The affair of all cash buyers and real estate: What are normal historical rates for all cash buyers when it comes to the housing market? Has big money peaked when it comes to the housing market?

It is astounding how people brush off an overall weak economy and suddenly justify all cash investors as somehow a normal part of the real estate market. Once again, we are in uncharted territory. The amount of all cash buyers is off the charts. Not only are these Wall Street investors but also foreign money flowing into targeted markets. It is one thing to push it off but it is another thing to actually look at historical data. It is amazing how quickly people drink from the fountain of cultural amnesia and suddenly forget the environment that led us into this mess. This is a fact however; never have we had so much of the real estate market dominated by all cash purchases. But what is a normal amount? Let us go ahead and look at historical data here to see what we can find.

All cash purchases hit a record in 2012

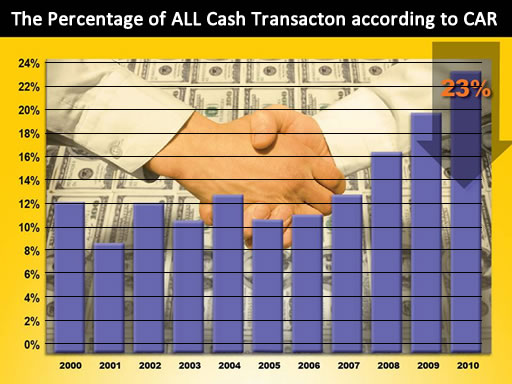

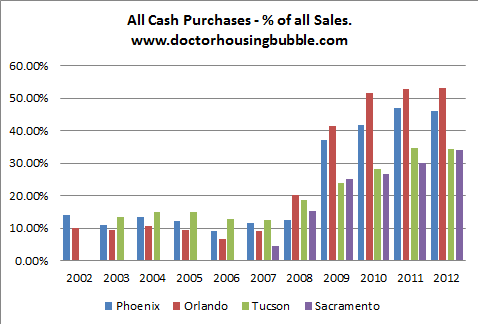

It is hard to find nationwide data for the real estate market going back past 2000 but here we have data on four large areas. Â It looks like overall, all cash purchases range from 5 to 10 percent:

What is amazing is how crazy some markets have gotten like Phoenix and Orlando where basically investors have become the vast majority of the market. Much of the price gains in the last year are driven by investors competing for the small lot of inventory regardless of what underlying rental yields will produce. The Fed of course is luring in buyers with stagnant incomes and low interest rates. The reality is, households are looking at their balance sheets and are saying “what the heck, rates are low so let us go dive in.â€Â It is more enticing especially when every headline is now talking about the reemergence of the housing market.

If you think this isn’t the case for California, think again:

Source:Â CAR, Buildbankroll

It got worse in 2011 and 2012. In fact, at least for data for Southern California, all cash buying hit a record of 35.8 percent in December (last month it was 35.6). Last year it was 33.7 percent showing that a large amount of buying in Southern California is coming from the all cash crowd, way higher than historical norms. And most of these people are not planning on living in these places. 31.4 percent of purchases in SoCal are absentee buyers. The monthly average dating back to 2000 is around 17 percent. In other words this is a market dominated by the all cash crowd. Some would like to pretend like this is normal but it is clearly not. This is hot money flooding into the market. If it isn’t big money, it is balance sheet weak buyers going in with FHA insured loans and the tiny 3.5 percent down payment.

Tracking the investor market carefully, you realize that these people do pay attention to incomes and local regional economics. When you are buying lots of homes, you better make sure the local crowd can cover a certain amount of rents to make yields worthwhile. There is no Fed incentive to renting so this money has to come from your net income. In other words, what you actually earn from the real economy instead of flipping homes like burgers. Signs are already showing a peak in investor buying, at least from the pro crowd:

“(Fortune) While this has gone on for some time, the investor frenzy might have peaked. Rents for single-family homes have essentially flattened — rising just 0.1% in March from a year earlier, according to a report released Thursday by real estate listing website Trulia. What’s more, in some cities where investors had the biggest appetite for properties on the cheap, rents have fallen: Take Los Angeles, where rents fell 1.9%; rents in Orange County slipped down 0.7%; Las Vegas saw a 1.9% drop. And in two other key investor markets — Atlanta and Phoenix — single-family home rents remained flat, rising less than 1%.

Meanwhile, rents for apartments have continued to rise, climbing 2.9% in March from a year earlier.â€

So much for rents going up forever and ever even in untouchable Southern California. The article goes on to point out that “small investors†are now becoming a bigger part of sales. Yeah, after the massive recent run-up. Of course it is hard to break out the type of all cash buyer from the 35 percent of purchases in Southern California. One thing is certain, this market is not normal. But this market has not been normal since the early 2000s. Basically you have to ask at what stage or bubble are we currently in? Does this boom have many years to go? I think most would feel comfortable if a flood of good paying jobs were coming online at the same time. Is that even the case?

Prices have surged in the last couple of years especially in certain markets. Very little supply and investor demand has been a large reason for this. We’ve discussed that the big question would be what happens to the market when investor demand pulls back? In SoCal, most investors trying to cash flow have to come in with big cash. It is funny to hear some all cash buyers saying they are cash flowing on a $500,000 purchase that rents for $2,000 in rent. Of course! But you’re basically getting a 4.8 percent return assuming you have no expenses, no property management, no vacancies, and no repairs. Most professional landlords realize that about 40 to 50 percent of gross rents will go to operating expenses. In other words, that $2,000 is really like $1,000. Then that 4.8 percent return turns into 2.4 percent. Can you see why the pros are pulling back? By the time the masses get in line the money has already been made.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “The affair of all cash buyers and real estate: What are normal historical rates for all cash buyers when it comes to the housing market? Has big money peaked when it comes to the housing market?”

Sort of within topic, I’m thinking the listed market is going to be saturated very quickly and will soften prices fast. It’s happening now.

Here in Atlanta, in neighborhoods I drive or walk thru regularly, there are amazing numbers of ‘prep to flip or rent’, new construction and regular homeowners putting houses on the market. The herd is stampeding.

And the new construction is VERY high-end. And I hear of 20-somethings talk of buying property. HELLO! — people have not learned from the recent meltdown!

I keep a dedicated eye on a market in North Carolina also and I’m seeing the properties that were lisited in Dec-Jan, that remain unsold, are now coming down in price.

So, DOC….I’m sure you have a regular roster of articles you’re working but if at some point in the future you might have something about sale price versus original list price in 1Q and 2Q 2013….that would be very revealing. Thanks for your good work.

Long time reader. First time commenter. Props to Dr. HB you da man for this great website.

It does amaze me how prices have rocketed up in the last 6-12 months. I am in the East Bay (Bay Area) and I cannot believe pricing. The inventory has completely seized up and prices have taken off. Multiple offers on everything I have considered. I will say I am starting to see a few more properties creep on the market at more reasonable prices, but still well above where they were a few months ago. Rents are starting to come down a little bit to become more affordable.

Could this all be a dead cat bounce? I did some reading and during the great depression people allowed renteres to live without paying just to make sure their units did not get destroyed or vandalized. If investors buy up all the properties and think they can charge what they want they are in for a surprise. As incomes are flat or declining people can only and will only pay so much. They may make payments for the first few months, but before the lease is up I would imagine a lot of landlords will be dealing with missed payments.

This can only be enjoyable for so long before the investors decide to sell them off and run to another investment. Housing just can’t be the best option longterm for hedge funds. It is only because the stock market it so frothy right now and interest rates are cheap.

I see the stock market taking a big hit, which in turn will get the hedge funds to unload their properties as well as other amateur flippers. Reasons stocks will go down:

1)Triple top has formed on the S&P 500 on declining volume

2)Earnings are down this quarter (See FedEx and Oracle Q1 reports)

3)Job numbers that came out today are dismal

4)Obamacare is going to start soon and will kill small business. More layoffs to come.

5)Tension with North Korea would send any normal stock market down by itself without any of the other reasons above.

It is very hard to sit and watch home prices once again go out of reach for many potential buyers, but I believe they will come back to reality and then some. I know the Fed will keep this going as long as they can, but at some point they will have to cease QE and raise rates.

Many of us seem to agree this crowded own to rent or flip model trade is too overcrowded. That being said, Big Ben Banckrupte cornered himself with announcing parameters for when QE-Infinity would slow and when interest rates would rise (although he can’t officially control this). Very frustrating watching my savings account with 20%+ down payment for a house turn to sht as I wait for an entry point to buy a house. I have not seen an inkling of slow down in semi-prime/prime LA as supply trickles out and is full of overpriced crap or recently ‘renovated’ in 4 months homes with profits of a couple 100k for that 4 months of ‘hard’ work for the investor. May just buy physical gold instead because, unless there is some US is too big too fail thing going on behind the scenes, this can’t end great.

Lots of folks on Seeking Alpha dot com talking themselves into a pullback right now. ‘Sell in April and go away’ type of talk.

The degree of all cash purchases and the extremely low labor force participation rate, back to 1978 level, represent two very dead canaries in the coal mine. In the first case, it is not that the rental business looks so good but that everything else looks so bad, period. In the second case, abject defeatism has sunk in like a railroad spike. In both cases, people are being driven to unnatural behavior by an economy in a state of other worldliness. When it blows up, there will be hell to pay.

Great post doc. I’ve been saying this the entire time from later last year to now. We are at the apex of appreciation, with the run of fools, and then the decline stage to go on this cycle.

With the upcoming FHA changes and other factors we are headed to where the market should be sooner than later. Late 2013 into 2014 should be decent season again.

The problem is that in a ZIRP environment, even a 2.4% return on your money is pretty good. I’d love to get that.

I would kill for 2.4% too. That being said, the risk attached to that 2.4% is too high to make it worth it, IMO. I love how fund/investor business models are confident in predicting the behavior of renters, many of whom are the same folks who were foreclosed on/aren’t the safest credits over a 3-5 year period, in a completely uncertain world that is hanging by a thread (aka QE). Good luck with that fellers.

San Diego Credit union pays 1.8% on a 5 year cd and a 6 month interest penalty for early withdrawl.

Take 300K, put 250K in a CD, 25K in NYCB and 25K in HYG, boom……you have 2.4%. YEs, there is some risk but not as much as sfh rentals.

The search for yield has come to this. Hedge funds going into the home rental market. I think the cash they have was borrowed before they got it. So it’s not earned money, it’s inflationary money.

As I’ve said before, the rental market is driven by earned money, not borrowed money. With the employment participation rate back to 1980 levels, how much earned money is really available to pay rents?

We should all keep in mind that interest rates at the present levels is not a sign of economic growth. It’s a sign of economic desperation.

The game is rigged. House (banks) always win. Homeownership is an illusion unless you have a lot of equity. Show me how to win a hand if it is at all possible.

Foreign and Wall Street money is pouring cheap U.S. Dollars into American real estate. They see a dollar crash that is imminent. With almost 3 billion dollars a day being infused in the American economy to prop it up, buying up select American real estate is prudent. The middle class locals that just want to live in a nicer area are sadly being chased out forever in shock.

Yes it may rent for something but they’re not going to be able to rent if for that much to many Americans after a dollar crash, rents will never go to zero but they’ll go down right along with it.

Paying in cash to launder the stolen bonus money. Owning outright the rent income goes on forever.

It is crazy, but if you are selling something desirable to either upgrade or downsize, it’s an OK time to go in my opinion. We’re currently in a deal for a house with my Daughter who is upgrading, and an Elderly couple who are downsizing.They are obligated to not attempt a market timing scheme, but to clean up and sell the town house as soon as they move into the larger house. Prices are trending up, which is in their favor, but if interest rates rise even 0.5%, that could wipe out all their gains when they finance my Wife’s share of the new place to buy her out. We want my Wife’s money back ASAP. In this cash environment, deals can be made quickly, lowering risk. The place is being bought as a tenancy in common with right of sale to all tenants.

I don’t know if Dr Bubble has any idea how many cash deals are generational family transactions like this, but we know of several other young couples with family involvement in their house purchases to one degree or another.

I am seeing inventory starting to pick up in some local markets of the east bay. Prices are still high, but I see them coming down.

My theory: Many have talked about blackrock / bloackstone I forget which, announced all the homes they bought to rent out and how they would only do this after they bought. I agree. So the smart money is already fully locked in. This tells me the demand is going to be much smaller now. As homes hit the market there will be less competition for them and prices will fall.

As I mentioned earlier rents are starting to come down a bit too. This process should drive future rents downward and spoke those big time investors. A lot of them can sell the homes for straight appreciation gains right now. I think they will for multiple reasons 1) the rental income will be worse than expected. 2) The profits to be made by selling are too great. 3) Other financial opportunities will look more attractive to them.

O’er in St Louis mo. A point a Minh is easy. Good neighborhoods

Rents have plunged in Culver City since 2007.

Rent for a 1 bedroom in CC in 2007 was 1600+. Recently, I’ve seen seen rents as low as 995 for 1 bedroom in CC.

Starting rent for a 2 bedroom apartment in CC in 2007was 2400+. A recent search has put this at $1600.

The Federal Reserve policy change (April 2012) allowing banks to turn REOs (foreclosures) into rentals have resulted in the rental market being flooded, at least here in Culver City.

Ernst, put down the pipe man. What are rents for the same exact unit today compared to 2007? That is the only thing that matters. I would guess they are the same or likely higher. From my personal experience, rents in the South Bay are definitely higher today than 2007. I don’t think Culver City is any different.

@Lord Blankfein wrote: “…From my personal experience, rents in the South Bay are definitely higher today than 2007…”

Sorry dude, but that depends on what your definition of the South Bay is. If you purposely exclude Hawthorne, Gardena, Lawndale, San Pedro, Lomita, Wilmington, Carson, Inglewood, Harbor City, Harbor Gateway and portions of Torrance, then yes, rents are definitely higher.

(Disclaimer: I work in real estate / financial services, primarily the 310 area code)

In the upper-mid tier areas and beach cities: Redondo Beach, Hermosa Beach, Manhattan Beach, El Segundo, Westchester, Rancho Palos Verdes, Pacific Palisades, Brentwood, Westwood, Beverlywood, Brentwood, etc. we have been jacking up rents to nose-bleed levels. Yet there is no shortage of top 25%’ers who are looking to move to those areas. You could even say there is something of a waiting list.

In the working class areas, i.e. the bottom 75%, rents have been slashed or no rent increases have taken place over the last couple of years. The same is true of real estate sales. All these bidding wars seem to be taking place amongst the top 25%.

It’s like a Tale of Two Cities, or better yet, a Tale of Two Economies. The top 25%’ers and the bottom 75%’ers.

Can you let me know where you are seeing rents so low in Culver City? I look around and see nothing for less than $1k. Rents were high in 2007, then they began to dip in 2009. I snagged a place during the rental bottom in late 2010, but now rents are back up again. Maybe not quite as high as 2007 in most of LA, but nearly there on the Westside.

Ernst, I’m going to have to disagree with with you there buddy. Rents took a little dip in 08 and 09 when the world was seemingly coming to an end, but they have jumped quite a bit in the last three years. You may be in real estate, but I have plenty of first hand evidence that record high rents are being asked and collected in places like Gardena, Harbor City, Carson, etc. And isn’t Culver City a new hipster community. If house prices are way up, then there is something that makes that area desirable. With desirability come high rents. Your sub $1000 per month rent in Culver City is likely in the worst area of the city in a coackroach invested building in the middle of gang land.

The inventory shortage definitely has something to do with this, but rents are definitely climbing again…don’t be fooled.

While 2.4% isn’t worth the risks & opportunity costs for most “pros”, for Asian investors it’s more about hedging in US$, because their own countries are starting a currency war (by debasing their currencies to make exports more competitive). So even if they break even (on rent and eventual exit) they are counting on appreciations against their own currencies. They could just save their cash in US$ accounts but earning near 0% interest is no better than just buying a house here and see what happens.

I think you’re giving far too much credit. I think it’s simply the same reason why some millionaires in this country exploit the welfare system and use food stamps – Because they CAN. Our system is by far the most exploitable due to the vast entitlement policies. No other country is as generous to illegals and foreigners who aren’t citizens. They come here knowing they can exploit all of our generous policies it’s like free lunch and who could blame them? The more money you have , the more financially savvy you are and if you’ve ever dealt with Asian clients you’ll know what I mean. They are extremely frugal in a financially savvy way.

Lots of articles for past few years on the increase of Chinese real estate buyers into a lot of the markets discussed on this blog:

http://usatoday30.usatoday.com/money/economy/housing/story/2012-04-03/us-homes-lure-chinese-buyers/53977638/1

There was also talk a couple of years ago of possibly allowing non-US citizens to gain immigration status by purchasing homes over a certain dollar amount (maybe like 500k?). I don’t think it passed, but perhaps its being ‘sold’ by those who make money selling real estate to Chinese investors as something that is enivitable.

I think one big thing that keeps foreign investment in the game (maybe longer than it should be on a return basis at least) is that fact that it is a foreign investment. I mean imagine if it was the opposite and you were purchasing real estate in Hong Kong. Even if you visit and use the net, at some point, you’re gong to be relying on ‘experts’ for advice as real estate is hyper local in these areas. Experts need to feed their families too, whether financial advisors, real estate brokers, etc, so you better be working with the most honest salesmen (with just different titles) ever (never?) known.

I was reading on a site that I connected to from a link here and some guy in another country was thinking zillow’s guestimates were actually accurate in terms of pricing for American homes as he was considering buying in FL as an investment, sight unseen….

I think this bed’s almost made! Lying in it in 10….9…..8…..

I’d like to see the numbers broken down into large funds “investing’, small landlords “investing”, and individuals simply buying with cash as they trade down from more expensive homes. I suspect that the Orlando, Phoenix, and Tucson numbers have to include the last. Yes, many Boomers are stuck up north, but, some own their homes free and clear, and, if they’re lucky enough to sell at today’s pricing, after owning for decades, then they could make out pretty well by moving south.

On another note, Yves Smith over at Naked Capitalism got ahold of an fund’s powerpoint pitch for selling this idea of single family rentals to other money, and a major component is the fact that they can raise rents by 5% A YEAR. Really. When, in act, in Vegas and, I think, Phoenix, rents have been dropping because so many of these homes have come on line so quickly. Let’s not even go near the fact that the customer base for these rentals won’t be seeing 5% wage increases anytime in the future. These guys are definitely doing the pump and dump, and, if they’re lucky, will make some money in the short term. Just don’t be the fool who helps them escape.

I am a flipper in the IE … The reason you are seeing more cash sales here, is that in a market where there are multiple offers on a property, the cash buyers will win the bid 90 percent of the time. It’s not because of a shortage of financed buyers.

“the cash buyers will win the bid 90 percent of the time”

Until the parasite flipper sells to an over-leveraging financed buyer because smart money doesn’t buy flips.

Its interesting that you think that way Joe. The truth is, Many buyers want a turn-key finished product ready to move in to. We purchase neglected homes in dire need of repair, invest the capital and labor to rehab, then re-market with added value… Hopefully with profit. In the last 12 months, 1/3 of our sales have been to cash buyers, and only 20 percent FHA. But thats not for lack of financed buyers. The point of my post was to comment to the authors assertion that the “investors have become the vast majority of the market”. Cash buyers will logically win the bid over financed, therefore the closing data is squewed.

As to your comment “smart money doesn’t buy flips”, I have seen so many people purchase a distressed property, then get buried thinking they can do the rephab cheaper. They could have purchased a flip, new or “standard sale used” for less money and no headache.

Plus, if you are a financed buyer, in the IE you can purchase a “like new” home for less than the cost to rent. And as an added bonus, thirty years from now, when you are ready to retire, the home is paid for.

Of course purchasers prefer the easy route and that’s not in dispute. What I do take issue with are purchases utilizing max leverage. I don’t appreciate the risk and price inflation that these behaviors introduce into the system that we all are a party to. I’d like to think that my instinct is wrong on this but my observation is that most people buying flips are doing it that way.

It’s great that there are flippers out there rescuing homes in “dire need”, though what I notice is that most flips are reasonably modest and livable before being flipped.

Added value that brings a reasonable profit is one thing. Added value that frenzied, emotional purchasers are overpaying for by a huge spread, thereby inflating asset prices to unsustainable levels is quite another. Maybe I’m wrong and most purchasers are being prudent but I’d be willing to bet that they aren’t.

Are you seriously claiming that it’s more cost effective for someone to buy a flip rather than pay a contractor to do the same work? I’ll tell you why I believe most people buy flips rather than go that route – because they don’t have the cash. Smart money recognizes the difference between a want and a need.

Agreed that the rent to own equation can favor owning in less desirable areas. The premise that anyone who purchases a house these days will stay in that same house for 30 years is a joke. Mobility is more important that ever at anytime before. Especially in a region with soul sucking traffic, long commutes, highly distributed centers of employment, and weak transit.

Leave a Reply