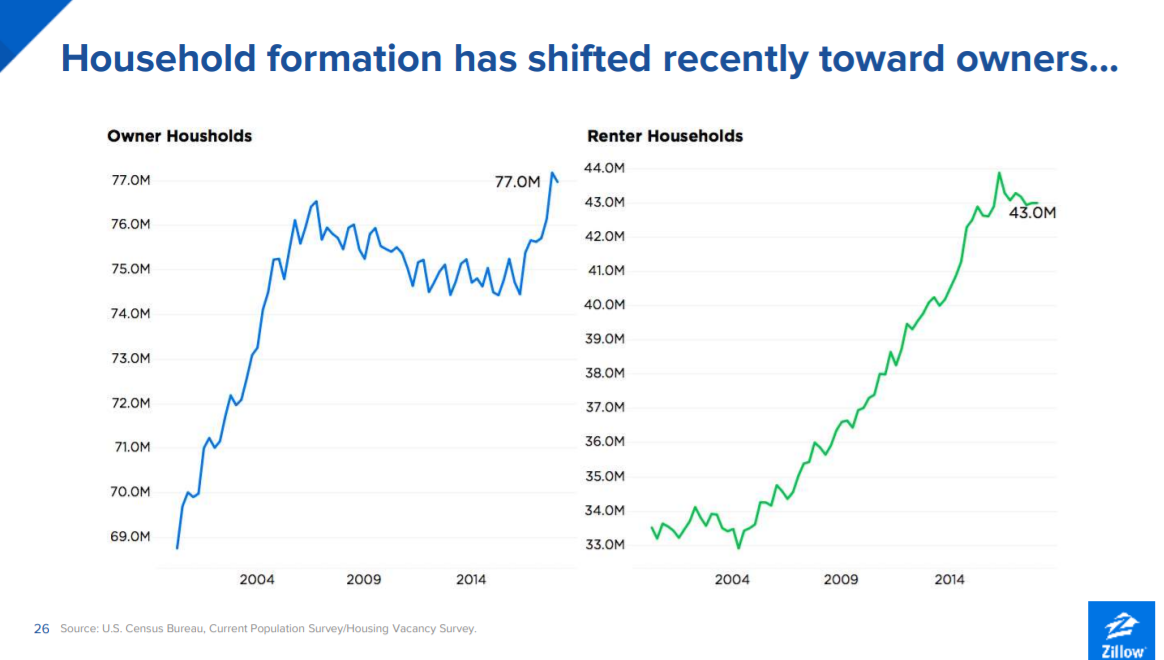

We’ve added 10 million new renter households over the last decade. What does it mean when renting is now part of the new American Dream?

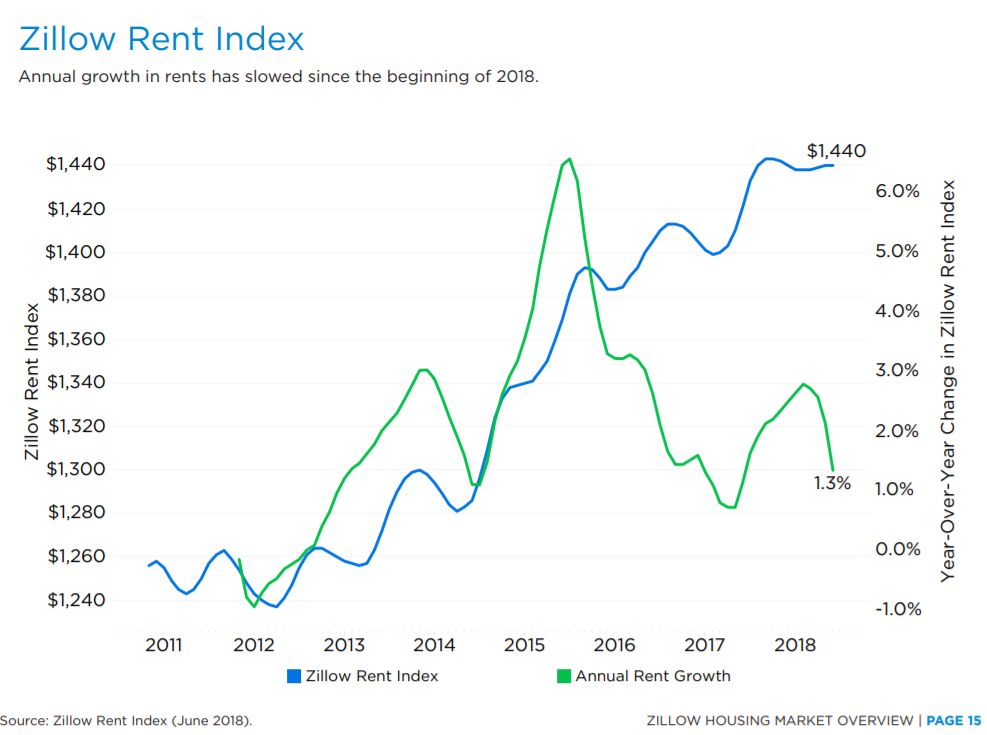

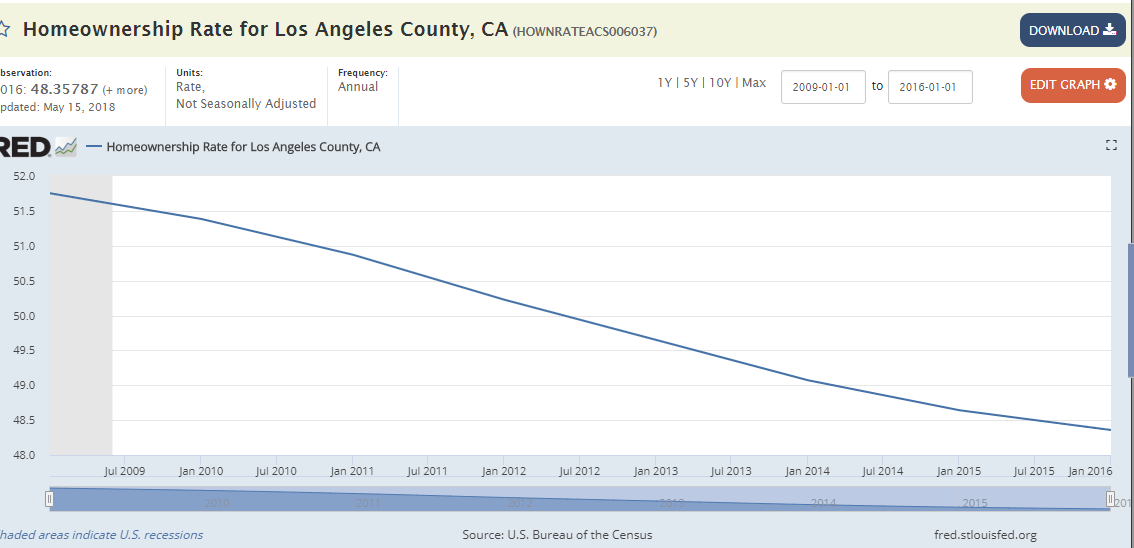

Since the Great Recession hit, we have added 10 million renter households. The trend to renting was largely spurred by the crash in the housing market but also over qualifying Americans to purchase a piece of the American Dream. The trend has slowed down but not in states like California where a renting majority is now solidly in place. Even Orange County, a place that was once thought an untouchable red region turned all blue. Then you have places like the Inland Empire that went solidly red. The bottom line is that many new households are opting to rent versus purchasing a home. This decade long trend is showing some signs of slowing however as rent price growth is slowing.

The trend to renting

The stock market has been on a massive bull run since 2009. This is one of the strongest stock markets we have seen in a generation. You would expect that home buying would be hot given all of the wealth being created. But not all Americans are participating in this and many are in deep debt. Student debt is over $1.4 trillion, auto debt is over $1 trillion and credit card debt is also more than $1 trillion. That is a lot of debt Americans are carrying.

In California, it is no surprise that you have millions of adult Millennials living at home with parents. Not enough money to rent let alone buy a home.

The trend to renting over owning is very clear:

The number of owner households is now barely above pre-housing bubble levels. Many that lost their home went into rentals and many younger Americans are opting to rent. So of course, this added some big pressure to rents:

The pressure on rents have come from the large 10 million new renter households being formed. But now both prices and rents are softening indicating a bit of a slowdown. You also have more Americans buying in areas and states where homes are moderately priced. In California, you have a renting majority so of course voting is going to reflect that. Some people feel they can live in gated enclaves while the rest of the population is living 10 to a house just to make the rent. You get a very clear split in the population and the new tax policy is going to hammer many California homeowners who have mega mortgages and deduct everything from SALT and other items. 2019 is going to be a shock to many California homeowners.

The reality of course is that many Americans are having smaller families or choose not to have children. Kids are expensive especially when both parents must work. Just look at childcare costs in many large areas where they can cost $1,200 to $1,800 per month per child. People don’t factor these things in but many Millennials are and this is reflected on the overall trend that we are seeing.

Los Angeles County, the largest county in the nation in terms of population is a renting majority area:

It is also one of the most expensive to live in. So you have many Millennials (those next in line to buy homes) not being able to afford to buy but deciding to either rent or to live with their parents. This trend will continue unless two things happen:

-1. Prices adjust lower to reflect lower incomes

-2. Incomes rise to provide more purchasing power

Since the economy now appears to be slowing, it looks like number one is the more likely option.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

366 Responses to “We’ve added 10 million new renter households over the last decade. What does it mean when renting is now part of the new American Dream?”

What is this “American Dream†of which you speak?

A Realtors dream to sell you an overpriced Crap Shack.

If you are a RE cheerleaders than skyrocketing rent is your American Wet Dream. For all others: We have to be asleep to believe it.

Can someone explain to me why anyone would purchase a home when you can rent the same home for like half the cost?

Buying means 3 out of 4 involved parties win.

Here the winners:

Realtards

Lender/banks

The seller (most likely an old boomer)

The loser:

You!

Buying makes sense if the market is about to recover after a crash. So buying at the peak (like now) is the worst time to buy.

Have you ever heard “buy low sell high� If so, that’s a phrase to memorize. Have you ever heard of buy super high and foreclose when you lose your job? That’s not a path to great riches. Is it more likely the latter happens in this environment? Yep! Is it more likely at some point in the near future we will get a bust (just like every time we had an extrem bull run? Yep! Do market go up forever? No.

So, if you buy high now that is really on you. Don’t cry later when a millennial buys next door for half the price you paid.

If you buy out of compassion for boomers, banksters and realtards that’s another story. Some people might like to make realtards and banksters rich. And some people might like like the boomers to have it all even though they don’t deserve it. I don’t want to talk you out of it. If you buy high now I have less competition during the bust.

What if you never care to Sell?

Just buy?

You may have the intention to buy and hold real estate for the long term. However, reality often gets in the way. 60% of all marriages end in divorce. People get sick, and health insurance has huge deductibles these days. Medical bills are the number one cause of personal bankruptcies in America. You can get sued. If you are in business for yourself, the odds of lasting ten years is about 4%. Being self-employed is a good way to lose everything.

The market can’t be controlled. You can avoid buying at or near the top.

Dude,

You gotta go long on something in this life (marriage, health).

Otherwise, buying RE is always a bad idea.

Well it looks like the recovery is over and now with the yield curve inverting today, a recession is on the horizon (a year out potentially).

Real Estate prices are going down:

https://www.zerohedge.com/news/2018-12-04/toll-brothers-shocks-13-plunge-orders-california-falls-staggering-39

https://www.zerohedge.com/news/2018-12-01/markings-top-price-cuts-bay-area-homes-are-exploding

yield curve has not inverted yet – still at 0.2%

Its a good question, but not everybody buys real estate for the same reasons. We bought last year because we needed a bigger place to live because of a growing family. Waiting 5 years or more for the bottom of the market wasn’t a very good option and who knows if the drop would be big enough to justify the wait especially as interest rates go up.

Compared to renting a bigger house, buying in fact was probably a 30% higher expense per month. But in the long term we believe we will at least break even. Plus the property we bought gave us space to launch a new small business.

Not everybody looks at real estate like they do the stock market, and it does not behave like the stock market either.

Of course Mind1, if everyone would be financially savvy, people like me wouldn’t profit as much. You need lots of people who buy high and foreclose later. A deep economic crash is the best thing since sliced bread. For me but NOT for everyone.most people seek instant gratification. You tell them delay your urge to have everything Now and they look at you as if they have seen an alien. I call it drive through mentality. They can’t wait and time, they have to get into lots of debt. I can’t help them but will certainly profit by it.

Play the game or get played by others.

The housing market in California (and many other places) has absolutely acted like the stock market for the couple of decades. Maybe you did what is best for you, but many of us are renting a halfway decent place in a nice area (for a very reasonable amount of money) and are in no desperate need to buy. Why pay more now when you can pay much less later? I bought a place in the last downturn (it’s now used as a rental), and we’ve made a 60+ percent ROI as of this time. That may very well decrease over the next few years, but it doesn’t matter because we’re keeping it anyway.

In any case, it pays to buy low. We did it last time, and plan to do it again (one for ourselves and hopefully a small rental or two).

Millie, not everyone puts money as their top priority. Some people prioritize quality of life such as living in a bigger own home/nicer neighborhood and walking to parks (as opposed to visiting open houses).

and yes, we know, housing market will crash by 50-70%, you will buy cash, meanwhile your rent is so cheap, nobody besides you has financial discipline and wits. You are very smart and we are all envy your vision and value your advice.

Life does not wait for a market crash.

Surge,

“Some people prioritize quality of life such as living in a bigger own home/nicer neighborhood and walking to parks (as opposed to visiting open houses).â€

Yes, as soon as you buy the grass gets greener. All you’re problems are gone and life is just as sweet as can be. Don’t worry about the overinflated price you paid. Price doesn’t matter! Spend away and live happy! Don’t think about losing your job or back up plans! Financial trouble only happens to renters not homeowners! Everybody knows that! Those 7 Mio foreclosures during the last rodeo where renters disguised as home owners! Buy now and start living! Or rent forever and be a depressed loser!

Number of homes on the market in LA, is 30% higher YOY.

https://la.curbed.com/2018/11/26/18112822/los-angeles-inventory-how-many-homes-for-sale

home prices sure have not fallen correspondingly though. After all, you too can live in scuzzy East Hollywood 750 sqft for only $600K.

https://la.curbed.com/2018/11/26/18112822/los-angeles-inventory-how-many-homes-for-sale

You say:

“”This trend will continue unless two things happen:

-1. Prices adjust lower to reflect lower incomes

-2. Incomes rise to provide more purchasing power””

I disagree.

In my opinion,

This trend will continue unless one of three things happen:

-1. Prices adjust lower to reflect lower incomes

-2. Incomes rise to provide more purchasing power

-3. Prices continues to rise faster than nominal income which means a lower standard of living ( i.e. stagflation ). In my opinion, this is the most likely case.

Were are the buyers going to come from for #3 to be correct ??? didn’t think it threw did yah ?? smh

The FEDS will provide enough liquidity in the system such that the wheels stay on. This is inflationary. They have to … there is no other option. This will be an inflationary recession … this happened in the 1970s. Prices went up during a slow economy.

Maybe from the government again…

I assume the buyers are going keep coming from where they have been coming from for the last 18 years.

If you think incomes rising is the answer, then just wait to hear all the howling and belittling that will occur when LA teachers go on strike in January. Besides, a 6% raise isn’t going to suddenly enable someone to buy a house. $75,000 per year sounds like a lot. But not in this market.

2019 will be a year of transition, in preparation for 2020.

Your crystal ball is working. I had a fortune cookie that said almost that the other night.

Rent in Los Angeles have almost doubled since 2011.

read it and weep Millennial…. rent is flat like the earth is flat:

Month All Beds 1 Beds 2 Beds

1/2011 1,585 1,342 1,730

2/2011 1,597 1,358 1,720

3/2011 1,636 1,386 1,771

4/2011 1,651 1,407 1,787

5/2011 1,670 1,422 1,836

6/2011 1,664 1,407 1,850

7/2011 1,563 1,321 1,775

8/2011 1,641 1,370 1,899

9/2011 1,779 1,512 2,040

10/2011 1,847 1,584 2,095

11/2011 1,852 1,620 2,112

12/2011 1,802 1,505 2,057

1/2012 1,837 1,529 2,090

2/2012 1,836 1,532 2,096

3/2012 1,927 1,590 2,101

4/2012 1,917 1,629 2,082

5/2012 1,933 1,694 2,136

6/2012 1,965 1,740 2,134

7/2012 2,033 1,785 2,262

8/2012 1,976 1,701 2,211

9/2012 2,031 1,759 2,265

10/2012 2,051 1,780 2,290

11/2012 1,986 1,766 2,197

12/2012 2,030 1,797 2,244

1/2013 2,015 1,761 2,275

2/2013 2,018 1,752 2,322

3/2013 2,042 1,771 2,357

4/2013 2,069 1,772 2,400

5/2013 2,040 1,767 2,354

6/2013 2,109 1,818 2,425

7/2013 2,123 1,805 2,460

8/2013 2,105 1,787 2,414

9/2013 2,130 1,858 2,448

10/2013 2,169 1,884 2,503

11/2013 2,064 1,791 2,393

12/2013 2,123 1,827 2,495

1/2014 2,186 1,903 2,551

2/2014 2,153 1,870 2,487

3/2014 2,088 1,821 2,413

4/2014 2,131 1,862 2,435

5/2014 2,096 1,810 2,393

6/2014 2,174 1,837 2,537

7/2014 2,208 1,837 2,553

8/2014 2,194 1,836 2,532

9/2014 2,199 1,888 2,489

10/2014 2,187 1,861 2,502

11/2014 2,222 1,899 2,512

12/2014 2,221 1,908 2,492

1/2015 2,198 1,911 2,528

2/2015 2,215 1,935 2,575

3/2015 2,338 2,022 2,656

4/2015 2,433 2,058 2,666

5/2015 2,550 2,050 2,706

6/2015 2,586 2,012 2,738

7/2015 2,435 2,024 2,731

8/2015 2,422 2,041 2,748

9/2015 2,453 2,101 2,798

10/2015 2,450 2,137 2,812

11/2015 2,461 2,155 2,819

12/2015 2,435 2,143 2,792

1/2016 2,444 2,170 2,822

2/2016 2,432 2,154 2,800

3/2016 2,575 2,292 2,955

4/2016 2,591 2,274 2,968

5/2016 2,595 2,286 2,985

6/2016 2,585 2,282 2,979

7/2016 2,603 2,290 3,006

8/2016 2,612 2,299 3,021

9/2016 2,614 2,303 3,027

10/2016 2,663 2,328 3,088

11/2016 2,601 2,291 3,029

12/2016 2,611 2,301 3,024

1/2017 2,618 2,305 3,014

2/2017 2,625 2,313 3,011

3/2017 2,558 2,243 2,978

4/2017 2,552 2,229 2,996

5/2017 2,503 2,194 2,914

6/2017 2,489 2,194 2,883

7/2017 2,511 2,209 2,904

8/2017 2,490 2,184 2,895

9/2017 2,524 2,218 2,947

10/2017 2,481 2,207 2,907

11/2017 2,445 2,183 2,863

12/2017 2,430 2,168 2,839

1/2018 2,461 2,188 2,901

2/2018 2,512 2,230 2,972

3/2018 2,554 2,252 3,012

4/2018 2,546 2,251 3,026

5/2018 2,742 2,388 3,214

6/2018 2,755 2,397 3,235

7/2018 2,799 2,444 3,286

8/2018 2,784 2,413 3,259

9/2018 2,819 2,437 3,309

10/2018 2,809 2,439 3,288

I guess I’m lucky to be paying 2011/2012 prices.

These are median prices.

You probably live in less than averaglely-desired area, so it appears as you are paying 2012 levels

Ditto!

Dang! My rent is so cheap in comparison! Could you post this list once a month so I can feel great about the deal of a century I am getting? Now I am thinking I should get my old landlord lady a big Christmas present! On second thought, I always tell her made up stories about how hard life is. can’t have her raise my cheap rent for the first time otherwise I can’t brag about it anymore! And Giving her a nice Christmas present might send the wrong signal. Anyways, thanks TankInSight!!!!

What’s most annoying about you is not what you post, but that you repeatedly post the same remarks in every thread, and multiple times in every thread.

We get it. Your rent is low. That has nothing to do with the topic, but okay, you were compelled to post it yet again for the zillionth time.

My question: How many more times do you plan to post about your low rent, in a poor neighborhood, that your landlady who hasn’t raised, in this thread alone?

How many times will you post “Buy now or be priced out forever” or “Making money is easy, just buy low and sell high” in this particular thread?

How many years has it been since you had a new thought?

You need to get your nice old landlord lady:

1) A basket of healthy fruit

2) A healthy veggie tray

3) A nice sweater to keep her warm

4) A good health insurance plan if she doesn’t have one.

Just keep her alive until you buy a house.

Nice old landlord ladies are much nicer than their greedy Boomer/Millennial kids who will inherit your home and notice how much below average your rent has been. .

The kids will likely sell your home or raise your rent. If there are no kids, probate will sell your home.

That is nice of you to think about giving your landlord a gift.

Millenial,

Any time you want to check back in to reality, please let the dear readers here know.

In the mean time, please post more about your BS open houses that you go to every weekend.

TA TA

Millie, for every person like you who pays ultra low rent, there are a hundred people who pay market rate rent. And we have heard plenty of them on this blog over the years complaining about another big rent increase. I sure hope that 1M house goes for 300K next year. I will buy several in cash.

The responses from our last remaining RE cheerleaders made me proud. Hit a nerve there. There is only one story here…..rents are skyrocketing, rents are skyrocketing! Buy now!! As soon as someone tells them a real life story about how ridiculously cheap rent is compared to these lists or compared to buying, our RE cheerleaders flip out. Classic!

The inflation drum and pretending rents are too high are the last resort for our remaining RE cheerleaders. Watch what will happen next year during the bust….they all disappear or turn ugly and our good Dr housing bubble will put them on the naughty list.

Curious. I wonder where your rents are coming from? Because this tells a different story:

https://www.rentcafe.com/average-rent-market-trends/us/ca/los-angeles/

If you dig further, it appears that average rent is incredibly skewed by high end rents and find that most places in each size category are actually under $2k per month.

Going a step further, rents in suburbs, even those with excellent public schools are even less than LA rents.

I’ll go first. Which of these is more likely?

1. Prices adjust lower to reflect lower incomes

2. Incomes rise to provide more purchasing power

How about incomes and prices rise as a result of inflation, but in real inflation adjusted value the prices drop a little.

In both cases -> affordability drops because of rising population and inflation

False premise.

Real estate is already ‘inflation adjusted.’ Real inflation rates for homes is a fallacy.

That is the whole point of housing, that it is tied to income, which is already inflation adjusted.

Joe R may be correct.

It has happened before.

Inflation from 1979-1982 in the US ranged from 10%-13%.

Inflation adjusted house prices during this time leveled off and then fell.

However, non-adjusted prices rose slowly.

https://i0.wp.com/inflationdata.com/articles/wp-content/uploads/2013/06/Inflation-Adj-Housing-Prices.jpg?ssl=1

News Alert:

Toll Brothers CEO blames media reports of housing slowdown for slowing housing

https://www.cnbc.com/2018/12/04/toll-brothers-ceo-blames-media-reports-of-housing-slowdown-for-slowing-housing.html

This is what I have argued … the media is trying to suppress housing with negative housing stories. The media is having some success, but I do not think it will work. And, I also think they are doing this in an effort to stain the Trump administration. Their end goal is to hurt Trump in the 2020 elections. Expect much more of this crap.

I think it has become more fair and balanced now.

During the last 3 years, our local news had segments on people who became lottery millionaires when they sold their home that they bought in the 1980’s for over 1M+ profit and retired in their 50’s.

How many Flip-or-Flop spinoffs are there that have been driving this insanity?

Bad bad media! It’s all the media’s fault!

Btw, looks like more rates hikes 🙂

https://on.mktw.net/2REpDWY

The media is now negatively influencing house prices by purposefully writing negative articles about housing? Man, that is about delusional as it gets. The media has been cheerleading this extraordinary run up and now, 2 years into the Trump presidency, they want to crush the party? When the final borrowed dollar becomes the snowflake that causes the credit avalanche no one will be able to sell these ridiculously priced homes. In all of the history of civilization man has never been able to unwind a debt bubble without a massive forgiveness. And doesn’t appear to be a part of the American soul. Thankfully, California is a walk away state. This time, much of the mortgage debt was issued by non-banks like Quicken, etc. Foreclosures will be faster this time around.

You must be on acid…

All this talk about Millennials and no one is talking about the elephant in the room. Most Boomers are ill prepared for a long retirement and the huge cost of healthcare and long term care. These house rich, cash poor will need to cash out there equity to pay bills.

There is going to be a rush for the door.

Social Security and a Reverse Mortgage should keep the boomers in their homes for many years. Reverse mortgages are already substantially reducing the supply of homes available for sale.

IOW, Boomers will increasingly take out reverse mortgages — leaving nothing for their Millennial children to inherit.

I dont think there will be a rush for the door by Boomers. Remember when 10,000 boomers per day starting retiring and everyone thought that they could sit back with popcorn and watch the housing market tank… it didnt happen.

Why:

here is my guess why the Boomers have not sold their homes en-masse:

a) renting out rooms long term on Craigslist

b) renting out rooms short term on AirBnB

c) renting out entire homes for far more than their mortgage from 20yrs ago allowing them passive income in their downsized living quarters (wherever they moved to, probably Fontucky)

d) allowing grown children to move in (and contribute to the mortgage)

e) allowing grown children and grandchildren to move in.

f) taking P/T jobs in the gig ekonomy (Uber, Lyft, etc).

Many boomers cannot afford to sell out UNLESS they move to Flyover country (Fontucky included) and they are simply too comfy in their old Westside home to move out even if they need to find a Taco Tuesday everyday.

I think I’m seeing it in my neighborhood. Boomers starting to sell those lotto tickets. You cant make it in California on six figures and you definitely cant make it on fixed income. How will they get hospital visits with an extremely overburdened socialized health care system? These houses are 50, 60 years old…do they have the cash for a roof or plumbing repair???

Doctor: The reality of course is that many Americans are having smaller families or choose not to have children. Kids are expensive especially when both parents must work.

OTOH, dirt poor Central American illegals are having anchor babies as soon as they arrive, so they can qualify to stay, and for the welfare benefits.

Americans are not having kids so they can earn more money, and pay more taxes to support illegal single moms’ kids.

We’re paying for our own replacement

Red state to blue state to brown state – a sh!thole where the streets are covered with feces and feces colored/covered people. Would you want to be a kid growing up in that? The only solution is mass extermination of the hordes.

The other thing people often leave out is that rents are essentially parasitic on the productive economy. Landlords for the most part do not produce anything (or very little), they simply siphon off money earned in the real economy that could have been better spent in the real economy. Money spent on rent doesn’t generate jobs or in any way expand the economy — it’s just a drag on capitalism. In fact, the most expensive rentals (in the best areas) are not more expensive because the landlord has done anything at all, but merely because of location. If pure capitalism is about creating wealth, non-productive (parasitic) drains on capitalism need to be taxed mercilessly. This was essentially Thorstein Veblen argument in the Theory of the Leisure class.

Sounds like straight out of Das Kapital. Trouble is with your thinking nobody would invest in long term capital investments. You forget, though we discuss it every time, the capital investment brings the possibility of loss. If you want to eliminate the opportunity to make money, will you also cover all the losses? Or is this just one way? You don’t have to let those grubby passive income people buy houses – you can buy them instead

Rent DOES generate jobs. LOTS of jobs.

* Larger buildings have on site managers and supers. Some have doormen.

* Buildings are serviced by all sorts of maintenance & repair people — roofers, electricians, plumbers, landscapers, painters, carpet installers, even government inspectors.

* Then there are manufacturers and retailers of carpeting, paint, plumbing, and other supplies, that all of the above use.

* And the insurance & bankers who service buildings and landlords.

* Don’t forget the lawyers, judges, legal system personnel (even the occasional private investigator) for all the court cases involving landlord and tenant disputes.

The above list is not exhaustive.

You sound like one of those people who imagine that buildings are self-sustaining money-spigots that incur no labor or expenses.

Large corporate landlords like REITS, I actually sort of agree with you. Non-Institutional owners do not fall into this category. As a small example, I am a landlord and I take old defunct buildings in disrepair with generally miserable tenants and make them habitable and cool and I keep rents low. My tenants are for the most part ecstatic to be where they are. On many occasions they even thank me for creating such well kept inspiring buildings at an affordable price.

So you could say I produce nothing and am a leach but my tenants would disagree with you. Without landlords like me there would be a lot of really low quality housing where large corporate entities treat their tenants like sheep and drag their feet to make even the smallest repair etc.

I don’t argue with you that there are a lot of really bad landlords, as with anything in life, but you cannot paint all ‘landlords’ with the same brush. It may work in a paperback vaccuum but not in real life.

While I agree that rent is somehow parasitic, on the other hand it does not matter who spends the money in the real economy – the renter or the landlord. If the landlord doesn’t spend it all, then he is investing it, which is good for the economy. If no spending and no investing, then the savings do help the banks liquidity for borrowers and other investors. Either way, I don’t see an impact on the real economy.

I rent out a house that I built myself. (I don’t mean I paid to have it built; I hammered the nails that keep all the walls together!) So I don’t care what a silly socialist professor thinks about me. And even if I had paid someone to build it, or bought it second hand, it is still allocation of capital that makes it available to a willing renter (like maybe Millennial?).

Absolutely joe! Anyone here can have me as a renter as long as you are giving me a gift just like my old landlord lady currently does! If you can save lot some of money each month by renting cheap than the question becomes: what’s not to like? You just do this until a nice crash happens and buy RE at a heavy discount. Many RE veterans believe it will be a 50% haircut in prices. I can see it and agree strongly.

If you ever decide to chuck civilization and move out to Bear & Mountain Lion Country, you might be interested in my place. However, I have a current tenant who was born in the Country and doesn’t want to leave. Since they pay the rent on time, I don’t want ’em to leave either.

That sounds all great. My plan for now: I will stay in SoCal for another 20-25 years than retire early. My tech job is here and I don’t want to work fully remotely. I also have never paid late in my life. In fact I pay rent a few days early. Never paid interest on a credit card either, I always pay it off right away and only use it because I play the “points gameâ€. Again, I think you would love me as a renter just like every landlord. It’s a win win until the housing market is ripe to invest in.

Sorry, but this is complete crap. I own rental property, and I would be happy to show you the expenses I’ve paid over the years to maintain it. Expenses for carpet, tile, bathroom fixtures, fencing, subflooring, plumbing materials, appliances, doors, fans, window coverings, air conditioners, heating systems, paint, lumber, drywall, etc. Where do you think all that stuff comes from? Do you think I maybe PAY businesses to get that stuff? Those businesses provide jobs for people to support their families.

I also have to pay a guy to put that stuff in, which helps him feed his family.

I also pay a property manager, which supports her business. That puts food on her table and supports the employees that she has so they can put food on their tables.

My property is also kept very nice, which has contributed to improvement in the area and rising property values.

Let’s also not forget the premiums I pay to my insurance company to protect it in the event a windstorm blows off the roof. Actually, that happened a while back. And guess what, I paid a roofer to fix it, which supported his business and helped put food on his table.

Oh, and the property taxes I pay help keep the roads paved and the schools open.

This idea that landlords don’t support the economy is complete garbage.

I wasn’t saying that landlords don’t have expenses, but they are generally the expenses that anyone living in the unit would have. Contrast rents with tacos: Tacos get cheaper and better because of competition, because of taco vendors working harder and harder. This is good for everyone, and a more expensive taco is going to have to be a better taco, or there will be no buyers. Also, each taco sold includes labor value added to the component parts (corn, meat, etc), thereby expanding the real economy.

By contrast, rents mostly increase without the units getting any better (no new labor value added). Landlords make more money in California solely because of scarcity, NOT because of increased quality. This is exactly the opposite of how wealth is created in a dynamic capitalist system. Every dollar that does to inflated California rents is pulled out of the productive economy and this threatens the entire California economy. Under-taxed (Prop 13) landlords are the single biggest drain on our productive (real world) economy – it’s a class of parasites.

It is laughable that being a landlord is parasitic. There is way more risk owning a rental compared to sitting on your ass buying stocks on your iphone. It’s another form of investment. I have preached over and over that any good investor is diversified…and that means owning RE. Coming up with the down payment, dealing with repairs, bad renters, vacancies is all part of the game. The key is knowing when and where to buy rental property. This separates the contenders from the pretenders. You can complain about boomers enjoying their Prop 13 spoils, get over it!

I am a landlord as well, however I do not see the need to pat myself on the back like you do. I do see most landlords as parasites. That’s what they are.

You could also say every time you take a dump, you help keep the economy going (Plumbers, Sewer workers, toilet makers, toilet paper companies…. etc).

But most people don’t feel the need to pat themselves on the back after taking a dump, I guess you do.

Cheers

I agree that landlords are parasitic (even though I am one, though I only have one unit). Many arguments to the contrary center around the fact that landlords spend money to maintain and fix stuff. However, this argument completely ignores the fact that the same (or more) maintenance and repairs would be made if all units were owner-occupied. You could argue (as some have) that landlords are incurring monetary risk and are rewarded for that risk, but being a landlord is not very risky for anyone that can do elementary school level math and makes investment decisions accordingly. I don’t really see any way around the fact that landlords are parasitic and effectively increase the cost of housing.

What, they can afford to pay rent? Fire up the student loan debt machine. There is still capacity.

What, they can afford rent?

What, these folks have cash flow to rent? Fire up the debt machine!

Merry Christmas:

https://www.wsj.com/articles/chinese-dumped-1-billion-of-u-s-real-estate-in-third-quarter-extending-recent-retreat-1543924802

I have to admit, I used to not like Millennial. I thought he was obnoxious and a loser of sorts. But he is like a fine wine, he gets better with time. I am a Millennial fan now.

I am particularly a fan of his ‘you must be new to RE’ and ‘As a RE expert I advise that you..’ I think he has effectively turned the silly RE bubble humper rhetoric that is so common back into the faces of Bubble Hummers themselves.

Pre-Millennial it was as if the RE agents of the world had a corner on these sort of statements, but no longer. This is maybe too red-pilled of a comment for the PC crowd amongst us, but it is almost like how the African-American community took the “N-word†and now use the term themselves amongst one another.

That is Millennial, he has turned your weapons against you. I’m a fan.

And no I’m not Millennial posing under a pen name as suggested or a Russian Bot.

Keep annihilating the Bubble Humpers Millennial, you are gaining a fan base.

I have challenged and defended Millennial. I disagree with the people who call him an internet troll or whatever. My personal favorite commentator is Flyover. Actually I wouldn’t come in here if we only had one type of opinion on this blog, and most of the regulars say something worthwhile some of the time.

Thank you guys! Like a fine wine…. I like it!

Yep, there are some quality posters here (flyover def one of them). Woody, Prince of Heck, Hotel California, nor cal breeze, etc some come and go.

Party is over. I am all in cash. Epic crash coming next year. A 50-70% crash in housing? I totally agree with Millie!

That’s because you ARE Millie.

Now 3 out of 6 indicators are checked off on master Logan Motashamis recession dashboard. Tick tock and his tone keeps changing quite a bit too.

This message is only for average people and bears.

For RE cheerleaders: nothing to see, this is just the start of a 30 year bull run. Buy now and don’t miss out!!! Next year millions of Chinese millionaires will line up and fight with lethal chopsticks to buy your home.

Buy now and don’t miss out!!!

That’s one. How many more times will you post this same remark in just this one thread?

Sol, trying to understand why you are getting so annoyed. I don’t recall you getting annoyed at the countless occasions when RE cheerleaders were making these statements:

It’s always a great time to buy

There are buses filled with foreign cash buyers touring the neighborhood, ready to buy.

Interest rates will never go up again in our lifetime

QE infinity

Buy now or you will never own

Rents can only go up, stop wasting your money on rent and buy

Incomes don’t matter

They are not building more land

And one of my favorite ones: THIS is The year when millennial go out and buy in droves!

We have no inventory!

The list goes on and on……I am just repeating the RE cheerleaders phrases. Why get annoyed at me? Now that the bubble is popping, I want to make sure we don’t forget these statements. Somehow these statements are only true when the market goes up but RE cheerleaders don’t want me to mention them during the bust? What changed? I didn’t buy 7 month ago when I was told that I need to buy now or else I can never own! I should be priced out forever, no? What happened to all the millennials that were gonna buy in droves and what happened to the Chinese millionaires wanting to buy? Is the bus still stuck in traffic?

What about interest rates? Why are they going up? We heard they will remain stagnant at 3% in our lifetime! Why is my rent not going up even though smart RE cheerleaders told me so? Why the neck is inventory increasing???? We heard there is no inventory!

If you are already annoyed now than the next few month and years won’t be much fun.

Millennial, I’m annoyed because in the last several years, I’ve only heard those statements from you. You repeat them endlessly, multiple times every thread. It’s like a Chinese water torture. Even if one likes water, it gets annoying if it drips ceaselessly every minute.

We on this thread are not stupid. We don’t need to be reminded of anything multiple times every thread. Say something original.

“in the last several years, I’ve only heard those statements from you. â€

Got it! So, when our RE cheerleaders make those statement you just don’t “hear itâ€.

It’s somehow totally fine to spread BS as long it’s coming from someone who profits from inflated prices. As soon as someone comes in and ridicules these phrases you get annoyed. In other words you hate a RE crash and can’t handle hearing the lines that your fellow cheerleaders repeatedly told us. Did you actually think it’s true? Someone can be priced out forever? Are you losing money when the market crashes? Does it bother you that I was right by saying the “there is no inventory†line wasn’t true? Or, are you agreeing with me that all of these statement are in fact bullcrap and you are tired of hearing them?

Milli, my big mistake was NOT listening to the real estate “cheerleaders.”

In 2013, I listened to Jim “HARD TANK” Taylor and his crowd. I kept waiting for a HARD TANK. When prices continued to rise in 2014, I assumed it was a dead cat bounce. I ignored the cheerleaders. Big mistake.

Even if the market crashes now, it’ll just go down to what it was in 2013. If that.

“Even if the market crashes now, it’ll just go down to what it was in 2013. If that.”

So, your thesis is that it would have been better financially to buy in 2013 instead of buying 5 years later for the same price, is that correct?

It depends on the individual and the situation but here is an example based on my model: save for a large down payment by renting a cheap apartment and buying low during a downturn:

In 2013:

Horst Kluppenheimer decides to purchase his first home.

500k, 50k down, 3% interest rate, 30y conventional, no Hoa (nice Horst!), PMI (.05% sry Horst), Homeowner insurance is $840 per year (guesstimate). A little bit of maintenance, lets call it $50 per month ($600 a year). Principal and interest is $1,897.22, thanks to Prop13 the property tax burden is solely on new buyers and boomers get a pass. That translates into $458.33 per month property tax. PMI, homeowner insurance and maintenance is $307 per month. PITI = $2,663.05

bubble inflates, Horst is happy as a clown and makes fun of his best buddy Egon Schniedelwutzer for renting.

Schniedelwutzer is as cheap as they come. He’s goal is to save lots of money monthly. He also doesnt want to pay PMI and rather rents a little crappy apartment for 1k a month.

5 year later the market hits a peak. lets see how they did so far.

Kluppenheimer spends 32k a year on housing for living in a decent house. And he gets a tax refund for itemizing interest and property taxes. Plus he’s got himself a wife. As we all know homeowner get wifes, renters usually watch porn. Since he is married his standard deduction was (until the trump tax reform) $12,700. He pays 18.8k in the first year for interest and property taxes. So being a homeowner lets kluppenheimer itemize and deduct $6,171.52 more as a homeowner compared to him renting. Say his marginal tax bracket was 28%, he gets himself a $1,728.02 refund in the first year. $144.00 a month. the following year the interest payments decreases slightly and the principal increases. Lets keep it simple and calculate the tax refund in favor of the homeowner for the five years (same tax refund for the next years).

So, total cash outflow for PITI is $159,783.09 (5 years), over the five years Kluppe got $8,640.12 back in taxes. Plus a wife, plus a decent house, plus he gets to make fun of Schniedel who rents. Everyone knows how big of a loser renters are. And the equity!! $49,921.36 was paid down during these 60 months. And the best of all, his house is now worth 700k (on Zillow).

Schniedelwutzer’s math is easier. first year 12k for rent. each year his rents increases by 3%. His landlord isnt as nice as Millie’s old landlord lady. Over 5 years Schniedelwutzer has nothing to show for except cash in the bank and stocks. He paid 63,709.63 in rent. Whaaat. Just out the window. What a waste. Makes his Landlord rich who drives a Lamborghini now thanks to Schniedel rent payments.

Now, the bubble pops. Schniedel has been watching the market and wasted his 5 years on open houses and watching the market. Kluppenheimer partied the last 5 years and spent like there is no tomorrow. After all, his house is making him rich (on screen). Instead of spending, Schniedel saved the difference between what the house would have cost him and his rent. $96,073.46 (Cash outflow as buyer $159,887.54

minus the cost for renting the cheap apartment $63,709.63). And he still got the initial 50k that Kluppenheimer put down as a downpayment. Schniedel invested it conservatively in a mutual fund which made him 5% per year ( after 5 years $63,814.08 ). He sells in order to invest in real estate. total cash available: $159,887.54.

Per Lord Blankfein, the prices will not go below 2013. Schniedelheimer buys next door to Kluppenheimer. He pays down 160k on the 500k house. interest rates are now 5%! Total cash outflow (PITI) is $2,403.53. The big difference however, Schniedel’s loan is 340k. Kluppenheimer’s remaining loan is the initial 450k minus 49k (principal in 5 years). Schniedel has no PMI and he can refinance when rates go lower. If he refinances to a 3% loan like Kluppenheimer, his PITI is now $2,011.79.

Over the 30y duration of the loan, Schniedel will pay $724,243.34 and Kluppe $891,198.53 ( I am excluding PMI on Kluppe’s total, evt he will get rid of it). Another simplification in favor of the homebuyer!

Now, obviously, to make this work you have to consider renting a cheap apartment instead of living 5+ years in a decent house. To me the savings and waiting for a market downturn is worth it. That doesn’t work for everybody. Provide some feedback and questions regarding the math. Thanks!

Millennial, this is a great analysis.

A few points.

1) As Surge has pointed out, it is hard to make life wait, so a family of 5 may not fit in a 1 bedroom apartment. Your comparison shows how someone saving by living minimally and renting can come out ahead even while waiting.

2) You analyzed the first 5 years comparing rent to home ownership differences fairly accurately (I’d wait to not pay PMI personally but your 3% mortgage may not have been available in 2013. It is likely the rate was 3.5%. )

3) You did not take into account the last 5 years of Schniedelwutzer’s mortgage. Schniedelwutzer’s will still be paying PI of 1,897.22 per month while Kluppenheimer will be paying nothing for PI during the last 5 years. On the back end, that is 60 * 1,897.22 = $144,180 more that must be added on. Of course, in 30 years, $1,897.22 may buy a cup of coffee after the enormous inflation some are predicting.

4) The analysis of principal paid will change over the life of the loan. ie the first 10 years, interest dominates the payments. After the the first 10 years, the principal payments dominate the loan. IMHO, that is one reason why housing should be a long-term investment.

Sorry.

60 * 1897.22 = $113,833.20

Millie,

I will do a high level critique of your example.

You say one guy pays 891k and the other 724k.

Over 30 years.

That is $460/month. (not inflation adjusted).

All the trouble with visiting open houses for 5 years, cramming into smaller place and waiting for something you cannot control. For a $460 / month????

LOL!!!!!

Dude, you can easily do consulting side gig. Like 10hrs/month to get you to $500 after taxes. Instead of visiting open houses

This also reminds me of an engineer co-worker who took a job in Silicon Valley in the late 90’s.

He negotiated for the hiring company to allow him to live in his camper in the company parking lot for free. He used the shower in the company building and cooked his own meals in the camper. He was in IT so he was always close to work to handle any network crisis. He had a high salary and no rent.

He also had no life (and no wife).

Surge,

somehow it sounds like you are not enjoying going to open houses? Thanks to open houses i learned a lot, found my realtor, found the floor plan i like, found the neighborhood i like. What do you like doing in your free-time? Any hobbies?

“Now that the bubble is popping, I want to make sure we don’t forget these statements.”

But, but Millenial. What about the crypto statements? They seem to have been conveniently forgotten. Don’t like mocking your own BS?

I know, I know… like everyone else, you got in at 50 cents and made millions.

The yield curve has inverted, it’s going to get ugly, get ready. Nobody knows where this thing is headed next.

A wise investor once told me “I bought when prices were flat, I bought when prices where high, I bought when prices were low, I always found cash flow and I always accumulated properties”.

12/04/18 (Last day the bond market was open:

1 Mo 2.37

2 Mo 2.42

3 Mo 2.42

6 Mo 2.58

1 Yr 2.71

2 yr 2.80

3 yr 2.81

5 yr 2.79 (wowie .. an inversion)

7 yr 2.84

10 yr 2.91

20 yr 3.05

30 yr 3.16

If you want to call this an inverted yield curve, OK.

Here’s an inverted yield curve from 2-12-08:

1 Mo 2.55

3 Mo 2.31

6 Mo 2.12

1 yr 2.06

2 yr 1.94

3 yr 2.13

5 yr 2.71

7 yr 3.13

10 yr 3.66

20 yr 4.43

30 yr 4.46

Note that you have to go out to 5 years to get a yield better than a 1 month treasury bond. Now that’s INVERSION!

Truth is wage growth is strong. Truth is the job market is strong. Truth is GDP is running well north off 3% on a yearly basis. That has not happened since the Bush was in the White House. Only a Democrat can’t see this because they do not like the current administration. They are praying for an economic collapse just so they can get back into power. That is the story.

JT, it’s getting boring with your political tantrums.

I dont care if we have a Muslim terrorist as president… THe only thing I care about is a market crash so i can buy RE at a heavy account.

Discount

75 % of my SFR property is to newly retired couples who want to enjoy their retirement , and do not want to be tied down to the mundane chores and responsibility of home ownership. I will continue to respond to their requests for maintenance items while using the monies to finish paying off the outstanding mortgages on the properties. Fortunately the rental parity is close, and I have many requests or available rental units. Yes , I am waiting to acquire at least one more property, but not at this current time. I have noticed that my tenants desire to attain, retain, and gain greater social status within their social class, low-status people emulate the respected, high-status members of their socio-economic class, by consuming over-priced brands of goods and services perceived to be products of better quality, and thus of a higher social-class. In striving for greater social status, people buy high-status products (goods and services) which they cannot afford, despite the availability of affordable products that are perceived as of lower quality and lesser social-prestige, and thus of a lower social-class. In a consumer society, the businessman was the latest member of the leisure class, a barbarian who used his prowess (business acumen) and competitive skills (marketing) to increase profits, by manipulating the supply and the demand among the social classes and their strata, for the same products at different prices.

Call me Scrouge is you want, but I will not do anything to stop you from committing financial suicide. It is your responsibility to control your own destiny, not mine. It is never too late to be quiet and listen to the old grey hairs who have seen this before.

Absolutely. But, who is to judge that paying for an experience of opening a nicely package product is not worth it. Or spending hundreds to get chicks drunk in vegas. Or paying extra just to avoiding wasting your time on mingling with those who you do not care to see or avoid frugality disease.

I do not see anything good in store for California right now. Kids ( I consider a kid to be under 30) can’t afford to rent. They can’t get a job that pays enough to buy a car from what I see. If a kid is lucky enough to find a good job, it’s most likely in an area where housing is even higher? What is the feeling from everyone about what is happening? What kind of income is needed to afford to buy a house? What does a starter home go for in most areas? ??????

Resubmitted… I crashed the site…

So much stacked up against the kids. $2500/month for a mortgage payment is likely a bargain? Are 200k jobs available? Seems like that is what is needed to live in California anymore….

Even in Arizona, the housing market is heading higher, fast. I don’t see jobs over 60k often, and that wage takes a pretty good education, likely in tech. Average home now is 350k… 60k salary won’t cut it. Even two incomes won’t cut it.

It seems that parents are taped out too…. can’t carry the kids too much longer?

I see the empty nesters approaching retirement doing well… but the ones I know have a couple of family members sucking off the hind tit….

Do I see things correctly or what am I missing? Seems like a lot of money has dried up? Parents at one time had money in the bank, safe in a CD, getting 4 to 6 % interest…. the past ten years, that quarterly check has been gone, and I think missed very much.

Wallstreet has been a hit or miss… my 401k is doing well, but as we know, it too can be gone in 60 seconds?

Feel free to pound me and let me know where I’m screwed up?

You are too negative and attribute too many of personal issues to external factors

Under 30 is a kid? That right there is why this country is screwed. You set your expectations and they live up, or in this case, down to them. Treat them like adults and make them man up. By 25 they should be solidly into the early stages of building their career, whether on the job or getting the advanced schooling. Back in my day (shakes fist at cloud), we werent given time to find ourselves – we got the boot and started hustling and made it happen. Loser helicopter parents created this loser snowflake generation. Not saying everyone in Gen Z or whatever it is (millenials are in their 30s, they cant be blamed for everything) is a loser but too many are because of the low expectations. It blew my mind 10 years out of college that there were guys in their mid 20s living with their parents – how the h3ll did that happen I wondered? Didnt exist in my day.

I think alot of these loser parents are codpendent or some such – they want their kids to be helpless and rely on them – same with their little rat dogs they have on their lap when they drive. Sure, there are massive impediments to young people – we’ve had near hyperinflation in housing, health care and education in the last 20-25 years (40+ actually) that have taken a massive toll on the culture but those are all government sponsored/financed mafias and the idiots seem to want more of the same – so easily fooled.

Mr. Limberg…. Your completely right! But the real estate cheerleaders here will tell you otherwise.

That’s why we are here picking up good ideas on rental property purchases and some of the ins and outs.

I bought my in laws a house to help them out, because they were being drained by my sister and brother in law. At the same time I had to update their old property with $15K to get it ready to sell. I put them on a budget based on their income, some of the freebie items SIL and BIL changed from free housing instead to a small cash stipend. Paid off all their debts, helped them where needed, but changed their lives, also BIL and SIL were forced to live within their means.

inlaws died, paid the difference (including extra equity I paid for) to the SIL and BIL, now the BIL is renting from me and Sis at 20% discount to what I could be getting, maybe even 30%. Barely break even for us, but in 15 more years it will be paid for and owned free and clear. Plus we help the family. Have had financial discussions with BIL and SIL, they are now beginning to listen and save some money instead of buying stupid shit stuff they don’t need.

SIL and BIL Health is getting better, finances cleaning up, but correlation is not causation.

Put my two through college with side biz that paid 25-30K/yr. Both are out debt free, one making more than $100k/yr in the southeast. the other one just out, moved to denver with boyfriend who makes about $50k, looking for work in 2% unemployment market. Should be at $40-60K within a year or two. That’s the American dream!

Empty nesters me and sis now with extra $50-70k/yr in savings can purchase new vehicles after 18 years driving clunkers that have broken down at 300-350K miles, Looking for more properties to get as rentals, if I cannot find them I will be buying land and developing it myself. I cant wait around and whine about market movements…make it happen instead. I have only 7-10 years to retirement and 7 sounds better than 10. Wife is working 6 years behind me, so i get to hit the trails while she finishes up filling her 401K. Ill take care of a few more rental units, get a couple more paid off and rental units become our SSN payment if SSN fails. We already have income from one unit, farmland, side consulting of >50K/yr. Enough to retire now on a meager existence. if we sell the 600K house, with 500K in equity, we downsize to the development neighborhood and build it a little bigger than the rental units. Then live happy life either way. Mexico riviera can be nice too, have some friends already there on less than 3k/month living the high life. Everyone needs options, as you can tell, I HATE payments, being the one to pay interest is a suckers’s game, be the bank if you can. Renting units makes me the bank. The problem with this board is that hard work is not recognized. I have been consulting and helping thousands, in fact more than 100,000 people have been helped by my consulting medical implement business. Yes, I have been rewarded such that it paid for a little more of a house, and paid for college for two, but I am no multi millionaire. My wife works professionally also in the medical field. She sees the people every day that sit around and complain, the ones who drink cokes like water, stuff garbage down their gullets, resulting in huge medical issues and shortened lives. People are not taking responsibility for their lot in life and until this changes, there is little future in the large cities, where sloth and graft are celebrated. We pay more than $50K/yr in taxes, We gave up on luxuries to get our kids the best schools and no debt. We helped our family members when needed, thousands of loans to them go unpaid. We work our butts off every week, and night and weekends consulting, taking care of then rental unit, paying taxes. And god willing we did it and then some.

We have seen it all in the last 30 years. a high percentage of people are just along for the ride. they get a GED and think they deserve a good paying job. They don’t want to put in the hard work it requires to be successful and they don’t take responsibility for their lot in life. They don’t want to move away to better areas where their income level can afford a home. I am here to tell you, if you are that person, stop crying and do something about it. Quit making excuses, pick up and move somewhere cheaper. Move away from negative family members that drag you down. Move away from stupid CA, there are plenty of other places and small towns that offer something you never had before: FREEDOM and OPTIONS. Quit waiting around for something to happen and make it happen instead! I moved back and forth from CA to Southeast, to CA, to TN to Southeast for better jobs, and to be closer to family members when needed. I could not have done it if I did not pick up and go. Quit whining about Prop13, quit whining about your lot in life, it’s your damn choices that get you where you are.

There are plenty of other DOERS here, learn from them. Make it happen for yourself by doing it yourself. Quit waiting around for something to happen and make it happen instead. It will be far more rewarding and you will gain experience, respect.

In California where we taxed to live in sunny weather, and where a modest single family home can easily be over $1 million, capping property tax write offs is yet another blow to the middle class family. While the middle class is being penalized with limits on property tax write offs Trump is lowering corporate taxes thereby increasing g ever more the gap between the super rich and the dwindling middle class. This isn’t capitalism. Another observation, the generations we are raising now, what kind of a future can they expect when their parents are overburdened with debt, taxes and ever increasing cost of education. Has anyone even considered the cost of emotional health our economy is placing on young families?

Flora, you must be a real estate agent. Only people who benefit from selling overpriced real estate would make such a statement “capping property tax write offs is yet another blow to the middle class familyâ€.

This is total BS. Why give out incentives to own? This is market distortion and these benefits are priced in which causes the housing market to be artificially inflated. That’s the last thing future generations need. They need a market crash so that they can afford to buy a home. Take your RE cheerleaders gear and try somewhere else 🙂

You’re telling her to leave? Who the hell are? You’ve taken over the doctors blog and now you’re shooing people off. Why don’t you start your own blog so I can ignore it.

Jed my buddy,

Don’t get too riled up. I don’t mean for her to leave in a literal sense. I appreciate the last remaining RE cheerleaders. My message is more like: nice try in pretending you are an avg person interested in sticking up for the middle class. Lots or RE cheerleaders are trying to disguise themselves as “normal peopleâ€. In reality they are pushing an agenda. It’s almost brainwashing. I like to expose them.

Awwww… but the picture from her business card is soooo cute!

Besides her points are not completely without merit, e.g. the dwindling CA Middle Class. However, the much bigger standard deduction that we get would offset the loss of the write-off for interest for most properties in the IE or other affordable parts of CA, and the expensive areas would be out of reach even with the write-off for Middle Class folks. The Govt. giveth & the Govt. taketh away, but that has nothing to do with Capitalism.

You are correct.

Sometimes it’s hard to swallow truth

>Middle Class

>California

Pick one. Politicians and their donors have made it so these two terms will NEVER be synonymous again.

The property tax, state income tax, and mortgage limits do not affect the middle class. A middle class person can not afford a 1 million dollar mortgage (as a million dollar home will only have 800k of debt vs 750k allowable and only missing out on 2500 dollar of deductions the first year (5% * 50k)). The million dollar mortgages are the domain of the top 5% which is not the middle class. The problem is one of perspective where people who are not in the middle class have this notion that they are. If you are in the top 20% you are not in the “middle.”

Yes, many people have considered this many times. But what is the point of just considering? Are you expecting a fix?

Flora, you are right. That is the reason I left CA. For me, it was for higher quality of life. Those who decide to stay there, for the most part, live a miserable life due to ratio between income and cost of living. Housing is only one component in the quality of life. It is their choice for one reason or another. However, they are not forced to live there.

Everyone is free to chose, but they can not chose the consequences of their decisions. In the end, the quality of life is the cumulative effect of those hundreds of little decisions we make in life. The government can not micromanage the economy. What is good for one person is not for another.

Friends and followers,

Here an update on the November housing data from Orange County! As many of you already know, OC housing data is a great indicator for whats to come.

Lets take a look. Freakin’ Amazing!

Active Inventory:

Last year at this time there were 4,323 homes on the market. That means that there are 58% more homes available today.

Demand:

In the past couple of weeks, demand experienced its largest drop of the year.

Last year at this time, there were 428 additional pending sales, 26% more.

Luxury End: The luxury housing market continued to slow considerably.

. For homes priced above $4 million, the expected market time increased from 484 to 716 days. At 716 days, a seller would be looking at placing their home into escrow around the middle of November 2020.

Buyers are now in the driver seat. The Expected Market Time for all of Orange County increased from 122 days to weeks ago to 124 days today, a Buyer’s Market (120 to 150 days) and the highest level since January 2011. It was at 62 days last year.

For homes priced below $750,000, the market is a Balanced Market (between 90 and 120 days) with an expected market time of 91 days.

Lastly, here my advice. This is just my personal opinion (based on experience) not financial advice.

For Sellers: Don’t make the same mistake so many others did during previous market shifts/turns/slowdowns: don’t wait too long. If you have to sell, better price below market. Its better so sell now (even with a loss) instead of chasing down the market during the crash (expected to be next year).

Buyers: Sit back and enjoy. Let the sellers come to you, offering you reduced prices and re-reimbursement for closing cost.

Happy Holidays!

Ps.: As soon as the San Diego housing data comes available I will certainly share with you my dear friends and followers.

You should just give it up and relocate to an area where you can afford a home. Or, you should consider going back to college and get an advanced degree so you can get a better job.

Sry JT, I am going to disappoint you. Not slowing down with the updates. Will continue to do so. Also, I could afford to buy but see no reason. Why buy high and waste money?

I do have a BA and a great job. Money isn’t the issue. Overpaying for real estate is what the problem is. Why pay too much and support an artificially inflated market? Lenders, sellers and agents will win in that transaction but not me. I will stick to my plan: save, stay in cash and invest in real estate when we see the crash. You can scream and protest all day long, you won’t be able to change my strategy. After all, real estate cheerleaders helped me with that one. I looked for the past years at arguments at both sides (bulls and bears). Years later I still cannot find a valid reason why buying overpriced real estate would make any sense for me (as a buyer). Let me know when you find that reason. I am a very patient guy!

Millennia;, how did you land up with your low income problem? If the only way you can afford is after a 50% to 70% price drop, your problem is your low income. I suggest you get your tail back into college and upgrade your education. That would give you a better path to success. Because, if you don’t, you will land up a 40 something living in a dreary massive apartment complex with rising rents and no money. Only education can fix your income problem.

JT,

My promise to all RE cheerleaders is that I will share details about the purchase of my first home as soon as it happens! I am thinking I am willing to buy when we get a nice reduction in price. 50-70% is in the cards by looking at the fast crashing market.

You ask what my story is? I tell you, after I started my career I wanted to buy. My realtor and lender lied so much that I asked myself why do all people profiting from my purchase have to lie so much? If buying makes sense why do you need all these cheap sales pitches? That’s when I started digging and I found these housing bubble blogs, read books and stories of first time home buyers. I started to understand the game. The game is called timing! In California it’s all about boom and bust. Now it makes all sense! Because the last thing RE cheerleaders want is a new buyer to understand the game. That’s why you have an army of RE cheerleaders posting on the internet stuff like “buy now or be priced out foreverâ€, “incomes don’t matter†etc.

I am here to share my story, educate others, keep my followers informed about the market and for the entertainment. And once in a while I hear a new funny sales pitch that I add to the portfolio. During the next bust I will have to reduce my postings as I will be busy with my home purchase.

Btw, just watching the DOW, another happy day for bears!!

Thank you for sharing Millennial! Appreciate it… Merry Xmas

In Orange County they buy the house and jack up the prices. If you read Trula, you see a lot of times they jack it up sometimes 80,000 dollars and it doesn’t sell.

In Orange County they buy the house and jack up the prices. If you read Trula, you see a lot of times they jack it up sometimes 80,000 dollars and it doesn’t sell.

I’ll tell you my personal opinion (and I have owned many homes). Only buy what you can afford and plan on owning for the long term. Factors for buying a primary residence and corresponding rules are different compared to an investment property. Buying an investment property is a pure math equation. When buying, many other factor need to be taken into account: proximity to jobs, transportation, buildable land, amenitites, schools, safety, etc. Policies that have left a housing shortage in CA won’t go away anytime soon. Everybody on this blog should have an advance degree in rental parity analysis at this point, it’s the single best indicator how cheap or expensive houses are at any given time.

“Everybody on this blog should have an advance degree in rental parity analysis at this point, it’s the single best indicator how cheap or expensive houses are at any given time.â€

Exactly! That’s why it’s so easy to tell that the current market is waaaay overpriced. My thesis all along… rents are dirt cheap compared to buying! Fight me! Show me the calc! Prove me wrong!

It’s Happening: San Francisco House & Condo Prices Fall

https://wolfstreet.com/2018/12/05/san-francisco-house-condo-bubble-prices-fall/

Why California’s Housing Market is in for Serious Trouble

https://wolfstreet.com/2018/12/04/california-housing-market-in-for-serious-trouble-foreign-home-buyers/

House prices in San Francisco are crashing hard. Check this out. Already down 15% from peak!!

Is somebody here still doubting we will see a 50-70% crash?

https://wolfstreet.com/2018/12/05/san-francisco-house-condo-bubble-prices-fall/

This will be a crash of epic proportions! I expect foreclosures to increase in the near future. If you bought recently and you see you “equity†evaporate you have little to no motivation paying that highly inflated mortgage! Especially if you see your millennial neighbor buying for half off next door. Walking away from that enormous debt is a smart idea in that case. Why overpay tremendously for the next 30years?

Mortgage rates are falling … I mentioned this a few times recently … Merry Christmas … except if you are Millennial … Millennial, repeat after me “Rates Are Down” … you were just telling he they were going to the moon.

https://www.cnbc.com/2018/12/06/mortgage-rates-drop-to-2-month-low.html?&qsearchterm=mortgage%20rates

Rates are a small component of affordability. Incomes are king and cash is the Joker. (See my next post about current interest rates on Govt. bonds. ) It is not the rising rates that will crash housing. Historically, rising rates are in a rising economy which gooses housing prices upwards. (A previous post of mine.) When people start losing employment and defaulting on debt is when the prices will go down big time, and especially in the most strapped communities of home owners. Same as last time. Big bargains in more “affordable” communities as working class owners get nailed again.

JT told us at the beginning of the year this 2018 spring selling season will be epic. In reality we hit a wall. Than he told us rising interest rates have no impact on prices. Lol.

Now, he is celebrating that rates can slightly decrease. Let’s take a look at what he is cheering about:

“The average rate on the popular 30-year fixed has fallen 19 basis points in the past week, from 4.94 percent to 4.75 percent on Thursday, according to Mortgage News Daily.

The drop comes after the 30-year fixed hit a recent eight-year high of 5.05 percent at the start of November.â€

In other words:

No way! Rates are down! Rates are falling! Hurry, lock in your rate today! It’s a great time to buy! Rates might go up! Buy now! Buy now! Before it’s too late!! You might be priced out forever!!

I am glad You still find things in this crashing market that gives you hope JT. It would be a shame if you disappear as well. Let’s keep this going. You are one of the top suppliers of RE cheerleader BS lines.

The spring season was epic. Record high prices. You missed your chance to share the wealth because you thought prices were going to crash in 2013. Bad call that set you back financially.

The RE market hitting a wall in spring was epic! I agree on that one. Since then we have rising inventory and decreasing prices. This will excellerate as we move forward. I saved money – lots of money – the last few years. Rent cheap during good times and buy during downturns seems to be a smart strategy. I’ll let you know when I buy, just have a bit more patience. We are not quite there yet 🙂

Treasury Yield Curve Rates 12*06*18

1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Yr 3 Yr 5Yr 7 Yr 10 Yr 20 Yr 30 Yr

2.36 2.42 2.41 2.56 2.70 2.75 2.76 2.75 2.80 2.87 3.01 3.14

This is almost as flat as Kansas; from 1 yr to 10 yr differs by 0.17 %!

A couple of weeks ago the curve was starting to actually look what you would think would be “normal”. The inversions that people see in this are just the noise in a flat rate curve in my opinion. We aren’t seeing a jump in short term rates yet.

Mind blowing what’s happening in seattle:

https://seattlebubble.com/blog/

“NWMLS: Home listing inventory skyrocketed in November as sales and prices both fell further”

“November’s year-over-year listing growth was an all-time record at a whopping 114 percent.”

114%!!!!!!

You got to check out his YoY graph!!

“The massive surge in active inventory has forced me to adjust the y-axis on this chart. We’ve hit new all-time records each of the last four months.”

Prices started to fall. We should see dramatic price crashes in seattle within the next few month and years.

JP Morgan article claiming fake news by those trying to spread discord for political reasons are rocking markets. Millennial’s posts sure fit the bill … he ishttps://www.cnbc.com/2018/12/07/why-are-markets-so-volatile-jpmorgan-guru-thinks-fake-news-to-blame.html trying to spread garbage …

Yelling “fake news†sounds like defeat!

Why don’t you counter with inventory/housing data?

You know the data doesn’t fit your narrative so you try to spin it in a political way.

The buyers sentiment has shifted. Potential buyers no longer fear of being priced out….they fear of catching the falling knife in a fast crashing housing market!

This is the death sentence for RE cheerleaders and this bubble.

You can yell, it’s the bad media, it’s a conspiracy, it’s the libtards, it’s the socialists, it’s fake news all day long. Nobody doubts the party is over. We all know it and by yelling fake news you are just saying “ I haven’t nothing left in the tank. Out of ammunition “

Yelling ANY news is a defeat. All these news/graphs/data you post is news because very few can put it in the proper context. You just gotta operate with your ears atuned to all the noise. Some people do it like millie (wait for a crash and live in frugal poverty meanwhile). Others focus on income and healthy finances and become imperveous to the actions of others.

What about being a relatively high income earner and living frugal temporarily to achieve a goal?

Millie, that is fine also.

And thats what i am doing….

Tons of open houses this weekend! Too many to see them all but I picked some interesting ones to check out. Usually, there is nobody there besides the realtor. Let’s see if it continues that way. The Buyers appetite for overpriced houses seems to be gone.

I also noticed that many houses that sat for many months and were taken off the market are now back on the market. With a much lower price! Now this makes sense again. For a while I couldn’t understand why you would not lower more dramatically or at least rent it out. In all fairness, some tried to rent it out but the asking rent must have been too high. The houses remained empty which didn’t make sense. Now they are back on sale for lower prices which means the seller gave up on the market. It’s smart. You don’t want to be caught chasing down the market during the bust next year.

Well it is holiday time, people are rarely buying in december. Some better deals to be had in December. You are getting desperate with this thing to convince yourself that RE is crashing

True, now that the market is crashing it becomes more and more fun sharing it.

Millie, I am waiting for your next update on open house situation and how agents are yawning. Please send out. I want to enjoy it over my $5 latte with ocean views.

Surge, Over Christmas and New Years I won’t get to it. I am overseas (Europe). I will send open house updates beginning of January. Until then, I will certainly continue to share articles about the housing crash. We just got good news from Las Vegas and San Diego (skyrocketing inventory!). I will keep you posted.

I know there has been some hyperbole from the doom and gloomers for a while, but they are about to be right soon. Anybody sweet talking rents or home prices has missed the memo that the downturn in RE has started throughout the US, esp. throughout inflated CA. The coming drop will be massive, there doesn’t need to be a crash just a slow and steady bleed. Investors won’t come back for a while and buyers will be missing as well as the 10 year expansion deflates. If you’re a flipper or want out better sell now and fast with a hefty price cut, if you’re a landlord prepare for much lower rents, though rents should hold up a little better than house prices.

Rents are so detached from the value of the underlying asset, that I don’t expect rents to change at all. I expect home prices to fall to meet where the rental market currently sits.

exactly!

I just paid a pretty penny to remodel my kitchen, I had ppl driving by if I was getting ready to sell or rent when they see contractors there. I’ll keep my 5 bd home in the valley for now, I can’t beat a $1900 mortgage unless I move out of Cali. If I cash out, I’ll be paying 2500 plus just for 3 bd for my kids.

Article from Robert Shiller. His claim is no one knows when the current housing boom will end.

https://www.msn.com/en-us/money/realestate/analysis-the-housing-boom-is-already-gigantic-how-long-can-it-last/ar-BBQDXjk?li=BBnb7Kz&ocid=mailsignout

But unlike you he knows it will end. That’s the point.

Plus, if the last bubble taught us anything it is that economists and so called experts are often times completely out of touch with where markets are heading. You remember that right? Bernanke in 06 etc.

“Experts” and “aware winning economists” simply interpret data and draw a conclusion like the rest of us. They still sit on the toilet.

Clearly, Millennial = nor cal fella

He’s also Done Deal in this thread and a dozen other handles.

Anytime you see a new name and he’s parroting Millie’s lines, it’s usually silly Millie pretending to be someone else.

JT, Jed,

I totally understand the concern. If a lot of people start talking about a crash etc. it scares the RE cheerleaders greatly. A change in buyer sentiment seals the deal for housing. Once the herd stops buying the market will collapse quickly. Therefore, all people that favor a crash and dislike higher prices must be one and the same person. If that helps you, please keep telling yourself that. It’s all good!

The Democrat socialist thugs who completely control Commiefornia have welcomed millions of criminal illegal invaders into the state. Illegals are crammed into houses and apartments turning what were once nice family neighborhoods in LA and the rest of SoCal into crime infested turd world sanctuary sh*tholes with their junk vehicles clogging the streets. Damn Commiefornia Democrat socialist thugs and may they burn in Marxist hell!