A Math Formula to Solve the Housing Market? Mathematically Determining how Much Home you can Afford.

Figuring out housing prices isn’t rocket science. There is no need for a master’s degree in financial engineering to figure this out folks. Even as the housing market continues its downward slump, we are still at overpriced levels. Why? Well historically, housing as an investment only tracks with the nation’s inflation rate. That is until a bubble appears and people start getting the notion that this time is different. I’m going to give you a very straightforward math equation on determining how much home you can afford. This is the maximum price you can pay without putting yourself into financial jeopardy and maintaining a cushion:

Wait a minute. You mean to tell me that the ridiculously simple equation above is the solution to restoring sane housing prices? Pretty much. I’ll explain why this is in a second but you need to remember that for nearly a decade, we had no semblance of checks and balances. No documentation loans clearly went on no established ratios since you had the ability to make up your family financial balance sheet. Even with some documented toxic loans, lenders and Wall Street did not care and took the loans anyways.

Now why is the 3 times yearly gross income rule a good one? First, you need to remember that as a rule of thumb, you should try avoiding spending more than one-third of your monthly income on housing. If you want to find out how much a month you will be spending on your home, a quick way of figuring that out is this:

This is a quick rule of thumb. For example, if your mortgage amount is $100,000 you can expect to have monthly housing costs of $1,000. Many investors usually have these formulas in the back of their mind when determining a good value for a property. These costs include the following:

Principal

Interest

PMI

Insurance

Taxes

Maintenance

Upgrades

A big mistake made by buyers, realtors, and lenders during the bubble was the fixation on principal and interest only. In fact, some of the main selling points of interest only loans were the cheap monthly payment. Well that was only one cost of the above many items. Some of the most toxic pay option ARMs didn’t even include the full interest amount.

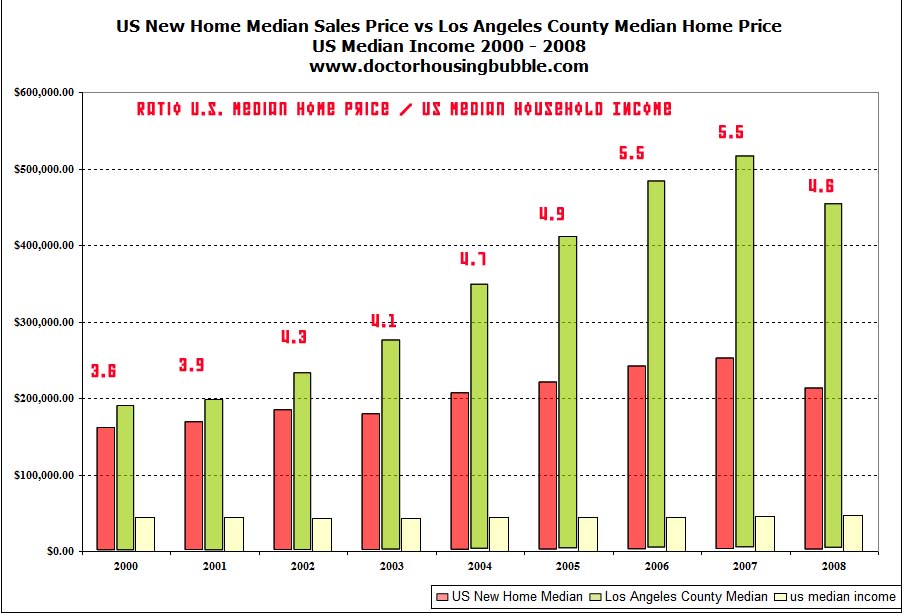

You may be thinking that this is too simple. Too straightforward and maybe, it belongs on some morning kid TV show. It is this simple however. And that is why people don’t like it. Sort of like losing weight. The formula for that is, eat less calories than you burn in a day and you will lose weight. Yet getting this discipline is the hard part, not the equation. What this tells us is housing prices have still a long way to go to adjust. I’ve put together on this chart below the U.S. median home price and also the U.S. median household income since 2000 to track the housing bubble. Just for kicks, I threw in the L.A. County median price to put one crazy bubble next to an amazingly insane out of this world bubble:

*Click to enlarge

As you can see from the chart above, U.S. median income for the past decade has remained stagnant. Yet home prices appreciated at an unprecedented pace. On the top of the chart, I quickly put the price-to-income ratio just to give you an idea of how high prices rose. Already in 2000, prices were at a 3.6 ratio, a little higher than we would like. Then all of a sudden, you have a non-stop growth to a ratio of 5.5! This was simply unsupportable. In addition, if you think that is bad, the peak price-to-income ratio in Los Angeles County hit above 11 at the height of the bubble. Meaning, the median home price in L.A. required the median household to spend 11 times their yearly income.

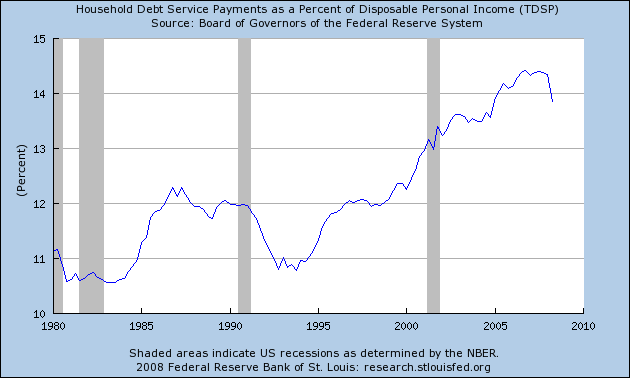

Now this would not be such an issue if incomes had kept pace, which clearly they did not. So it leads you to the question that if household incomes weren’t keeping pace, how did people manage to pay more for homes? In one word, credit.

The above chart goes to show a clear sign of what has occurred in this past bubble. More and more of a family’s income went to servicing current debt payments. When we consider the $700 billion bailout plan and one component of injecting capital into banks the primary reason again is to get credit going. This of course should lead you to question why we are trying to spur credit (debt) when debt is what got us into this mess in the first place? Nowhere do we see legislation trying to clamp down on stricter lending. In fact, the marketplace has suddenly tightened up and the government wants to loosen it up again.

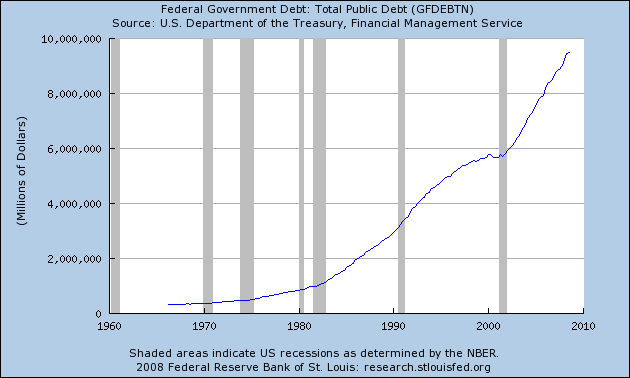

The government has led the way in acquiring debt so you would expect similar behavior from the populace:

Total public debt has blasted through the $10 trillion mark and with the price tag of these bailouts, we can expect to see $11 and $12 trillion very soon. At a certain point you need to return to prudent lending standards yet at the moment, the government seems to want to return to the heyday of the housing bubble. We can’t go back since we have reached a critical inflexion point. That is, we cannot throw more debt at the problem and expect it to go away. That is why certain states like California will not see a housing bottom until 2011 or even deeper into the future.

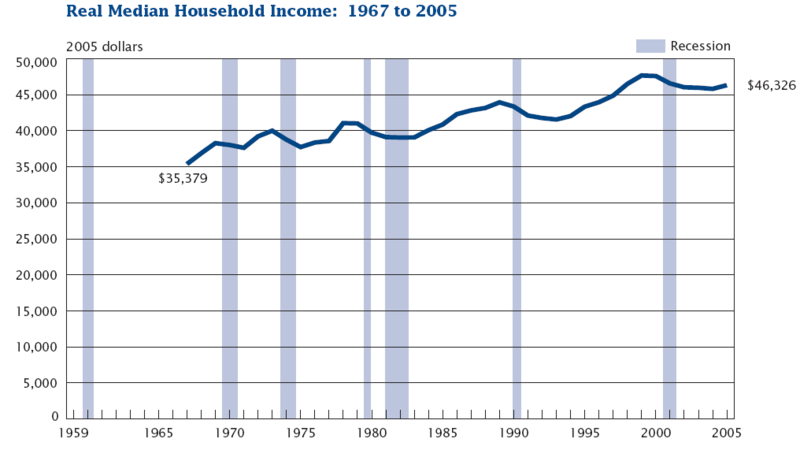

Take a look at real median income produced by the Census Bureau:

What you’ll see is slowly growing household income, that is until this decade where income even dipped a bit. Of course, some of that growth also comes from the fact that we now have 2 workers per household which has increased since the 1950s.

Is the formula for housing prices really that simple? That is, 3 times gross household income is the maximum value of a home one can afford? It is. So if your household income is $100,000 you can buy as much as $300,000 worth of home. If you make $1,000,000, you can buy up to $3,000,000. Makes you wonder if we’ll ever see these ratios again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “A Math Formula to Solve the Housing Market? Mathematically Determining how Much Home you can Afford.”

Is it 3 times gross income vis-a-vis the price of the home or the amount of the mortgage? If I inherit $1,000,000 and earn $100,000 a year, then couldn’t I buy a home for $1,300,000, by putting $1,000,000 down and financing $300,000?

Yes, it really is that simple. Yet I still see people dispute it.

On the local (Seattle) media here the REA runs ads with fake “real people” saying they went to some independent-sounding website about how now is “a good time to buy.” And the media, which relies on advertising revenue from the realtors, routinely runs puff pieces about how it’s such a good time to buy.

But the year-to-year sales figures here are horrible, down over 30%. Prices are correcting but not nearly enough. Inventory is measured in years. Just recently I saw new condo “work/live” units (the new culture, apparently, is to have your family live above your subsistence-providing store) selling for a whopping $500/SF! Not surprisingly, they’re still vacant.

I think part of the problem is that, after so many years of living in fantasy land, where uranium counter tops would garner you a 50% instant “appreciation in price,” it’s just hard to fathom that one should be able to actually buy a habitable home for the insignificant-sounding price of $150,000 or less. The last time I can remember this being the case here for a house within the city limits was around 1990!

One other comment…

Another way to resolve this discrepancy between income and housing prices is, of course, higher wages. Fat chance of that happening. We don’t make anything in this country anymore. All of our living-wage-paying jobs have been sent overseas to slave labor countries, encouraged by republican tax policies that lavish tax benefits and otherwise subsidize such actions.

It really is as simple as that, pretty much. One qualifier worth mentioning is interest rates. When I bought my first house in the early 80’s I bought down the interest rate to 18 1/2%! Conforming loans are now, what, around 6%? How much you can afford to pay is one third of your income. How much loan on third of your income will support is a function of the interest rate on the loan. I wish I could find my HP12c. Interest rates are at near historic lows now. Heaven forbid we see 19% loans again or even worse. Someone whose income could support a $200K loan at 6% might not be able to support a $100K loan at rates we once saw. Loans are at near historic low levels now. Higher interest rates = lower prices. Lower interest rates = higher prices. Lately interest rates have headed up. Another reason to look for lower prices. It is nice when the concept is simple. Thanks for highlighting it.

Your home mortgage should be 3X your income ONLY if you have no other debt, such as car loans, credit card balances, school loans, whatever.

Additionally, your payment calculations should include what you pay in heat, maintenance, HOA or condo assessments, and taxes. That will often mean your mortgage should be only 2X your income, for taxes and utilities, and/or assessments, and property taxes will be large add-ons to your monthly payments.

Applying this yardstick to loans will bring prices down another third, at least, across the country, for since 1980 or so, lenders have been using the 4X income yardstick, which means people start out making payments that guarantee a permanent diet of raman noodles and applesauce. Additionally, we can pretty well count on utilities taking a bigger % bite our of our incomes going forward, so make allowances for heat bills in cold climates being 20% to 40% higher in the next few years.

Comrade Dr. Housing Bubble,

On your list of housing expenses, you should also include the hidden “tax” of ill conceived homeowners association dues and special or public improvement district levies. In most new home communities, you can expect to pay between $30 and $300 per month during normal times. Of course, these are not normal times and delinquent homeowners are simply not paying HOA dues. The district levies usually are included in your property tax and your mortgage company probably pays it out of an escrow account. Here is the problem, HOAs are going to have to make up lost dues from existing homeowners (good luck with that) or let the weeds grow. The districts used property values to underwrite the bonds that the levies are paying off. The bonds are probably worthless at this point since home values have plunged. Where this leads is a big mess that has yet to be reconciled much less discussed. Worse, lenders and builders are still not including this monthly housing cost in calculating whether a buyer qualifies so the beat goes on.

Apparently, Dr. HoBub has missed identifying the underlying cause of this nation’s economic quagmire, as well as the corresponding solution:

http://www.entrepreneurdoctors.com/2008/10/donny-deutsch-t.html

Don’t miss out on the gems of wisdom and enlightenment provided in the 4th and 5th paragraphs…

Bwahaha!

Dr HB, Thank you for breaking it down so simply. Slowly but surely people will get back to reality. Buying a house to “live in” instead of getting rich. The bubble has popped and it is now just a matter of time to see how fast they deflate in different markets. With consumer spnding now in the tank, the stock market teetering and the next big wave of Alt-A loans resetting in 2009, I suspect the lagging affluent areas will decline rapidly.

The sooner the better in my opinion. Otherwise it is a slow grinding for years and years.

http//www.westsideremeltdown.blogspot.com

Thanks Comrade DHB – I can’t believe how many douchebags on the NoVA bubble site think 3x income is “obsolete”, and I can’t wait to buy their houses for half of what they paid in 2004/5!

This cuts right to the heart of the matter. Shocking, 11x income. Really makes you wonder if people in California lost their minds.

Why should I bail out a guy making $90K/yr who bought a $1.2M home? You mean I’m punished for being responsible & not overextending myself like the home next door with two 26 year olds each earning $55K living in a $1.1M home?!?!? What is wrong with this country? WHERE IS THE OUTRAGE?!?!?

This is one of the best articles ever published on DHB! Please continue to ram home the fact that “it’s the income, stupid”!

Greed cannot be always be regulated, but why not cap sellers price increases at the rate of inflation since purchase date? Any “overage” in selling price negotiated by the buyer and the seller would be split 50/50 between the seller and the Government over the inflation based price minimum. The seller then “wins” with a quasi market gain, tempered by the penalty of sharing that gain with the Government. Buyers gain with tamped down prices – for which they have to full doc qualify for with 5% down – and the Feds win with an income stream that would be used strictly to pay down Government debt.

Hadley,

If you bought the $1.3M home with $1M down payment, you’d probably be okay with the mortgage. On the other hand, the property taxes, insurance and maintenance would kill you big time.

OK, if people that make over 100K are in the top 10 percent of wage earners here in the US, and if one makes say 150K/year, they can buy approximately 450K of house. If that person wants to buy in a nice area like Newport Beach, they would have to wait for home prices to drop below 500K. Houses in one decent area of Newport sold in 2006 and 2007 for 1.3 to 2.3 mostly. From the looks of things (no one is selling- – a few are listed and are not moving — still very inflated pricing based on NIMBY), that 500K price is pretty far in the distance…or will it ever happen for that top 10 percent wage earner? Something doesn’t add up here…

So what’s the median household income in L.A? Under 70k? Even 70k would mean most people could only afford a house if it cost $210,000. Do you really think houses are ever going to drop that low in L.A..

No, reality is the 50% of the population will never be able to afford houses.

I agree with the 1st post, shouldn’t it be

3 x gross income = mortgage amount

not house price but amount mortgaged, so if you make a 80K and put 20% down you could buy a 300K home??

RE: TardSpotter’s comment

I read the article, it reminds me of “The Secret” by Rhonda Byrnes.

Apparently all of us who are suffering economically are not suffering because of any real consequences to our (or someone else’s) actions. We’re suffering because of our negative thoughts.

Imagine that! A whole nation of negative pessimistic people who were optimistic enough to buy into the housing ponzi scheme!

Re: SoyPerdido’s comment:

I’ve been waiting for Dr. HB to post a graph comparing the sales of “the Secret” books & DVDs to the rise in home values for a while now.

I’m wondering what it would look like. I have a strange feeling about it…

So help me God, please save me from any more “positive thinking” or “power of attraction” crap from Rhonda Barnes or Tony Robbins or Brian Tracy or the rest.

The core reason we are in the situation we are in is because we have developed a Culture of Delusion in this country and 70% of the population has bought into it- it is our country’s true religion. We have a country of a few hundred million overgrown children who function mentally on the level of six-year-olds, to the point where it’s considered a virtue to be able to ignore reality and suspend your disbelief in magic.

And it goes clear to the top. I work at a brokerage firm as the compliance officer, and have to listen to the brainless babble on CNBC all day. It kills me when I hear that consumer “sentiment” is causing people to buy less, because I didn’t know the consumers’ “feelings” had anything to do with it. When the cupboard is bare and the bank account is empty and the cards are maxed and your job had disappeared, it doesn’t really matter what your “sentiments” regarding the situation are- you just don’t have anything to spend.

All this “The Secret” stuff and people will figure out why it’s called “LaLa land”. I’m envisioning paying for a 700k starter home … I’m taking out an balloon mortgage but the money will appear once I learn to let it in to my life.

But be fair, even though there are a lot of new agers, there are still a few sane people left here. They are called housing bears (oh and they are also often called renters :)).

This is surely a rule of thumb – but it completely excludes interest rates – and this is why Greenspan is culpable. The rule should be that you can afford a house that a third of your income can pay off in a 25 year mortgage at a given interest rate. Of course we cannot predict interest rates – but if we artificially depress interest rates as the Fed did, then we can say with surety that people will borrow as much as one third of their incomes will allow them to, and look at whatever is available at that price. The average wage in London is £24,000. £72,000 will not buy you a studio flat within a hundred miles of the capital. Even after this shitstorm plays out it still probably won’t.

Yeah, I’ve been advocating this for years. It seems preposterous coming from California, where people were buying houses that cost more than ten times income, but it’s necessary if one wants to be able to afford the house comfortably, through thick and thin.

I’ve recently been urging people to go a step further and buy a house without a mortgage at all! Impossible? How about living with a family member for five years, rent free, scrimping and saving the whole time. It ought to be possible to save up three years worth of gross income over five years, at which point one can go out and pay cash for a house. They they can extend the same favor of rent free housing to someone else.

Dave

http://daveeriqat.wordpress.com/

Finally someone has injected some sanity into this insane housing market. During the height of the bubble I had a “friend” suggest that I go out and get a “ninja” mortgage for a house. When I pressed my “friend” on why I should put myself and my family in financial jeopardy her response was “Why not? Everyone else is doing it.” Well now lots of the “everyone else” are facing foreclosure. Maybe I should be doing that too.

Keep up the excellent work!

No – you still have to pay property tax – which is based on the assessed valur of the home – not your mortgage amount. Some places have 2.5% per year of the assessed value in property tax. That is a lot of money on a 1.3 million dollar home.

One comment about the US “public” debt being at $10 trillion. The debt held by the public, i.e., actual bonds paid for by investors in the market and tradeable in the market, is closer to $6 trillion. The rest is funny money government trust fund debt. It’s not really relevant, since it is not held by investors, and is explicitly, by law, not tradeable on the market. It gives Social Security a political, but not legally binding, claim on future government revenues, but it can be welshed on, and will be, without violating the full faith and credit of the US government to real investors in the market place.

Of course, in the new era of frugality, government will have to be frugal too. I say, cut back all discretionary non-defense programs to FY 2000 levels, completely cut farm subsidies and other corporate welfare, completely eliminate HUD and SBA, and roll all welfare programs into an enlarged EITC program, where everyone gets the same amount as a refundable tax credit, that either eliminates taxes up to $20,000 or so, or, for those earning less than that, eliminates taxes and gives a modest cherry on top. The key is to eliminate the bureaucracies and give everyone the same amount. Right now, some poor get a lot and others work really hard and get nothing.

And no more bailouts, other than those baked into the cake, such as FDIC.

Leave a Reply