Affordable Housing: Finding Affordable Housing just got Easier in California.

Affordable housing and California usually are not used in the same sentence. Whenever people think of California I can assure you that affordable housing is not the first thing that pops into their mind. Yet there may be a positive aspect to the current housing bubble bursting and that may include more affordable places for young first time buyers and those looking to purchase a place without giving up their first-born to a life of debt servitude.

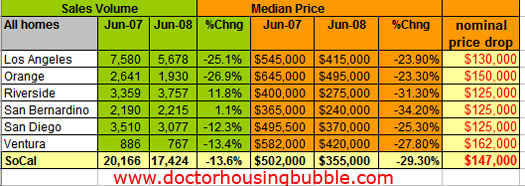

Today, the DataQuick numbers were released for June and once again the numbers are simply abysmal. The much anticipated spring bounce did not happen and now we stare at the $500 billion Pay Option ARM tsunami that will barrel on us like a 30 foot wave. April, May, and June gave us as much action as watching a public access cooking show. Let us take a look at the brutal numbers before recapturing the bear market rally on Wall Street:

If you are wondering why the Pasadena based IndyMac Bank collapsed on Friday and was taken over by the FDIC, you only need to look at the above number. It is unprecedented that every Southern California county is now off by $125,000 from last year. The aggregate figures for Southern California show a stunning drop from $502,000 to $355,000 in one year! Imagine $147,000 in supposed housing equity disappearing into thin air. Incredibly, the FDIC mentioned that they froze IndyMac HELOC which should have been done ages ago!

It really makes you wonder how beholden politicians and a large portion of the American public is simply addicted both physically and psychologically to the debt paradigm. A mission of many of the government organizations that help people find housing is affordability. The free market is now doing what the government has failed to do for such a long time. Prices are now correcting and it is becoming more likely that housing will go back to its blasé station in life as a slow but steady investment. Something where you live and if you are lucky, will not be booted out onto the streets when you retire. We need to breakout of the idea that housing was the absolute pinnacle of our so-called capitalistic system.

The chart above also demonstrates that sales are still declining. The only two areas with positive sales numbers were in the Inland Empire where the median price now stands at $275,000 and $240,000. Yes, we are talking about California housing here. Can it be that the solution to the current malaise is actually a price correction? The proof is in the pudding here folks. Yet the government wants to put a backstop to this with their absurd bailout plan for Fannie Mae and Freddie Mac which will only delay future buyers the opportunity to purchase affordable housing.

Make no mistake though, certain areas will always remain prime. I’ve gotten a few e-mails were people have told me, “hey doc! I’m going to buy me a 1,500 square foot home in Santa Monica for $200,000!” I’m not sure how realistic that is. If you have a solid income then maybe you’ll be able to swing a home for a lower price than the absurd prices of even today, but you have to understand that prices also reflect local area demand. Clearly there will be a bottom at a certain point. What the Inland Empire demonstrates is if the price is right, people will come back and buy:

“(DQNews) Foreclosure resales continue to be a dominant factor in today’s Southern California market accounting for 41.1 percent of all resales. That was up from 39.2 percent in May, and up from 7.3 percent in June a year ago. Foreclosure resales ranged from 18.9 percent in Orange County last month to 62.3 percent in Riverside County.”

With 4 out of 10 homes being a foreclosure resale, distress properties are actually becoming the market makers and determining current and future trends. Given that our California state politicians have mentally checked out and we still have a $15 billion budget deficit that is now past deadline, it will be interesting to see how they will fund the 2008-09 fiscal year. From preliminary reports, it looks like they want to borrow once again.

So why did the stock market rally nearly 300 points today? Wells Fargo “tamer” than expected profit decline and boost in dividend was enough to send the stock up by a stunning 32%:

“(Forbes) In addition to sinking oil prices, investors found relief in a decision by Wells Fargo & Co. to boost its dividend that helped counter some of the market’s concerns about the health of banks. The San Francisco-based bank’s move to raise its payout, along with its tamer-than-expected profit decline, was seen as a bullish sign for the troubled sector.”

Oil came tumbling down as well falling an additional $4.14 to land at $134.60. Since oil for sometime was the story du jour a drop like this was also a welcome sign. Recently the IndyMac Bank collapse and Fannie Mae and Freddie Mac troubles have amazingly pushed the oil issue to the second story of the day.

This brief bear market rally was fueled by the following:

-Bernanke and Paulson practically giving the GSEs carte blanche in regards to the current mess – unprecedented with access to the discount window and all

-Rules going after shorts in the GSEs. Which is almost like saying, “let us force a market bottom on these stocks.”

-Oil dropping to $134. Need we remind you that oil was $96 when the year began?

-And frankly, the market was oversold in the extreme short-term

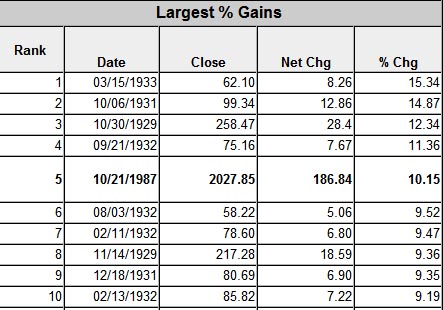

Markets don’t go down in a straight line. Just look at the Great Depression. The Crash of 1929 harmed stocks but the bottom was not reached until a few years later. During the interim, stocks had brief rallies. In fact, some of the strongest rallies occurred after the crash:

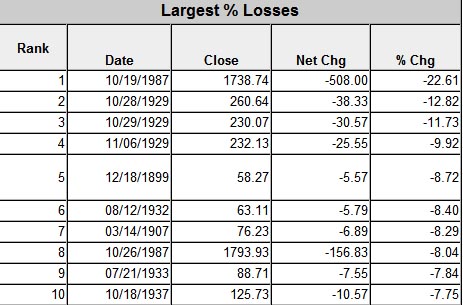

Some of the largest percentage gains in the market occurred in 1929, 1931, 1932, and 1933. In fact the three largest up days happened in 1933, 1931, and 1929! Now you need to contrast that with the largest percentage drops:

The biggest down days occurred in 1987 and 1929. You’ll also notice that 6 of the top 10 downs days occurred during the Great Depression. 9 out of the 10 biggest up days occurred during the Great Depression! Do not be fooled. This is a brief technical rally. The overall news is bad. First, look at the Southern California prices we just went in detail above. The last hope for the Pay Option ARMs is a sudden upsurge in California prices. Not going to happen. Heck, our politicians can’t even get the budget done on time!

Next, the CPI came out today with a stunning 1.1% jump which is something given how the BLS massages the data. This was mostly last page news information but this is a big deal. The PPI and CPI are now soaring like an eagle. In the ultimate sign of desperation, a company out in San Francisco is touting a service that allows people to pay their mortgage with a credit card. If only I was making this stuff up:

“(Houisngwire) If borrowers can pay their mortgage via credit card, will they? One company, San Francisco-based ChargeSmart LLC, is betting that the answer is “yes.” The company, whose service also targets auto and student loans as well as utility bills, said Wednesday morning that it will allow borrowers to pay their mortgage via a Visa or MasterCard through a network of more than 4,000 billers across the United States.

The company isn’t the first to push credit card payments of mortgages. Last year, American Express announced a pilot program with Indymac Bancorp Inc. (IMB: 0.00 N/A) and American Home Mortgage that allowed prime borrowers the option to enroll at origination in a program to pay their mortgage via their American Express card.”

I’m not surprised that IndyMac Bank and American Home Mortgage with their infinite financial wisdom thought this crap was somehow a smart idea. Paying debt with debt. Well you can’t blame people since they are taking a page from our politicians. But this is nothing more than a Ponzi scheme and stealing from Paulson to pay Angelo. Be forewarned that these are bear market rallies and we have many more banks that will be failing in the upcoming months.

And if you need further CSI evidence, the FBI is now investigating potential mortgage fraud at IndyMac Bank:

“(WSJ) WASHINGTON — Failed lender IndyMac Bank is among nearly two dozen banks under scrutiny by the Federal Bureau of Investigation for possible mortgage fraud, U.S. officials said.

The big Pasadena, Calif., bank was seized by regulators last week, the third-largest bank failure in U.S. history. It specialized in home loans to borrowers who lacked full documentation for their income or assets and have a higher default rate than other loans.”

I’m sure that’ll make the sale of the defunct bank go smoother. Also, from most news interviews that I’ve heard of, the bulk of the people are taking their money out. Why would you keep your money with this institution? There are plenty of other places to put your money with companies that didn’t fuel and speculate in this housing bubble or thought credit card mortgage payments were smart ideas. I’m sure many are pulling their money out because it just doesn’t sit right with them to keep their money in company so fraught with problems that they now have the FBI investigating them. It also doesn’t help when cops are called out while you wait for your money:

“(DailyNews) Police ordered angry customers lined up outside an IndyMac Bank branch to remain calm or face arrest Tuesday as they tried to pull their money on the second day of the failed institution’s federal takeover.

At least three police squad cars showed up early Tuesday as tensions rose outside the San Fernando Valley branch of Pasadena-based IndyMac.”

I’m surprised Bernanke and Paulson didn’t add a clause to the housing bailout package of jailing home price depreciation.

The reality is that market forces are proving here in Southern California that lower prices and more affordable housing will move homes. There is no need for further taxpayer money to prop up this historical bubble. But people are wedded to the idea of maximum debt and I’m not sure how long it will take to break this psychology. A major social tipping point is near. When you can say affordable and California in one breath, you know things are changing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “Affordable Housing: Finding Affordable Housing just got Easier in California.”

Good post DOC, but I have to correct you on 1 point. As oil prices continue to rise the Inland Empire will become LESS not MORE atractive to home buyers because the cost of commuting will out weigh home savings compared to living in Orange & Ventura counties. Infact the further away from the coast & L A you are the worse it will be.

Politicians and their special interest campaigns and PR (some powerful big developers) supporters are coming at this from another angle. The state has mandated cities continue to upzone and cities are mandating “smart growth”. It is like monopoly, except only the big developers are allowed to build “houses” and “hotels”, so they will still be able to turn a profit for a long time to come even in a down market, where as, the small spec developer will be squeezed.

More housing stock is on the way with the expressed intent of attempting to drive down the price of housing with a flood of units. And! in some places these increased densities are directly subsidized by the taxpayer.

I currently have my savings with Wamu, I know they will probably follow in the same fate of Indymac within a few months. Where is a relatively safe place to hold my savings? BofA, Wells Fargo?

Ramon: Perhaps try your local credit union. I’m very wary of the big banks.

Someone sent me this link:

http://www.puredoxyk.com/index.php/2008/07/16/black-monday-2008-foreclosure-apocalypse/

And I was wondering what the good people here thought about it. Is it true? And if so, why would banks want to do this? It doesn’t seem to make any sense and so seems suspect to me. How would one verify a story like this? Any ideas?

Awesome post as always doc! Keep up the great work.

I moved my savings over to Wells Fargo from WAMU on Tuesday. I am in the middle of a move and didn’t want the hassle if the FDIC came in. Besides, I have not liked Wamu since banking with them 6 years ago.

Thanks you Gale for the info. I read the article about Black Monday. All I can say is that I hope its true, it might be harder to get a loan later, but the house prices would drop extremely fast. Maybe dropping so far down to be able to buy in cash.

regarding the market bottom for RE prices, for the same reason that the prices crumbled from the bubble highs (affordability vis a vis salaries), the market will find a stable bottom. When people can buy houses on 30-40% of their gross income, I expect enough people will start buying houses to maintain those prices. Looking at median cases for socal, we’d expect wages in a median area to be 40-60 thousand per household which would put nominal house prices at $150,000-250,000. Whether they get that low remains to be seen, but I’d be absolutely shocked if they ever got lower. Just looking at the traditional lending guidelines of 3-5x annual wages for a reasonable maximum home purchase price, if we assume a young, college educated couple with 3-5 years in the labor force each, we can expect a household income of 80,000-120,000 which would put upper-middle-class prices around $250,000-$500,000.

Now the interesting thing is, if you look at the case-schiller index and fit a trend line to the mid-1990’s when housing was more or less following inflation and project that trend to today as if the bubble never happened, that’s pretty much where it we’d be. And if you look at the current rate of dropoff in prices, they should cross that trendline in 2009-2010.

Wells Fargo is still not fessing up to all the 2nd mortgages they’re holding that are worthless.

Sean, given the price differential between Orange and Riverside ( more than $200,000) even high gas prices are ‘bearable’ and I presume you get a lot more home for your money in Riverside than Orange County. Just the tax savings alone would put over 400 gallons of gas in your tank per year. At 20 miles per gallon that’s 8000 miles worth of commuting. Those buying now, unlike those who bought at higher prices a year or two ago, can factor in current fuel prices in their buying decision. It won’t be a $200 or so bolt out of the blue every month.

Looks like the Grim Realtor has finally arrived in San Francisco. Median home prices in Marin and SF down over 11% year on year. IT CAN HAPPEN HERE!

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2008/07/16/financial/f094838D13.DTL

Scott,

you are assuming that gas prices will retrench to where they were last year or earlier. Unfortunitly that will not be the case. Oh sure they may drop for a little wile, but the long term trend will be higher & higher prices. Because of this I stand by my prire statement, unless most people start walking more & start using public transport, these types of areas wont hold there value.

I’m going to reccomend a book called “The Long Emergency” by James Howard Kunstler. http://www.kunstler.com is his web site. Everybody should read it,you may question his perdictions as I did, but he has his facts in order

People will have to adjust one way or another that you may not be able to live in a place where the car is the only way to be moble.

It really makes you wonder how beholden politicians and a large portion of the American public is simply addicted both physically and psychologically to the debt paradigm.

Talking about addiction to a ‘debt paradigm, this interview was posted over at Paper Economy. Listen to the woman at 24:45. She says:

Quote:

“I’m not having problems with money, except I have credit card debt that I can’t pay down.”

She even talks about her patriotic consumerism. The insanity must stop.

http://www.papereconomy.com/videos/npr_feldsteinonpoint.wma

I have been banking with Wells Fargo for about 10 years now.

Don’t have any complaints. What I can tell you is that the people

working at my branch have been there for years, know their long term customers by first name, and they do go the extra mile.

Of course, I don’t know anything about their financial stability.

They did offer some of the toxic mortgages during the mortgage lending haydays

But which bank didn’t?

Maybe someone can dig a little deeper and find out who the other 9 or 10

banks are that are on the FDIC chopping block?

I guess the safest thing right now is to keep your deposits under

100K per account and spread your bank accounts around a bit.

I have got savings accounts with a Credit Union and my regular

Wells Fargo. Don’t keep all your eggs in the same basket!

My gut feeling tells me to get out of WAMU now.

They are advertising like crazy for new accounts and offer anything

from free checks for life to no fee accounts. That looks like a desperate

attempt to get deposits…

Sean –

I beg to differ. Supply is higher, demand is lower. Speculation is what has driven the price of oil. Think of commodities as the next bubble. (Tech being the first, then Real Estate, no Commodities)

With the cost of oil and gas up, consumption is down. This trend will continue. At some point, this bubble will deflate as well.

Some will say that China and India’s thirst for oil will only continue to increase, but keep in mind they are exporting countries. The world’s demand has now decreased for their goods, so who will they sell their exports to? The vast majority of their own people really can’t afford their own products. How many less container have been shipped to the US?

Now if the SEC were to put a curb on oil speculation like they just created (starting on Monday the 21st to the 28th, or can be extended up to 30 days) to counter the Financial Services/Bank short sellers, as the Doctor mentioned, what will happen to oil?

I suspect we will see a small bounce before markets finally find the bottom. As prices drop and things look cheap compared with 2006, there will be a rush to buy. Once the rare buyers with twenty percent down and solid incomes are gone, then most sellers will have to start dropping prices again. The first price rises will be celebrated nationwide; Lereah will hold a parade in his own honor; Wall Street will rally 1000 points. Then it will all reverse.

I don’t care about demand here or there. Real estate is local, but this market is regional and national right now. The real bottom will come when inventory is back to historical levels, when there are sufficient buyers with twenty percent down (so, basically, RE will never recover..ha ha ha), when Price-Income ratios drop to about 2.5, and when unemployment starts declining again.

As you said, it’s about affordable housing. It is not about “more affordable” (meaning less unaffordable) but plain old affordable. Until we have enough people earning enough money to finance enough homes, the market MUST drop.

I have had running debates about the national median income and whether to use household or individual. My belief is that the long term Price-Income ratio is based on individual income and should be between 2.5 and 3.0 nationally. In higher income areas, the ratio is higher. Consequently with a national median income of $48.5k the national median house price must drop to about $122k from about $196k right now.

I don’t care if houses are bigger, countertops are marble, or everyone gets a pool. It doesn’t matter. If that mattered we would all drive Ferraris whatever our income.

Burn, baby, burn.

We’re not anywhere near the bottom, nor are we anywhere near affordability for the average person.

When cops and teachers can buy a house in SOCA(and I’m talking maybe 250K) then the thing has corrected.

It will take a couple more years I believe.

Stop taking the short term view, as I said the long view is higher fuel prices. The fact is those who sell us oil are running out of it, or using it for there own countries needs. As less oil ends up on the open market the higher the price becomes. One of the social problems I’ve noticed is the inability for many americans cant think globally. The atitude goes something like this-I demand to the world you MUST sell us oil cheeply or else we will just take it by forse, & now our bluff has been called resulting in an unessessary war. Our VP put it best when he said that “our way of life was non nogociable.” Oh really! Would anybody say that now, with everything that has been happening lately?

We are not there yet, but we are very close to a major inflection point where people will have to make a choice between lower cost housing with expensive commutes or housing cost that are higher with far less commuting costs. Pick your poison.

There’s a happy medium between the two Sean. It’s called renting 🙂

My husband worked at Countrywide for I think 3 years, first in loan servicing and then as a loan officer. He wasn’t a good loan officer because he couldn’t bring himself to recommend these terrible loans for people who didn’t know what they were getting in to.

The comment about “paying debt with debt” was something he told me came up almost daily while he was in loan servicing. People wanted to pay with credit cards so they could get cash back or reward points from their credit cards. Plus the minor pleasure of “sticking it to the man” and costing the mortgage company 1% or more in credit card fees.

In general, the idea of paying with a credit card has appeal, because of the “free money” angle, but it ONLY works for people who pay off their cards every month. All those other mortgage companies were smart to limit their exposure to risk as much as they did by forbidding payments on credit cards.

Also, my husband predicted the blow up from predatory lending over two years before the huge downturn: http://www.splorp.org/predatorylending-moronsdotorg.php

Leave a Reply