2010 Economic Forecast for California: What 10 Reasons Will Keep a lid on the Housing and Economic Recovery for California?

Every December I like to do a synopsis of the California economy and the impact on housing. 2009 has been a tough year for housing. If we had to sum up what occurred in California it is that housing sales jumped because of massive cuts in prices. Without the giant crutch of FHA insured loans and the Federal Reserve artificially keeping mortgage rates lower housing would be in a different position. And the other position isn’t necessarily bad. Lower prices would lower the housing burden on many. Keep in mind that the bailout of crony Wall Street with backstops of $14 trillion would have been enough to pay off every single prime, near prime, and subprime mortgage in the entire country. What the bailouts accomplished was to repair the failed bets placed by the crony bankers. The proof should be that 2009 saw the largest number of foreclosure filings and many Wall Street banks are dishing out record bonuses.

So here we are, nearing a close to the 2009 year and California is still in a difficult position economically. The unemployment rate is the highest on record and the government is bleeding money since revenues have evaporated. The access to easy loans is now gone but people can still get lenient terms with FHA insured loans.

My prognosis for California in 2010 is a continuation of a weak employment environment, continuing fiscal deficits, and a popular election that will focus on the economy. The housing market will continue to remain weak but we will see more price cuts appearing in mid to upper priced neighborhoods. Let us go through the 10 reasons why the California economy and housing market will face another challenging year in 2010.

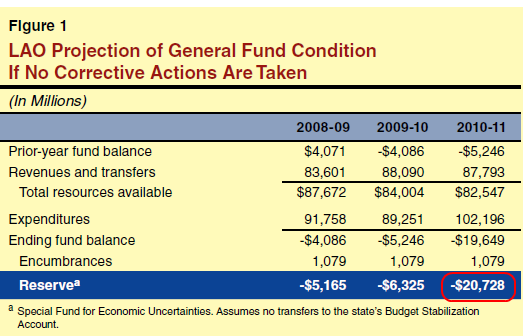

Reason #1 – Budget Deficit

There is probably no better indicator of the health of the current economy then current revenues into state coffers. The state of California has high income, sales, and capital gains taxes that go up in boom times and tank in recessions. This recession has caused shock and awe to those in Sacramento. In the last go around the state had to patch up some $60 billion in budget deficits. People took a deep sigh of relief but the reality is, we are facing another $21 billion budget deficit next year. The above data highlights this problem.

And it isn’t next year alone. The Legislative Analysis Office projects $20 billion annual budget deficit up all the way through 2015. This is going to be a drag on the economy without a doubt. How did we patch up the last gap? Big cuts and taxes. That is the only way to balance a state budget. Hard choices will need to be made next year yet again. Whatever the choice happens to be Californians are going to have less money in their pockets.

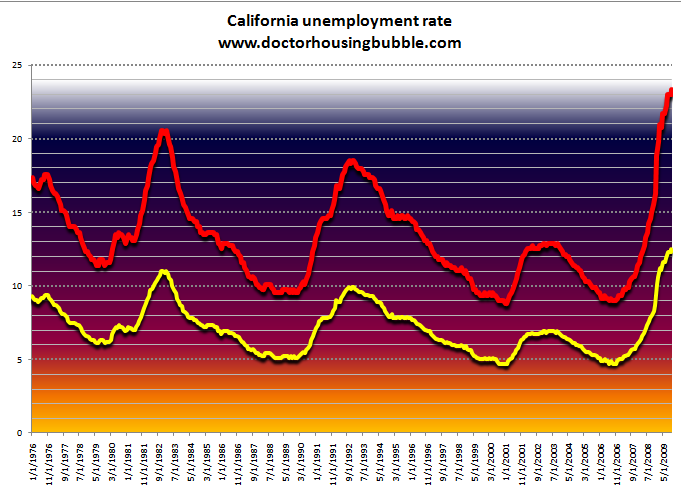

Reason #2 – Unemployment

I find it troubling that with all the talk of housing programs, tax incentives, cheap mortgage rates, and other subsidies that the most important driver of housing is missing. Jobs. The vast majority of Americans pay their mortgage with income they earn from a job. This is so obvious yet the lack of attention here shows how out of touch Wall Street and banks are from average Americans. Unemployed Californians are less likely to buy a home. They are also less likely to buy big ticket items.

One aspect of the California economy that is rarely examined is how closely housing was tied to many big revenue industries. Finance, construction, retail, and other aspects of real estate industries provided numerous high paying jobs. Those are gone and probably for good. The state benefitted from these jobs in higher revenues but now that is gone. It is a double whammy. We have yet to see a concentrated growth of good paying jobs in the state (to the contrary, we are still losing jobs).

Reason #3 – Underemployment

In California the headline unemployment rate is at 12.5 percent, the highest since records started being kept. Yet if we include the underemployment rate we reach an astonishing rate of 23 percent. How in the world is this good for housing? Until we see a stabilization in this data point talking about booming housing is absurd. Housing at a certain point needs to connect with the real economy.

The underemployment problem is at the highest we have ever seen. Like Japan that has nearly one-third of its workforce on part-time employment, we are starting to see shifts in our economy that may become permanent. With the high cost of healthcare and other non-wage costs for employers, it may be easier for employers to simply higher consultants or temporary workers and circumvent the need to provide adequate wages to employees. But that leaves many contenting with high insurances costs and using more of their shrinking salary to pay for costs that are simply going up.

It is hard to see this trend changing. We have allowed our manufacturing base to simply disappear over the past three decades. The biggest input cost in manufacturing is labor and it is hard to see how the U.S. can compete with low cost producers overseas. People have a penchant now for cheap goods. It is a deal with the devil in many ways. If we want cheap goods as a country we have to be willing to accept that more and more jobs will be leaving this country. If this is unacceptable, then we must be prepared to pay more for goods as many Americans are tightening up their budgets. Both choices are painful.

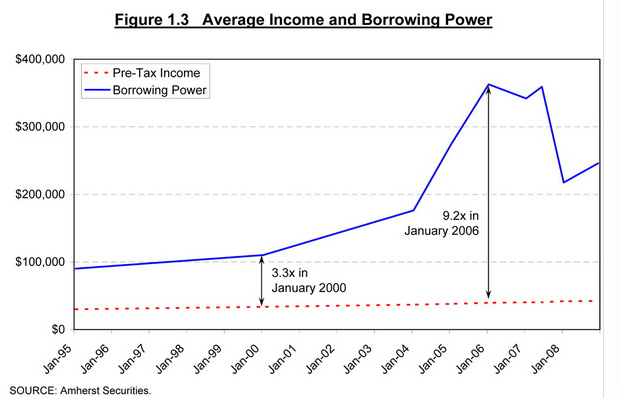

Reason #4 – Lack of Alt-A and Option ARMs

Source:Â T2 Partners

When I hear about arguments about the triumphant return of housing values I simply look at the above chart and realize that it is mathematically impossible. Since the government is now the lender of first, second, and last resort at least they are verifying income even with FHA insured loans. Yet the chart above showed how absurd lending standards got and were exploited especially here in California. This was the fuel that flamed the housing price bubble.

Yet the major source of housing appreciation in the state is now gone. The leverage to lift the world has been removed. With Alt-A and option ARM products buyers were able to get 10 and even 15 times leverage to purchase a home. Countless people making $50,000 a year went no doc and bought $500,000 homes. The $500,000 home in California was the median home back at the peak. Without this leverage, prices can only go up so high when they do start going up. Real incomes are unable to support current prices in many places. The $250,000 median price only reflects the large volume of sales in the lower end. Next year we will see more price reductions at the mid tier as prices reflect the current economy and lack of maximum leverage products.

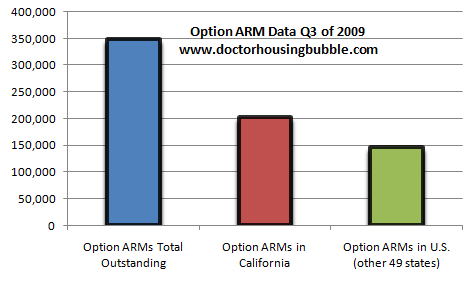

Reasons #5 – Option ARM Recasts

The bulk of option ARMs have yet to hit recast dates. 60 percent of current outstanding option ARMs find their home in California. This is largely a one state problem. Florida, Nevada, and Arizona have the remaining large share of the loans but no state comes close to matching California. The problem with these loans are many are in the mid tier markets. The subprime debacle has already washed away much of the lower end of the market. Borrowers had less of a buffer in those areas.

Yet the option ARM does a good job hiding problems for a long time. The teaser payment can last for a few years and once that first recast hits, it is game over. Currently, 40 percent of all option ARMs are already 60 days late and we have yet to hit the major recast points. Once these homes start selling at lower prices comps will also take a hit.

Reason #6 – HAMP Failure and Growing Foreclosures

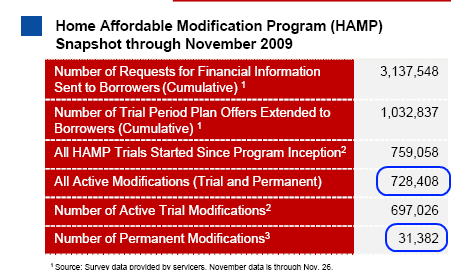

Another argument from the housing bulls was how banks were going to use programs like HAMP to stop the foreclosure mess. All it did was stall the inevitable. Last week data on HAMP came out and showed an utter disappointment. Only 4 percent of all current trial mods have entered into a permanent stage. California with 148,000 of the trial mods probably saw somewhere around 6,000 permanent modifications. 6,000 modifications at a time the state is seeing over 450,000 notice of defaults being filed in 2009.

Why is HAMP a failure? Because the offer to borrowers is basically converting them into long-term renters. Many in California bought as speculators although they won’t say this. They used products like option ARMs because they were never planning on staying at any home longer than a few years. Now they are stuck with a product they don’t want. Banks like Wells Fargo are trying to convert option ARMs into interest only loans for six to 10 years but how much good this will do is yet to be seen. One thing is clear however and that is HAMP is a failure.

With the failure, we can rest assured that many additional foreclosures are going to hit the market as banks are no longer able to keep homes off the books. People forget that a home with no payment or lack of payment is costing the bank money. And at a certain point, reality needs to be confronted. HAMP started with speed in May and here we are in December with no success.

Reason #7 – Housing Still Overpriced

Home prices in many areas are largely overpriced. They simply do not justify local economies. But in areas like the Inland Empire where homes are selling for $100,000 to $150,000 local incomes can now justify current prices. These areas may have household incomes of $40,000 to $60,000 and this can support the current price even with a government backed loan.

But places like Pasadena and Culver City for example, still have the housing bubble delusion that kept prices inflated for the past few years. Take for example Culver City. The median home price is $620,000 yet the median household income is $82,000. There is simply no justification for the current price. Take even a household making $150,000 and the current price is still much too high. It is likely that we will see price corrections in these areas in 2010. We will probably see 10 to 15 percent price drops by the end of the year in the median price.

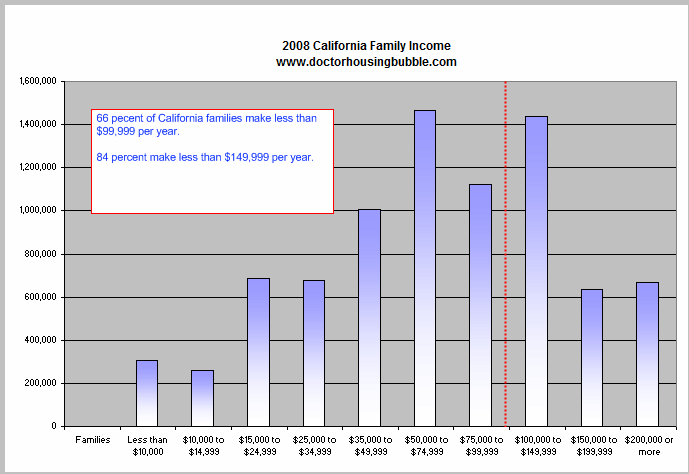

As a state California income is not off the chart as you can see above. Even the current median price of $250,000 is too high given income data. If we simply erase the bubble decade, prices should be near $200,000 to $225,000.

Reason #8 – Allure of Real Estate Tarnished

There was a time, say before 2007, when saying that the best investment you can ever make was buying your home. Those days are long gone. Tired, repetitive, and catchy mantras regarding real estate have slowly disappeared.  Buying a home is the biggest purchase for most Americans. This decision shouldn’t be taken lightly. But it was. It was taken for granted that home prices would never fall. The opposite actually occurred. Not only were home prices expected to rise they were expected to rise significantly. Many started depending on home equity lines and home equity loans as new sources of income to make up for stagnant wages.

Yet housing prices can go down and go down significantly. It is clear that many more people are now exercising more due diligence when they buy a home:

The price drop nationwide has been painful but the price drop in California has been epic. And just because sales have increased does not mean home prices are going up. It seems like exhaustion is occurring with first time buyers and investors thinning out of the market. Even talking with successful real estate investors many are now cautious in jumping into this highly unstable market.

The happy day psychology is now gone. This consumer behavior added to the mania and this is also largely gone. Take away the no doc maximum leverage loans and add in massive price drops and people start hesitating when they buy a home.

Reason #9 – Too Much Debt

“Dec. 9 (Bloomberg) — U.S. homeowners have lost about $5.9 trillion in value since the housing market’s peak in March 2006 as mounting foreclosures and the recession weighed on prices, according to Zillow.com.

Almost half a trillion dollars was wiped out this year through November as housing headed for a third straight annual decline. New foreclosures and higher mortgage rates in 2010 may hinder a rebound, the property data service said today in a statement.â€

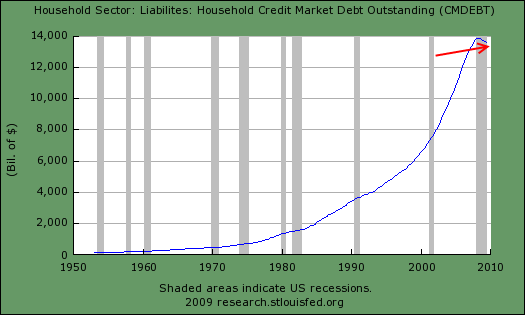

Homeowners are too leveraged. Here’s the problem. Housing values have fallen by nearly $6 trillion yet the mortgage doesn’t adjust with the market. Say you bought at the peak for $600,000 and the home is now worth $300,000. You went in with a zero down loan. Your home can only fetch $300,000 yet banks claim your home is worth $600,000 and they expect you to pay at that level. It isn’t like the mortgage adjusts to this new reality. That is why if you pull up mortgage debt it moved very slightly during this correction:

Notice how little the above dipped? The way the system is fixing this discrepancy is buy foreclosures, bankruptcies, and defaults. This is how the average American is forced to deal with this pain. The crony Wall Street bankers have even poorer balance sheets yet they have unlimited access to the best government money can buy so they operate under different rules.

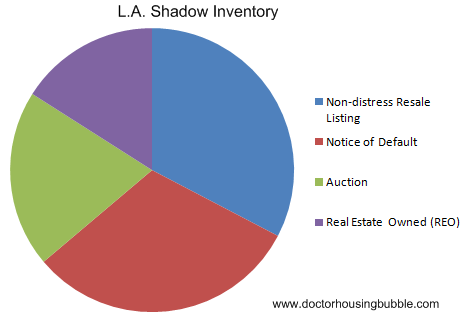

Reason #10 – Shadow Inventory

Finally, shadow inventory is another big factor in the market. With HAMP being a failure and banks trying their own mods that will also fail, many of these homes will be hitting the market in 2010. Sure there was a buffer in 2009 but how long can this go on? If the economy doesn’t improve a bank can modify all it want but with no income, the home is gone. You need a healthy economy to have a healthy housing market. This should be no stunner but banks think they can hide inventory off the market by not moving on non-payers or playing games with HAMP and other temporary stalling tactics but eventually things will need to change.

Many banks with California loans are praying for massive inflation. They are hoping that eventually wages will speed up and suddenly a $500,000 shack won’t seem expensive. Yet what is happening with banks is that they are hoarding the money so no money is entering the real economy to cause any sort of inflation. To the contrary, with access to credit being stifled we are seeing signs of dis-inflation. Clearly prices collapsing in home values isn’t a sign of price inflation.

Shadow inventory can be hidden for only so long. This is another variable that will be a factor in 2010.

Conclusion

It is hard to see how the housing market recovers in 2010 in California. My old prediction that home values may see a trough in 2011 seems like a reasonable estimate. Given the recast patterns and budget deficits, times will be tough in the state. Trying to keep home values inflated is merely delaying the inevitable reality.

There is even an interesting micro trend that foreclosure may provide a mini stimulus. For example, take someone struggling to make a big $4,000 mortgage. They suddenly decide to strategically default and rent a place for $2,000. They now have $2,000 more a month to spend in the economy. We have seen some weird things like this occur in this bubble.

Overall I would be cautious about buying a home in 2010. We still don’t know how the state is going to patch up the $21 billion deficit and we have yet to see any employment trends show marked improvement. Until these things hit, the best course of action might be to sit tight.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

31 Responses to “2010 Economic Forecast for California: What 10 Reasons Will Keep a lid on the Housing and Economic Recovery for California?”

I think you’re dead on. I can’t see housing in CA truly gaining any traction for many years. The apartment market in L.A. is positively brutal for owners now and incredible for renters. I’ve been here 15 years and never seen it anywhere this good for renters (including in the mid-90’s, when I was actually a landlord). Rents are plummeting, and are already back to about 2000 levels in my area. In fact, I’m in a rent controlled unit and have been since 2000, and my unit is actually now OVERPRICED, based on other places I have looked at. That’s pretty shocking, given how 2 years ago it was hard to find a single vacancy anywhere in the area, and prices were sky high.

One look at the jobs market, and it’s hard to see the rental situation improving for years to come. Unemployment may well level off next year, but it’s already at a staggering 14% in L.A. If it levels off at 15%, how many years would it take to get back even to single digits? And what will be the source of those new jobs?

Yet despite all this, flippers are still alive and well in my neighborhood. It is breathtaking, really. There are several foreclosures that have gone to seed on the next block, yet one flipper is looking to almost double the price he paid in July. Here’s the house:

http://www.zillow.com/homedetails/821-S-Genesee-Ave-Los-Angeles-CA-90036/20608899_zpid/

Looks like they put up new drywall and new windows, and, according to the realtor’s flyers in front of the house, they are now asking $1.2 million – a full $150,000 above the Zillow bubble peak “zestimate” in 2007. For that price, you’d think they would have tossed in a few $5 shrubs. It’s hard to guess what these people are thinking, but from the looks of it, flippers are at work a couple houses up the block too. There’s also another empty house for sale or rent around the corner.

It’s amazing that in the current environment – with foreclosures all over this area and increasingly desperate landlords advertising free months rent with huge banners – that flippers are still attempting this. It’s also hard to see how things will improve for sellers or landlords for many, many years. In the end, it should be a huge positive for everyone else, as rents and eventually mortgage payments will soon be back in line with local wages.

I think you’re dead on. I can’t see housing in CA truly gaining any traction for many years. The apartment market in L.A. is positively brutal for owners now and incredible for renters. I’ve been here 15 years and never seen it anywhere this good for renters (including in the mid-90’s, when I was actually a landlord). Rents are plummeting, and are already back to about 2000 levels in my area. In fact, I’m in a rent controlled unit and have been since 2000, and my unit is actually now OVERPRICED, based on other places I have looked at. That’s pretty shocking, given how 2 years ago it was hard to find a single vacancy anywhere in the area, and prices were sky high.

One look at the jobs market, and it’s hard to see the rental situation improving for years to come. Unemployment may well level off next year, but it’s already at a staggering 14% in L.A. If it levels off at 15%, how many years would it take to get back even to single digits? And what will be the source of those new jobs?

Yet despite all this, flippers are still alive and well in my neighborhood. It is breathtaking, really. There are several foreclosures that have gone to seed on the next block, yet one flipper is looking to almost double the price he paid in July. Here’s the house:

http://www.zillow.com/homedetails/821-S-Genesee-Ave-Los-Angeles-CA-90036/20608899_zpid/

Looks like they put up new drywall and new windows, and, according to the realtor’s flyers in front of the house, they are now asking $1.2 million – a full $150,000 above the Zillow bubble peak “zestimate” in 2007. For that price, you’d think they would have tossed in a few $5 shrubs. It’s hard to guess what these people are thinking, but from the looks of it, flippers are at work a couple houses up the block too. There’s also another empty house for sale or rent around the corner.

It’s amazing that in the current environment – with foreclosures all over this area and increasingly desperate landlords advertising free months rent with huge banners – that flippers are still attempting this. It’s also hard to see how things will improve for sellers or landlords for many, many years. In the end, it should be a huge positive for everyone else, as rents and eventually mortgage payments will soon be back in line with local wages.

PS – That same house is listed here: http://www.movoto.com/real-estate/homes-for-sale/CA/Los-Angeles/821-S-Genesee-Ave-204_09-413407.htm

It looks like they redid the kitchen and bathrooms too. And still no landscaping other than grass. Does anyone believe granite counter tops and a new bathroom justify the $565k increase in price since the July sale?

Falling rents aid homeowners in mortgage trouble

Southern Californians facing the loss of their homes are finding refuge in rentals. At larger apartment complexes, monthly rents have declined an average of 4.9% in the last year.

Thanks Doc. I wish that you were running the treasury.

I like the picture of the homeless raccoon. We need more levity on this blog. The data is just to depressing.

Bunning Statement on Bernanke: ‘You Are the Definition of a Moral Hazard’

Instead of taking that money and lending to consumers and cleaning up their balance sheets, the banks started to pocket record profits and pay out billions of dollars in bonuses. Because you bowed to pressure from the banks and refused to resolve them or force them to clean up their balance sheets and clean out the management, you have created zombie banks that are only enriching their traders and executives.

You are repeating the mistakes of Japan in the 1990s on a much larger scale, while sowing the seeds for the next bubble.

In the same letter where you refused to admit any responsibility for inflating the housing bubble, you also admitted that you do not have an exit strategy for all the money you have printed and securities you have bought.

That sounds to me like you intend to keep propping up the banks for as long as they want.

Even if all that were not true, the A.I.G. bailout alone is reason enough to send you back to Princeton. First you told us A.I.G. and its creditors had to be bailed out because they posed a systemic risk, largely because of the credit default swaps portfolio. Those credit default swaps, by the way, are over the counter derivatives that the Fed did not want regulated. Well, according to the TARP Inspector General, it turns out the Fed was not concerned about the financial condition of the credit default swaps partners when you decided to pay them off at par. In fact, the Inspector General makes it clear that no serious efforts were made to get the partners to take haircuts, and one bank’s offer to take a haircut was declined.

I can only think of two possible reasons you would not make then-New York Fed President Geithner try to save the taxpayers some money by seriously negotiating or at least take up U.B.S. on their offer of a haircut. Sadly, those two reasons are incompetence or a desire to secretly funnel more money to a few select firms, most notably Goldman Sachs, Merrill Lynch, and a handful of large European banks. I also cannot understand why you did not seek European government contributions to this bailout of their banking system.

Bunning To Bernanke: You Are A Systemic Risk

Jul 15, 2008

San Diego entry level home inventory low, prices rapidly accelerating. Read about it over the next couple months! Flipping time is back.

Check the San Diego MLS, you will find sales picking up, prices up (Entry level to $500,000). Apparently shadow inventory will only trickle to the market, lifting of mark to market will continue to manipulate the supply. Buyers are having a hard time finding homes in North County, resulting in bidding wars!

Assuming the market will be flooded with foreclosures may prove wrong.

hlowe

The truth hurts! If only the govt would accept that, bite the bullet and let the cards fall, we could get through this mess quicker. Artificialy propping up the $800K and lower markets is just pulling more suckers into the game at selling them down the river. Incomes declining, inflated prices and irresponsible media headline reporting, does nothing except draw out the problem and make the end result worse. Smart money is obvoiusly on the sidelines waiting for the coming real estate collapse in markets over $300K. Right now, being able to rent higher priced properties at half the buying cost is a no-brainer. The confluence of lower incomes and shadow inventory overload will

unltimately trumps the govt.

The over $800K market continues to decline, having no support and accelerates in 2010, while the entire market hits bottom in 2011. From there, we could drag along the bottom for some time.

Big declines on Westisde of LA, that should have occurred in 2009, hits in 2010.

http://www.westsideremeltdown.blogspot.com

Doc, since 50% of the homes in California are non-owner occupied shouldn’t we also pay great attention to investors? Aren’t there a good amount of investors with cash that will create demand in 2010? It seems like you have been mainly focused on the 50% of homes that are owner occupied.

Lets look at a couple of factors, 1 the actual construction of the house independent of the lot and external utilities is about the same in Des Moines and Ca. 2 the land price is very different. This reflects the first law of real estate location location location. Now the better climate in Ca than Dallas, and being near the sea and the mountians add something to Ca, but the question is how much they do they add is the lifestyle worth twice the average price??

Having lived thru the great Houston house price bust in the late 80s where my house went down 50% (but I had bought early enough that I never got underwater) I knew it could happen, and if anyone had studied Ca history at all they would have seen it happen in the Bay Area a lot as the Comstock waxed and waned, and in LA in the 1887 crash.

So the fundamental question becomes how much more for the Climate etc of CA than for Des Moines? When is the premium to high for living in CA?

Ruh oh, the House of Reps just passed the new finance bill which does not provide for “cram downs.” Now what?

Meanwhile, I have a pile of cash and would like to buy. However not buying for what the banks debt is and I’m afraid to offer because I can see further drops.

hlowe

>>

And another Realturd heard from!! LYING through his/her teeth.

>

Jim the Realtor would laugh to hear you say that nonsense. His most recent blog post – linked to by Calculated Risk – is about the NOW and COMING McMansion foreclosures in San Diego. Wwe are taking the ones where $1,000,000+ is owed, can’t pull $700Kish at the courthouse steps and are now hitting the market – 3800, 4900 sq ft houses with ocean views.

>

http://www.calculatedriskblog.com/2009/12/jim-realtor-mcmansion-foreclosures.html

>

Do get the REAL information. The rest of us do and therefore KNOW you are lying. You see anyone with more sense than a gnat can do the math. The math proves that lies are being spouted.

There will certainly be continued downward pressures on housing.. especially in CA. That said, I have some questions about the information presented in the article:

Are 40% of ALL Option Arms are already delinquent? If so, doesn’t that mean that the number of recasts coming will be 40% less?

The full number of coming CA Opt-A recasts of 200,000 sounds like a lot but if 40k homes are sold per month in CA and the recasts result in foreclosures that take a year to process, the recasts may not have as big of an impact as projected.

How much of an impact has the lack of new home construction had on supply? I wonder if the lack of new home inventory is creating more “shadow demand” on resale homes.

There is also the fact that the down market has reduced the regular supply as people who would normally put their homes for sale cannot (fewer move up sellers). This could change in spring 2010 as more people take advantage of the current environment in the sub-750k market to jump out of their homes.

Is it possible that the large number of distressed inventory is being offset to some degree because the other two forms of supply are constricted? This would mean that the foreclosure moratorium in 09 would have had an outsized impact on supply. It also means that the current market needs more distressed properties to get onto the market faster. This is certainly the current case in the sub-750k market.

AnnS

Ask your family what they think of your opinions. Then go see the homes for sale, in escrow and compare with recent sold comparables. After you do some actual investigating on what’s happening NOW, in the area I presented, re-read my comment. Then consider apologizing for the behavior you have demonstrated here and perhaps then to your family if need be.

Jim you may want to check for yourself, if you cover this area.

hlowe –

AnnS has done her research, as have most who read this blog. Perhaps you should quit trying to spread panic and propaganda in order to boost your sagging income, as you are obviously involved in trying to find suckers to overpay on real estate. And if anyone should apologize, it should be people like you who tell everyone to shove their head in the sand and ignore all common sense, logic and economics – because people like you are the ones who are responsible for the current state of America’s economy.

Steve, prove me wrong! For others with an open mind, watch the reports coming. Doctor perhaps you will beat them to it by providing the facts I have spoken of. Your followers seem to be waiting for the information to come from you.

By the way I don’t make a living selling real estate, instead I thought some would appreciate the info I provided. I will be proven right. Does not mean I am giving advice for the future. Upper level housing prices are continuing to fall!

Steve, your assumptions of me are incorrect! Perhaps you will look in the mirror after you see the reports come out and realize you were wrong.

Yes, I agree that the realturds are at fault for helping to ruin our economy, as well as ruin many people’s lives. They have no shame.

There should be no premium to live in CA instead of IA. I’d live in Des Moines over anywhere in the IE. Housing is based on incomes not on percieved and totally subjective premiums.

Except for agricultural folks, a view of and access to an ocean will always be worth more than the view of a cornfield sea….

I completely agree except this one:

…home values may see a trough in 2011 seems like a reasonable estimate.

You are too optimistic of values bottoming down in 2011. I am guessing you meant that for bottom tier housing.

Reason Number 11: The THOUSANDS of propective move up buyers who are removed from the market for 3-5 years while they lick their financial wounds and heal their credit.

Reason Number 12: The disappearance of investor friendly lending; not flipper friendly- INVESTOR (ie buying house with a substantial down payment at a price where the local rents will make it pay as an INVESTMENT).

Reason Number 13: The disappearance of financing for the self employed borrower. Anybody who is self-employed and takes full use of the tax advantages built into the tax code for self emplyed people, will not qualify for a loan, even though they may have huge cash flow.

The day the market starts finding its’ footing is the day you hear an announcement that says that experienced investors and self employed people with provable assets and cash flows (ie bank statements to prove it) are able to qualify for some kind of financing (not those fog-a-mirror-have-a-house loans).

Notwithstanding all your other Reasons above, which I am in complete agrreement with, but as long as we have so many willing buyers stuck on the sidelines by an over-correction in lending guidelines for non-owner-occupant/self-employed borrowers, even as they have under-corrected in owner-occupant-wage-earner guidelines (esp. re down payment), we will have a tough time finding the brakes.

I think one thing that has to be factored in to this whole equation is that a lot of money is off the books. $Billions of drug money is laundered through banks via the housing industry, and the billions made by the equally honest financial industry are sitting in off-shore banks. Lots of government money gets funnelled into hot pockets. Although most of us are going broke, the top tier does not play be the same rules, just in case no one has noticed yet…

http://www.guardian.co.uk/global/2009/dec/13/drug-money-banks-saved-un-cfief-claims

The corruption is so rampant and the documentation is deliberately difficult to trace, so don’t expect things to play out in a predictable manner. Odds are, the Ponzi scheme that is American and world finance will go through so terrible gyrations, but only guys like Maddoff rob from the rich. Most of the ones being gored are middle class. Always has been, always will be. Not much to gain stealing from the poor, but guys like Mozilla have all the money they need. At some point the game is just body count.

PS ‘to’ is the preposition form eg. “to the point” ‘too’ is the adverb form eg. “too much corruption” “me too” “Citi to pay back TARP by diluting current common stock shareholders, who are too stupid to complain”

If H Lowe is the same shmo from Lowe Enterprises all I have to say to him is…

Enjoy the CRE bust!

Fool

Very good synopsis.

One additional tidbit that you and the readers may want to ponder: how does housing behave in an economic cycle?

It’s a question worth asking because there is a correlation between and asset and how it behaves in a recession. And the behavior of the business cycle is virtually universal.

If one uses previous recessions (and depressions) as a guide, housing is always the LAST thing to correct (fully) in any economic cycle. So if one looks at the Great Depression, the recessions of the 70s and 80s, one sees a trend. So for an overview, a recession and the business cycle follow this behavior:

1. Stock market peaks, followed by a peak in employment, followed by a peak in housing.

2. Stock market corrects, followed by peak unemployment, followed by a trough in housing.

If one uses the late 80s recession as a guide, we had the crash in the stock market in 1987. Umemployment peaked in 1990 and it was 1994 before the bottom was reached in housing.

So looking at our current scenario, we could say (at least currently) that the stock market bottomed in march of 2009. Unemployment is roughly around 10% right now, but all indications seem to point to the fact that it will rise until mid to late 2010. With that being said, it will be 2011 at the earliest that we can expect any reasonable ‘bottom’ in housing. But realistically, probably 2014 is a more logical bottom since we will need some level of a job recovery before housing finally stabilizes. The 2014 number also corresponds with the expected range of the full housing bubble, which began in earnest in the late 90s and peaked in 2005-2006. Generally speaking, bubbles are symmetrical. So if it took roughly 7-8 years to reach the peak, it will take 7-8 years to reach the trough.

I think the major fallacy that is occurring right now is people are assuming a the current drop in housing represents the correction. That is only partially true. Mainly because this recession is unique in one way from all others. Housing is not merely affected by the recession, it is the CAUSE of the recession. So beyond just the bubble valuations and the housing euphoria, once those artificial gains are (mostly) erased, we now have the downswing in housing that is feeling the effects of the credit squeeze and the high unemployment rate.

http://blog.youwalkaway.com/?p=471

You have got to hear this. The 12 days of default Christmas song!

HILARIOUS!!! A must see!!!

Job market worsens for recent college graduates

Unemployment among young adults is worse than the U.S. average. Little relief is in sight.

For 20- to 24-year-olds, the jobless rate rose four-tenths of a percent to 16% in November, even as unemployment nationally slipped to 10% from 10.2%.

I actually think Hlowe is right. The system is so corrupt it is allowing the banksters to hold properties back. It’s been holding so long now, I think they built a financial Hoover Dam to hold the flood back. The sad fact is, the U.S. government and the FED CAN hold the prices artificially high by simply not releasing homes onto the market, and by subsidizing the losses on the EMPTY homes.

I wonder how bad it will get before people take to the streets. My guess is about 2 years. Look for martial law in the future, we already live in a perpetual police state.

hlowe –

You idiot.

I see accuracy in most of what you say.

No jobs means no purchasing of big ticket items (even cars). And since this job market is continually being pushed downward by our jobs going to China, this will continue.

No sales of big ticket items means no tax revenue for the state. So the state attempts to increase taxes. But fewer people are in CA to pay those higher taxes because residents of CA are continuing to LEAVE the state and the unemployed won’t be paying much in the way of income tax.

The Federal Judges are calling the shot on the CA prison system’s medical department and have sole power to order INCREASED spending by the State. AND,,,,,,, one solution that has been offered by the state is to SPEND ONE BILLION dollars on a new prison starting in 2010. That is an additonal one billion that the State isn’t admitting to (yet).

2010 will be a FULL year of continued recession with a possible extension right into 2011 … no … make that a PROBABLE extension right into 2011.

The state has two choices. Cut prison costs… or cut social programs. They can’t raise taxes enough to cover their debt….. even if the public allowed them to. And last year, the public said NO to four ballot propositions that the State begged for.

Great Blog. It looks like that the federal tax credit borrowed from future sales, and this summer’s sales will be disappointing. A few days ago, I was going to put my home up for sale in Burbank. Tudor, upgraded, 1350 sq ft for the Zillow price of $577,000. But I did some research and saw how large the inventory was compared to the sales, so I put the idea on the shelf for maybe next summer, or when things become more normal. Your Blog’s info makes me confident in my decision.

It’s now Fall 2010 and it’s interesting to read an older post about predictions for this year. Every point made here is holding true and it’s hard to see any changes in the forseeable future. Since 2008 I did not expect housing to bottom out until 2012… remember that every 6 months or so analysts regurgitate their latest prediction of… “look for growth starting in the first/second half of the year…”. If anything has changed in my outlook it is that I no longer expect recovery in 2012. I think it’s going to be longer. Our fiscal and unemployment problems are deep and structural. We are not in a normal recession and there will be no normal recovery pattern as we have seen in past years. It’s definitely a scary time.

Leave a Reply