4 Economic Trends and Stories Impacting the way you Live: Retail Sales up Because of easing in Credit Standards, Millionaires no More, Bankrupting on Foreclosures, and Bear Market Rallies come out of Hibernation.

The market seems to be in a bear market rally. This is typical and driven more by technical measures as opposed to fundamental signs of health in the economy. Initial unemployment claims are at a record high coming in at 654,000 for February. This tells us that we can expect unemployment to be a major factor in 2009. In addition, 4 states now have unemployment over 10 percent including the biggest state in the union, California. Retail sales decreased slightly but this in large part has to do with credit becoming a bit more accessible in recent weeks. Yet is this really a sign of health? This hits at the core of the paradox of thrift where the only way people can spend more is if they go into further debt.

Now there are four stories that I want to discuss today because I believe they give a solid sense of what is currently going on in our economy both on a sociological and financial level. The first story we will discuss is the slight decline in retail sales. You may be asking yourself, how can retail sales be going up while unemployment numbers keep going higher and higher? Simple. It is the problem that got us here in the first place and that is spending via debt. The next story highlights the enormity of the wealth destruction in 2008. Millions of millionaires can no longer claim the status of millionaire. Many of these, were investors with the guru himself, Bernard Madoff who is now going away on a nice unpaid vacation. The third story we will discuss is that bankruptcy and foreclosures are still rising in this climate. What is disturbing about this is we have invested hundreds of billions to stem foreclosures and yet very little is improving. Bottom line? It is money poorly spent especially money going to bailout Wall Street and banks. And finally, we will examine previous bear market rallies including those during the Great Depression. Keep in mind the market was rallying in the early 1930s as unemployment kept making its trek upward to 25 percent.

Retail Sales – The Truth in the Pudding

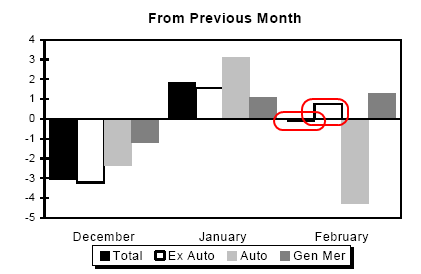

As is becoming common, expectations have now been lowered to the ground where the news that a company turned a 1 cent profit is sufficient evidence to create a triple digit rally. Yet people forget that companies are in the business to turn profits! So this shouldn’t be a stunner but that is the kind of market we are currently in. The general market was expecting a drop in retail sales for February of 0.5 percent. As it turns out, retail sales fell only by 0.1 percent. Excluding autos, retail sales actually went up 0.7 percent. Let us take a look:

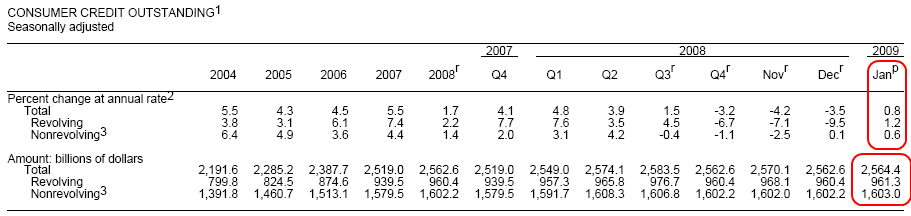

This is great news right? Not exactly. In recent weeks there has been a massive push to increase liquidity in the consumer credit markets. This includes the U.S. Treasury pumping up their TALF program which seeks to increase access to consumer debt. You might be asking yourself, “but isn’t massive debt the reason we got into this mess in the first place?” Correct. So logically in the mind of Wall Street it would only make sense to double down and increase debt. And we can even show that some of this bounce in consumer retail spending was due to more debt:

*Click for sharper image

What a shocker. Revolving and non-revolving debt increased in January according to data from the Federal Reserve. In fact, this increase came on top of 3 consecutive months of contractions in the credit markets. See, it would be one thing if our country was seeing low unemployment and a healthy economy. Then you would expect to see a normal increase in credit. So the fourth quarter of 2008 was realistic in that consumers were pulling back because of the forces of reality. That is, they had spent too much just like those on Wall Street. However, increasing liquidity in the debt markets only sets us up to a deeper and more painful contraction when it does occur because we are denying reality.

I remember a few years ago when I started this blog, an unbiased observer looking at the housing market would easily recognize that it was a bubble. Incomes did not justify prices. Yet many (I would argue most) did think things justified the prices. Either way, this has proven to be wrong. You cannot inflate your way to prosperity. Yet here we are again trying to prop the market up with the illness that got us here. It is somewhat disturbing to say the least.

Millionaires Drop – Blame it all on Madoff

Austerity is hitting everyone. Including those at the upper echelons of our society:

“March 11 (Bloomberg) — The millionaires’ club in the U.S. became more exclusive last year after a 38 percent drop in the Standard & Poor’s 500 Index helped thin their ranks to the fewest since 2003.

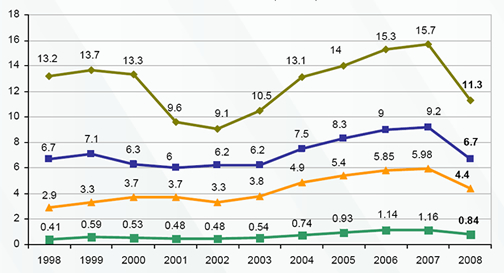

Families with a net worth of at least $1 million, excluding primary residences, declined to 6.7 million in 2008, a decrease from 9.2 million a year earlier, according to a survey of 3,750 high net-worth U.S. households conducted by Spectrem Group.”

The U.S. has now lost 2.5 million millionaires. Now, this doesn’t mean they are broke and living on gruel but it does make people think about the perma-growth model. What is the perma-growth model? It is this belief that everything can keep going up with no unintended consequences. More cars can be added to the world with no issue. Homes can keep going up in value no matter what. There is no end point for Starbucks locations. The stock market is assured an 8 percent return each year. These are all wrong models yet we were operating under that assumption for decades. Now we are forced to deal with the consequences. The world does have limited resources. Many of these millionaires now realize that markets can retract and retract fiercely.

Of course, many of these millionaires thought they were diversified in the market. That is not the case. We are now back to approximately 2003 levels (look at the purple line):

*Soucre:Â Spectrum Group

Now keep in mind this data runs up to the end of 2008. Well as many of you know, the markets have been getting hammered in 2009 aside from this bear market rally so we can expect more folks to fall out of the millionaire rung. I wouldn’t be surprised if we go back to 1990s levels erasing the real estate and equity bubble of this decade. I know many in this group may feel “poorer” but much of their wealth was clearly on paper. Keep in mind many of these millionaires were in savings or out of the market so their wealth remained. Yet the fall off by 2.5 million, a drop of 27 percent shows you how many were dependent on the bubble for their paper profits.

Even the uber-wealthy saw declines:

“The number of households with a net worth of more than $5 million declined to 840,000 in 2008 from 1.16 million in 2007, a 28 percent drop, according to the study.

Affluent households, which the survey defined as those with net assets from $500,000 to $1 million, fell to 11.3 million from 15.7 million, also a 28 percent decrease, Spectrem said. ”

So roughly 1 in 4 millionaires got knocked down a rung in 2008.

Bankruptcies and Foreclosures

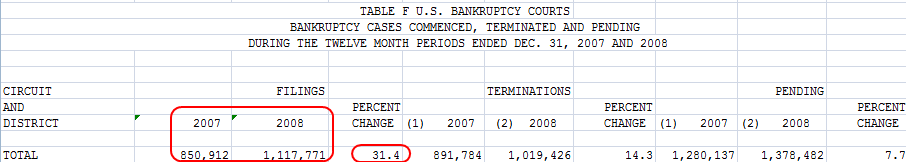

Another troubling indicator of market distress is bankruptcy filings. You need to remember that this is even more indicative of the difficulties in the economy because legislation has actually made it harder to file in recent years. Overall filings are up 31 percent in 2008:

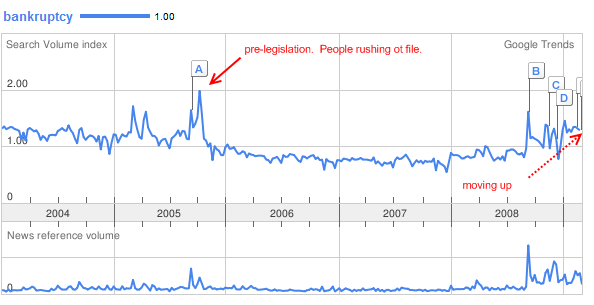

This is data from the U.S. Courts Federal Judiciary site and tells us much about what is going on in our economy. This has been a steady increase. Since December of 2006, there were approximately 600,000 bankruptcy filings. December of 2007 had 850,000. We are now at 1.1 million. You can expect this number to only go up in 2009. The quarterly data should be out sometime in April for the first quarter of 2009 but we can safely assume that it will be higher given the turmoil in our economy and massive job losses. You can already see this trend via Google Trends:

Expect more of this in 2009.

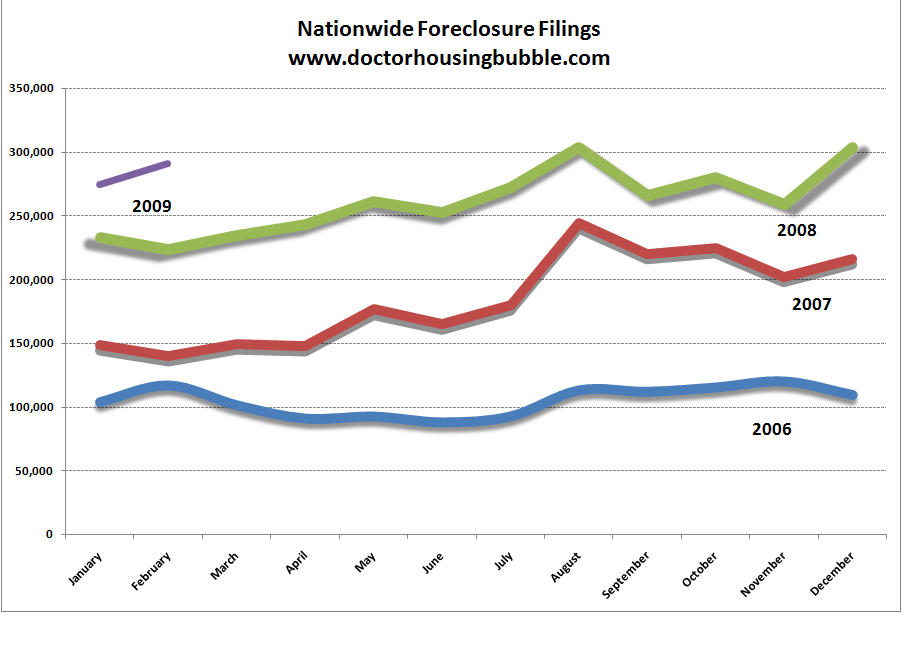

Also, another fundamental sign the economy is still in tough times is the rise in foreclosures. What is more troubling about the data released this week is this is in conjunction of all the major programs, moratoriums, historically low rates, and every imaginable thing being thrown at the problem. What this tells us is people were treading lightly and someone living paycheck to paycheck who just lost their job is going to be helped very little by a low mortgage rate. And this is another reason that I see this crisis lasting well into 2011. Even though we may see a bounce in the stock market earlier, the fundamental real world feel is going to be deep for Americans for years. Let us look at nationwide foreclosure filings:

You can already see that we are starting higher than 2008 and that was a historically bad year and we didn’t have access to all the moratoriums or loan modification programs in the current market. The fact that we have hundreds of billions in Option ARMs and Alt-A loans in the market yet to hit their mutating ways, we can expect this problem to last for a few years.

Bear Market Rallies

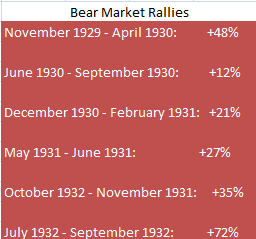

Some people think that stock market rallies only happen in full on bull markets. That is not the case. In fact, some of the fiercest short term jumps happen when the economy is in utter disarray. Let us take a look at the Great Depression for example:

From November of 1929 to September of 1932, the Dow saw 5 rallies over 20+%. One hit 72% and one hit 48%! In fact, the 72 percent rally happened right after the market hit the abyss. Yet as we all know, the Great Depression caused fundamental problems in the economy that lasted the entire 1930s. So only looking at the stock market as an indicator is problematic. And keep in mind the rally occurred right on the heels of thousands of bank failures in the 1930s and unemployment spiking to 25%.

We also have the problem of interpreting math results. For example, everyone was cheering the 40 percent rise of Citigroup this week but forgot to mention that this amounted to 40 cents. You gained 1 quarter, 1 dime, and 1 nickel for each share you owned. The rally we are currently seeing is strictly a technical rally. Don’t fool yourself into thinking otherwise. It is the same as the Great Depression bear market rallies. We will test lows again soon. Maybe once those stress tests are released or when the 1st quarter results are announced starting in April of 2009. For the mean time, enjoy the bear market rally.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

27 Responses to “4 Economic Trends and Stories Impacting the way you Live: Retail Sales up Because of easing in Credit Standards, Millionaires no More, Bankrupting on Foreclosures, and Bear Market Rallies come out of Hibernation.”

I hate to say it but I am a bankruptcy attorney. I also litigate. I get at a minimum three calls per week from potential clients who want to sue their lenders for allowing them to borrow money.

I was working at a pizza shop making $30000 a year and I bought a house for $500,000 with no money down. In fact I walked away from the closing with $3000 which I used to buy a car on credit.

The house is now worth 250,000 I cant sell it and why should I pay the mortgage of $3800 a month.

That was America and for that matter the world. Look at Great Britain, they are in the same situation.

I deal with CEOs. Most are there to enrich themselves. They could care less about their employees or stakeholders. They would rather take a 4 million bonus when a company had a bad year than to forgo it and keep 30 people working. I dont believe them. I dont trust them. They lie and get away with it. It is all about them.

We dont need the real estate market to go up. We need it to stabilize. However, that is not going to happen until at least 2011. Until the market stabilizes and stops its free fall then the buyers will stay on the sidelines. It is that simple.

Koolaid is King

The prevailing mentality is that this will all pass and it will be business as usual soon. Every day more people are starting to figure out that “money for nothing and your chicks for free” is just not a sustainable way to run a society. There must be more to life than steal from anyone and party ’til it’s over. I guess what is amazing is that many of us are kind and generous, but that so many are evil. Is that all we can think to do with this brief time we have here under the sun is accumulate un-affordable junk and party until it’s time for the dirt crib?

Anyone have thoughts about the deflationary/inflationary cycles that are going to be hitting us soon? I agree with the good doctor on most things, especially his post about CA housing not hitting a bottom until 2011, but with all of the fiscal nonsense that’s happening nowadays, it almost seems like we of sound mind should get our money into something of substance before inflation diminishes the money that we’ve squirreled away in the bank.

Anybody have any suggestions where to look, charts, data? Thanks.

Loved the article, some good comments by others as well. I will be the first person to say I gave up on predicting what is going on in our economy. I think the bottom line is that we don’t know.. Now, yes we know some of the factors that pushed us in this direction, however at this point it is purely emotional and the markets are just starving for some confidence…

http://utahcribs.wordpress.com/

In the graph from Spectrem Group:

The number of affluent people with net worth between $500,000 to $1 million are represented by the brown line at the top.

< Notice that the number now is lower than the number in 1998

The number of millionaires is represented by the purple line (second from the top)

< Notice that the number now is the same as it was in 1998

The number of people with net worth of $1 million and $ 5 million are represented by the orange line (third from the top)

< Notice that the number was increasing significantly between 2002 and 2007, then dropped 26% in 2008.

< The number in that group is still well ahead the the number in 1998, even after last years drop.

The number of people with net worth of over $ 5 million are represented by the green line (bottom line)

< Notice that even with the drop in 2008, the number of mega wealthy has more than doubled in the last 10 years.

For the most part, the affluent ($ 500K to $1 Million) and the millionaires are the people that work the hardest and have the most EARNED INCOME. Â Many of them are small business owners. Many of them are baby boomers who reached the peak of their earning potential in the last 10 years. Â The number of millionaires should have jumped up a lot over the past 10 years. Â Why not? Â The people with the highest EARNED INCOME also pay the most income tax ( over 30%). Â The overwhelming tax burden has made it difficult for them to get ahead in real terms.

A lot of the mega wealthy are the banksters and crooked CEOs that made a killing in the last 10 years. Â in 2006 the average CEO earned $ 430 for every $1 earned by the average employee. Â Many of the banksters earned more in a month than an ordinary person earns in a lifetime. Â The mega wealthy have a lot more UNEARNED INCOME (capital gains, tax free municipal bonds, etc. Â The megawealthy only pay about 17% income tax.

Here is the real kicker. Â A millions dollars today is worth a lot less than it was worth in 1998.

This screen shot is from the Bureau of Labor Statistics Inflation calculator at: Â http://data.bls.gov/cgi-bin/cpicalc.pl

When you take inflation into consideration, the number of millionaires would need to be 30% higher today just to stay even with the number in 1998. Â In reality, a lot of wealth has evaporated in the past 10 years.

The screen shot from the Bureau of Labor Statistics website did not copy and paste into my comment earlier. Type in “1998” and “2009” to see the effects of inflation.

Has anybody figured in the fact that around late January and thru February and March most households receive their tax refunds?

Yes, there is more money out there right now… but it is short lived and not income from wages. Most low income households with children enjoy a nice tax (pay) check around this time and they spend it… fast and furious.

By April that money will be gone… and then what?

Citigroup profits?!!!!! Bwahahahahhahahahaha!

How many BILLIONS did they steal from us?

How many billionaires have the bailouts made?

Kill ’em all. Just kill ’em.

Comment by chubbuni13

March 13th, 2009 at 12:06 pm

Anyone have thoughts about the deflationary/inflationary cycles that are going to be hitting us soon? I agree with the good doctor on most things, especially his post about CA housing not hitting a bottom until 2011, but with all of the fiscal nonsense that’s happening nowadays, it almost seems like we of sound mind should get our money into something of substance before inflation diminishes the money that we’ve squirreled away in the bank.

Anybody have any suggestions where to look, charts, data? Thanks.

____

Don’t worry about inflation. The real problem is that there is not ENOUGH income in the US to pay the bills as it is. It is basic supply-demand – 1st week of Econ 101.

>>

If households do not have enough income to pay for the car, the house, college, food etc, then prices have to drop to the point the where sellers can sell those things to buyers. Doesn’t matter how many people would like to buy something as the real question is (a) how many want to buy it AND (b) can afford to buy it.

>>

For there to be inflation in prices, there would need to be inflation in incomes. Right now (and for quite awhile in the future) there is an excess supply of workers (around 22,000,000 out of 150,000,000 in fact.) An excess labor supply means that wage increases are not bloody likely.

>>

This “oh god there is going to be inflation’ is being pushed by the right-wing alarmists who hate unemployment insurance and a whole host of similar things. It is a scare tactic.

>>>

The situation in Germany in the mid-20s is NOT comparable. That was a problem caused by the valuation of the mark based upon the gold standard which was then in vogue. In short Germany did not have enough gold to back the money in circulation but more money was needed to run the economy and issuing it devalued the mark in terms of the gold backing it….. Much more complicated than that but it had to do with the gold standard. VIrtually every country in the world went off the gold standard in the early ’30s as it turned out to be deflationary for their economies.

>>>

The inflation in the 70s occurred from the external shock of oil prices. The inflation kept going up and up because workers were able to obtain increases in income that not only kept up with inflation but kept their incomes above the rate of inflation. That created an inflationary spiral. And as explained above, rising wages are not on the menu in the US this time around.

>>

This topic has come up occasionally at the Economist’s View. You can go pull up the old articles there. http://economistsview.typepad.com/economistsview/

Dr. HB,

As a fellow Californian, I hope you’ll help get out the message that Prop 1A is a fraud and a massive tax increase.

Thanks,

W.C.

You can’t drop taxes forever. I don’t think Prop 13 is going to be repealed anytime soon, and the money has to come from somewhere.

I love you Dr. Bubble! Great articles & keep up the good work. U are right on target.

AnnS:

“If households do not have enough income to pay for the car, the house, college, food etc, then prices have to drop to the point the where sellers can sell those things to buyers. Doesn’t matter how many people would like to buy something as the real question is (a) how many want to buy it AND (b) can afford to buy it.”

AnnS, you fundamentally misunderstand inflation. Don’t worry, 99% of people would agree with you, given the sorry state of education today, so consensus is on your side.

Inflation is not a function of wages, but a function of creating of too much money, either credit or printing-press money.

This is why counterfeiting is such a heinous crime – only Governments are allowed to counterfeit!

Comment by Kaboom

March 14th, 2009 at 5:41 pm

AnnS:

“If households do not have enough income to pay for the car, the house, college, food etc, then prices have to drop to the point the where sellers can sell those things to buyers. Doesn’t matter how many people would like to buy something as the real question is (a) how many want to buy it AND (b) can afford to buy it.â€

AnnS, you fundamentally misunderstand inflation. Don’t worry, 99% of people would agree with you, given the sorry state of education today, so consensus is on your side.

Inflation is not a function of wages, but a function of creating of too much money, either credit or printing-press money.

This is why counterfeiting is such a heinous crime – only Governments are allowed to counterfeit!

___

I DO NOT “MISUNDERSTAND” INFLATION. After multiple degrees – incuding economics – I know exactly what “inflation” is.

>>>

Alll this “oh there is too much money in the system and it is the money supply that causes inflation” is a lot of HOGWASH! That is the bet cry of the wacky right-wing libertarians who keep pratting on with discredited theories and wailing ath we aren’t on the gold standard (a disasterous mechanism with incrasing production and a limtied supply of gold that worsened deflation in the ’30s.).

>>>

It is COMPLETE nonsense and flies in the face of the fundamental concepts of supply and demand determining prices. Doesn’t matter if there is an extra virgin $200,000,000,000 sitting in a vault. If the money is NOT in the hands of potential buyers, it does NOT afect prices. Period.

>>>

Inflation in the prices of goods and services can only happen if there are enough buyers who have enough money to drive up the prices.

>>

And an increase in incomes in the US for the bottom 90% is not bloody likely.

And Kaboom – I’ll stack my graduate degrees in those subjects up against the condesending nonsense from you any day!

Unemployment in Los Angeles is now 12%. 12%, that’s just an astounding figure for the official rate, which leaves out so much!

Still housing prices refuse to drop as much as they need to. I’ve noticed that people are renting out their houses rather than selling them in the down market. Maybe the Dr should discuss this new scenario (never have there been so many houses for rent before in my opinion). Now these housing rentals can’t possibly be profitable unless these people bought years and years ago (before the bubble). But then many people did buy years and years ago. And everyone is in denial (not just a river in Egypt) that the new housing prices are here to stay. But short of the very high inflation scenario, it seems we will have to have affordable housing prices. We are going through hell first to get there though (12% unemployment already!). All those responsible for this housing bubble should not be forgiven.

Thanks AnnS and Kaboom for your insightful comments. I don’t have an economic background but it just seems like the US government already has a crippling debt load and with all of this new spending, the only way it can alleviate some of its burden is to inflate away that debt printing money.

Still, I think it’s a good point that you make AnnS about a surplus of workers competing for fewer and fewer jobs. I am eagerly awaiting the demise of the West LA housing market as my fiance and I have money in the bank and are just waiting for prices to come down to reasonable levels. Thanks all.

I hope everyone watched the Daily Show on March 12. Jim Kramor just got ROSTED! I can’t believe it was John Stewert who exposed one of the biggest finantial fraudsters on TV.

Go to the Daily Show homepage if you haven’t watched it, it’s unapoligetic & to the point. I was blown away in how Jim couldn’t get off the hook, although he did try.

Truth be tolled, I’m not a DS fan.

Ok Kaboom you need to get more specific on whether you believe inflation or deflation will occur the rest of this year. All you gave was a definition. Will more credit or less credit (money) be created this year. I believe AnnS was correct in her assertion that with falling wages there will be falling prices. Everyone knows the FED wants to restart the credit bubble, but so far they have failed spectacularly.

Another term for Perma-Growth?

~

Cancer.

~

The end is the same, too.

~

rose

AnnS:

“I DO NOT “MISUNDERSTAND†INFLATION. After multiple degrees – incuding economics – I know exactly what “inflation†is. “

Ben, Ben Bernanke, is that you? Your literacy skills are on the wane, despite your multiple graduate degrees. In fact, you sound like embittered trailer-park trash, living upon Government hand-outs, and re-living your “glory” days.

Kihei, a good and salient question, however, a credit contraction is not deflationary, despite what leftist trailer-park trash might say. Credit is not “money”, it is fictitious.

If credit reflected “savings”, then yes, deflation would be a worry. However, where credit evaporates, and a credit binge implodes, the only loser are the lenders, and those who have to pick up the tab – you and me – the taxpayers.

People who do not pay taxes through choice or circumstance are the winners.

We should have seen this coming, when you let wall street run around with zero oversight and zero laws holding them back, this was bound to happen eventually. It does not help that they all employ the lobbyists that buy off your elected leaders.

AnnS – wow, a degree in economics. Ben Bernanke has a degree in economics, too, as did Sir Alan Greenspan. They’ve “helped” us so much, because their degrees enabled them to sidestep simple, inconvenient things, such as common sense.

I suppose that degrees are so exceptionally meaningful, so unfathomably important, because they convey an intimate understanding of the world that everyone else simply cannot grasp. Just ask, for instance, degreed individuals such as Hank Paulson, G.W. Bush, Dick Cheney, Alberto Gonzalez, Robert Rubin, or Franklin Raines. Let’s throw Robert MacNamara into the pool, too, because he was one of the “best and brightest.” All hail those with degrees, and bow down to their knowledge!

Sit down and read a book entitled “Propaganda” by Jacques Ellul. You might come to understand that the most “educated” individuals in a modern society, i.e., the society’s intellectuals, are themselves exceptionally prone to propaganda and thought pattern limitation. They’re also the least likely individuals to realize that such is the case, largely because of their self-reinforcing belief that they, being well “educated,” must have “learned” that which is correct and true.

I have multiple degrees, too, spanning both hard and “soft” sciences. BFD. After many decades of real-world experience, I’ve come to realize that modern degrees are basically “certificates of indoctrination compliance,” and they convey nothing about a person’s ability to truly t h i n k. I personally know geniuses that didn’t graduate from college, including one whose highest level of education was the 7th grade. I also personally know several Harvard MBA’s whose institutionally-certified profound educational and business expertise directly ran several companies straight into the ground, despite advice repeatedly provided to these MBA’s by various lesser-degreed individuals over the past several years.

Perhaps, since you’re multiply-degreed, you can tell us exactly why a) society has arrived in the current situation; b) the vast majority of others with single and even multiple degrees (including economists) overwhelmingly failed to foresee the current situation; and c) such degreed individuals failed to successfully navigate society along a (much) less problematic path than we’re presently experiencing. Please also precisely explain exactly what we should do to successfully remedy the present situation(s) in the shortest timeframe possible.

After all, isn’t it time to put each of your degrees to good use?

Comment by AnnS

March 15th, 2009 at 1:19 am

And Kaboom – I’ll stack my graduate degrees in those subjects up against the condesending nonsense from you any day!

“Condescending nonsense”?

I fervently hope that you are not going to pull the “Race Card” on me.

Or is it the case that my apparent “condescension” was perceived by you as manifesting a sense of intellectual superiority?

In any case, despite your strident ad hominem quoted above, I can assure you that your post of 13/3/09 11:10 p.m. was full of holes, and I am frankly surprised that you are so offended that someone had the temerity to point this out.

As we say in the GRWC, “tough luck”.

@Kaboom

Although it may be futile, I think the point is that although we have been printing money as fast as we possibly can since the S&L bailout of the 80’s, the dollar has actually strengthened in many of those years, backed only by an enormous financial house of cards and the world’s most powerful military. Zimbabwe cannot print all of the dollars that they wish to, but for various reasons we can, until someone blinks (such as Wen Jaibao). We’ve tried the gold standard a number of times, but like everything else, there is no algorithm to compensate for human behavior. The world has become too complex for simple theories, although I like Ron Paul too.

Doc, I think we need an Rx for some Nap Time here.

~

Trust you all saw the news that a trillion in Magick Monopoly Money is going to go from the Fed to the T:

http://www.nytimes.com/2009/03/19/business/economy/19fed.html

~

Compare that trillion to the overall M1 and M2 money supplies:

http://www.federalreserve.gov/releases/h6/Current/

~

I.e., as an order-of-magnitude exercise.

~

Commenter #41 at the NYT piece noted, “It’s not federal and there are no reserves. Just debt, inflation, taxation, war and tyranny.” Hear, hear.

~

rose

This has been some good material you provided relating to this matter. I do not go along with every thing, nevertheless, you undoubtedly made some very nice points.

Leave a Reply