… for centuries. That’s why a man who grew up in Indonesia and Hawaii and whose sum total of life in the continental US consists of New York City ( Columbia) Boston ( Harvard) Chicago ( to start his political career) and Washington, D.C. talking about rural America is like me talking about life at the

Playboy Mansion! It’s a place I’ve heard of but never been to. That’s why Obama was way out of line to say that people who have always had their guns, their churches and their suspicion of outsiders are bigots crushed by economic circumstance. No they’re not. They are a lot more content than some commuter trapped in bumper to bumper traffic, worried sick his job will disappear in a merger, be outsourced and well aware he is only a paycheck or two away from financial disaster. Compare this to the average denizen of my small mountain town population 2000. They’ve got land they’ve owned for generations. They’ve got a huge family network and friends who won’t look at them as failures if they get laid off. Hell it give them the time they need to fix up the farm. I knew a guy who BUILT his own lumber mill! I mean built it out of used electric motors and stuff from junk yards. He’d fell trees on his land and saw it up into lumber and sell it to contractors building second homes for lawyers from Winston Salem! Others just raised more cattle. Unemployment is an alien concept to them.

I do find it completely frustrating that as soon as someone mentions what is wrong with the U.S. they get completely trashed and then some of the the same people say they want change. If there were no problems you wouldn’t need change and the first step in fixing a problem is acknowledging that you have one. So please stop shooting the messenger.

I also have to object to the previous post by Scott about if you aren’t from fill in the blank small town in America you can’t have anything to say about small town America. Not all of Hawaii is “the city” and just because he went to school in some big towns doesn’t mean he doesn’t know a thing or two about living in the country. We have many people who live in cities and many who don’t in this country and we need someone who can speak for everyone, not just country types or city types. You show your ignorance by basically saying that since his experiance wasn’t exactly like yours his opinions are worthless.

I completely agree with Scott above. Read The Millionaire Next Door and The Millionaire Mind, by Thomas Stanley. The vast majority of people who have a net worth of over $1 million live in small towns, own their own businesses, live in houses that cost less than $200,000, drive used cars, and for entertainment go to high school football games on Friday nights. Believe it, because it’s true. Bitter is not the word to describe them.

Barak Obama is a clown, just another failed affirmative-action Marxist from Harvard. He doesn’t have a clue about who the American people are or how they live. And he can’t even bowl his age.

I don’t know why rural America would be bitter; I certainly wouldn’t expect it. They suck up the subsidies: farm, ethanol, tobacco farmer’s relief, drought relief, water projects, phone service subsidies, road building in places where the traffic is too light to justify it, Hummers for homeland security in places no foreigner has ever heard of, etc, etc, from the tax dollars of the economic engines in the big cities on the coasts. Urban America==net tax drain. Better yet, they rail against communism and the Soviets, blissfully unaware of the irony of doing so while a 1/3 of all farmers go and collect their checks from Uncle Sam.

I’d expect bitterness to be found among the middle class with children who get to work off this insane debt to the Chinese. That’s where I’d start looking. I haven’t so far decided to have kids and, funny enough, over the last two years, no one has asked why not.

@ Ed – you ask “While LA’s a very diverse place, I’m wondering if maybe people are richer than we think” NO THEY ARE NOT.

***** Here are the icnome breakdowns for LA County and, in paranthesis, the comparable national income groups/data for the most recent data which is 2206. There is a 1 year lag in data.

***** Median Household income: $51315 ($48,200); Median Family Income – meaning household of individuals related by blood or marriage: $56,930 ($58,256) Households with incomes under $25,000: 24,5% (25.3% ) Households with incomes from $25k -50K: 24.15% (25.94% ) Households with incomes from $50K -75K: 18.15% (19% ): Households with incomes from $75K-100K: 11.54% (11.84% ) Households with incomes from $100,000 -150,000: 12.14% (10.89% ) Households with incomes from $150K -$200K : 4.57% (3.56% ) Households with incomes over $200K: 4.91% (2.85% )

****** There are not sufficent variationsin the income brackets to justify the higher prices in LA county as compaared to nationally.

@ SCOTT – Very eloquent and very accurate. I was grossly offended by Obama’s crack that small towns and rural areas “cling” to religion, guns, xenophobia and bigotry and anti-outsourcing of jobs to India as a compensation for the losses of jobs and some kind of pathetic subsitute and false security blanket like a lot of 3 yr old children hugging thier ‘blankie’ and talking about their imaginary friend. I’ll take my small village over DC and Chicago (having lived in both) any day. The other day one of the good ‘ole boy contractors leaned back against his pickup and delivered an analysis of the Bear Sterns debacle and the credit markets that would have done this blog (or any blog) proud – and the guy drinks beer, maybe did an associate’s degree, hunts and watches NASCAR. He knows exactly what is and is not in his economic interest – and he is not buying the Obama spiel which he sums up with “So what? The guy talks too much artsy-fartsy feel good crap and hasn’t done anything in his life except talk about himself in those books. Wouldn’t hire him on a crew with no experience. He can promise whatever he wants but he doesn’t have any experience getting anything done. We need jobs and to do something about healthcare. Voting for that guy is buying a pig in a poke.’ (Honest – these is practically verbatim. I was laughing so hard I spilled my coffee.) Obama’s problem is that people like this – practical, to the point, and not into the feel-good psycho-babble really wouldn’t hire him for a job since they deal with the worlld in terms of ‘show me what you have done before I hire you.’

http://dictionary.reference.com/browse/bitter

Note definition #9.

http://www.youtube.com/watch?v=pmeBSWI9sF8

DHB, meet Mr. Mortgage.

http://www.census.gov/population/www/cen2000/migration.html

particularly http://www.census.gov/prod/2003pubs/censr-12.pdf and http://www.census.gov/prod/2003pubs/censr-9.pdf

Some interesting data. Note that in 2000, fewer than 20% of the US lived in “non-metropolitan” areas. Some 45% of the population was over the age of 40.

The anti-Obama comments are telling, for several reasons.

First, he has engaged – and enraged, evidently – but he has also made you sit up and take notice. You may not like it, you may disagree, perhaps despise, or even hate what he has to say. All well and good – this is the US, after all. That most politicians avoid controversy like Tangelo avoids sunblock is also a common complaint (and not just here.) So he gets shredded when he actually voices an opinion? If he is anecdotally repeating something he said, how much different is that from AnnScott’s good ole boy or Scott’s bucolic tobacco farmers? (If I mistakenly assume tobacco in NC, my apologies – but it’s not called Tobacco Road for nothing.)

You might say it’s different because he’s angling to be our leader. OK. Then should he follow the classic political game that both Hillary and McCain play – cry on cue, tout military experience, pander? And that’s somehow reassuring to you?

AnnScott and Scott, your criticism appears to take two forms: he ain’t been there so he cain’t talk about nuthin; and, he’s book-smart but not street/farm smart. Does this mean then that anyone / everyone who’s lived in a city or surrounding – that is, 80% of the US population – is then unqualified to speak empathetically about their interpretation of the distress that might exist for the other 20%? And more to the point, the logical implication of your views is that ONLY non-metro people have any common sense, and even more incredibly, there is limited pain being felt ‘in the heartland’. You do see that this latter conclusion follows from your arguments, don’t you? And from reading your comments these few months, I can’t believe YOU believe that.

The question boils down to this, for me. A self-proclaimed economic know-nothing who will continue to spend money on a hopeless war; a continuation of the Imperial Presidency (30% of the population has known a Bush or Clinton in the White House – remember Pres 41 was VP for 8 years); or, as Monty Python might put it, Now for something completely different.

http://video.google.com/videoplay?docid=-572077907195969915

@ exit – I most certainly did NOT say that Obama could not have an opinion. I was pointing out that his conclusion that non-major urban voters do NOT vote against their own economic interest nor do they ‘cling’ (what a loathesome dismissive patronizing word) to guns, religion, anti-illegal immigrant or anti-free trade as some kind of subliminal transference to an illogical belief system. It is NOT empathy to use a prejorative word (cling) and then string together behaviors and beliefs with one of the list basically calling the people bigots. Between us, my husband & I have 2 doctorates and 2 masters in areas different from the doctorates – and we were from Chicago. We were offended. Obama is a wordsmith – he choose exactly the word that reflected his attitude towards working class non-college grad voters (who happen to be 73% of the voters.)

And as far as his premise goes that non-metropolitan voters do such things and thus do not vote for Democrats, that is a lot of bullhockey. Paul Krugman pulled up the voting pattern history. http://www.nytimes.com/2008/04/18/opinion/18krugman.html?hp

So not only was Obama condesending and patronizing, he was WRONG. Among other things, it is the wealthy churchgoers who vote based upon religion.

****I don’t know what I will do come the general. I’m no fan of Clinton and think McCain is 3 bubbles off on a good day, economically clueless and trying to refight Vietnam through Iraq. (And as far as my appalling 13th cousin King Georgie goes – well, sorry,guys, every family has one and we forgot to keep that branch of the family locked in the attic.)

@ Emmi you wrote “They suck up the subsidies: farm, ethanol, tobacco farmer’s relief, drought relief, water projects, phone service subsidies, road building in places where the traffic is too light to justify it, Hummers for homeland security in places no foreigner has ever heard of,”

***** Uh huh. Well I suggest you leanr the difference between metropolitan, micropolitan areas and rural. Got to say, I have never seen more than 1-2 Hummers in my micropolitan area – leave those to the soccer moms and ‘gotta prove I’m a man’ crowd in the exburbs. The deputies drive jeeps and older Dodge patrol cars. No ethanol here – just cherries, 70% of the cherries produced in the US. No roads built here (or anywhere similar to it where I have lived) in my lifetime – we leave that to Boston with the Big Dig and LA who needs more roads. And yes, foriegners have definitely heard of us – had about 20 Japanese tourists crowding the local convenience store on Monday (god knows why – I’m still wearing sweaters and definitely NOT hitting the beach.)

**** The rural areas do produce one thing that major urban areas do not – FOOD.

The point being made is that the criticism of Obama is by and large an irrelevant one. To argue over it is to not see the forrest for the trees.

The forest is that this country is in deep s#@% economically. It’s the economy stupid (and the war, but the impact of the war is starting to show in the economy).

And a few people who might be offended by Obama’s comment (I don’t agree with the comment but as I say it’s irrelevant) argue over it while Rome burns. And Rome is burning.

So you like Hillary because she has more experience being in the white house as she was first lady and can get her husbands advice? Ok, well I could see her not being an absolutely terrible leader (compared to the one we have!), but many people who support Obama know perfectly well that Hillary has such experience. They don’t like the policy positions such experience illustrate! They aren’t sure Clinton wouldn’t have gone to war with Iraq were she President. They know certain abuses of civil liberties started happening under *Bill* Clinton. They know she sucks up to big corporate etc. money. They aren’t sure she won’t just say whatever people want to hear.

@AnnScott

Ah yes, the food issue. Scary. Hear about Ug99? If that – when that- hits our shores and croplands, look out. The economic model that promoted massive agri-business growing monoculture has been discussed by Pollan. Little garden plots in the urbs will have no long term impact if the major grains get this rust, and food prices skyrocket here at home.

That Obama offended you (many) with what you term elitist assumptions is not surprising. But don’t you think the moderators questions in the last debate were equally condescending? A lapel pin? A Weather Underground 8 year old? What about the economy, bailouts, Iraq / Afghanistan, healthcare, social programs? Oh, right, after the ‘important’ stuff gets asked.

Frankly, I don’t care if our leaders our elitist. They should be, so long as they don’t go about ripping off the Treasury like the current bunch. The US is an historical freakshow, an anomaly, a circus – and requires some different people in charge, ones who are willing to step on toes, challenge the status quo, and try to navigate us out of this whirling cesspool. I would have supported McCain 8 years ago, like I would have supported Bush Sr. in 80. But time passed them by and they have to pander to the core constituency that by-passed them the first time, the so-called ‘conservative’ voter. Clinton – um, didn’t vote for her husband. At least they’re smart, if stupid about some things (you know).

At least we can talk about this stuff. Some of these blogs are impossible…

AnnScott, Oh yeah, Yakima County is doing it all alone, without any handouts from the feds:

http://farm.ewg.org/sites/farmbill2007/top_recips1614.php?fips=53077&progcode=farmprog&enttype=indv

As to the rest, none of the current candidates has a chance of fixing thing. It’s going to decay until it gets renewed the way my compost pile renews things. I’ve never been so glad to not have kids as I am now.

hey Doc, you’re getting some good run over at CR.

See this bit posted over there on Obama? http://www.truthout.org/docs_2006/041608A.shtml

Emmi, I’ve got two young sons. I try not to worry too much about the world they’ll inhabit, but still…

What goes up, must come down. What does down will definetly go up. It happens over and over again. Buy low, sell high. This isnt Rocket Science!

Obama, Clinton… what’s his name?

Isn’t going to change a thing. Money talks and B.S. walks.

Democrats or Republicans. This is the only Democracy I heard

of that has only 2 evils to choose from.

Usually don’t get too excited about the whole drama since 99% of

the gibberish and venom candidates spew is just that. Meaningless

BlaBlaBla. As soon as they succeed all promises are forgotten.

And the reality of “life goes on as usual” will continue.

4 to 8 years later we get a new crop and everybody thinks it’s high

time for a change. Especially if a President happens to get re-elected.

Out with the old and in with the New.

Only it isn’t really anything new, is it? Same old… Money Talks…

and you know what Talks, and talks and talks you out of yours.

Ich wuensche Ihnen einen schoenen Tag.

Schadenfreude is besser als keine Freude.

Reena

Leave a Reply