5 Reasons Why The Housing Market Will Continue to Decline Until 2010: Extrapolating The Free Ride Bird and Dancing with the Housing Pied Piper.

Many know the story of the Pied Piper of Hamelin. Legend has it, that in 1284 the town of Hamelin Germany was suffering from rat infestation. The townsmen where worried and desperate for any help. In comes a man in colorful garment promising the town that he would lure the rats away. The townsmen in return promise to pay the man. The man accepts the offer and plays a musical tune on his flute luring the rats away where they are led to water to drown. Even though he succeeded as promised, the people in the town refused to pay. The man left but later returned to the town to seek revenge. After returning, he played his pipe once again but this time lured children of the town away never to be seen again.

Now I’m sure many of you have used the term “pay the piper” but apparently many are now reneging on this promise and simply walking away from their mortgage obligations. What we suffer in this decade is a consumption infestation built on credit and when push came to shove, many people weren’t too attached to their homes. From a business stand point, if you are severely underwater on your mortgage walking away may be the best option. In fact, we are now seeing people employ this technique on auto loans and also credit cards. After all, if you are having a difficult time paying a resetting mortgage you may also opt to let the $80,000 luxury car go with it. In a USA Today piece there is a new trend emerging, some mystics and erudite economist are calling it Spend Less Than You Earn (SLTYE):

“There’s no turning back soon for mortgage loan originator Martin Richardson of Suffolk, Va. He used to buy four suits a year at J.C. Penney (JCP). In the past year, he didn’t buy any and will make do with his wardrobe again this year.

“I can’t afford it,” he says. “Nothing could lure me back. Not two-for-ones. Not 20% off. Nothing.”

It’s not just leaner times, Richardson says. “I won’t go back to my old ways when the economy improves,” he says. “It’s hard for friends to understand, but I’m working on becoming more of a minimalist. It’s a relief to have less.”

I think Henry David Thoreau just shed a tear from heaven. This is all well and good but the transformation is happening more out of necessity than the idea that it is now trendy to spend within your limits. What has occurred over the past two decades is an incredible consumption society that with stagnant wages, used credit to bridge the gap over the Nile river into believing they were somewhat wealthier than they truly were. So what are the five reasons housing will continue to decline over the next three years? There are many more but here is a brief list that we will go over; free ride bird no longer flying, new budget line item of servicing debt, down payments be gone, rewriting universal laws, and salt in the consumption engine.

1 – The Pied Piper Wants your Custom Home and Mercedes

*click to see free ride bird leave our economy for a few years.

The picture above sums up the past decade of our economy. At a certain point, the gig was going to end and we were going to have to face the music. The assumption made by many people, especially here in California, is that we had a large enough base of wealthy consumer that would contribute to ever increasing housing prices. As I wrote back in April of 2007 in America’s Codependence on Housing: 30% of Job Growth Contributed by Real Estate. 5 Point Plan on how the Bubble Will Burst, I looked at the Catch 22 that we found ourselves in. We became so reliant on housing that the only way the economy would continue to grow is if housing kept going up. Housing took a larger chunk out of our paychecks. You can read the article for greater details on this but the final point I made was we would be facing a housing led recession before any perma-bulls were willing to admit the fallacy of their own perpetual motion machine built on mortgages.

The free ride was built on easy access to credit fueled by the lax lending standards of the Federal Reserve and the lack of any enforcement of any laws. We had a monumental shift in psychology during this time. Through financial alchemy and risk management, it was no longer necessary for you to save to purchase homes or any other consumption items. Through the art of loans, you were able to have that $70,000 car on a 6 year note or that glorious $600,000 McMansion with a 2/28 Option ARM Mortgage. So what if your income was only $75,000 because you had to keep up with folks making $14,000 passing you up in the fast lane buying homes in the $700,000+ range. But all this spending was nothing more than a pyramid scheme. You had to keep getting new credit via refinancing or credit cards to simply keep the game going. In fact, many homes were the gift that kept on giving. With HELOC, you had a built in ATM machine with your house and many came to rely on their home as another source of credit.

Like any Ponzi Scheme, the game ends when there is no new money coming in. The housing market, even when it was stalling not even declinding, started showing cracks in early 2007. The gig was up.

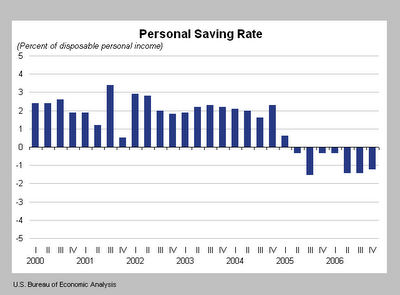

2 – When Servicing Debt Eats into Your Nonexistent Savings

Take a long hard look at the above charts. How can it be that a booming housing market with so many artifacts of wealth floating around have underneath its hood, a society that was heading toward a negative savings rate and had a larger percentage of each paycheck being eaten up by servicing debt? There is a sense of irony that in 2005 when we hit the absolute peak of the housing bubble, that is the same year that we solidly entered a negative savings rate as a nation. That is, we were spending more than we were taking in. We’ve learned well from our government who has a continual monthly trade deficit.

This didn’t seem like a problem when credit was easy and the only requirement to get a loan was the ability to fog a granite countertop. Now, with the August 2007 credit crunch, easy credit is becoming more and more of a historical footnote. You may be thinking, but didn’t people need to have some cash to purchase homes during this boom? If you say that housing was accelerating while savings was dwindling, how were so many millions of Americans able to purchase homes with negative savings rates? Well my friends, creative financing had a solution to that one and it was called no money down.

3 – Down Payments are Coming Back!

You may be surprised that in 2006, 21% of all California buyers went no money down. This is a stark contrast from 2000 when only 3.9% of buyers went no money down. Keep in mind that well into the middle of 2007, many of these absurd mortgage products were still floating out in the market. However, with the advent of tighter credit standards the market has completely dried up. Bringing the down payment back and simply looking at income (refer to point #2) was enough to pop the entire housing market. Nationally, we already know that we are facing a correction. But just take a look at the data for California:

|

Data for January 2008 |

|||||

|

State of California |

Current |

Last |

Year |

M-to-M |

Y-to-Y |

|

Period |

Period |

Ago |

Change from Last Period |

Change from Year Ago |

|

| Existing Home Sales (SAAR) |

313,580 |

297,970 |

446,820 |

5.20% |

-29.80% |

| Median Home Price |

$430,370 |

$476,380 |

$551,220 |

-9.70% |

-21.90% |

| Unsold Inventory Index (months) |

16.8 |

14.2 |

7.6 |

18.30% |

121.10% |

| Median Time on Market (days) |

71.6 |

66.6 |

68.7 |

7.50% |

4.20% |

| 30-year fixed-rate mortgage (FRM) |

5.76% |

6.10% |

6.22% |

-0.34% |

-0.46% |

*Source: California Association of Realtors

How bad is it here in California? Well having a median price drop of $120,850 statewide isn’t a sign that the market is recovering. In one year, we have already seen a statewide drop of 21% – interesting that we had 21% of people going no money down in 2006. Coincidence? Of course. Interesting facts? Absolutely! Aside from price, I draw your attention to unsold inventory and median time on the market. Unsold inventory has increased a whopping 121% in one year. What this means is we will keep on seeing major price drops as the market continues to adjust. The fact that lenders now require even token down payments of 5% is 5% too much for many saving starved buyers. The 80/20 piggyback loans or the 90/10 loans are no longer available. Even with Fannie Mae and Freddie Mac gearing up for the jumbo market, you will still have to show you have the income to support the payment. Unless Freddie and Fannie are willing to do Pay Option ARMs this, they can raise caps to $1 billion because underwriting on these loans actually examine income and your ability to pay, something that wasn’t done for past years. This may all be a small sign of what is to come but people are now realizing that the housing bunny rabbit may be a figment of their imagination.

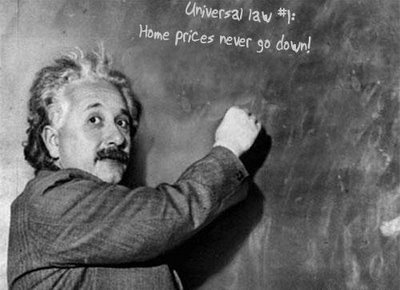

4 – E=mc2 and Housing Never Goes Down

What happens when something you believed in for your entire life is now shattered? Last year we’ve witnessed the first national median price decline in housing since the Great Depression. Given that the majority of our population never lived through this time, we are now witnessing something that is new to our generation. Many of the 20 to 30 something finance and real estate hot shots never learned in real estate class that prices do decline if you look at a longer history. I’ve seen many finance books that conveniently leave out the Great Depression when calculating returns on the S&P or the DOW. How nice, why don’t we leave out the Dark Ages and the Inquisition out of history books? For those of you interested in the past and what we can learn from it, I suggest you take a look at our Lessons from the Great Depression series.

Yet we live in a time that is based on hyper-consumption so it logically followed that larger homes and bigger mortgages would not keep many from taking the dive. Why not? Never in recent memory have prices declined and not here in California where everyone earns $200,000 per year and sweats gold. The lines that were being told to people simply blew me away. Home prices never go down! Let us use the 20 percent returns we were having during this boom plus the peak $550,000 price to follow it out seven years:

Assuming 20 percent yearly gains:

|

1/1/07 |

$551,220 |

|

|

1/1/08 |

$661,464.0 |

year 1 |

|

1/1/09 |

$793,756.8 |

year 2 |

|

1/1/10 |

$952,508.2 |

year 3 |

|

1/1/11 |

$1,143,009.8 |

year 4 |

|

1/1/12 |

$1,371,611.8 |

year 5 |

|

1/1/13 |

$1,645,934.1 |

year 6 |

|

1/1/14 |

$1,975,120.9 |

year 7 |

*base year price of January 2007 is based on actual California median price

Following this logic, a home would double in price almost every 4 years. Even a simple back of the napkin calculation showed that this was not possible. Of course the above model is now shattered and not only are we seeing prices drop but prices fiercely correcting since much of the wealth that was created was fictional. Also, many lenders and Wall Street did not predict that many people would simply moonwalk away from their purchases.

There is a double-edge sword to 24/7 information flow. Good ideas get spread quicker than ever before but so do bad. When housing was ramping up the idea “housing always goes up” was enabled by easy lending policies by lenders and the Fed accommodated this bubble plus all the housing porn on cable networks. Wall Street created the pen for it to play in. In similar fashion, people in trouble now realize “why pay when you can walk away” is a good idea and the flow of information is educating people on the reasons to do this. One of the reasons this is so appealing is the idea of simple living.

5 – Resurrecting Henry David Thoreau and Simple Living

Keeping up with the Joneses can be exhausting. In fact, we are seeing a shift in our culture that having less may be similar to having more. A couple of weeks ago, there was a fascinating piece on 60 Minutes highlighting the statistically happiest nation, Denmark. The U.S., as you may already know was nowhere even in the top 20. One of the main reasons for this I’m sure came to a shock to many Americans. Was it because they had more money? No. Was it because they had bigger McMansions and faster cars? No. In fact, there reason had nothing to do with money. It was that they kept their expectations low. If you lower the bar, even a slight success makes you happy. They interviewed four students and they were asked about their perception of Americans. One student to paraphrase said, “Americans seem to want it all. They want the bigger home, the better job title, the more expensive car. It never seems like enough. I’d be happy with having a healthy family and doing something I love.” This wasn’t said in a condescending perspective, but more as a naturalist looking at a habitat from the outside.

Many Americans are now realizing that being tied to material items comes at a heavy costs. If you have beaucoup debt you are unable to do other things. When you ask Americans to imagine a wealthy individual, they will tell you that they drive in a foreign luxury car, wear a $5,000 watch, and live in an uber McMansion. Yet the reality is very different. As highlighted in the Millionaire Next Door, many of the day to day millionaires drive nice but not super expensive cars, live in modest homes, and don’t spend ridiculous amounts on artifacts of wealth. The book was written before the housing bubble but the fact remains, wealth is not possession of expensive items. Wealth is having the freedom to do what you want. Having massive amounts of debt hanging over your head is not wealth, it is a financial albatross that will take your freedom away. Many Americans realizing this new concept, are deciding to walk away. So what if their credit is ruined, they can rent so the logic goes. This is a new sociological trend and is only in its infancy. These are not new however. The idea of being happy on very little was exemplified by families coming out of the Great Depression. When everything is taken away, many will realize a sense of liberty they have not experienced ever in their life.

Of course not everyone will welcome this change. We are a long way from having any sort of bottom or cleansing from this bubble and there are still entrenched interests that will fight to prop up the market. Deeply ingrained ideas take time to change but the seeds of change are sprouting up all across this nation. Why do you think the change message is catching on with many? There is something going on that is changing a large portion of society. Those that don’t take heed are simply ignoring the psychological facts of human nature. At a certain point cleaning out the garage is a good idea. Even if you doubt what is going on, simply look at the number of people walking away from their homes. We really need to prioritize our goals as a nation. You want to know where our money is going? Take a look at the breakdown for the Federal Budget top four expenditures:

Social Security: 21%

National Defense: 19%

Medicare: 14%

Interest on Debt: 9%

With only these four areas, we are spending a whopping 64% of our entire budget. And get this, the first baby boomers are now going into full retirement only to put more stress on Social Security and Medicare. Things do need to change and many Americans are finally waking up to the reality that the pied piper is back and seeking revenge.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “5 Reasons Why The Housing Market Will Continue to Decline Until 2010: Extrapolating The Free Ride Bird and Dancing with the Housing Pied Piper.”

“This is a new sociological trend and is only in its infancy. These are not new however. The idea of being happy on very little was exemplified by families coming out of the Great Depression. When everything is taken away, many will realize a sense of liberty they have not experienced ever in their life.”

I’m very lucky to have a Dad who was growing up during GD-1 and even luckier to have paid some attention over the years. The only thing he has ever bought not completely in cash was the $15,000 mortgage on the $32,000 house. New car once every 12 years or so.

Shut the door on that icebox !!!

Shut that light off – what do you think our name is – Edison?

Turn that tripe (on TV) off!!!

Throw that crap in the alley.

Wall Street is a den of thieves.

Save your money.

Don’t work for anybody else.

Many people dig their own graves with their own knife and fork.

Dr. HB

Well done. I couldn’t have said it better myself.

Oh, and I’m still waiting for the Iraqi oil revenues to pay for the war….

Great article … sort of an aside .. but … I’m curious about the paying interest on our debt point. Is that foreign debt? I’m not savvy in the ways of finance, but learning. Isn’t it the case that b/c the Fed loans money at interest to our market that one way are another that interest cost is passed on to customers down stream? In other words, isn’t a huge chunk of ‘the markets’ money ultimately going to service debt to the Fed?

So, the government makes money by borrowing it and we pay interest on that debt to China (or whomever) via our taxes, and the Fed prints money, and we pay interest on that debt to the Fed (via interest to the local money retailers). If I’m totally off-base on this perhaps someone could recommend a good book on the topic.

Anyways, thanks for your blog.

For me the one good thing about this financial mess is that it has inspired me to begin trying to learn how money and markets work.

I’m amazed at what I’ve learned so far about the economy and shocked that in the course of several years of education (enough for a Ph.D.) that nobody taught me about money. It’s both a fascinating and frightening topic!

Thanks For Educating ‘The People”

Sigi

As always, thank you for this site.

If it cheers anyone up, though, Calculated Risk continues to cast doubt on the notion that most underwater folks are “moonwalking” away from their mortgages.

The idea of walking away from mortgage obligations is just another example of the “Don’t Blame Me” generation. They want it all but, none of the responsibility associated with the payback.

As usual a great article with charts to substantiate your thinking.

Brilliant stuff and people need the constant reminder.

No or minimal debt + savings = freedom.

We have been pounding this into our own children’s heads, going so far as to ‘forcing’ them to turn over 10% of their income to us that we put right into their own savings. It took a couple of years, but they have caught the bug and are seeing the light. I only wish I had listened to my own parents on this.

Keep up the great work Dr…and please everyone, let’s fight any bailout schemes thrown forth by our pandering politicians.

Just to substantiate the spend now and save later, take a look at this:

“Despite Costs, More People Raid 401(k)s for Cash

Why the surge in 401(k) loans? Until recently, soaring home prices made it easy for consumers to tap their home equity for funds. But now that home prices are dropping rapidly in many markets, more workers, loaded with debt and struggling to make mortgage payments, are turning to their retirement plans. In the Transamerica study, which surveyed more than 2,000 full-time employees at for-profit companies, 49% of those who borrowed from their retirement savings said they took the loan to pay off debt, up from 27% in 2006.”

CBS MarketPlace

This is not a good sign. Going after your retirement accounts early is not a good sign especially to serve as a bridge loan. People need to do what they can to stay afloat but again, the idea of simply extending more credit as the cure all is quickly ending. Its like using your Visa Card to pay your Mastercard bill.

I agree that people shouldn’t be overly attached to their houses or to material goods. Either you’re in over your head or you’re not. If you are? Bankruptcy. Walk away. Go rent for a few years, it won’t kill you.

Otherwise? Pay off your debts and live within your means. It’s a nice feeling, waking up in the morning without having to worry about money. Most people don’t seem to think like that, though. If I took a trip down the street to the local mall I’d see a parking lot filled with BMWs, Mercedes, Lexuses, Hummers, etc. Most of these were probably purchased via a HELOC.

I, on the other hand, sort of like my 12-year-old Japanese car. It runs great. Just a little while ago I was planning my next tropical vacation.

Yes, I need to learn this too: “Blessed are the poor in spirit, theirs is the kingdom of heaven.”

While I wouldn’t argue with any of the points you made, how do they add up to 2010 being the end of the decline?

Will everyone STOP grouping Social Security with the rest of the US budget, I want the ~2.4 trillion of Social Security Trust paid back by whoever took it, tax cuts for the rich, wars, whatever. Yes it is, time to pay the piper!

The book called Affluenza by Oliver James describes how the need to have more material things causes more depression and that the Danish people are much happier because they don’t have the Affluenza Virus. Excellent blog you have.

It must be noted that Social Security isn’t like the other categories of public spending – it’s financed by the payroll tax (with a surplus), and its finances aren’t really comparable to, say, defense spending which is an expense that comes out of general revenue.

Social security is a ponzi scheme, let it fail

Baby boomers in the US have always been more numerous and had more of everything than any generation ever did or ever will again. For all their talk about “sustainability” and “new leadership,” look at where we’re at! They talk about it, buy books about it, hold salons about it, then live like absolute gluttons and spoiled brats with no sense of anything other than themselves and now. Maybe the rest of us younger people can teach this generation of entitlement minded irresponsible brats a thing or two about taking responsibility and living within our means. I’m not worrying about the rebalancing. I’m not looking forward to it either. Already boomers of my acquaintance are throwing fits everywhere I look because their pipe dreams are ending. Like all addicts they’re looking for a substitute addiction. Now to “frugality.” But it’s a healthy rebalancing and needed and anything deferred is that much more painful. As for the “new frugality,” I’ve always lived this way. Leave it to boomers to try to turn it into a lifestyle trend. Oh well, there’s always a dollar to be made translating stupidity books, particularly idiot’s guides.

We sold our home in Calif in 2005 and have been living in a motorhome waiting for the house prices to crash. We were so sure this was going to happen. But now stupid Bernake is ruining the interest rates. How does anyone live on 3.25%? We will all have to have a million dollars to retire! We have 1/4 of a million and we are barely getting $10K/year in interest.

Even in the trailer paying no rent you can’t live on that.

Social Security is hardly a Ponzi scheme. More like a Very large insurance fund. A fund that was robbed and the perps will walk .

Is there anyway for the rich and wannabes to get priority to service in defense of the Homeland? They are the beneficiaries of all the trading in blood for oil anyway.

Texas justice steal a loaf of bread get 50 years, steal peoples dreams and future you are a hero. Did that ENRON guy really die, his widow sure lucked out.

How can anyone blame banks or mortgage companies for bamboozling people who didn’t add, subtract, multiply, and divide before signing a complex financial contract? People who wanted the next new shiny exciting thing and didn’t bother to think about anything else? Who figured they could walk away from any commitment they didn’t feel like honoring, or sue and make someone else pay? And what does this say about elementary education?

I didn’t get my arithmetical skills in grade school, which by the 1960s was too busy scrambling my brain with New Math to teach me anything practical. Nor in high school, which taught me to pass standardized tests with high scores so I could get my Ivy League education. My father (born in 1919; I’m 49) was a sheet-metal mechanic with only an eighth-grade education. He sat me down when I was ten to show me how mortgages worked. He taught me about compounding interest. He showed me how the interest on loans crushes a household budget. He showed me how a person needs to save against the vagaries of historical cycles, and how the banks aren’t in the business of being on your side. He taught me about the Rule of 72. My mother would welcome my wanting to help calculate and write out (and later contribute to) bills, showing me how she managed our household’s very modest finances (120 dollars a week up to the early 1970s). She carried a clicker calculator at the supermarket, and we shopped from a list, and we banded together with others to get bargains.

These lessons–and the experience of going through the runaway inflation of the ’70s with these people as parents–made all the difference in my life. And in my current lack of fear about the rebalancing that’s unfolding. In place of this simple common sense and wisdom, and solid skills that people used to get in four to eight years of public schooling, we now have a culture of acquisition at all costs.

@finnskogar

Not long ago on Minyanville this post, “The Courage to Choose,” appeared. Addressing the ‘culture of acquisition’ that you mention, the author posits a slightly different term – the “Age of Aspiration.” He also bemoans the loss of, and need of reintroduction of, four words: “I can’t afford that.” http://www.minyanville.com/articles/index/a/15340

Insofar as your comment as to ‘why blame the banks’? That is a classic ‘caveat emptor’ argument, but also pre-supposes that those who took the loans actually had the capacity to understand the information and operated in an emotional vacuum, where they could make rational decisions. While I understand your point, I would counter that the banks were active participants in providing irrational financial instruments and then pushing them along with irrational propaganda (ever see the American Dream ad series by, say, the NAR, CFC, BofA, WAMU, or any other large financial institution?) Consequently even somewhat sophisticated borrowers bought in.

That does not absolve the borrowers, of course, and I oppose bailouts. However, IMO, absolving the financial edifice of culpability in this debacle irresponsibly encourages Moral Hazard by those same providers. The analogy made here and elsewhere of lenders as “Toxic waste pushers” is for a very good reason – would you absolve a company that wittingly or unwittingly provided poisonous or noxious goods to a buyer to get off scott-free, by arguing the buyer ‘should have known’ that what they were buying was toxic? You yourself bemoaned the educational system – if it was / is structurally incapable of providing elemental economic education, then how are the students who are required to attend to learn about how to deal with fraudulent suppliers?

It’s not so much whose fault anymore – most everyone will feel the pain. It’s how do we teach the next generation of buyers those economic principles that your folks so commendably taught you. That, plus punish those companies who pushed the toxin right along with those borrowers who are now being economically and credit punished for buying in.

Wow, great article and this really nails it “Wealth is having the freedom to do what you want. Having massive amounts of debt hanging over your head is not wealth, it is a financial albatross that will take your freedom away.”

Back in 2005 I saw the real estate market reaching insane levels and I got to the point where I said to myself, “Time to sell” I could hardly sleep at night when the house didn’t move after a month. In October 2005 my house closed and I walked away with a very nice 6 figure sum only to have my friends say I was crazy to sell as the market was going to the moon.

Fast forward to today, A friend just confided in me, he is walking away from his house. He had a second @ 15% and was always on the yearly refi program. He called the lender and said see ya. His credit was already in the dumpster, but he looked good and smelled good and drove a nice sports car. His neighbor was a speculator and owns 5 empty homes that he is unable to rent in the same neighborhood to cover his costs. He figures if he rents them at market rates, he’ll lose 5-6K a month. So he’s walking away as well.

I live in the Seattle area and everyone is singing the same song here, “It’s different, we’re immune” Yeah right. My wife and I are watching the market to buy another home and figure next February or March 2009 might be a good time to get serious. This all depends on interest rates, however. The only way to prop up the dollar at this point is to raise rates, I’m afraid.

The “Millionaire Next Door”, should be required reading for anyone who cares about their financial future.

Just read a brief article in the North County Times about the town of Murrietta, which is setting up foreclosure clinics (and is planning to fine banks for untended properties.) http://www.nctimes.com/articles/2008/03/05//news/top_stories/1_10_273_4_08.txt

It says that over 700 houses have been foreclosed on and another 600 are starting the process. That’s 1,300 houses in a city of about 95,000. Assuming each house holds about 4 residents and no one lives in apartments, then there are roughly 22,000 houses in Murrietta. So at least 1 in 22 houses in Murietta is bank owned (or just about to be)?!

“why don’t we leave out the Dark Ages and the Inquisition out of history books?”

Dark ages? You mean those with spledid sword fights and glory knights? What’s wrong with that?

Yeah it is in the history book, but we only want the good part of it.

I think it will not decline despite of economic crisis. Shelter is a basic commodity.

HELLO?! Although I know my way around, I am no economic expert but I could see there was something wrong (the water was receding before the tsunami, I guess.). When I would bring this up to people they would tell me to enjoy the ride, how prices in Florida were just too low for too long. I thought maybe I was worrying for nothing but I guess that nagging doubt was right after all. Better to listen to your gut then a expert who’s first solution is to buy more of the toxic debt nobody wants.

People were buying way over their head. Instead of a starter home, the young couple wanted the big house with a pool. It was hard NOT to sell a house. They got questionable loans & didn’t seem to care about the penalties even after explained to them. But how can the same exact model house be going up $10,000 a month with no sign of hitting the brakes? It was a literal run away train. The builders were giddy buying up lots & completely filling in blocks of vacant land within weeks (I still have many vacant, never occupied homes around my home for 15 years with tall grass). Where were the jobs? With all the experts we hire, nobody can COUNT the number of building permits & figure in how much more or less roads, services, drainage, schools, etc. are going to be needed for this growth. These ivy league school grads are full of stale air instead of any new ideas.

Our next President should have a YEARLY review with objectives & consequences, like we all have. RESUMES do matter but only the accomplishes count. Everyone can ask, “What have you done for me lately?” It’s about time the People of this great country get to say, “YOUR FIRED!” Let’s push our agenda…not theirs.

Leave a Reply